Japan

Wood Products Prices

Dollar Exchange Rates of 25th

April

2020

Japan Yen 107.48

Reports From Japan

Bank of Japan pumps money into the economy ¨C says

the taps will stay open

The International Monetary Fund has said that because it

is unlikely the global disruption of demand caused by the

pandemic will subside in a short time they anticipate the

export dependent Japanese economy could contract by

over 5% this year, a drop which would be worse than

during the 2008/9 global financial crisis.

The Bank of Japan (BoJ) clearly agrees with the IMF as on

27 April it announced a massive expansion of monetary

stimulus, the second in a month, to aid corporate Japan

and also finance the government's emergency package

which now stands at yen 117.1 trillion after the

government approved a revised supplementary budget for

fiscal 2020.

The increase from the initial package worth yen 108.2

trillion comes after a decision to offer a cash handout of

yen 100,000 to every person in Japan. The decision by the

Bo follows those of other central banks that have

announced similarly huge support for their economies and

nationals.

SMEs can only survive if lock-down ends in a few

months

After declaring a month-long state of emergency in the

seven prefectures with the fastest pace of infection spread

a nationwide state of emergency has been declared in

Japan due to the country¡¯s worsening coronavirus

outbreak. This decision from the central government paves

the way for regional governments to launch local

campaigns urging everyone to stay off the streets.

The state of emergency will remain in force until 6 May

but media reports speculate that it is increasingly likely

that the emergency will be extended beyond 6 May when

the current regulation expires. After the recent surge in

corona virus cases in Tokyo experts warned that the

emergency medical facilities are close to collapsing.

The Japan Times, reporting on a survey conducted by NN

Life Insurance in late March (i.e. before the nationwide

state of emergency) says 60% of small and midsize

companies say they can survive if the pandemic ends in

the next few months.

Around 16% said their business can survive until the end

of May but 7% said they can only make it through the end

of March.

There are reports that the government is considering a

support package for small businesses that were

temporarily idle during the current state of emergency.

See:

https://www.japantimes.co.jp/news/2020/04/27/business/economy-business/japan-small-midsize-firmspandemic/#.XqfDOLYzbIU

Companies looking for legal ways to terminate nonpermanent

workers

The state of emergency triggered by the corona virus has

resulted in a surge in non-permanent workers being laid

off. Economists are forecasting that one million newly

unemployed could be added to statistics, a figure higher

than during the 2008-2009 global financial crisis.

The first response of many small companies was to

consider temporary business suspension but recently the

mood among companies has changed with many seeking

ways to dismiss employees. Labour unions in Japan have

pointed to a trend to shortening temporary employees¡¯

contracts in preparation for layoffs.

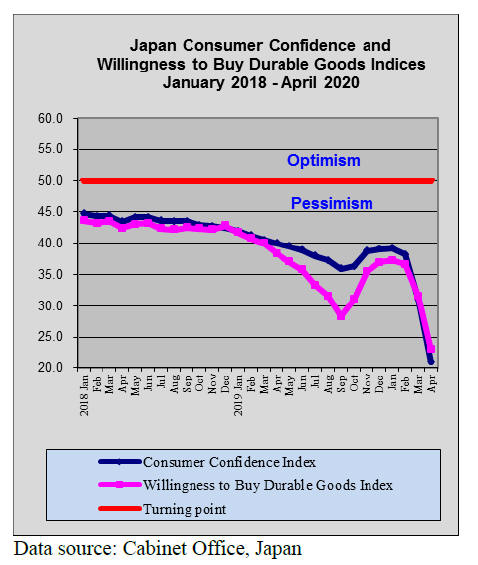

The April consumer confidence survey showed a steep

decline in all individual indices. The index for general

household sentiment dropped to the worst ever seen in the

past two decades.

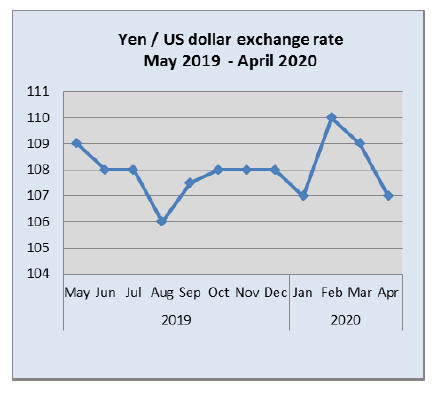

Yen remarkably steady against the US dollar

The news that the BoJ will expand its monetary easing to

counter the impact on the economy from the corona virus

outbreak surprisingly failed to drive the yen down against

the US dollar, it barely moved and remains around yen

107 to the dollar.

