Japan

Wood Products Prices

Dollar Exchange Rates of 10th

June

2020

Japan Yen 107.12

Reports From Japan

US$300 billion extra budget has been approved

A record almost US$300 billion extra budget has been

approved by the Japanese government aimed at financing

struggling companies, providing payroll subsidies,

supporting low income households and expansion of the

health care sector. The government has assessed that the

country is facing its worst economic crisis in decades but

the new expenditure will add to the public debt.

Some 30% of the extra budget will go to help small firms

where a rent subsidy is proposed. A massive budget has

been agreed as a coronavirus reserve fund if there is a

serious second wave of infections. Some economists say a

third or even a fourth extra budget may be needed. The

extra government spending has pushed the country¡¯s fiscal

health to become the worst among major economies.

Business sentiment at 11 year low

The recent business sentiment survey conducted by the

Ministry of Finance and the Cabinet Office shows

business sentiment among large Japanese companies in the

second quarter fell to the lowest in 11 years as the impact

of the coronavirus control measures hit both

manufacturing and non-manufacturing sectors.

The Business Sentiment Index in the second quarter was

the lowest since the first quarter of 2009 during the global

financial crisis following the collapse of Lehman Brothers

Holdings the previous year. The latest figure is also worse

than that in the April-June quarter of 2011 after a massive

earthquake and tsunami that hit northeastern Japan.

In related news, the total value of machinery orders

received by 280 manufacturers operating in Japan fell over

8% in April from the previous month and private-sector

machinery orders (excluding volatile ones for ships and

those from electric power companies) declined by 12.0%.

Forecasts for the April-June period suggest machinery

orders could drop a further 5% with private sector

machinery orders also set to fall further.

Care needed when looking at unemployment statistics

Unemployment data from Japan¡¯s Statistics Bureau

reported a rate of just 2.6% in April, the latest monthly

data. In contrast to other countries where lockdowns have

decimated companies such low unemployment is unreal.

As always the devil is in the detail as the data exclude an

estimated 4 million people who while still ¡®attached¡¯ to

their companies but are not working and may or may not

be collecting a salary. Including this stock of ¡®grey

unemployment¡¯ then the figure jumps to around 12%, still

a remarkably low figure compared to other countries.

See:

https://www.japantimes.co.jp/news/2020/06/07/business/economy-business/official-jobless-rate-japan-ignoresleave/#.Xt2prXkzbIV

First quarter GDP beats expectations but economy still

in a recession

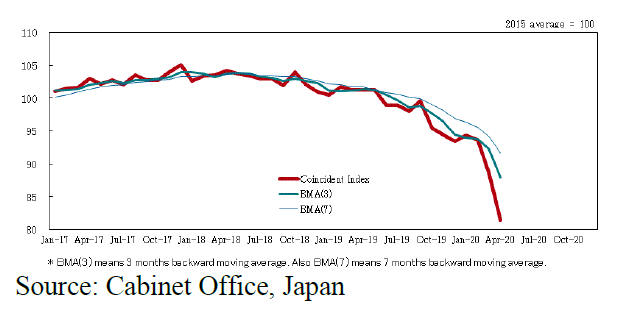

Cabinet Office GDP data for first quarter 2020 were much

better than anticipated but this did not alter the picture of

the Japanese economy being in recession.

GDP declined 0.6% in the first quarter 2020 compared to

the previous quarter, better than the expected 1%

contraction. A series of April data including exports and

factory output indicate Japan is experiencing the worst

economic slump for half a decade.

The Bank of Japan is continuing its policy of trying to

stimulate demand but this approach has been questioned

by some who say the focus should be on supporting

struggling businesses rather than trying to spark overall

demand as consumers are fearful of what may lie ahead

and are in no mood to spend.

Easing of travel for businesses

Australia, New Zealand, Thailand and Vietnam are the

first countries from which nationals will soon be welcome

in Japan. To begin with Japan will allow up to 250

business people such as executives and engineers to enter

the country.

Japan currently bans entry to nationals or those having

visited 111 countries and regions. Discussion are ongoing

for polymerase chain reaction (PCR) testing of people

leaving Japan for those countries that are again open to

visitors that can prove through testing that they are not

infected.

