|

Report from

Europe

EU tropical timber trade weakened before

COVID

lockdown

Having reached the highest level in more than a decade in

October 2019, EU27+UK trade in tropical wood and wood

furniture products slowed in the last two months of the

year, a trend which accelerated in January and February

this year. Contrary to expectations, with the large western

European countries implementing COVID-19 lockdown

measures during the month, EU imports of tropical wood

products picked up again in March this year.

However, the rise in March is almost certain to be

followed by a very large downturn in April and May with

the shutdown of large sections of the European economy.

During March, widespread reports emerged of timber

importers putting existing orders on hold for 30 to 60 days

and refraining from making new orders.

By the end of the month, importers were already

struggling to deal with a build-up of stock that could not

be shifted as manufacturers, retailers and construction sites

went into lockdown. The only question now is just how far

and for how long will trade decline in the months

following March.

Given current uncertainty, the market position reported

here cannot be taken as providing any real insight into

future trends. Instead, it is better viewed as a picture of the

baseline to measure the size of the expected fall when it

inevitably comes.

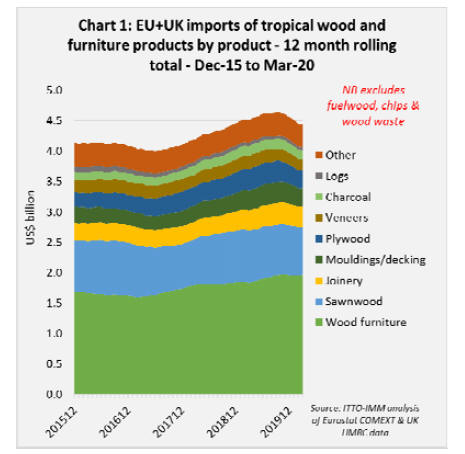

Chart 1 shows twelve monthly rolling total US$ value of

imports (to iron out seasonal fluctuations) from tropical

countries into the EU27+UK of all wood and wood

furniture products listed in HS Chapters 44 and 94

(excluding fuelwood, wood waste and chips).

After hitting a high of US$4.64 billion in October 2019,

the 12-month rolling total fell to US$4.45 billion in

February this year, a level maintained into March.

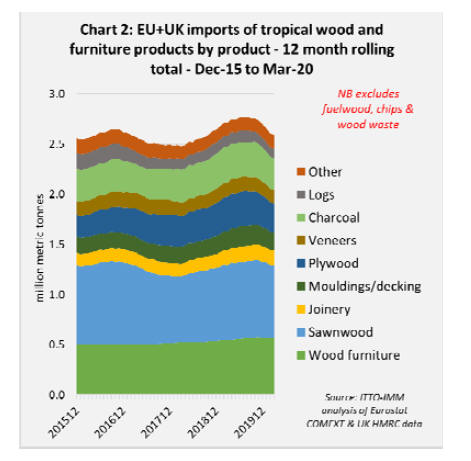

Chart 2 shows that the trend in import tonnage closely

matches the US$ value trend (implying it is not only due

to exchange-rate fluctuation). The 12-month rolling total

quantity of EU27+UK tropical wood and wood furniture

imports increased to a peak of 2.77 million tonnes in

August 2019 before slipping back to 2.60 million tonnes in

February this year, a level maintained into March.

The decline in European imports in the last quarter of

2019 and first two months of this year of course predates

any COVID-19 influence and coincides with a period of

broader slowdown in the EU economy. Both the eurozone

and the EU27+UK grew only 0.1 percent during the last

three months of 2019 compared with the previous quarter,

according to official statistics, the EU¡¯s worst performance

since the beginning of 2013.

All of Europe¡¯s largest economies deteriorated at the end

of last year, Germany and the UK recording flat growth,

and Italy and France seeing a 0.3% and 0.1% contraction,

respectively.

