3.

MALAYSIA

New regional trade deal gets closer

The Malaysian business community is excited over recent

positive developments in regional trade. Although India

pulled out at the last minute, 15 other countries—the ten

member countries of the Association of Southeast Asian

Nations (ASEAN) plus China, Japan, the Republic of

Korea, Australia and New Zealand—agreed in Bangkok

on plans for what could become the world's biggest trade

agreement, the Regional Comprehensive Economic

Partnership (RCEP). Countries aim to sign the agreement

next year to start freeing up trade between members.

Few details have been released, but the agreement will

progressively lower tariffs across many areas. Its backers

say that, just as importantly, the agreement will let

companies export the same product anywhere within the

bloc without having to meet separate requirements and

complete separate paperwork for each country.

The 15 participating countries make up nearly one-third of

the world’s people (it would have been nearly half with

India) and nearly one-third of global domestic product.

India can join later, if it wishes.

Departmental restructuring underway in Sarawak

The Sarawak Forest Department is undergoing a

restructuring. According to Director Hamden Mohammad,

the restructuring will more clearly define the roles and

responsibilities of the Forest Department and the Sarawak

Forestry Corporation (SFC) in managing forest resources

and conserving Sarawak’s biodiversity.

“As agreed, the Forest Department will regulate all forest

areas in Sarawak in the aspect of management and

operations, while SFC will manage the national parks and

wildlife protection,” said Director Hamden.

In other news, talks are underway with Singapore for

Sarawak to produce semi-finished furniture for companies

based in Singapore..

“We are thinking of a dedicated furniture park for

Singapore companies in Sarawak, so that you can get the

raw materials that you need to produce good furniture. We

can perhaps increase export of our furniture,” said

Sarawak Chief Minister Abang Johari Tun Openg.

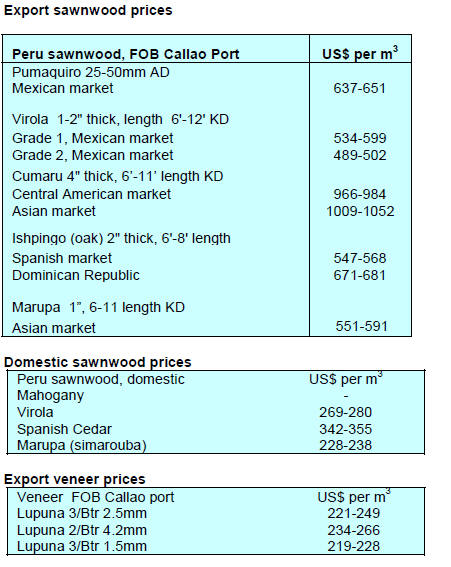

Exports in first eight months of 2019

The Statistics Department has released export data for the

first eight months of 2019. Sarawak’s log exports totalled

937,006 cu.m in January–August (down from 986,997

cu.m in the same period in 2018) at a value of MYR

501,982,000 (down from MYR 537,005,423).

The Republic of Korea has purchased no logs from

Sarawak to date this year. Indonesia is now the largest

importer of Sarawakian logs.

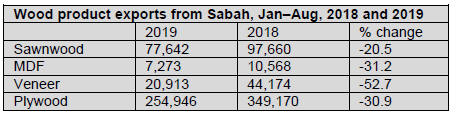

The total value of Sabah’s timber product exports was

MYR 749,900,129, down by 25% compared with the same

period in 2018 (MYR 1,008,048,127).

It will be seen from the above that Indonesia is

the major

market for sarawak’s log exports.

4.

INDONESIA

Log production predicted to grow by 15%

next year

The Association of Indonesian Forest Concessionaires

(APHI) estimates that log production will grow by 10–

15% next year, both from industrial plantations (HTI) and

natural forests, according to a report in Bisnis. APHI

Executive Director Purwadi Soeprihanto said that the

production of logs from natural forests this year is

predicted at 5.4 million m3 and HTI production is

estimated to be stable at 40 million m3.

See: https://ekonomi.bisnis.com/read/20191105/99/1166881/

produksi-kayu-bulat-diprediksi-tumbuh-hingga-15-persen

Chinese investors relocate furniture factories to Java

According to a report in TEMPO, Indonesia’s Investment

Coordinating Board (BKPM) has indicated that 59

Chinese investors in wood and furniture businesses will

relocate factories to Central Java.

The reasons given for the relocation include Indonesia's

stable investment climate and the simple licensing process

in Central Java.

