3.

MALAYSIA

Malaysian furniture to penetrate

South Korean market

South Korea’s largest furniture exhibition, KOFURN

2019, the 2019 Korea International Furniture and Interior

Exhibition concluded recently. This was the 30th event

since the fair was first organised.

Given that ASEAN countries are major furniture

producers the ASEAN-Korea Centre (AKC) organised an

ASEAN Pavilion in KOFURN 2019 which exhibited

furniture and interior items from 84 companies in eight

ASEAN member states namely Indonesia, Lao PDR,

Malaysia, Myanmar, the Philippines, Singapore, Thailand

and Viet Nam. Ten Malaysian furniture companies were

invited.

The ASEAN/Korean Centre is an international

organisation established in March 2009 to increase trade,

accelerate investment flows, invigorate tourism and enrich

cultural exchanges between ASEAN member states and

South Korea.

Tenfold rise in forest fines proposed

A massive RM5mil fine is being proposed for those found

to have unlawful possession of forest products. The

maximum fine at the moment RM500,000. For trespassing

the government plans to increase the fine from RM10,000

to RM30,000.

Water, Land and Natural Resources Minister, Dr. Xavier

Jayakumar, said the proposed fines would be included in

the amendments to the National Forestry Act 1984. The

ministry had discussed the matter with several states and

the proposed amendments would be presented to

parliament. The changes would only be in effect in

Peninsula Malaysia as Sabah and Sarawak have their own

Forest Ordinances.

Advanced technology can boost Sabah furniture

production

Sabah is aggressively promoting automation and smart

manufacturing in the wood processing industries. Mohd.

Shafie Apdal, Sabah’s Chief Minister, said that advanced

technology for manufacturing can expand the output of

high value wood products while holding down costs.

The Chief Minister said research, development and

innovation can deliver highly competitive products for the

global market. Sabah has established about 226,000 ha. of

forest plantations of which around half are of high-value

commercial species. The plantation species include acacia

(66%), albizia falcataria (16%), rubber (11%) and teak

(4%).

Sarawak - No more oil palm plantations

The Sarawak Chief Minister, Abang Johari Tun Openg,

has announced a new land use policy under which the

Sarawak State Government will no longer approve new oil

palm plantations.

Read more:

https://www.theborneopost.com/2019/12/03/nomore-new-oil-palm-plantations-focus-is-on-conservingenvironment/

This move is in response to global concerns that

Sarawak

is allowing forest clearing for oil palm plantations. In a

recent meeting with officials from the EU the Chief

Minister explained the efforts being made to protect the

forest in Sarawak.

The EU Parliament recently adopted the ‘Delegated

Regulation’ under the European Union Renewable Energy

Directive II to effectively ban palm oil in biofuel by 2030

claiming cultivation has led to deforestation.

The Malaysian government has refuted this claim calling it

misleading and economically detrimental to the industry,

especially to the some 650,000 smallholders in the

country.

4.

INDONESIA

Monitoring timber production and

trade

The civil society organization, Jurnal Celebes recently

released a report "Strengthening Indonesia’s Independent

Forestry Monitoring Network to Ensure a Credible Timber

Legality Verification System (SVLK) and Effective VPA

Implementation".

Between October 2018 and December 2019, Jurnal

Celebes monitored the management, distribution and trade

of timber in the provinces of North Maluku, Central

Sulawesi and Southeast Sulawesi and in the provinces of

South Sulawesi and East Java.

Their report raises concerns related to forest harvesting

and extraction such as logging outside concession areas

and subsequent conflict with communities; selling wood

products obtained from outside concession areas and

undertaking harvesting without first conducting

environmental impact assessments.

The report also identifies infringements by companies

including misreporting timber species on transport

documents and loaning SVLK certificates to uncertified

businesses.

Commenting on the report, Stephen Rudgard, FAO

Representative of Indonesia, said the regulations should be

reviewed to provide for prosecution of illegal forestry

activities and there should be an expansion of joint

supervision between civil society and law enforcement

officials in the field to limit environmental impacts and

conflict with local communities.

