|

Report from

Europe

Pace of growth in EU tropical timber imports slows in

the third quarter

The EU¡¯s trade in tropical wood products was more

buoyant in the first nine of months of 2019 than the same

period in 2018. However, the rise in imports, which began

in the second quarter of 2018, has levelled off since June

this year.

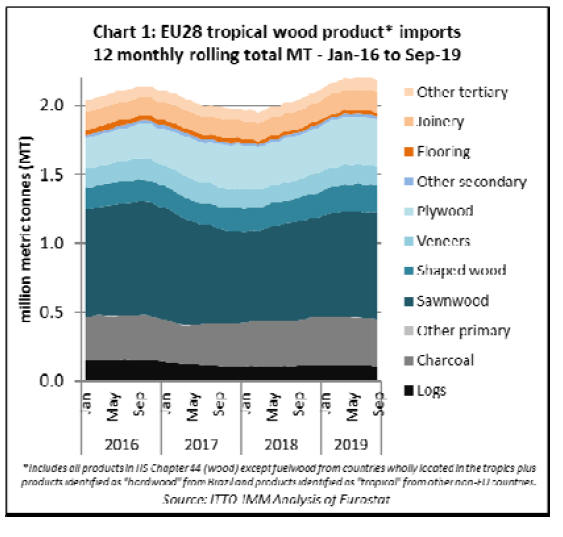

Chart 1 shows twelve monthly rolling total imports (to

iron out seasonal fluctuations) into the EU of all tropical

wood products listed in HS Chapter 44 (excluding

fuelwood, wood waste and chips). It shows that the 12-

month rolling total dipped to 1.95 million metric tonnes

(MT) in March 2018, then increased to a peak of 2.21

million MT in June 2019 before slipping back slightly to

2.19 million MT in September 2019.

The slowing pace of growth in European tropical wood

imports coincides with mounting signs of weakness in the

wider economy. In its new Regional Economic Outlook

for Europe, issued on 6th November, the IMF points out

that growth has slowed this year. Although that¡¯s mainly

due to weaker global trade (thanks to the US-China

tariffs), and a slowdown in manufacturing this year, there

are signs that the weakness is spreading.

According to the IMF, ¡°for most of the region, the

slowdown remains externally driven. However, some

signs of softer domestic demand have started to appear,

especially in investment. Services and domestic

consumption have been buoyant so far, but their resilience

is tightly linked to labor market conditions, which, despite

some easing, remain robust. Expansionary fiscal policy in

many countries and looser financial conditions have also

supported domestic demand¡±.

IMF forecasts that Europe¡¯s growth will decline from

2.3% in 2018 to 1.4% in 2019. A modest and precarious

recovery is forecast for 2020, with growth reaching 1.8%,

as global trade is expected to pick up and some economies

recover from past stresses.

IMF notes that this projection masks significant

differences between ¡°advanced¡± (i.e. mainly Western) and

¡°emerging¡± (mainly Eastern) Europe and that ¡°growth in

advanced Europe has been revised down by 0.1 percentage

point to 1.3 percent in 2019, while growth in emerging

Europe has been revised up by 0.5 percentage point to 1.8

percent¡±.

In total, the EU imported 1.66 million MT of tropical

wood products in the first nine months of 2019, 5.3%

more than the same period in 2018. The total value of EU

imports of tropical wood products in the January to

September 2019 period was €1.80 billion, 9% more than

the same period in 2018.

So far this year, there have been gains in EU imports of

tropical sawnwood, charcoal, plywood, mouldings, and

joinery products. These have been only partly offset by a

decline in imports of tropical logs, veneers, and flooring.

7% rise in EU imports of tropical sawnwood

EU imports of tropical sawn wood increased 7% to

582,500 MT in the first nine months of 2019 compared to

the same period in 2018. Import value increased 3% to

€557.9 million.

This aligns with market commentary earlier in the year,

with sawn hardwood importers reporting generally steady,

in some cases strong trading in 2019 including in tropical

timber, despite some slowdown in economic activity and

increased downside concerns about the medium-term

outlook.

