Japan

Wood Products Prices

Dollar Exchange Rates of 10th

February

2020

Japan Yen 109.77

Reports From Japan

Bank of Japan ready to expand stimulus

measures

According to Masazumi Wakatabe, Deputy Governor at the Bank of Japan (BoJ),

the Bank will expand its economic stimulus measures if the economy is at

risk from a contraction brought on by weakening global demand and by

heightened risks from the coronavirus outbreak which is already hurting

corporate sentiment around the world. Wakatabe said risks remain high

especially as it is unclear how the coronavirus epidemic will affect Chinese

manufacturing and imports.

While Japan¡¯s economy appears to have contracted in the final quarter of

last year the BoJ expects a recover this year.

Increase the consumption tax to contain Japan¡¯s massive debt says

IMF

Reuters has reported that Paul Cashin, International Monetary Fund mission

head for Japan, has warned that Japan¡¯s tourism, retail and export sectors

will be affected by the coronavirus outbreak.

This has already been reported by hoteliers and retailers in Japan who saw

massive hotel cancelations and a sharp drop in tourist arrivals and retail

sales in February. The IMF will provide an update on economic prospects for

Japan in its April global forecast.

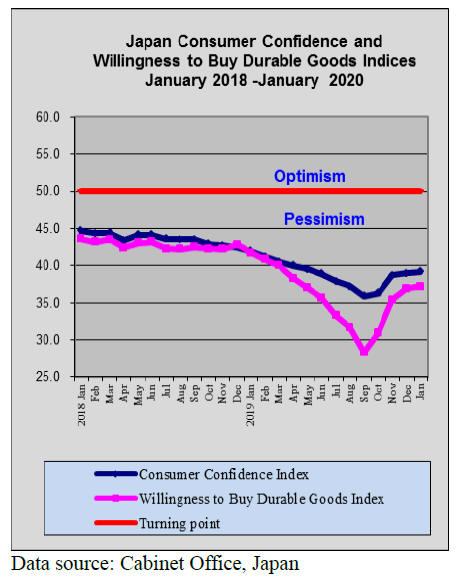

The coronavirus outbreak, coming on the heels of the 2019 increase in

consumption tax, is weighing on the economy. Household spending in Japan

dipped almost 5% in December 2019 from a year earlier.

Following the 2019 tax increase to 10% household spending fell over 5% in

October after the 2% decline in November. Under such circumstances consumers

immediately cut back on discretionary spending and the household furniture

sector is often an early victim.

In related news, the IMF has recommended that Japan incrementally raise its

consumption tax to fund growing social security costs. The Fund also warned

that Japan¡¯s public debt seems on track to rise to 2.5 times the size of the

economy by 2030 unless the country does not have a credible fiscal policy.

The IMF said the consumption tax would need to be lifted to 15% by 2030 and

to 20% by 2050 to finance surging costs because of the aging and shrinking

population.

See;

https://mainichi.jp/english/articles/20200211/p2g/00m/0na/019000c

Business conditions ¡®worsening¡¯ says Cabinet Office

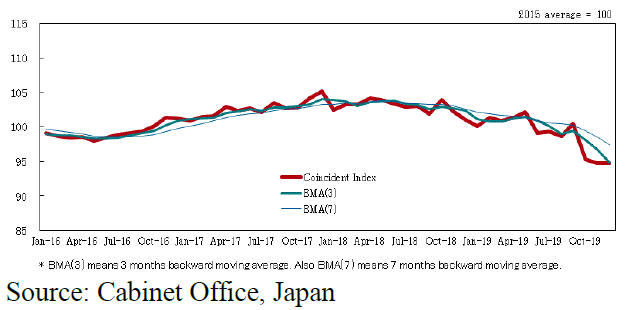

Japan¡¯s Cabinet Office data is supporting the view that the country¡¯s

economy may have entered a recessionary phase after a period of growth since

December 2012.

The composite index of coincident economic indicators is ¡°worsening,¡±

according to the Cabinet Office which reported conditions were ¡°worsening¡±

for the fifth consecutive month.

The coincident index, which reflects current economic conditions, stood at

94.7 in December against 100 for the base year of 2015.

Tax and virus, a double whammy for

consumption

The Japanese Prime Minister has instructed officials to prepare plans in

readiness to mitigate the effects of the coronavirus on the economy. The

media has reported that the government will compile emergency plans before

the end of February.

