Japan

Wood Products Prices

Dollar Exchange Rates of 10th

November

2019

Japan Yen 108.88

Reports From Japan

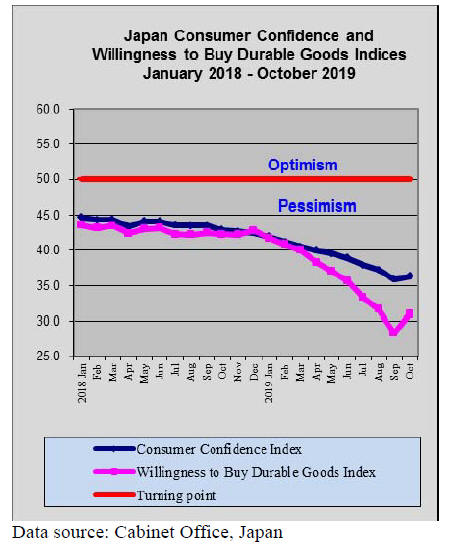

Hopes for growth pinned on domestic consumption

The Cabinet Office¡¯s gross domestic product (GDP)

figures show annualized 0.2% growth in the third quarter

of 2019, far short of expectations. There could have been a

decline if it was not for the surge in personal spending

ahead of the October increase in consumption tax. The

third quarter slowdown is in contrast to the 1.8%

expansion in the second quarter.

Before the tax increase, consumers rushed to buy home

appliances and daily necessities. Consumer spending

accounts for more than half of Japan¡¯s GDP, and any

slowing of consumption would cast doubt on the Bank of

Japan¡¯s optimism that robust domestic demand will offset

the impact of the global economic slowdown.

The disappointing news was that exports fell by nearly

1%, mainly because of a slowdown in machinery

shipments to China.

Big spending on infrastructure to feature in

supplementary budget

To speed recovery in areas hit by recent natural disasters

and to cope with other risks to the economy, such as the

China¡ªUS trade row and the UK¡¯s exit from the EU, the

government will earmark funds in a supplementary budget

for fiscal 2019, which ends in March 2020.

This will be the first such financial package in three years,

and spending on reconstruction work will address

damaged roads, bridges, river embankments, homes and

farming facilities. The local timber trade is already

anticipating huge demand for wood products, and this

could lead to a rise in plywood imports, which have fallen

sharply this year.

Economy steady after tax hike, but companies holding

back on investment

According to a Reuters poll, most Japanese companies say

the impact of the latest rise in consumption tax has not

resulted in a steep downturn in consumer consumption,

which was very pronounced when the tax was raised five

years ago.

The consensus amongst economists is that the Japanese

economy looks likely to avoid a drop in private

consumption thanks to the measures introduced by the

government to soften the impact of the tax.

Despite the positive signs, the majority of Japanese

companies remain cautious about investing, saying there is

little chance of big pay increases next year.

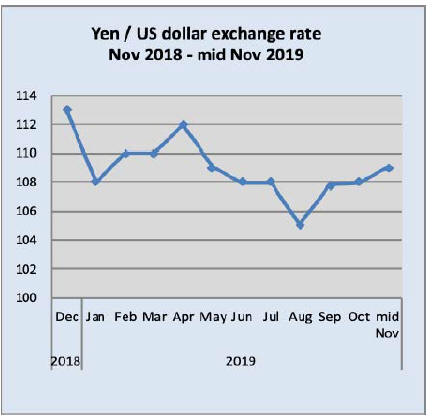

Is Bank of Japan about to change course? Risk of

stronger yen worries exporters

At a recent meeting with the media, the Governor of the

Bank of Japan (BoJ) welcomed the government¡¯s plan for

a supplementary budget, saying that a mix of fiscal and

monetary stimulus could help the country attain its

inflation target.

Analysts were quick to pick up on these statements

as

seeming to imply that monetary policy alone is not

working. From the beginning, many analysts doubted that

the 2% inflation target was attainable, a view also held by

some Japanese bankers and academics.

