4.

INDONESIA

Survey - Impact of

pandemic on timber sector

1. Are mills still operating?

Most wood industries are still operating, but they

unfortunately are decreasing production. Some factory

operations will continue for the next few months since

Indonesia has implemented a semi-lockdown in Jakarta

beginning 10 April to be followed by a lockdown in West

and East Java in the near future.

Another cause of lower production is the postponement of

orders by importers in the European Union, America and

parts of Asia. However, Indonesia's wood product exports

for the first quarter 2020 have not been seriously affected

by the pandemic. The types of products that experienced a

decline in exports were HS 470329 (Wood pulp; chemical

wood pulp) and HS 442199 (Wood; not of bamboo).

2. Have workers been laid off?

Partly, a sort of an interim lay off. Some companies apply

a shift-based work to minimise the production cost.

(HIMKI indicated that lay offs total 280,000).

3. Are laid off workers receiving payments?

They are being paid but not full payment (based on

agreement). Some companies still pay workers with full

wages, but the production target is decreased.

4. Are companies already receiving government support?

Not yet, the government is still assessing data from

impacted companies and workers affected by lay offs.

Some associations propose government support such as

relaxation/reduction of PPH tax for the companies,

reduced regulation of import and subsidy for 180,000

workers monthly wages.

5. Have orders been cancelled?

Orders from the international buyers, especially the

countries badly affected by the pandemic, have been

postponed. However, countries less affected continue to

place orders, although the export process at the port is

slightly hampered due to restrictions on working hours and

the implementation of the shift work system. This will get

worse for the next few months due to strict business and

social interaction restrictions.

6. Estimated % change in shipments since Jan 2020 to:

China, EU, US, Others

The exact figure cannot be obtained yet but exports to

China are moving but exports to Europe in countries such

as Italy stopped in February/March.

7. Are mill stock levels increasing?

Stocks of finished materials are accumulating because the

goods that are ready to be sent do not get loaded.

Estimated rise in stocks 70%.

8. How much time would be required to ramp up

production to pre-crisis levels?

Maybe more than 1 year provided the government gives

full support and provides incentives for industries related

to reduction of taxation and bank interest rates. For the

Plywood industries, it depends on market conditions, if

export destinations have reopened their markets the

industry will be ready to supply soon.

For wood working companies, If the government provides

assistance to the industry in the form of tax breaks,

simplification of export regulations, funding assistance for

co-affected workers the time needed to recover the

company's economic conditions will be fast.

9. What will be the main challenges in ramping up

production?

The main challenges for increasing the value of wood

production are: There is a decline in European and

American market demand, while customers continue to

demand delivery of goods on time when the government

implements a lock down policy.

The government needs to eliminate the technical

verification policy (LS) to reduce bureaucracy. Company

cash flow is disrupted and the government has not yet

implemented a policy of reducing/relaxing the export and

import taxes. Procurement of imported raw materials is

disrupted so relaxation of import licenses is needed.

10. Are containers still being loaded at the port?

Last month, when the lockdown was less effective

containers were still there for the destinations not affected

by the pandemic. But problems arose with trucking to a

port because forwarders were operating reduced shifts.

11. Are containers readily available?

As of April there were reports of a shortage of containers

but few were being stuffed as importers requested delayed

shipment.

280,000 furniture sector workers laid off

Abdul Sobur, Secretary General of the Indonesian

Furniture and Crafts Industry Association (HIMKI), has

reported that, in addition to the thousands of workers laidoff

in the retail, hotel, and restaurant sectors, furniture

manufacturers have indicated that they have had to lay off

some 280,000 workers.

Indonesian furniture industries are labour intensive with

around 2.1 million employed. The current crisis has meant

that furniture companies have had to make cuts in

production which has impacted labour.

The HIMKI has 3,500 member companies and there are

around 400,000 workers in the factories but as of mid-

April about 70% are laid off". One main problem is that

many export destinations are closed to shipments in others

importers have asked for delayed shipments.

Sobur has determined that large sized HIMKI member

companies may be able to retain employees for around 8

weeks but for medium and small companies they will not

be able to equal the 8 week wage payments.

Sobur urged the government to quickly disburse Direct

Cash Assistance (BLT) to employees who were laid off to

sustain their livelihood.

See:

https://kumparan.com/kumparanbisnis/industri-mebel-jugaterimbas-corona-280-000-karyawan-dirumahkan-1tBMcYEWYcN

The corona epidemic in Indonesia has had a devastating

impact on workers as many businesses in all sectors have

shut down and furloughed or laid off their employees.

Ministry of Manpower data shows that over a million

workers in about 75,000 companies in the formal and

informal sectors have either been told to stay home or

have been laid off .

Ida Fauziyah, Minister of Manpower, urged companies to

make layoffs their last choice. She said options could be

to reduce wages or reduce working days. The media

reports her as saying “The (current) situation and

conditions are indeed challenging but this is the moment

for the government, business people and workers to work

together and find a solution to mitigate the impact of

COVID-19”.

