Japan

Wood Products Prices

Dollar Exchange Rates of 10th

January

2020

Japan Yen 109.46

Reports From Japan

Growth prospects depend on impact of stimulus package

Despite the governments almost US$250 billion stimulus

package analysts warn the economy is expected to grow

only modestly in 2020 as the rise in the consumption tax

and risks in the global economy are likely to undermine

sentiment and investment.

Japan¡¯s Center for Economic Research has forecast growth

at less than 0.5% in fiscal 2020. This was determined after

consulting 35 private-sector economists. At 0.5% this

would be the second-lowest growth rate in six years.

Growth in the Japanese economy is very sensitive to

exports and analysts point to falling exports for the past 12

consecutive months and how it is unlikely that the global

economy will revive to spur Japan¡¯s short-term economic

prospects.

Several commentators in Japan are speculating that the

Bank of Japan (BoJ) could revise up its economic forecast

for the new fiscal year beginning in April, anticipating a

boost from the government¡¯s stimulus package. Such a rise

would allow the BoJ to maintain its current policy.

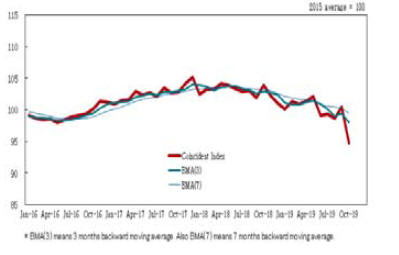

Business sentiment in Japan

Source:

https://www.esri.cao.go.jp/en/stat/di/di-e.html

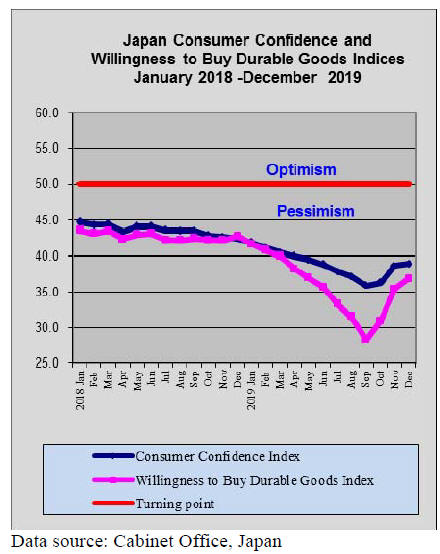

Consumers reeling from tax hike

While there has been a recent rise in consumer confidence

the fourth quarter 2019 paints a different picture as

confidence dipped to a five year low. A recent BoJ survey

says consumers cut back on eating-out and shopping

immediately after the consumption tax increase signaling

that the prospects for the economy are, at best, fragile.

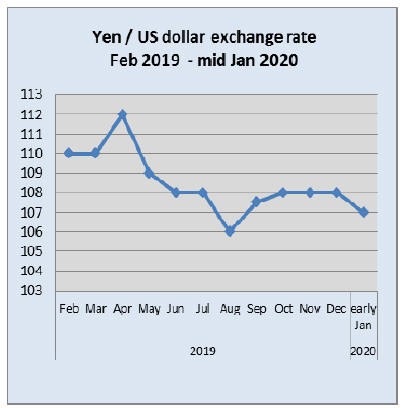

Yen plunges on Middle East tensions ¨C

quickly

recovers

The Japanese stock market plunged and the yen/dollar

exchange rate surged in early Janauary as tension in the

Middle East prompted investors to seek the ¡®safe-haven¡¯

yen. The dollar briefly dropped to a three-month low

immediately after the Iran incident but within 5 days had

recovered bring the yen back to 108 to the dollar.