What comes next is a major question. If the BoJ changes

course, it could have a huge impact, say analysts. For

example, it could lead to a surge in the yen on a wave of

¡°safe haven¡± buying, which would jeopardize the

performance of exporters and undermine growth.

Sporty wood-cellulose car at Tokyo motor

show

Visitors to the Tokyo Motor Show 2019 had the

opportunity to see how eco-conscious designers tackle the

motor industry. With funding from the Ministry of the

Environment, a team from the University of Kyoto built a

sporty ¡°nano cellulose vehicle¡± (NCV) with the aim of

reducing the weight of cars to achieve better fuel

efficiency and thus a reduction of CO2 emissions.

The nanofibres used were from cellulose extracted from

trees through pulping and fibrillation; they were mixed

into a resin for moulding.

See: https://www.city-cost.com/blogs/City-Cost/GQPxLliving_

sustainablelife_tokyo

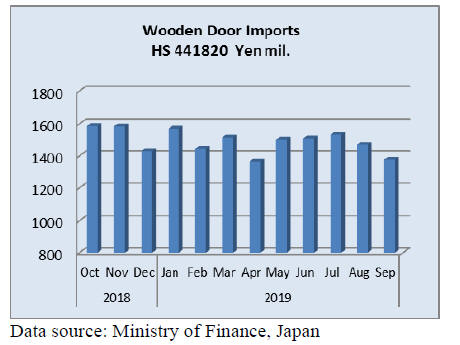

Import update

Wooden door imports

The value of Japan¡¯s imports of wooden doors

(HS441820) dipped in August and dropped further in

September this year by around 6%. Compared with a year

earlier, September imports were flat.

As in previous months, the top two shippers, China and

the Philippines, accounted for more than 80% of arrivals.

The other small but significant shippers in September were

Indonesia and Malaysia.¡¡

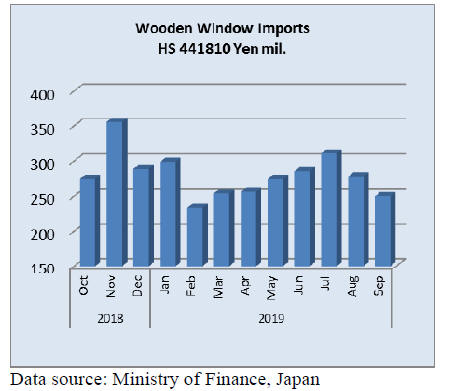

Wooden window imports

The value of wooden window (HS441810) imports

dropped in September by 10%, month-on-month, but

imports were flat to September, year-on-year. The top

shippers in September were China (60% of imports) and

Indonesia (19%).

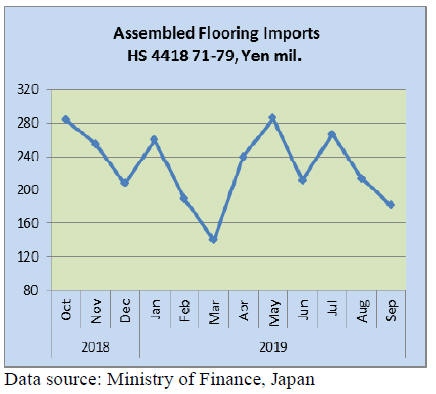

Assembled wooden flooring imports

The value of Japan¡¯s assembled wooden flooring imports

traditionally see-saw between peaks and dips. The dip in

imports in August and September, however, has not been

observed before.

Wooden flooring imports (HS441871-79) in September

2019 were down by 22%, year-on-year, and by 15%,

month-on-month.

The bulk of August¡¯s assembled wooden flooring imports

were of HS441875; the main shippers in September were

China and Indonesia.

