4.

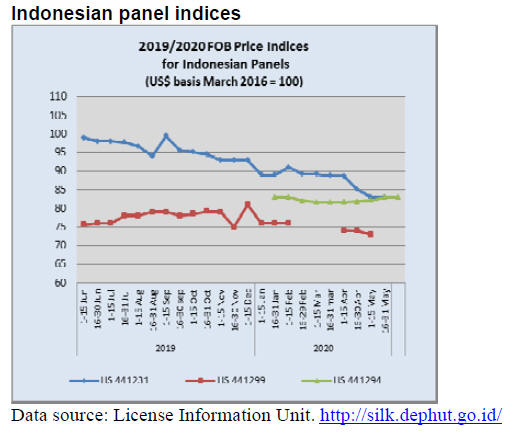

INDONESIA

Output from timber sector fell

around 10% in April

The current pandemic has put enormous pressure on

timber companies which have found the flow of orders

from international markets has collapsed.

The Chairman of the Association of Indonesian Forest

Concessionaires (APHI), Indroyono Soesilo, said that

output from the timber sector fell around 10% in April and

that he expects a steeper decline in May.

He commented that action by the government in relaxing a

range of regulations to ease the burden on companies is

helping with maintaining the work force.

He proposed some further steps including expanding the

implementation of the Timber Legality Verification

System (SVLK) at the global level, strengthening market

intelligence for Indonesian manufacturers, arranging

business meetings and trade missions, and boosting the

function of the Indonesia Timber Exchange (ITX).

The Indonesian Ambassador to South Korea, Umar Hadi

said the potential for expansion of Indonesian processed

wood products sales based on SVLK to South Korea offers

opportunities as South Korea has a law on ‘Sustainable

Use of Timber’. In addition, he said South Korea’s

economic growth depends heavily on international trade.

https://ekonomi.bisnis.com/read/20200518/99/1242254/dampakvirus-corona-pengusaha-hutan-berharap-pemulihan-pada-paruhkedua-2020

Upstream/Downstream integration would benefit

furniture sector

Wang Sutrisna, Finance Director of PT Integra

Indocabinet Tbk (WOOD), has said furniture sector

companies in Indonesia feel that government policies are

not encouraging growth in the sector and should be

reviewed.

See:

https://entrepreneur.bisnis.com/read/20200510/263/1238481/pentingnya-optimalisasi-industri-mebel-dari-hulu-ke-hilir

Wang said that despite having a huge potential there is a

lack of upstream/downstream integration in the sector

which in other countries delivers many benefits.

SVLK important for boosting exports

The Coordinating Minister for Maritime Affairs and

Investment, Luhut Binsar Pandjaitan, stressed the

importance of the Timber Legality Verification System

(SVLK) related to sustainable forest management to meet

export market demand for verification of legality.

In related news the Minister of Industry, Agus Gumiwang

Kartasasmita, proposed that SVLK be mandatory in the

upstream wood processing industry but voluntary in the

downstream wood processing industry as this would ease

the burden on SMEs.

The Secretary General of the Ministry of Environment and

Forestry, Bambang Hendroyono, said the Ministry plans to

make it easier for SMEs to comply with the SVLK

regulations and would be providing incentives for the

SME sector.

51 million hectares of protected areas

Siti Nurbaya, Minister of Environment and Forestry said,

at a panel discussion during the ‘World's Forests 2020’

(SOFO 2020) hosted by FAO, that while Indonesia's

annual deforestation was over 3.5 million hectares in the

period 1996 to 2000 it has fallen sharply to 0.44 million

and will continue to fall.

Deforestation rates have declined sharply during the

period of the present government which is committed to

meeting global targets for forest security.

The Minister said Indonesia has 51 million hectares of

protected areas or more than 28% of the land and her

ministry is working hard to develop a protected area policy

to connect fragmented animal habitats separated due to

concession allocations.

See:

https://republika.co.id/berita/qar1o5330/deforestasimenurun-bukti-komitmen-pemerintah-lindungi-hutan

5.

MYANMAR

Pandemic update

As of 27 May 2020 there were 206 confirmed cases out of

21,593 tested since the first case was confirmed on 23

March. Yangon is the ‘hot-spot’ with 161 cases, of which

82 are being treated in hospital.