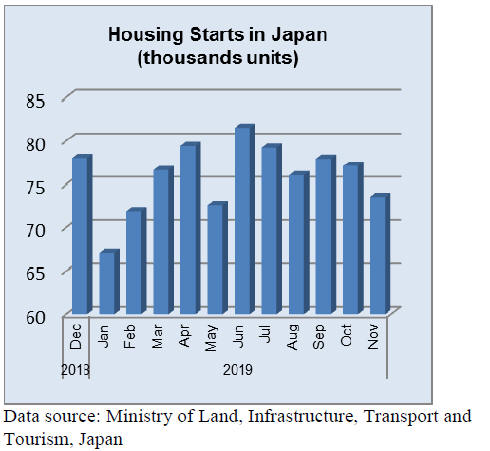

Disappointing November housing starts

November housing starts were down almost 5% from the

previous month and down over 12% year on year. The

decline in November was the third consecutive drop in

starts some of the decline can be attributed to the severe

storms Japan experienced in the autumn of 2019.

'Mass timber' for concept housing development

At a recent event in the US Toyota and its partner BIGBjarke

Ingels Group announced plans for a new concept,

high-tech ¡°Woven City¡± to be constructed on a site at the

foothills of Mount Fuji.

This, say the companies involved, will be a solar and

geothermal powered green city. The buildings will be built

using mass timber construction.

Import update

Furniture imports

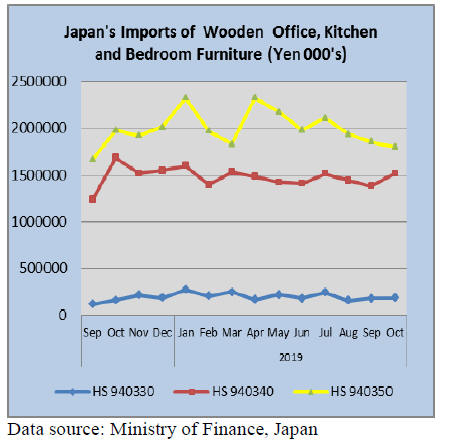

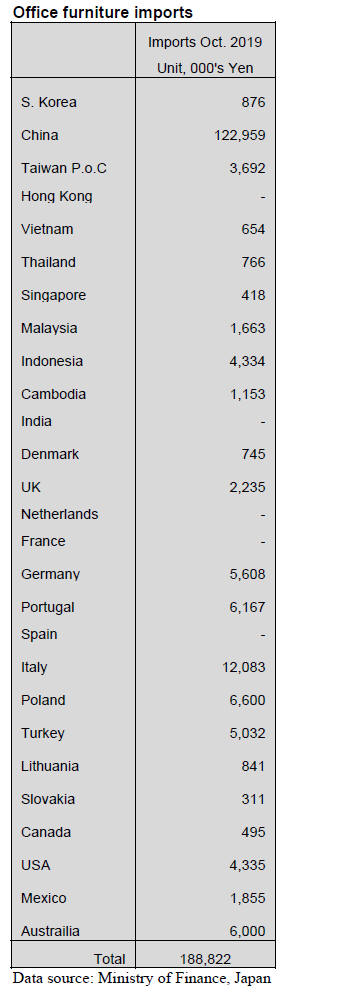

Office furniture imports (HS 940330)

Year on year, Japan¡¯s October 2019 wooden office

furniture (HS940330) imports were up 17% building on

the rise seen in September. Imports from China, the main

supplier, were up almost 20% in October, imports from

Italy, a regular supplier of office furniture to Japan, almost

doubled. In contrast, imports from Poland, also a major

supplier of wooden office furniture to Japan almost

halved.

The top three suppliers in October, China, Italy and Poland

accounted for around 75% of all wooden office furniture

imports. China alone accounted for 65% of October

imports.

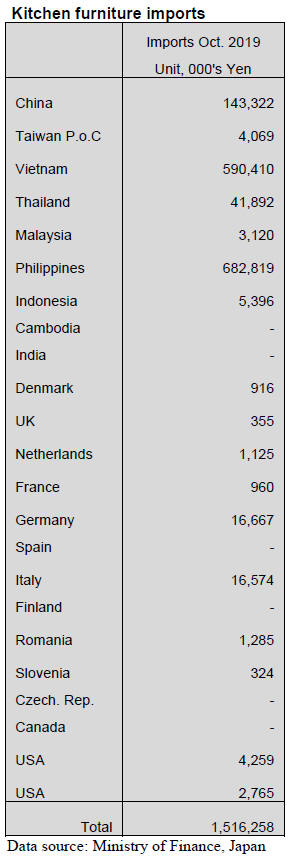

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s wooden kitchen furniture (HS

940340) imports in October reversed the decline witnessed

in the previous two months. Despite the turn-around in

October, year on year imports of wooden kitchen furniture

were down 10%.

