3.

MALAYSIA

MTIB support for Bumiputera entrants

to furniture manufacturing sector

According to Mohd. Kheiruddin, Malaysian Timber Industry Board (MTIB)

Director General, Malaysia exported RM12.5 billion’s worth of wood products

between January and July this year. In 2018, the timber industry contributed

1.6% to the Gross Domestic Product and the export value of timber products

recorded a 4% decline to RM22.29 billion, compared to RM23.22 billion in

2017.

In related news, Mohd. Kheiruddin said the government remains committed to

encourage more participation of Bumiputera companies in the furniture

industry explaining that MTIB manages the Bumiputera Furniture Entrepreneur

Scheme and provides training and guidance for new entrants to the sector

through the Wood Industry Skills Development Centre.

MTCC Conference - certification as a driver for innovation

Over 200 participants including some from Singapore and Indonesia joined a

dialogue on certification as a driver for disruptive innovation and the

future of certification in a digital economy as part of an MTCC conference

to celebrate its 20th anniversary.

Themed “Pushing Boundaries Advancing Sustainability”, the one-day conference

addressed development and progress of timber certification in Malaysia as

well as looking to the future of certification beyond 2030.

The conference provided a platform for industry and the MTCC to discuss how

Malaysia’s certification scheme and processes could remain credible,

effective and efficient in delivering market access.

The first shipment of 732 cu.m of MTCS-certified sawnwood was exported to

the Netherlands in July 2002.

For more see:

https://mtcc.com.my/mtcc-organises-conference-to-bridge-present-and-future-outlook-for-certification-beyond-2030/

In related certification news, the Malaysian Palm Oil Board has said estates

of more than 40 hectares with palm oil mills that fail to obtain the

Malaysian Sustainable Palm Oil (MSPO) certification or begin the process of

certification before 1 January 2020, will be penalised under the Malaysian

Palm Oil Board (Licensing) 2005 regulation number 15. The MSPO certification

will be mandatory from 1 January.

Bamboo plantations - time to explore new sources of commodity income

The Malaysian Government intends to provide soft loans to encourage the

bamboo plantation sector. Teresa Kok, Minister of Primary Industries, said

the loan could be up to RM10,000 per hectare with repayments to begin after

seven years.

Currently the Malaysian government provides loans

under the Forest Farm Development Programme but these are primarily for

rubber plantations. The Minister said the time has come for Malaysia to

explore additional sources of commodity income so should seize on the

growing opportunities in the international bamboo trade.

4.

INDONESIA

Attracting investment

in Indonesia’s furniture manufacturing

A delegation, led by the Chairman of the Investment Coordinating Board

(BKPM), Thomas Lembong, travelled to China in an effort to boost investments

from China in Indonesia’s furniture manufacturing sector.

Indonesia has recognised that China’s furniture exports, at over US$20

billion a year, dwarf Indonesia’s exports which are less than 10% of that.

This business promotion exercise has been well prepared and involved

discussions on incentives that could be offered to Chinese companies that

wish to invest in Indonesia.

See:

https://www.tubasmedia.com/ri-tawarkan-insentif-fiskal-untuk-relokasi-industri-mebel-china/#.XZIMXfkzbIU

Expanding market share in the US furniture market

Abdul Sobur, Chairman of the Indonesian Furniture and Crafts Industry

Association (HIMKI), has said his Association is teaming up with the

Indonesian Furniture Designers Association (HDMI) in an effort to develop

furniture designs to suit the requirements of individual markets.

Through this approach, said Sobour, it will be possible for local companies

to expand market share in the main importing countries in particular the US.

The association has an export target of US$1.8 billion for this year with

around a third being exports to the US.

See:

https://ekonomi.bisnis.com/read/20191001/257/1154043/indonesia-siap-ambil-pangsa-mebel-china-di-as

Environmental Fund Management Agency established

In a joint statement the Coordinating Ministry for Economic Affairs, the

Ministry of Environment and Forestry (KLHK) and the Ministry of Finance

officially launched the Environmental Fund Management Agency (BPDLH) within

the Ministry of Finance.

The Minister of Environment and Forestry, Siti Nurbaya, said the BPDLH will

be one of the financing mechanisms for environmental protection and

management that can be utilised by various parties.

