|

Report from

Europe

Recovery in EU wood imports continues in 2019

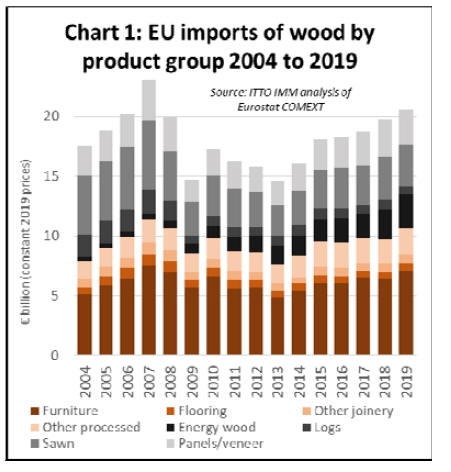

The total value of EU28 imports of wood products was

20.51 billion euro in 2019, 4% more than in 2018. This

followed an increase of 5% to 19.7 billion euro in 2018. In

2019 EU28 import value was at the highest level since

2008 just before the global financial crises (Chart 1).

The rise in imports into the EU occurred despite

unfavorable exchange rates and weakening economic

growth during 2019, particularly in the second half of the

year. According to the EU Winter 2020 Economic

Forecast published on 13 February, GDP growth in the

EU27 (i.e. excluding the UK) slipped to 1.5% in 2019,

down from 2.1% in 2018. A further slight fall to 1.4% is

projected for 2020.

The slowing economy fed through into a 4% decline in the

value of the euro against the U.S. dollar last year

following an 8% fall the previous year. The British pound

dipped to an all-time low against the US dollar and other

top currencies in the middle of 2019 as concerns mounted

over Brexit, although it did rally to some extent towards

the end year.

On the other hand, EU currencies remained reasonably

strong relative to currencies in several key Eastern

European supply countries, including Ukraine, Russia, and

Turkey. These exchange rate fluctuations generally

favored EU imports from Eastern Europe and acted as a

drag on imports from North America and Asia.

Slow economic growth expected to continue in the EU

Looking to the future, the EU¡¯s Winter Forecast suggests

that the ¡°external environment remains challenging¡± but

that ¡°continued employment creation, robust wage growth,

and a supportive policy mix should help the European

economy maintain a path of moderate growth¡±. In a

positive note for the timber sector, the Forecast also

suggested that ¡°private consumption and investment,

particularly in the construction sector, will continue to fuel

economic growth¡±.

It was also noted that ¡°the European economy could

benefit from more expansionary and growth-friendly fiscal

policies and enjoy positive spillovers from more benign

financing conditions in some euro area Member States¡±.

However, the Forecast also suggests that ¡°overall the

balance of risks continues to remain tilted to the downside.

The ¡®Phase One' trade deal between the US and China has

helped to reduce downside risks to some extent, but the

high degree of uncertainty surrounding US trade policy

remains a barrier to a more widespread recovery in

business sentiment.¡±

The outbreak of the ¡®2019-nCoV' coronavirus, with its

implications for public health, economic activity and trade,

especially in China, is identified in the Forecast as a new

downside risk. ¡°The baseline assumption is that the

outbreak peaks in the first quarter, with relatively limited

global spillovers. The longer it lasts, however, the higher

the likelihood of knock-on effects on economic sentiment

and global financing conditions¡±.

On Brexit, the Forecast notes that ¡°While there is now

clarity on trading relations between the EU and the United

Kingdom during the transition period, there remains

considerable uncertainty over the future partnership with

the UK¡±.

As a forward-looking report, the EU Winter 2020 Forecast

excludes the UK which ceased to be an EU member on

31st January 2020 (although the UK is still subject to EU

regulations until the end of the transition period on 31st

December 2020).

For data on the UK, it is now necessary to look to the UK

Office of National Statistics (ONS), which reports that the

UK economy saw no growth in the final three months of

2019, as manufacturing contracted for the third quarter in

a row and the service sector slowed around the time of the

election. The ONS figures showed the UK economy grew

by 1.4% in 2019, marginally higher than the 1.3% rate in

2018.

