|

Report from

North America

Survey finds 63% of US wood manufacturers

remain

operational

A recent survey by the Wood Component Manufacturers

Association provides insight into the challenges faced by

member businesses in the midst of the pandemic.

Forty-nine companies, including manufacturers of interior

wood components, architectural wood components,

furniture components, lumber and dimension stock, and

technology, equipment and tool providers, responded to

the survey, which was conducted in April.

When asked if their companies were open or closed for

business, 63% said their operations remained open as

essential businesses. Allowed to choose multiple

responses, more than 65% said their manufacturing facility

and offices were open as they complied with current social

distancing requirements, while 14% said they were open

for important appointments only.

Of those businesses classified as closed, approximately

20% had essential personnel reporting to the facility while

others worked from home, 8% reported it had some staff

working from home, and 6% said they were fully closed

except for emergencies.

See:

https://www.woodworkingnetwork.com/news/woodworkingindustry-news/survye-reveals-impact-covid-19-componentsmanufacturing-industry

Despite pandemic imports of hardwood products

rebounded in March

US imports of wood products rebounded in March, albeit

to still-diminished levels, after a dismal February. Imports

of tropical hardwood, plywood, veneer, flooring and

mouldings all saw gains in March.

However, imports from China fell steeply across the board

even after several months of decline while imports from a

number of countries rose sharply to fill the need,

suggesting that US importers are modifying their supply

chains.

The import data is encouraging considering that March

was the first month where businesses across the US were

under severe restrictions.

However, it is too soon to say what the full economic

effect of the pandemic may be on the US where to

infection and mortality rates are the highest in the world.

Much of the U. wood products industry remains operating

as the US Department of Homeland Security has identified

the industry as an essential critical infrastructure

workforce in the nation¡¯s response to the coronavirus

pandemic.

US sawn tropical hardwood imports rise

US imports of sawn tropical hardwood recovered

somewhat in March, growing by 28% from February¡¯s

record low. The 12,950 cubic metres imported is more

than one-third less than that of March 2019.

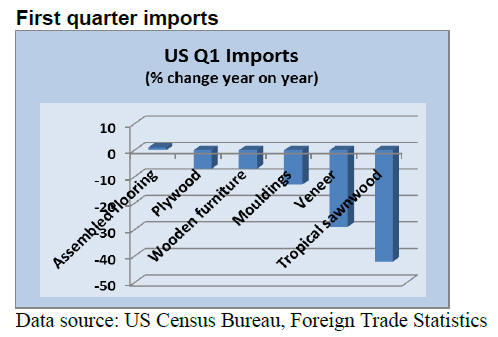

Through the first quarter of 2020, imports are down 42%

year to date. Imports from Ecuador fell by 14% in March

and are down 74% year to date. Imports from Brazil,

despite increasing by 62% in March, are 40% behind 2019

year to date.

Imports of jatoba, sapelli, ipe, and acajou d¡¯Afrique all

rebounded in March, but remain well behind last year¡¯s

imports year to date. Imports of balsa fell by 18% in

March and lag 2019 by 74% year to date.

Canadian Imports of tropical hardwood fell by 5% in

March but remain 4% ahead of 2019 year to date. Imports

to Canada from Ecuador more than doubled in March to a

level not seen in nearly three years. Canadian imports

from Ecuador are up more than nine-fold over 2019 year

to date.

Surge in hardwood plywood imports

US imports of hardwood plywood grew by 29% in March.

The volume was nearly 8% higher than that in March 2019

and was up 6% over 2019 year to date. Imports from

China fell by 67% in March and year to date are only half

of last year¡¯s first quarter total. Imports from Indonesia

and Ecuador were up sharply in March.

Italy tops list of veneer shippers to US

A surge in imports from Italy helped US Imports of

tropical hardwood veneer recover from a dismal February

as March imports rose by 56%. Despite the gain, the

month¡¯s imports still lagged behind March 2019 import

levels by over 30%.

Imports from Italy more than quadrupled in March and

imports from Cote d¡¯Ivoire more than doubled. Imports

from several other countries were also volatile, but in the

negative direction: imports fell sharply from China (down

77%), Ghana (down 68%), Cameroon, (down 77%) and

India (down 65%). Year to date, imports are down by

29% through the first quarter of the year.

Modest rise in hardwood flooring imports

US imports of hardwood flooring rose by 12% in March.

While the value of imports has remained somewhat

consistent, the sources of supply has shifted drastically.

Imports from China fell by 85% to its lowest level in more

than 10 years, while imports from Brazil dropped 99%, to

a level not seen in three years. Meanwhile, imports from

Malaysia and Indonesia grew by 64% and 145%

respectively.

Year to date, imports are down 23% through the first

quarter. Imports for March were 20% less than that of the

previous March.

Imports of assembled flooring panels from China also fell

sharply in March dropping 80%. Year to date, imports

from China are down 32% through the first quarter.

US moulding imports showed slight gain

US imports of hardwood mouldings rose 2% in March but

were down more than 18% from March of 2019. Imports

from China fell by 40% to the lowest level in more than a

decade while imports from Malaysia dropped by 30%.

Imports from Brazil made up the difference, rising more

than three-fold from a disastrous February. Total year to

date imports are down 13% with year to date imports from

China down 55% through the first quarter.

US GDP shrank n the First Quarter

Gross Domestic Product fell 4.8% in the first quarter

according to Commerce Department numbers that provide

the first detailed glimpse into the damage the coronavirus

wreaked on the US economy.

This marked the first negative GDP reading since the 1.1%

decline in the first quarter of 2014 and the lowest level

since the 8.4% plunge in Q4 of 2008 during the worst of

the financial crisis.

The biggest drags on the economy were consumer

spending, nonresidential fixed investment, exports and

inventories. Consumer expenditures, which comprise 67%

of total GDP, plunged 7.6% in the quarter as all

nonessential stores were closed and the cornerstone of the

US economy was taken almost completely out of

commission.

Durable goods spending tumbled 16.1% while

expenditures on services were down 10.2%. Exports

dropped 8.7% while imports fell 15.3%, including a 30%

drop in services.

Steep rise in unemployment claims

Another 3.2 million Americans filed first-time claims for

unemployment benefits during the first week of May,

increasing the US jobless rate to 14.7%, the Department of

Labor reported. That brings the total number of

seasonally-adjusted initial claims filed since mid-March to

33.5 million.

Initial claims are considered a proxy for layoffs or

furloughs, and that level represents about 21% of the

March labor force. For April, the US Bureau of Labor

Statistics reported that the US economy lost 20.5 million

jobs, by far the biggest drop since the US began tracking

the data in 1939.

These numbers are staggeringly high; weekly jobless

claims were hovering in the 200,000s in the last few years

before this crisis. However, the number of initial claims

has fallen each week since peaking at 6.9 million in the

last week of March.

|