See:

https://en.tempo.co/read/1268924/59-chinese-investorsrelocating-

furniture-factories-to-java

Plywood, bamboo, rattan listed in US GSP

programme

The US Trade Representative (USTR) has indicated that

laminated bamboo plywood (HS 44121005), thin plywood

measuring less than 66 mm (HS 44123141155), and rattan

for hand-made souvenirs (HS 46021223) are eligible for

cuts in Generalized System of Preferences tariffs on

exports to the US.

US says trade preference talks to conclude soon

US Commerce Secretary Wilbur Ross said recently that a

US review of a trade preference facility for Indonesia

would conclude soon, and he predicted “far more

investment” by US companies in Indonesia as a result,

according to a report in TEMPO.

The USTR has been reviewing Indonesia’s eligibility for

the GSP facility for more than a year due to concerns

about market access for US goods, services and

investment.

By retaining GSP and opening up more market access in

both directions, Indonesia and the US aim to more than

double their trade in the next five years to US$ 60 billion

(up from US$ 28.6 billion in 2019), according to

Indonesian Chief Economic Affairs Minister Airlangga

Hartarto. “We want to open access for our furniture and

textiles and we have programmes to import more cotton

and wheat from the US,” he was reported as saying.

See:

https://en.tempo.co/read/1269174/u-s-says-talks-on-indonesiatrade-

preference-to-conclude-soon

Association urges streamlined regulations

The Indonesian Furniture and Crafts Industry Association

(HIMKI) has urged the government to immediately fix

regulations that hamper the export of Indonesian furniture

and handicraft products.

HIMKI Secretary General Abdul Sobur identified the

Timber Legality Verification System (SVLK) as a

particular obstacle, saying that it should not be required

once the timber reached downstream industries such as

furniture manufacture, if the upstream supply has already

been verified as legal. Mr Sobur said that reducing

regulations on exports was key to reducing Indonesia’s

trade balance deficit.

See: www.industry.co.id/read/57089/ekspor-furnitur-dankerajinan-

loyo-himki-desak-pemerintah-benahi-regulasi

Furniture exports down

The export performance of Indonesian furniture and

handicraft industry products has stagnated in recent years,

according to a report in Bisnis. The export value of

industrial products made from wood and rattan was

US$ 1.49 billion in 2018, down from US$ 1.63 billion in

2017. The Director of the Forest and Plantation Products

Industry of the Ministry of Industry (Kemenperin), Edy

Sutopo, blamed this partly on logistics and a lack of

attractive designs.

5.

MYANMAR

Myanmar grapples with FLEGT

The Workshop to Formulate the Road Map on FLEGT

was conducted in Nay Pyi Taw in early November

involving the national and subnational members of the

Multistakeholder Group and representatives of the EU and

the European Forest Institute (EFI), according to the

Forest Department.

Moreover, an EU representative was in Myanmar in early

November amid uncertainty about the status of

negotiations on the voluntary partnership agreement

(VPA) between the EU and Myanmar. Myanmar’s Forest

Law Enforcement, Governance and Trade (FLEGT)

process with the EU began in 2015.

One exporter said that timber businesses were under

pressure from two fronts: increasing difficulty in accessing

the EU market, and declining harvest volumes. The

exporter said the private sector was in a weak position to

tackle market access issues.

According to a source close to EU importers, the European

Timber Trade Federation recently sent an expert from

NepCon (a non-profit organization working

to support better land management and business practices)

to review legality issues in Myanmar.

The expert reportedly met with officials from several

institutions, including the Forest Department, the

Myanmar Timber Enterprise and the Myanmar Forest

Certification Committee.

Business gets a little easier

Myanmar has moved up in the World Bank’s Ease of

Doing Business ranking, from 171 in 2018, according to U

Thant Sin Lwin, Director-General of the Directorate of

Investment and Company Administration (DICA), as

reported by state media.

The World Bank report found that Myanmar showed

substantial improvements in five areas of doing business—

1) starting a business; 2) dealing with construction

permits; 3) registering property; 4) protecting minority

investors; and 5) enforcing contracts.

Myanmar launched an online company registry platform,

merging several procedures and reducing the need for inperson

interactions. It also enacted the Myanmar

Companies Law, which stipulates the duties of directors

and changes in shareholdings.

Myanmar expects to attract more investment as

manufacturers seeking to relocate production from China

to skirt US tariffs encounter capacity constraints in

Vietnam, according to a report in Bloomberg.

