|

Report from

Europe

UK tropical wood trade succumbs to

pandemic impact

The value of UK imports of tropical wood products was

US$360 million in the first four months of 2020, 19% less

than the same period last year. Although a significant

decline, the downturn is perhaps less than might have been

expected given the exceptional circumstances surrounding

COVID-19.

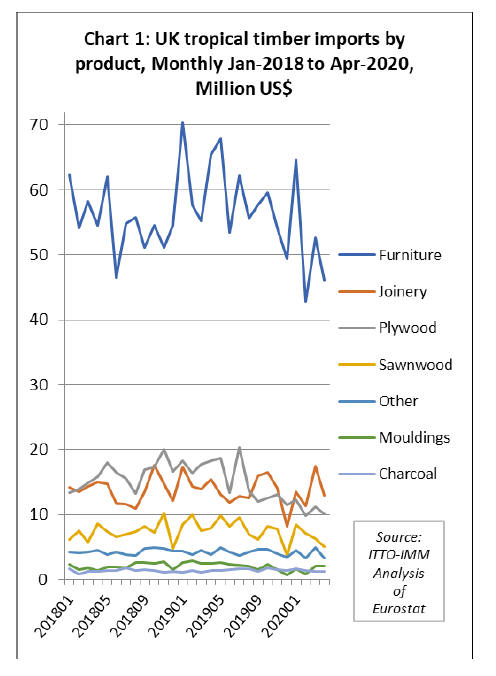

It is also notable that the start of the decline for most

products predated the period of lockdown initiated in the

UK from 24th March. UK wood furniture imports from

tropical countries have been weakening since the start of

2019 and were particularly slow in February this year.

Imports of tropical plywood and sawnwood have also been

sliding since the middle of 2019 (Chart 1).

The trade data to end April implies that the market was

slowing even before the lockdown was implemented and

has probably captured only a small portion of the COVID-

19 downturn. A more severe downturn can be expected in

May and June.

To some extent weak imports in February and March this

year were due to the earlier implementation of COVID-19

lockdown measures in Asian countries which disrupted

raw material supplies and exports, particularly of wood

furniture from South East Asia and tropical hardwood

faced plywood from China.

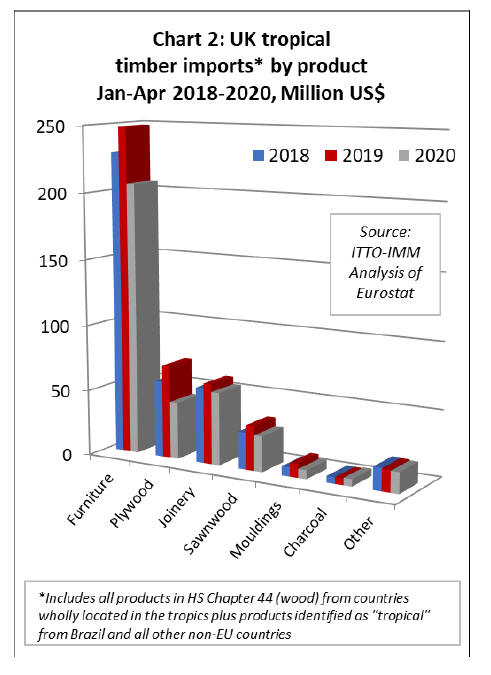

Comparing the first four months of 2020 with the same

period the previous year, UK import value of wood

furniture from tropical countries fell 17% to US$206.1

million.

Imports of tropical plywood were down 39% at US$43.4

million, tropical joinery products were down 9% at

US$55.2 million, tropical sawnwood fell 20% to US$26.9

million, and mouldings/decking declined 35% to US$6.8

million (Chart 2).

