4.

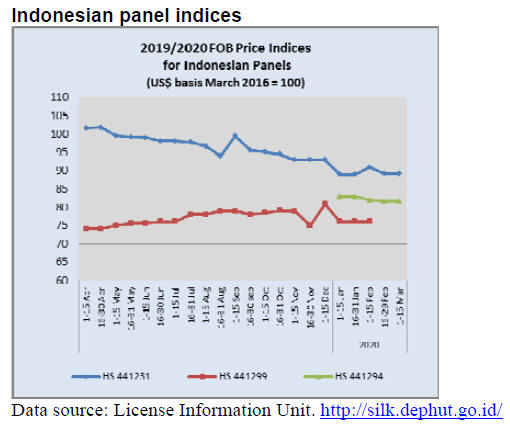

INDONESIA

Sharing experiences in addressing

illegal timber trade

Speaking in the Annual Session of the Enforcement

Committee of the World Customs Organization

Committee) in Belgium Yuri O. Thamrin, the Indonesian

Ambassador to Belgium said Indonesia continues to

collaborate with the European Union in combating the

illegal trade in wood products and this collaboration can

be an example for other countries.

The WCO Secretary General, Kunio Mikuriya, agreed

saying the experience of Indonesia in addressing trade in

illegally harvested wood products needs to be shared with

law enforcement and Customs administrations in other

countries.

During the meeting, Ambassador Yuri asked the EU to

strengthen their policies so that countries that satisfy EU

regulations have an advantage over others that do not.

Yuri reiterated Indonesia's strong commitment to stamp

out the trade in illegal wood products saying he hopes EU

importers will not buy illegal wood from any country.

Government acts to alleviate impact of corona virus on

timber industry

Susiwijono Moegiarso, Secretary of the Coordinating

Ministry for the Economy, announced that in cooperation

with other ministries the government is preparing

economic stimulus packages to address the impact of the

corona virus.

A focus of measures proposed will be how to address the

depletion of raw materials for manufacturers and

exporters, said Susiwijono. It has been learnt that

consideration is being given to simplifying the rules on

export trade. These include changes to the Timber Legality

Verification System (SVLK) for wood products, to

phytosanitary certification and certification of origin. Also

under consideration is relaxing import regulations for raw

materials.

The aim of the proposed measures is to accelerate imports

and reduce logistics costs.

For more see:

https://bisnis.tempo.co/read/1315308/4-paketkebijakan-ekonomi-antisipasi-pasokan-bahan-bakumenipis/full&view=ok

In related news the Chairman of the Indonesian Chamber

of Commerce and Industry (Kadin), Rosan Roeslani,

specifically said it would be desirable to ease restrictions

on both raw materials and ancillary products needed

during manufacturing.

Rosan pointed out that supply chains have been disrupted

due to the virus and this is a serious issue for

manufacturers as it is difficult, in a short time, to find

alternative sources previously supplied from China which

accounts for a large proportion of raw materials and

auxiliary goods supply to Indonesia.

See:

https://tagar.id/imbas-corona-kadin-minta-pemerintahrelaksasi-impor

US decision may mean loss of market share for

Indonesia

The US government's decision to exclude Indonesia from

the list of developing nations can affect its current account

balance according to the Institute for Development of

Economics and Finance (Indef).

Indef has urged the government to try and reverse this

decision which will make Indonesia's exports to the US

more expensive and could result in failing market share in

the US. The US is a major market for Indonesia's textiles,

garments, footwear, rubber, furniture and electronics and

exports were worth over US$17 billion last year.

IFEX 2020 Postponed

The Indonesian Furniture and Craft Industry Association

(HIMKI) and Dyandra Promosindo has confirmed

postponement of the Indonesia International Furniture

Expo (IFEX) 2020.

See:

https://pressrelease.kontan.co.id/release/kepentingankesehatan-di-atas-segalanya-himki-dan-dyandra-tunda-pameranifex-2020

5.