In the face of weakened consumer confidence due to the consumption tax

increase and because of the prospect of an economic slow-down as a result of

the virus outbreak, there is little chance of an improvement in confidence

in the January to March period.

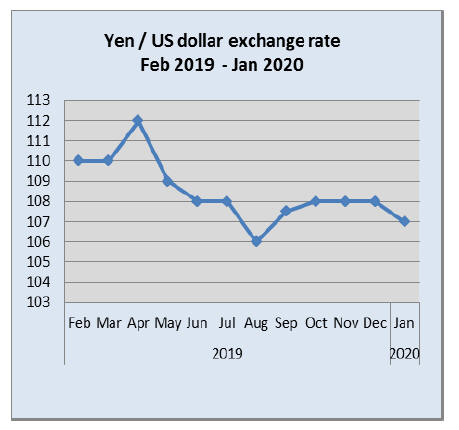

Yen dips to 110 but likely to strengthen

With diminished opportunities in Japan domestic investors are seeking

returns outside of Japan which is putting a downward pressure on the

yen/dollar exchange rate. In mid-February the yen was at around 110 to the

US dollar and analysts are forecasting continued yen weakness in the

short-term.

However, there is a general consensus that the yen is under-valued and that

because Japan continues to have a very large current account surplus, over

the medium to long-term a strengthening of the yen seems likely. The yen

/dollar exchange rate is close to 110 for the dollar, the weakest it has

been for many months.

Business model built on abandon home

remodelling

The latest survey has shown that Japan has around 8.5 million unoccupied

homes and the number continues to rise as families now tend to live

separately in their own homes and show no interest or cannot afford to

maintain their parents empty house. The problem of abandoned homes is

exacerbated where there is a drift of younger people to the cities.

For one new company in Japan, Katitas Co. this has become a business

opportunity. Katitas buys old homes considered worthless in a country that

spurns second hand everything, renovates them and sells them to people who

have only modest incomes or as second homes to city folk.

Houses in Japan are not built to last like those in western countries and

Japanese homes typically depreciated to zero over about 20 years and are

often then replaced. A Ministry of Land report says sales of pre-owned

houses represent just 15% of Japan¡¯s housing market the market compared with

around 80% in the US.

See:

https://katitas.jp/index_en.html

Import update

Furniture imports

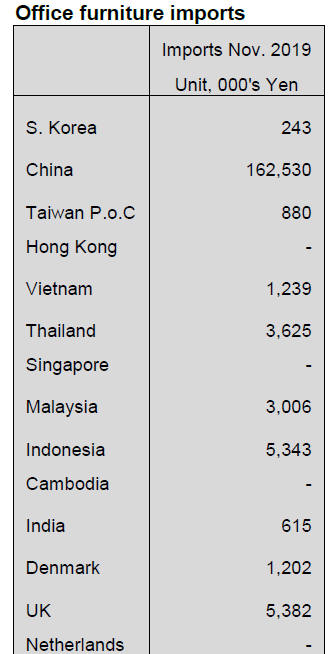

Office furniture imports (HS 940330)

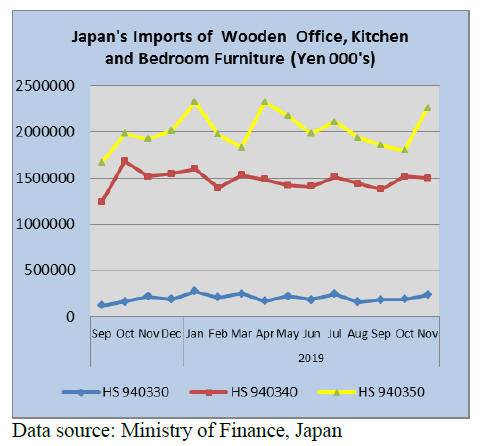

The dominance of Chinese shippers of wooden office furniture (HS940330) to

Japan extended into November 2019 where imports from manufacturers located

in China accounted for around 70% of all wooden office furniture imports in

the month.

The other main shippers were Poland and Italy, each contributing around 5%

each to November imports. November imports from China were up over 30%

adding to the 20% rise seen in October 2019.

Year on year Japan¡¯s November 2019 wooden furniture (HS940330) imports were

up 8% and month on month there was a 25% rise.