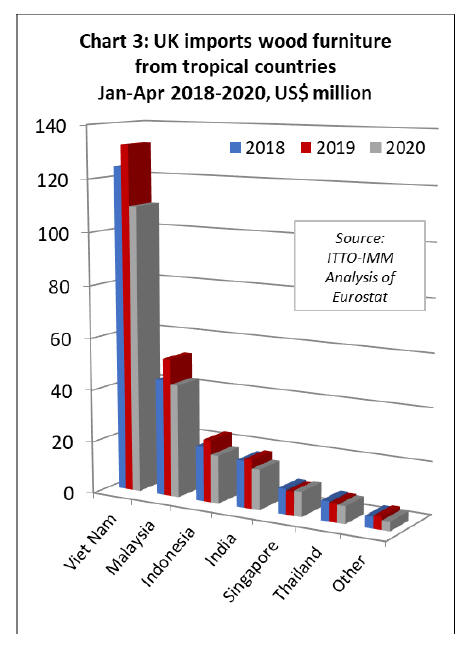

UK imports of wood furniture declined sharply from all

the leading tropical supply countries in the first four

months of this year (Chart 3).

Imports from Vietnam were down 17% at US$109.5

million, imports from Malaysia fell 18% to US$43.2

million, imports from Indonesia declined 23% to 18.4

million, and imports from India fell 17% to US$15.4

million.

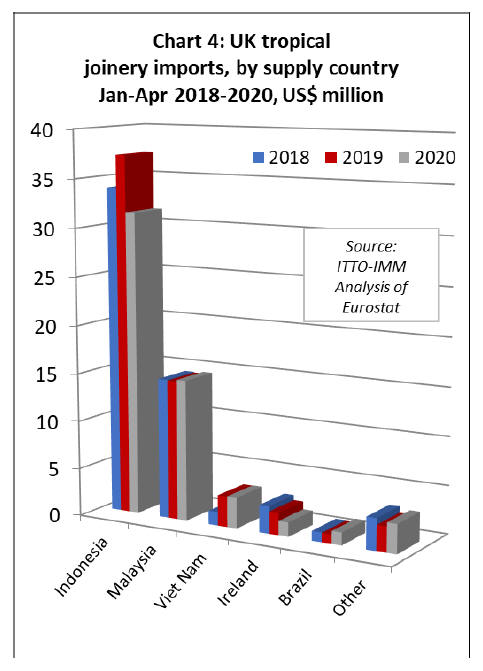

Indonesia loses ground in UK joinery market

After making gains in 2019, UK imports of tropical

joinery products from Indonesia, mainly consisting of

doors, fell 16% to US$31.5 million in the first four months

of this year.

In contrast, UK imports of joinery products from Malaysia

and Vietnam (mainly laminated products for kitchen and

window applications) made slight gains in the first four

months of this year, increasing by 1.3% to US$14.7

million from Malaysia and by 0.8% to US$3.2 million

from Vietnam. (Chart 4 above)

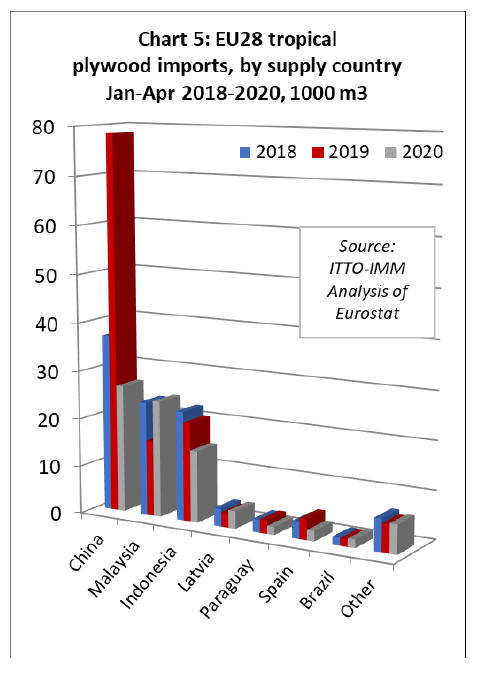

UK imports of tropical hardwood plywood from China

crash

The UK imported 26,600 cu.m of tropical hardwood faced

plywood from China in the first four months of this year,

66% less than the same period last year. UK imports were

at unusually high levels in the first half of 2019 after a

period of slow buying in 2018 due to Brexit uncertainty.

