|

Report from

North America

Some Indonesian lauan and meranti plywood now

eligible for duty-free entry to US

The Office of the US Trade Representative has redesignated

certain lauan and meranti plywood from

Indonesia (HTS 4412.31.45) as eligible for duty-free entry

under the Generalized System of Preferences (GSP)

program. Lauan plywood is a critical input for US

manufacturers in the recreational vehicle (RV) industry.

¡°Duty-free entry of this unique international product is a

win-win for RV manufacturers and the IWPA members

that supply them,¡± said Cindy Squires, International Wood

Products Association (IWPA) Executive Director.

US importers and users have been paying an estimated

US$ 1 million per month in additional duties since this

product was removed from the GSP program in 2016. The

re-designation became effective on 1 November 2019.

See:

https://www.iwpawood.org/news/475896/USTR-Redesignates-

Lauan-Plywood-as-Duty-Free-Under-GSP.htm,

https://www.govinfo.gov/content/pkg/FR-2019-10-31/pdf/2019-

24008.pdf

Mislabelling still a problem for the US timber industry

Forensic testing suggests that the mislabelling of consumer

goods containing wood in the US remains a problem

across industries, including furniture, flooring, musical

instruments and sporting goods, according to a study

reported in MarketWatch. The study, undertaken by the

World Wildlife Fund, the World Resources Institute and

the US Forest Service, found that 62% of sampled

consumer goods containing wood¡ªmostly imports¡ª

included labelling errors.

Researchers examined 73 commercial wood products sold

by major US retailers, comparing them with the US Forest

Service¡¯s reference specimens. The US is the world¡¯s

largest importer of wood and wooden furniture by value,

at US$ 51.5 billion in 2017, representing 22% of all global

imports.

See:

https://www.marketwatch.com/story/odds-are-strong-yourhardwood-

floor-was-harvested-illegally-2019-11-

04?reflink=MW_GoogleNews

Sawn tropical hardwood imports rebound

US imports of sawn tropical hardwood grew by 17% in

September following a weak August. Imports rose to

18,714 cubic metres in September, 9% higher than

September 2018. Imports are ahead of 2018 by 18%, yearon-

year.

Imports from Ecuador recovered after a poor August,

rising by 66%; nevertheless, they are 9% down on 2018

totals, year-on-year . Imports from most trade partners are

up by more than 10% so far this year.

Imports of both balsa and sapelli increased in volume in

September. US sapelli imports are up by nearly one-third,

year-on-year, but balsa imports are 9% below 2018 totals,

year-on-year. Unit values for most hardwoods have

remained fairly steady since spring, although teak prices

have been more volatile.

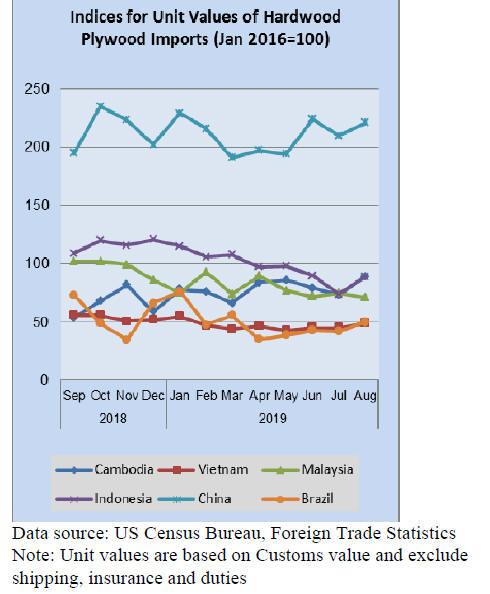

Hardwood plywood imports steady but down significantly

US imports of hardwood plywood are well below that of

last year. Import volume fell by 2% in September and is

10% behind 2018, year-on-year.

Imports from the Russian Federation and Malaysia were

down by more than 20% in September and are lagging

overall, year-on-year. Imports from Vietnamcontinue to

grow, rising by 15% in September and ahead by 81%,

year-on-year. Imports from China were down by 8% and

are now less than half of what they were in 2018, year-onyear.

Tropical veneer imports drop again

Imports of tropical hardwood veneer fell by 42% in

August as imports fell off drastically from Italy, the top

foreign supplier to the US. September is historically slow

for veneer imports from Italy, but a 97% plunge in

September resulted in the worst month in more than three

years.

Imports from China were the strongest they have been in

16 months, more than doubling August numbers (which

had doubled July¡¯s totals)¡ªnevertheless, imports from

China still trail 2018 by 52%, year-on-year. Total US

imports of hardwood veneer are down by 21%, year-onyear.

Flooring imports recover after slow summer

US imports of hardwood flooring grew by 33% in

September, having declined for each of the previous three

months. Imports from Malaysia, Vietnamand Indonesia

were all up sharply for the month. Imports overall are up

by 7%, year-on-year.

Imports of assembled flooring panels were up 9% in

September but were slightly behind totals for September

of last year. Imports from Vietnamwere up by 39% in

September and are outpacing 2018 totals by 118%, yearon-

year.

US imports of hardwood moulding were flat in September

and remain 25% down compared with 2018, year-on-year.

|