The main suppliers of wooden kitchen furniture in October

were, as in previous months, the Philippines, Vietnam and

China. October shipments from the Philippines were up

10% month on month with Vietnam seeing an 8% rise

month on month and China recording a rise of over 60%.

As in previous months Germany and Italy feature in the

top 20 suppliers of wooden kitchen furniture but between

them have only around 2% of total October shipments into

Japan.

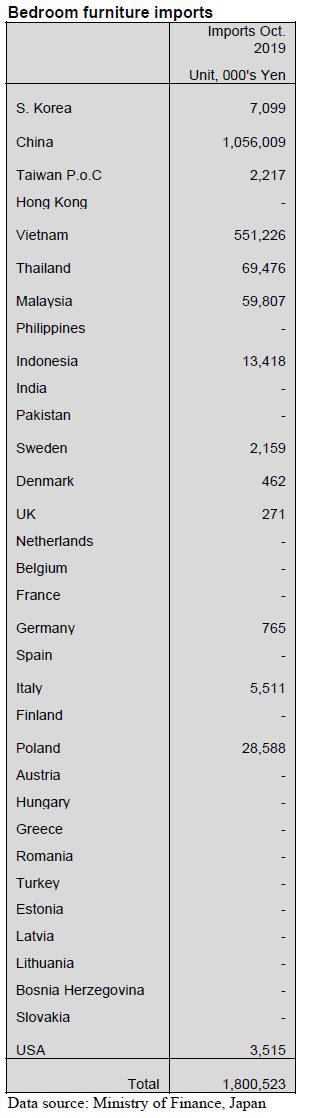

Bedroom furniture imports (HS 940350)

Year on year, the value of Japan¡¯s October 2019 wooden

bedroom furniture imports were down 9% and while

shippers in China maintained their dominance of imports

of wooden bedroom furniture (58% in October) there was

no increase in the value of imports over the previous

month.

The other significant suppliers are Vietnam, which held a

30% share of Octber imports, Thailand, 4% and Malaysia

3%. October shipments from Vietnam were down 14% in

October, shipments from Thailand dropped 18% in

October while shipments from Malaysia rose sharply.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

Revision of Forestry Partnership Act

The Forestry Agency is making up revised Forest

Partnership Act for submitting to next year¡¯s ordinary

session of the Diet.

Objective is to activate and widen activities of the Forest

Partnership when demand of domestic logs is rapidly

increasing so by allowing of merger of the partnerships

and transfer of business to promote log sales and

maintenance of the forestland.

In fiscal year 2017, total amount of business by the

partnerships was 272 billion yen in which log production

and sales were 100 billion yen and forest maintenance was

160 billion yen. Target after ten years is total business of

315billon yen in which log sales of 120 billion yen and

forest maintenance of 160 billion yen.

Business expansion of the forest partnership has been done

by merger of the partnerships. After the revision is

officially authorized, local partnership remains and tying

up only business with other partnerships becomes

possible. In the concrete, business of one partnership can

be transferred to other partnership totally or partially. Also

business is split and be transferred. Agricultural cooperatives

are authorized to transfer of business and

merger or become stock company as means of

rearrangement of the system.

Also to strengthen management base by activating board

of directors, distinction of sex and age class should be

considered to encourage female and successors¡¯

generation become directors. Also at least one director

should be able to manage sales. Present law stipulates new

additional director has to be in the same generation with

others but this rule is changed.

Forestry owners¡¯ association is co-operative system by the

forestry partnership act and forest owners are official

member. There are 621 associations in Japan and number

of the association is 1.51 million. Forestland by the owners

is 1,640,000 hectares, 70% of privately owned forestland.

