3.

MALAYSIA

Malaysian Wood Expo 2019

The first Malaysian Wood Expo 2019 will run 19 to 21

November 2019 at the Putra World Trade Centre in Kuala

Lumpur. The organisers are promoting the event for its

strength in networking, accessing developments in

technology and brand building.

This Expo will be jointly organised by the Malaysian

Timber Council and the Panels & Furniture Group of

timber magazines. It is endorsed by the Malaysian Wood

Industries Association (MWIA), The Timber Exporters'

Association of Malaysia (TEAM), The Malaysian Panel-

Products Manufacturers' Association (MPMA), Malaysian

Furniture Council (MFC), Malaysian Wood Moulding &

Joinery Council (MWMJC) and Association of Malaysian

Bumiputra Timber and Furniture Entrepreneurs (PEKA).

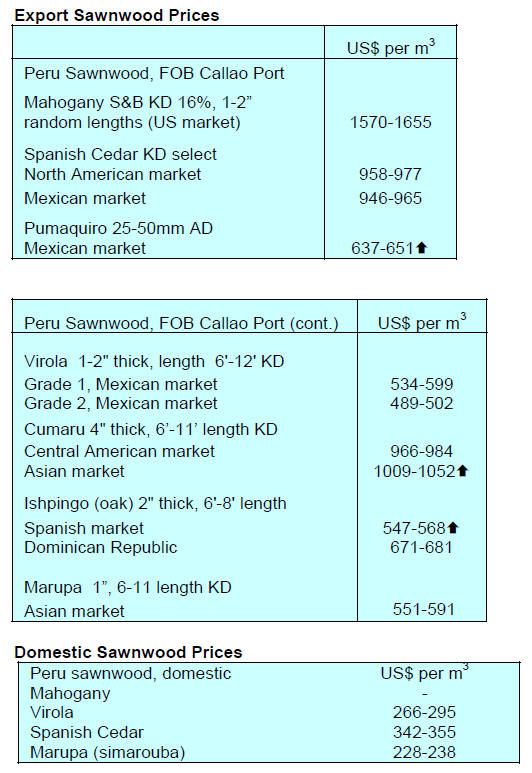

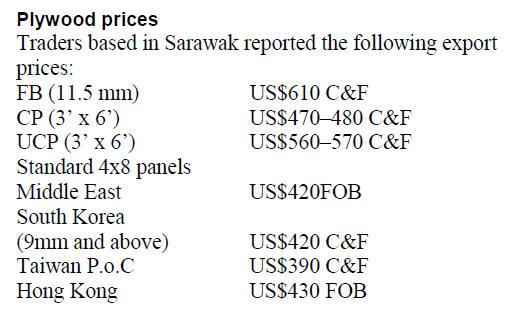

Plywood industry seeks help from State to address

falling competitiveness

The Sarawak Timber Association (STA) plywood

members and the Sarawak Timber Industry Development

Corporation (STIDC) recently met to discuss issues facing

the timber industry and how best the State government and

STA members can work together to overcome these

challenges.

One issue raised was the declining market share for

Malaysian plywood in the Japanese market, the biggest

market for Sarawak plywood. Participants at the meeting

also noted that Sarawak is losing market share around the

world to shippers in Indonesia, Vietnam and China who

are more price competitive.

It was also noted that domestic logs are now more widely

used for plywood production in Japan due to incentives

offered by the Japanese government.

Over the past few years plywood production cost in

Sarawak have risen due to increases in log costs and

labour. It was stated that log cost have risen over 20%

since 2017 because of increases in the Hill Timber

Premium from RM0.80/cu.m to RM50.00/cu.m, increases

in the Timber Premium (Rehabilitation & Development)

from RM0.60/cu.m to RM5.00/cu.m; rising adhesive cost

(+12%) and increased logistic costs per unit volume

because of the reduction in harvest and hence production

levels.

Added to this has been the rise in the minimum wage in

Sarawak from RM9200 to RM1,100 per month in 2019.

Also, from January 2018 employers are required to bear

the cost of the levy for foreign workers at RM1,010 per

worker. Previously, the cost was borne by employees

themselves.

STA plywood producers reported they are unable to pass

on the added costs to their buyers and that the only way

the sector will survive is if the industry works with the

authorities to restore the competitiveness of the industry.

Sarawak - one million hectares of planted forests by

2025

Sarawak Deputy Chief Minister, Datuk Awang Tengah Ali

Hasan, said Sarawak will focus on planted forests and high

value-added products for its timber industry in view of

declining resources from natural forests. He also said the

state was targeting one million hectares of planted forests

by 2025 which will become the main source of raw

materials for the timber industry.

He noted there was a 12% decline in Sarawak’s timber

export revenues in the first three quarters of this year.

Exports from the State were worth RM3.48 bil. between

January to September this year, down from RM3.96bil in

the same period last year.