The authorities in Myanmar warn that the country is likely

to face a surge in cases because of the scheduled

repatriation of about 30,000 migrant workers from

Thailand. All returnees will be required to stay at

quarantine centres for 21 days.

Myanmar has not implemented a lockdown as yet but

transportation between Yangon and other cities remains

restricted and only a few domestic air routes are operating.

In Yangon only some areas have ‘stay home’ restrictions.

Other measures in the city include a ban on gatherings of

more than five people and social distancing. Restaurants

remain closed but shopping malls have re-opened but with

limited operating hours.

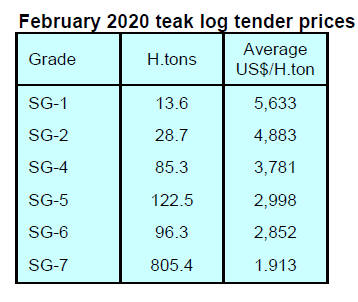

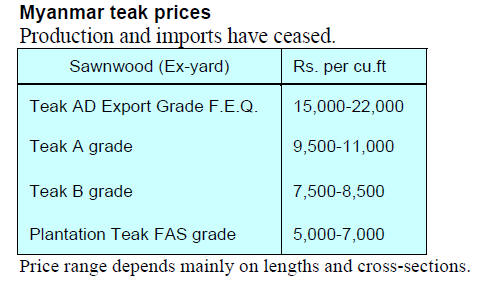

Tender sale postponed again – millers fear log

shortage

As a result of the suspension of the Myanma Timber

Enterprise (MTE) log tender sales for the three months

from March to May, manufacturers have started to worry

about a hardwood and teak log shortage.

Usually the tender sale in April is suspended because of

the Myanmar New Year Holiday but this year the

extended suspension of sales is likely to cause a problem

for export millers.

The MTE also suspended tender sales for logs and

sawnwood destined for domestic consumption which are

priced in Myanmar Kyats. Analysts comment that the

MTE must be facing financial problems as there has been

no income for three months. According to manufacturers

in Myanmar, MTE has, in an effort to assist timber buyers,

extended the repayment schedule for at least another one

month from end of May.

According to The Confederation of Trade Unions in

Myanmar (CTUM), 47 factories in Yangon have either

closed or reduced their workforce, making 6,355 factory

workers redundant. Most are from the garment sector and

so far there have been no shut-down in the wood products

sector.

CTUM says at least 10 more factories have reduced their

workforce since it compiled its figures, some of them

temporarily but others permanently.

Some of wood industries have reduced their workforce

laying off mainly daily wages workers, the most

susceptible in this downturn. A few timber plants have

reduced the number of working days and some have

allowed voluntary resignation.

State Counsellor Daw Aung San Suu Kyi has said

rebuilding employment opportunities will be at the top of

the agenda in the post-coved period.

See:

http://www.mizzima.com/article/over-6300-factoryworkers-yangon-region-lose-jobs

Illegal timber seized

The local media has quoted the Director of the Forest

Department in the Mandalay Region as reporting seizure

of over 1,400 tons of illegal timber in the region in the first

five months of this year. The seized timbers comprised

over 200 tons of teak, over 200 tons of other hardwoods

and close to 1,000 tons of other timber products.

Zaw Win Myint, Director of the Forest Department, said

concerted action in cooperation with other Departments

against smugglers can greatly reduce illegal logging and

smuggling.

This year there have been 421 smuggling cases in which

120 smugglers were arrested and 66 various types of

machinery seized.

Ethnic groups urged to conduct virus health education

The Peace Commission and Committee for Coordination

with Ethnic Armed Organizations has presented medical

supplies to the Ethnic Armed Organizations (EAO) in

Yangon.

Dr. Tin Myo Win, Chairman of Peace Commission and

Committee for Coordination with Ethnic Armed

Organizations, urged the ethnic groups to conduct virus

health education based on the medical advice from the

Ministry of Health and Sports. Dr. Tin Myo Win urged the

ethnic groups to effectively use the medical supplies for

fighting against the virus.

IMF Loan

Myanmar’s Union Parliament approved a proposal to seek

US$700 million in loans from the International Monetary

Fund (IMF) to plug budget deficits resulting from

increased spending on economic recovery, health sector

improvements and social security.

Myanmar has forecast the budget deficits to widen this

fiscal year made worse by the extra spending needed to

mitigate the impact of pandemic on the economy.