Myanmar

Karen National Union encouraging

forest conservation

The domestic press in Myanmar has reported that one of

the major ethnic groups in Myanmar, the Karen National

Union (KNU), has said it will introduce conservation

measures and forest demarcation and inventories to

combat deforestation. The plan entails encouraging the

‘taungya’ system in village owned forests.

Harvesting for basic needs will be permitted but

commercial scale harvesting will be prohibited. The report

says the KNU Forest Department has established 39

village-owned forest plots, 29 permanent forest areas and

3 protection forests. It has been estimated that around 60-

65% of forests are in ethnic minority States.

Forestry sector contribution to the economy

According to the Ministry of Commerce, earnings

generated by the forestry sector in 2018/19 totalled

US$174 million. In addition, the Myanma Timber

Enterprise, the Forest Department and private companies

in the formal sector alone account for over 4% of national

employment according to a Myanmar Extractive Industries

Transparency Initiative (MEITI) report.

There is huge employment in the ‘informal’ timber sector

and as investments in the forestry and wood processing

sector increase so do employment opportunities.

However, companies face huge challenges in meeting

current domestic and international timber production and

export requirements and it has been rumoured that one of

Myanmar’s top timber exporters is likely to cease business

by year end.

Initiatives to support forestry sector

There are several initiatives aimed at supporting the timber

sector strengthen forest management and wood product

manufacturing. While not yet confirmed it is understood

the World Bank is preparing a support package aimed

mainly at plantation development.

In related news, the World Bank and the Korea Forest

Service recently signed a forest cooperation agreement to

support forest restoration, community forest conservation,

ecotourism and landscape restoration. One of the first

countries that could benefit from this is Myanmar.

See:

http://www.businesskorea.co.kr/news/articleView.html?idxno=41686

Winding down community FLEGT preparedness

Recently the Forest Department and Fauna and Flora

International held a workshop to formally end the project

“FLEGT Preparedness for Small Holder Timber Producers

in Myanmar”.

This project was supporting community forestry

production of verified legal timber. There are around

200,000 ha. of recognised community forest, both natural

forest and plantations, in Myanmar.

Public events cancelled

In response to the corona virus outbreak the Myanmar

government has announced restriction on mass gatherings

and public events including the traditional Thingyan water

festival until the end of April. The media reports that no

cases of the corona virus have been detected so far in the

country.

6. INDIA

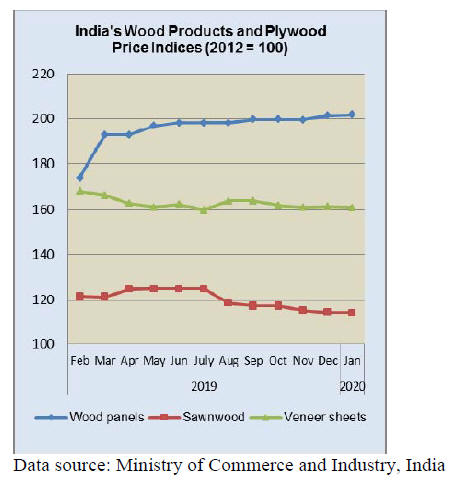

Lower prices for veneer but price

index unchanged

The official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for January 2020 rose to 122.9 from

122.8. The index for the group 'Manufactures of Wood and

of Products of Wood and Cork' remained unchanged at

133.1 despite a slight fall in prices for veneers.

Already in January there were signs of a slow-down in

manufacturing put down to the impact of the corona virus

risk and analysts say the import/export trade is

experiencing some slow down because shipping

opportunities have fallen as shipping companies respond

to the virus risk.

The annual rate of inflation based on monthly WPI in

January 2020 stood at 3.1% compared to 2.6% in

December 2019.