See:

https://www.thestar.com.my/news/regional/2020/04/10/indonesia-sees-12-million-workers-furloughed-laid-off-in-virus-hiteconomy

Virus hits informal sector - Stimulus aimed at avoiding

recession

The impact of the pandemic is already hurting small

businesses and the informal sector is particularly hard hit

and will suffer more according to the Minister of Finance,

Sri Mulyani Indrawati. He predicted that economic growth

would decline sharply in 2020 and a recession is possible.

Against this backdrop the Minister said the planned

stimulus measures might not be sufficient adding that in

January the Ministry thought the pandemic would only

impact the tourism sector. But that was incorrect so a

second stimulus package was prepared focusing on the

manufacturing sector but even here the extent of the

damage being done was underestimated.

In mid-April the President announced a Rp 405 trillion

(US$25 billion) stimulus package for virus mitigation

focusing on healthcare, social safety net, tax breaks and

debt restructuring for corporations and small businesses.

See:

https://jakartaglobe.id/business/stimulus-aimed-at-avoidingrecession-as-covid19-hits-informal-sector-hard

https://en.antaranews.com/news/145154/indrawati-forecastscovid-19-pandemic-to-dampen-economic-growth

Exporters will continue with SVLK

Executive Director of Association of Indonesian Forest

Concessionaires (APHI), Purwadi Soeprihanto, said that

the association was committed to meeting the Timber

Legality Verification System (SVLK) requirements for

products to be exported adding that the SVLK has reduced

the stigma of illegal logging and weak forest management

in Indonesia.

Purwadi said he hopes that the SVLK requirements for the

small enterprises could be simplified, especially related to

business licensing requirements and assistance for

implementing SVLK certification.

Purwadi estimated that processed wood product exports

will decline this year because the five main export

destinations for Indonesian processed wood, China, the

United States, Japan, the European Union and South

Korea are badly affected by the pandemic.

5.

Myanmar

SMEs severely affected by pandemic

According to exporters, some of planned shipments of

wood products have been postponed by buyers in India,

the EU and the US but, as of mid-April, analysts report

there have been no mill closures as a result of the

pandemic but work has stopped for the Myanmar New

Year holidays.

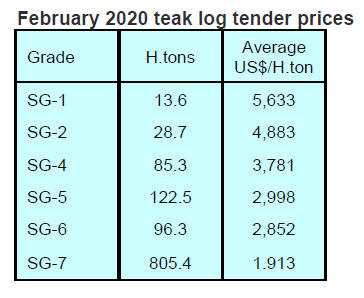

The Myanma Timber Enterprise (MTE) postponed the

teak and other hardwood tenders sales in March and the

tender sale for April has been postponed because of the

Myanmar New Year Holiday.

Analysts say SMEs will be severely affected as they rarely

have financial resources to sustain their business through a

long period of closure. Most manufacturing, agricultural

and tourism industries in Myanmar have been severely

affected and farmers and fruit producers who rely on the

Chinese market have suffered huge losses.

The Myanmar Investment Commission (MIC) says it will

be issuing emergency loans to around 400 small

businesses that have suffered financial losses due to the

pandemic sweeping the world. The loan scheme was

announced in March and the Union of Myanmar

Federation of Chambers of Commerce and Industry

(UMFCCI) began accepting the loan

applications immediately.

In other news, the government has announced that

households in the country will not need to pay for the first

150 units of electricity in April, a measure to lessen the

impact of the pandemic affects.

Survey - Impact of pandemic on timber sector

The ITTO analyst in Myanmar conducted a survey of

timber companies in the second week of April. The

responses to the structures questionnaire are reported

below.

1. Are mills still operating?

Myanmar started the national New Year holiday on 10

April and all factories remained open until 9 April. At that

time the Government urged ‘voluntary home stay’ and

suspended domestic travel. It is not yet clear how

Myanmar will handle the situation when the holiday

period ends on 19 April. The authorities in Yangon, the

commercial hub, have not issued any advice on what

measure will be introduced after the holidays. Most

workers have not returned to their home city because of

the travel restriction.

2. Have workers been laid off?

As of 10 April no workers had been laid off in the timber

industries. But for labour-intensive factories, such as in the

garment industry, there have been lay-offs . According to

the EU ambassador for Myanmar an estimated 25,000

workers from more than 40 factories have been laid off.

According to estimates provided by the EU half of the

700,000 garment workers in the country, most of whom

are female, are at great risk of either being suspended

without pay or losing their jobs permanently.

3. Are laid off workers receiving payments?

There have been some disputes between the government,

employers and trade unions over the need for support.

However, the immediate effects of the pandemic are not

yet clear since factories are closed because of the New

Year holidays.

4. Are companies already receiving government support?

The MIC has announced the availability of interest-free

lions for SMEs and over 400 have applied with 55

companies securing approval. The processing of loan

applications will restart after the New Year holiday.

5. Have orders been cancelled?

In the timber industry some orders have been postponed

but it is hard to get accurate data and facts. Buyers in the

EU have suspended most of garment shipments.

For the timber industries about 50-100 containers are

ready to ship but some are delayed. The value of pending

shipments is said to be between US$4 to 6 million.