Various factors contributed including continued Brexit

uncertainty, slumping global trade, which hit European

exports, widespread strikes in France over President

Macron¡¯s pension reforms, and weaker domestic demand

for goods and services in Italy, alongside continuing

political difficulties. During this period, the euro also

continued to weaken against the US dollar, eroding the

purchasing power of European importers.

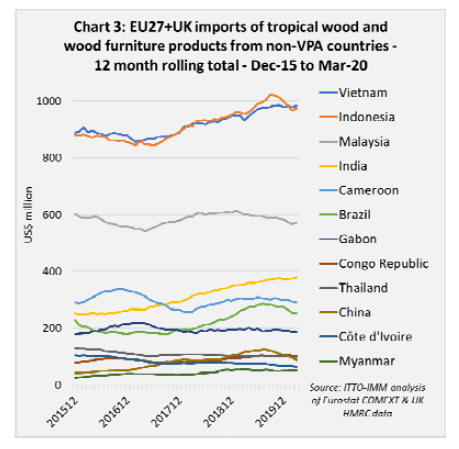

Considering EU27+UK imports of tropical wood and

wood furniture from individual tropical countries key

trends in the period just prior to the onset of COVID-19

pandemic (in declining order of significance in total EU

trade ¨C see Chart 3) include:

Imports from Vietnam, which were flat in 2016 and 2017,

increased consistently throughout 2018 and in the first

nine months of 2019, before levelling off in the last

quarter of 2019 and first quarter of this year. While

EU27+UK imports from Vietnam continue to be

dominated by wood furniture (HS 94), more recently there

has also been growth in imports of a range of other wood

products in HS Chapter 44, notably charcoal and other

energy wood, plywood, laminated wood, planed

sawnwood, and doors.

Imports of wood furniture from Indonesia made large

gains in the second and third quarter of 2019 and

maintained the high level through to the end of March

2020. In contrast to furniture, EU27+UK imports of

plywood, wooden doors, and mouldings/decking from

Indonesia slowed dramatically in the second half of 2019

after strong growth during the previous two years.

Imports of wood furniture from Malaysia also

strengthened in the 12 months to March 2020, but at

slower pace than for Indonesia and Vietnam. However, the

gains made by Malaysian furniture were offset by a

significant decline in EU27+UK imports of Malaysian

sawnwood and plywood. Malaysia was losing ground to

both Cameroon and Brazil in the EU27+UK market for

tropical sawnwood, and to China, Indonesia and Russia in

the market for hardwood plywood.

Imports from India were rising without interruption in the

period before the onset of the COVID pandemic in

Europe, hitting an all-time high of US$379 million in the

year to March 2020. Import growth has been continuous in

Germany, now the largest EU destination for Indian

products.

Imports from India mainly consist of wood furniture made

from local plantation species such as mango, sheesham,

acacia and rubberwood, often in rustic styles which are

hand-crafted.

EU27+UK wood imports from Cameroon, mainly

sawnwood destined for Belgium, continued their

rollercoaster ride, the volatility brought on by supply side

problems, notably shipment delays caused by bureaucratic

red tape and poor infra-structure after many years with

little or no investment at Douala, the country¡¯s only major

port. Between March 2018 and June 2019, imports from

Cameroon were rising, but then declined for the next nine

months to end March 2020.

EU imports of tropical wood products from Brazil,

comprising mainly of sawnwood and decking destined for

France, Belgium and the Netherlands, increased strongly

to a peak of US$286 million in the year ending August

2019 before falling back to US$251 million in the year

ending March 2020. Slow growth in the domestic

economy and the weak currency have encouraged exports

from Brazil in recent years.

However, EU27+UK imports began to weaken from the

middle of last year in response to Europe¡¯s slowing

economy and to tougher EUTR requirements imposed on

operators to demonstrate negligible risk of illegal harvest

for products originating in the Brazilian Amazon.