The Environmental Advocacy Journalists Association or JURnaL

Celebes, consists of NGO activists and journalists in South

Sulawesi. The institution is committed to drive the process of

solving environmental problems, natural resource management

and social problems through mentoring and capacity building.

See:

https://en.tempo.co/read/1280041/recommendations-toimprove-legal-timber-production-and-trade

Indonesia seeks to learn from Vietnam’s success

The Indonesian Furniture and Crafts Industry Association

(HIMKI) recently visited furniture plants in Viet Nam to

understand how the furniture industry in Vietnam was able

to improve its exports in recent years. Also, as many

companies from China are relocating their factories to Viet

Nam, a HIMKI spokesperson said they want to understand

how Viet Nam supports incoming businesses.

Indonesia-South Korea trade worth US$20 billion

The Indonesian Ambassador to South Korea, Umar Hadi,

recently highlighted the increase in bilateral trade between

Indonesia and South Korea over the past five years.

In 2018 trade between the two countries was worth around

US$20 billion with Indonesia exporting some US$11

billion.

He noted that Indonesian products with potential to

penetrate South Korean markets include wood products,

food, beverages, processed seafood products, automotive

components and electrical items. He also referred to the

number of South Korean companies that have invested in

Indonesia.

Sengon residues in demand in South Korea

Sengon (the trade name for Paraserianthes falcataria)

processing waste such as sawdust and chips is in demand

in South Korea and one company in South Korea, Inakor,

imports both products from Indonesia.

Ari Satria, Director of Export Product Development in the

Ministry of Trade said, after visiting the South Korea

factory, that sengon sawdust can be used as animal

bedding while sengon chips can be used as a medium for

mushroom cultivation. Inakor has reportedly imported

around 48 containers of sengon residues last year.

Community forests urged to link with larger companies

Indonesia’s Minister of Cooperatives and SMEs, Teten

Masduki, has urged community forest owners and

managers to consider greater cooperation to raise their

competitiveness and open the way into the global value

chain. One of the support mechanisms being developed by

the ministry is for partnerships with large businesses.

Teten hopes that the community forest sector can generate

foreign exchange by establishing cooperatives and making

deals with larger companies as this could improve the

livelihood of remote communities and farmers.

5. INDIA

Growth prospects dip for 2019-20

The Reserve Bank of India (RBI) revised GDP growth

down to 5% for 2019-20 from the 6.1% projected in

October 2019. At the same meeting the RBI kept the key

policy rate unchanged at 5.15% and decided to continue

easing efforts to support growth while ensuring that

inflation remains within the target set.

Markets had widely expected a sixth rate cut from the RBI

because of the slow growth in the Indian economy.

Smuggling attempt - Red sanders shipped as auto

parts

Indian police have broken a red sanders export smuggling

ring that used forged documents submitted to Customs

authorities and shipped around 58,000kg of red sanders

worth an estimate US$14 million over the last year. The

ring reportedly obtained the red sanders from the forests of

Andhra Pradesh and smuggled the timber to various

countries.

The illegally exported timber was declared as 'auto parts'

on Customs documents. The authorities said there is a

huge demand for red sanders in China and to avoid

detection the red sanders shipment was routed through

Malaysia, Dubai, Vietnam and Hong Kong from where it

was sent on to its final destination.

See:

http://timesofindia.indiatimes.com/articleshow/72080893.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Developers see growth in ‘senior living space’ housing

market

The Indian residential market recovered modestly in 2018

after a disastrous 2017 with residential sales growing by

over 40% year on year and the recovery of sorts extended

into the first nine months of 2019 with sales increasing by

14% compared to the same period in 2018.

Despite the improvement sales do not match levels

achieved in the pre-demonetisation period which, say

analysts, indicates a growth potential that the residential

market has if consumer sentiments improves.

On the supply front, new projects have declined almost

10% year on year in the first three quarters of 2019 as

compared to the same period last year. The liquidity

crunch continues to hold back developers’ decisions to

launch new projects.