6. Are mill stock levels increasing?

For the timber industries stock levels are not increasing

much since mills buy logs in small quantities every month.

For the garment factories stocks are not high since the

main supplier of raw materials (China) has reduced

shipments because of the pandemic.

7. How much time would be required to ramp up

production to pre-crisis levels?

It is estimated that the timber industries will need a

minimum 2 months to raise production to pre-crisi levels.

8. What will be the main challenges in ramping up

production?

The financial stimulus package will be key factor after

the pandemic is controlled.

10. Are containers still being loaded at the port?

In the period up to the beginning of the holidays, port

operations were normal with some signs of congestion.

11. Are containers readily available?

Yes

Workers targeted for support by EU

According to the Centre for Economic and Social

Development (CESD), a Yangon-based think tank, around

40% of Myanmar’s factories, mainly garment factories,

have been severely disrupted by the pandemic putting at

risk the livelihood of thousand of workers, mainly women.

It is estimated that one-third of the factories closed depend

on exports to the EU.

The Myanmar media has reported that European Union

will provide 5 million euros to establish an emergency

fund to support female workers in Myanmar’s garment

sector who have lost their jobs.

See:

https://eurocham-myanmar.org/post/542/European-Unionto-Myanmar-announces-emergency-cash-fund-for-garmentworkers

The EU Ambassador to Myanmar has been reported as

saying over 25,000 workers in more than 40 factories have

been laid off as the garment industry tries to cope with the

devastating financial impact of the pandemic.

European Chamber of Commerce survey of companies

There are many European companies in Myanmar and

they were recently surveyed by the European Chamber of

Commerce in Myanmar to assess their views on the likely

economic impact of the pandemic. The report of the

survey which is available online says “According to the

respondents, more than 60% claim they are already either

significantly or moderately affected; with a forecasted loss

of revenue averaging from 30% to above 50%, small and

medium companies would be the most impacted and

automotive, FMCG, retail and manufacturing are sectors at

the frontline.

While 34% of the respondents answered that the recovery

from the impacts of COVID 19 will depend on how the

supply chain across all industries will react, another 51%

of the respondents estimate a recovery within 6 months.”

See:

https://eurocham-myanmar.org/post/538/EuroCham-Myanmar-survey-results-on-COVID-19-economic-impact

More banks approved

The Myanmar Times has reported that operating licenses

have been granted to seven Asian banks bringing to 20 the

number of foreign banks operating in the country. ). There

are 13 foreign financial institutions currently allowed to

operate in the country.

For details see:

https://www.mmtimes.com/news/myanmar-opens-seven-moreasian-banks.html

Eucalyptus and acacia plantations planned

The Myanmar Investment Commission (MIC) has issued a

joint venture investment permit to Habras-MZZ Plantation

Myanmar Co. Ltd. for establishment of Eucalyptus and

Acacia plantataions to produce wood chips. The

plantations wll be in the Sinma Reserve Forest, Pathein

District, Ayeyarwady Region. The announcement did not

mention the capital and the plantation area.

6. INDIA

Shipment update

Indian ports are closed to both imports and exports.

Packed export containers cannot move as the receiving

end ports are closed in most cases. There are import

containers waiting to be discharged but as workers cannot

travel discharging is held up. Until restrictions are lifted

nothing can move. In some cases the shipping companies

are waiving demurrage charges.

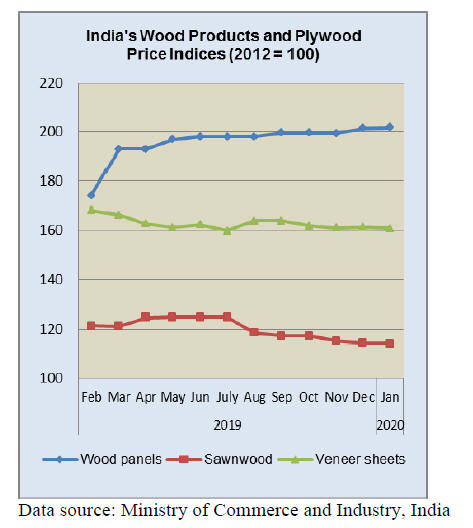

Veneer prices edge down

The official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for February 2020 declined to 122.2

from 122.9 from the previous month.

The index for the group 'Manufactures of Wood and of

Products of Wood and Cork' declined by 0.3% to 132.7

from 133.1 for the previous month due to lower prices for

plywood/blockboard (3%), composite panels (2%).

However, the price of veneer sheets, wooden box/crates

and some other processed products inched higher.

The press release from the Ministry of Commerce and

Industry

can be found at:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Furniture imports may face restrictions

The government is considering restrictions on imports of

furniture to help protect domestic manufacturers and

reduce imports of non-essential items. In 2018-19 India's

furniture imports amounted to US$603 mil. with over half

coming from China.

The Department for Promotion of Industry and Internal

Trade has suggested to its commerce counterpart to put the

restrictions. Putting a product in restricted category means

an importer will require a license for the inbound

shipment.