U Maung Maung Win, Deputy Union Minister for

Planning, Finance and Industry, said the government needs

to increase stimulus spending to revive the economy,

upgrade the health sector and provide cash and food for

low-income households even as government income

declines.

In related news Myanmar will also receive some US$1.8

billion in financial support for development projects from

the Asian Development Bank.

6. INDIA

Powerful cyclone causes immense

damage

The powerful cyclone (Amphan) that slammed into the

coastal region on the India/Bangladesh boarder is said to

have caused damage estimated at US$13.2 billion dollars

in West Bengal alone according to the state government.

Pandemic update

There were 66,330 serious coronavirus patients in India as

of 20 May. Happily around 40% of the total had

recovered. Maharashtra is badly affected and continues to

report high numbers of cases. It was the first state to

confirm over 40,000 coronavirus cases. Delhi, the national

capital reported 11,659 cases.

However Tamil Nadu had the highest number of

coronavirus cases (13,967) after Maharashtra. The

Lockdown in India was extended until 31May 2020.

Analysts write “the public and trade are tired as the

economy suffers for want of action. Workers have been

frustrated and millions of them have left their work sites

and returned to their home states. The industry feels that

their return, even when the lockdown ends, will take time

so it is very doubtful the industry can return to normal

quickly”.

The government has announced plans for a further easing

of restrictions. From 8 June, restaurants, hotels, shopping

centres and places of worship will be allowed to re-open in

the least affected areas but in areas with a high numbers of

infections the lockdown will remain.

Over half the timber mills in Kandla remain closed

The timber industries in Kandla import annually around 4

million cubic metres of timber accounting for

approximately 65% of India’s total timber imports. There

are nearly 2,000 saw mills and more than 100 plywood

units in the proximity of Kandla port where 80,000-

100,000 direct labourers are employed.

Despite the central government’s easing of restrictions of

work it is estimated that well over half the mills in Kandla

remain closed and commentators in India say it could take

years for industrial output to get back to pre-crisis levels

as demand has collapsed.

When the timber mills closed thousands of workers were

laid-off and headed back to their home states to wait out

the crisis. Navneet Gajjar, president of Kandla Timber

Association has been reported in Financialexpress.com as

saying it could take at least a year to bring normalcy in the

industry as those labourers who have gone back to their

states will not return for 5 months.

The other problem facing the industry is the huge stock of

imported timber at the ports awaiting collection. Importers

say, currently, they cannot pay the 18% GST and 5%

import duty in which case the timber the timber would go

to Custom bonded warehouses. Eventually the importers

will have to collect the timber and at that time will be

presented with a extra bill for storage.

For more see:

https://www.financialexpress.com/industry/asias-largest-timberindustry-incurs-rs-1500-crore-loss-due-to-coronavirus/1958302/

US urged to relocate from China to India

The US is currently exploring with India, Australia, Japan,

New Zealand, South Korea and Vietnam options on

diversifying supply chains to eliminate dependence on

China to create what has been dubbed an “Economic

Prosperity Network” of trusted partners.

To drive this initiative the Indian government has been

discussing with US companies amendments to the tax and

labour laws that would make India a favoured destination

for companies. Several Indian states have taken the

initiative to streamline investment procedures and are

looking for the central government to keep up the

momentum on this initiative.

Read more at:

https://economictimes.indiatimes.com/news/economy/foreigntrade/india-looks-to-lure-more-than-1000-american-companiesout-ofchina/articleshow/75595400.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