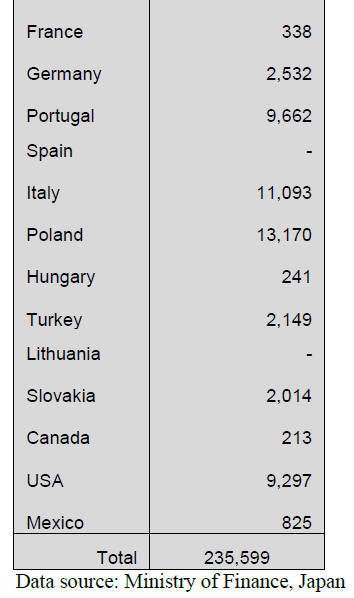

In contrast to the growth in imports of office

furniture, Japan¡¯s November 2019 imports of wooden kitchen furniture were

flat both year on year and month on month.

The top supplier in November was the Philippines at 46% of total monthly

import values closely followed by Vietnam which contribute a further 37% to

overall imports in November 2019.

Manufacturers in China are not big players in the wooden kitchen furniture

segment in Japan contributing just 8% to total November 2019 imports.

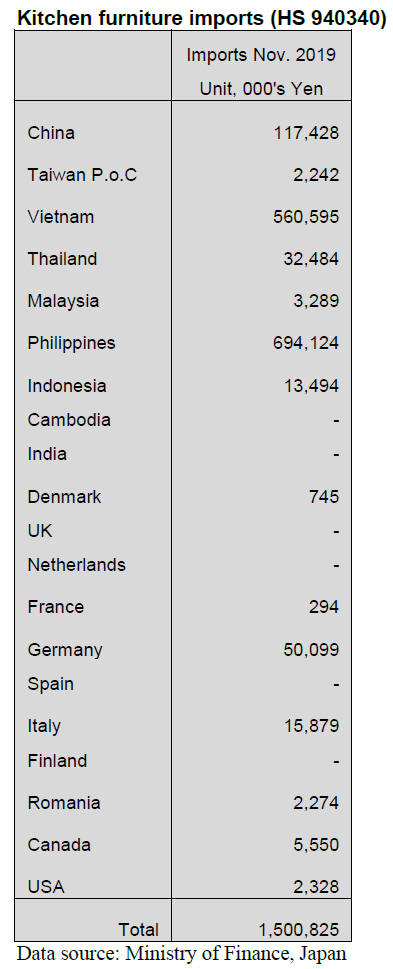

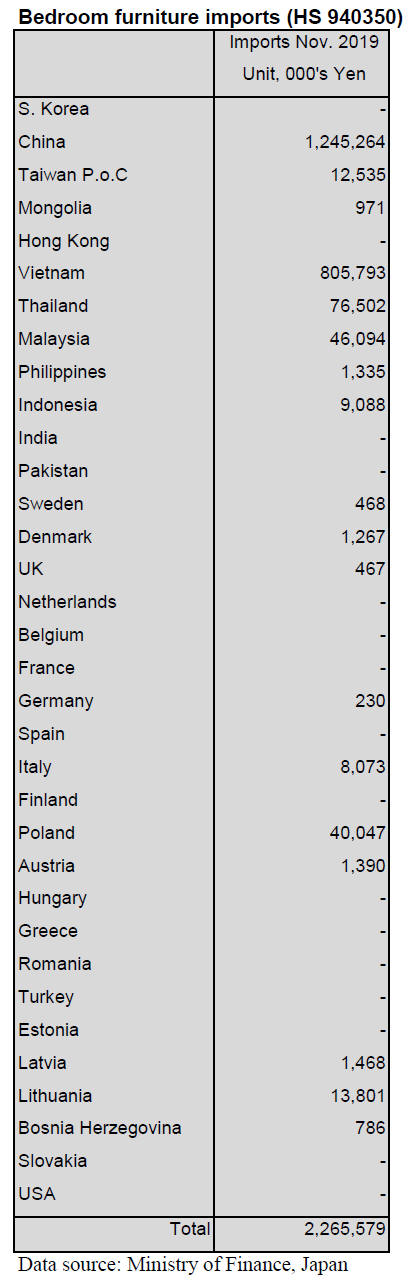

After three months of consecutive declines November

2019 imports of wooden bedroom furniture (HS940350) reversed direction

rising 26% month on month. The top two suppliers in November 2019 were China

and Vietnam with shippers in Thailand and Malaysia capturing just 5% between

them of November 2019 imports.