However, the market suffered from over-stocking in the

second half of last year as consumption slowed. This year,

UK imports have been further dampened by COVID

related supply problems in China.

Likely due to supply problems elsewhere, UK imports of

plywood from Malaysia, which have been in long term

decline, recovered ground in the first four months of 2020,

rising 55% to 24,200 cu.m.

However, imports from Indonesia fell 27% to 15,000

cu.m. In recent years, the UK has been importing small

volumes of tropical hardwood faced plywood from Latvia.

Imports of this commodity were up 21% at 3,600 cu.m in

the first 4 months of 2020. (Chart 5)

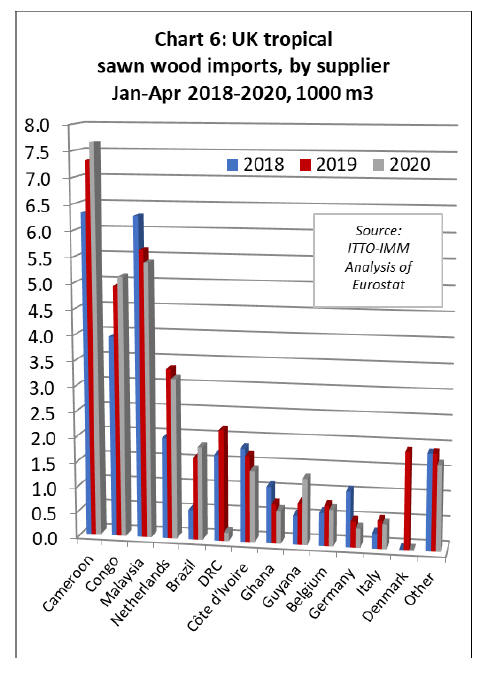

UK tropical sawn hardwood imports small but diverse

The UK is now a relatively minor market for tropical sawn

hardwood, importing less than 100,000 cu.m in each of the

last two years, making it only the fifth largest European

importer for this commodity (after Belgium, Netherlands,

France and Italy).

UK imports of 30,000 cu.m in the first four months of

2020 were 12% less than the same period in 2019.

UK tropical sawn imports are sourced from a large range

of countries, both directly in the tropics and indirectly

from other European countries (Chart 6).

UK imports from Cameroon, the leading supplier,

increased 5% to 7,700 cu.m during the four-month period,

while imports from the Republic of Congo were also up,

by 4% at 5,100 cu.m. However, imports from DRC fell to

negligible levels in the first four months of 2020 after

reaching more than 2,200 cu.m in the same period last

year.

UK imports from Malaysia were 5,400 cu.m in the first

four months of 2020, 4% less than the same period in

2019. Indirect imports into the UK via the Netherlands

were down 6%, at 3,200 cu.m, after significant growth last

year. Imports from Brazil increased 14% to 1,800 cu.m,

while imports from Guyana were up nearly 60% at 1,300

cu.m.

Many UK merchants lack space and finance to carry the

ideal inventory of tropical sawn hardwood which should

include a wide range of boards in different widths and

lengths for bespoke joinery work. Most UK merchants

therefore focus on stocking just the more familiar types of

hardwood, in defined ranges to suit particular market

segments.

The main tropical hardwood species in demand in the UK

now are sapele, meranti, utile and for decking, Bangkirai.

Sapele is strongly favoured as a good all-rounder for both

internal and external joinery with reasonable density and

good machining capabilities and good for paint

applications.

Utile is still favoured as it tends to be more stable than

many external hardwoods. Idigbo/framire (mainly from

Cote d¡¯Ivoire, was formerly popular but importers report

having difficulty obtaining assurances required for EUTR

compliance.

Meranti is still popular in UK window and door

manufacturing, although wide variation in the density of

meranti supplied has been an increasing issue for some

importers and manufacturers. Many merchants also stock

meranti mouldings for the replacement market, including

skirtings, architraves and window cill sections.