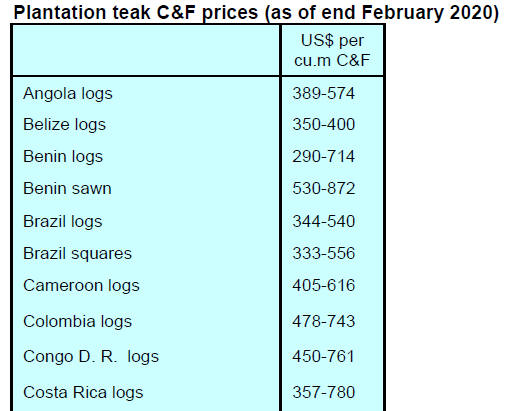

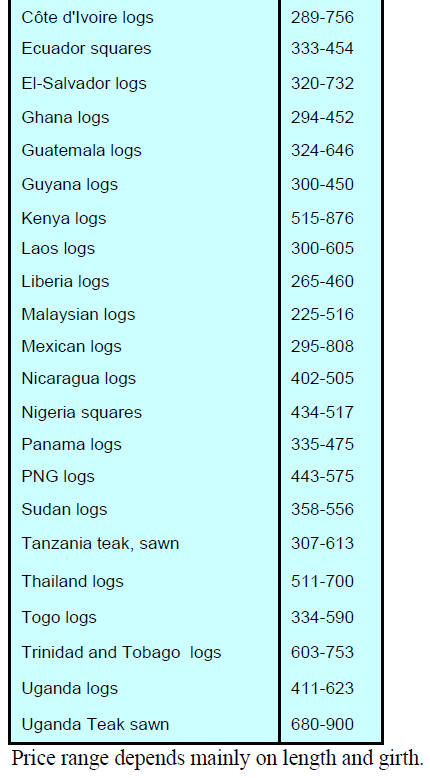

Plantation teak

Due to current international situation new business

transactions are at a stand-still. C&F prices have not been

updated as there has been no trade.

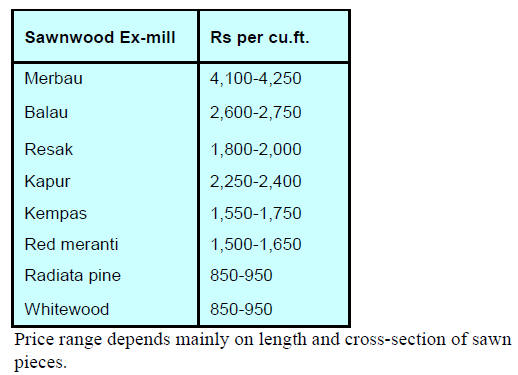

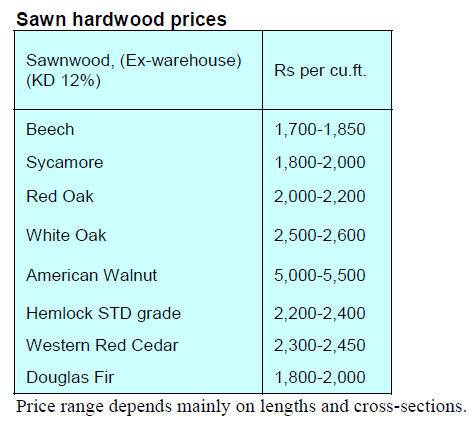

Locally sawn hardwood prices

Production and imports have ceased.

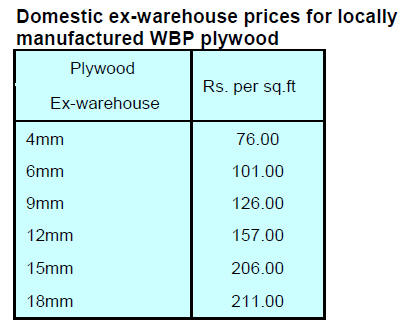

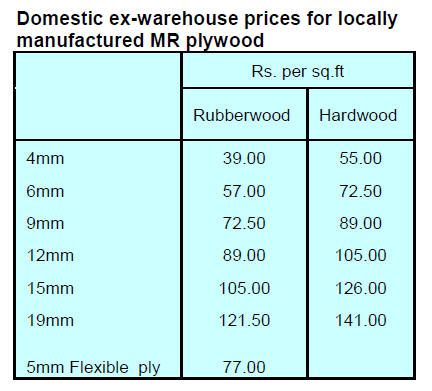

Plywood

Production and sales have ceased due to the Lockdown in

heavily affected areas and most of the workers have

moved back to their states. But in some states where the

virus spread is minimal, resumption of production has

been permitted but few mills are taking advantage of this.

Recently the Karnataka and Kerala Plywood

Manufacturers Associations meet to consider how to

respond to the current situation and announced the

intention to increase plywood prices to cover the

anticipated increased cost of labour, timber and chemicals.

As most other states are under lockdown price adjustments

are still under consideration and the final picture will

emerge only after the Lockdown is lifted over the entire

country.

7.

VIETNAM

COVID 19 update

As of 25 May Vietnam’s Ministry of Health confirmed a

total of 325 cases of the corona virus of which 267 have

recovered and been discharged from hospital. No deaths

have yet been reported. Between 16 April and 25 May no

new cases caused by community transmission have been

recorded.