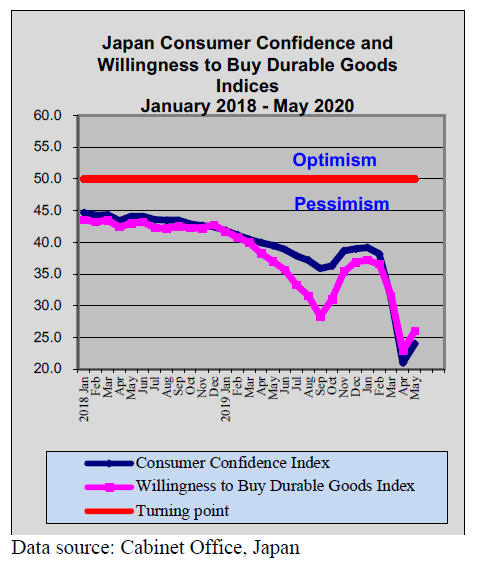

Consumption set to rise as businesses re-open

The data on household spending in April fell shows an

11% decline year on year, the fastest pace ever recorded as

the coronavirus control measure forced people to stay

home and job insecurity became a major concern.

However, the decline was slower than forecast. While

analysts anticipate consumption will begin rising in June

as businesses re-open after the national lockdown, any

rebound will be slow and fragile.

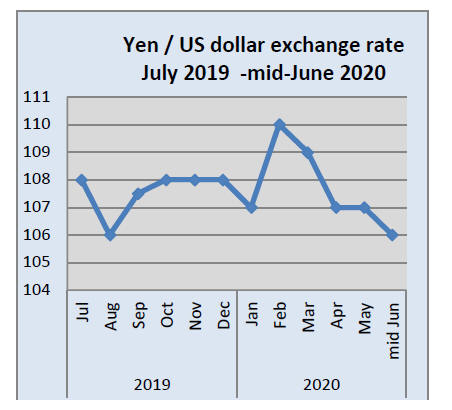

Dollar slides but yen remains steadye

In the first two weeks of June the US dollar dipped against

most major currencies as a result of the extensive protests

in the US and because prospects for the US economic

recovery have become less clear. The much hoped for ¡®V¡¯

shaped recovery now appears to be unlikely.

The uncertain economic outlook in the US resulted in

some money movements to the yen but this was not as

significant as in other periods of crisis and the yen moved

only in a narrow band.

Also pushing the dollar lower were the grave projections

from the US Federal Reserve which said it will take years

for the US economy to regain the jobs lost as a result of

the pandemic.

The US Federal Reserve Chairman said that the US

economy could see unemployment lingering at around

10% this year and that interest rates are likely to remain at

a near-zero level until 2022 at the earliest. The US

economy is forecast to contract by 6.5 per cent this year

according to the Fed.

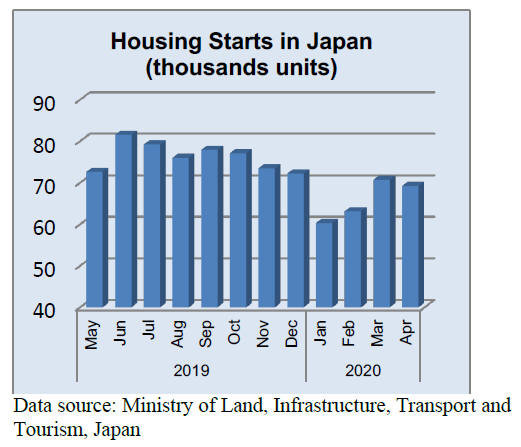

Decline in orders for new homes

Major house builders in Japan have reported falling orders.

A survey of the seven main builders revealed that orders in

April 2020 were just 65% of that in April 2019 and the

lowest for 3 years. The Japan Lumber Reoprt has said

Asahi Kasei Homes reported a 40% decline in orders and

had temporarily closed its show houses.

For more see the contribution from the Japan Lumber

Report on page 15.

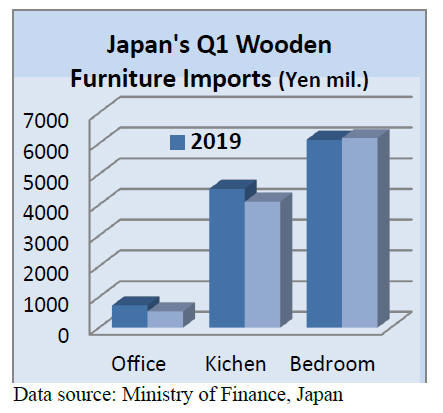

Furniture imports

The value of Japan¡¯s first quarter 2020 imports of wooden

office furniture (HA940330) dropped 27% year on year

and there was a drop of 9% in the value of wooden kitchen

furniture (HS940340) compared to Q1 2019. In contrast,

the value of Q1 2020 wooden bedroom furniture

(HS940350) remained at the same level as in Q1 2019.