The press release from the Ministry of Commerce and Industry

can be found at:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

State government moves to boost housing

In its 2020-21 budget the Maharashtra government

reduced stamp duty on property purchases. The lower

rate will apply in the areas falling under the Metropolitan

Region Development Authority and municipal

corporations of Pune, Pimpri-Chinchwad and Nagpur.

Currently, home buyers in Mumbai pay a stamp duty of

6% plus a 1% registration charge. In Pune, the stamp duty

currently is 6%. According to Housing.com this could

boost home buyer sentiment in the affected residential

markets of the state.

See:

https://housing.com/news/stamp-duty-land-deals-mmrrecovered-per-2017-18-rates/?utm_source=internal&utm_medium=email&utm_campaign=subscribersDigest

Disrupted supply chains

Indian companies are now facing disruptions of their

operations as the effects of the corona virus spread. The

biggest impact at present is on trade with China which has

expanded to over US$90 billion in recent years with the

Indian economy becoming ever more reliant on imports

from China.

Indian imports from China, at around US$75 billion last

year, are far above the roughly US$20 billion in exports

from India to China.

See:

https://www.forbes.com/sites/krnkashyap/2020/03/04/indiaseconomy-feels-the-pain-of-the-coronavirus-outbreak-inneighboring-china/#15b78b50d7cc

New record for US hardwood exports to India

According to a presentation by the American Hardwood

Export Council (AHEC) 2019 was a record year for US

hardwood exports to India with the value of sawn

hardwood and veneer exports totaling US$6.448 million.

Statistics were compiled from United States Department of

Agriculture (USDA) data released in late February 2020.

AHEC revealed that in 2019 sawn hardwood shipped from

the US to India increased by 72% in value to US$2.356

million and by 140% in volume to 4,082 cubic metres.

Exports of US hardwood veneer to India increased by 4%

to US$ 4.092 million.

According to AHEC, restricted domestic hardwood

availability, together with firm growth in the retail

furniture, handicraft and hospitality sectors drove demand

for a wide range of species making India an attractive

long-term prospective market for US hardwoods.

The top six American hardwood timbers exported in 2019

were hickory (1,229 cu.m), red oak (920 cu.m), walnut (

282 cu.m), white oak (358 cu.m), ash (356 cu.m) and

maple (240 cu.m).

For more see:

https://www.americanhardwood.org/en/latest/news/new-recordfor-us-hardwood-exports-to-india

Increased import duty an issue for Ikea

In the latest budget the Indian government increased

import duties on furniture from the present 20% to 25% a

move aimed at supporting domestic SME furniture

makers.

It has been reported that an executive of Ikea, which has

stores in India, met with the government to explain the

increase will impact its business which is centered on

providing affordable furniture but that the company will

do its best to absorb the rise in the import duty.

Ikea said, though the government's recent increase in

customs duty on imported furniture will have an impact on

its business it will not pass on the increase to customers.

See::

https://economictimes.indiatimes.com/industry/services/retail/ikea-not-to-pass-on-duty-hike-impact-on-imported-furniture-tocustomers/articleshow/74339902.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Domestic online furniture retailer sees earnings rise

Pepperfry, one of India’s online home furniture retailers

has reported solid revenue growth for 2019. Co-founded

by former eBay employees the company began as with a

focus on fashion and lifestyle but then moved to include

furniture.

Read more at:

https://yourstory.com/2020/01/furnituremarketplace-pepperfry-financial-results

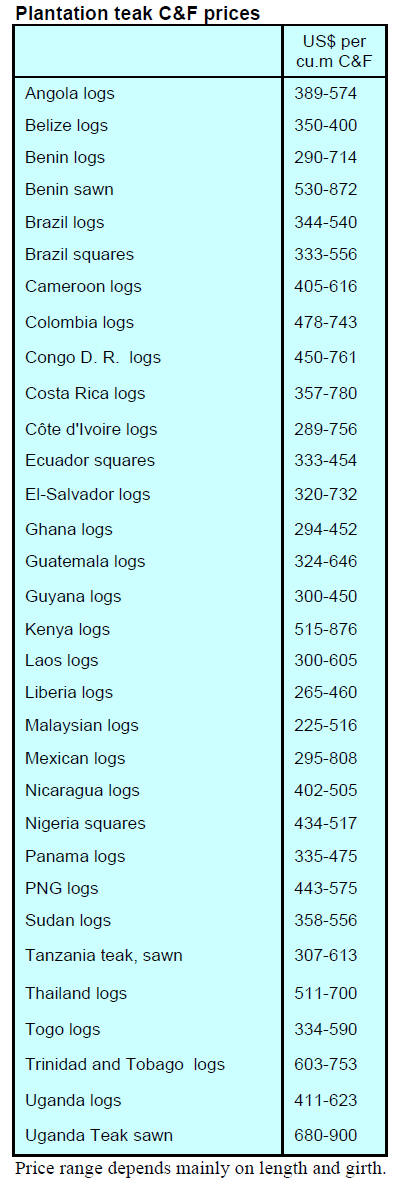

Plantation teak prices

Traders report that freight rates have begun to rise, an

indirect response to a slowing of container traffic due to

virus control measures. This has slowed down the

movement of shipments. Plantation timber prices have not

moved reflecting to steady but now uncertain demand

prospects.

C&F rates at Indian ports for teak timbers from multiple

sources continue in the range as given earlier. Importers

are carefully watching exchange rate movements and the

rupee has weakened a bit and is trading at around Rs.73 -

74 per US dollar.

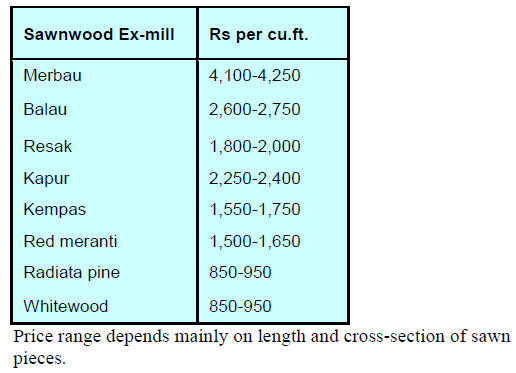

Locally sawn hardwood prices

Prices remain as reported at the end of February.

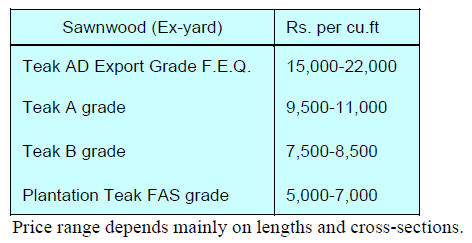

Myanmar teak prices

Prices remain as reported at the end of February.

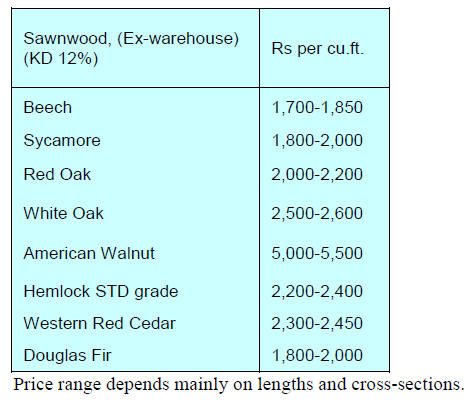

Sawn hardwood prices

With more than adequate supplies, even in the face of a

modest rise in demand, prices are holding as reported at

the end of February.