In the first three quarters of 2019 plywood, the state’s

main timber export product, saw a 21% decline in export

earnings to RM1.76 bil., down from the RM2.25 bil. in the

same period in 2018.

Japan remains Sarawak’s main plywood export market,

worth RM1.7 bil. between January to September this year

but this is a year on year drop of around 13%. Other major

markets are India (RM394mil), the Middle East

(RM327mil), Taiwan P.o.C (RM239mil) and South Korea

(RM193mil).

Timber industry ‘umbrella body’ for Sabah

The Sabah State Government is looking into setting up a

platform where all timber players can come together with

relevant State departments and agencies to discuss and

plan the development of the industry, as well as seek

solutions to issues affecting the sector.

This platform will serve as an umbrella body for the Sabah

Timber Industry Association (STIA), Timber Association

of Sabah (TAS), Sabah Furniture Association and Sabah

Bumiputera Furniture Association. Sabah, Chief Minister,

Mohd Shafie Apdal, said the industry has considerable

potential if it is well managed which will require

commitment from the private sector and the State.

Major mangrove planting exercise

As part of the Mangrove and Suitable Tree Species

Planting Programme, over 6 million trees have been

planted along the Malaysian coastline. The planting

programme involved collaboration between the Forestry

Department of Peninsular Malaysia and Forest Research

Institute Malaysia. This was announced during events held

at the national-level commemoration of the International

Day for the Conservation of the Mangrove Ecosystem.

4.

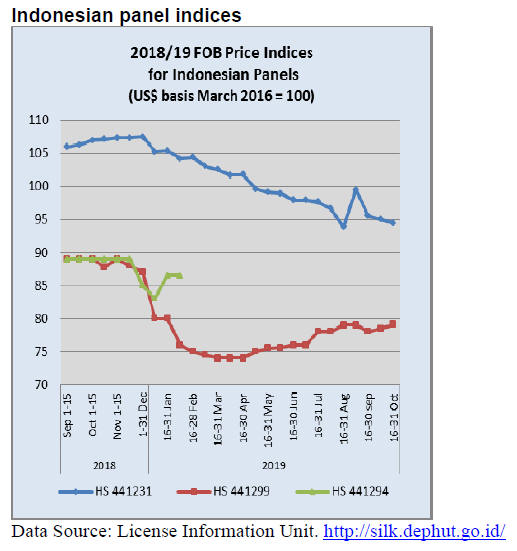

INDONESIA

Indonesia's lightwood potential for

export to Europe

During the fourth Indonesian Lightwood Cooperation

Forum (ILCF) which involved stakeholders and academics

from various universities, Marolop Nainggolan, the

Director for Export Development Cooperation in the

Ministry of Trade said Indonesia has the potential to meet

the demand of lightwood for the international market,

especially in the European countries.

Marolop urged the private sector and the universities to

work together to determine what the market will accept

and how to competitively manufacture products for export.

Government relief on VAT and SVLK for exporters

The government plans to provide some value added tax

(VAT) relief as well as relief on legality requirements for

wood products in order to boost exports. Indonesia’s

Minister of Trade has reported that, on instructions from

the President, he will prepare proposals for relieving some

of the burden of SVLK certification which the timber

industry has been requesting for some time.

The approach being considered is to require SVLK

certification only of upstream segments of the timber

industry and eliminate the SVLK requirement for

downstream industries. Airlangga Hartarto, Minister of

Trade indicated a revision of the VAT will be made for the

benefit of wood product exporters. According to the

Minister this new policy is intended to boost the

competitiveness of the furniture industry.

The Ministry of Industry also plans to offer incentives for

wood product exporters.

See:

https://ekonomi.bisnis.com/read/20191017/12/1160313/pemerintah-siapkan-insentif-keringanan-ppn-dan-svlk-untuk-eksporproduk-kayu

Strong performance of non-wood sector

The Production of non-timber forest products (NTFPs)

between January and August this year increased sharply.

Data from the Directorate General of Sustainable

Management of Forest Products (PHPL) in the Ministry of

Environment and Forestry, NTFP production in the eight

month to August increased over 80% to 263,000 tonnes,

compared to the same period last year.

Johan Utama Perbatasari, Director of Environmental

Services and Non-Timber Forest Products Business, said

that the increase of the NTFP production was supported by

application of an information system linking producers

and end-users.

See:

https://ekonomi.bisnis.com/read/20191014/99/1158626/produksihasil-hutan-nonkayu-indonesia-melejit

Forging links between furniture designers and

manufacturers

The Ministry of Industry has launched a programme to

encourage the development of the Indonesia’s furniture

manufacturing sector. Abdul Rochim, Director General of

Agro Industry in the Ministry of Industry said government

support will focus on creative and innovative design

concepts for the industry.