China supply shock as shutdown extends

The shutdown of Chinese companies over the past month

has disrupted shipments to India but many importers had

already stocked up knowing Chinese factories will close

for the Lunar holiday but they did not anticipate the virus

lockdown.

Indian importers say that, despite some factories in China

being back at work, others have deferred re-opening and

this has reduced the flow of imports not only of furniture

but also of panel products used by Indian manufacturers.

As a result of the disrupted supply chain of products from

China retailers turned to domestic manufacturers only to

find that they too cannot work due to the Indian lockdown.

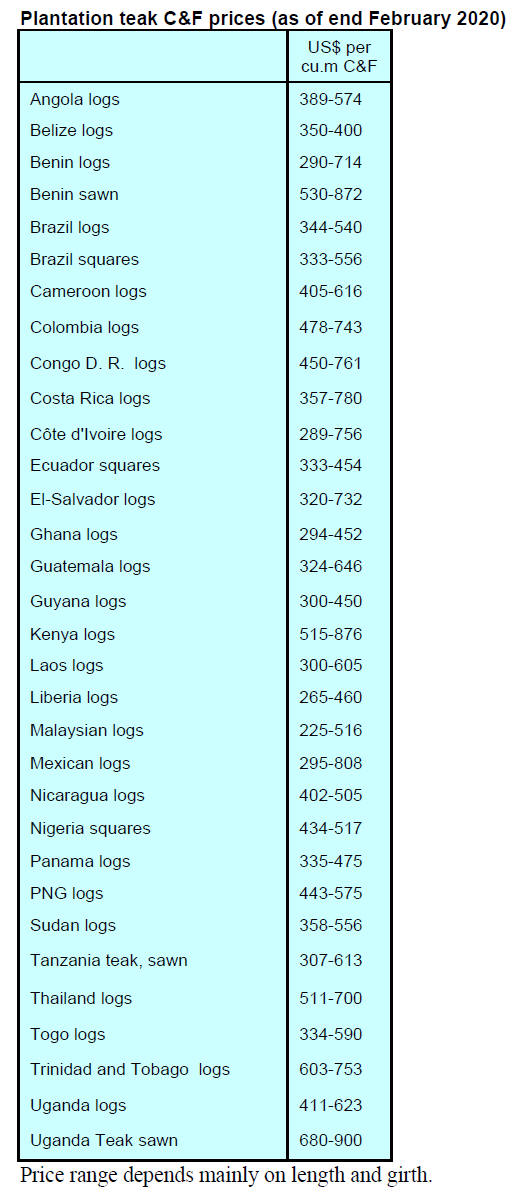

Plantation teak

As a result of the current pandemic business transactions

have come to a standstill. Even if trade was ongoing the

staggering currency fluctuations with Indian Rupee around

Rs76 to a US dollar would challenge importers. Until

currencies stabilise no importer would dare conduct

business.

Brazil and Ghana continue to offering relatively high girth

logs but Indian importers are waiting for exchange rates to

stabilise as exporter prices are in US dollars. It has been

reported that Colombia has offered sawn teak sizes

(inches) 3x3,3x4 and 4x4.for US$440 CNF, Indian ports.

C&F rates at Indian ports from various other sources

continue within the same range as given earlier.

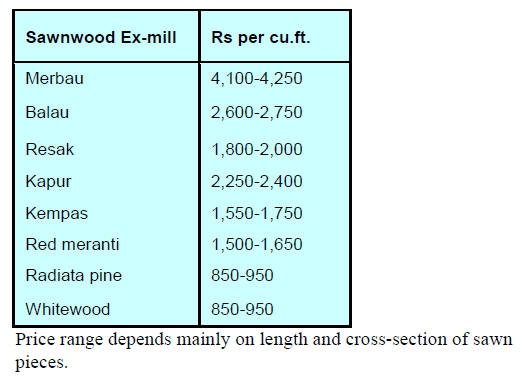

Locally sawn hardwood prices

Prices reported at the end of March are shown below. As

all trade is under lockdown no contracts are in play but

analysts suggest prices will have to rise if the rupee/dollar

exchange rate continues at the current level.

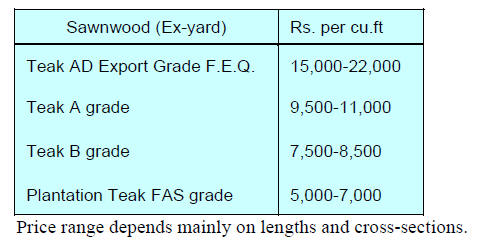

Myanmar teak prices

As all work has stopped in India there is no domestic

demand for Myanmar teak at present.

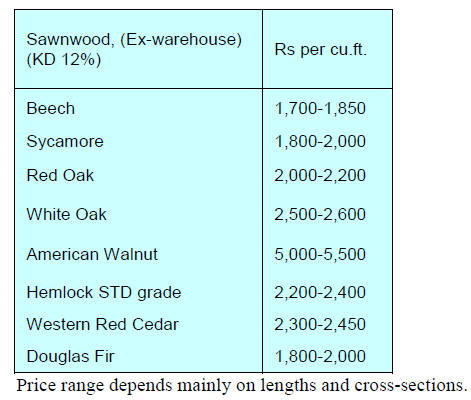

Sawn hardwood prices

Prices reported at the end of March are shown for

reference. There are no sales at present.