Year on year Japan¡¯s imports of wooden bedroom furniture in November 2019

were up 18% and there was a 26% increase in import values from a month

earlier.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published every

two weeks in English, is generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market precisely as it appears in

the JLR.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Hot topics of 2019

2019 is remembered as the year with series of natural disasters. Series of

typhoons hit Japan in summer months. Typhoon number 15 was small in size but

had very strong wind. It passed through Tokyo Bay and damaged many houses in

Chiba prefecture and resulted in many blowdown trees then typhoon number 19

brought record rain fall, caused devastated flood in many places as many

river banks failed and many houses were inundated and submerged in regions

north and north east of Tokyo.

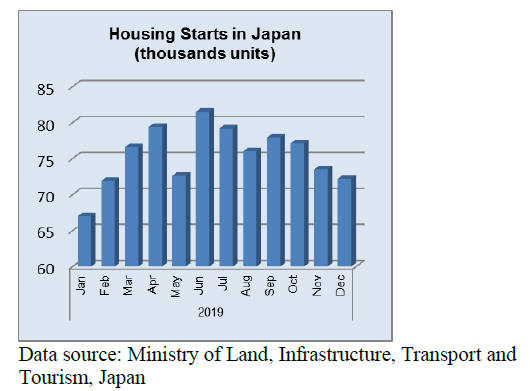

Another issue is increase of consumption tax from 8% to 10% since October.

Orders for housing before the tax hike were expected but there was not much

upsurge. Housing starts were particularly impacted continuous decrease of

rental units by overbuilt. Obviously boom of investment for building

apartments by record low housing loan interest busted.

After all there was not much drop for overall housing starts despite large

drop of rental units. This kept precutting plants busy all through the year

and domestic softwood plywood demand continued robust all through the year.

Two new plywood mills started in 2019 but there was no oversupply of

softwood plywood. However, labor shortage and trucking shortage become

headache for plywood manufacturers.

Constructions for the 2020 Tokyo Olympic Games peaked in 2019. The New

national stadium was completed and this is unique structure with many wood

products are used. Economy after the games is worried as there is not much

stimulus after the Olympic boom is over.

World wood products market in all through 2017 and first half of 2018 was

led by two big countries of the U.S.A. and China but after the trade war

started between these two countries, demand in two countries sharply receded

and the market plunged.

Development of super thick plywood

Seihoku Plywood (Tokyo) is developing super thick plywood with thickness of

more than 50 mm and it is applying to obtain JAS certificate. This will

allow Seihoku to participate in the new engineered wood market.

Presently the maximum thickness Seihoku is manufacturing is 32 mm.

Manufacturing of thicker panel is the same as standard panel but there is

limit of thickness for press so the process after press is used LVL line.

Seihoku happens to have LVL manufacturing line so through production of

super thick plywood is possible.

Thickness of veneer is 3.73 mm, thicker than standard veneer to make

standard plywood. Species it uses is domestic larch. Veneer goes through

veneer strength measuring machine and veneer with 100E -120 E strength is

recovered to manufacture super thick plywood.

Subject of plywood industry is to manufacture thicker panel and

non-structural panel. Thicker panel is aimed to become as new wood products

to compete with lumber, laminated lumber and structural LVL and it becomes a

new market for plywood manufacturers.

Seihoku has already succeeded to manufacture 200 mm thick plywood (width of

1,000 mm and length of 2,000 mm) by plying 57 veneers. This is used as

structural material for woo based eleven stories high training facility

Obayashi Corporation plans to build. 200 mm thick plywood is put in between

two 150 mm thick structural LVL posts and tied with drift pins.

Plywood

Movement of domestic plywood in January continues active but that of

imported plywood is getting slower and the importers are cautious in placing

new orders to the suppliers in Malaysia and Indonesia.

Domestic plywood manufacturers have been experiencing very active shipments

exceeding the production for last four months so that the inventories are

down to minimum. The shipment continues busy in January and the users are

asking quick delivery of delayed contracts and some plywood mills have

started filling February orders already so the mills work hard to manage

production and shipment.