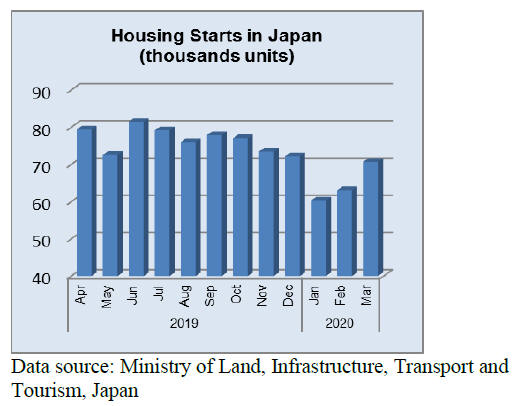

Better than expected housing starts

Japan¡¯s housing starts for March fell almost 8% year on

year but this was significantly better than the forecasts

made in February.

Import update

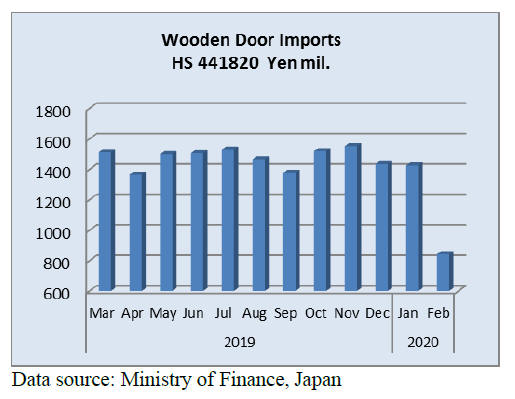

Wooden door imports

The sharp drop in wooden door (HS441820) imports was

little surprise. Year on year, the value of wooden door

imports dropped over 40%. There was also a 40% drop

compared to levels in Janaury before the impact of the

pandemic started to bite.

As in previous months four shippers accounted for over

90% of Japan¡¯s February 2020 imports of wooden doors

(HS441820). The main shipper was China which

accounted for 43% of all door imports. This was sharply

down on the 65% contribution to imports in January.

Shippers in the Philippines secured a greater market share

in February accounting for 35% of imports, up from the

19% in January. The other two main shippers were

Indonesia and Malaysia both of which saw a slight rise in

shipments in February.

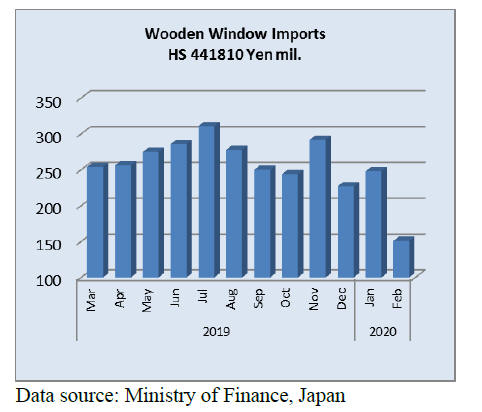

Wooden window imports

Mirroring the trend with door imports, the value of Japan¡¯s

imports of wooden windows (HS441810) also fell sharply

in February. Year on year, February imports dropped

around 36% and month on month there was a slightly

faster decline.

In February four shippers, China, US, the Philippines and

Sweden, once again provided over 90% of the value of

Japan¡¯s wooden window imports. Manufacturers in China

accounted for 36% of February 2020 shipments of wooden

windows to Japan followed by the US (24%), the

Philippines (26%, up significantly from January

shipments) and Sweden (6%).

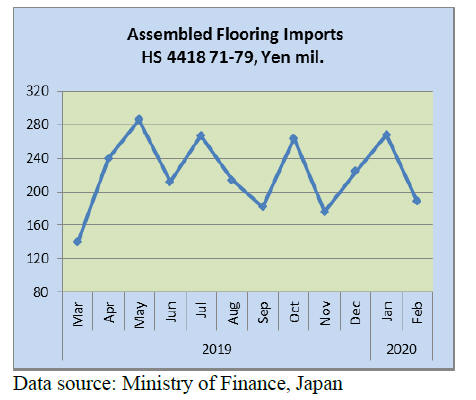

Assembled wooden flooring imports

Surprisingly, Japan¡¯s imports of assembled flooring

(HS441871-79) in February were not showing any signs of

decline. In fact, the cumulative value of imports for the

first two months of 2020 were sharply up on the same

period in 2019. As can be seen in the graphic on housing

starts there was a rise in starts in February which likely

drove up imports.