EU27+UK imports from Gabon were very volatile on a

monthly basis during 2019 and first quarter of 2020, but

overall, on an annual basis, were flat at around US$190

million. Imports into the EU from Gabon comprise mainly

veneer, mostly rotary veneer used to manufacture plywood

in France; sawnwood, much imported via Belgium; and

plywood, which goes mainly to the Netherlands and Italy.

EU27+UK imports of decking/mouldings from Gabon are

still low but have been strengthening.

EU27+UK imports from the Republic of Congo (RoC),

comprising sawnwood, logs and veneers, which were

rising consistently throughout 2018 and 2019, were easing

back in the first quarter of 2020 even before the onset of

the COVID pandemic. Much of the recent growth in

European trade with RoC has comprised logs and

sawnwood destined for Belgium and veneers destined for

France.

EU27+UK imports of timber products from Thailand

consist primarily of furniture, with smaller quantities of

plywood, fibreboard, and charcoal. The main European

destinations are the UK, Germany and France.

Total EU imports from Thailand were stable at an annual

level of just over US$100 million between June 2017 and

January 2020 but showed signs of slowing in February this

year even before the full effects of the pandemic became

apparent.

There was uninterrupted increase in EU27+UK imports of

plywood with a tropical hardwood face from China

between January 2017 and September last year, with US$

value rising from US$50 million to over US$120 million

during this period.

However, with a sharp deterioration in the European

market for plywood at the end of last year, imports had

fallen back to only US$88 million in the year to March

2020. Around two thirds of all EU27+UK imports of

Chinese tropical hardwood faced plywood are destined for

the UK.

After a period of stability in 2018 and the first half of

2019, the long-term decline in EU27+UK imports from

Côte d'Ivoire resumed in the second half of 2019 and

continued into the first quarter of 2020.

The recent decline has been particularly pronounced for

veneers into Italy and Spain, and sawnwood into Belgium

and the UK.

EU27+UK imports of wood products from Myanmar, after

rising from US$35 million in 2017 to US$53 million in

2018, remained at this higher level throughout 2019 and

the first quarter of 2020. Imports from Myanmar comprise

mainly sawnwood with smaller volumes of

mouldings/decking and veneer.

Imports from Myanmar have continued despite high

profile EUTR prosecutions of importers of Myanmar teak

(in Sweden and the Netherlands) and the conclusions of

the EC¡¯s FLEGT-EUTR expert group (most recently

reiterated at their 12 December 2019 meeting) that ¡°it is

not possible to come to a negligible risk of illegally

harvested timber from [Myanmar], in particular due to a

lack of sufficient access to the applicable legislation and

documentation from governmental sources¡±.

While imports from Myanmar into Germany, Belgium and

the Netherlands fell to negligible levels in 2019, these

declines were more than offset by a big rise in imports by

Italy, Greece and Croatia.

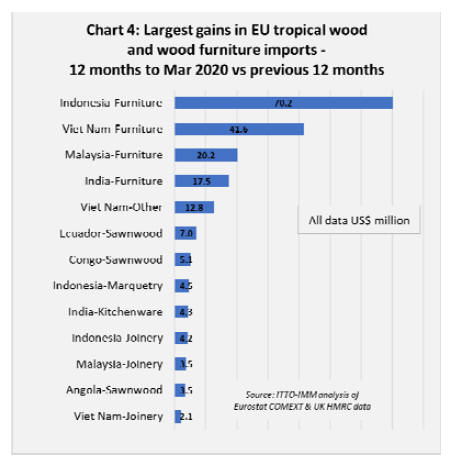

Overall shift to value-added products in EU 27 +UK

tropical imports

Overall, the biggest gains in EU27+UK tropical timber

product trade in the year to March 2020 are all in the wood

furniture sector, from Indonesia, Viet Nam, Malaysia and

India (Chart 4). Many of the other large gains during this

period were made in value-added product groups such as

marquetry, kitchenware, and joinery products.