The government is maintaining its suspension on entry

into Vietnam by non-nationals, including people with a

Vietnamese visa exemption certificates. Only Vietnamese

nationals, diplomats and designated highly skilled workers

are allowed to enter the country. All persons entering

Vietnam must undergo medical checks and 14-day

quarantine upon arrival.

Economic growth prospects

The International Monetary Fund has stated that

Vietnam’s economic growth may slow to belowr 3% this

year but may pick up to 7% in 2021. Vietnam has entered

a “new normal” as the Government has allowed the

reopening of businesses including non-essential services

except for entertainment businessses.

Timber industry among those most affected by

pandemic

According to VIFOREST, the timber sector is expected to

resume its growth momentum from the third quarter of

2020.

At a recent meeting to decide on support for the timber

sector, Dr. Nguyen Xuan Cuong, Minister of Agriculture

and Rural Development, highlighted 4 measures to boost

post-covid recovery in the timber industry.

Policy interventions to support over 5,000 sector

enterprises in accessing the government’s

US$10.8 billion credit support package, lower

interest rates, delay in the collection of taxes and

land fees and financial assistance for employers

and employees.

As Vietnam has emerged as one of a few

countries effectively managing the impact of the

virus support will be provided to capture market

opportunities in those consumer countries that are

resuming business activities. Encouragement will

be given to initiatives such as trade fairs and

other forms of off-line trade development as well

as online marketing of wood products.

The industries in the sector will be assisted to

review and revise their business strategy to adapt

to the “new normal” as preparation for the

anticipated economic ‘take off’ beginning in the

third quarter of this year.

Support for restructuring of the sector toward

sustainable development through promoting large

timber plantation establishment, diversification of

export markets and intensifying value adding of

made-in-Vietnam wood products and developing

Vietnam as a world leader in wooden products.

Vietnam intends to deepen integration into the global

wood product supply chain with well-developed brands

and highly ethical corporations. The Minister also mention

the opportunities in the domestic market of almost 100

million wage earners.

For more see:

http://tongcuclamnghiep.gov.vn/LamNghiep/Index/bon-nhomgiai-phap-lon-khoi-phuc-nganh-go-4183

First Vietnam Forest Certification certificates granted.

On 17 May 2020, the Vietnam Administration of Forestry

(VNFOREST) granted the first domestic forest

certification certificates to 3 companies in the Vietnam

Rubber Group (VRG). These first certificates cover 11,400

ha. of rubber plantations managed by Binh Long, Phu

Rieng and Dau Tieng Rubber Companies.

In 2019, Vietnam became 50th member of PEFC and the

Vietnam Forest Certification Scheme (VFCS) was

recognised worldwide. Achieving these first VFCS has

marked a turning point in the cooperation between

Vietnam and PEFC.

See:

https://en.nhandan.com.vn/business/item/8676602-first-114-000-ha-of-rubber-recognised-with-sustainable-forestmanagement-certificate.html

8. BRAZIL

Pandemic control measures by Federal

government

and action by companies in the forest sector

The increase of corona virus cases in Brazil has put

pressure on the Federal Government to adopt more active

measures to contain the spread. However, the most

effective procedure, according to the Ministry of Health, is

social isolation.

The role of the Federal Government in support of

businesses has, so far, been limited to the release of

credits, financial resources and the temporary suspension

of some taxes while the State Governments are responsible

for effective control measures.

As for the forest sector, the main measures adopted by the

Federal government are as follows:

“Corona-voucher”: Law 13.982/20 provides an emergency

basic income of R$600 to informal, self-employed and

those workers without fixed income.

Credit for employment maintenance: Provisional Measure

no. 935/2020 releases a credit of R$51.6 billion for

employment maintenance. The amount is earmarked for

the implementation of the "Emergency Benefit for

Employment and Income Maintenance".

This programme aims to reduce the social impacts related

to the pandemic through the payment of financial aid to

workers who have reduced working hours or suffered

contract suspension.

A measure to support those whose working hours and

wages have fallen (Provisional Measure no. 936/2020)

aims to prevent mass layoffs due to the virus. This

arrangement allows companies to negotiate with

employees for up to 70% of the employee's working hours

and wages without the intervention of labour unions and

will run for three months. This measure creates a top-up

benefit paid by the government and provides employment

stability.