Of the four categories of flooring tracked, HS441875

made up around half of Japan¡¯s February imports with

most coming from Indonesia and Malaysia followed by

HS441879 which added a further 26% to the total value of

assembled wooden flooring imports. The main shipper of

HS441875 in February was France.

There were only small shipments of HS441871 in

February and imports of HS441874 were primarily from

manufacturers in China.

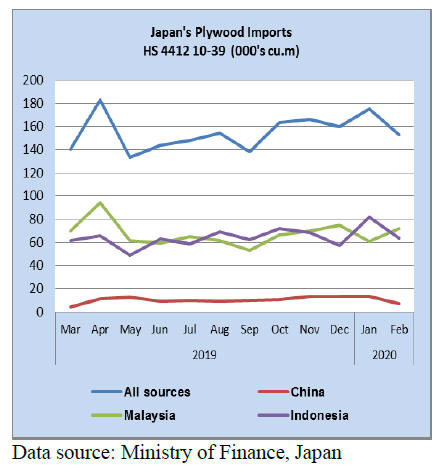

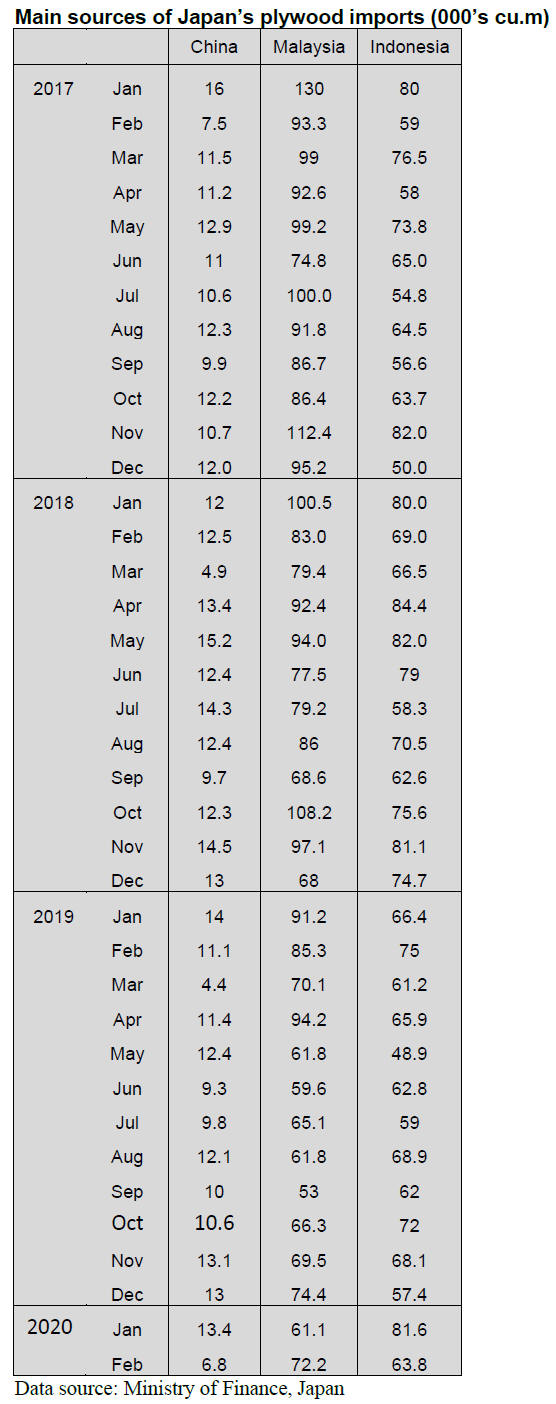

Plywood imports

Although in February Japan had not experienced a major

impact from the corona pandemic there were signs in the

construction and house building sectors that there was a

slow-down. Year on Year Japan¡¯s February imports of

plywood (HS441210-39) dropped 17% and compared to a

month earlier import volumes were down 12.5%.

There was a 50% decline in both year on year and month

on month plywood imports from China because many of

the mills in that country had ceased operation for the

Spring Festival which began on 25 January for 7days.

During the holidays workers return to their home

provinces but after the holidays and because of travel

restrictions many found they could not return to work

which hampered production.

Japan¡¯s imports from the main plywood suppliers,

Indonesia and Malaysia both experienced a 15% decline in

February.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

Wood demand projection meeting

The Forestry Agency held wood demand projection

meeting on 23March. Average new housing starts

forecasted by 12 private think tanks are 847,000 units and

two think tanks forecasted less than 800,000 units. Major

house builders also reported that orders are declining and

it is general view that starts of detached unit would

continue severe by slowdown of economic condition

resulted by corona virus epidemic.