More positively, ONS data shows that the UK economy

expanded 0.3% in December compared with the previous

month, better than expectations. This, combined with

recent sentiment indicators, suggests the UK economy has

picked up since the general election on 12th December.

EU wood furniture imports rise 10% in 2019

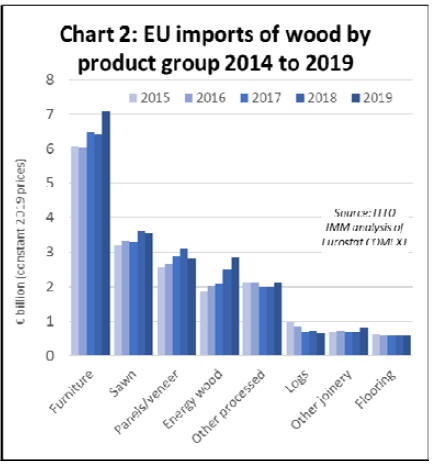

Considering individual products (Chart 2), the value of EU

imports of wood furniture increased by 10% to 7.07 billion

euro in 2019 after a 1% fall in 2018. After flat lining in

2018, imports from China, the EU¡¯s largest external

furniture supplier, increased throughout 2019.

Imports from Turkey, the second largest external supplier,

also made some gains, but not as large as those made by

several tropical suppliers including Indonesia, Vietnam,

Malaysia and India. Furniture imports from Bosnia were

weakening throughout the year, but imports from Serbia

were rising.

EU imports of sawn wood declined 2% to 3.57 billion euro

in 2019, losing some of the gains made the previous year

when imports increased 10%. After a strong first quarter,

sawn wood imports slowed dramatically from April 2019

onwards.

During this period, the pace of sawn wood imports fell

rapidly from all four of the leading suppliers, Russia,

Belarus, Ukraine, and the United States. Of tropical sawn

wood suppliers, imports from Cameroon and Brazil

increased, partly offset by a continuing fall in imports

from Malaysia.

EU imports of panels (mainly plywood) decreased 9% to

2.83 billion euro in 2019, wiping out the 8% gain made the

previous year and the first fall in imports of this

commodity for 6 years. Imports from Russia and Belarus,

which experienced particularly dramatic growth in

previous years, slowed throughout 2019.

Imports from China finished the year 2019 up on the

previous year but were weakening in the second half of

2019. Imports from nearly all the other main suppliers ¨C

including Brazil, Ukraine, Chile and the US ¨C were

weakening during 2019. Indonesia fared better than most,

a strong rise in plywood imports from the country in the

first half offsetting a slow down towards the end of the

year.

The long-term rise in EU imports of energy wood

continued in 2019 with annual import value rising 13% to

2.84 billion euro building on 20% growth the previous

year. There was another sharp increase in EU imports of

energy wood from the United States in 2019 (now

dominated by pellets), to reach nearly 1.3 billion euro,

with most destined for the UK. Imports of energy wood

also increased sharply from Russia, to nearly 0.5 billion

euro, and Belarus, mainly destined for continental EU.

Imports were stable from Canada and Ukraine.

EU imports of logs declined 9% to 660 million euro in

2019, after rising 3% the previous year. The downturn was

due partly to a slowdown in imports from Russia in the

second half of 2019, while all EU imports of logs from

Belarus ceased in 2019 after tightening of log export

controls in the country.

After rising 3% in 2018, EU imports of wood flooring

made another 3% gain to 610 million euro in 2019.

Flooring imports from China, by far the largest external

supplier accounting for around two thirds of the total,

continued to rise strongly in the first half of 2019 but

began to lose ground in the second half of the year, while

imports from Ukraine continued to make gains throughout

2019. Imports from Switzerland, Malaysia and Indonesia

were sliding throughout the year.