With labour wages rising in Thailand, some Thai

enterprises are discussing moving their businesses to

Myanmar, according to U Thant Sin Lwin. These

businesses are engaged in manufacturing LEDs, auto parts

and accessories, among other things. Globally, the

ongoing China–US trade dispute saw combined FDI to the

CLMV countries (Cambodia, Lao PDR, Myanmar and

Vietnam) rise by 4% in 2018, to US$ 23 billion.

More foreign banks to operate in Myanmar

The Central Bank of Myanmar (CBM) will issue two types

of licences—foreign bank branch licences and subsidiary

licences—in the upcoming third round of licensing from 1

January 2020, according to a statement, as part of an

initiative to open up the domestic banking market to

foreign banks.

Nine foreign banks got the green light in 2014 and four in

2016, in which they are allowed to conduct onshore

wholesale banking business. Branch licensees are allowed

to establish one place of business only, and a minimum

paid-in capital of US$ 75 million is required for

operation.

See: https://elevenmyanmar.com/news/cbm-to-issue-two-typesof-

licenses-for-foreign-banks

6. INDIA

Low demand, high taxes plague Kutch

timber industry

Asia’s biggest notified Imported Timber Conversion Zone,

in the district of Kutch (in Gujarat in western India), is

struggling, according to a report in The Times of India.

A reduction in demand has forced several sawmills to cut

production, and the high Goods and Services Tax (GST)

and a depreciation of the rupee have eroded their margins.

GST is applicable to any goods or services imported into

or exported from India.

The rate of the GST on timber imports is currently

18%.

The Kandla Timber Association has requested a reduction

in the rate of the IGST to 5%.

The upfront payment of GST and other expenses is a high

imposition on the industry, which may take up to 8 months

to manufacture and sell the finished products using the

imported timber (and thereby recoup GST outlays).

Nearly 70% of India’s timber imports go through ports in

Kandla and Mundra. India’s largest timber cluster lies

within 15 km of Deendayal Port, previously known as

Kandla Port, stretching between Gandhidham and Anjar.

The Deendayal Port Trust’s plan to develop a furniture

park in the region has hit a roadblock, with industry

players reluctant to take up plots on lease due to high rent.

See:

http://timesofindia.indiatimes.com/articleshow/71872354.cms?ut

m_source=contentofinterest&utm_medium=text&utm_campaign

=cppst

Amazon expands furniture range

Amazon India has expanded its range in the furniture

category to over 160,000 products, especially from small

and medium-sized businesses, ahead of the festive season,

according to a report by Press Trust India.

Amazon, which has pumped billions of dollars into its

Indian operations in the last few years, said its furniture

business has grown by over 120% in the last year. Around

25% of furniture buyers use finance schemes, such as nocost

equated monthly instalments (EMI).

More than 65% of Amazon’s sales are from customers

beyond the big urban conglomerates in cities such as

Nasik, Raipur, Vellore, Udupi, Kota, Kollam and

Palakkad. Online marketing is also enabling small and

medium-sized businesses in artisan hubs to sell their

products to a nationwide customer base.

The press release from the Ministry of Commerce and Industry

can be found at:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Real estate industry under pressure

A slump in the residential property market means that

many builders are struggling to repay loans to shadow

lenders (housing finance firms outside the regular banking

sector, also known as non-banking financial companies—

NBFCs).

Indian financial authorities, including the central bank and

government, have said that the banking sector’s bad loans

are on the decline for the first time in four but the number

of property developers falling into bankruptcy has doubled

in the past nine months, piling pressure on shadow lenders.