BPDLH will secure and distribute funds for environmental protection. BPDLH

funding will be sourced from public and private sources both domestic and

foreign said the Minister. Disbursements by the Fund will focus on small

grant, green investment projects and capacity building for communities and

also for officials.

5.

MYANMAR

Multi Stakeholder Group still

active but no apparent engagement with EU

Analysts in Myanmar are not clear on the current status of the VPA/FLEGT

negotiations between Myanmar and the EU as the UK Department for

International Development (DFID) suspended its financial support for the

negotiations about one year ago.

Some commentators have said that Myanmar is no longer considered a VPA

country but the EU VPA website says “Currently, Myanmar is in a preparation

phase. The purpose of this phase is to prepare and establish strong

foundations for a successful negotiation should Myanmar and the EU decide to

negotiate a VPA.” While the Myanmar Multi Stakeholder Group (MSG) is still

active there is no apparent engagement with the EU.

It has been learnt that recently an assessor from NepCon, a non-profit

organisation that builds commitment and capacity for mainstreaming

sustainability, recently visited Myanmar to assess the timber legality

framework in the country and spent time with the MSG, the Forest Department,

the Myanma Timber Enterprise and the Myanmar Forest Certification Committee

(MFCC).

Barber Cho, Secretary of the MFCC, confirmed the visit explaining this was

planned with Palladium, DiFID and the European Timber Trade Federation

(ETTF) before DiFID suspended support for Myanmar’s VPA negotiation process.

Palladium is an international advisory and management business and was the

fourth-largest private sector partner for the UK Government's Department for

International Development (DFID).

The NepCon assessor focused on Myanmar’s ‘CoC Dossier’ and the Myanmar

Timber legality Assessment System (MTLAS) and Cho said the authorities in

Myanmar were completely frank and transparent with the assessor.

Manufacturers applaud investment plans for energy sector

The energy sector has been allocated a massive amount of funds in the Budget

for fiscal 2019-20, which commenced October 1. This is the first time the

energy sector has attracted the highest portion of government spending. The

energy sector has been under funded for years causing in hydropower and

other power generation projects.

Electricity prices have been raised in Myanmar and the government will

benefit and can therefore invest more in power supplies which will encourage

investment in manufacturing.

6. INDIA

Manufacturing could get boost from

rate cut

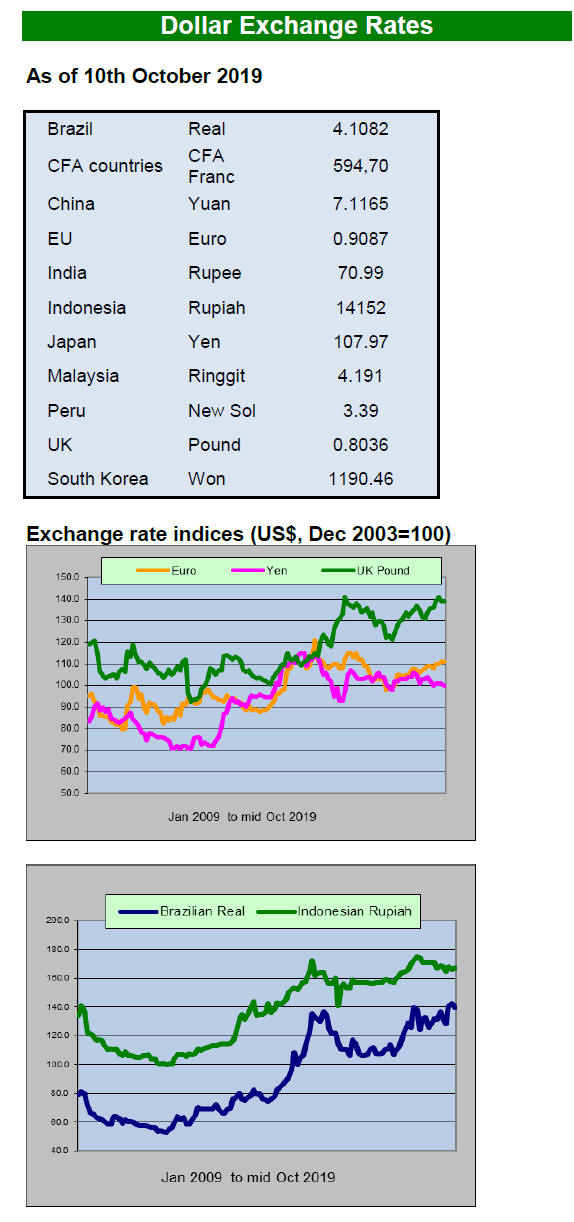

India’s GDP growth dropped to a six-year low of 5% in the second quarter and

according to the Reserve Bank of India (RBI) the economy is likely to face

more risks in the near term from a combination of domestic and global

issues.

