Japan

Wood Products Prices

Dollar Exchange Rates of 10th

May

2020

Japan Yen 107.13

Reports From Japan

State of emergency partially lifted

27 of Japan¡¯s 47 prefectures have, as of 14 May, relaxed

the ¡®stay-at-home¡¯ requests issued in response to the

spread of the corona virus but the nationwide state of

emergency is still in place giving prefectural authorities

discretion on what to relax.

The prefectures where restrictions have been eased do not

include 13 prefectures with a relatively high number of

corona cases, including Tokyo, Osaka and Hokkaido

which says the government require "special caution."

Despite the easing residents are asked to avoid

nonessential travel, not to cross prefectural borders and

avoid crowded and poorly ventilated areas.

The same day the easing of restrictions was announced the

government said it will prepare a second extra budget to

finance measures to ease the impact of the pandemic on

businesses and households. In April the government

agreed a US$240 billion supplementary budget for the

current fiscal year which began in April.

The measures introduced to try and limit the spread of the

corona virus have had a big impact on the economy

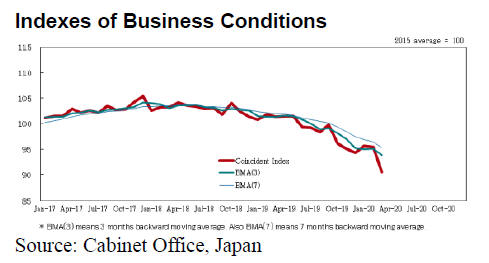

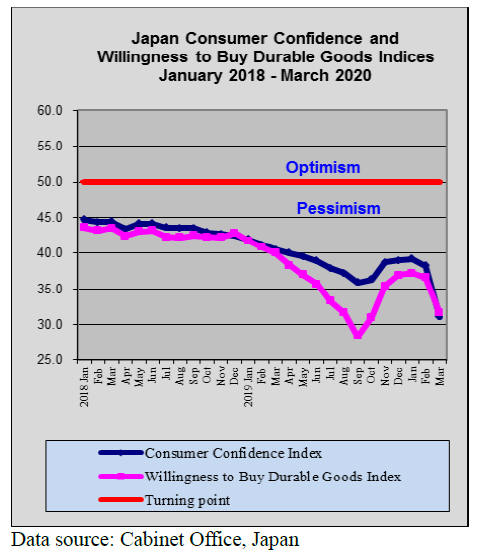

driving growth to the lowest in almost a decade. Business

confidence has slumped dramatically with the index for

business confidence dropping sharply, even faster than

immediately after the Great East Japan Earthquake and

Tsunami.

The Japanese Cabinet Office maintained its assessment

that economic conditions are ¡°worsening¡± as factory

production and household spending continue to slow. The

pandemic has impacted every country and job losses due

to lockdowns and failing businesses in Asia alone are

estimated at 68 million.

Japan has not been immune to job losses even though it

has maintained a fairly low unemployment rate over the

years.

The pandemic and the nationwide state of emergency

drastically changed the fortunes of many workers in Japan

and the national unemployment rate was around 1% higher

in January even though the full impact of the lockdown

had not hit. With zero income and diminishing cash

reserves many businesses are under pressure to lay off

workers.

Too heavy dependence on one source

The Japanese government plans to provide subsidies to

Japanese companies with overseas production sites to

relocate back to Japan or to Southeast Asian countries as

the pandemic has highlighted the dependence of Chinese

manufacturing plants and how supply chains can be

quickly disrupted.

The local media has reported a US$2.2 billion allocation

will be incorporated into the government¡¯s emergency

stimulus package to help firms diversify their supply

chains. The initiative came after many manufacturers,

especially car makers, suffered a shortage of parts

produced in China. Japan is heavily dependent on factories

in China producing wood products and where Japanese

companies have plants in China they too will be viewing

the need to diversify supply chains.

Retail sales evaporated in March

March factory output fell at the fastest pace in five months

according to the Cabinet Office analysis and retail sales

dropped sharply. Factory output dropped almost 4% in

March month on the sharpest fall in since October last

year.

On the domestic front the Japan Department Stores

Association said that sales in March fell over 30%, the

largest drop ever recorded mainly because the number of

overseas visitors to Japan fell to almost zero. The

Association has said April figures are likely to be worse.

On the other hand, online sales have been rising as people

adjusted to having more time at home, mothers had to

cook for the families who stay home and as home work

stations.

A lot of people have been able to work from home and

while this is viewed as a temporary measure it could be

here to stay which would have widespread impact on life

styles and consumption.

