US Dollar Exchange Rates of

26th

February

2020

China Yuan 7.0046

Report from China

New Forest Law to crack down on illegal timber

The new forest law will become effective on 1 July 2020.

Article 65 of the newly revised Forest Law clearly states

that a timber processing enterprise shall establish an entry

and storage account for raw materials and products. No

unit or individual may purchase, process or transport trees

of illicit origin, knowing that they have been cut or cut

indiscriminately.

This provision provides a more clear legal basis to crack

down on illegal timber purchasing, processing and

transportation and also provides a clearer legal guide for

timber processing enterprises to fulfill their duty of due

diligence on timber legality.

See:

http://www.forestry.gov.cn/xdly/5201/20200214/101450070278948.html

Domestic timber wholesale markets resume business

It has been reported that timber from South America and

Southeast Asia recently arrived in Guangzhou and

Dongguan Ports and has been off-loaded. The domestic

timber wholesale markets have started work after the lull

due to the virus risk. The trade media (Wood365) has

reported that small volumes of timber have been delivered

to the wholesale markets after passing virus epidemic

prevention and control measures.

However, traders report activity at the markets is very

quiet and sales have not returned to normal as many

manufacturers have not resumed production despite the

arrivals of timber raw materials. Analysts say they do not

expect a recovery of trading until the end of March.

Enterprises resume production in China

Preventative measures including restricted access, body

temperature checks and disinfection of public areas have

undertaken. Large gatherings are avoided and workers

have been advised to wash their hands frequently and wear

a mask when away from home. Some businesses,

especially foreign-funded enterprises resumed operations

in China while strengthening epidemic prevention and

control measures.

It has been also reported that some wood products

enterprises have resumed production .

See:

http://www.chinadaily.com.cn/a/202002/24/WS5e5360c8a310128217279cf4.html

Reduced particleboard production in Guangdong

It has been reported that the production of wood-based

panels in Guangdong Province fell in 2019 with

production of particleboard dropping around 10%. The

main reason for the decline is said to be because some

large scale enterprises have stopped operations.

Several fibreboard enterprises in the Guangdong Shaoguan

Forest Region have ceased production. It has been

reported that Guangdong Hanhong Wood Industry Co.,

Ltd which has two German fibreboard lines with an

annual capacity of 240, 000 cubic metres has cut

production due to weak demand.

Measures to support the economy

It has been reported that the State Council decided to

waive the tolls on toll roads throughout the country until

the virus epidemic is brought under control. Other

measures being arranged are reductions in corporate social

insurance and an extended period for paying housing

provident fund.

These measures are aimed at ensuring continued

agriculture production and to secure stable employment.

In order to mitigate the impact of the epidemic on

enterprises during the time plants are closed medium,

small and mini-sized enterprises in all provinces except

Hubei will be exempted from corporate taxt,

unemployment and employment injury insurances and

housing provident fund payments up until June 2020.

Different measures are proposed for large enterprises.

See:

http://www.mot.gov.cn/guowuyuanxinxi/202002/t20200217_3333808.html

Big rise in logistics costs

Wood365 has reported that the China Logistics and

Purchasing Federation (CLPF) found that 85% of

enterprises report the epidemic is having a huge impact on

their operations and some risk bankruptcy. Many

enterprises considered starting operations after the 10

February deadline but most did not resume work.

Transport and freight rates have started to rise apparently

the result of the current epidemic. In a survey the CLPF

found 70% of companies thought transport costs would

increase by more than 10%, but around 40% said they

would rise by more than 20%. Some even suggested a

30% rise.

See:

https://www.sohu.com/a/374505303_737510

Lanzhou City ¨C the logistics centre for Russian timber

It has been reported that Russian timber will be distributed

to all parts of the country after arriving via the China-

Europe express railway terminal in Lanzhou City, Gansu

Province. This, say analysts, will promote the wood

processing industry and strengthen the supply chain for

imported timber the Western Region.

The Lanzhou New Industrial Zone is a major logistics

centre for Russian timber and it is anticipated the Zone

will attract investment in processing thus establishing a

new industrial cluster.

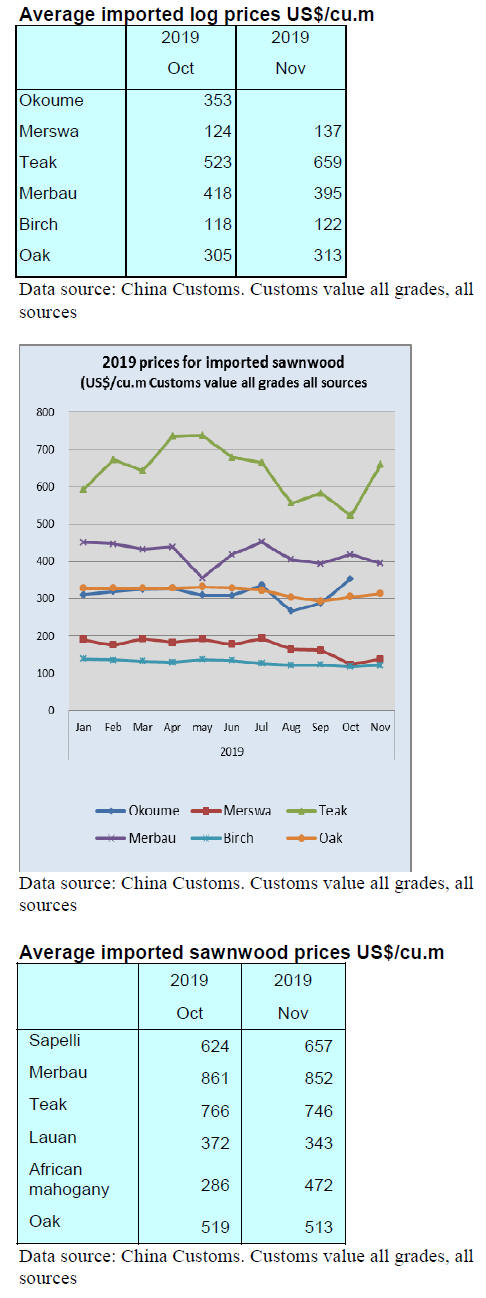

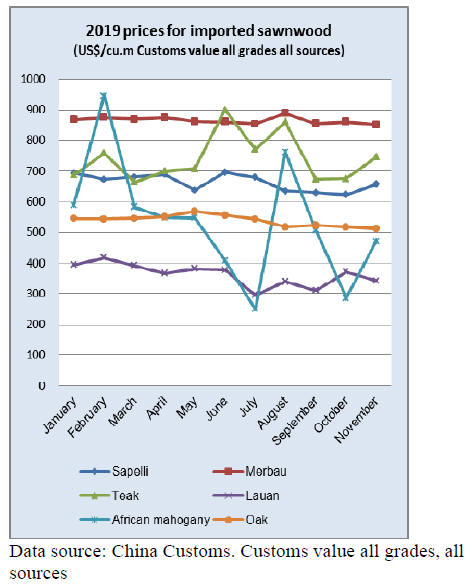

Imported C&F price data series

In an effort to provide more transparency on imported

timber prices in China a data set is provided below

showing average prices for some key timbers imported.

It should be noted that these average C&F prices are

derived from the import volumes and values as reported by

China¡¯s Customs.

We apologise for not being able to up-date the average

prices, China Customs is operating with a skeleton staff

due to the virus outbreak.

|