|

Report from

North America

Tropical sawnwood imports fell in August

US imports of sawn tropical hardwood slowed in August, falling 25% from

July¡¯s strong volume. Imports dropped to 15,970 cubic metres in August,

3% lower than that of August 2018. Despite the decline, imports remain

ahead of 2018 by 19% year to date.

Imports from Ecuador fell by 56% in August and are now down 11% from

2018 year to date. Imports from Ghana and Cote d¡¯Ivoire also declined

sharply in August and are now down by about one-third year to date.

Despite also seeing weaker volume in August, imports from Brazil,

Cameroon, and Malaysia remain well ahead of 2018 year to date.

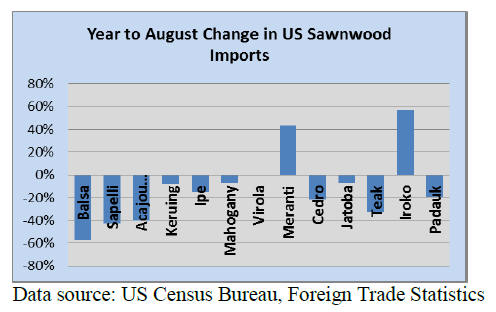

Weaker Balsa and Sapelli imports drove the decline. Balsa imports fell

by 57% in August and lag 2018 volume by 11% year to date. Sapelli,

acajou d¡¯Afrique, and teak imports also slowed in August, but still lead

their 2018 pace year to date. Jatoba imports fell slightly in August but

continue to more than double 2018 volume year to date.

In contrast, Canadian imports of sawn tropical hardwood in August more

than doubled compared to July, rising to their highest level in 12

months. The surge, which saw strong gains among most wood types, helped

bring 2019 imports more in line with last year¡¯s numbers. Import

volumes, year to date, are now down only 6% from 2018.

Hardwood plywood imports fail to sustain growth

After impressive gains in July, US imports of hardwood plywood retreated

by 17% in August to a level still better than most of this year, but

about 20% lower than August 2018.

Imports from Russia rose by 10% in August but declined by more than 10%

from every other major trading partner.

Imports from Indonesia fell by 41% in August and are now down 35% year

to date. Year-to-date imports from China have fallen to just above half

of what they were in 2018. Total import volume is down 9% year to date

and the value of imports is down by 19% in US dollars terms.

A group of US plywood producers have filed a lawsuit against two

certifying entities and the accrediting agency responsible for

certifying 35 Brazilian mills as meeting structural grade requirements

for plywood panels.

According to the suit, tests commissioned by the plaintiffs and carried

out by the American Plywood Association showed that the panels

experience high failure rates when tested under the PS1-09 standard.

See:

http://nahbnow.com/2019/09/u-s-plywood-producers-file-suit-over-brazilian-wood-certifications/

Tropical veneer imports from China and Cameroon falling

Imports of tropical hardwood veneer fell by 16% in August despite a rare

bounce in imports from China. While imports from China more than doubled

in August versus July, numbers have fallen off so steadily throughout

2019 that imports were still more than 40% below August 2018.

Imports from China are down 60% year to date. Imports from Cameroon have

also been falling steeply this year and continued to do so in August,

down 88%. Imports from Ghana also fell in August but remain 46% ahead of

2018 year to date.

Imports from Italy fell by 17% in August and now stand roughly even with

2018 year to date. Total US imports of hardwood veneer are down 19% year

to date.

Flooring imports from Vietnam down over 60%

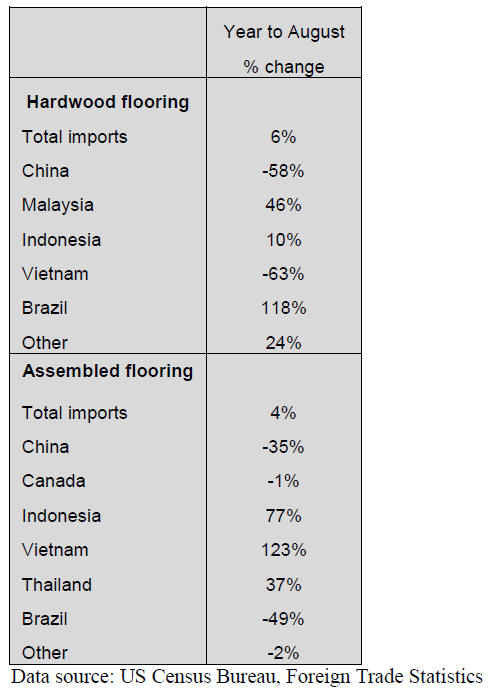

US imports of hardwood flooring fell by 20% in August, declining for a

third straight month. Imports fell from nearly all trading partners with

imports from Vietnam slipping 73%. Imports from Vietnam are down 63%

year to date. Imports from China are down 58% year to date after falling

11% from July to August.

Despite a drop of 16% in August, imports from Brazil remain more than

double that of 2018 year to date. Overall imports are ahead of 2018 by

6% year to date, due to a strong spring.

Imports of assembled flooring panels stayed level in August and remain

up 4% year to date. Gains in imports from Indonesia and Thailand were

offset by lower imports from China, Canada and Vietnam.

Across the board decline in year to date moulding imports

US imports of hardwood mouldings rose by 15% in August, fueled by a 40%

gain in imports from China. Despite the one-month rebound, imports from

China trail 2018 by 49% year to date.

Imports from Brazil trail 2018 by 54% year to date but gained 2% in

August. Overall US imports of hardwood moulding are down 27% year to

date.

Cabinet sales dip

US cabinet manufacturers reported a decrease in cabinet sales of 3.4%

for August 2019 compared to the same month in 2018. According to the

Kitchen Cabinet Manufacturers Association (KCMA)¡¯s monthly Trend of

Business Survey, participating custom sales increased slightly at 1.2%,

but both semi-custom and stock sales were down 7.6% and 1.3%

respectively.

Year-to-date cabinet sales are up just 0.3% with custom sales down 1.2%,

semi-custom sales down 4.8%, and stock sales up 4.5%.

See

https://www.kcma.org/news/press-releases/august-2019-trend-of-business

Sustainably top green features for millennials

According to the National Association of Home Builders' recent "What

Home Buyers Really Want" report, it was components using certified

sustainably harvested timber that was among the top ¡®green¡¯ features

that millennials want in a home. 53% of respondents rated components

built using sustainably harvested lumber as either "essential/must have"

(17%) or "desirable" (36%).

Energy efficiency certifications such as Energy Star-rated appliances

and Energy Star ratings for the whole home were the most in-demand

features, desired by 75% and 71% of respondents, respectively.

See:

http://eyeonhousing.org/2019/10/top-green-features-millennials-want-in-a-home/

|