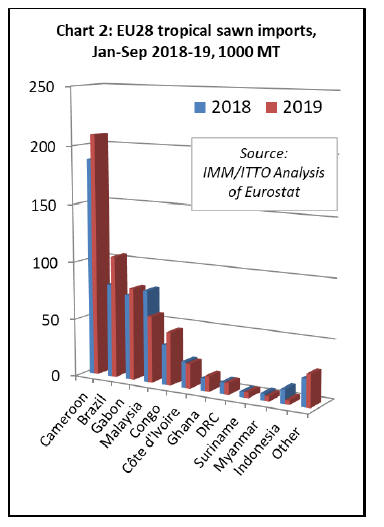

Imports from Cameroon, particularly slow in 2018,

increased 11% to 209,000 MT during the first nine months

of 2019. Imports also increased sharply from several other

countries including Brazil (up 30% to 105,100 MT),

Gabon (up 8% to 79,600 MT), Congo (up 32% to 45,800

MT), and Ghana (up 20% to 13,300 MT).

After a strong start to the year, imports from DRC were

10,100 MT in the first nine months of 2019, only 1% more

than the same period in 2018. These gains offset a 28%

decline in imports from Malaysia, to 57,500 MT, and a 6%

decline from Côte d'Ivoire to 20,900 MT (Chart 2).

The decline in EU imports from Malaysia this year was

attributed by some importers to a decline in the availability

of PEFC certified product following the suspension of

MTCS certification in Johor and Kedar states in May this

year which led to the total certified area in Malaysia to fall

by around 25%.

According to MTCS, both states are now working to

regain their MTCS certificates. At present, MTCScertified

forest areas consist of 4.2 million hectares of

natural forests and 109,025 hectares of forest plantation.

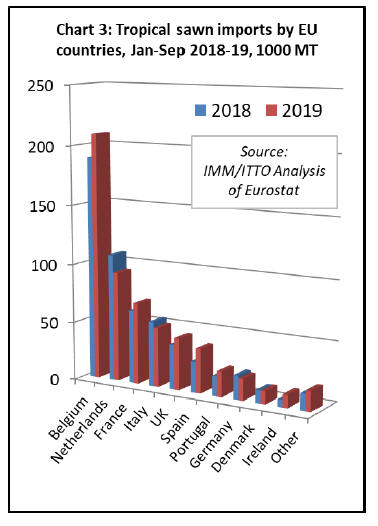

The trend towards increased concentration of tropical

sawn wood imports into the EU by way of Belgium has

continued this year. In the first half of 2019 compared to

the same period in 2018, imports into Belgium increased

11% to 209,200 MT. (Chart 3)

However, direct imports of sawnwood from tropical

countries also increased in some EU countries in the first

nine months of 2019. Imports increased in France (up 11%

to 69,400 MT), the UK (up 16% to 44,200 MT), Spain (up

38% to 43,700 MT), Portugal (up 28% to 21,400 MT), and

Ireland (up 78% to 10,800 MT).

These gains offset declining imports in the Netherlands (-

13% to 93,600 MT), Italy (-9% to 50,500 MT) and

Germany (-9% to 18,200 MT).

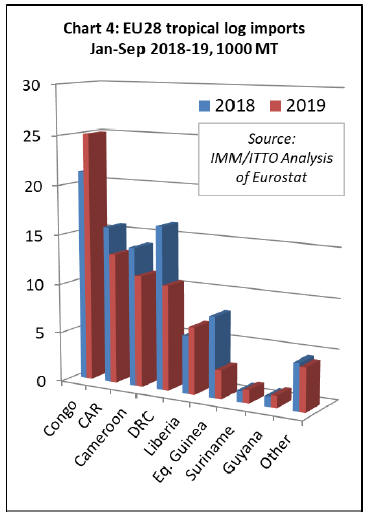

EU imports of tropical logs slow in third quarter

After recovering ground in 2018 and stabilising in the first

half of 2019, EU imports of tropical logs slowed in the

third quarter of 2019. Imports of 76,700 MT during the

first nine of the year were 13% less than the same period

in 2018. Import value fell 14% to €37.3 million during the

period.