According to JLL Research, an increasing number of

developers are venturing into the senior living space of the

Indian real estate market. There has been a marked

increase in the number of senior living projects since

2010. It is estimated that the population above 60 years of

age in India will rise to approximately 170 million by

2025.

The report says “seniors are also evolving as a customer

segment and have demands different from seniors in

earlier times. A significant section of seniors today are

independent, financially stable, well-travelled, socially

connected and as a result, have well developed thoughts of

how they want to spend time after retirement.”

Since land prices in the major cities are very high senior

living has more potential in tier-2 cities where land prices

are lower.

See:https://www.jll.co.in/en/trends-and-insights/research/indiareal-estate-market-update-q3-2019-residential

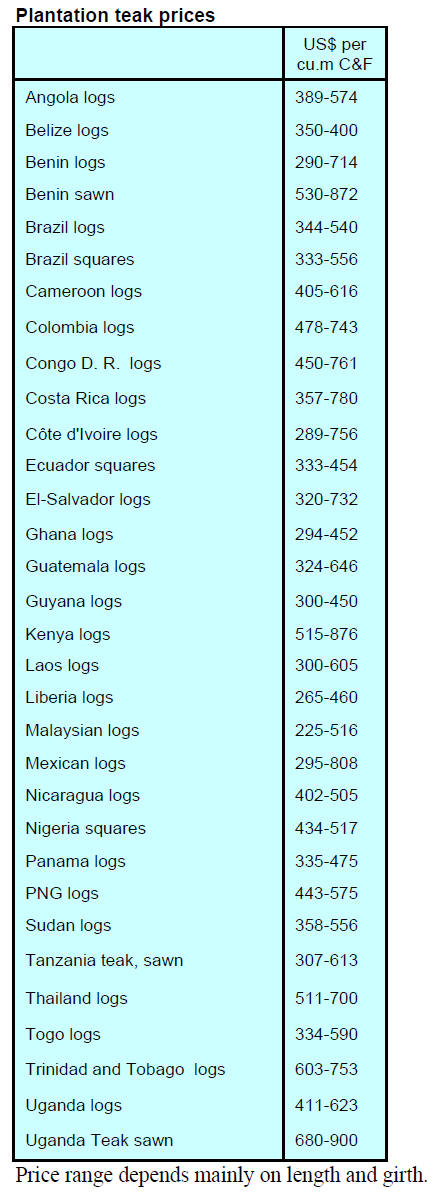

C&F prices for plantation teak landed at Indian

ports

continue within the same range as given earlier reflecting

the stable rupee/US dollar exchange rate. Analysts report

the GST Council is working on re-aligning the GST rates

and this news has buoyed the hopes of timber trade for a

reduction

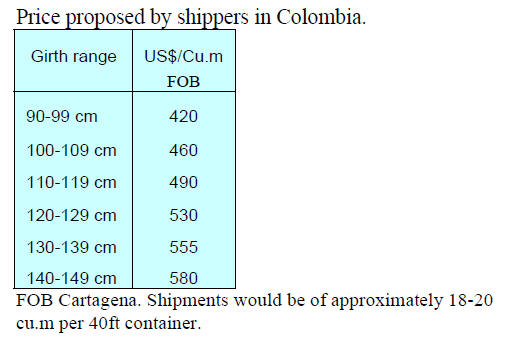

Teak logs from Colombia

Recent offers of large size and good quality teak logs from

Colombia are in direct competition with teak from

Myanmar. Also, there have been several offers of good

size and quality teak from Nicaragua and Ghana.

However,with consumer demand being flat there have

been few contracts agreed.