According to Provisional Measure No. 938/2020, ‘Release

of financial resources for states and municipalities’ the

Federal government will release up to R$16 billion to

states and municipalities for four months. The funds

guarantee the maintenance of funding made available last

year even with the fall in Federal and State revenues.

Administrative Ordinance n° 897/2020,’ Suspension of

FGTS payment’ provides for the suspension of FGTS

payment (Fund for Employment Time Guarantee/Fundo

de Garantia do Tempo de Serviço) for March, April and

May.

Zero IOF on credit: Decree n° 10.305/2020 reduces to zero

the ‘Tax on Financial Operations’ (IOF - Imposto sobre

Operações Financeiras) charged on credit operations.

Currently, the IOF for credit operations is 3% per year.

Some companies in the forestry sector have been helping

the public. For example Suzano Papel e Celulose, a

Brazilian pulp and paper conglomerate announced that it

will start distributing 159 respirators and 1 million face

masks.

Klabin, the biggest paper producer, exporter and recycler

in Brazil started construction and purchased equipment for

the immediate installation of 10 ICU beds and 40

infirmary beds at the Telêmaco Borba regional/ Campaign

Hospital.

Veracel Celulose joined with partner companies to donate

more than 86,000 health and hygiene items to the health

departments of the municipalities of Porto Seguro and

Eunápolis.

Bracell, another pulp sector company donated 18

respirators, 350,000 face masks, 40,000 medical aprons,

33,500 surgical gloves, 680 face shields, 250 medical

goggles, 164 protective coveralls and 4,000 cleaning and

hygiene items to states where it operates.

Crisis in the Bento Gonçalves furniture cluster

With revenues of R$384 million in the first quarter 2020

the Bento Gonçalves furniture cluster recorded a 3.3%

decrease in revenue compared to the same period in 2019.

However, the decline in revenue at 1.38% in the first

quarter for all sectors in the state of Rio Grande do Sul

was not as high as in the furniture sector.

The March figures were particularly bad according to the

Secretariat of Finance in Rio Grande do Sul. March data

was negative and it is likely that this will continue into

April.

The performance of the international trade sector also

weakened dropping over 7%, driven down by the over

35% quarter on quarter drop in trade with the US in 2020.

According to the Furniture Industry Association of Bento

Gonçalves (Sindmóveis) an improvement is expected from

the second half of the year, with economic activity

recovering from the 3rd and 4th quarter of this year but job

recovery will extend into 2021.

According to the Furniture Industry Association of Bento

Gonçalves (Sindmóveis) the Bento Gonçalves furniture

cluster includes about 300 industries in the municipalities

of Bento Gonçalves, Monte Belo do Sul, Pinto Bandeira

and Santa Tereza and many are already feeling the effect

of the pandemic on their businesses.

First quarter exports are not encouraging says Sindmóveis

and there have been around 2,600 layoffs by furniture

companies in Bento Gonçalves and around 40% of the

companies have introduced reduced working hours.

The Brazilian Association of Furniture Industry

(ABIMÓVEL) commented that the furniture sector was

the eighth largest production sector in the country and is a

major employer with some 260,000 direct jobs in the

sector.

ABIMÓVEL expects that things could worsen if there is

no quick recovery of the economy, if trade does not

resume, if credit lines are not made available and if

support for micro, small and medium-sized companies is

not provided.