Over the past few months domestic manufacturers have experienced subdued

demand which prompted a cut back in production, efforts to reduce

inventories and fewer purchases from suppliers. This say analysts was partly

why the RBI to cut interest rates in early October. The October cut was the

fifth cut in 2019 and it had an immediate impact on the rupee/dollar

exchange rate which dipped below 71 to the US dollar.

The quarter percent cut in rates is aimed at kick-starting the economy

lifting it from its six-year low. Borrowing rates have been lowered to 5.15%

which should help boost the housing market.

However, a CREDIA spokesperson recently commented that the government’s

US$1.4 billion fund to finance stalled housing projects is unlikely to

succeed as the sector is facing its worst crisis in decades because consumer

and business confidence are at a low level.

See: //economictimes.indiatimes.com/articleshow/71132591.cmsutm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Procedures for export of red sanders

A recent Indian government announcement sets a timeline for red sanders

producing States to finalise the procedures for the export of this valuable

timber.

See:

https://dgft.gov.in/policies/notifications

The text reads as follows:

Subject: Export of Red Sanders wood by Directorate of Revenue Intelligence

{DRI), State Governments of Andhra Pradesh, Maharashtra, Tamil Nadu and

Karnataka - Extension of time regarding.

1. In exercise of powers conferred by Section 3 of the Foreign Trade

(Development & Regulation) Act,1992 read with Para 1.02 of the Foreign Trade

Policy (2015-2020), the Central Government hereby makes the amendments in

Notification No. 47 (RE-2013)/2009-2014 dated 24.10.2013 read with

Notification No. 6/2015-2020 dated 06.05.2015, Notification No. 24/2015-2020

dated 29.08.2016, Notification No. 25/2015-2020 dated 02.09.2016,

Notification No. 40/2015-20 dated 27.11.2017, Notification No. 08/2015-20

dated 23.05.2017 and Notification No. 48/2015-20 dated 03.01.2019.

2. Directorate of Revenue Intelligence (DRI) and State Governments of Andhra

Pradesh, Maharashtra, Tamil Nadu and Karnataka shall finalize the modalities

including allocation of quantities to various entities, as applicable, for

export of the balance quantity of Red Sanders wood and shall complete the

whole process of export latest by 31st December, 2019.

3. Other provisions of Notification No. 47 (RE-2013)/2009-2014 dated

24.10.2013 read with Notification No. 24/2015-2020 dated 29.08.2016 (for

Andhra Pradesh and DRI), Notification No. 25/2015-2020 dated 02.09.2016 (

for Tamil Nadu and Maharashtra) and Notification No. 40/2015-20 dated

27.11.2017 (for Karnataka) shall remain unchanged.

See also:

https://dgft.gov.in/sites/default/files/Noti%2012%20dt%2029.07.2019%20Eng_0.pdf

Imported plantation teak

The Goods and Services Tax Committee at its last meeting did not consider

the requests from the timber sector for a reduction in GST rates for raw

material inputs to the industry. Manufacturers continue to push for a

downward revision of the 18% GST on wood products.