Japan pledges huge financial contribution to

IMF for

poorest countries

As Japan tries to rescue its own economy a significant

financial contribution to the International Monetary Fund

has drawn praise from IMF Managing Director, Kristalina

Georgieva, who reported that Japan has pledged an

amount equal to about 20% of its GDP to respond to the

economic challenges in the world's poorest countries.

Japan, the world's third-largest economy, is the largest

contributor to IMF financial resources and the largest

contributor to the fund's concessional lending facilities.

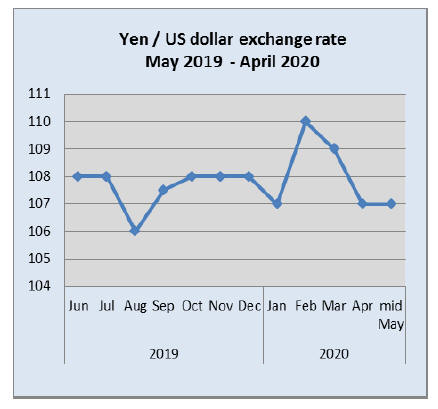

Yen stability maintained

The yen maintained its stability against the US dollar in

early May on the back of comments from the Bank of

Japan (BoJ) that it would adopt additional monetary

stimulus to support the US$1 trillion stimulus efforts by

the government.

In testimony to the Japanese parliament, the Governor of

the BoJ said that the Bank would use all available tools

to stimulate the economy. Some analysts interpreted his

statement as suggesting printing money and driving

interest rates even lower.

Work from home may be here to stay

Many home designers are already discussing how the

pandemic will impact residential designs. The home office

is top of the list for many architects who say the home

office should be quiet and away from everyday

disturbances but not isolated.

Space is another issue as is how air enters and exits a

home. It is likely that for some years people will be

spending more time at home than before even after the

pandemic is under control and this will drive then to think

in terms of sanctuary from a troubled world.

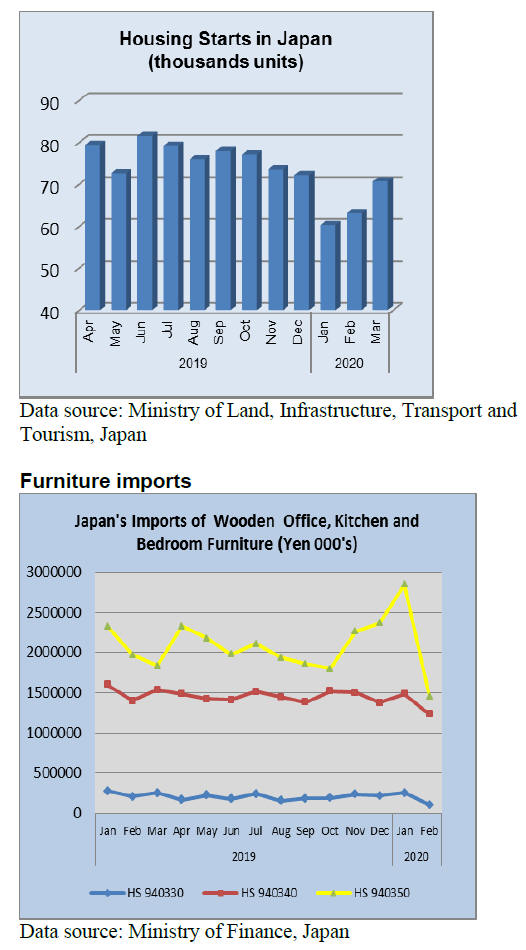

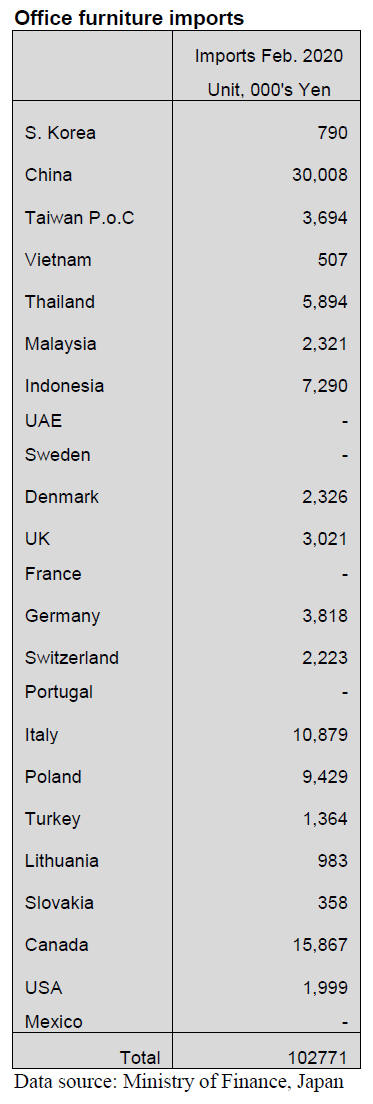

Office furniture imports (HS 940330)

Given the steep drop in business sentiment it is no surprise

that there was a considerable decline in wooden office

furniture (HS9940330) in February. Year on year, the

value of February imports was 35% down and compared

to a month earlier February imports crashed 59%.