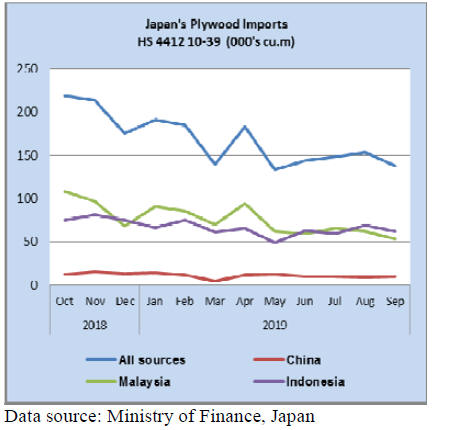

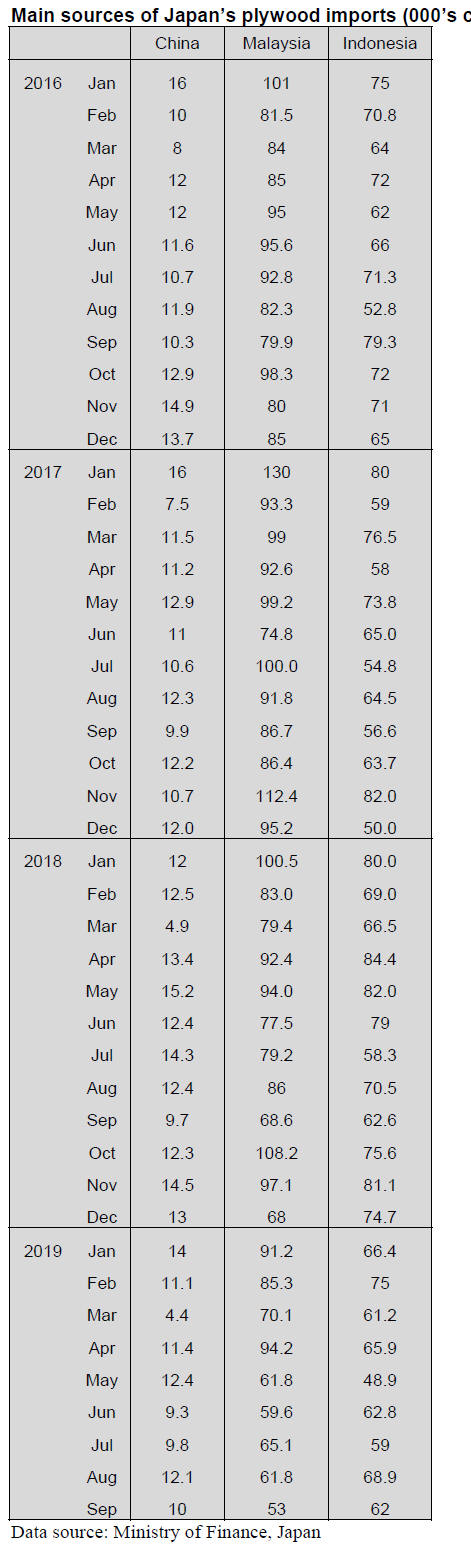

Plywood imports

As in previous months, HS 441231 dominated Japan¡¯s

plywood imports. It accounted for over 80% of all

plywood imports by volume in September, most of which

was shipped by suppliers in Malaysia and Indonesia.

Year-on-year September plywood arrivals from Malaysia

were down a further 23%. Imports from Malaysia in

January this year were over 90,000 cu.m but by September

had fall to just 50,000 cu.m. Shipments from Indonesia are

holding up better¡ªflat, year-on-year, and down only 10%,

month-on-month.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Log supply drops by typhoon damages

Typhoons hit Tokyo and North one after another since last

September and the Ministry of Agriculture, Forestry and

Fisheries reported total damage as of October 29 is

estimated about 126.8 billion yen out of which damages

on forestry is 38.7 billion yen. Many farm products were

damaged right before harvest then heavy rains ruined

logging road system by land-slides and flood.

Disruption of road system hampers hauling of harvested

logs so that log supply is getting declining. This is time for

sawmills to buy and accumulate fresh fall cut logs to

replace summer cut logs with heavy moisture content so

mills¡¯ log inventory is low so without such incident, log

prices should be firming seasonally but logs are not

available as sawmills want so that log prices are climbing.

Lumber market of structural materials of post and beam

for housing has not changed much and stays almost flat

while there are increasing demand for materials such as

furring strip, low priced board and batten for repair works

of typhoon damaged houses.