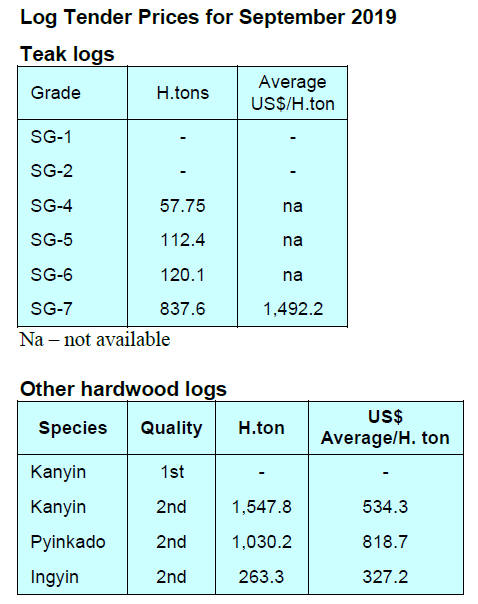

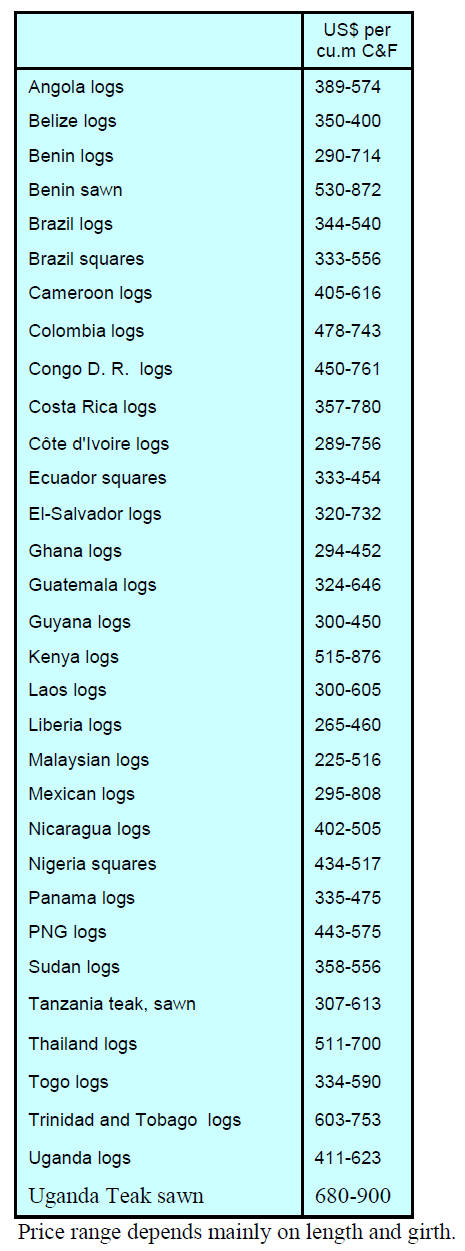

C&F prices for imported teak at Indian ports from various other sources

continue within the same range as given earlier.

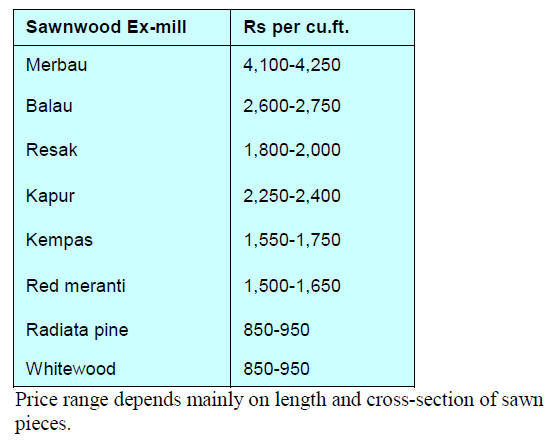

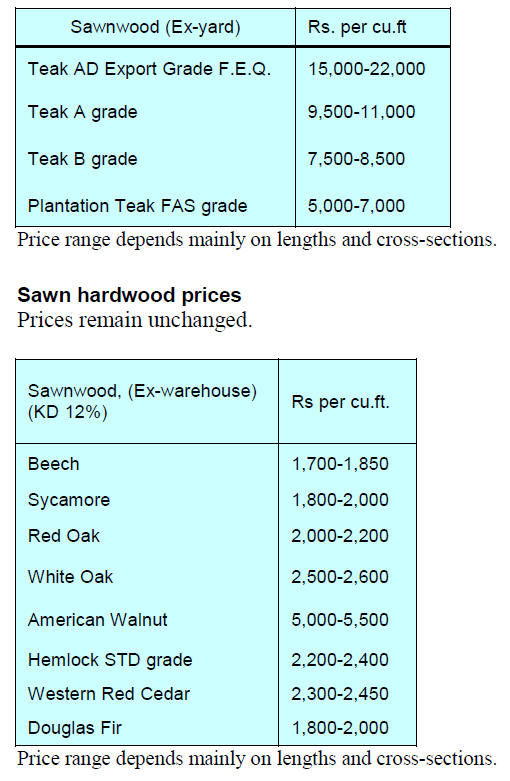

Locally sawn hardwood prices

Prices have been maintained as reported last time. Demand and imports are

stable.