The programme will seek to bring together designers, for

example those associated with the Indonesian Furniture

Designers Association (HDMI), with businesses. An

extensive support pack is envisaged covering compiling

furniture design catalogues, conducting market

assessments through prototyping and market intelligence.

See:

https://www.gatra.com/detail/news/452770/ekonomi/pengembangan-desain-agar-furnitur-rambah-pasar-global

Businesses welcome news of second term for Forestry

Minister, Siti Nurbaya

Siti Nurbaya Bakar's appointment as Minister of

Environment and Forestry for a second term has been

widely welcomed by businesses. The Association of

Indonesian Forest Concessionaires (APHI) Executive

Director, Purwadi Soeprihanto, commended her

contribution to forestry and the timber industries over the

past 5 years saying she laid the foundation for improving

forest governance and provided direction for accelerating

investment, especially the development of industrial

timber plantations.

2019 forest fires more than in 2018

The area in Indonesia consumed by fire up to September

this year has exceeded the total burnt during all of 2018

according to official data.

Raffles Panjaitan, Forest Fire Management Acting

Director in the Ministry of Forestry and Environment

reported that by the end of September 2019 a total of

857,756 hectares had been destroyed.

See:

https://www.channelnewsasia.com/news/asia/indonesia-forestfire-area-burned-haze-exceeds-2018-12020974

5.

MYANMAR

Illegal chainsaw felling an issue in Kayah

State

According to the Forest Department, some 44,000 tons of

illegally harvested teak and other hardwoods were seized

over the past 11 months.

Of the total, over 11,250 tons, mostly teak, were seized in

Kayah State in eastern Myanmar. Kayah State is bounded

on the north by Shan State, on the east by Thailand's Mae

Hong Son Province and on the south and west by Kayin

State.

Ohn Win, Minister of Natural Resources and

Environment, has urged the Forest Department to take

effective measure against illegal logging especially that

carried out by small time operators with chainsaws. He

encouraged greater use of the Community Monitoring and

Reporting System.

Thilawa Special Economic Zone promoted at

investment forum in Japan

During a recent visit to Japan, State Counsellor Daw Aung

San Su Kyi, attended the Second Myanmar Investment

Conference. In her address to the meeting she cited the

example of a major Japanese automobile manufacturer that

recently announced its intention to invest in an assembly

plant within the Thilawa Special Economic Zone which

she said demonstrates investor confidence in Myanmar.

Since its opening in 2015 there have been 113 investment

projects approved and 76 companies have started

commercial operation according to the Myanmar-Japan

Thilawa Development Ltd, which oversees development

of the zone.

In August, Myanmar, Japan and the US jointly announced

efforts to promote responsible and ethical investment for

the benefit of all the people of Myanmar and for the

county’s economic development.

AMRO’s 2019 Annual Consultation Report on Myanmar

Myanmar’s economy picked up in the 2018/19 financial

year after slowing during the six-month transition in

FY18. The turn-around was supported by an improvement

in business sentiment amid renewed reform momentum

according to the ASEAN+3 Macroeconomic Research

Office (AMRO), a regional macroeconomic surveillance

organisation that aims to contribute to macroeconomic and

financial stability in ASEAN.

However, AMRO says on its website risks to growth stem

mainly from continued ethnic tensions, uncertainties in the

global economy related to trade protectionism, geopolitical

risks and energy prices.

The weak banking system remains a key vulnerability in

the economy. At the same time, Myanmar also stands to

gain from investment inflows due to the accelerating

relocation of manufacturing into the country. AMRO

concludes “Sustaining reform momentum with timely

implementation is crucial”.

See:

https://amro-asia.org/amros-2019-annual-consultationreport-on-myanmar/

6. INDIA

An all-out effort to boost growth –

tax cuts welcomed

by industry

The Indian government is considering changing the

personal tax structures which, along with the recent cut in

corporate taxes, the lowering of levies on foreign funds,

relaxed foreign investment rules and reorganisation of

state run financial institutions is aimed at boosting growth

which has dropped to the slowest pace in nearly six years.

The IMF regional representative for India has said the

Fund is optimistic that India’s economic growth will

rebound in the next financial year in response to the

measures introduced by the government.