The forecast by think tanks is based on forecast in late

February and steep drop of stock market in March and

depressed economic condition by corona virus are not

reflected so next forecast would be much lower.

As to log export to China, by stagnating Chinese economy

and heavy rush of European beetle damaged logs into

China, the export volume would drop largely in 2020.

For domestic wood use, concern is how long corona virus

outbreak would last and how badly influence the economy

and general view is that the demand would be lower than

last year by dropping housing starts.

For logs to manufacture lumber, demand decrease would

be as bad as following year of Lehman shock in 2008 so

the second quarter supply would be down by 31.7% from

the same quarter last year and third quarter would be down

by 17.9%.

On imported logs and lumber supply, second quarter

would be down compared to last year. Particularly,

purchase of radiate pine logs and lumber from New

Zealand and Chile for March and April shipment would be

sharply down by 55.6%. For the third quarter, there are

views that the demand should recover with economic

stimulus measures and corona virus epidemic comes to an

end but other views are that the confusion would continue

so that the demand would keep dwindling.

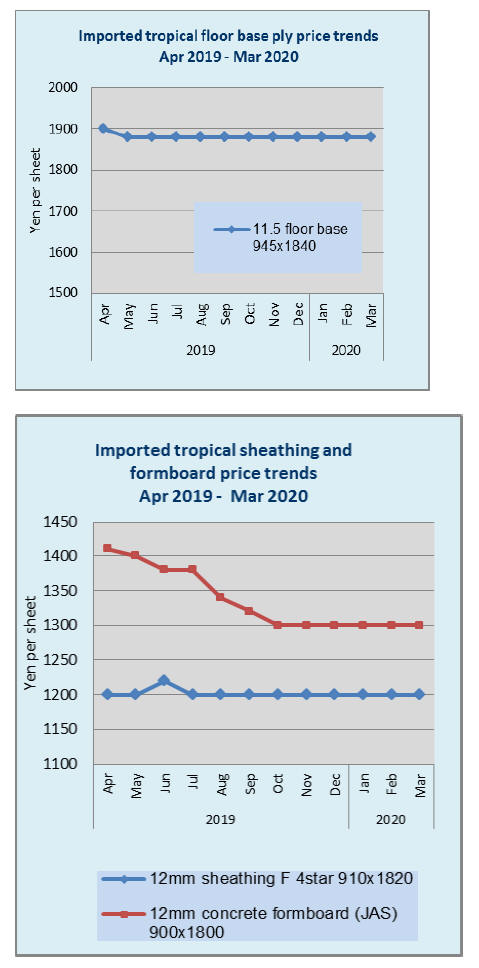

Spreading plywood production curtailment

The first quarter demand is slow every year then outbreak

of corona virus rapidly cooled the market and plywood

prices have been dropping consistently.

Hayashi Plywood and Ishinomaki Plywood have

announced production cutback already by 15-20% and

now the largest manufacturer, Seihoku group announced

to curtail the production by 15-20% since April after the

12 mm 3x6 plywood prices dropped below 1,000 yen per

sheet delivered. Since March, low price offers started

spreading and with bearish future, buyers limit purchase

volume so the movement is stagnating.

Seihoku plans to stop further slide of the prices by quick

action to reduce the supply volume. It stops Saturday

working and overtime working.

May has many holidays and it is maintenance month so

the production will be down. How long it will continue

production cutback depends on demand and if the demand

stays weak, it will continue production curtailment

program.

Nisshin group (Shimane prefecture) announced to reduce

the production of long plywood and special size plywood

for house builders by 10% in April then 20% in May. The

group produces about 60,000 cbms of plywood a month.

Its inventory in January was 0.4 month but the inventory

of special items increased to three months so it decided to

reduce production of these items.

Key Tec Co., Ltd (Tokyo), plywood and LVL

manufacturer has started reducing the production of

structural softwood plywood by 15% since March 23.

Monthly production of 5,800 cbms will be reduced to

4,900 cbms. Shipment of structural LVL for housing is

also dropping. The monthly production is 4,000 cbms but

now it is 3,500 cbm.

Now almost all plywood manufacturers in Japan have

started production curtailment uniformly.