Myanmar teak prices

With due care necessary to maintain revenue, GST council has not been able

to offer any relief. Markets have accepted the situation. The general

conditions are improving and loans and credit facilities are started afresh

and hope demand will improve.

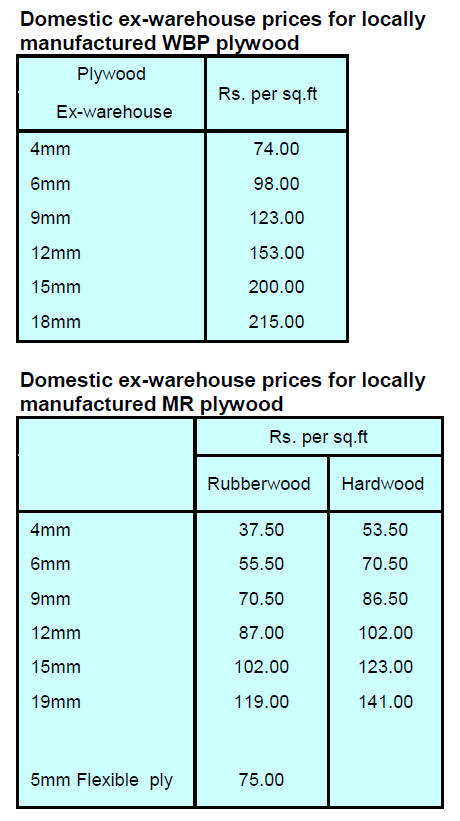

Plywood

The ex-warehouse prices have not been raised and continue as previously

reported. Manufactures complain that there is now a shortage of good quality

peeler logs and that recovery rates are suffering. The diminishing

availability of the traditional peeler log species has encouraged millers to

turn to other species which are more readily available.

The presence of Chinese made plywood is growing in the Indian market as

Chinese manufacturers seek alternative markets to the US to avoid high US

tariffs.

7.

VIETNAM

Surge in foreign investment

from China

The surge in the number of new FDI projects into Vietnam’s wood processing

sector continues. Most of the investment is in woodchip production,

processing industry services, wooden pallet production and composite panel

products.

Xuan Phuc,(Forest Trends) has reported that most of the incoming investment

is from China. In the first 5 months of 2019 there was a total investment of

over US$50 million from China, 1.7 times the amount in the same period in

2018.

Tran Quoc Khanh, Deputy Minister, in the Ministry of Industry and Trade has

called for a registration system so the ministry can track investment and

exports in critical sectors such as panel products as there is a need to

effectively manage the export supply chain. This he said would aid Customs

in eliminating fake labelling and prevent fraud.

Vietnam’s exports of wood products to the US are around about US$3-4 billion

annually and Vietnam is the second largest supplier to the US after China

.In the first 7 months of 2019, China’s market share of the US furniture

market fell sharply while Vietnam gained market share. Tran Quoc Khanh said

this is an opportunity for Vietnamese firms to fill the gap in US imports

but will require companies to address their productivity, marketing and

procurement policies.

Dien Quang Hiep, Chairman of Binh Duong Wood Processing Association (BIFA)

has pointed out that one of the biggest drawbacks at present is that there

are no production clusters and networks among Vietnamese companies which is

allowing new entrants in the sector to gain an advantage.

In related news, Le Trieu Dung, Director of the Chamber of Commerce and

Industry, said that it is necessary for the authorities to be on the lookout

for signs of fake relabeling of exports especially in the plywood sector.

In 2018 and the first 6 months of 2019, the Vietnam Chamber of Commerce and

Industry (VCCI), in conjunction with the Customs Department, Vietnam Chamber

of Commerce and Industry (VCCI), inspected a number of the Vietnam based

enterprises from which there was a sudden and sharp increase in export

volumes.

The survey was intended to uncover fake export labelling. The US Customs

service also had a team in Vietnam to investigate the sudden rise in wood

product exports seemingly originating in Vietnam which raised suspicions of

cross-border trade between Vietnam and China for re-export.