Challenges, but some cautious optimism in UK

Further insights into the status of the UK sawn hardwood

market came from a webinar organised by the London

Hardwood Club in early June, featuring speakers from the

UK tropical import sector alongside American and

European hardwood producers.

The event, which attracted 48 participants, covered

pandemic impacts, species supply and demand trends, UK

market acceptance of further processed hardwood products

and market outlook.

Despite the COVID 19 lockdown measures, in place now

in the UK for nearly two months, there are some more

positive signs emerging in the UK hardwood market.

Several seminar participants said that the market remained

¡®some way off the norm¡¯, but that business was picking

up.

¡°At the start of the Covid-19 lockdown we were looking at

the sharp end of doing very little at this point and in April

sales were down 60-65%,¡± said one importer.

¡°But through May into June we¡¯ve seen renewed activity

and we¡¯re now back to around 60% of normal levels.¡±

Another said they had gradually upped activity: ¡°We

closed for two or three weeks, but now we¡¯ve got 50% of

staff working. We don¡¯t see sales returning to 100% in the

near future, but we hope to have all our people back by the

end of the government furlough programme in October.¡±

Focusing on West African supply, Guy Goodwin of NHG

said that, bar a temporary shutdown in Ghana, the

pandemic had not to date significantly hit production.

Prices for red hardwoods also remained firm, underpinned

by renewed buying in China and Vietnam.

Mr Goodwin anticipated mills ¡®in the tiers below

mainstream producers¡¯ being most affected by wider

contraction in demand, leading to some price cutting.

Cancelled orders had also seen some ¡®distressed parcels¡¯

coming on to the market.

However, he did not anticipate the tropical price slump

and capacity contraction seen after the 2008 economic

crash. ¡°Mills learned the lesson from that and became

more cautious and reactive to the market situation, so

there¡¯s less over-production,¡± he said.

¡°Also, many concession holders are at the end of 25-30-

year harvest cycles, so forest being worked is less rich in

commercial species. We expect this to keep prices firm,

particularly for kiln-dried, certified, EUTR-compliant

timber.¡±

For the European hardwood supply sector, Alex Boisson

of Italian-based oak producer Florian Group, said the

pandemic had reduced demand internationally and the

outlook was uncertain.

The Asian market was particularly hard hit and overall the

post-pandemic so-called ¡®new norm¡¯ had yet to take shape.

¡°Business is moving, but not as we knew it,¡± he said.

¡°Requests are day to day.¡±

Florian had faced mill operational challenges due to

COVID-19, but its key concern was the three month

shutdown in harvesting in Croatia and Hungary, where it

also has mills in addition to those in Italy and France.

Resulting tight supply was underpinning log prices, which,

Mr. Boisson forecast, would lead to lumber price inflation,

despite demand levels.

He also said that it was imperative to develop the market

for the ¡®central part of the log¡¯. Hardwood sawmills need

to sell lumber from the entire thickness and grade

spectrum of the log, both to turn a profit and avoid

finished stock build up and associated bottlenecks and

overheads.

Demand for lower grade European lumber had been hit by

the pandemic, notably in South East Asia and this

compounded the effect of deterioration in European raw

material quality.

¡°In the last 10- 15 years European logs have declined in

quality and diameter,¡± said Mr. Boisson. ¡°Previously the

resource was yielding 30% A quality logs. Today that¡¯s

down to 15-20%. We increasingly need to be creative and

find an outlet for lower grades, perhaps through

modification, or engineering and new applications. It¡¯s key

to how we survive as sawmills.¡±

On the UK, Mr. Boisson said there was more hardwood

stock on the ground than elsewhere in Europe, the

consequence of ¡®excess buying¡¯ prior to lockdown, with

importers hedging against anticipated logistical problems.

The market, he added, was also historically more resistant

than European neighbours to value-added, further

processed products. By contrast, German window

producers, for instance, tended to use fingerjointed and

laminated hardwood exclusively.

This sentiment was echoed by a UK timber importer who

noted that ¡°UK end users are conservative. They¡¯re wary

of anything new and not particularly fashion-led.¡±

However, there were signs of UK end users coming

around.