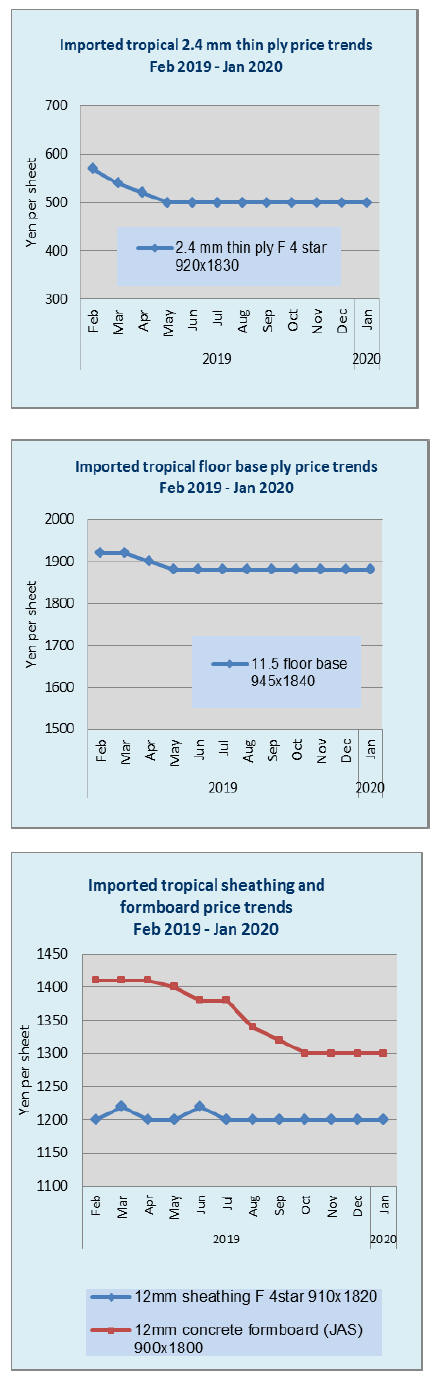

Meantime movement of imported tropical hardwood plywood is getting

stagnating. Up until early December last year the prices moved up on

concrete forming panel and structural panel by rehabilitation demand of

typhoon damages but by late December, such demand faded. Movement of coated

concrete forming panels is slow by lack of demand. Some tight items are

filled by arrivals during the New Year¡¯s holidays so the market prices are

barely holding and chance of price increase is very remote so the prices

seem to remain in bottom range.

The importers feel that it is risky to accept high priced offers by the

suppliers because of weak market in Japan so future orders are declining.

South Sea log and lumber

Supply and demand of South Sea hardwood logs are well balanced. Producing

regions of Malaysia and PNG are in rainy season so log production is low now

but users in Japan have acquired enough logs.

Chinese purchase of PNG logs remains slow due to depressed market in China.

Movement of laminated free board of merkusii pine and Chinese red pine

continues sluggish after round of the demand for shops and public facilities

has been done for a time being. The inventory in distributing channel is

limited so there is no surplus.

Domestic logs and lumber

Since beginning of the year, lumber orders have been much slower than normal

years. Normally the orders last through month of January and some items are

tight in supply but in this winter, inquiries on structural materials are

very little so the dealers have hard time to sell.

Meanwhile log production has been very stable by favorable weather since

last November in everywhere in Japan so that log market is weakening. Demand

for logs has peaked in last November and December so January trading is

quiet.

In Eastern Japan, logging road system damaged by typhoons in last summer and

fall have not been repaired yet but overall log supply is recovering to

normal year level or slightly low then in the areas west of Tokyo log supply

is ample without any tightness so log prices are generally weaker.

In Eastern Japan, 3 meter post cutting cedar log prices climbed sharply

after the typhoons in last fall but they are getting back down to

12,000-13,000 yen, 1,000 yen down from the peak and there are some low

prices like 11,000 yen in some areas. Also prices of sill cutting cypress

logs shot up steeply but they are now back down to normal like 17,000-18,000

yen, 1,000 yen down.

Demand for domestic lumber peaked in last November and orders started

slackening in December. Outlook for new housing starts in February and March

is uncertain so precutting plants and dealers have started reducing

purchases. As log prices are softening, lumber prices are likely to go down

and they are just watching how things turn.

Sawmills are reducing the production to tighten the market as the market

prices are weak but are holding yet.

Apart from new housing, there are active demand for restoration works by

typhoon damaged areas and ground retaining board of cedar and red pine,

girder and floor joist of Douglas fir and cypress and cedar floor board are

moving well.

|