In the first nine months of 2019, EU imports of tropical

logs increased by 18% to 25,100 MT from Congo, the

leading supplier, by 16% from Liberia to 6,700 MT, by

17% from Suriname to 1300 MT, and by 20% from

Guyana to 1,200 MT.

However, these gains were offset by falling imports from

the Central African Republic (-17% to 13,200 MT), DRC

(-35% to 10,600 MT), Cameroon (-20% to 11,300 MT),

and Equatorial Guinea (-64% to 2,900 MT) (Chart 4).

After a more buoyant second quarter, imports of tropical

logs slowed into France and Belgium in the third quarter

of 2019. By the end of the first nine months, France had

imported 28,900 MT of tropical logs, 13% less than the

same period in 2018, while imports into Belgium were

down 23%, at 18,300 MT. Imports were also down 21% to

11,700 MT in Portugal during this period.

Rising log imports in some smaller markets, including

Italy (+3% to 7,900 MT), the Netherlands (+18% to 2,100

MT) and Spain (+11% to 2,100 MT) were insufficient to

offset falling imports in France, Belgium and Portugal.

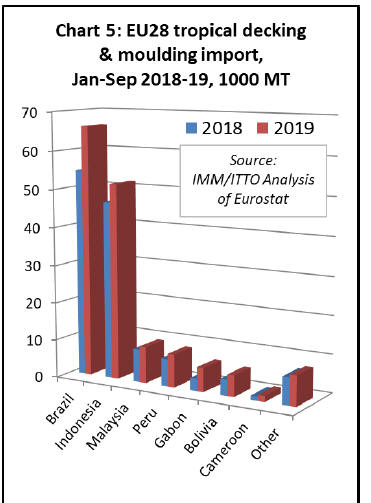

EU imports of tropical decking buoyant this year

EU imports of tropical mouldings (which include both

interior mouldings and exterior decking products)

increased sharply, by 19%, to 157,600 MT in the first nine

months of 2019. Import value increased 26% to €239

million.

EU imports of tropical mouldings increased from all the

leading suppliers of this commodity in the first nine

months of 2019 including Brazil (+21% to 66,300 MT),

Indonesia (+10% to 51,600 MT), Peru (+20% to 8,600

MT), Malaysia (+11% to 9,500 MT), Gabon (+95% to

6,400 MT) and Bolivia (+33% to 5,600 MT) (Chart 5).

In the first nine months of 2019, imports of tropical

mouldings increased in France (+36% to 49,500 MT),

Netherlands (+39% to 26,600 MT), the UK (+26% to

9,400 MT), Italy (+18% to 6,800 MT) and Denmark

(+18% to 3,800 MT). However, imports weakened in

Germany, down 6% to 28,300 MT, and Belgium, down

3% to 22,400 MT.

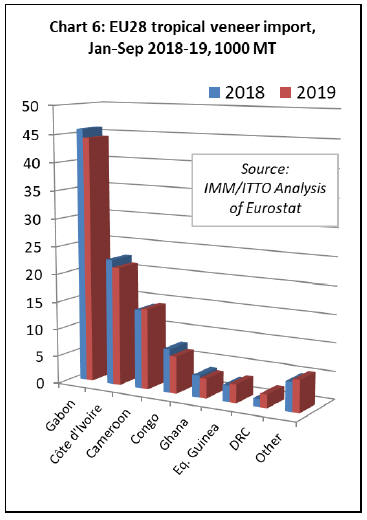

EU imports of tropical veneer down 6%

Following a similar trajectory to sawn hardwood imports,

EU imports of tropical veneer slowed in the third quarter

of 2019 after a strong performance in the first six months

of the year. Imports, which were up 10% on the previous

year in the first half of 2019, declined 2% to 102,000 MT

in the nine months to September. Import value decreased

1% to €131.7 million during this period.