The businesses are forest maintenance of thinning,

clearing of underbrush and replantation then log harvest

and sales of logs. Production and sales by each unit has

been steadily growing but there are 319 associations,

which produces less than 5,000 cbms a year and 21

associations, which logs sales are less than 50,000 cbms.In

short, there are many small scale associations.

In viewing such reality, revision of the law is considered

to activate and increase the activities by tying up with each

other when demand for logs is increasing with larger

sawmills and start-up of biomass power generation plants

all over Japan. However, there are comments among

members that revision of the law does not guarantee

expansion of business unless there is financial assistance.

Manpower shortage is another obstacle.

Sumitomo Forestry¡¯s overseas housing business

Sumitomo Forestry (Tokyo) announced that total housing

sales in North America and Australia exceed 10,000 units

in current term ending December 2019. Overseas housing

business started in 2003 in Seattle, Washington, U.S.A.

then in China in 2004 and in Australia in 2009.

In current term, total sales in the U.S.A. are 7,920 units,

12.0% more than last term and 2,300 units (13.0% more)

in Australia making total of 10,220, 5.2% more. It started

working with Henry group in the U.S.A. in 2010 then

bought out five more house builders in the U.S. A. and

subsidized them to form consolidation group.

It now has developed the business in ten states of

Washington, Texas, California, Arizona, Virginia, North

Carolina, South Carolina, Pennsylvania, Utah, West

Virginia plus Washington, D.C.

Besides traditional 2x4 units built for sale, it has started

building town house for multi-family, which is easier to

buy. One of subsidiaries, Crescent Community builds

multi-family apartment and commercial buildings and

Mark III properties is engaged in development of property

for housing so business is diversifying now.

In Australia, standard of housing loan examination

tightened so the housing market is cooling down. In Asia,

it started development of detached unit and condominium

in Indonesia and Thailand but this would not contribute

business profit since large project like this would take

more than four years from planning to sales.

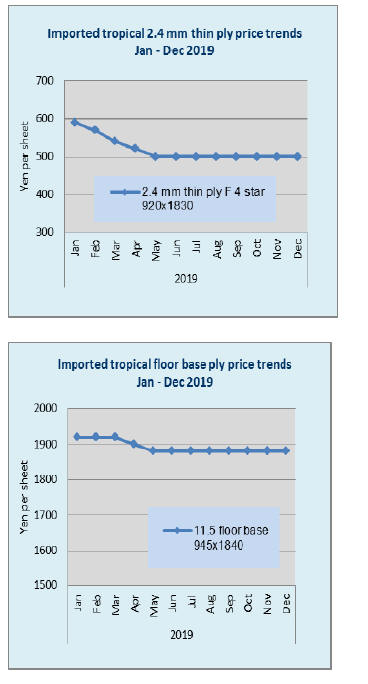

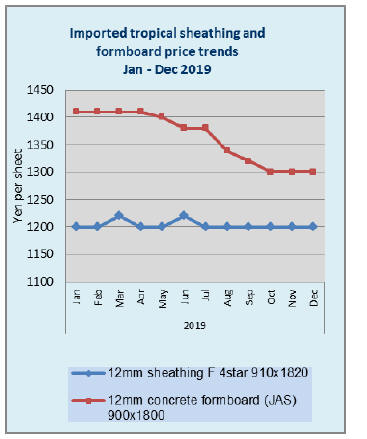

Plywood

Demand for domestic softwood plywood is robust and the

supply is getting tight in some areas because of shortage of

trucks .Imported plywood market lacks vigorousness with

weak demand. The supplying plywood mills in Malaysian

and Indonesia have kept pushing the export prices and

some items in Japan are short and the prices are gradually

climbing but not fast enough to catch up fast pace of

suppliers¡¯ price hike.

Movement of domestic softwood plywood is active all

over Japan. On top of orders from precutting plants,

wholesale channels are procuring materials for typhoons¡¯

and flood damages in Eastern Japan.

Orders for renovation and non-residential buildings are

also active. Domestic plywood manufacturers have been

running with full capacity to catch up busy demand and

the monthly shipment surpasses production.