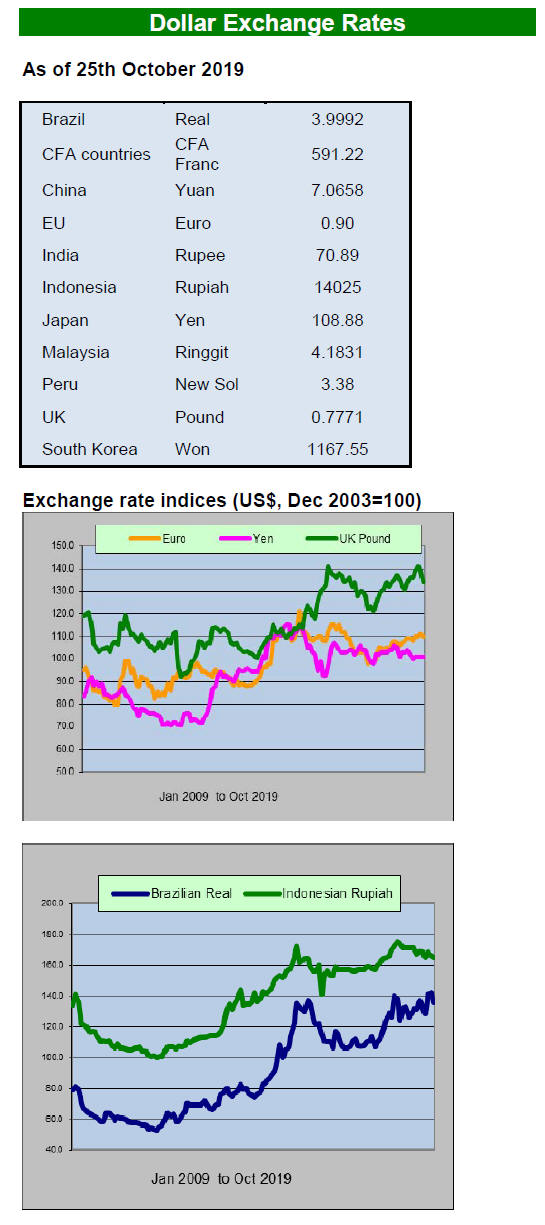

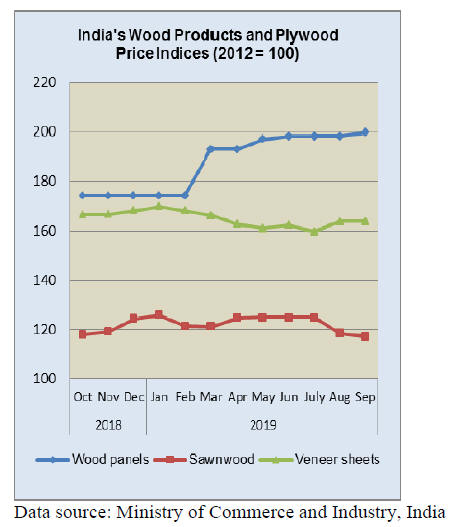

Benign inflation makes for dull trading

The official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for September 2019 declined to

121.3 from 121.4 for the previous month. The index for

the group 'Manufactures of Wood and of Products of

Wood and Cork ' declined to 134.0 from 134.1 for the

previous month due to lower price of composite panels

and sawnwood.

The annual rate of inflation based on monthly WPI in

September 2019 stood at 0.33% compared to 5.22% in

September 2018.

The press release from the Ministry of Commerce and Industry

can be found at:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

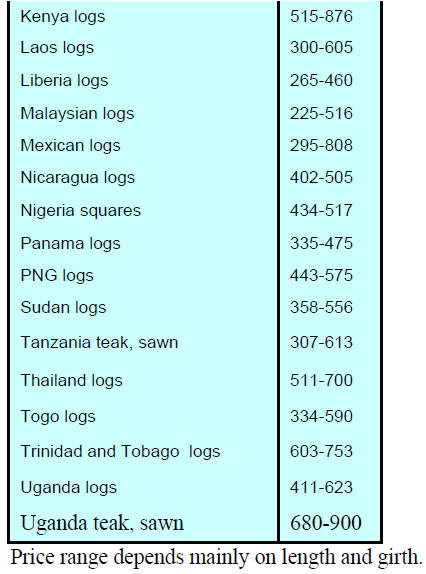

Imported plantation teak

Analysts report that the timber sector has become resigned

to the fact that their efforts to have the government lower

the GST rates for wood products have failed for the time

being.

Under the present economic conditions in the country the

government and the GST Committee is in no mood to do

anything that will cut government revenues, particularly as

a raft of tax cuts and other measures have been

implemented to try and boost growth prospects.

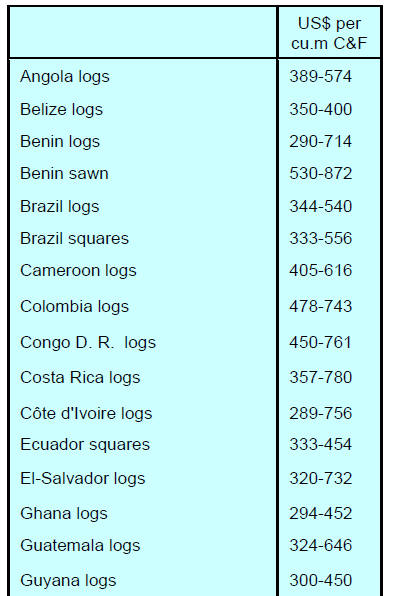

C&F prices for imported teak at Indian ports from various

other sources continue within the same range as given

earlier.