See: //economictimes.indiatimes.com/

articleshow/71563262.cms?utm_source=contentofinterest&utm_

medium=text&utm_campaign=cppst

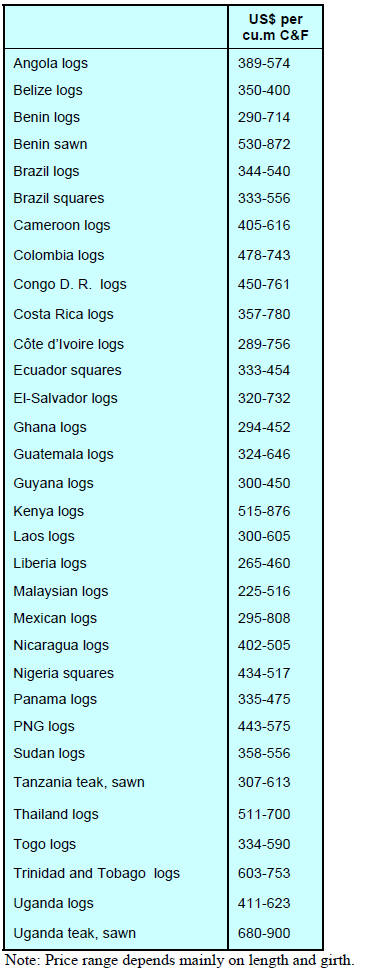

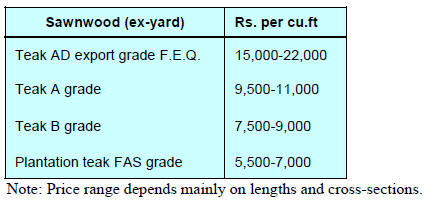

Imported plantation teak

C&F prices for imported teak at Indian ports from various

sources continue within the same range as given in

previous issues (and as shown in the table below).

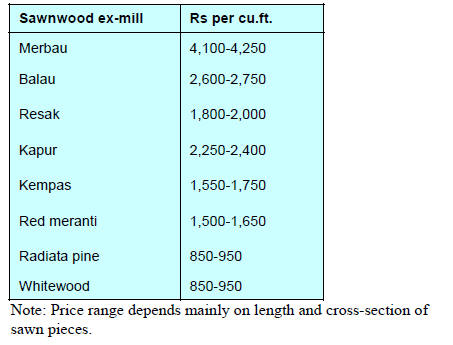

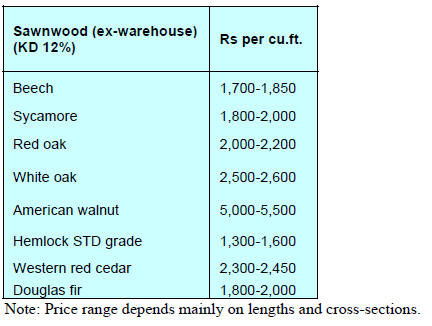

sawn hardwood prices

Demand and imports are stable, and prices are in the range

below, as previously reported.

Myanmar teak prices

General financial conditions continue to improve in this

market, and prices have been steady.

Sawn hardwood prices

Prices are unchanged from the previous edition except for

hemlock, which has declined significantly (by up to

Rs 900 per cubic ft), with lower-quality products now

being imported to meet smaller-dimension requirements,

mostly for furniture.

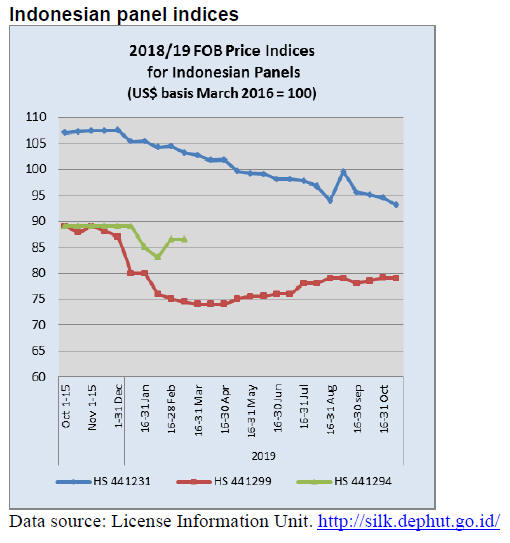

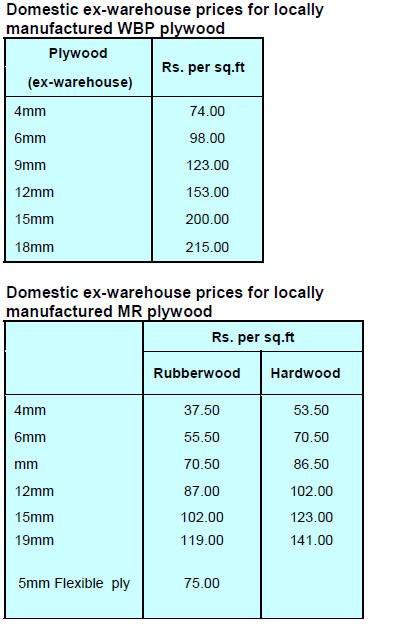

Plywood

Chinese plywood arrivals continue to increase as a result

of the reduced volumes going to the US market due to the

trade dispute between China and the US. Prices are

unchanged from the previous edition.

7.

VIETNAM

Exports, imports still growing

Vietnam exported wood and wood products valued at US$

995 million in October 2019, bringing the total export

value in the first ten months of 2019 to US$ 8.52 billion,

up by 17.8% compared with the same period in 2018.