See:

https://nongnghiep.vn/khuyen-khich-phat-trien-trong-rung-go-lon-post250769.html

https://saigondautu.com.vn/kinh-te/ngan-chan-gian-lan-thuong-mai-trong-xuat-khau-go-72903.html

Concerns raised over raw material availability

Concerns have been raise over the rapid increase in wood chip production and

export which, say analysts, could threaten raw material availability for the

domestic solid wood processing industry. In response the authorities in

Quang Nam Province are seeking the development of technical standards for

forest management and harvesting for chip plantations.

In Quang Nam Province there are about 200,000 ha of plantations, mainly

acacia. Most of this area is of small scale household plots and harvesting

is done when the trees are around 3-4 years old. The harvested timber is

chipped and shipped to China from Dung Quat Port.

Currently Quang Nam harvests about 1 million tonnes of acacia annually.

There are 16 chip processing plants in the Province but there are fears that

the local supply will soon be insufficient and that the chip mills will turn

to neighboring provinces such as Da Nang and Quang Ngai. Analysts point out

that local raw material suppliers could be vulnerable should China introduce

restrictions on imports.

There are more than 100 major wood processing plants In Binh Dinh and they

are exporting to over 80 countries and territories. The wood processing

sector contributes a lot to provincial development but companies are finding

it a problem to secure raw materials.

Every year local manufacturers import more than 200,000 cu.m of wood raw

materials of which sawnwood accounts for around 85% with the balance being

logs and composite panels.

According to the Department of Industry and Trade, in the first 9 months of

this year, the Province's wood furniture manufacturing industry index rose

by nearly 7% year on year and the index for ‘other’ wood products jumped

around 27%. In the same period furniture exports reached over US$340

million, up 20% over the same period last year and accounting for 51% of the

total exports of the province.

Mr. Le Minh Thien, Chairman of Binh Dinh Timber and Forest Products

Association, said “despite the high export growth rates, the production of

export wood processing enterprises in the province faced many difficulties

in raw materials supplies. The local producers and exporters had to import

more than 80% of raw wood materials with many risks about legality and

origins”.

He pointed out that under these circumstances it is very challenging to

manage production costs and maintain competitiveness in the global market.

In responding to these comments Ngo Van Tong, Director of Department of

Industry and Trade, said there are plans develop large scale timber

plantations forests in the province by 2025 to meet 50% of raw wood

materials demand for the province's wood processing industry. Investments in

plantations would continue until they are contributing around 80% of the raw

material requirements of factories in the province.

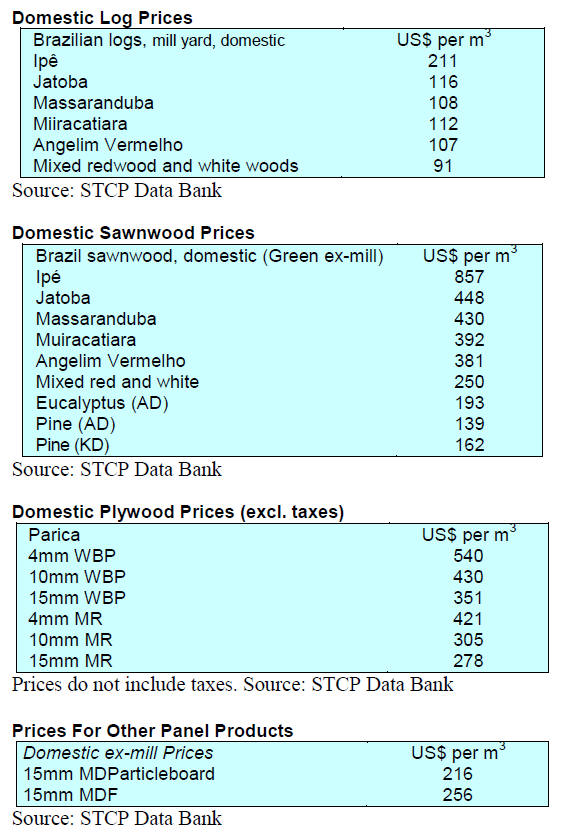

8. BRAZIL

Results of ABIMCI forestry sector study

announced

The Brazilian Association of Mechanically-Processed Timber Industry (ABIMCI)

launched its ‘Sectoral Study 2019’ which addresses national forestry issues

and provides profiles of the timber and furniture industry including

socioeconomic indicators, market statistics such as production, consumption,

export and import data. The final report provides crucial information for

planning and promotion of sectoral development.