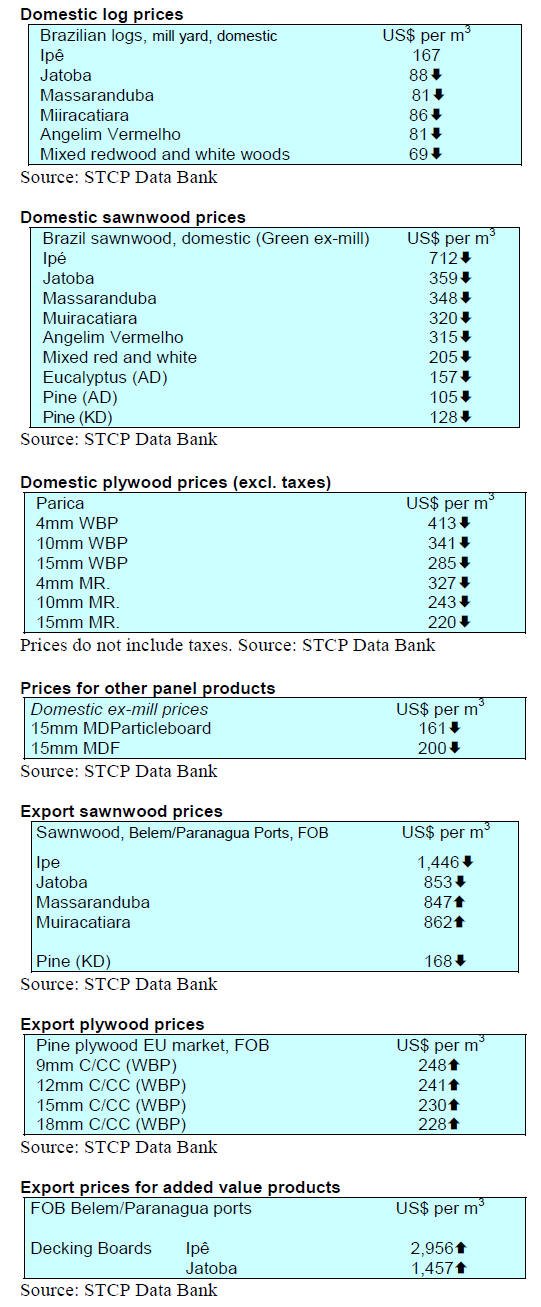

Export update

The value of April 2020 exports of wood-based products

(except pulp and paper) declined around 3% compared to

April 2019, from US$245.8 million to US$239.0 million.

April pine sawnwood export values were slightly down

year on year from US$46.0 million to US$45.6 million

this year. In contrast export volumes increased 11.0% over

the same period, from 221,300 cu.m to 245,600 cu.m.

The volume of tropical sawnwood exports decreased year

on year a massive 30% in April, from 45,200 cu.m in

April 2019 to 31,400 cu.m in April 2020. The value of

exports also dropped by about the same percentage

US$18.5 million to US$12.6 million over the same period.

Pine plywood exports bucked the downward trend

increasing 24% in value in April 2020 compared to April

2019, from US$40.1 million to US$49.9 million. The

volume of exports also rose jumping over 35%

from147,800 cu.m in April 2019 to 200,900 cu.m in April

this year.

However. Both the volume and value of tropical plywood

exports dropped in April. The volume was down 29%) and

the value dropped 19% from 8,600 cu.m (US$3.2 million)

in April 2019 to 6,100 cu.m (US$2.6 million) in April

2020.

The export market for wooden furniture has weakened

sharply and the value of exports declined from US$44.4

million in April 2019 to US$25.8 million in April 2020,

almost a 42% drop.

Brazil-US trade facilitation

The Brazilian timber industry, represented by the Brazilian

Association for Mechanically Processed Timber

(ABIMCI), recently sent a written request to the

governments of Brazil and the United States urging both

sides to facilitate trade and good practices between the two

countries.

This came about because of the joint initiative of the

Business Coalition for the Facilitation of Trade and

Barriers (CFB), led by the Brazilian National

Confederation of Industry (CNI), the US Chamber,

Amcham and 28 other entities, including ABIMCI.

The request includes binding commitments in priority

areas such as customs modernisation and trade facilitation,

good regulatory practices, electronic commerce and

combating corruption. The Coalition believes that a

proposal for a trade modernisation agreement could be

reached without the need for the involvement of Mercosur

or legislation of the United States.

The document also states that, if implemented, the

proposal would reduce costs, increase trade and bilateral

investment and would also represent a first step towards a

more comprehensive future trade agreement.

According to ABIMCI, this initiative is timely due to a

close relationship between the two countries and because

the current pandemic is affecting the economies of both

countries significantly. Joint action in areas that enable

better synergy for businesses would be beneficial, says

ABIMCI.