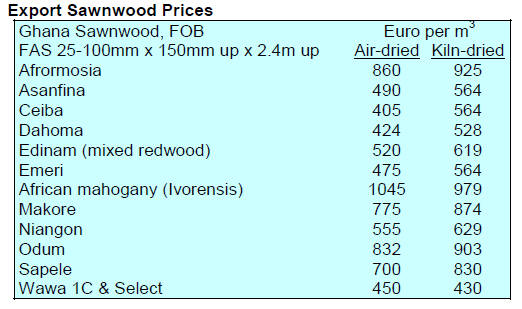

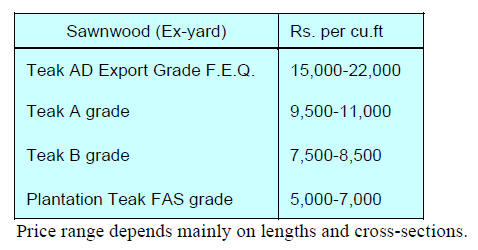

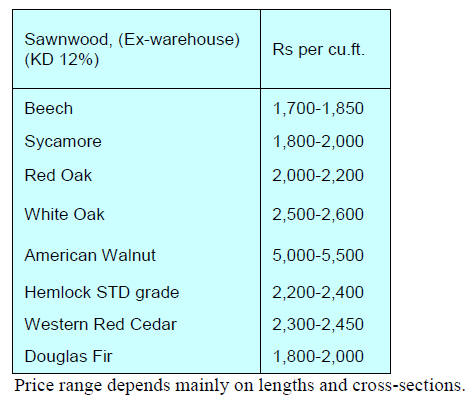

Locally sawn hardwood prices

Prices have been maintained as reported prevously.

Demand and import volumes remain well balanced.

Analysts sense a modest improvement in demand for

wood products and the government is trying to help the

manufacturing sector through tax adjustments. This, along

with news that GST rates may be adjusted, has been

welcomed by the timber industry. However, the rise in

demand for engineered wood products like WPC, MDF,

particleboard is undermining markets for solid wood in

many enduses.

Myanmar teak prices

The availability of good quality hardwoods such as

merbau and iroko is impacting demand for Myanmar teak

in some enduses. Importers have mentioned that shipments

of teak from Myanmar are slow due to the conditions

prevailing there.

Sawn hardwood prices

Prices remain unchanged.

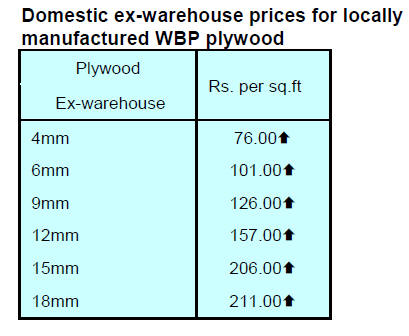

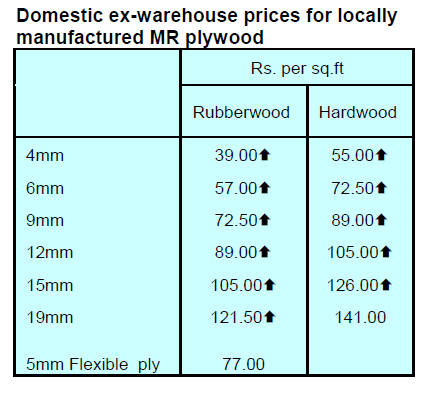

Plywood price increases

Container freight rates have risen pushing up the cost of

imported veneers, chemicals and logs. As a result of the

increased freight charges plywood manufacturers have

raised prices for plywood.

6.

VIETNAM

Be proactive to take advantage of

trade deals says

industry expert

Viet Nam has the opportunity to increase exports of wood

products to other Comprehensive and Progressive

Agreement for Trans-Pacific Partnership (CPTPP)

member countries . This was the message conveyed by

Nguyễn Thị Thu Trang, Director of the Viet Nam

Chamber of Commerce and Industry’s WTO and

Integration Centre.

To take full advantage of the opportunities said Nguyen

Thị Thu Trang the products must meet the CPTPP’s rules

of origin and conform with sanitary and phytosanitary

requirements and meet technical standards in the partner

country.

“If we do not meet their requirements, we cannot utilise

the preferential tariffs that CPTPP member countries offer

to us.”