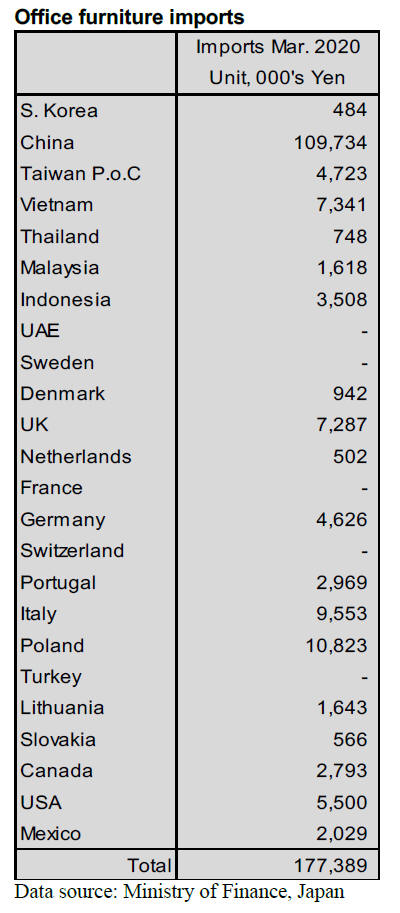

Office furniture imports (HS 940330)

March saw a steep increase in the value of wooden office

furniture imports despite the weak business sentiment.

But this was not enough to lift the value of imports back to

March 2019 levels. March 2020 imports were down

around 30% month on month.

Imports of office furniture (HS940330) in March 2020

from China surged by a factor of three compared to a

month earlier. Chinese shippers captured a 62% share of

Japan¡¯s March imports of wooden office Furniture

maintaining their position as the main suppliers.

Traditional suppliers, Poland and Italy, contributed around

6% each to Japan¡¯s March imports.

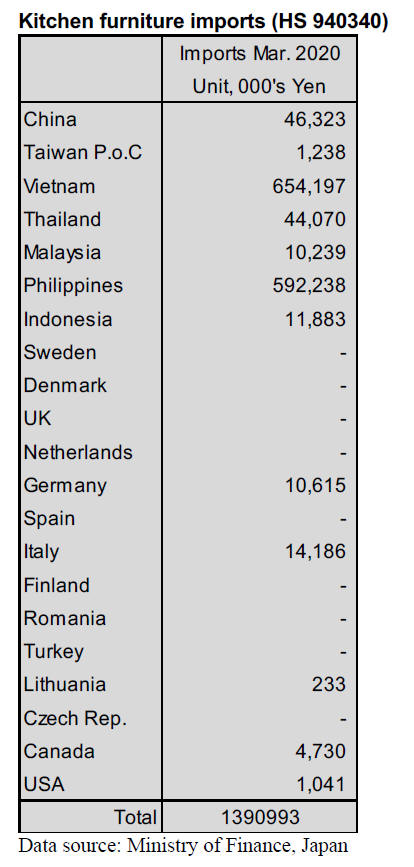

Kitchen furniture imports (HS 940340)

As a result of a 40% increase in the value of wooden

kitchen furniture from Vietnam, the country just topped

the previous top shipper, the Philippines from which the

value of shipments to Japan in March were at the same

level as a month earlier.

Vietnam and the Philippines accounted for almost 90% of

Japan¡¯s imports of wooden kitchen furniture (HS940340)

in March 2020. In March 2020 there was a steep, over

50%, decline in shipments from China.

Year on year, Japan¡¯s imports of wooden kitchen furniture

(HS940340) in March dropped almost 9% continuing the

downward trend from February. Month on month, the

value of March imports of wooden kitchen furniture

dropped around 12%.

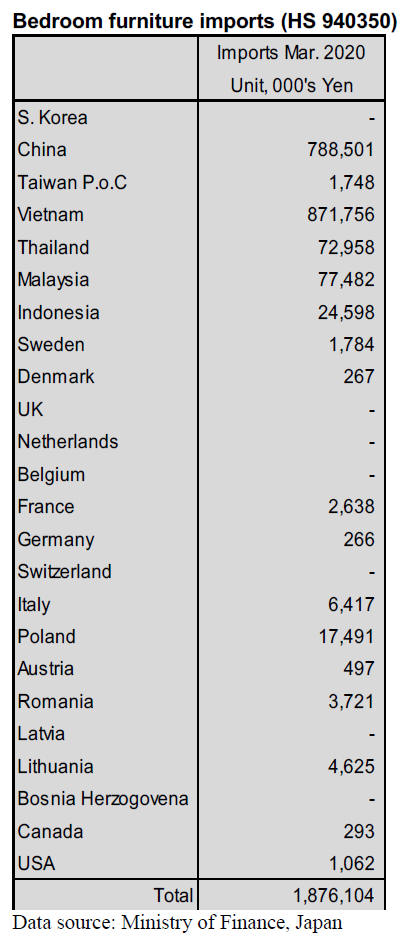

Bedroom furniture imports (HS 940350)

The value of wooden bedroom furniture imported into

Japan in March 2020 rebounded by almost 30% from the

decline seen in February.