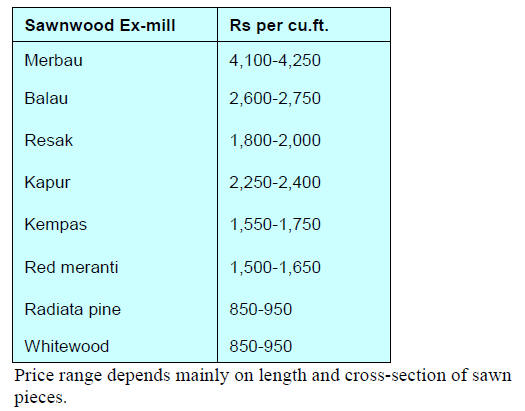

Locally sawn hardwood prices

Prices have been maintained as previously reported.

Recent statements by the Malaysian Prime Minister on the

Kashmir issue have attracted criticism from the Indian

government which has hinted of possible retaliatory

economic measures aimed at Malaysia. While such

measures have not been introduced, analysts report that

Indian importers have cooled on imports from Malaysia.

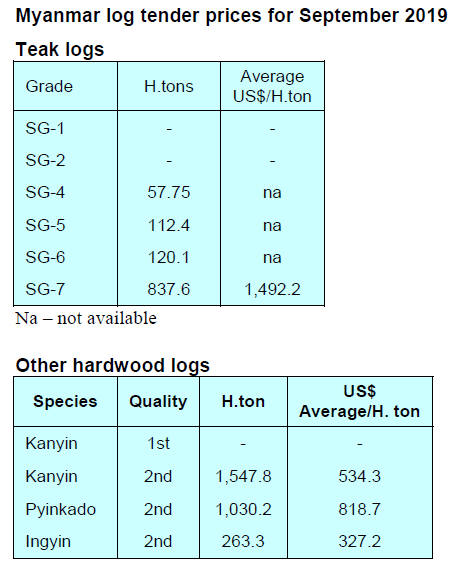

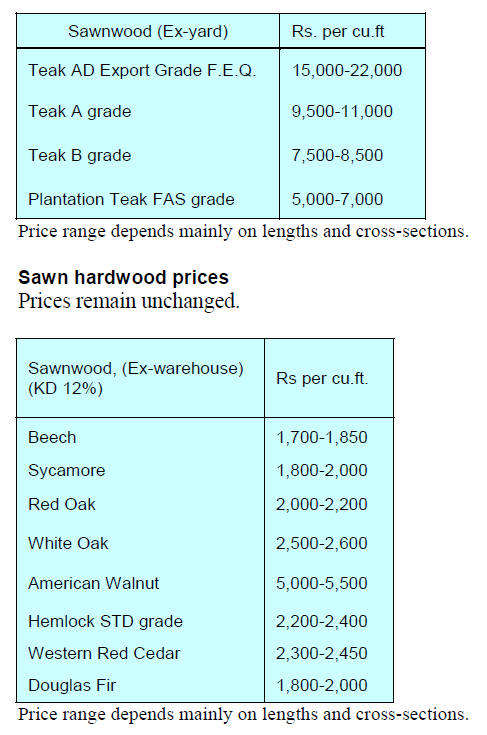

Myanmar teak prices

While demand is at best only stable traders report that

there have been improvements in that they are now more

able to secure loans and credit facilities.

In addition interest rates have fallen and the recent round

of economic stimulus measures could boost consumer

spending and drive up demand.

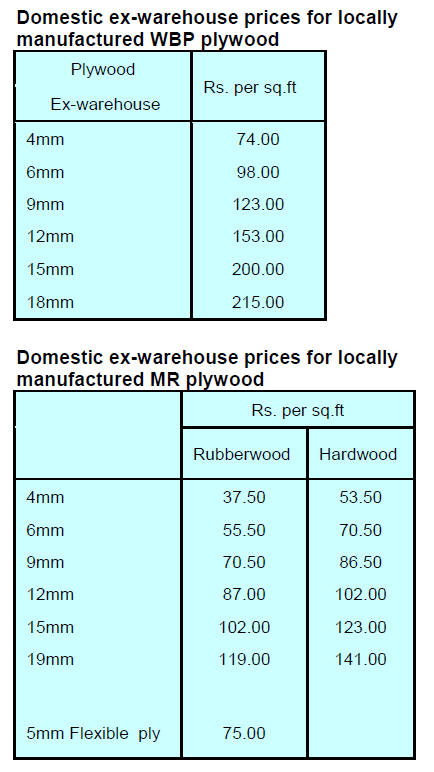

Plywood

Imports of competitively priced plywood manufactured in

China continue to rise as mills in China seek alternative

markets for plywood which previously went to the US.