Since logging road repair takes time, log supply will

continue tight so the log prices will stay up high. Because

of unchanged slow lumber market and climbing log prices,

some sawmills consider to curtail production.

Wood demand projection meeting

The Forestry Agency held the second wood demand

projection meeting in late September. Forecast of new

housing starts by 13 think tanks for 2020 is average of

870,000 units while the forecast for 2019 is 893,000 units.

Only four think tanks forecasted over 900,000 units and

the lowest forecast is 810,000 units.

Reason of pessimistic forecast is slowdown of world

economy and Japanese economy will be influenced. The

forecast is revised downward from previous forecast so

that import of logs, lumber and plywood is also revised

downward for the fourth quarter of 2019. The first quarter

forecast of imported logs and lumber would decrease

compared to the same quarter this year.

By declining demand, import of logs and lumber would

continue decrease next year. Domestic log demand for

lumber would decrease but for plywood the demand would

increase.

Radiata pine logs and lumber from New Zealand and Chile

would decrease because of depressed crating lumber

market affected by trade friction between China and the

U.S.A.

Domestic plywood supply will increase by new plywood

mills coming on stream so the first quarter 2020 would

increase but imported plywood supply would stay

unchanged from 2019. On structural laminated lumber

supply, domestic supply would decrease for the fourth and

first quarter but supply of imported lumber would increase

due to lower prices.

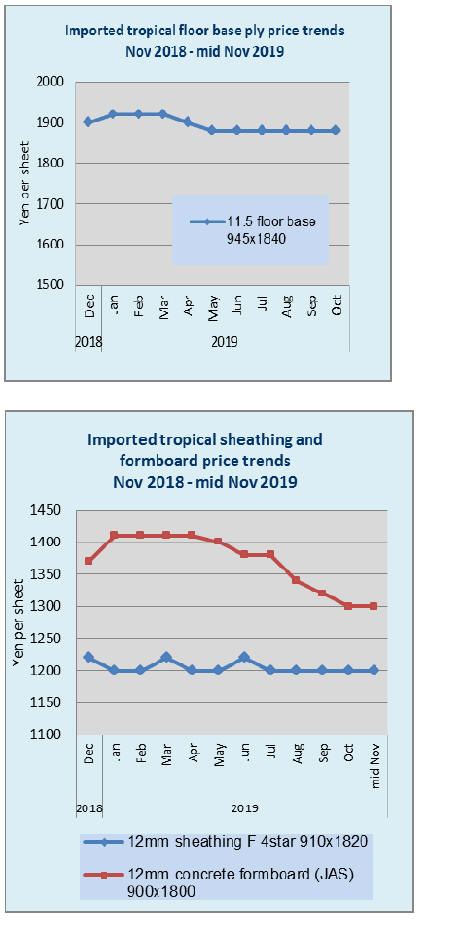

Plywood

Domestic softwood plywood business continues active

while imported South Sea hardwood plywood business is

stagnating.

Shipment of domestic softwood plywood to precutting

plants are very busy so that the inventories by

manufacturing mills are low. The manufacturers¡¯

production is full now and any additional production is

difficult because of tighter working rules, which makes

overtime and weekend operations difficult.

In early August, one plywood mill¡¯s long panel production

line stopped by mechanical trouble so other mills

increased long panel production, which reduced

production of 12 mm structural panels so the inventory of

standard panel became tight. In fall, trucks are hard to get

because it is harvest season and many trucks are taken to

transport farm products like rice so deliveries are delayed

by a week to ten days but precutting plants runs without

much problem so far.

Series of typhoon hit Eastern Japan in last two months,

which damaged many houses by flood and landslide so

orders are increasing for plywood for repair works. With

labor shortage for rehabilitation works, such demand

would continue long period of time.