Combined, the US, China, Japan and the Republic of

Korea accounted for 80.6% of the total export value in the

first ten months of 2019. Viet Nam’s exports of wood and

wood products to the US grew by 11.5% over the period,

to US$ 2.09 billion.

Vietnam imported more than US$2 billion of wood and

wood products in the first 9 months of 2019. China is the

single biggest supplier, accounting for 22.9% of the total

value (US$430 million), up by 41.4% compared with the

same period in 2018.

The second-largest supplier was the US, with a total

import value of US$258 million, up by 12.4% compared

with the same period in 2018.

There was also a marked increase of imports from the

Russian Federation from a relatively low base.

US investigates imported Vietnamese plywood

The import tariff on Vietnamese plywood in the US

market is in range of 0–8%; meanwhile, the anti-dumping

duty on Chinese plywood is 183.36% and the anti-subsidy

tariffs for imported Chinese plywood are 22.98–194.90%.

The US Department of Commerce conducted an antievasion

tax investigation in September 2018 against

Chinese plywood products with an external veneer made

from pine.

According to the Chairman of Binh Duong Furniture

Association, Mr Dien Quang Hiep, “Previously, China

was always the biggest competitor of Vietnam in

exporting plywood into the US. Now, as impacts of the

US-China trade war, the US importers have to replace

Chinese partners by others like Viet Nam. That is why

Vietnam should take this advantage as a priority importing

market of the US in future.”

As reported in the previous edition, the Vietnamese timber

sector is concerned that the increasing gap in the trade of

wood and wood products between Vietnam and the US

will increase the risk of anti-dumping and anti-subsidy

investigations, with potentially serious impacts on the

Vietnam wood processing industry. This risk is becoming

a reality due to possible practices involving Vietnamese

and Chinese plywood manufacturers.

The US Customs and Border Protection has conducted an

investigation into Vietnamese plywood imports.

See: https://customsnews.vn/vietnamese-goods-most-sued-bythe-

us-for-trade-remedies-12516.html

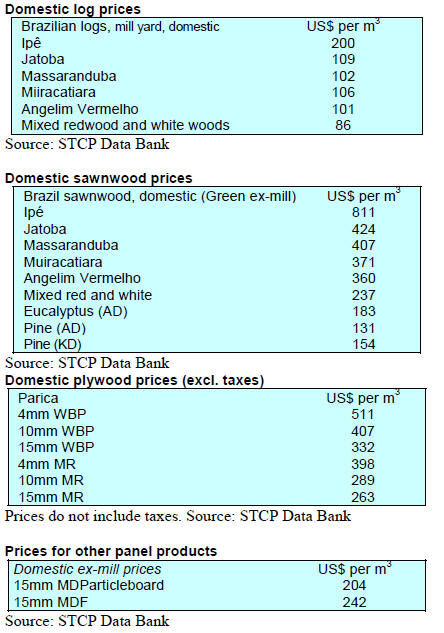

8. BRAZIL

Mato Grosso reduces forest regulation red

tape

The state deputies of Mato Grosso approved a draft bill on

23 October 2019 that brings state legislation into line with

the Brazilian Forest Code, classifying wood consumers

according to the size of the undertaking. Thus, individuals

or companies considered large consumers are required to

submit sustainable supply plans (SSPs) indicating how

they will meet demand for raw materials and woodfuel.

Those consuming less than 49,500 cu.m of roundwood per

year do not need to submit SSPs.

The Center for Timber Producers and Exporters of Mato

Grosso State (CIPEM) expressed the view that the change

will reduce red tape in the sector. The previous proposal

required the preparation of SSPs by those consuming more

than 12,000 cu.m of roundwood per year. The bill also

requires that individuals and companies consuming more

than 24,000 stere metres per year of charcoal are required

to maintain or establish forests, directly or in partnership

with third parties, to ensure the sustainability of operations

through their SSPs.

Transforming Rio Grande do Sul furniture sector

The aim of a programme launched in mid-October in

Bento Gonçalves in the Brazilian state of Rio Grande do

Sul is to transform the Rio Grande do Sul furniture chain,

encompassing industry, commerce and services, to make it

more innovative, competitive and sustainable, according to

a report in Remade.