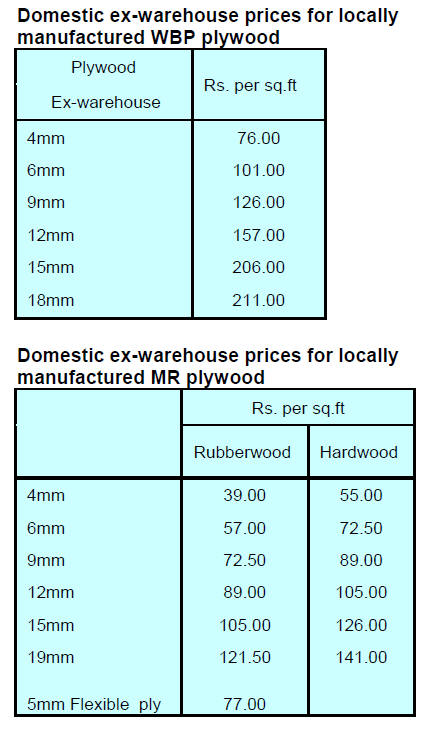

Plywood

Markets are closed due to Lock out. Factories are closed

and the workers have returned to their home states.

7.

VIETNAM

Vietnamese industry - growth disrupted

In the recent decade, based on 2 key competitive

advantages, including cheap labour (average monthly

wage of US$300) and an abundant wood supply (3 million

ha. of fast growing acacia plantation and 1 million ha. of

rubberwood., Vietnam’s wood and wood product

(W&WP) exports have consistently grown at over 10%

annually. This growth was maintained during the first two

and half months of 2020 when W&WP exports earned

US$2.047 billion, a year on year growth of 18%.

With the COVID-19 pandemic spreading in the US

(market for nearly 50% of W&WP shipped from

Vietnam), Japan (13%), China (12%), EU (10%), South

Korea (10%) the well-developed supply-demand chain has

been disrupted.

Survey - Impact of pandemic on timber sector

A quick survey conducted recently by VIFOREST and

local associations including HAWA, BIFA, FPA Binh

Dinh Associations with 124 enterprises shows the severe

impacts of the pandemic on Vietnamese wood industry.

Huge financial losses by enterprises

Responding to the questionnaire circulated by VIFOREST

and its associates, 76% of enterprises state that they are

facing pandemic damage and the initial loss is estimated at

VND3,066 trillion (around US$130 million); 24% of the

surveyed enterprises say that they have not identified

damage.

Most enterprises have reduced production, some have

to closed their factories

Over half (51%) of the respondents say that they had to

reduce production; 35% of enterprises assume that their

business can be maintained for some while, but suspension

may not be avoided in coming days; only 7% of

enterprises remain operational.

The situation, however, may turn worst at any time

because the entire industry live on the orders left from

2019, and no new ones have made in 2020.

The army of unemployed/unwaged workers is massive

The quick survey shows that about 45% of the labour

force employed in the wood processing industries have

lost their jobs due to the pandemic. Out of the 124

interviewed enterprises, 105 respondents informed that

before the virus outbreak they employed 47,506 workers

but they have now laid off 21,410.

The burden of loan repayments, social insurance

payments, taxes and other costs is acute

83 respondents complained that they are unable to pay

VND 178.6 billion of social insurance for their employees

(VND2.15 billion each enterprise on average);

50 enterprises responded that they cannot manage to cover

VND174.6 billion of VAT (equivalent to VND3.49 billion

per enterprise);

The income tax 64 enterprises have to pay is amounted to

VND212.9 billion (VND3.1 billion each) is beyond their

financial capacity at this crisis time; 61 enterprises tend

unable to handle VND44 billion of land rental fees (in

average, VND0.7 billion each enterprise has to pay);

The accumulated outstanding loans that 96 enterprises have

to settle amounts to VND 6,207 trillion (VND64.7 billion per

enterprise).

Emergency supports/rescue interventions by the

Government needed

The emergency support/rescue intervention sort by the

surveyed enterprises can be grouped á follows:

Financial intervention to support workers who lose their

jobs:

78 enterprises asked the Government to provide financial

support for the minimum wage (VND3.6 million per worker

per month) for workers who temporarily lost their job.

The Government is considering paying half of this minimum

wage, while the employers can get access to low/non interest

loan to cover the rest.

Immunity/postponement of taxes and fees applicable for

enterprises:

31% of surveyed enterprises have requested the Government to

exempt 100% of taxes, including corporate income tax, VAT,

as well as social insurance and land rental fees; 31% have

proposed to reduce 50% of these taxes and fees; 15% have

requested to reduce current payment level to 40% or less.

Extending the term for outstanding loan repayment:

30% of the surveyed enterprises tend to favour commercial

banks extending the term for loan repayment for an additional

6 month period; 29% prefer a 9 month extension; 13% ask for a

12 month extended; 6% for an extra 5 month period.