Indian mills that rely on log imports for plywood

manufacturing have begun to look for alternative sources

shunning Malaysia because of comments made by

Malaysia’s Prime Minister. Analysts say local mills are

looking to other South East Asian suppliers for logs.

On the business front, in an interview with the Indian press

Keshav Bhajanka, Executive Director of Century Ply said

his company is anticipating double-digit growth this fiscal

year. He said the MDF and particleboard sectors of the

business have been doing well and that the new MDF

plant in Hoshiarpur is now operational. Bhajanka

commented that demand for woodbased panels will

depend on an improvement in the real estate sector.

Analysts note that, until recently, the Indian plywood

industry was dependent on Myanmar, Indonesia and Laos

for its face veneer requirements but that today the industry

is turning to African shippers.

See:

https://www.thehindubusinessline.com/companies/centuryplyboards-looking-at-double-digit-growth-thisfiscal/article29774729.ece#

'Bamboonomics' – an initiative to provide

jobs

The Minister for Tribal Affairs, Arjun Munda, said his

ministry will launch an initiative aimed at boosting

employment in rural areas.

The focus will be on bamboo cultivation and utilization

and will be managed by the government's

Entrepreneurship Development Programme through the

Pradhan Mantri Van Dhan scheme. The Van Dhan

Scheme, launched by the Prime Minister in 2018, aims to

establish skill development centres for the so-called tribal

groups.

7.

VIETNAM

Growing opportunities to forge new

business links in

the US

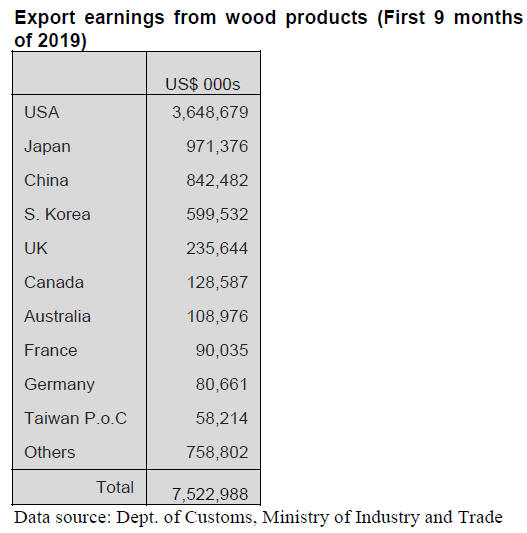

Vietnam’s exports of wood products increased

significantly in the first 9 months, most notably exports to

the US rose by a third. The General Department of

Customs has reported exports of wood products in

September reached US$862.2 million, up 21% over the

same period in 2018.

The cumulative value of wood product exports in the first

three quarters of 2019 was US$7.52 billion, up nearly 18%

over the same period in 2018. The United States, Japan,

China, South Korea and the United Kingdom are the major

export markets for Vietnam's wood and wood products.

Vietnam’s wood processing industry is taking advantages

of US demand for wood products from sources other than

China in an effort to minimise the impact of tariffs.

Exports to the US topped US$3.64 billion between

January and September this year.

Greater US surveillance of trade practices

likely

Opportunities to promote exports of wood and wood

products to the US market continue but so do the

challenges in eliminating commercial fraud. The

Vietnamese timber sector is concerned that the growing

trade deficit between the US and Vietnam will lead to the

US increasing its surveillance of trade practices in to

protect its domestic timber industry from unfair

competition.

There has been an increase in Vietnam's wood products

exports to other markets such as Japan (+17.5%), the UK

(+12.5%), Canada (+11%), Germany (+13%) and Taiwan

P.o.C (+26%).

Foreign investments surging ahead

According to the Foreign Investment Agency (Ministry of

Planning and Investment) foreign investment into Vietnam

in the first 9 months of 2019 was US$29 billion, up 4.3%

compared to the same period in 2018. Of this, some

US$16 billion has already resulted in new capacity being

installed. 3,094 new projects were granted investment

registration certificates, an increase of 26% year on year.

FDI flows from China and Hong Kong increase sharply in

the year to September with investments from China

doubling and those from Hong Kong quadrupling

compared to the same period last year due, say analysts,

mainly to the impact of the US-China trade conflict.

For the year to September the number of delegations

visiting Vietnam was up 30% with most being from Japan,

South Korea, China, Hong Kong and Singapore.

8. BRAZIL

Steady year on year increase in

output from forest

plantations

According to a survey on the extractive sectors by the

Brazilian Institute of Geography and Statistics (IBGE) the

value of Brazilian forest production was R$20.6 billion in

2018, an increase of 8% compared to 2017. There has

been a steady year on year increase in the value of output

driven by forest plantation output. However, extraction

from natural forests fell 2.7% year on year in 2018.