The “Connect: Furniture sector in Transformation”

programme has been created by the Furniture Sector

Transformation Center, led by the Brazilian Support

Service for Micro and Small Businesses (Sebrae-RS), with

support from the Furniture Industry Association of Rio

Grande do Sul (Movergs), the Bento Gonçalves Furniture

Industry Union (Sindmóveis), the Senai Institute of Wood

and Furniture Technology and the Brazilian Furniture

Industry Association (Abimóvel).

The programme is designed to benefit the sector as a

whole. “We are here to transform what already exists with

better approaches and a good business environment. We

need to break some paradigms, think big even though we

are small. So we need everyone to get involved,” said the

Furniture Sector Transformation Center president.

Mato Grosso forest sector seeks more access to EU

About 20 forest-sector actors in Mato Grosso attended a

workshop convened by the Center for Timber Producers

and Exporters of Mato Grosso State (CIPEM) in Cuiabá in

October 2019 on the prospects for increasing trade with

the EU.

The workshop was the result of a partnership between

CIPEM and the Netherlands-based Sustainable Trade

Initiative (IDH), signed in April 2019.

At the event, IDH presented data on the forest sector as

well as export scenarios and trade rules for supplying

major buyers in the EU.

According to IDH, Brazil has the capacity to trade around

40% of all wood consumed in the world, given its

approach to sustainable forest management and the fact

that the country has the planet’s largest areas of

rainforest—yet it produces only 10%. IDH indicated that

the State Secretariat of the Environment (SEMA)’s Forest

Products Trade and Transport System (SISFLORA) is

aligned with EU requirements.

Sustainability a requirement for export

The Brazilian Furniture Industry Association (Abimóvel)

says that entrepreneurs are becoming more aware that

sustainability leads to more effective resource

management, enabling them to be more competitive in

Brazil and in new market niches and to better align with

major consumer trends.

Many companies are changing their processes to suit these

market conditions. In partnership with the Brazilian Trade

and Investment Promotion Agency (Apex-Brazil),

Abimóvel has conducted studies that are now

underpinning initiatives to improve the ways in which

companies deal with sustainability, such as the Furniture

Sector Sustainability Program (SIMB). SIMB has emerged

as a tool to help Brazilian companies comply with

international requirements and align with new

consumption trends.

9. PERU

Peru’s first forest transparency portal

launched

Peru’s first forest transparency portal was launched in

October in the Loreto Region. The portal provides

information on how the Loreto forest authority is

managing the region’s forest and wildlife resources,

thereby contributing to transparency.

The portal is an initiative of the Loreto regional

government through its Forest Development and Wildlife

Management Department, with technical support from

USAID FOREST, the US Forest Service, and DAR, an

NGO.

The portal provides information in eight categories: 1)

regulatory and planning instruments; 2) inventory of forest

resources; 3) geographic information; 4) national forest

management; 5) forest and wildlife registries; 6) access

modalities; 7) forest and wildlife monitoring and control;

and 8) forest supervision. It integrates various national and

regional information systems developed by forestry

authorities, as well as information from other sources.

See:

http://transparenciagerfor.regionloreto.gob.pe

SERFOR announces traceability system

The National Forest and Wildlife Service (SERFOR)

recently published a document called “Traceability of

Timber Forest Resources” in the official newspaper El

Peruano, outlining its plan for a mechanism to track wood

and wood products from extraction in the forest to

commercialization.

The purpose of the mechanism is to guarantee legal origin

and promote sustainable forest management and

competitiveness.

The mechanism will have three main stages: registration

and verification; tracking through primary processing; and

a methodology for ensuring legality in secondary

processing.

Mexican fire expert advises Peru

Mexican Oscar Rodríguez, a forest fire management

expert, has visited Peru to provide advice on training

personnel in forest firefighting. The visit was supported by

USAID FOREST and the US Forest Service.

Rodríguez has broad experience in forest fire control and

training in several Latin American countries. The visit is

part of efforts to develop a standardized curriculum and

improvement of the qualification system so that forest

firefighters trained in Peru will attain the same standard as

those of their peers in other countries in the region. This

will also better enable Peruvian institutions to work

together to address forest fires.

Peru charges illegal loggers in Amazon deaths

Authorities in Peru have charged five men in the timber

industry with the 2014 murders of four indigenous

activists who had battled illegal logging in the Amazon.

Two timber executives and three loggers have been

charged with the shooting deaths of the activists, said

prosecutor Otoniel Jara, who works in the Ucayali region.

Environmentalists say the case is unprecedented in Peru.

See:

https://www.japantimes.co.jp/news/2019/11/01/world/crimelegal-

world/peru-charges-loggers-over-amazondeaths/#.

XcijuSMzbIU