Imports from Vietnam, the top supplier in March, rose

15%, there was an almost 50% rise in shipments from

China and shipments from both Malaysia and Thailand,

while small, rose sharply. However year on year the value

of March 2020 imports were flat.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

Corona virus hazard

The Japan Forest Products Journal made emergency

survey regarding corona virus pandemic by sending out

questionnaires to 300 companies and 131 responded.

Questions are measures to minimize impact of corona

virus pandemic, the most concerned matters, forecast of

housing starts of this year and estimate of performance

result.

There are many comments that this is unprecedented

incident so there is no material to judge future market

since it is not cyclical business fluctuation. Many sound

like resignation or pessimism.

Gathering of people is prohibited and everything is

cancelled, disrupted and postponed. All the economic

activities are hampered and degree of stagnation is getting

deeper day after day.

The government lifted state of emergency for all

prefectures but there is fear of second and third wave once

restriction is eased. For prevention of infection, human

contact is prohibited and self -imposed quarantine at home

is recommended so working people stay home and do

telecommunication. Large cities become ghost town

without crowd and all type of consumer activities died

down.

Housing starts have been dropping month after month.

Consumption tax hike in last October is first blow then

came corona virus outbreak, which is second blow.

Housing starts were less than the same month a year

earlier for nine consecutive months since last September

and this would continue for months to come and decline

should be steeper in coming months.

Housing starts of following year of Lehman shock in 2009

dropped by 305,000 units. In 1973, housing starts after the

first oil shock dropped by 589,000 units and similar drop

would come from now on.

Some comment that this incident may be paradigm shift to

change stereo type and established system. This is

beginning of new life style and working style to accept

teleworks like e-learning and remote diagnoses with

doctor and tele conference with zoom.

Anyway influence to demand of building materials is

uncertain yet but market confusion is inevitable and

damages business management severely. With declining

housing starts, demand for building materials would surely

decrease. Sawmills and plywood mills have already started

curtailing the production by dropping orders and log

supply is becoming excessive.

Other parts of the world is suffering the same trouble so

the supply from overseas sources may become tight but

the concern is stronger to drop of the demand in Japan.

Large drop of orders for major house builders

April orders for large house builders declined

considerably. Quarantine at home started in March and

people visiting model house exhibition sites decreased

largely and sales promotion events are cancelled as face to

face negotiations became prohibitive by corona virus

infection.

Every year, series of holidays in early May draw many

potential buyers to the exhibition sites. Potential buyers

visit various model houses and make up their mind later so

number of visitors is a sort of guideline for future housing

starts.

Eight major house builders disclose orders compared to

the same month a year earlier. April orders by seven

companies are only 65% of April last year, the lowest in

last three years. Asahi Kasei Homes, which closed

exhibition sites, dropped by 40%.

March number was 77% but March last year was much

higher than usual year with 128% because of rush-in

orders before the consumption tax raise. This was the

highest in three years. March orders were almost flat with

January and February orders.

March is book closing month so that builders push sales

with some discount and buyers know this so they firm up

order in March unless there is any reason to wait after

March.

Major house builders say that potential buyers would

decide which builder they prefer after two to three months

of the visit but sales campaigns stopped in late February

and sales activities practically stopped for March and

April. Visitors to the exhibition sites in May are limited of

potential buyers with reservation so the number of visitors

was less than half of normal year. Number of visitors in

early May is normally the largest in a year and orders

would increase toward summer but this year is different

and future looks gloomy.

Lehman shock in September 2008 shook every sector of

economy and housing starts started dropping since

December 2008 and decrease of housing starts had

continued for 16 months to March 2010. Real recovery

started in summer of 2010 so it took nearly two years to

recover.

Housing starts in 2009, following year of Lehman shock,

were 788,410 units, 28% less than 2008 and the lowest.

Owner¡¯s units were down by 11% but condominiums were

58% less and units built for sale were 21% less.

Many condo builders went bankruptcy in this year.

Difference this time is that developers are more firm after

shaky ones are all gone.

Since human contact is now prohibitive, house builders are

losing contact with potential buyers and new measure

should be developed and one is virtual housing exhibition

named.

My home market¡¯ people who are looking for new house

can find favorite model house by internet or smart phone.

Number of access to the web site continues increasing

month after month. This could be a new way for marketing

houses but changing past business style is not so easy for

marketing people of house builders.