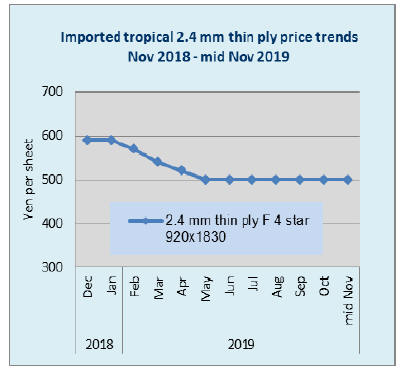

Movement of South Sea hardwood plywood is stagnating

with small orders particularly for concrete

forming panel but after typhoons¡¯ damages, there are more

orders for temporary shelter materials so the prices seem

to be hitting the bottom and if this move continues, the

prices may go up.

Impact of TPP and EPA

TPP (Trans Pacific Partnership) agreement became

effective in December 2018 and EPA (Economic

Partnership Agreement) with EU countries did in February

2019. By these agreements, import duty on Canadian SPF

lumber is reduced from 4.8% to 2.4% and that on OSB is

reduced from 5-6% to 2.5% -3% and after 16 years, both

will be abolished to zero %.

On EU¡¯s SPF lumber with 4.8% duty, structural laminated

lumber with 3.9% and OSB and particleboard with 5.0-

6.0%, duty rate will be reduced by 0.3-0.8% every year for

seven years and will become zero after 16 years.

Malaysia, one of participating country, has not completed

procedures but after it is done, tropical logs and hardwood

plywood duty of 6-10% will be reduced to 3-5% and be

zero after 16 years. The Japanese government allocated

large amount of budget to protect domestic wood industry

since reduction of import duty will make foreign products

more competitive and become threat to domestic wood

industry and would cause shrinkage of domestic wood

demand.

In 2015, 29 billion yen of budget was spent for

strengthening lumber and plywood industry. In 2016, 33

billion yen and in 2017, 40 billion yen then in 2018, 39.2

billion yen were allocated. This budget was spent to

subsidize building of lumber, plywood and laminated

lumber plants with necessary machines and introduction of

harvesting machines for forest unions and log suppliers,

which feed necessary logs to processing plants and also

preparation of logging road system.

During 2009 and 2014, total of 373.4 billion yen were

allocated to subsidize renewing sawmill facilities and

enlarging production capacity and this ensured supply

capacity and stable quality of domestic wood products.

Also this promoted shifting of raw materials from

imported wood to domestic wood. Also with help of the

subsidy, new large lumber mills and plywood mills were

built in prefectures, which did not have such production

facilities before.

Producing mills actually moved into where there is little

competition of log procurement. This move also helps

spread out producing facilities in many areas and this

guarantees stable supply when natural disasters like

typhoon, flood and earthquake hit certain area, which

damage producing facilities in the areas.

Actually there have been such disasters every year

recently but by increasing supply capacity outside

damaged areas, it guaranteed stable supply of domestic

wood products.

By constant enforcement of domestic wood industry in last

several years, self-sufficiency rate has been improving.

Actually it is result of decrease of imported logs and

lumber in 2017 and 2018 while domestic wood products

increased.A

Before import duty reduction starts by these agreements,

Canadian SPF lumber and European structural laminated

lumber are more competitive by drop of supply prices due

to depressed own markets and this stopped the move of

shifting to domestic wood like SPF lumber. On plywood,

structural panel is now mainly all domestic but floor base

is mainly relying on tropical hardwood plywood yet.

SPF lumber

Import duty is reduced from 4.8% to 2.4% after TPP

became effective since December 31, 2018. At the first

quarter price negotiations, duty reduction was not much

issue since the export prices of J grade has been dropping

largely from the peak prices of US$ 700 per MBM C&F in

the third quarter in 2018. The market prices have been

nosediving much larger than duty reduction.

The first quarter prices in 2019 were down to US$560 then

price drop continued after the first quarter by US$50 and

US$30 and the third quarter prices were US$490-500,

30% drop from the peak. Therefore, the focus is difference

between domestic lumber prices in the North America and

J grade prices.

Regardless of import duty, Canadian SPF lumber prices

would change by other factors. By anti-dumping duty and

countervailing duty on softwood lumber exported to the

U.S.A. since 2017, break even prices of Canadian sawmill

moved up then log prices climbed by tight supply as

annual allowable cut in B.C. is largely reduced after

extensive mountain beetle damaged lodge pole pine timber

harvest was done.