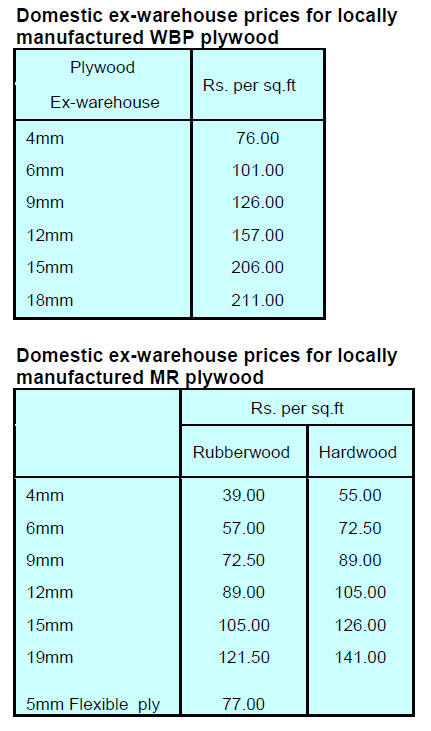

Plywood

Plywood wholesale prices have not moved since the end

February report despite some improvement in demand

which has lasted for a few months. The main worry among

manufacturers is that domestic and imported raw material

costs may rise due to disruptions in production and trade

brought on by responses to the corona virus.

China has emerged as a supplier of panels in the Indian

market and as many plants in China have resumed

production supplies have not been affected.

7.

VIETNAM

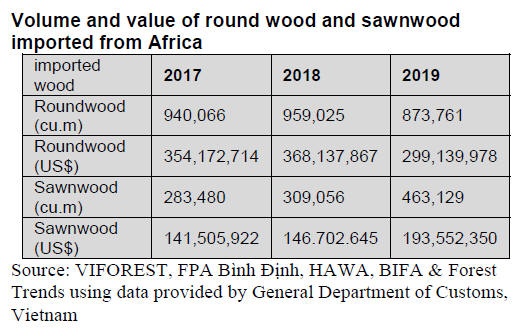

Vietnam’s imports from Africa

Africa, in general, and Cameroon, in particular, has

become a top supplier of roundwood and sawnwood for

Vietnam.

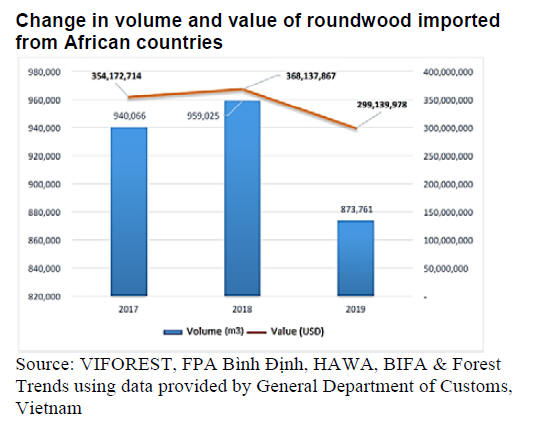

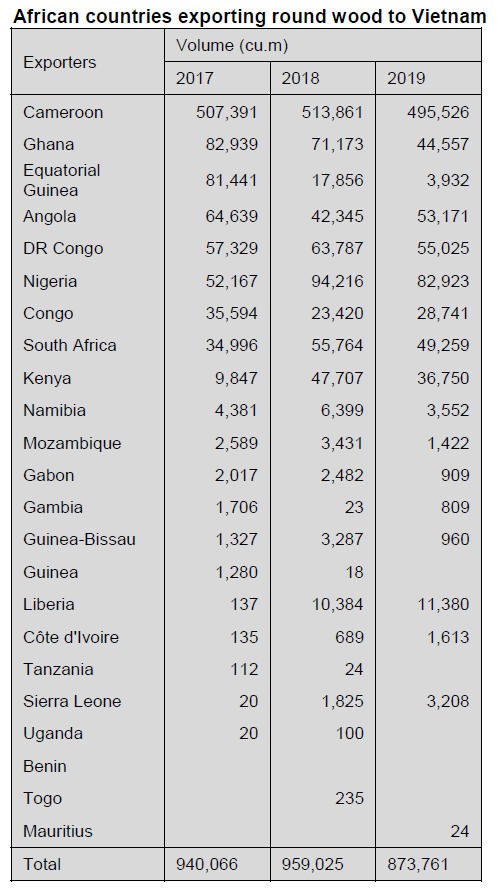

Roundwood imported from Africa into Vietnam

In 2019, Vietnam imported 873,700 cu.m of roundwood

from various African countries with value of US$299

million (a decrease of 9% of volume and 19% of value

over the comparable period of 2018).