This study highlights the importance of planted forests in Brazil which, in

2018, extended over an estimated 8.1 million hectares with 73% eucalyptus

(5.92 million ha.), 20% pine (1.59 million ha.) and 7% with other timber

species (591,000 ha.). Out of the 591,000 ha. rubber tree accounts for 39%,

acacia (27%), paricá (15%) and teak (15%).

Hardwood species such as paricá, teak and poplar are traditionally used in

the production of sawnwood and veneer. Other timber species that have been

planted include African mahogany (Khaya senegalensis) and Australian cedar (Toona

ciliata).

In Brazil, sawnwood and plywood from native hardwoods is produced mainly in

the northern and central western regions of the Amazon. According to the

ABIMCI study, production and consumption of Amazon hardwoods has declined in

recent years.

Over the past decade production of hardwood sawnwood fell by almost 13%

annually in the period 2009-2018. In 2018, Brazil produced 2.4 million cu.m

of hardwood sawnwood, while in 2009 it produced 8.4 million cu.m.

Brazilian production of hardwood plywood has also fallen. In 2018, Brazil

produced 249,000 cu.m of hardwood plywood from Amazon species while in 2009

national production was around 587,000 cu.m (an almost 60% decline in 10

years).

The decline in production is due, says the ABIMCI report, to environmental

controls and bureaucratic hurdles in the approval process for forest

harvesting and management permits.

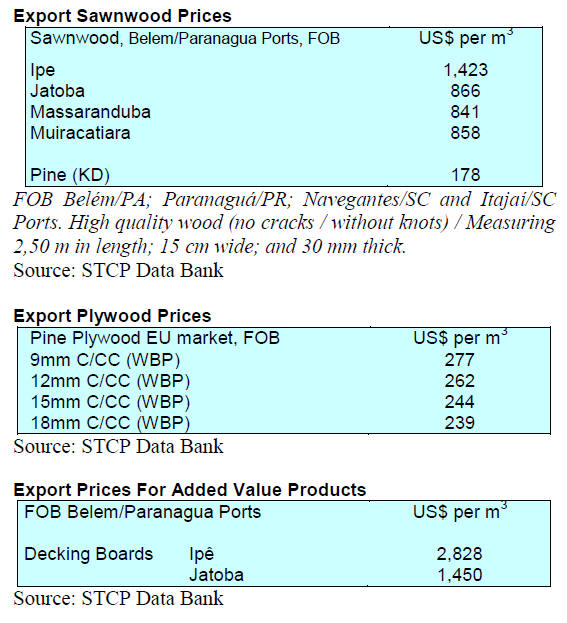

Trends in hardwood plywood and sawnwood exports

According to the ABIMCI study, in 2018 Brazilian exports of hardwood

sawnwood totaled about 556,000 cu.m and earned US$222 million. This was the

highest level of hardwood sawnwood exports for the last 8 years.

However, between 2009 and 2018, Brazilian export volumes of hardwood

sawnwood fell by 2.5% and the value of exports dropped almost 14% in the

same period.

Over the same period there was a decline in the value and volume of hardwood

plywood exports. In 2009 exports amounted to 97,000 cu.m (US$54 million) but

in 2018 this dropped to 61,000 cu.m (US$ 30 million).

Bento Gonçalves exports continue to increase

Export earnings by the Bento Gonçalves' furniture cluster rose 13% between

January and August this year compared to the same period of 2018. This

performance surpassed the results of the furniture industry of the state of

Rio Grande do Sul and Brazil as a whole.

According to the Ministry of Economy/Foreign Trade Secretariat (SECEX),

local companies exported US$29 million in the first eight months of 2019.

The main buyers of furniture manufactured in the Bento Gonçalves furniture

cluster were Uruguay, followed by the United States, Saudi Arabia, Chile,

Colombia, Mexico, Panama, Paraguay and Peru. It is noteworthy that the US

went from the 4th main buyer to 2nd place, and the United Kingdom, which was

not even among the top 10 destinations, now ranks 6th.

The Bento Gonçalves furniture cluster increased its exports by 13% compared

to a growth of only 2.5% in Rio Grande do Sul State exports.