Japan, Malaysia, Singapore, Australia, New Zealand and

Chile are countries that Viet Nam has bilateral or

multilateral FTAs with. The CPTPP creates another

preferential tariff scheme for businesses, who, depending

on which FTA offers more advantages, should choose that

to export under, she said.

“We export a lot to CPTPP member countries, but our

market share remains modest, for instance at 2-2.9 per cent

of their footwear imports and 0-6 per cent of garment and

textile imports.

There is still much more room for Vietnamese firms to

boost exports. “Canada, Mexico and Peru are countries

that Việt Nam does not have free trade agreement with,

thus CPTPP offers great opportunities for Vietnamese

firms to access these markets through preferential tariffs.”

Read more at

http://vietnamnews.vn/economy/569444/vnexporters-can-only-take-advantage-of-cptpp-withpreparation.html#q0yu6Vv5WVLuGMYA.99

More action on relabeling

Vietnam’s exporters have benefitted from the US/China

trade war and have been forced to address the issue of USbound

China made products being transported through its

territory to evade US tariffs as this threatens the reputation

of domestic manufacturers.

Recently the government prepared a list of products that

are reputedly at risk of re-routing from China through Viet

Nam.

In another bid to assuage US concerns of Chinese rerouting,

Viet Nam’s Ministry of Industry and Trade

announced it will suspend exports of some plywood goods

to the US from late December as it has been discovered

that products made in South Korea and Taiwan P.o.C have

been shipped to Viet Nam for minor processing before

being re-packaged and shipped as “Made in Vietnam”

products.

Is the rise of FDI in Viet Nam’s timber industry of

benefit or concerning?

Although FDI is seen as a key driving for the development

of the Vietnam’s wood processing sector some

government agencies have stressed that this also brings

many challenges and risks such as the illegal trade in raw

materials, unfair competition as well as socio-economic

negative impacts.

Dien Quang Hiep, Chairman of Binh Duong Timber

Association (BIFA) has pointed out that the rapid increase

of FDI in Vietnam’s wood processing sector especially by

Chinese enterprises has created fierce competition for

labour, raw materials and market share. There has also

been a rise in product origin fraud and price transferring.

This, said Dien Quang Hiep, requires attention to three

issues First, a nationally-wide review of all three types of

investment is required looking at new investments, capital

raising projects and business cooperation contracts.

Secondly, the national authorities should closely

coordinate with local timber associations to limit

‘informal’ investment arrangements and thirdly, the

Ministry of Industry and Trade and functional ministries,

government bodies should strengthen border control and

trade security.

The main countries investing in Viet Nam are China,

Japan and South Korea. By the end of September 2019,

Vietnam's wood processing industry attracted almost 70

new investment proposals worth over US$58 million. This

was around two and a half times higher than before the

beginning of the US/China trade dispute.

See:

https://haiquanonline.com.vn/vua-mung-vua-lo-khi-gia-tang-fdivao-nganh-go-117013.html

South Korea investigating dumping of plywood by Viet

Nam

In December the Korean Trade Commission announced an

anti-dumping investigation on plywood imported from

Vietnam. This came about as Korea’s domestic

manufacturers complained that imports from Viet Nam are

damage the domestic industry.

According to the Korean news agency, Vietnam's wood

products have a 40% market share in Korea, a market

worth around US$650 million.

It has been reported that the Korean Wood Production

Association is proposing an anti-dumping duty of 93.5%

on Vietnamese plywood in stark contrast to the antidumping

rate from 3.96% to 38.1% for plywood imported

from Malaysia and China.

