|

Report from

North America

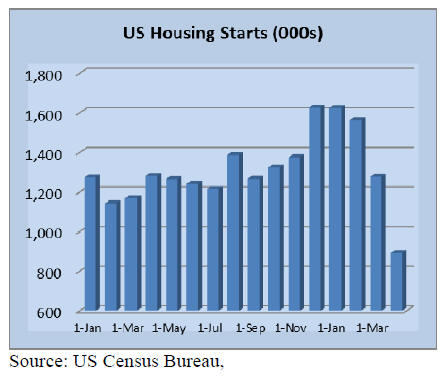

Housing starts plunge by the most ever

recorded

The Commerce Department reported that US housing

starts in April plunged by the most ever recorded as

sweeping lockdowns to contain the pandemic continued to

slam the housing market. Residential starts slumped 30%

from the previous month to a seasonally adjusted annual

rate of 891,000, the lowest level since 2015.

Building permits fell 21% from March to a seasonally

adjusted annual rate of 1.07 million, a five-year low.

The slump in applications to build was the biggest since

July 2008. Single-family housing starts dropped 25% to a

rate of 665,000, also a five-year low. Home building fell in

all four regions last month.

Next month's report may show a rebound in construction

as the housing market begins to stabilise. US homebuilder

sentiment rose by more than expected in May following a

record drop in April. In addition, mortgage applications

increased in the last weekly survey from the Mortgage

Bankers Association.

In related news, US Existing-home sales dropped in April,

continuing what is now a two-month drop in sales brought

on by the pandemic, according to the National Association

of Realtors. Each of the four major regions experienced a

decline in month on month and year on year sales, with the

Western US seeing the greatest dip in both categories.

Total existing-home sales dropped 18% from March to a

seasonally adjusted annual rate of 4.33 million in April.

Overall, sales decreased year on year by 17% from a year

ago (5.23 million in April 2019). April¡¯s existing-home

sales are the lowest level of sales since July and the largest

month on month drop since July 2010.

Homebuilder confidence posts solid gains

After the sharpest one-month drop in the history of the

index in April, homebuilder sentiment bounced back

slightly in May as US builders saw a quick rebound in

interest from buyers.

Confidence in the market for single-family, newly built

homes drove the index 7 points higher in May to 37

according to the National Association of Home

Builders/Wells Fargo Housing Market Index. Anything

above 50 is considered positive, so sentiment remains in

negative territory. The index stood at 66 in May 2019 and

hit a recent high of 76 in December 2019.

Sentiment plunged an unprecedented 42 points in April, as

the pandemic shut down much of the economy and job

losses soared. Homebuilding continued, deemed an

essential business but buyers pulled back decisively.

Now, buyers appear to be shopping again, in person and

virtually. Record low mortgage rates are also helping with

affordability.

Cabinet Sales up 5.4% for March

According to a press release from the Kitchen Cabinet

Manufacturers Association (KCMA)¡¯s monthly ¡®Trend of

Business Survey¡¯, participating cabinet manufacturers

reported an increase in cabinet sales of 5.4% for March

2020 compared to the same month in 2019. Sales of

custom cabinets increased 2.7%, semi-custom increased

slightly at 0.5%, and stock sales were up 9.4%.

The March numbers were strong as well. Cabinet sales

overall were up 12% compared to February with custom

up 11%, semi-custom sales up 10%, and stock sales up

14% compared to the previous month. Year-to-date

cabinet sales increased 6.4% overall with custom sales up

5.4%, semi-custom sales up 0.8%, and stock sales up

10.6%.

Survey participants include stock, semi-custom, and

custom companies whose combined sales represent

approximately 70 percent of the US kitchen cabinet and

bath vanity market.

See:

https://www.kcma.org/news/press-releases/march-2020-trend-of-business

Sawn hardwood prices fall then reverse direction

The cost of many construction materials has trended down

recently and hardwood sawnwood prices in April were

down almost 9% from a month earlier according to the

Bureau of Labor Statistics (BLS) Producer Price Index

Report for April. Falling energy prices were said to

account for much of the decline.

The April BLS price index of materials and components

for construction was down 0.3 percent from March, before

seasonal adjustment but still it was 0.5 percent higher than

a year ago.

However, rising demand stemming from a surge of do-ityourself

projects by consumers working at home coupled

with restricted supply due to mills operating at a lower

capacity led to an upsurge in sawnwood prices in April

according to the National Association of Home Builders.

Pandemic hits hardwood exports to China

In the first two months of 2020 the total export value of

US hardwoods to China and Southeast Asia was US$241.5

million, down 7.6% compared to the same period of 2019.

In the first two months of this year the value of hardwood

exports to China declined almost 15% year on year to

US$167 million. On the other hand, US hardwood exports

to the Southeast Asian markets showed a promising

growth despite the pandemic as export value reached

US$74.4 million, up 14% year on year with Vietnam

accounting for 84% of total hardwood exports.

|