Sawnwood from Ecuador also appears in the list of largest

gainers, probably balsa wood, an assumption made more

likely by the fact that most of the increase was destined for

Denmark and Germany, large manufacturers of wind

turbine blades for which balsa is a key raw material.

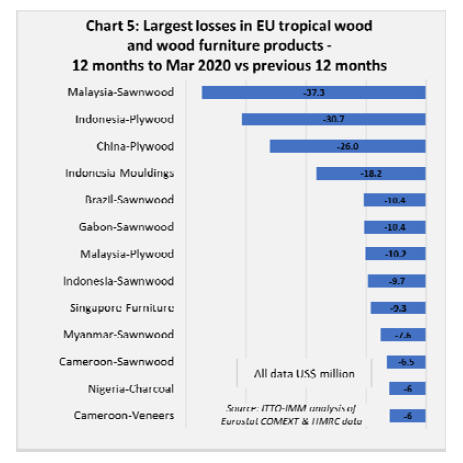

There is more evidence that the European tropical timber

trade in the period just prior to the COVID pandemic was

shifting towards more value-added products in the list of

the largest losers (Chart 5). The biggest declines in

EU27+UK imports in the 12 months to March 2020 were

almost exclusively in more traditional secondary

processed products such as sawnwood, plywood, and

mouldings/decking.

No pandemic impact in March trade data

The lack of any strong COVID signal in the tropical

timber trade data to the end of March is more obvious

from the monthly data. The period of COVID-19

lockdown in Europe began in Italy with an emergency

decree on 9th March covering the Lombardy region,

Italy¡¯s financial and industrial powerhouse. The Spanish

government followed with a general confinement order for

most of the country from 14th March. Then came

lockdowns in France (17th March), Belgium (18th March),

and the UK (23rd March).

The German Federal government did not implement a

nationwide lockdown in response to Covid-19, but during

March state governments across the country progressively

tightened restrictions on movement, prohibiting large

gatherings, calling on people to stay at home, and asking

that they observe other social distancing measures in an

effort to stop spread of the virus. However, the German

government also stressed the need to keep key sectors of

the national economy functioning and issued a decree

allowing construction activity to continue.

The Netherlands also stopped short of a complete

lockdown. Instead, in a series of measures issued on 12

March, the Dutch government asked that people stay at

home as much as possible, banned gatherings except those

¡°necessary to ensure the continued daily operations of

institutions, businesses and other organisations¡±, and

encouraged other social distancing measures.

In March and April, according to a report by Bollore

Logistics, European ports continued to operate despite

difficult conditions and containers were being processed

for onward movement, although clearances by some

customs authorities was slower and there were border

bottlenecks. Most shipping companies continued to

operate, although they were adding surcharges and

available space and equipment had become very restricted.

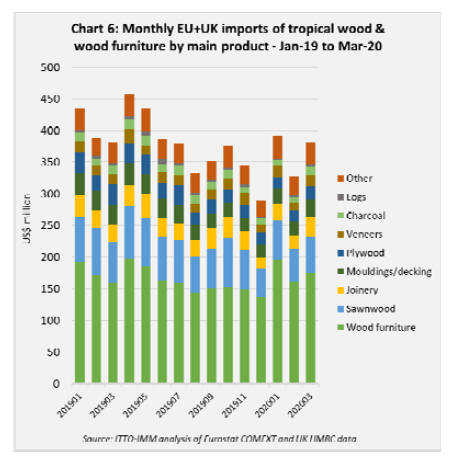

Chart 6 highlights that while EU27+UK monthly trade

was highly volatile in the last quarter of 2019 and first

quarter of this year, trade in March was significantly

stronger than in February, and not noticeably slower than

the same month in the previous year. Imports from

Indonesia were particularly strong in March this year, at

US$96 million, the third best monthly import performance

from Indonesia in the last 5 years.