Cameroon top roundwood supplier for Vietnam

In 2019, Cameroon exported 495,500 cu.m of roundwood

to Vietnam worth to US$181 million.

In recent years imports of African roundwood into

Vietnam has declined in both volume and value.

Of special note is the fact that Cameroon alone has been

exporting around half million cu.m of roundwood to

Vietnam. Though, in 2019, both the volume and value of

roundwood exported by Cameroon to Vietnam has

declined however, this country still remains as the top

roundwood supplier for Vietnam.

Imported wood species

Tali/okan, doussie, sapelli, padouk are the 4 top imported

species.

Tali/okan, doussie, sapelli and padouk are the major

imported species. In 2019, import of tali/okan roundwood

amounted to 333,600 cu.m equivalent to US$ 123.7

million.

Hoàng Diệu and Cảng Xanh in the South of Vietnam and

several ports belonging to Hải Phòng City in the North are

top delivery ports for wood imported from Africa into

Vietnam.

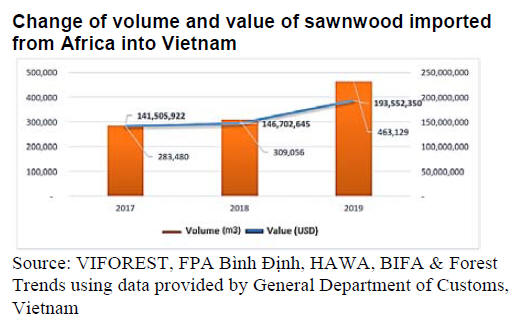

Sawn wood import volumes and values

In 2019, the volume of sawnwood imported from Africa

into Vietnam was 463,000 cu.m (an increase of 50% over

the comparable period of 2018) worth US$193.5 million

(an increase of 32% over the comparable period of 2018).

The increase of sawn wood import is in contrast to the

decline in roundwood imports from Africa to Vietnam.