The area of Brazil’s planted forests totalled 9.9 million

hectares in 2018 comprising 7.5 million hectares of

Eucalyptus and 2.0 million hectares of pine, the balance

being a range of species.

Wood product output expanded 8.5% in 2018 compared to

a year earlier. There was a decline in 2018 output values

for wood for energy generation. However, there was a rise

of about 19% in the value of charcoal production.

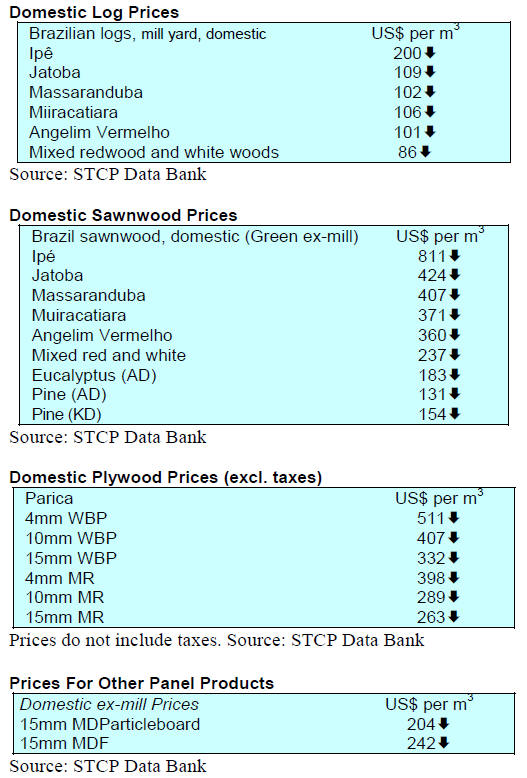

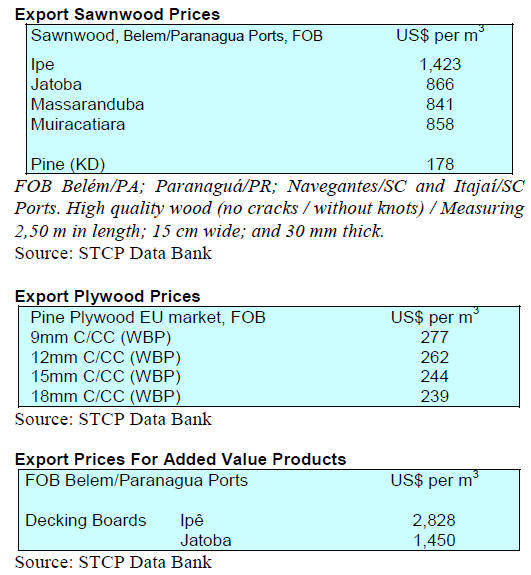

Export update

In September 2019, the total Brazilian exports of woodbased

products (except pulp and paper) decreased 21.6%

in value compared to September 2018, from US$ 269.6

million to US$ 211.3 million.

The value of Pine sawnwood exports in September 2019

fell 35% year on year to US$32.5 million from US$50.4

million in September 2018. In terms of volume, exports

declined 31% over the same period, from 237,700 cu.m to

164,300 cu.m.

Tropical sawnwood exports in September 2019 declined

38% in volume, from 55,700 cu.m in September 2018 to

34,400 cu.m in September 2019 and the value of exports

dropped 47% from US$23.5 million to US$12.5 million,

over the same period.

The value of pine plywood exports declined 49% in

September 2019 in comparison with September 2018,

from US$63.7 million to US$32.4 million. At the same

time export volumes dropped 24% from 188,200 cu.m to

142,800 cu.m.

As for tropical plywood, exports decreased in volume (-

56.4%) and in value (-58.2%), from 11,700 cu.m (US$ 5.5

million) in September 2018 to 5,100 cu.m (US$ 2.3

million) in September 2019.

Furniture exports – 85% wooden

The Brazilian Furniture Industry Association

(ABIMÓVEL) and the Brazilian Trade and Investment

Promotion Agency (APEX-BRAZIL) recently released

furniture export data. This shows there was a year on year

3% fall in export earning in September.

Between January to September 2019 export earnings grew

by 0.6%, year on year but on an annualised basis there was

an over 4% rise in export earnings. Over 85% of Brazil’s

furniture exports are of wooden furniture. The main

markets for furniture exports are the United States

followed by the United Kingdom and Uruguay.

Brazil/ Mexico business round

During the mid-September ‘International Timber Week’

held in Curitiba, the Brazilian Association of

Mechanically Processed Timber Industry (ABIMCI), in

partnership with the Brazilian Export and Investment

Promotion Agency (Apex-Brazil) and the Paraná

Federation of Industries (FIEP), organised business

contacts for a trade mission from Mexico seeking to

develop partnerships with Brazilian wood product

manufacturers.