See:

http://vietfores.org.vn/tin-tuc/han-quoc-dieu-tra-chong-banpha-gia-van-ep-nhap-tu-viet-nam/

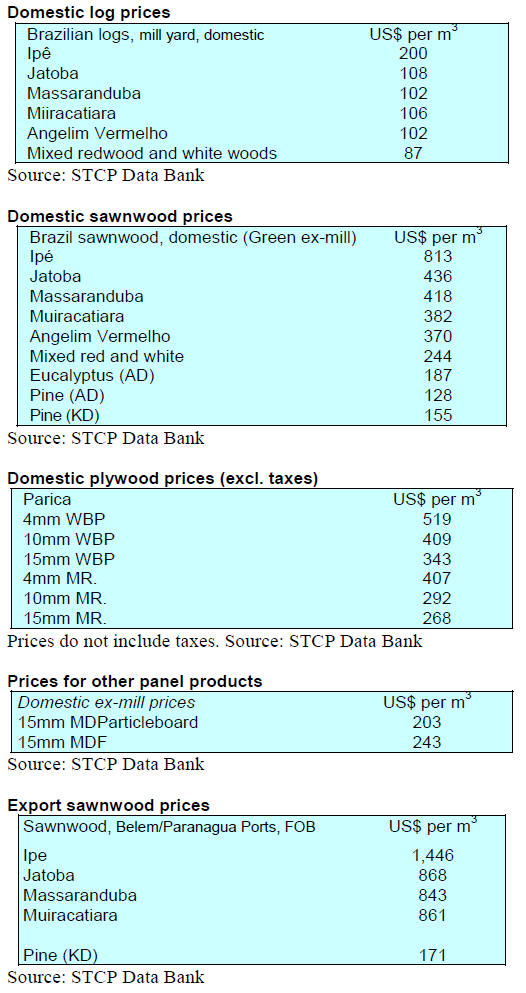

7. BRAZIL

Not illegal but difficult to verify-

timber sector works to

reduce uncertainty

Entrepreneurs and representatives from five states in the

Amazon region (Acre, Amazonas, Mato Grosso, Pará and

Rondônia) attended the ‘First National Meeting of the

Forest Based Sector’ which was held in Cuiabá, Mato

Grosso. The aim of the meeting was to discuss issues

related the native species timber segment and to consider

strategies to improve the organisation of this sector

throughout the country.

The meeting was supported by the National Forum for

Forest-Based Activities (FNBF), with the support of the

Center for Timber Producers and Exporters of Mato

Grosso State (CIPEM).

The timber industry was unanimous in identifying

verification of legality as one of the main problems to

expanded trade in native timbers. This, it was agreed,

stems largely from the numerous and sometimes divergent

laws and regulations applied to the sector.

The meeting participants consider that the native timber

sector applies strict control and is subject to careful

monitoring but that there are legal provisions that open the

way for excessive and unwarranted scrutiny by public

officers and that this causes inconvenience and

undermines the business operations of those entrepreneurs

which are working diligently and obeying the law.

A representative from the Association of Timber

Industries Exporters of Para State (AIMEX) mentioned

that the company he represents is headquartered in Europe

and stated “We buy wood from Brazil and often receive

inquiries abroad about the legality of timber products.

Observing the sector's commitment to sustainable

production through forest management has been

satisfactory.”

Environmental Rural Registry – the basis for policy

decisions

In early December the director of the Brazilian Forest

Service (SFB) attended a board meeting of the

Parliamentary Agricultural Front (Frente Parlamentar da

Agropecuária - FPA) of the Lower House to present data

from the Environmental Rural Registry (CAR).

During the presentation, the director highlighted the

importance of the Rural Environmental Registry as an

effective tool in agribusiness and forestry planning and its

role in policy development, support programmes, projects

and activities for control, monitoring, environmental and

economic planning and combating illegal deforestation.

The SFB intends to provide the CAR platform to States

and the Federal District in early 2020 for updating and

based on the updated information it will be able to

properly plan public policies for sustainable development

of rural properties, combining productivity and

environmental conservation.

The president of the FPA, said "It is an opportune time to

bring together the Ministry of Agriculture, the Brazilian

Forest Service, the Brazilian Institute for Environment and

Renewable Natural Resources (IBAMA), the Chico

Mendes Institute for Biodiversity Conservation (ICMBio),

the National Institute of Colonization and Agricultural

Reform (INCRA) and the rest of the public sector to build

together the legal certainty that will ensure sustainability."

Furniture production on the rise

Furniture production in the state of Rio Grande do Sul was

8 million pieces in September 2019, up 4.8% compared to

the previous month according to Market Intelligence

Institute (IEMI).