Impact of corona virus outbreak

In Malaysia, the Prime Minister announced stay-at-home

order to prevent further spreading of corona virus

infections but allowed operation of plywood

manufacturing in Sarawak, which is basic industry in

Sarawak. MDF plants are running through March 20 but

operation of chip plant and particleboard plant stopped. By

closure of government administration offices, it becomes

impossible to acquire legal timber harvest and log export

permit.

In Canada, the government ordered to ban entry of

foreigners except for Canadian citizens, diplomats and

airline workers. The international flights are allowed to

use only four cities of Montreal, Toronto, Vancouver and

Calgary.

Interfor, one of major lumber manufacturer in B.C.,

Canada, announced to reduce the production of all the

sawmills by 60% for two weeks. West Fraser announced

to reduce the production of sawmills in B.C. by 18% and

Southern pine mills in the U.S.A. by 24% for two weeks.

It also announced to reduce production of plywood by five

billion square feet per week. Both companies reviewed

and decrease capital investment plans in 2020.

In the U.S.A. new housing starts had kept climbing until

February then peaked off in the first week of March by

rapidly spreading corona virus infections so the lumber

market started plunging and SPF lumber prices dropped by

30% in one month. By local government restrictions,

business activities are largely hindered.

New Zealand government ordered people to stay home on

March 26 for four weeks. Export of logs and logging

would stop by this since workers are prohibited to go out.

Supply of radiate pine logs and lumber would drop

considerably. There is possibility that log and lumber

inventories at port or sawmills can be shipped out if the

government allows.

Negotiations on logs are disrupted. Export log prices for

China were about $105 per cbm C&F in late February but

the demand in China is coming back so the log prices are

$7-10 higher now with curtailed production by New

Zealand suppliers. Nelson Pine Industry, MDF

manufacturer, stops the operation for four weeks.

Tachikawa Forest Products (Hiroshima prefecture) has

been buying crating lumber from New Zealand. Now the

supplying mill in New Zealand requests Tachikawa to

provide letter to prove that the lumber is necessary for

emergency use since the lumber is used for crating food

and medical articles in Japan. The New Zealand mill attach

the letter for submitting to the government organization to

get permit for export.

Daiken announced to stop operation of two MDF plants in

New Zealand from March 23 to April 22.

Domestic logs and lumber

Log production is steady in March. Meantime movement

of lumber, plywood and laminated lumber is getting dull

day after day and plywood mills have started reducing the

production so log demand is dropping. Actually logs are

oversupplied so the market prices are weakening.

Sawmills have procured enough winter harvested logs,

which have longer life and have ample inventory then

from now on it is season when log quality deteriorate with

more moisture so mills are cautious in buying logs from

now on.

At the same time, lumber demand is dropping so mills¡¯ log

purchase is shrinking. Log market prices are 10,500-

12,000 yen per cbm on 3 meter post cutting cedar. 15,000-

16,000 yen on 3 meter post cutting cypress and 16,000-

17,000 yen on 3 meter sill cutting cypress. They are 2,000-

3,000 yen down from January.

Lumber demand was forecasted weak this year at

beginning of the year by decreasing housing starts after the

consumption tax increase since last October then since

March, corona virus infections started spreading and it

seems to prolong quite a while so lumber demand is much

severe than initial forecast.

March lumber sales by sawmills were almost the same as

March last year but April would be much worse. Actually

Tokyo lumber market has started skidding since March. 3

meter KD cedar 105 mm post prices are about 49,000 yen

and 120 mm is 44,000 yen, which are 1,000-2,000 yen

lower than last month.

Plywood

Movement of plywood is stagnant on both domestic and

imported plywood.

Domestic softwood plywood movement has started

slowing in March and the prices started sliding so the

manufacturers are quickly reducing the production.

Together with slowdown of demand, there are low price

sales before book closing month in March to secure sales

amount so the market is confused with unrealistic low

offers. The manufacturers stepped up production

curtailment before the market plunges into chaos.

New fiscal year started in April after last year¡¯s settlement

is over so the dealers have started new business plan but

unfortunately corona virus outbreak started in March so

nobody knows how serious and how long it would

influence the business. Actually business activities are

slowing down by the government order of stay-at-home.

Business is surely shrinking as movement of people is

restricted.

In Malaysia, the situation is the same as Japan. The

government is restricting various activities and plywood

mills in Sarawak are allowed to keep operating but log

harvest and transporting are restricted and various permits

are not obtainable since the government administrati

In Japan, inventory of imported plywood is getting low but

the demand has started declining by corona virus so there

is no shortage feeling although port warehouses report that

outgoing is now much more than incoming volume.

|