EU imports of ¡®other¡¯ joinery products (i.e. excluding

flooring and mainly comprising doors and laminated wood

for window frames and kitchen tops) increased 12% to 800

million euro in 2019, after flat lining the previous two

years. There was particularly strong growth in imports of

this commodity group from Indonesia, building on gains

made in the previous year, while imports from China and

Malaysia also made ground.

Recovery in EU imports from China

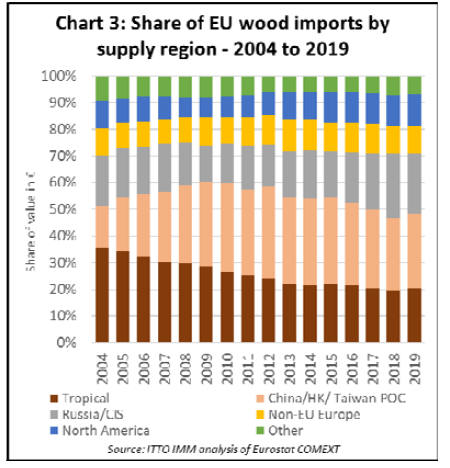

The total value of EU imports from China increased 6%

from 5.34 billion euro in 2018 to 5.71 billion euro in 2019,

mainly due to a partial recovery in imports of Chinese

furniture, and to a lesser extent joinery products and

plywood. After falling between 2015 and 2018, China¡¯s

share in total EU imports of timber products recovered

from 27.1% in 2018 to 27.8% last year (Chart 3).

After several years of rapid growth, EU imports of wood

products from CIS countries increased only 1% in 2019,

rising from 4.71 billion euro in 2018 to 4.74 billion euro

last year.

The share of CIS countries in total EU imports declined

from 23.9% in 2018 to 23.1% in 2019. The growth in

imports from Russia, Ukraine and Belarus all began to

slow last year. The slowing trend was apparent in imports

of sawnwood, plywood and logs from the CIS region.

However, EU imports of CIS energy wood and furniture

products continued to rise in 2019.

EU imports from non-EU European countries remained

flat, at 2.08 billion euro, in 2019 and share of imports from

these countries also remained level at just over 10%.

While imports from Bosnia and Herzegovina, Norway and

Switzerland slowed last year, imports from Serbia and

North Macedonia were rising.

EU imports from North America increased 4.3% from

2.30 billion euro in 2018 to 2.4 billion euro in 2019. The

region¡¯s share of total EU imports remained flat at 11.7%

during this period. Rising imports of pellets, and to a

lesser extent barrels, offset declining imports of

sawnwood, furniture, and veneers from North America.

The vast majority of EU imports from North America are

now from the United States and only small proportion

from Canada.

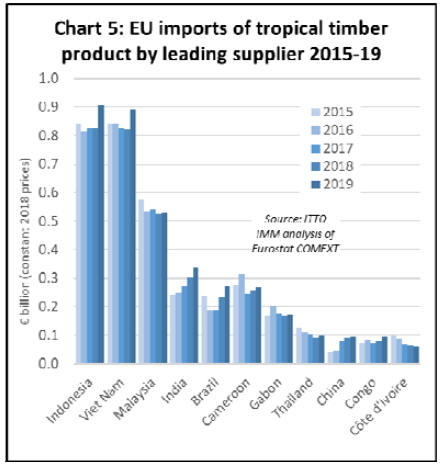

EU imports of tropical wood products up 7% in 2019

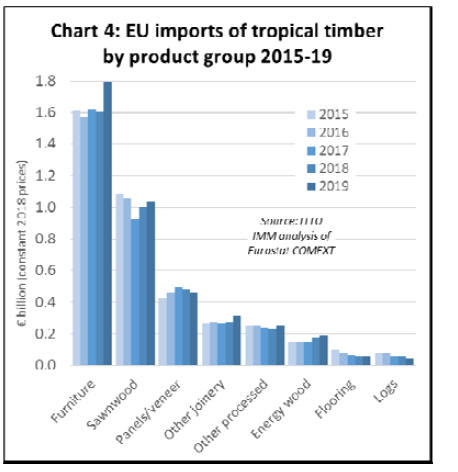

The total value of EU imports of tropical timber products

(including direct imports and imports via third countries

such as China) increased 7% to 4.16 billion euro in 2019.