Mr Boisson commented that ¡°five years ago, our

engineered exports to the UK were zero. Today they

comprise 25% of the total. We expect the trend to continue

and that we¡¯ll be selling less solid, thick lumber to the

market.¡±

Speaker Dennis Mann, export sales manager of Baillie

Lumber, a leading US hardwood exporter, emphasised that

the poor prospects for lower grades was also a major issue

facing the American hardwood industry. ¡°Our key

challenge is what to do with the centre of the log. Right

now, there¡¯s just no home for sleepers, cants, truck deck

flooring, pallet timber, or chips for paper mills,¡± said Mr

Mann.

¡°A lot of these products are tied in with transportation of

goods and as that¡¯s significantly reduced, so has demand.¡±

Mr. Mann suggested that as economies emerge from

pandemic lockdown more widely, this industrial lumber

logjam should gradually ease, but the timescale was

uncertain and, while unresolved, it could cause further

problems.

Difficulties in moving lower quality material inevitably

impact supply of better grades and Mr Mann predicted

tightening supply in 1.5-2¡± and thicker white oak in

coming months.

Turning to the UK, Mr. Mann said it had not only

remained the U.S. hardwood sector¡¯s biggest European

market, and fourth biggest export market overall, it was

also among its most consistent. Its annual U.S. imports

averaged around $83 million for the last four years,

comprising 75-80% white oak, tulipwood and walnut.

One question from a webinar participant was on future

supply of American ash given the emerald ash borer

infestation. Mr Mann responded that there were still areas

of pest-free forest, particularly away from roads. ¡°Ten

years ago we thought it would all be gone by now,¡± he

said.

¡°Today we estimate there¡¯s still another three to five years

supply of viable, unaffected timber.¡±

Mr. Mann was also asked about U.S. supply of FSCcertified

and said demand for it was mainly from the UK.

¡°FSC requests are 90- 95% UK, with inquiries monthly.

From elsewhere we¡¯ll get two or three every few months.¡±

One importer saw increasing prospects for modified

temperate hardwoods to widen applications for less

durable material. ¡°We¡¯ve done a number of successful

projects in thermally modified U.S. tulipwood, with

another significant one in the pipeline,¡± they said. ¡°We

think it¡¯s got a good future.¡±

UK still in lockdown while rest of Europe eases

restrictions

Lockdown measures in the UK, one of the nations most

affected by COVID-19, are being eased but more slowly

than elsewhere in Europe. Strict social distancing is still in

place, with restrictions on the numbers of people that can

meet from separate households. People who can work

from home should continue to do so "for the foreseeable

future".

UK workplaces may only open if made safe for staff, with

more cleaning, staggered working shifts and, for office

workers, no hot-desking. Most people entering the UK -

including British citizens ¨C must self-isolate for 14 days.

UK citizens are strongly advised not to travel abroad.

Most schools are still closed.

In continental Europe, lockdown measures are being lifted

cautiously, in phases. Businesses are reopening and many

children are back in school. Many of Europe's internal

borders will be open again from mid-June and there are

hopes that external borders will be lifted from 1 July.

Germany began reopening shops in April. In early May

control of lifting the lockdown was handed to the 16

federal states. But Chancellor Angela Merkel stressed that

an ''emergency brake'' will be applied anywhere that sees a

surge in new infections.

Italian lockdown restrictions were eased from early May

and people are now able to travel for longer distances, as

well as visit their relatives in small numbers. On 3 June,

Italy unilaterally reopened its borders and ended regional

travel restrictions.

In France, restrictions began to ease on 11 May, and phase

two of the easing began on 2 June, including an end to a

100km (62-mile) travel limit. Nearly all of France is now

in a so-called "green zone", where restrictions can ease

faster. Paris has moved from a red to an orange zone.

Belgium, the world's worst affected country in terms of the

number of deaths per head of population, entered a third

phase of deconfinement measures on 8 June, with the

reopening of hotels, bars and restaurants, extended social

life and eased tourism restrictions.