Reduction of loan interest rates applied by currently

commercial banks:

52% of respondents proposed lowering annual loan interest

rates down to 2-5%; 11% wish to have 2% rate; 5% can afford

the rate varying 5.1-7.0%.

Other emergency requests:

Struggling to survive and the hoping to overcome the pandemic

in the near future, apart from the above-mentioned requests,

enterprises also indicate specific considerations to be taken by

relevant authorities at central and local levels, namely:

Management boards responsible for running

Management boards responsible for running

industrial parks to offer one year exemption of

maintenance payment;

Leaders of Binh Duong Province to issue “red

Leaders of Binh Duong Province to issue “red

book” (land use certificate) so that enterprises

operating in provincial industrial parks could

leave necessary collateral for bank loans;

Extension the term for outstanding loan

Extension the term for outstanding loan

repayment without lowering the enterprise credit

rating;

Temporarily stop charging VAT on imported

Temporarily stop charging VAT on imported

goods;

Reduce the charge for goods

uploading/unloading

Reduce the charge for goods

uploading/unloading

at ports;

Temporary support livelihood of those workers

Temporary support livelihood of those workers

who are not eligible to get unemployment

insurance, and, thereby, enable suffering

enterprises to keep workers for post-pandemic

restoration of production;

Provision of preferential commercial loans

Provision of preferential commercial loans

needed for enterprises to maintain and improve

production capacity and get readiness for

business development while the pandemic gets

over;

Support to maintain the limit of short-term

loans

Support to maintain the limit of short-term

loans

to survive until the time when production and

business get re-normalised;

Stop collecting trade-union fee until the end

of

Stop collecting trade-union fee until the end

of

the pandemic;

No regular inspections on enterprise taxation

and

No regular inspections on enterprise taxation

and

other performances during the remained months

of 2020;

Allow enterprises to negotiate with their

Allow enterprises to negotiate with their

employees to fix non-employed wage/suspended

production subsidies;

Conclusion

This survey of 124 wood enterprises illustrates that the

COVID-19 pandemic is having a devastating impact on

the timber industry sector of Vietnam. Even though the

situation is changing fast and the worst picture be yet to

come the export-biased wood industry of Vietnam is

already facing a crisis.

The package of emergency support proposed by the

government to adjust fiscal policies, social insurances,

credit support, tax and fee exemption or reduction etc. is

insufficient and inadequate to protect the industry from the

impact of this pandemic. In all likelihood Vietnam not

see growth of W&WP exports this year.

Source: Data/information collected from 124 enterprises through

a quick survey and analysed by VIFOREST in association with

HAWA, BIFA, FPA Binh Dinh and the Forest Trends team.

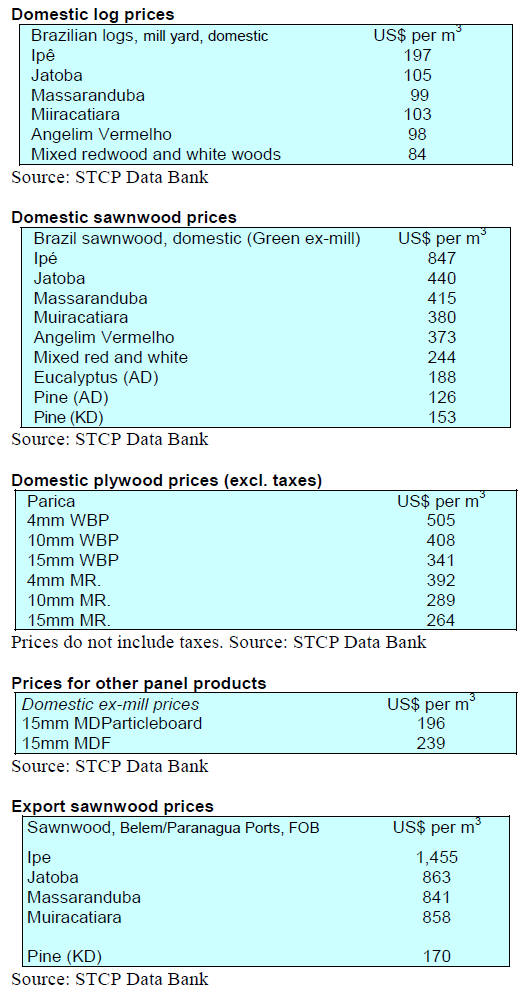

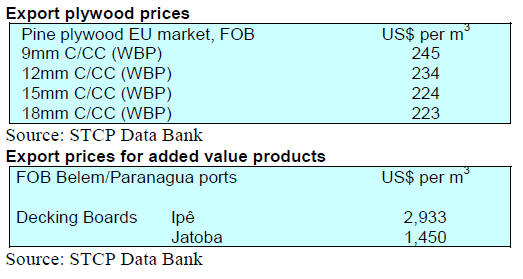

8. BRAZIL

Survey - Impact of pandemic on timber

sector

1. Are logging operations still working?

Yes, no significant change

2. Are mills/factories still working?

Depends on the segment. Pulp and paper 100%, solid

wood industry depends on the State or municipality

decisions. Most states have no significant restrictions but

some municipalites have stopped industrial operations.