This follows a 2% increase in import value in 2018.

The share of tropical timber in the total value of EU wood

product imports increased from 19.7% in 2018 to 20.3% in

2019, rebounding to the level of two years earlier.

Considering the long-term trend, after falling continuously

from 36% in 2006 to 22% in 2013, the share of tropical

countries in EU imports stabilized in the range 20-22%

during the six years between 2014 and 2019.

The increase in the total value of EU wood product

imports from the tropics in 2019 was driven mainly by

wood furniture with other smaller gains in imports of

tropical sawnwood, ¡®other¡¯ (i.e. non-flooring) joinery,

other processed wood products, and energy wood. These

gains offset a decline in imports of tropical panels/veneers,

flooring and logs (Chart 4).

In 2019, there was a 10% increase in EU imports of wood

furniture from tropical countries, from 825 million euros

to 904 million euros. Imports of tropical sawnwood

increased 3% during the year, from 1,006 million euros to

1,040 million euros, building on the recovery of the

previous year.

There was also a sharp 16% increase in EU imports of

¡®other¡¯ joinery products from tropical countries in 2019,

from 273 million euros to 316 million euros, with good

growth in imports of tropical doors and laminates. Imports

of energy wood, mainly charcoal, also increased, by 8%

from 177 million euros to 191 million euros. However, EU

imports of tropical logs, panels/veneers, and flooring were

either flat or declining in 2019.

The value of EU imports from the two leading tropical

suppliers, Indonesia and Vietnam, increased sharply in

2019, both benefitting from a significant increase in

shipments of wood furniture.

Imports from Indonesia increased 10% from 825 million

euros in 2018 to 904 million euros in 2019. Imports from

Vietnam increased 8% from 822 million euros to 890

million euros during the same period.

During 2019, there were also significant gains in EU

imports from India (by 12% to 339 million euro, mainly

furniture), Brazil (by 16% to 271 million euro, mainly

hardwood sawnwood and decking), Cameroon (by 5% to

268 million euro, mainly sawnwood), and Congo (by 17%

to 93 million euros, mainly sawnwood).

However, imports from Malaysia fell slightly, by 1% to

531 million euros last year, with gains made by Malaysian

furniture offset by a sharp fall in EU imports of Malaysian

sawnwood. EU imports from Côte d'Ivoire also continued

to decline in 2019, losing another 9% to only 61 million

euros.

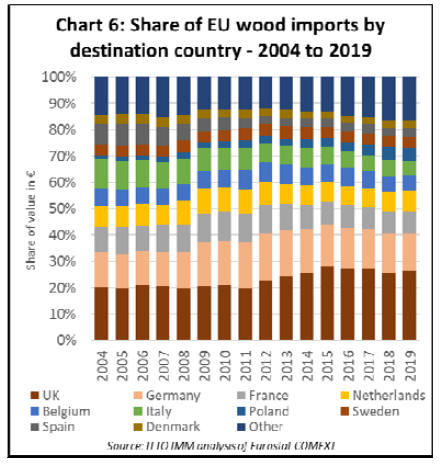

One quarter of EU wood imports destined for the UK in

2019

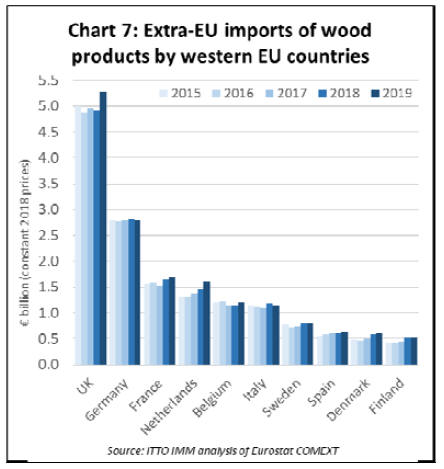

In 2019, the UK was by far the largest importer of wood

products into the EU from outside the bloc, highlighting

the impact of Brexit on the EU¡¯s position in the global

wood products trade. The UK¡¯s share of total EU imports

of timber products from outside the region increased from

24.9% in 2018 to 25.7% in 2019, reversing a slight

downward trend of the previous year. (Chart 6).