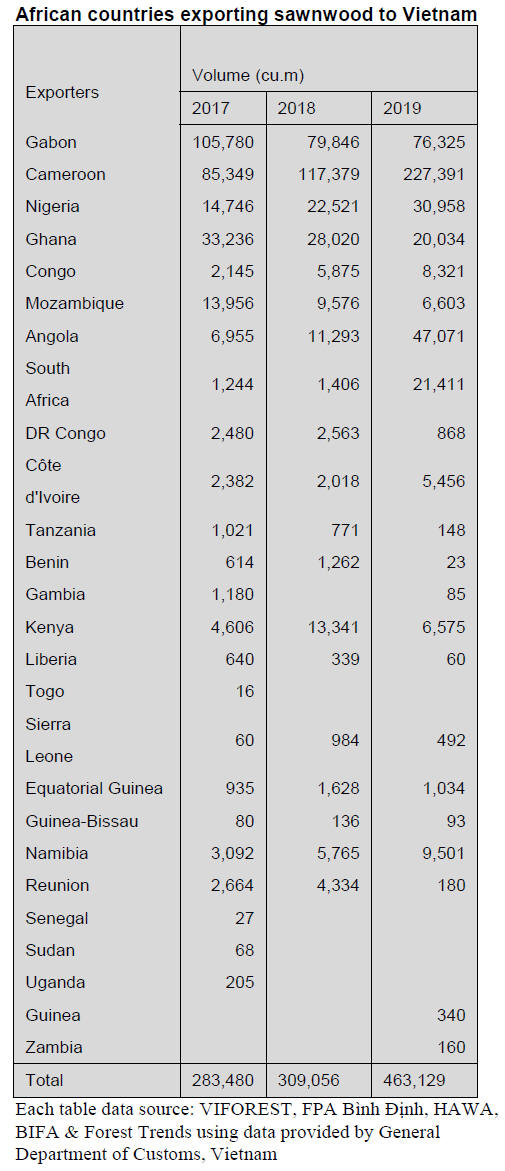

Cameroon, Gabon, Nigeria, Angola, Ghana and South

Africa are top listed suppliers of sawnwood for Vietnam in

both volume and value. The volume and value of

sawnwood imported from Cameroon, Nigeria, Angola and

South Africa sharply increased, while from Gabon and

Ghana dropped in continuum.

In 2019, in particular, the volume of sawnwood imported

from Cameroon doubled over the comparable period of

2018 and the value increased correspondingly. The import

of sawnwood from Gabon showed a contrary trend with a

decrease of 95% and 83% in volume and value relatively

as compared with the same period of 2018.

Imported species

As with logs, tali/okan topped the imported sawnwood

species. In 2019, Vietnam imported from Africa 216,300

cu.m of tali/okan roundwood equivalent to US$104.6

million.

Following tali/okan, doussie ranked number 2 with

106,400 cu.m (US$44.9 million) amongst sawnwood

species imported from Africa into Vietnam.

In addition, mussibi/rosewood is listed as the top imported

species.

It is noted that, in 2019, the import of sawnwood of

various species, including tali/okan, doussie and rose

wood have increased considerably. In particular, the

volume of imported tali/okan sawnwood has increased by

1.4 times (1.25 times in value) against 2018.

Most of sawnwood imported from Africa into Vietnam

arrives at Hai Phong City in the North of Vietnam.

8. BRAZIL

More plantations than first assessed

in Minas Gerais

The Forest Industry Association of Minas Gerais (AMIF)

has adopted advanced techniques for surveying and

monitoring forest plantations in the state in order to

facilitate traceability.

According to the most recent survey carried out by AMIF,

the forest plantation area, including all species, totalled 2.3

million hectares almost 18% higher than announced after

an earlier survey. Of the species planted eucalyptus still

represents the highest percentage. AMIF says there is

scope to introduce more species such as Australian cedar,

African mahogany and rubberwood.

Wood products produced in Minas Gerais State are

consumed mainly by the steel industry and pulp industries

as well as being used to produce laminate flooring, woodbased

panels and sawnwood.

Furniture industry growth in Mato Grosso State

Although the major furniture clusters in Brazil are located

in the Southern Region the furniture industries in Mato

Grosso do Sul State has performed well. The furniture

industry anticipates a growth of up to 20% in the Gross

Production Value (GPV) for 2020. If this is correct sector

output would go from R$205.5 million in 2019 to R$246.6

million this year.

According to the Inter-municipal Union of the Furniture

Industry in Mato Grosso do Sul (SINDMAD/MS), in

recent years the furniture sector in the state has

experienced difficulties resulting in stagnation of output

and sales. However, since December 2019 the sector saw

an increase in sales which has generated an expectation of

growth of 20%.

The furniture industry in the State has 372 manufacturing

plants which together employ 2,700 workers according to

the Industries Federation of the State of Mato Grosso do

Sul (FIEMS).

The challenge for the sector is to better structure the

furniture industry as there are many small woodworking

plants which often work in the informal sector. According

to SINDMAD sales by the furniture industry are closely

linked to the civil construction sector which projects

growth of 2% this year.

Wood and wood products half of Acre state exports

Acre State is one of major timber producing states in the

Amazon Region together with Pará and Mato Grosso.

According to the Ministry of Economy, more than half of

the goods exported by the state of Acre are wood and

forest products.

Exports from Acre were US$3.3 million in February 2020

and of this 60% was of forest products. While wood

products accounted for around 40% much of the balance

was of Brazil nuts.