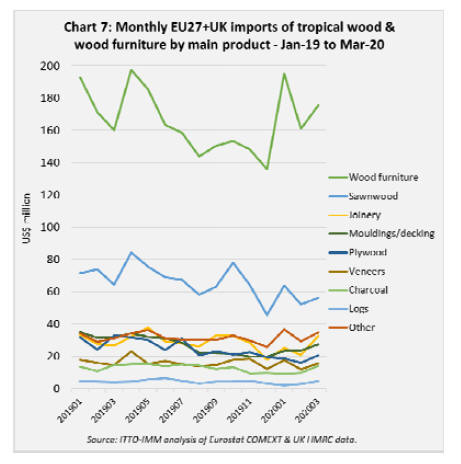

Chart 7 shows that EU27+UK imports of all tropical wood

and wood furniture products were higher in March than in

February this year.

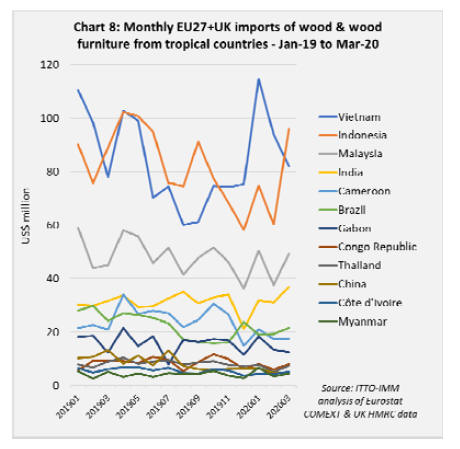

Chart 8 highlights that in March 2020, EU27+UK imports

of tropical wood and wood products from Indonesia and

India were particularly strong, while imports from most

other countries, with the possible exception of Vietnam,

were yet to show any signs of weakness brought on by the

COVID lockdown measures.

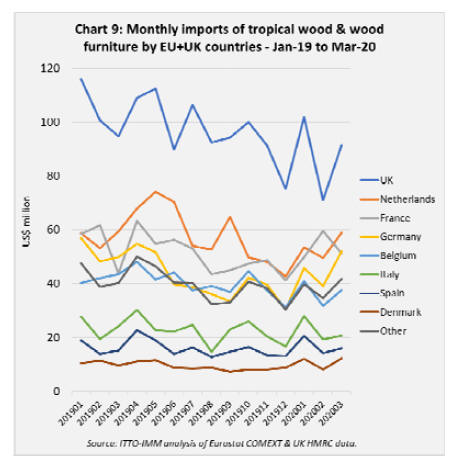

Chart 9 shows that nearly all the major European markets

imported more tropical wood and wood furniture products

in March this year compared to the previous month.

France was the only significant market to record a

decrease, but this followed a strong rise in imports in

February.

It would be wrong to read too much into this trade data

which only captures the very beginning of the lockdown

period. Indices of economic activity in the EU27+UK

plunged in April and were only recovering slowly in May

as the lockdown was eased in most European countries.

On 6th May, the EC predicted a decline in EU economic

activity this year of 7.5%, and slightly more than that for

the eurozone. The EC also warned the outcome could be

worse if the pandemic turns out to be longer or more

severe than currently envisaged.

The EC report outlines sharp falls in hard-hit countries

such as Italy, Spain and France ¡ª all of which will see

their GDP drop by more than 8% this year. In Greece and

Spain, the fall is forecast to be well over 9%. Even in

Germany, which has won praise for its handling of the

coronavirus crisis, the downturn is expected to 6.5% in

2020.

According to European Commissioner for the Economy,

Paolo Gentiloni, "in 2021 we expect a rebound of 6.1% in

the EU and 6.3% in the euro area ¡ª not enough to fully

make up for this year's loss". UK GDP growth this year.

On 7th May, the Bank of England forecast that UK GDP

would fall 14% this year and tentatively predicted a 15%

rebound next year if coronavirus restrictions can be lifted

without a causing a second wave of the virus.

|