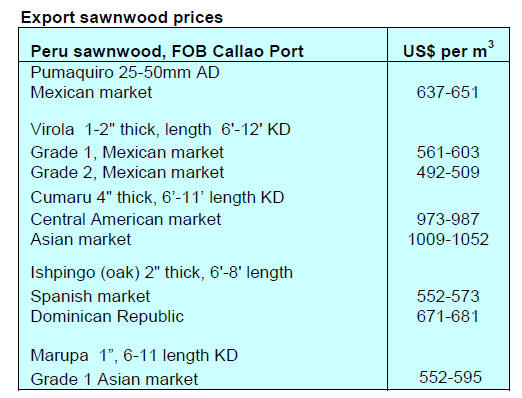

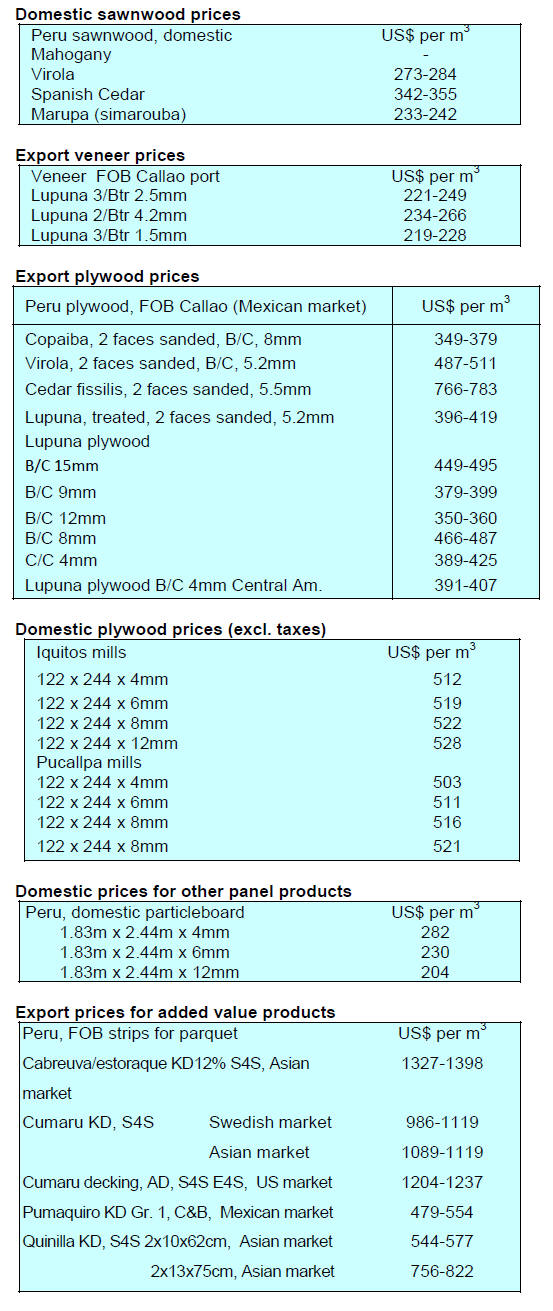

9. PERU

January exports down 20%

The Exporters Association (ADEX) has reported that in

January Peruvian timber exports were worth US$9.1

million FOB, this represents an almost 20% decline from

the US$11.2 million export earnings in January 2019. In

January 2020 exports of semi-manufactured products

accounted for 54% of total exports while sawnwood

accounted for a further 37% share. The export value of

both groups of products was down year on year.

Of the US$9.1 million exported in January, China was the

main market with a 43% share which was up significantly

year on year. Mexico was the second largest market in

January with 12% share but here export earnings dropped.

Other markets of note were France and Denmark.

Expansion of certified forests

Despite the difficult times the world is facing due to the

pandemic initiatives to protect and responsibly harvest

tropical forests continue. FSC forest management

certification has expanded steadily in Peru as companies

and communities adopt more responsible harvesting

strategies. This year two new certified areas located in the

Ucayali region have been reported.

Online legal timber information system

The National Forest and Wildlife Service (Serfor) has

announced that in early 2021 its online system to help

verify the legal origin of Peruvian timbers will be

operational. The National Forest and Wildlife Information

System (MC-SNIFFS) will collect and report the

information generated at each stage of the production

chain from origin to market.

Recently a review was conducted with managers and

specialists from Serfor and the regions with technical

support provided by the USAID Pro-Bosques Project. To

ensure efficiency and transparency efforts are being made

to develop an effective and integrated computer system.

In the coming months a review processes will be

conducted with forest managers in the Loreto, Ucayali,

San Martín and Madre de Dios regions in order to

consolidate a proposal for Serfor and the regional

authorities in the Peruvian Amazon.