Exporters in China, Poland and Italy featured as top

suppliers of wooden office furniture but in February there

was a new entrant in the top rank, Canada. Shippers in

China accounted for 29% of February imports followed by

Canada at 15% and Italy and Poland at around 10% each.

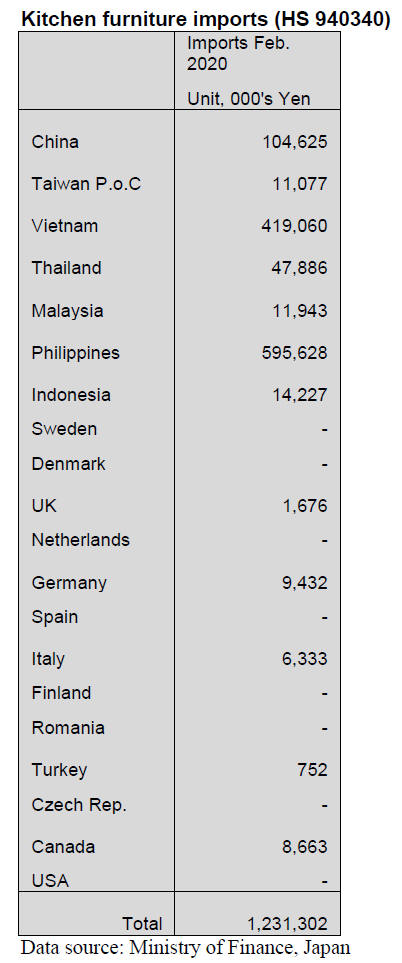

Kitchen furniture imports (HS 940340)

The Philippines and Vietnam accounted for over 85% of

Japan¡¯s imports of wooden kitchen furniture (HS940340)

in February, up some 10% from a month earlier. A further

8% of the value of imports was shipped from China

leaving little market share for others.

Year on year, Japan¡¯s imports of wooden kitchen furniture

(HS940340) in February dropped 9% but there was a rise

of around 12% compared to the value of January imports.

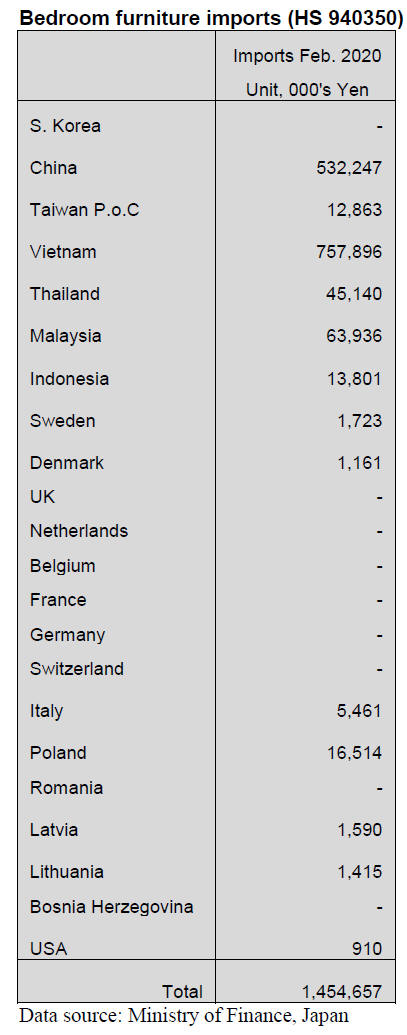

Bedroom furniture imports (HS 940350)

The value of February imports of wooden bedroom

furniture (HS940350) tumbled a massive 49% compared

to the value of January imports. Year on year, wooden

bedroom furniture imports dropped 26%.

Vietnam topped the list of wooden bedroom furniture

shippers in February accounting for just over half of all

Japan¡¯s wooden bedroom furniture imports however,

shippers in Vietnam saw the value of February shipments

drop 24%.

Manufacturers in China accounted for a further 36% of

Japan¡¯s imports of wooden bedroom furniture but there

was an almost 70% drop in the value of exports compared

to a month earlier.

