US Dollar Exchange Rates of

25th

April

2020

China Yuan 7.0819

Report from China

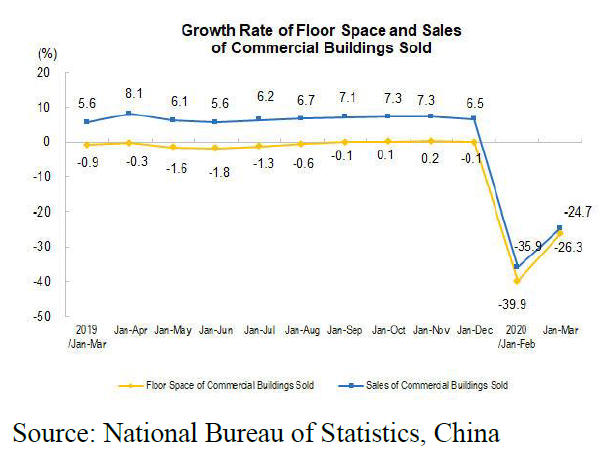

Housing sales in the first quarter down 8%

In a press release the National Bureau of Statistics reports

that in the first quarter 2020 investment in real estate

dropped almost 8% year on year. However, China¡¯s

residential housing market began a steady revival in

March as real estate companies reopened across the

country following the easing of the nationwide shutdown.

Sales in eight of the large cities jumped to levels

well

above that in the last quarter of 2019 before the virus

outbreak caused a shut-down. The beginning of a recovery

is a relief to the industry which has been offering buyers

heavy discounts to boost sales. A lively housing market is

good for timber sales and for sales of furniture.

See:

http://www.stats.gov.cn/english/PressRelease/202004/t20200420_1739751.html

Furniture retailers will be welcoming the recovery in the

housing market as they have seen furniture sales drop

almost 30% in the first quarter 2020. In March, retail sales

of consumer goods were down almost 16% year-on-year.

See:

http://www.stats.gov.cn/english/PressRelease/202004/t20200420_1739765.html

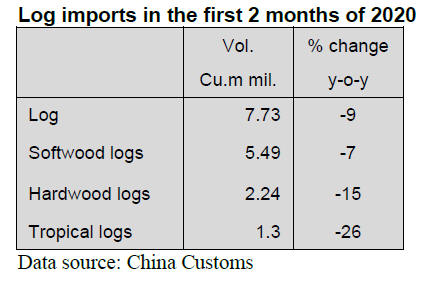

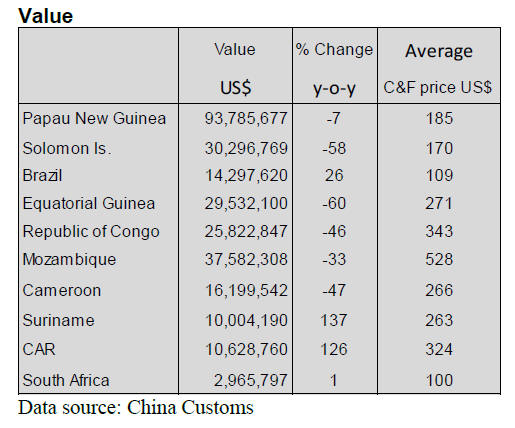

Decline in China¡¯s imports of tropical hardwood logs

China¡¯s log imports in the first two months of 2020

totalled 7.73 million cubic metres valued at US$1,104

million, a year on year decline of 9% in volume and 27%

in value.

Of total log imports, softwood log imports fell 7% to 5.49

million cubic metres and accounted for 71% of total log

imports. Hardwood log imports fell 15% to 2.24 million

cubic metres (29% of total log imports).

Of total hardwood log imports, tropical log imports were

1.30 million cubic metres valued at US$3.25 million,

down 26% in volume and 37% in value from the same

period of 2019.