With low inventories, some plywood mills started

restricting to take orders from new buyers and additional

volume even for regular customers.

Truck shortage becomes usual problem in December by

year end heavy cargo transportation so delivery delays a

week to ten days. Trucking cost is also climbing so the

manufacturers may have to pass this onto delivered prices.

On imported plywood, the importers have started

increasing the sales prices as the producing plants continue

to increase the export prices and reduce the production by

log shortage. Therefore, bottom feeling is spreading in the

market. The prices of concrete forming panel and

structural hardwood plywood are climbing with busy

demand for storm rehabilitation works.

Coated concrete forming panel movement is not busy

despite dropping inventory because of stagnating

demand for construction.

Domestic logs and lumber

Demand for domestic logs and lumber is steady as

precutting operations are peaking. Log supply in Western

Japan is ample so that the market is on weak side but in

Eastern Japan, log supply is scarce because of recent

typhoon and flood so log prices are climbing. Lumber

market prices are hard to increase because prices of

competing whitewood laminated umber and Douglas fir

lumber are softening so passing high log cost onto lumber

sales prices is difficult.

Post cutting cedar log prices soared but after log supply

recovered, prices dropped down. Cypress log prices are

2,000-3,000 yen higher than November and sill cutting

cypress log prices are 18,000-19,000 yen since cypress

lumber is used for repair of inundated houses. In Western

Japan, cypress log prices are dropping and sill cutting

cypress log prices are now 19,000 yen from 23,000 yen in

November.

Lumber movement is firm particularly KD structural

lumber for precutting plants and this seems to continue

through December. Wholesalers¡¯ lumber business dropped

down once after the consumption tax increase in last

October but it recovered gradually. Particularly in Eastern

Japan demand for board, taruki, sill and beam is picking

up for repair of flood damaged houses and retaining board,

piling and board for restoration works of land slide,

collapsed road and rivers.

Vietnam bans import of Chinese plywood

On the 12th of November 2019 the Vietnamese Minister

of Industry and Trade of Vietnam signed and announced

Circular No. 22/2019/TT-BCT on Temporary Suspension

of border-gate transfer business and temporary import of

plywood (HS 44.12) into Vietnam for re-export to US.

This Circular takes effect from December 27, 2019 to

December 31, 2024.

While export of Chinese plywood for the US is decreasing

by trade conflict and Vietnam is taking over such business

and export to the US is increasing but there is some

concern that some Chinese outfits are exporting Chinese

made farm products and industrial products as Vietnamese

products and ship out to the US through Vietnam to avoid

the increased duties in the US.

Since last June, the Vietnamese government tries to stop

such detour trade and tightened rules and penalties on

Chinese products, which are destined to the US as

Vietnamese products and this new regulation is one of

such restrictions.

Chinese supplies hemlock lumber

China National Forest Products, Tangshan, Hebei

province, China will start supplying KD hemlock genban

and green square for Japan market. It imports hemlock

logs from B.C., Canada. It has started trail shipment and

plans to supply 2,000 cbms a month. It plans to expand the

volume to 4,000 cbms a month.

This company is engaged in importing and marketing logs

and lumber and also in lumber manufacturing. It also

manages forestland and develops wood processing

complex. The mill has five band saws, edger, molder and

planer and has capacity of producing 5,000 cbms a month.

Dryers have 3,500 cbms capacity. Hemlock is dried for

two weeks with 65-70 degrees so 7,000 cbms can be dried

in a month. It uses North American species of hemlock,

Douglas fir, red cedar, spruce and Southern pine plus

radiate pine from New Zealand.

In the wood processing complex where sawmill is located,

there is MDF plant which can take sawmills¡¯ residue as

raw material. The port has four berths for 50,000 ton ship

and has fumigation yard. After the port opened in 2014,

total logs unloaded at the port is four million cbms, out of

which about 50% is Canadian logs. The mill has been

manufacturing concrete forming board but to make value

added products, it started supplying hemlock products to

Japan. Voyage to Tokyo takes only four days and it will

take order by container base.

|