The EU imported 44,200 MT of veneer from Gabon in the

first nine months of 2019, 4% less than in the same period

in 2018. Imports also declined from Cote d¡¯Ivoire (-6% to

21,400 MT), Republic of Congo (-15% to 6,600 MT), and

Ghana (-10% to 3,600 MT).

However, imports from Cameroon stayed just ahead of last

year¡¯s level, at 14,500 MT two percent more than the same

period in 2018. There was also a significant increase in

imports from DRC, by 69% to 2,400 MT, in the first half

of 2019 (Chart 6).

In the first half of 2019, tropical veneer imports increased

by 1% in France to 36,600 MT, by 6% in Italy to 26,500

MT, by 2% in Greece to 8,200 MT, and by 11% in

Romania to 4,500 MT. However, imports fell by 13% in

Spain, to 15,700 MT.

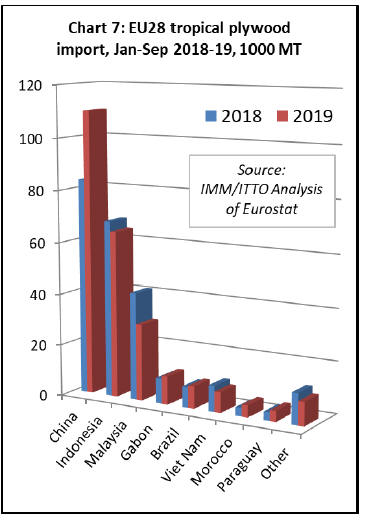

Large Chinese suppliers increasingly dominant in UK

tropical plywood imports

EU imports of tropical plywood products were 250,100

MT in the first nine months of 2019, 4% more than the

same period last year. Import value increased 7% to

€221.5 million.

A large and growing proportion of the plywood faced with

tropical hardwood imported into the EU is manufactured

in China. The EU imported 110,000 MT of this product

from China in the first nine months of 2019, 32% more

than during the same period in 2018. When linked with

news that numerous smaller mills in China have closed in

recent years due to new emissions controls, and anecdotal

reports from European buyers of a greater focus on quality

and species content due to EUTR and CE Marking

requirements, the strong implication is that the trade is

becoming more concentrated amongst a few large

consolidated suppliers in China.

Although direct imports of plywood have increased from a

few tropical countries this year, the total volume was

down 12% at 122,300 MT in the first nine months of 2019.

Imports increased from Gabon by 12% to 11,100 MT,

from Brazil by 8% to 8,700 MT, and from Morocco by

41% to 4,600 MT.

However, these gains were not enough offset declining

plywood imports from the two largest tropical suppliers,

Indonesia and Malaysia, this year. Imports from Indonesia

declined 6% to 64,500 MT and fell 29% from Malaysia to

29,700 MT.

A brief surge in imports from Vietnamearlier in the year

also faltered in the third quarter so that total imports were

down 20% at 8,100 by the end of the nine months to

September 2019. (Chart 7).

EU imports of tropical hardwood plywood during 2019 are

being strongly influenced by market issues elsewhere in

the world, notably the US-China trade dispute which has

led to a dramatic decline in Chinese hardwood plywood

exports to the United States and increasing diversion of

Chinese product to the EU, mainly destined for the UK.

In the first nine months of 2019, UK imports of tropical

plywood products increased 19% to 140,300 MT, despite

widespread reports of overstocking and declining plywood

consumption in the country.

UK imports of tropical hardwood plywood from China

increased 72% to 78,800 MT in the first nine months of

2019, while UK imports from Malaysia fell 29%, to

25,100 MT, and were down 7% from Indonesia to 26,900

MT.

In contrast to the UK, tropical plywood imports declined

into all other major EU markets in the first nine months of

2019, including Belgium (-21% to 26,300 MT),

Netherlands (-11% to 24,200 MT), Germany (-7% to

18,600 MT), France (-3% to 14,700 MT) and Italy (-4% to

12,300 MT).