In the year-to-September industrial production in the state

of Rio Grande do Sul grew 2.5% compared to the same

period of 2018. This was higher than that registered in the

national furniture industry over the same period. Over the

past 12 months the furniture industry expanded by 4.0% in

Rio Grande do Sul State while at a national level the sector

contracted.

In October 2019, furniture exports increased 1.6% and

were worth US$16 million. The three states in the

southern region, Santa Catarina, Rio Grande do Sul and

Paraná accounted for over 80% exports followed by the

State of São Paulo, with 14%.

The major markets for furniture exports from Rio Grande

do Sul State were the United States, 16%, Uruguay, 14%

and Peru, 12%. Exports to Argentina increased month on

month by over 45%.

Log export of native species under discussion

Media reports say the authorities in Brazil are considering

allowing the export of Amazon native tree species in log

form. The authorities are considering this after being

lobbied by timber businesses.

Current regulations establish that only exotic plantation

species such as eucalyptus and pine can be exported as

logs. The export of logs of native species is prohibited.

The current legislation requires that native timbers must be

processed in Brazil before export.

According to the Estadão newspaper the export of

roundwood of native species is being evaluated by the

Brazilian Institute for Environment and Renewable

Natural Resources (IBAMA). IBAMA, an agency under

the Ministry of the Environment (MMA), has already been

quizzed on this by representatives of the National Forum

for Forest-Based Activities, an organization made up of 24

institutions of the timber sector.

If the proposal for roundwood export is approved IBAMA

plans to recommend exports be limited to logs of native

species harvested in areas with sustainable management

plans.

See:

http://www.remade.com.br/noticias/16494/exportacao-dearvores-nativas-pode-ser-autorizada

8. PERU

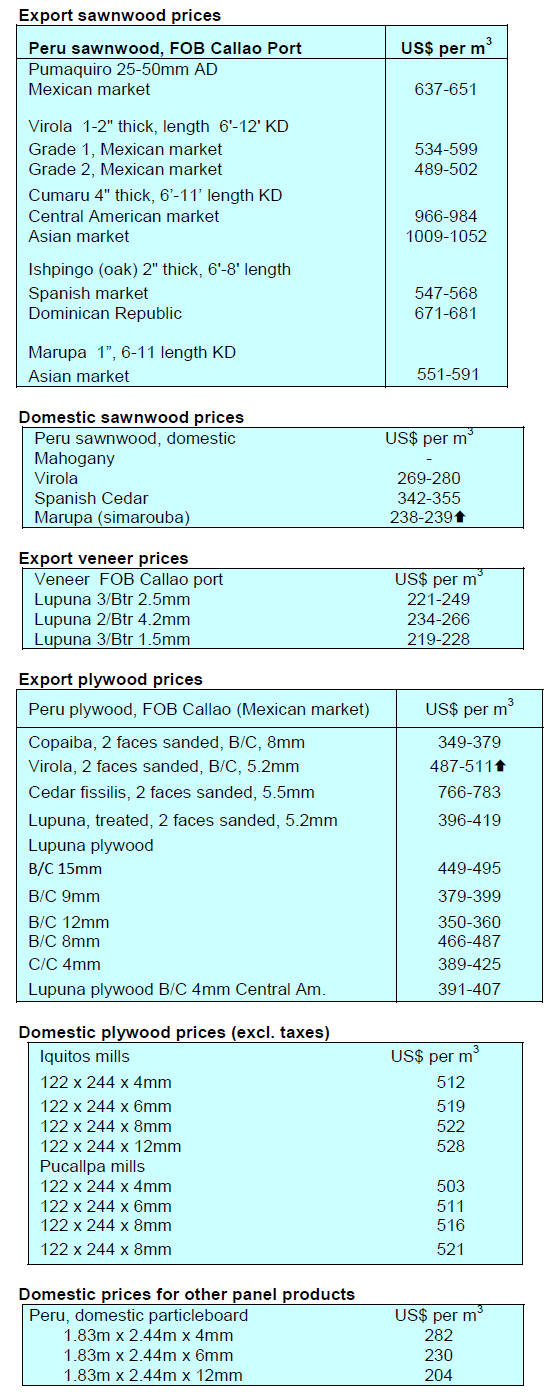

First three quarter 2019 exports

The Association of Exporters (ADEX) has reported that up

to September 2019 Peru’s timber exports were valued at

US$90.9 million FOB. This represents a 4% increase on

the same period in 2018.