The Netherlands imposed a far less strict lockdown than

neighbouring countries. Prime Minister Mark Rutte

unveiled a five-phase plan for easing lockdown

restrictions, which kicked in from 11 May and is now well

advanced.

On 1 June, Spain moved into a second phase of the

planned removal of lockdown for 70% of Spaniards.

However, Madrid, Barcelona and some other regions

continue under tighter phase-one restrictions. The state of

emergency is to end on 21 June, restoring freedom of

movement.

Portugal, which has had fewer coronavirus cases and

deaths than some other south European nations, is now

near the end of a three-phase plan announced on 4 May to

reopen different sectors of the economy every 15 days.

Greece, another country so far less affected by the

pandemic, has been relaxing lockdown measures since

28th April and has declared that the tourist season will

start on 15 June, with the opening of seasonal hotels on the

same day.

Poland is due to open borders with other EU countries on

13 June, lifting restrictions, mandatory quarantine, and

border controls for EU nationals who will be free to travel

and transit through the country. Fitness clubs, cinemas,

theatres, and amusement parks, which have remained

closed for two months, were allowed to open from 6 June.

OECD predicts UK to suffer largest economic

downturn

The UK is forecast to suffer the worst recession of the

world¡¯s 37 rich nation economies as GDP shrinks by up to

14 per cent this year and one in ten workers are left

unemployed. In its latest global forecasts, the Organisation

for Economic Cooperation and Development (OECD)

ranks the UK alongside France, Italy and Spain, saying

that all four countries will lose more than a tenth of

national output to the pandemic in 2020.

The OECD modelled two scenarios. The first assumes that

the virus recedes and the second models a second spike in

the final three months of the year.

A second spike is judged by the OECD to be just as likely

as the virus remaining under control.

In the benign scenario, the UK suffers the deepest

recession of all OECD members, just ahead of France, as

the economy shrinks by 11.5% in 2020 and unemployment

jumps to 9.1% from 3.9% at the last official reading.

In the double hit scenario, Spain and France fare slightly

worse as UK GDP falls 14% and unemployment climbs to

10.4%. Germany and the US shrink by just short of 9% in

the worst case scenario. All countries recover some of the

lost ground in 2021, with catch-up growth under both

scenarios.

Sharp decline in European construction continues in

May

Although the headline figures from IHS Markit

Construction Purchasing Managers Index (PMI) for the

eurozone and UK in May were better than in April, they

still indicated a steep decline in construction activity. For

the eurozone, the PMI rose to 39.5 in May, up from a

record low of 15.1 in April (a score below 50 indicates

contraction).

Survey data showed Germany and France recorded a third

straight month of decreasing construction output in May,

although the decline slowed markedly amid easing

lockdown measures. Italy posted a marginal rise in

construction activity in May following a collapse in April.

Business expectations among eurozone building

companies remained negative in May, with the Future

Activity Index coming in below the neutral 50.0 level for a

third straight month.

Concerns were linked to the longer-term impact of the

COVID-19 pandemic on construction activity. Germany

and France both reported a negative outlook, while Italian

business sentiment turned positive for the first time in

three months.

The UK construction sector also suffered one of its worst

results in May since the PMI surveys began as building

work was grounded by the pandemic and lockdown

measures. Construction firms fear a recession and

postponement of new projects in the next year despite a

gradual reopening of sites in May.

The IHS Markit/CIPS UK Construction PMI registered at

28.9 in May, picking up from the record low of 8.2 in

April. Around 64% of the UK survey panel reported a

drop in construction activity during May, while only 21%

signaled an expansion. Growth was attributed to a limited

return to work on-site following shutdowns in April due to

the coronavirus outbreak.

As in the eurozone, UK building companies remained

downbeat about their prospects for the next 12 months.

Recession worries and fears of postponements to new

projects were commonly reported.

Throughout the eurozone and in the UK, construction

supply chains remained under severe pressure in May,

with delivery times continuing to lengthen at the secondquickest

rate in the PMI series history.

Anecdotal reasons suggested logistical bottlenecks,

material shortages at distributors and limited supplier

capacity due to social distancing rules.

|