|

Report from

North America

Bill could ban timber imports from Brazil

On 10 September thirteen Democrats in the US House of

Representatives introduced H.R. 4263, the Act for the

Amazon Act.

This proposal seeks to prohibit the importation of several

products from Brazil, including timber products classified

under heading 4403 of the Harmonized Tariff Schedule of

the United States, and prevent the Trump Administration

from negotiating a free trade agreement with Brazil due to

Brazil's "failure to aggressively fight the fires in the

Amazon rainforest and deforestation tactics more

generally."

The bill also targets imports of beef, soy, sugar, pulp and

paper, tobacco, corn, and energy products.

See:https://www.congress.gov/bill/116th-congress/housebill/4263/text?q=%257B%2522search%2522%253A%255B%2522hr4263%2522%255D%257D&r=1&s=1

US housing starts soared to a 12-Year high in August

US homebuilding surged to more than a 12-year high in

August as both single- and multi-family housing

construction increased, suggesting that lower mortgage

rates were finally providing a boost to the struggling

housing market.

Housing starts jumped 12.3% to a seasonally adjusted

annual rate of 1.364 million units last month, the highest

level since June 2007, the Commerce Department

reported. Data for July was revised to show homebuilding

falling to a pace of 1.215 million units, instead of

decreasing at a rate of 1.191 million units as previously

reported.

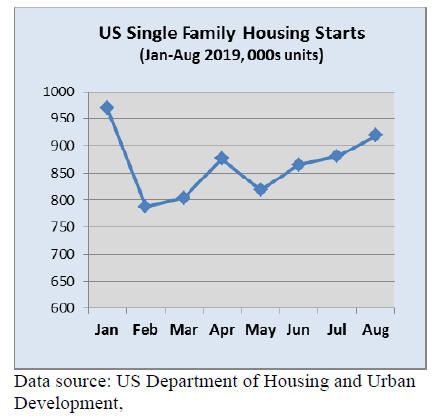

Single-family homebuilding, which accounts for the

largest share of the housing market, increased 4.4% to a

rate of 919,000 units in August, the highest level since

January. Single-family housing starts increased in the

West, Midwest and the populous South, but fell in the

Northeast.

The housing market, the most sensitive sector to interest

rates, had until now shown few signs of benefiting from

the Federal Reserve¡¯s monetary policy easing, which has

pushed down mortgage rates from last year¡¯s multi-year

highs.

Sales of existing homes edge up

Existing-home sales inched up in August marking two

consecutive months of growth according to the National

Association of Realtors. Three of the four major regions

reported a rise in sales, while the West recorded a decline

last month.

Total existing-home sales rose 1.3% from July to a

seasonally adjusted annual rate of 5.49 million in August.

Overall sales are up 2.6% from a year ago (5.35 million in

August 2018).

Lawrence Yun, NAR¡¯s chief economist, attributed the

increase in sales to falling mortgage rates. ¡°Sales are up,

but inventory numbers remain low and are thereby

pushing up home prices,¡± said Yun. ¡°Homebuilders need

to ramp up new housing, as the failure to increase

construction will put home prices in danger of increasing

at a faster pace than income.¡±

See:

https://www.nar.realtor/newsroom/existing-home-salesincrease-1-3-in-august

Manufacturing growing but at a slower pace

While the overall US economy grew for the 124rd

consecutive month, economic activity in the US

manufacturing sector contracted in August for the fifth

straight month according to the nation¡¯s supply executives

in the Manufacturing ISM Report on Business.

Comments from the ISM panel reflected a notable

decrease in business confidence. Manufacturing supply

executives reported contracting exports and imports, with

executives from the wood products industry reporting the

largest decrease in imports among the 16 ISM sectors.

However, the wood products sector did show growth in

August.

US wood product distributors and manufacturers saw

sales rise in line with firm single-family housing starts

which have been given a boost by low mortgage rates.

See:

https://www.instituteforsupplymanagement.org/ismreport/mfgrob.cfm?SSO=1

NAFTA split ruling in US-Canada softwood dispute

A "Chapter 19" dispute panel convened under the North

American Free Trade Agreement issued a decision in part

upholding the US International Trade Commission's

findings on imports of softwood sawnwood from Canada.

The panel upheld the finding that Canadian imports are

causing adverse impact on US industry while also

remanding the ITC's final determination due to how it

addressed elements that address the business cycle and

condition of competition, interim 2017 data,

substitutability conclusions, volume analysis, price effects

analysis and specific aspects of the price suppression

analysis.

The panel instructed the ITC to submit its redetermination

within 60 days.

See:

https://www.federalregister.gov/documents/2019/09/10/2019-19533/north-american-free-trade-agreement-nafta-article-1904-binational-panel-review-notice-of-nafta-panel

|