Two S.E. Asian shippers Malaysia and Thailand were the

third and fourth ranked shippers in February and both

maintained market share.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

Outbreak of corona virus

Worldwide pandemic of corona virus is giving huge

damage to the world economy. China, origin of the virus,

says the peak of pandemic is over but it continues

spreading in other parts of the world. There is no safe

place to evacuate in any part of the world. This is the first

experience for the people and nobody knows what to do

and how to end.

It is inevitable to see economic damages and we may face

unexperienced depression after the storm is over.

Business activities have already slowed down

considerably by the government request to stay home and

avoid human contact, which is the only way to curb

spreading of the virus. Major house builders had steady

orders until February then by request of staying home,

sales activities practically stopped since face to face

negotiation is basic between house buyer and house sales

man.

At the same time, many house exhibition sites are closed

so future housing starts would drop in populated regions.

Japanese house builders rely on supply of various

materials from China and while China suffered virus

outbreak, the supply stopped and Japanese house builders

were unable to complete house building and deliver on

time. The largest short item was toilet from China. House

is incomplete without toilet. Chinese supply is recovering

in April but Japanese demand may shrink.

In North America, new housing starts in the U.S.A. are

dropping by corona virus pandemonium so demand of

wood products is decreasing. Interior Canadian sawmills

are reducing the production to protect workers from virus

but at the same time, it is by depressed North American

lumber market.

China market is recovering since March and purchase of

logs restarted but supply side has corona virus problem in

Europe and New Zealand so the purchase is not as easy as

before.

In Japan, major laminated lumber manufacturer decided to

reduce the production by 30% by uncertain supply of

lamina from Europe. Lumber mills in Finland had a month

long strike so laminated lumber market in Japan is firm

now. Plywood mills in Japan have started production

cutback to restore deteriorating market.

Domestic log market is skidding by lack of demand and

the prices are falling. Only hope is restart of log export to

China. After all, demand for wood products is slowing but

the supply side also has problems so both seem to keep

shrinking worldwide.

Softwood plywood prices stopped skidding

Since middle of March, plywood manufacturers

announced production curtailment and are determined to

stick to their proposed prices and are not accepting any

low priced offers from the dealers. After new fiscal year

started in April, the market prices stopped skidding and

the prices are coming back up to 1,000 yen per sheet

delivered. In March the prices were down to 950 yen.

If the production is reduced as the manufacturers propose,

supply volume would be down by 80,000 cbms in April

and May and if the shipment recovers, the inventory

would drop down to 110 M cbms, which is record low

figures so the dealers started worrying future supply

tightness.

However, unfortunately corona virus pandemic started in

March and the market is now confusing and the movement

is getting slower so future demand is uncertain. Stay-athome

request hampers normal business activities and the

most important measure to stop spreading corona virus is

to avoid meeting people so telework at home is now main

style of business.

South Sea logs and lumber

Log production in Malaysia and PNG is dropping by

stopping measures of corona virus infections but the

Japanese users have ample inventory now so there is no

panic but future is uncertain. Chinese production of red

pine laminated free board and LVL is steady and shipment

for Japan is smooth.

Demand for laminated free board is firm for furniture

manufacturing and the Japanese users place orders earlier

in fear of repeated spread of corona virus. Indonesian

mercusii laminated pine board continues steady supply.

LVL movement is slower by depressed crating demand

and also for construction.

Firming export prices of PKS (Palm kernel shells)

Spot export prices of PKS from South East Asian

countries are firming after Malaysia supply is stagnating

due to lockdown for preventing spread of corona virus.

The buyers shifted the supply from Indonesia, where the

supply has been tight since last fall so the export prices

accelerate climbing.

In Malaysia, port inventory is dropping and even if there is

cargo at the ports, loading works stopped then palm oil

plants¡¯ operations are down and trucking to ports is

hampered by various restrictions so logistics of fuel

materials are confusing. Present spot base supply prices of

PKS in Indonesia are about US$105 per ton FOB. C&F

cost would be about US$140 per ton, which is about

US$10 higher than last January. Indonesia also suffers

corona virus so there is insecurity of Indonesian supply

too.

In Japan, there are power generation plants, which rely on

PKS as fuel. They are looking for substituting supply

sources or increase use of wood pellet to tide over. Since

corona virus problem is the first experience for everyone

so nobody knows how soon it would be over and future is

uncertain.

PKS inventory the power generating companies carry is

about half month to one month. They can continue

operating if they can find substituting sources even with

higher prices but based of FIT system, they cannot add any

extra prices onto sales price of electricity.

March PKS contract was cancelled on some generating

company but it increased use of domestic wood chip to

cover shortage of PKS.

|