The Bento Gonçalves Furniture Industry Union (Sindmóveis) estimates that

furniture exports will increase in the coming months.

9. PERU

Amazon business congress

Business and government representatives from the Amazon Regions recently

participated in the first business congress which was inaugurated by the

President of the Republic, Martín Vizcarra Cornejo. The President was

accompanied by the Ministers of Foreign Affairs and Transportation and

Communications; Gustavo Meza-Cuadra and Edmer Trujillo.

The President confirmed his government’s commitment to the Amazon and the

Governor of Ucayali, Francisco Pezo Torres, said that the Amazon represents

60% of the Peruvian territory and through applying Sustainable Development

Goals (SDGs) has great potential. The event sought to identify the economic

and social contributions that development of the Amazon could bring.

Businessman Samuel Dyer of the Pro Ucayali group said that the full

potential of the Amazon can be released if there is a private/public

alliance. Entrepreneurs want to invest, he said, but putting in place

supportive infrastructure must be a priority.

Dyer reminded participants that there is an estimated 10 million hectares of

deforested land in Peru’s amazon and this offers an opportunity for

investment in reforestation. Dyer suggested half of this area could be

reforested with an investment of around US$25 billion. To achieve this, he

said, would require that the rapid completion of a National Competitiveness

Plan.

Regional governments move forward in Amazon zoning

With technical assistance from the National Forest and Wildlife Service

(SERFOR) the Amazon regional governments of San Martín, Ucayali, Loreto,

Amazonas, Junín, Madre de Dios and Huánuco are moving forward with the

process of forest zoning.

This was reported by the Executive Director of the SERFOR, Alberto Gonzales-Zúñiga

Guzmán, who said that forest zoning will open the potential and identify the

limitations for the direct or indirect use of forest and other natural

resources.

Ucayali, with 3 million hectares of its territory categorised has advanced

in forest zoning. The areas define protection and conservation zones; land

reserves for indigenous peoples in isolation or initial contact and

prioritised ecosystems for biodiversity conservation.

The zoning plan for Loreto could be approved this year as progress has been

good helped by the transfer of funds from the central government.

Strengthen supervision of cedar marketing

Next year, the implementation of action to strengthen the control of the

marketing of cedar will begin in support of the conclusions of the

Eighteenth Meeting of the Conference of the Parties to the Convention on

International Trade in Endangered Species of Wild Fauna and Flora (CITES) in

respect of trade in cedar. Peru has ten species of cedar and of those four

are endemic.

The Deputy Minister of Strategic Development of Natural Resources, Gabriel

Quijandría, stressed the importance of informing the public, private and

specialist on the latest decisions taken by CITES.

Timber concessions study in the final stage

A study on the operation of the timber forest concession model from the

social, economic sustainability and legal perspectives is expected to

provide a means for development of new sustainable concession management

systems for Peru.

This study is being led by SERFOR and is already in the final stage of

development. It is being undertaken with the technical support of the USAID

FOREST Program and the United States Forest Service (USFS) along with a

Peruvian NGO.

Information has been collected dating back 15 years on the forest

concessions in Loreto, Ucayali and Madre de Dios. This will reveal what has

happened in the past and how to improve the ecological sustainability of the

forest in the future. The study and recommendations will be presented at the

end of this October.

Re-allocation of non performing forest concessions

Inactive forest concessions in Ucayali and Loreto allocated more than 15

years ago are being brought into operation because the regional forestry and

wildlife authorities have introduced a legal device termed the ‘Abbreviated

Procedure’. This procedure allows cancellation of a concession agreement and

re-allocation to a new concessionaire.

Through this procedure more than half a million hectares of none performing

concession agreements have been reallocated in Ucayali and Loreto. Some of

the concession areas have suffered illegal logging and encroachment.

In September the Regional Government of Loreto approved 13 forestry

companies as qualifying to take advantage of 63 timber forest concessions

which will be valid for 40 years.

In Ucayali, last month the Regional Government launched the Abbreviated

Procedure for the granting of 26 concessions.

Currently, the authorities in Loreto are evaluating applications in

accordance with the Guidelines for granting forest concessions for timber

purposes by the Abbreviated Procedure published by SERFOR.

It is estimated that over 600,000 hectares of production forests in Ucayali

and Loreto will be brought into production.