US Dollar Exchange Rates of

25th

May

2020

China Yuan 7.1693

Report from China

Real estate sales in the first four months of 2020

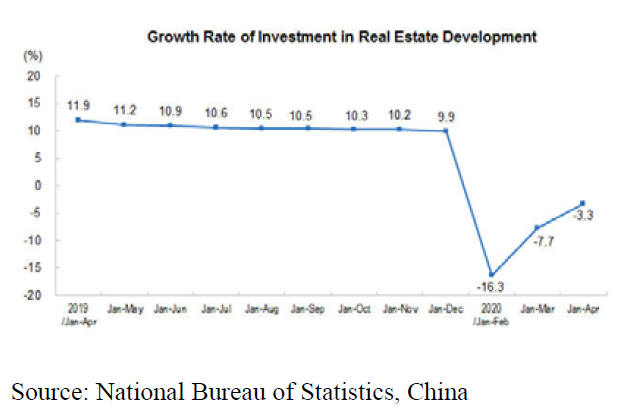

China¡¯s National Bureau of Statistics has reported that

investment in real estate development in the first four

months of 2020 was down 3.3% year on year and

investment in residential buildings dropped over 4% in the

same period. The value of land purchased for real estate

development in the first four months of 2020 was 12%

lower than in the same period in 2019.

See:

http://www.stats.gov.cn/english/PressRelease/202005/t20200518_1745962.html

Dramatic decline in log imports from ASEAN

China Customs data is showing that China¡¯s log imports

from ASEAN in the first quarter of 2020 were 14,209

cubic metres valued at US$16.5 million, a drastic decline

of over 90% in both value and volume compared to the

same period in 2019.

First quarter 2020 log imports from the main ASEAN

countries; Laos 7,417 cubic metres, Vietnam 1,753 cubic

metres, Cambodia 1,733 cubic metres and Indonesia 1,286

cubic metres were over 90% less than a year earlier.

China¡¯s log imports from ASEAN in 2019 totalled

179,468 cubic metres valued at US$174 million, down

34% in value and 29% in value respectively over 2018. In

2019 China¡¯s log imports from Laos dropped 30%,

Cambodia (-56%), Malaysia (-62%) and Vietnam (-62%).

Sharp decline in sawnwood imports from ASEAN

According to China Customs sawnwood imports from

ASEAN countries in the first quarter of 2020 totalled

862,056 cubic metres valued at US$254 million, down

81% in volume and 82% in value respectively over the

same period of 2019.

Over 75% of China¡¯s sawnwood imports are sourced from

Thailand alone and in the first quarter of 2020 they

totalled 675,457 cubic metres valued at US$186 million,

down 81% in volume and 82% in value respectively. A

further 7% of China¡¯s sawnwood imports come from the

Philippines (62,712 cubic metres valued at US$6 million)

but here too there was an over 80% decline in the first

quarter.

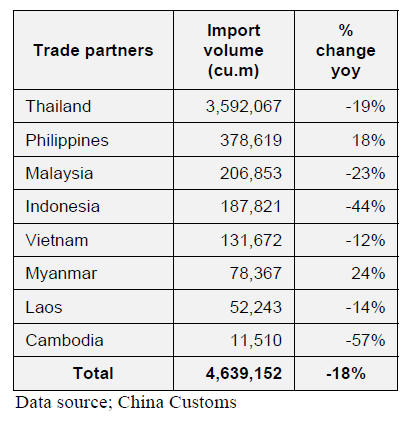

China¡¯s sawnwood imports from ASEAN in 2019 came to

4.64 million cubic metres valued at US$1.43 billion, down

18% in value and 28% in value over 2018.

In 2019, 77% of China¡¯s sawnwood imports were

imported from Thailand (3.59 million cubic metres valued

at US$1.04 billion) but there was a year on year decline of

19% in volume and 26% in value. In 2019 a further 8% of

China¡¯s sawnwood imports were sourced in the

Philippines and amounted to 378,619 cubic metres valued

at US$46 million, up 18% in volume and 5% in value year

on year.

Rise in plywood imports from Vietnam in 2019

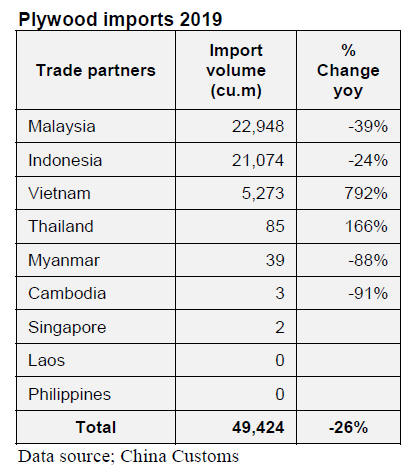

China¡¯s plywood imports from ASEAN in 2019 fell to

49,424 cubic metres valued at US$26.28 million, down

26% in value and 23% in value over 2018.