This type of event provides an opportunity for direct

communication between the customer and the vendor

making the path easier and speeds up the trade expansion

process. Brazil's relationship with Mexico has grown.

There are high expectations from both parties for

expanded trade as Mexico’s domestic production of wood

products is not high so must import much of its timber

requirements.

The National Association of Mexican Forest Products

Importers and Exporters expressed a keen interest in

strengthening its relationship with Brazilian companies

exporting wood products.

ABIMCI intends to replicate this experience with other

countries such as South Africa and countries in the

Caribbean. Marketing internationally has become a

challenge given the state of the global economy but such

events can help forge new business links.

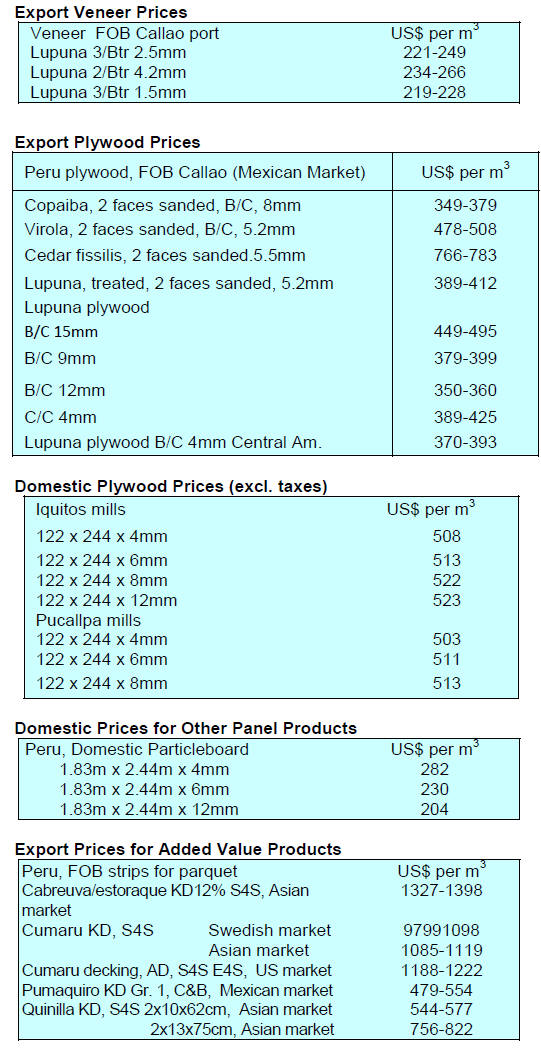

9. PERU

Timber exports to Mexico

rising steadily

According to the Association of Exporters (ADEX), in the

first eight months of the year Peru’s wood product exports

totalled US$80.1 million (FOB), unchanged from the same

period in 2018.

China continues to be the main market for the wood

products industries with a 39% share of all wood product

exports but this year exports to China fell just over 9%.

Mexico was the second export market accounting for 11%

of exports and in the first eight months there was an

almost 9% rise in the value of exports to this market.

Other markets include France and the US. In both markets

demand fell in the first eight months of the year compared

to a year earlier.

Dominican Republic and Mexico the main markets for

sawnwood

Sawnwood exports between January and August of this

year were valued at US$14.5 million (FOB), down around

2% year on year. The main markets for sawnwood was the

Dominican Republic with a 37% share of total sawnwood

exports followed by Mexico with a 34% share.

Exports of sawnwood to the Dominican Republic

expanded 17% year on year in the first eight months of

2019 and there was a 9% rise in exports to Mexico over

the same period. China ranks third in terms of sawnwood

exports.

SERFOR presents guide on wood products

The National Forest and Wildlife Service (SERFOR) has

published an ‘Explanatory Guide and Catalogue for the

Identification of Wood Forest Products’.

This contains an updated list of wood products classified

in terms of the origin of the product, the level of

manufacturing and the suggested end-uses.

The Guide is divided into six groups: fuel and wood

waste; round, squared and rough wood; sawn wood, sheets

and boards based on wood; semi-finished products and

other manufactured products.

This Guide was prepared with the technical support of the

FOREST, USAID programme and the US Forest Service

with participation of regional governments, the National

Superintendence of Tax Administration (SUNAT), the

Ministry of Production (PRODUCE) and the private

sector.

Seminar addresses due diligence in international

timber trade

Last month ADEX and the NGO NEPCon held a seminar

on "Legality in International Trade in Wood". The seminar

address issues such as the system of due diligence of the

wood, international timber market regulations, presenting

supply chain information and evaluations, risk assessments

of illegality in Peru and how these can be mitigated.

The seminar was based on the due diligence system of

NEPCon which NEPCon says is recognised by the

European Union (EU).