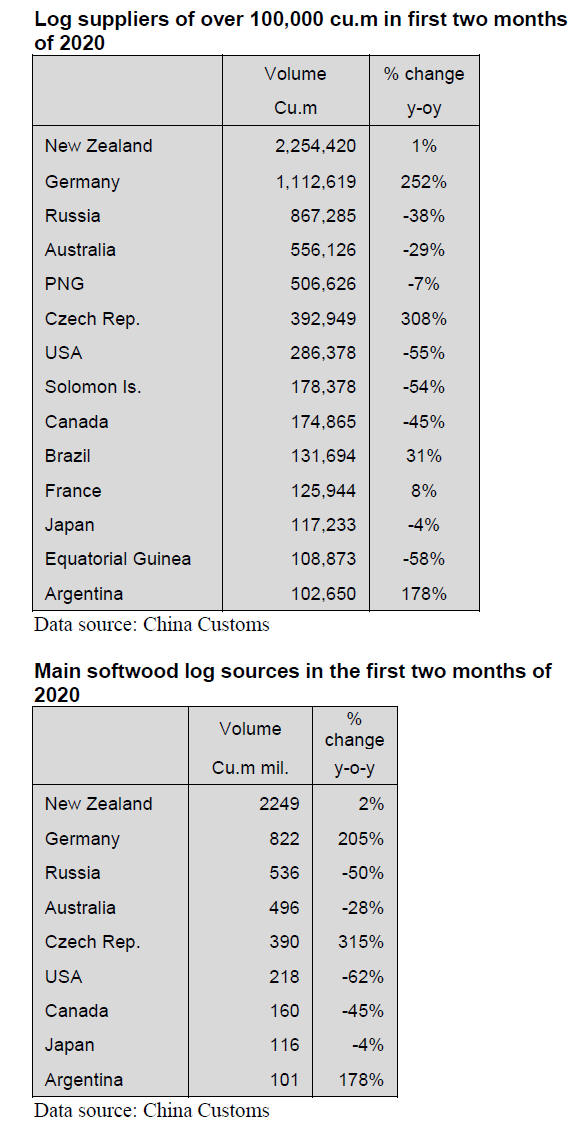

Germany the second largest log supplier

Among supply countries providing more than 100,000

cubic metres of log imports in the first two months of 2020

were Germany and the Czech Republic where imports

soared over 250% and 300% respectively and to 1.11

million cubic metres and 393,000 cubic metres

respectively. In 2019, around 12 million cubic metres of

standing timber in North Rhine-Westphalia alone was lost

toa bark beetle attack and efforts are underway to salvage

as much of the timber as possible.

China¡¯s log imports from Argentina also soared over

170% to 103,000 cubic metres. In addition, China¡¯s log

imports from Brazil, France and New Zealand rose 31%,

8% and 1%. All other sources saw a sharp decline.

New Zealand was the main log supplier to China in the

first two months of 2020 accounting for 29% of total log

imports. Imports from New Zealand totalled 2.25 million

cubic metres in the first two months of 2020, a year on

year slight increase of 1%.

The second ranked log supplier was Germany at 1.11

million cubic metres, a year on year soaring of over 250%,

accounting for about 14% of the national total. The

average price for imported logs from Germany was the

lowest at US$90 per cubic metre.

The third ranked supplier of logs was Russia at 0.867

million cubic metres, a year on year increase of over

300%.

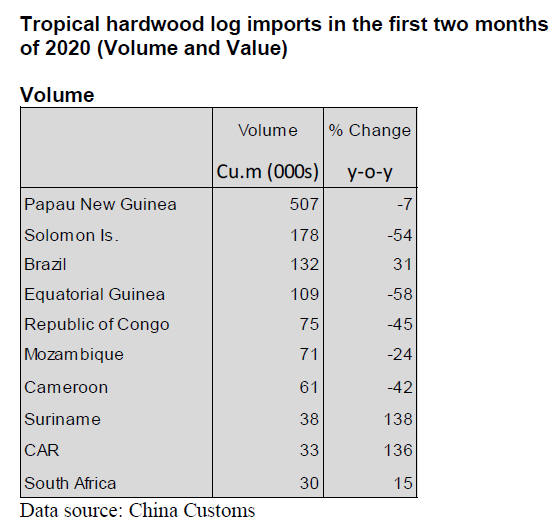

Decline both in volume and value of tropical

hardwood

log imports

Tropical log imports in the first two months of 2020

amounted 1.30 million cubic metres, down 26% year on

year and accounted for 17% of the national total.

In the first two months of 2020, China imported tropical

logs mainly from Papua New Guinea (39%), Solomon

Islands (14%), Brazil (10%), Equatorial Guinea (8.4%),

the Republic of Congo (5.8%), Mozambique (5.5%),

Cameroon (4.7%), Suriname (2.9%), CAR (2.5%) and

South Africa (2.3%). Just 10 countries supplied 95% of

China¡¯s tropical log requirements in the first two months

of 2020.

Among top source countries for tropical hardwood log

imports, imports from Surinam and the CAR jumped

138% and 136% to 38,000 cubic metres and 33,000 cubic

metres respectively.

The volume of log imports from Brazil and South Africa

also rose 31% and 15% to 132,000 cubic metres and

30,000 cubic metres respectively.

However, most of countries from which tropical log

imports declined greatly included Equatorial Guinea (-

58%), Solomon (-54%), the Republic of Congo (-45%)

and Cameroon (-42%).

Before their log export bans Laos and Myanmar were a

major source of tropical logs for China. However, China¡¯s

log imports from Laos in the first two months of 2020 fell

to just 5,602 cubic metres valued at US$8.04 million,

down 59% in volume and 50% in value. China¡¯s log

imports from Myanmar fell to just 434 cubic metres

valued at US$0.58 million, down 82% both in volume and

in value.

Sharp rise in tropical log imports through

Qingdao

Port

In the first two months of 2020, 74% of imported tropical

logs arrived at three major ports, Zhangjiagang, Qingdao

and Jingjiang ports. The volume of tropical logs handled at

Qingdao Port rose over 400% year on year to 324,000

cubic metres valued at US$D74 million.

However, tropical log imports through Zhangjiagang port

and Jingjiagn port were 400,000 cubic metres and 255,000

cubic metres valued at US$97.46 million and US$67.43

million cubic metres respectively all down from a year

earlier.

|