US Dollar Exchange Rates of

10th January

2020

China Yuan 6.9197

Report from China

Real estate development in the first eleven months of

2019

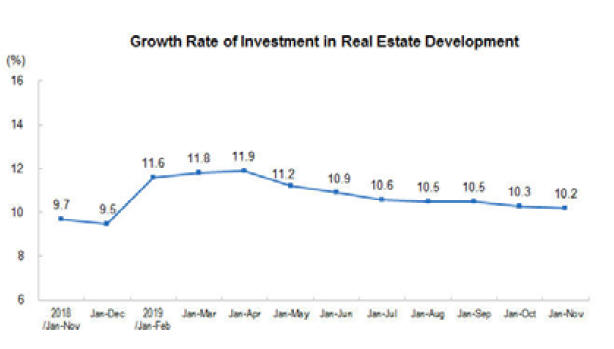

Total investment in real estate development in the first

eleven months of 2019 showed a rise of 10% year-on-year

but there was an overall decline in investment for most of

this year. Investment in residential buildings was up by

14.4% but this was at a slower rate than a year earlier.

Source:

http://www.stats.gov.cn/english/PressRelease/201912/t20191217_1718042.html

In the first eleven months of 2019 the land

area purchased

by the real estate development enterprises was down by

14%.

New foreign investment law takes effect

The most recently updated Foreign Investment Law took

effect 1Janauary 2020. This is a comprehensive and

fundamental set of legal standards for foreign investment

activities with unified provisions for the entry, promotion

and protection and management of foreign investment.

The new law has replaced the Law of the People's

Republic of China on Sino-Foreign Equity Joint Ventures,

the Law of the People's Republic of China on Wholly

Foreign-owned Enterprises and the Law of the People's

Republic of China on Sino-Foreign Contractual Joint

Ventures passed between 1979 and 1990. The changes

were made as the previous laws could not address the

emerging challenges in foreign investment, including

intellectual property rights.

The new law provides foreign investors with more rights

and more convenient registration procedures. Most

Chinese cities have rolled out favorable policies to attract

foreign investment such as offering low cost or even free

space for manufacturing, low taxes for the first year,

and/or incentives to attract foreign technology transfer.

Analysts expect foreign investment in wood product

manufacturing and trade will increase as a result of these

changes to the law.

see

http://www.fdi.gov.cn/1800000121_39_4872_0_7.html

http://www.npc.gov.cn/npc/c30834/201903/121916e4943f416b8b0ea12e0714d683.shtml

https://www.guancha.cn/economy/2019_03_20_494381.shtml

Import tariffs adjusted

According to the Customs Tariff Commission of the State

Council, China has adjusted import tariffs for a range of

products effective 1 January 2020 to promote high-quality

development of trade.

The adjustments will be made to expand imports, to

promote the coordinated development of trade and

environment and to advance the development of the ¡°Belt

and Road¡± initiative.

To stimulate imports China will implement provisional

import tax rates that are lower than the most-favourednation

(MFN) tariff rates for over 850 commodities.

The country will introduce or reduce the provisional

import tax rates on products including frozen pork, frozen

avocados and non-frozen orange juice amid efforts to

moderately increase the import of daily consumer goods

that are relatively scarce in the country or have foreign

characteristics to better meet people's needs.

China will apply zero import taxes on pharmaceutical

products containing alkaloids for asthma treatment as well

as raw materials for the production of new diabetes

medicines to reduce medication costs and promote the

production of new medicines.

China will also lower the provisional import tax rates for

some wood and paper products.

In 2020, China will continue to apply conventional tariff

rates on some products originated from 23 countries and

regions under the relevant free trade agreements or

preferential trade arrangements.

Further tariff reduction will be made according to the free

trade agreements China has separately signed with New

Zealand, Peru, Costa Rica, Switzerland, Iceland,

Singapore, Australia, the Republic of Korea, Georgia,

Chile and Pakistan, as well as the Asia-Pacific Trade

Agreement.

In 2020, China will continue to apply preferential tariff

rates to the goods from the least developed countries that

have established diplomatic ties and completed the

exchange of Notes on the establishment of diplomatic

relations with China.

China will also make adjustments to the applicable

countries in line with the United Nation's list of the least

developed countries and China's transition period

arrangements.

Starting from 1 July, 2020, China will implement the fifth

MFN tariff concession on 176 information technology

products and accordingly adjust the provisional import

tariff rates of some information technology products.

The tariff adjustments will help reduce import costs,

advance opening up to a higher level and allow other

countries and regions to share in China's development.

See:

http://english.www.gov.cn/news/topnews/201912/23/content_WS5e001724c6d0bcf8c4c19456.html

http://www.gov.cn/xinwen/2019-12/23/content_5463213.htm

Forest Law adopted

A revised Forest Law had been adopted by 13th National

session of the Standing Committee of the National

People's Congress with aim to better protect forest

resources and spur ¡®green development¡¯. The new law will

take effect on 1 July, 2020.

A new chapter "Forest Ownership" has been added to the

new Forest Law which stipulates that the ownership and

use rights of forest lands, forest and trees shall be

registered and certificates shall be issued by the

registration authorities. Legitimate rights and interests

shall be protected by law and shall not be infringed upon

by any organisation or individual.

For the purpose of environmental protection, infrastructure

construction and other public interests the law provides for

requisition forest land and trees and says the examination

and approval procedures shall be handled according to law

and fair and reasonable compensation shall be given.

Under the new Forest Law, the management system for

forests is defined and the forests are divided into public

and commercial forests. Public forests shall be strictly

protected and commercial forests shall be operated

independently by forest operators according to the law.

With regard to commercial forests it is clearly stipulated

that the country encourages the development of

commercial forests and that forest owners shall operate

such forest of their own according to law and may take

necessary measures to improve economic efficiency

without damaging the environment.

The new Forestry Law has abolished the timber transport

licensing system, improved tree cutting licensing system

and optimised the procedures and conditions for the

issuance of timber cutting licenses. The law explicitly

requires competent forestry authorities to take measures to

facilitate the application for cutting licenses.

See:

http://www.greentimes.com/green/news/lyyf/fzxw/content/2019-12/30/content_444921.htm

Tax reduction for wood-based panel

enterprises

The State Tax Administration has issued a new edition of

the guidelines on preferential tax policies to support

poverty alleviation. The guidelines point out that taxpayers

can enjoy tax preferences if they produce wood-based

panels and products made from raw materials such as

sawdust, bark and other wood residues.

The amount of tax payable by an enterprise manufacturing

wood-based panels and products from sawdust, bark and

residues shall be calculated at 90% of enterprise incomes.

|