In February the markets for Acre exports were Hong Kong

(US$548,000, 17%), China with 16%, the United States

with 13% and Peru with 12%.

Forest plantation sector stable in 2019

The latest IBÁ (Brazilian Tree Industry) report, pointed

out that in 2019 exports of forest products totalled US$9.7

billion. Pulp exports earned US$7.5 billion while paper

products earned US$2 billion and wood-base panels

US$265 million.

In 2019, China remained the main market for Brazilian

pulp with exports amounting to US$3.2 billion. In

contrast, markets in Latin America are mainly for woodbased

panels (US$164 million) and paper (US$1.2 billion).

According to IBÁ, 2019 was a year of an adjustment for

the forest industry. Despite the country's sectoral challenge

and economic instability the sector maintained its

contribution to national exports. Looking to the future,

investments of about R$32.9 billion are anticipated.

Between 2014 and 2017, investments were around R$20

billion such that the forecast investment demonstrates the

long-term and sustainable vision of the entire sector.

9. PERU

Traceability and transparency - the

benefits of the

‘Operations Book’

Following extensive training of regional government

officers in Madre de Dios, Loreto and Ucayali by the

National Forest and Wildlife Service (SERFOR), on 2

March 2020 authorised forest land title holders began to

use the ‘Operation Book’ to record harvesting.

The ‘Operations Book’ is of vital importance in supply

chain management as it allows traceability and

transparency contributing to the fight against illegal

activities. The information in the ‘Operations Book’ will

serve as an input for the preparation of the forest transport

guide and to check harvesting against approved

management plans.

Support on forest fire management

For the first time, Peru has a roadmap for forest fire

management that provides an inter-sectoral plan for forest

fires management.

The development of the roadmap was led by the National

Forest and Wildlife Service (SERFOR) with technical

support from the USAID FOREST program and the US

Forest Service.

The roadmap has been prepared by an inter-sectoral group

made up of institutions including SERFOR, the National

Service of Natural Areas Protected by the State

(SERNANP), the Fire Department, the Fire Department

Firefighters, the National Institute of Civil Defence

(INDECI), the Ministry of Culture and the Joint Command

of the Armed Forces.

An exchange of experiences is key to training of worldclass

forest fighters and two Peruvian brigades travelled to

California during the high fire season to participate in a

specialised 60-day course with elite brigades in US forest

fire service.

OSINFOR showed progress in its management

In late February forestry sector stakeholders came together

at the invitation of the Organism for the Supervision of

Forest Resources and Wildlife (OSINFOR) to share

experiences on progress in management in the sector.

According to OSINFOR, implementation of forest

management plans has improved significantly. According

to the OSINFOR Management Information System

(SIGOSFC), the extent of over harvesting and under

reporting harvests has fallen significantly.

In related news, an agenda for further institutional

strengthening of OSINFOR has been developed with

support of Hank Kashdan, the now retired Associate Chief

of the US Forest Service.

The work will focus on three themes: institutional

strengthening, territorial coordination, and capacity

development in communities. This initiative was made as

possible with the support provided to OSINFOR by the

USAID FOREST program and the US Forest Service.

Regional independence allows for flexible budget

management

It has been reported that in 2019 the forest authorities in

Loreto, Ucayali and Madre de Dios successfully

negotiated for additional budgets from the Ministry of

Economy and Finance.

The extra money was used to strengthen activities that

regional governments conducts on prevention, control and

surveillance issues on activities that threaten forest and

wildlife resources; forest and wildlife zoning; national

forest inventory and permanent production forests; and

granting rights of access to forest and wildlife resources

and follow-up and verification actions.

Audits revealed that over 90% of the extra budget

allocations were efficiently utilised.

The Ministry of Economy and Finance has a facility to

provide extra budgetary support and in 2019 it was the

first time that a forest authority requested an additional

budget directly from the ministry. This was possible as

beginning last year the three regions have greater

independence in the administration of their own resources.