Imports from the main supply countries of ASEAN,

Malaysia and Indonesia declined in 2019. Imports from

Malaysia dropped 39% and from Indonesia there was a

decline of 24% (22,948 cubic metres and 21,074 cubic

metres respectively).

However, China¡¯s plywood imports from Vietnam in 2019

rose substantially in 2019 to 5,273 cubic metres.

Due to the impact of the pandemic, China¡¯s plywood

imports from ASEAN in the first quarter 2020 fell

dramatically to 9,840 cubic metres valued at US$4.66

million, down 80% in volume and 82% in value over the

same period of 2019.

Dramatic rise in plywood exports to Myanmar

in 2019

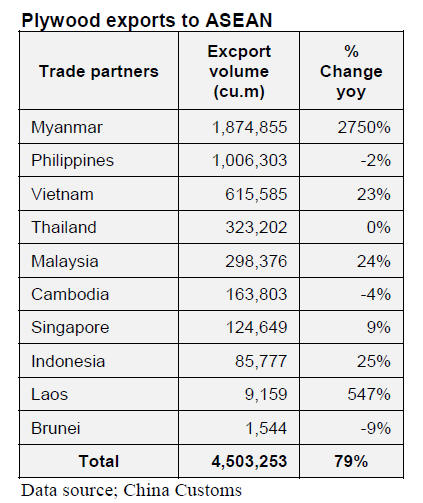

China¡¯s plywood exports rose to ASEAN countries in

2019 and totalled 4.5 million cubic metres valued at

US$1.01 billion, up 79% in volume but only 1% in value

over 2018.

Over 75% of China¡¯s plywood exports to ASEAN

countries were shipped to Myanmar, the Philippines and

Vietnam. Shipments to Myanmar rose dramatically to 1.87

million cubic metres, to Vietnam shipments rose 23% to

615,585 cubic metres.

However, China¡¯s plywood exports to the Philippines fell

2% to 1 million cubic metres in 2019.

In the first quarter 2020 China¡¯s plywood exports to

ASEAN fell dramatically to 418,415 cubic metres valued

at US$163 million, down 91% in volume and 84% in

value over the same period of 2019.

The main ASEAN importers (84%) of China¡¯s plywood

were the Philippines (130,812 cubic metres), Vietnam

(105,299 cubic metres), Malaysia (60,007 cubic metres)

and Thailand (57,235 cubic metres).

Furniture trade with ASEAN

The value of China¡¯s furniture imports from ASEAN

suddenly declined over 85% to US$30.95 million in the

first quarter of 2020. The main supply countries in

ASEAN, such as Vietnam, Malaysia, Thailand, Indonesia

and Laos saw exports plummet; Vietnam -90%, Malaysia

-87%, Thailand -84%, Indonesia -85% and Laos -87%.

The value of China¡¯s furniture imports in 2019 from

ASEAN countries also fell year on year dropping 19% to

US$2.62 billion. The main shippers in ASEAN, such as

Vietnam, Malaysia, Thailand, Indonesia and Laos saw

declines of 26%, 1%, 2%, 32% and 15% respectively.

Vietnam is the top furniture supplier to China accounting

for 42% in the first quarter of 2020 and 51% in 2019.

The value of China¡¯s furniture exports to ASEAN also

dropped sharply (-81%) to US$210 million in the first

quarter of 2020. Exports to Malaysia fell 75%, to the

Philippines -82%, to Singapore -86%, to Indonesia -79%,

to Thailand -81% and to Vietnam -89%.

In 2019 the value of China¡¯s furniture exports to ASEAN

were down 9% to US$1.115 with 96% of shipments being

made to Malaysia US$297 million, Singapore US$230

million, the Philippines US$193 million and Indonesia

US$122 million. However, the value of China¡¯s furniture

exports to Thailand and Vietnam rose 5% and 10%

respectively.

China/ASEAN particleboard trade

China¡¯s particleboard imports from ASEAN in the first

quarter of 2020 were 49,828 tonnes valued at US$11.29

million, down 83% both in volume and in value. Thailand

and Malaysia were the main ASEAN suppliers accounting

for 65% and 33% of all imports from ASEAN countries.

In 2019 China¡¯s particleboard imports from ASEAN were

297,651 tonnes valued at US$67.59 million, down 26% in

volume and 31% in value. The suppliers were Thailand

(158,340 tonnes) and Malaysia (117,650 tonnes).

In contrast, China¡¯s particleboard exports to ASEAN in

2019, at 46,989 tonnes valued at US$25.72 million, were

up 60% in volume and 21% in value year on year. China¡¯s

particleboard exports to ASEAN amounted to 9,840

tonnes valued at US$5.73 million, down 79% in volume

and 78% in value respectively in the first quarter of 2020.

|