With these factors, J grade prices would be higher in

future together with another climbing factor of higher

ocean freight by switching to use low sulfur oil by law

since 2020.

European lumber

Between EU and Japan, after EPA became effective,

import duty of 10 items of wood products will be reduced

step by step and totally abolished in 2025. Present rate is

2.9% on laminated lumber, 3.6% on lumber and 4.5% on

wooden board. Compared to before EPA, reduction of

duty is 1.0% on laminated lumber, 1.2% on lumber and

1.5% on wooden board.

Gradual reduction is to alleviate excessive impact to the

market by immediate abolishment. This is the second year

after the agreement became effective but there is no

impact to the market because suppliers¡¯ prices dropped by

slump of worldwide market and the exchange rate moved

from 130 yen plus in 2017 and 2018 to 118-119 yen per

Euro now.

This reduces the yen cost. When the agreement started,

reduction of import duty reduces imported cost so it makes

European products more competitive but now the prices

for the fourth quarter on lamina are Euro 220 per cbm

C&F and on redwood laminated beam and whitewood

laminated post, the prices are down to less than Euro 400.

These price level is unprofitable for the supplying mills

and some Scandinavian mills plant to curtail the

production.

Duty reduction helps compete European lumber to

domestic cedar laminated lumber. Present cedar laminated

post prices are 1,750 yen per piece delivered and

whitewood laminated post prices are down to about 1,800

yen so they compete to get more market share now.

Plywood and wooden board

Import duty reduction by TPP and EPA does not give

much impact on competition between domestic products

and imported products. Rate of duty reduction varies by

items but the maximum reduction is 5%. On Malaysian

hardwood plywood, export prices has been climbing by

tight log supply while the market in Japan of imported

plywood shows no sign of recovery so duty reduction is no

help.

In short, gap between high export prices and stagnant

market prices in Japan continues and duty reduction is not

large enough to fill the gap.

Also duty reduction rate on Canadian and European OSB

is small and when housing starts in Japan is weak

particularly on rental units, there is no incentive to use

OSB by small duty reduction.

Domestic plywood and imported plywood have been

having different market so even if duty reduction helps

increase supply of imported plywood, there will be very

little influence on domestic plywood market. After the

supply of South Sea hardwood plywood became unstable,

floor manufacturers in

Japan are switching to use domestic plywood.

Chinese wood buyers¡¯ inspection tour

The Japan Wood Products Export Promotion Council

recently held business meeting with four Chinese wood

products buyers and inspection tour of Japanese wood

industry.

The visitors visited Chugoku Lumber and Miyasako

Lumber in Hiroshima prefecture and Meiken Lamwood,

Yamashita Lumber and Innosho Woods in Okayama

prefecture. The business meeting was held in Okayama

city together with export promotion seminar.

The Council arranged one week tour for the visitors for

touring various wood products manufacturers, which are

anxious to export the products to China and exchanged

information.

At the Japanese wood products export promotion seminar,

four Chinese buyers individually made lecture about

Chinese wood products market. Log import by China for

the first half of 2019 was about 30,000,000 cbms, 2.5%

less than the same period of last year but softwood logs

and lumber import increased from 2018.

Imported softwood logs and lumber are used for furniture

and interior furnishing. Demand for furniture, children¡¯s

desk and furniture like desk and drawer and casket on

every important occasion of life like wedding, child birth

and funeral and such demand is closely forecasted. Some

buyer plans to specialise Japanese cypress products as

cypress is Chinese favorite species. Another commented

that Japanese cedar prices are competitive and with

expanding Chinese logistics, cedar pallet has better chance

in China.

In China, non-residential wooden buildings like hotels and

library draws much attention recently so that there is more

chance to use wood in China in future. Four Japanese

companies participated business meeting. The group

visited Okayama Prefectural College¡¯s alumni hall, which

is built with 3 and 4 meter 120 mm cypress square.

|