Supply adjustment by the national forest

Demand for domestic logs has been declining since last

March and the prices are dropping so four regional forest

management offices of North East, Kanto, Chuubu and

Kyushu decided to reduce log harvest.

For standing timber with cutting contract, time

limit is

extended for one year without any penalty so the

harvesters have option of cutting time. This should reduce

logs harvested only by restriction of time limit without any

market. It is unusual that multiple regional office decides

to reduce harvest uniformly. Other regions of Hokkaido,

Kinki chuugoku and Shikoku plan to have supply

adjustment meeting in May.

National forest regional office holds supply adjustment

meeting once every three month after investigation

through log suppliers, processing plants and forest unions

to find out demand and supply of logs with price trend

then it decides if the supply should increase or reduce.

Kyushu regional office is the first one to take step for

harvest reduction in March because log export to China

sharply decreased after corona virus pandemic so log

inventory is swelling up and log prices are dropping.

Other six regional offices were not aware of such crisis in

March yet but in April after the state of emergency was

declared, things changed so much that Kanto, North East

and Chuubu office held special meeting in late April to

decide supply reduction.

North East office reports that lumber demand suddenly

dropped and log inventory is increasing at yards, plywood

logs are oversupplied by production curtailment by

plywood mills and restriction of receiving logs by mills,

some paper manufacturing plants limit buying logs. Kanto

office reports drop of log prices and Chuubu office reports

future orders of lumber is uncertain and operation of

sawmills and precutting plants keeps dropping month after

month.

Only active field is biomass power generation business.

Supply shortage of logs for power generation is feared so

that timber with heavy percentage of low grade should not

be included for time limit extension since logs for biomass

power generation have been smoothly consumed and some

of plywood logs are sold as biomass logs.

South Sea (tropical) logs

Plywood mills using South Sea hardwood logs have ample

orders to supplement tight supplied hardwood plywood

from Malaysia and Indonesia and they carry two to three

months log inventory.

Log supply in April was satisfactory. It was feared that

entry restriction of foreigners for corona virus infection by

PNG may influence log supply but there is no serious

impact so far. Log harvest continues in Sarawak, Malaysia

but the volume is very limited. Movement of South Sea

lumber has been very inactive.

The supply is also low. Supply of Indonesian mercusii

pine laminated free board is low because of series of

holidays after Ramadan, Islamic fasting.

Wood supply statistics in 2019

The Ministry of Agriculture, Forestry and Fisheries

disclosed 2019 wood supply statistics.

Total log supply for lumber, plywood and wood chip

manufacturing was 26,348,000 cbms, 0.7% less than 2018.

Domestic log supply increased by 1.1% as log supply for

lumber and plywood manufacturing increased.

Imported log supply decreased by 9.0%. Share of domestic

logs in total log supply increased by 1.6 points to 83.1%.

Although housing starts in 2019 were 905,000 units, 3.9%

less than 2018, domestic log supply for lumber increased

by 2.5%. Imported logs for lumber decreased by 8.4% and

lumber import decreased by 4.5% so domestic logs

covered some of imported products share.

As to lumber shipment by use, that for construction

decreased by 2.7% but that for engineering works

construction, which is all domestic wood, increased by

18.4%. For plywood manufacturing, domestic logs

increased by 5.6% while imported logs decreased by

11.6%.

Since plywood imports decreased by 15.8%, domestic

share increased. Two plywood mills and one LVL plant

started in 2019, which contributed increase of domestic

wood consumption. By species, cypress increased by

35.0% and spruce and fir by 18.6%.

Logs for wood chip manufacturing are practically all

domestic wood, which was down by 7.0%. This is three

straight years decline. Imported wood chip increased for

2017 and 2018 but it decreased by 2.2% in 2019.

Domestic wood chip production decreased by 7.7%, the

lowest in last ten years. Demand of wood chip for

particleboard and hardboard was firm in 2019 but that for

pulp and paper decreased.

Imported log volume in 2018 was less than five million

cbms then in 2019, it was less than 4.5 million cbms.

Based on the forest and forestry fundamental plan set in

2016, target of domestic log supply and utilization for

2020 is 15,000,000 cbms for lumber manufacturing,

5,000,000 cbms for plywood and wood chip

manufacturing, six million cbms for fuel and one million

cbms for other use like export and mushroom farming,

making total of 32,000,000 cbms.

Based on 2019 result, accomplishing target volume for

lumber and wood chip for pulp looks very unlikely and

target for 2025 of 18,000,000 cbms for lumber and

6,000,000 cbms for pulp chip manufacturing seems very

remote.

|