A small increase in imports into Greece, by 4% to 2,300

MT, did little to mitigate this downward trend.

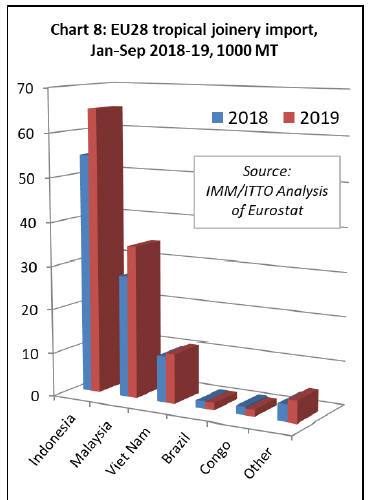

Indonesia and Vietnam boost share of EU tropical

joinery imports

EU imports of tropical joinery products, mainly doors

(from Indonesia), and laminated window scantlings and

kitchen tops (from Indonesia, Malaysia and Vietnam),

increased 19% to 119,700 MT in the first nine months of

2019. Import values also increased rising 26% to €244.1

million.

EU imports in the first half of 2019 increased from all

three of the countries that dominate international trade in

tropical joinery products including Indonesia (+19% to

65,100 MT), Malaysia (+25% to 34,700 MT), and

Vietnam(+8% to 11,500 MT) (Chart 8).

In the first half of 2019, imports of tropical joinery

products increased by 9% to 48,200 in the UK, by 75% to

37,300 MT in the Netherlands, and by 1% to 14,400 MT

in Belgium. There were also significant gains in two

smaller markets for tropical joinery products, Ireland

increasing 97% to 2,500 MT and Poland up 50% to 1,300

MT. These gains offset a 22% fall in France to 8,100 MT,

and a 14% fall in Germany to 5,500 MT.

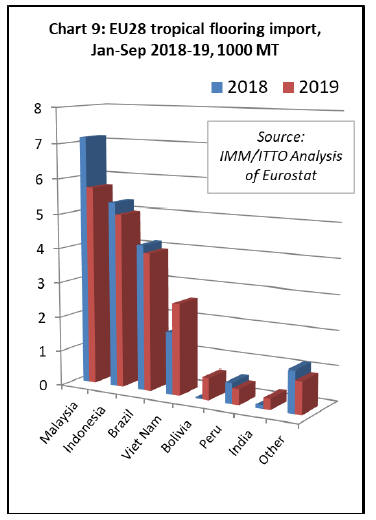

Another fall in EU imports of tropical flooring

EU imports of flooring products from tropical countries

fell a further 4% to 19,700 MT in the first nine months of

2018, continuing a long term decline in response to tough

competition from European and Chinese manufacturers

and non-wood alternatives, fashion trends favouring

temperate timbers, supply constraints, and challenges of

EUTR conformance. The value of EU imports of wood

flooring was more stable, at €45.7 million in the nine

month period, only slightly less than €45.8 million in the

same period last year.

This year, falling imports from traditionally the leading

suppliers ¨C Malaysia (-20% to 5,700 MT), Indonesia (-6%

to 5,000 MT), and Brazil (-5% to 4,000 MT) ¨C has been

partially offset by rising imports from Vietnam(+47% to

2,600 MT), Bolivia (from near zero to 600 MT), and India

(+187% to 300 MT) (Chart 9).

In the first nine months of 2019, tropical wood flooring

imports recovered a bit of ground in France (+25% to

5,400 MT), UK (+54% to 2,200 MT), and the Netherlands

(+11% to 1,700 MT).

However, imports fell in most other significant European

markets including Belgium (-3% to 2,500 MT), Italy (-

16% to 1,600 MT), Denmark (-38% to 1,500 MT),

Germany (-17% to 1,400 MT), and Spain (-1% to 1,400

MT).

|