UK imports from outside the EU increased by 7% from

4.92 billion euro to 5.3 billion euro in 2019. The UK was a

significant recipient of rising EU imports of wood

furniture from China and Vietnam and pellets from the

United States in 2019. The Netherlands was the only other

Western European country to experience significant

growth in imports of wood products from outside the EU

last year, experiencing a significant rise in imports of

wood furniture from China and Indonesia (Chart 7).

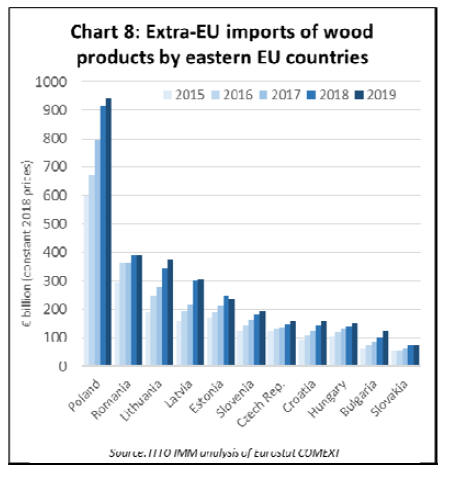

Meanwhile several Eastern EU countries continued to

record quite large and consistent gains in imports from

non-EU countries last year. Significant increases were

recorded in Poland, Lithuania, Latvia, Slovenia, Czech

Republic, Croatia, Hungary, Bulgaria, and Slovakia in

2019. However, imports into Romania and Estonia slowed

in 2019 after making gains the previous year (Chart 8).

The continuing strength of Eastern European imports is a

reflection both of their proximity to large external

suppliers in Russia, Ukraine and Belarus, relatively higher

rates of economic growth and construction sector growth

in Eastern Europe, and the establishment of new wood

processing and manufacturing capacity in the region.

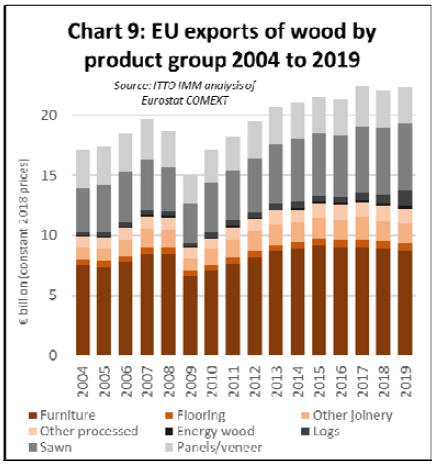

Slow growth in EU wood product exports in 2019

In 2019, the EU exported wood products with a total value

of 22.3 billion euro, a 1% increase compared to 2018 (22.1

billion euro) but below 2017 (22.4 billion euro) when

exports were at record levels (Chart 9).

Although EU exports of wood furniture, sawnwood,

panels, and ¡®other¡¯ joinery products, this was offset by a

rise in exports of energy wood, flooring, other processed

products and, particularly notable, a sharp increase in log

exports, much of it comprising softwood and destined for

China.

The combined effect of last year¡¯s large rise in EU

imports, balanced by a more moderate growth in EU

exports, was to reduce the EU¡¯s trade surplus in timber

products with the rest of the world from 2.37 billion euro

in 2018 to 1.81 billion euro last year. Longer term, the

EU¡¯s trade surplus in wood products has now fallen by

70% since 2013 (when it stood at over 6 billion euro) as

growth in EU imports has outpaced exports.

|