Of the US$90.9 million exported China continued to be

the main export market with a 39% share, down slightly

from 2018. Mexico was the second ranked market

accounting for around 12% of exports and in Mexico

demand increased almost 8%.

Other significant markets included France (10%of exports)

up almost 50% year on year while in the case of the US

there was an almost 10% drop in the value of exports.

Sawnwood exports

Sawnwood exports in the first eight months of the year

were worth US$16.5 million FOB and much of this was

shipped to the Dominican Republic (35%) and Mexico

with 35% share.

Alliance to combat deforestation in the Peruvian

Amazon

Toyota’s office in Peru has announced an Alliance to

combat deforestation in the Peruvian Amazon. The Toyota

del Peru website has details and says:

“With the objective of contributing to the conservation and

protection of Amazonian forests, Toyota del Perú signed

an alliance with the Yamino native community and the

NGO Cima to carry out joint actions in favor of a more

sustainable Amazon and thus counteract the effect gases

greenhouse.”

The initiative includes joint actions to combat

deforestation caused by monoculture of oil palm and

illegal logging in the Cordillera Azul National Park,

Ucayali region, where the Yamino community is located.

Toyota del Perú acquired 900 carbon credits from the

Cordillera Azul National Park to compensate for the

ecological footprint of its operations, also contributing to

the preservation of this Amazonian forest.

Yehude Simon, Manager of Public Relations and Social

Responsibility at Toyota del Perú said Toyota is

committed to consolidating itself as an agent of change for

society, so the environmental issue is one of our

priorities. While Toyota has been promoting the use of

vehicles with hybrid technology in order to transform the

car into a more friendly one with the planet, we want to go

further and, therefore, we will work with other actors who

are committed to these objectives.”

Toyota explained that the strategy is to provide technical

and economic support for local families to develop

productive activities that promote eco-sustainable tourism

in the area, as well as enhance the production and

marketing of handicrafts and textiles representative of the

Kakataibo culture.

See:

https://www.toyotaperu.com.pe/noticias/toyota-delper%C3%BA-forma-alianza-para-frenar-la-tala-ilegal-en-laamazon%C3%ADa-peruana

Financial mechanisms for the forestry sector

The National Forest and Wildlife Service (SERFOR)

recently held a workshop on Sustainable Finance for the

Forestry Sector involving the participation of public and

private organisations from Guatemala, Colombia and

Costa Rica. The workshop aimed at exchanging

experiences and analysing financial mechanisms for

access to credit and forest investment as well as payments

for eco-system services.

The event was able to identify mechanisms, tools and

public policies that would help boost investment in forests

for sustainable production in the Peruvian Amazon which

minimise social and environmental risk levels.

Forestry delegation on technical exchange to US

Thirteen public servants, researchers, teachers and

representatives of the private forestry sector recently

participated in an exchange visit to Oregon and Wisconsin.

The aim was to gain experience of the United States Forest

Service model for forest research management and its

articulation to the private sector.

The Peruvian delegation was made up of members of

SERFOR; the National Council of Science, Technology

and Technological Innovation (CONCYTEC); the

Technological Institute of Production-CITE Forestal

Maynas; the National Institute of Agrarian Innovation

(INIA); the Forest Executive Board of the Ministry of

Economy and Finance; the National Agrarian University

La Molina (UNALM); the National University of the

Peruvian Amazon (UNAP); and a private sector

representative.

This visit was conducted with the technical support of the

USAID FOREST program and the United States Forest

Service in collaboration with Oregon State University

(OSU).