Very had to estimate a percentage but is small.

3. Have workers been laid off?

The government has proposed legal provisions to mitigate

the impact. Options are anticipated, holidays, leave,

reduction of working hours with reduced salaries,

suspension of contracts.

Generally, so far, few companies have laid off workers but

the virus problem is just starting and will get worse in the

next few weeks.

4. Are laid off workers receiving payment?

Government assistance includes a small amount of money

over the next 3 months for unemployed persons and a

contribution to complement part of the salaries in case of

suspension or suspension of contract.

5. Are timber companies receiving government support?

Government support to companies includes a package of

credit lines. In addition payment of taxes were postponed.

6. Are companies still fulfilling orders placed pre-crisis?

Some domestic and international orders have been

cancelled. Force Majeure has been invoked. This is

expected to increase.

7. Are domestic logistics for the timber industry

functioning?

There are no logistical problems

8. What will be the main challenges in ramping up

production?

The problem is demand, there will be no problem in

ramping up production at the end of the crisis.

9. Please estimate how long it would take for production

to get back to pre-Covid Crisis levels?

Production will begin immediately the crisis is over.

10. What is your estimate (in US$) of national total lost

sales in Q1 2020 compared to Q1 2019?

For 202 it is estimated that a reduction of between 40-

50%. Most reduction expected in the next 6-9 months but

effect will be felt into 2021.

11. Comments, suggestions

All will depend on the recovery of the economies of the

importer countries. In the case of Brazil the domestic

market is quite important and the local economy is

expected to be affected in 2020 and into 2021. Brazil’s

exports of pulp and paper areis not expected to be

significantly affected. Markets for solid wood products are

highly concentrated in China USA and some EU member

states.

Exports of solid wood products to China (and other Asian

countries) will also decline but will be less affected. On

the other hand, exports to the USA and EU will decline

sharply in 2020 and into 2021.

Impact of and response to pandemic

The economic impact of the corona virus outbreak and the

measures adopted to try and slow its spread are having a

huge impact. Brazilian manufacturing activity in March

declined at the fastest rate in three years and the real sank

to a record low of 5.27 to the US dollar.

The impact on SMEs, especially those in the informal

sector, is the most critical because the

lockdown restrictions and containment measures mean

most workers in this sector are now without an income.

Paulo Guedes, The Minister of the Economy said the

government will spend about 98 billion reais (US$18

billion) to help the over 50 million informal workers

affected by nationwide lockdowns, part of an overall 800

billion reais government support package.

Other enterprises will benefit from a variety of non-tax

measures relating to employment and public health. The

government also introduced measures relating to tax

measures.

Tax and international trade facilitation measures

announced

There have been other decisions on measures for the

protection of the economy and maintenance of jobs and

incomes and the forestry and timber sectors will be offered

support. Some of the decision announced by the Ministry

of Economy for manufacturers include:

Zero IOF rates on credit operations for 90

days

Zero IOF rates on credit operations for 90

days

(Zero IOF is a macroeconomic concept

describing conditions with a very low nominal

interest rate,)

Extension of the deadline for filling

individual

Extension of the deadline for filling

individual

income tax return to June 30 (usually it is end of

April)

Postponement of the payment of federal taxes

Postponement of the payment of federal taxes

(PIS, COFINS and Employer's Social Security

Contribution) to August-October that would be

paid between April and May.

In addition, the Business Coalition for Trade Facilitation

and Barriers has suggested additional measures would be

essential:

Adjustment of the Reintegra (Special Regime

for

Adjustment of the Reintegra (Special Regime

for

Reintegrating Tax Values for Exporting

Companies) rate to 3%

Extension of the deadline of the Drawback

Extension of the deadline of the Drawback

concession acts due in 2020

Swiftness in the issuance and extension of

import

Swiftness in the issuance and extension of

import

licenses for 90 days

Postponement of deadlines for payment of

Postponement of deadlines for payment of

customs charges and fees

Total exemption of the physical presentation

of

Total exemption of the physical presentation

of

receipts for cargo clearance

Exports disrupted

There are great uncertainties in the how domestic and

international demand will evolve in the short-term and in

the longer term if the pandemic is not quickly controlled.

With the closure of borders many companies have export

containers stopped at the ports. Sindusmobil (Union of

Construction and Furniture Industries of São Bento do Su)

has reported that in the municipality of São Bento do Sul,

the major furniture manufacturing and export cluster, the

situation is uncertain as companies cannot plan as they do

not know when the situation will get back to normal.

In Arapongas municipality, which ranks third among the

largest furniture exporters in the country, the situation is

no different. Sima (Arapongas Furniture Industries Union)

reports that there are companies that produce primarily for

export and have lost this business.

For Sindmóveis (Union of Furniture Industries of Bento

Gonçalves), the supply and demand shocks caused by the

corona virus will significantly impact furniture exports and

the entire Brazilian industry. The extent of and likely

outcome of this crisis is still too early to assess.

