US Dollar Exchange Rates of

10th

May

2020

China Yuan 7.083

Report from China

First quarter GDP reflects virus control impact

The measures taken by the government to stop the spread

of the corona virus outbreak resulted in an almost 7% drop

in GDP in the first quarter 2020. This was the first

quarterly contraction since the data series began in 1992

according to the National Bureau of Statistics (NBS).

To support the economy and help struggling businesses

the government has taken a series of measures including

cutting interest rates on loans, expanding bank liquidity to

encourage lending and cutting or waiving taxes. Measures

to help the unemployed and low-income households are

being implemented.

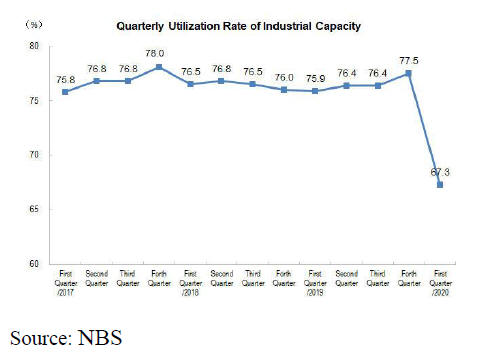

The NBS has reported the utilisation rate of manufacturing

capacity in the first quarter of 2020 was 67%, almost 9%

lower than the same period of last year.

Plywood exports crumble

According to China Customs, in the first quarter of 2020,

China¡¯s plywood exports were 1.85 million cubic metres

valued at US$787.6 million, a drop of 85% and 82%

respectively over the same period in 2019.

The main markets for plywood exports in the first quarter

were the Philippines (131,000 cu.m), UK (129,000 cu.m),

Japan (125,000 cu.m), UAE (111,000 cu.m), Vietnam

(105,000 cu.m) and Saudi Arabia (104,000) all of which

were significantly down year on year.

First quarter plywood imports were 35,068 cubic metres

valued at US$26.85 million, a decline of around 80% in

both volume and value. Over 70% of China¡¯s plywood

imports are from five countries, Russia (16,002 cu.m),

Indonesia (4, 886 cu.m), Malaysia (3,368 cu.m), Vietnam

(1, 547 cu.m) and Japan (1, 290 cu.m).

Sharp drop in wooden furniture exports and imports

China Customs data is showing that in the first quarter of

2020 the value of China¡¯s wooden furniture exports fell

84% year on year to US$3.104 billion.

The main markets were the USA (US$882 million), Japan

(US$254 million), UK (US$211 million), Australia

(US$188 million), South Korea (US$150 million) and

Canada (US$119 million) all dropping around 80%

compared to the first quarter 2019.

China imports small amounts of furniture which, in the

first quarter 2020, were worth US$203 million, down 80%

year on year.

Rise in the value of wooden doors output in 2019

The total output value of wooden door in 2019 reached

RMB153 billion, an increase of 4% over the same period

2018. The export value of wooden doors was USD639

million, down 6% from 2019.

Custom made home furnishings are an important new

market in China and this has spread to wooden doors

enterprises. In 2019 eight major custom-made home item

manufacturers (Piano, Holike, Topstrong, Shangpin, Olo,

Sogal, Jinpai, and Zbom) achieved sales of RMB25.991

billion, up 17% year on year.

China's wooden door market index (WDMCI) in the first

quarter of 2020 shows that, once the worst of the

pandemic was over, market demand has gradually

improved. Further improvement will depend on how the

housing market develops.

http://www.forestry.gov.cn/xdly/5188/20200317/104457637191269.html

Decline in the value of output in Guangdong

The value of wood processing industries in Guangdong

fell 52% to RMB75.212 in the first quarter of 2020. The

value of output wood processing industries, wood-based

panel industries, wooden furniture industries and bamboo

and rattan furniture industry was RMB1.089 billion,

RMB3.299 billion, RMB16.391 billion, RMB0.58 billion,

down 43%, 35%, 31% and 20% respectively. In general,

flooring enterprises have fared better and they have a

steady flow of raw material.

Ensuring stable national timber supply

The production and international trade in timber raw

materials for Chinese enterprises has been disrupted by the

pandemic.

Because of the dependence of Chinese manufacturers on

raw material imports the current disruption to trade flows

has meant companies have had to diversify sources and

they have also started discussing the development of

overseas forest resources and timber procurement in order

to maintaining the stability of the global timber supply

chain.

|