Furniture industry back to work in Bento Gonçalves

On a brighter note the Bento Gonçalves industries

resumed operations on 6 April following Municipal

Decree authorisation. Sindmóveis provided guidance to

manufacturing companies in the furniture sector on how to

adopt other practices in order to prevent contagion in the

workplace, recommending working-from-home where

possible and adoption of flexible work policyies such as

phased work schedules.

Sindmóveis emphasised that manufacturing companies

have avoided layoffs, opting for alternatives approaches

but the recent moves are expected to limit unemployment

from now but a decline in production is inevitable and job

losses very possible.

9. PERU

Forestry paralysed by lockdown

A nationwide lockdown in Peru was announced on 16

March with some of the region’s most stringent

containment measures. Peru introduced gender-based

restrictions. Women were permitted out on Tuesdays,

Thursdays and Saturdays. Men permitted out Mondays,

Wednesdays and Fridays. Everyone had to stay home on

Sunday.

All activities in the forestry and timber sectors have been

stopped until further notice and recreational activities,

college classes, universities and institutes, cinemas,

theaters, as well as productive activities have been closed

except for priority or strategic activities such as food

production, health services and banking.

The International Monetary Fund forecast that this

decision will drive the country into a recession with

growth set to contract 4.5% this year.

The tough lockdown has slowed the rate of spread of

infection and in the number of people requiring

hospitalisation which is being interpreted as the country is

on the right track and can plan for a gradual reopening of

the economy next month. President Martin Vizcarra

suggested some restrictions could be eased in May despite

the rise in infected people identified in a mass testing.

Vizcarra announced a huge stimulus package including

cash handouts and cheap business loans one of the largest

packages yet to be announced in South America.

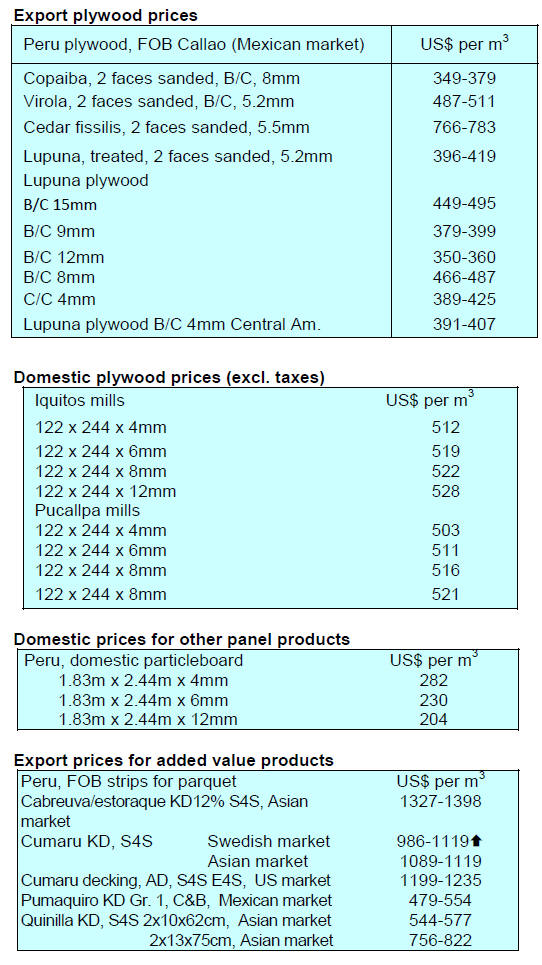

2019 export performance

The Exporters Association (ADEX) has reported that 2019

wood product exports earned US$124.9 million FOB. This

is almost the same as export earnings in 2018. Semimanufactured

product exports accounted for around 65%

of wood product exports followed by sawnwood (22%)

where there was an 18% increase year on year. Exports of

builders’ woodwork dropped over 30% and exports of

veneer, plywood as well as furniture and parts were lower

than in 2018.

Of the US$124.9 million exported in 2019 China

continued to be the main market, accounting for a 40%

share of export values but this was down 4% year on year.

Mexico was the second largest export markets accounting

for 11% of exports. Here export earnings were up almost

5%. The other major markets were France and the US

which each accounted for around 9% of export earnings in

2019.

Sawnwood exports in 2019 earned US$27.4 million

significantly up on 2018. The main destination for

sawnwood was the Dominican Republic (33% of all

sawnwod exports). Sawnwood exports to the Dominican

Republic increased over 25% in 2019 from a year earlier.

The other markets were Mexico (25%) and China (24%).

Loreto region achieves highest forest zoning

nationwide

Peru has the challenge of zoning 125 million ha.

corresponding to 97% of its territory and progress has

been made with the approval of the first stage of forest

zoning in Loreto as a result of cooperation between the

Regional Government of Loreto and the National Forest

and Wildlife Service (Serfor). Loreto is now the region

with the largest area of forest zoned at 15.9 million

hectares.

With an area of 36.9 million hectares, Loreto has the

largest área of tropical rain forest and with the approval of

its forest zoning has taken a big step to credible

sustainable management of its natural resources.