Japan

Wood Products Prices

Dollar Exchange Rates of 25th

September

2019

Japan Yen 107.54

Reports From Japan

¡¡

Bank of Japan sees external factor as

risk to growth

The Economy, Trade and Industry Minister, Yasutoshi

Nishimura, said at a news conference that he relies on the

Bank of Japan (BoJ) to make appropriate decisions to

maintain the economy on its growth track.

The BoJ has given an explicit signal that it was concerned

about risks to the economic recovery and promised to

review what action is required at its next meeting due after

the consumption tax rises.

At a press conference, Haruhiko Kuroda, BoJ Governor

said ¡°With the slowdown in overseas economies

continuing and downside risks on the increase, we judged

it¡¯s becoming necessary to pay closer attention to the

possibility of losing momentum towards our price stability

goal.¡±

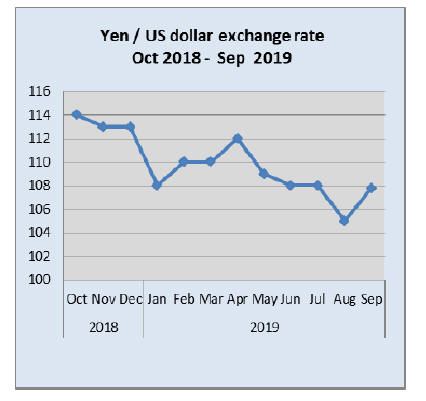

He went on to say the cut in US interest rates may drive

yen appreciation thus undermining exports. Fortunately for

the BoJ the US Federal Reserve did not signal further cuts

leaving the yen/dollar exchange rate at around yen 108 to

the dollar, a rate the BoJ is comfortable with.

Some relief in Japan after trade agreement with US

A ¡®limited¡¯ trade deal between US and Japan which cuts

tariffs on US farm goods coming into Japan has been

signed. This could expand trade between the US and Japan

by around US$7 billion say analysts as Japan will lower

tariffs on US farm goods and the US will lower tariffs on

Japanese machine tools .

The Japanese government and Japanese business leaders

have welcomed this interim agreement which offers shortterm

security for Japanese auto exports. But, given the

unpredictability of the current US administration all

remain cautious.

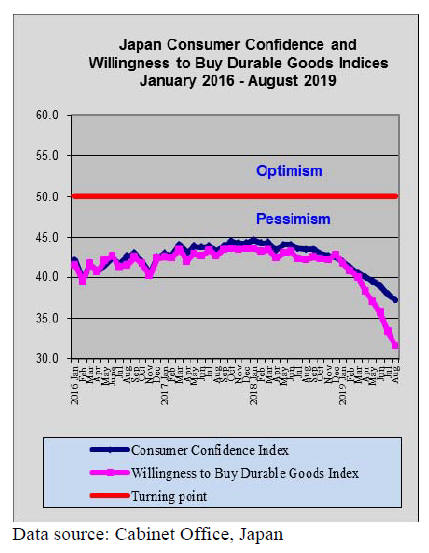

Consumers bracing for the 1 October tax hike

The Japanese economy has grown for the past three

quarters, though the pace was slower than initially

estimated in April-June period as business spending

slipped but the latest assessment is positive as strength in

domestic demand is counterbalancing weakness in

international trade. However, the question is will the

increase in consumption tax from 8% to 10% on 1 October

herald in another downturn as happened after the past rise?

In this latest tax change food and drink (with the exception

of alcohol and eating out) will stay at an 8% tax rate. But

daily use products will attract a 10% tax.

Yen steady at 107-8 to the US dollar

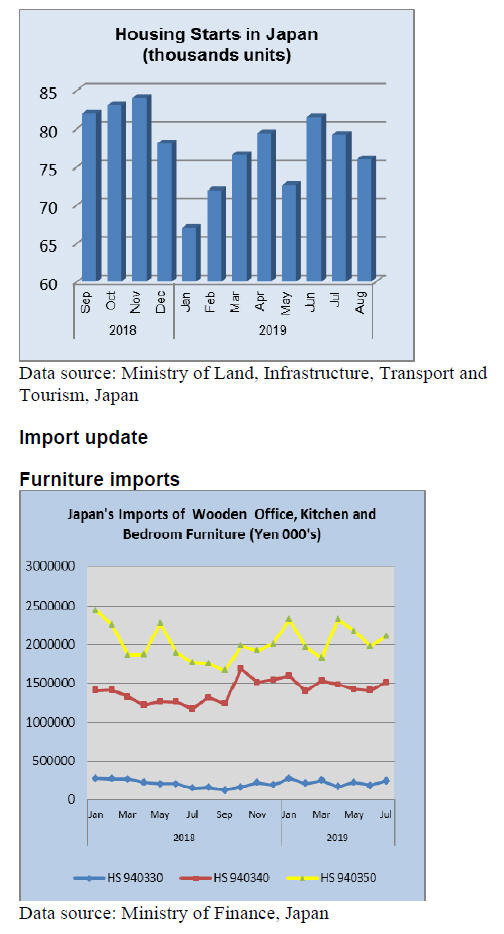

According to the latest Cabinet Office Economic Report it

is the government¡¯s view that the economy is recovering at

a moderate pace but weakness in exports is of concern.

Exports in August dropped 8% year on year according to

Ministry of Finance data.

While the report maintained its positive outlook there were

cautionary words on the housing sector where growth

prospects were downgraded for the first time in more than

18 months due to the decline in new home construction.

20,000 homes damaged in typhoon

A powerful typhoon, the 15th of the year in Japan, hit the

Tokyo area in September and it is only recently that the

full extent of the damage to homes and businesses has

been known.

Chiba Prefecture, encompassing Tokyo's eastern outskirts

and the rural B¨s¨ Peninsula, was worst affected and the

local government has reported that over 20,000 homes

sustained damage. In addition over 500 public schools in

Chiba Prefecture (some 40%of the total) have confirmed

damage.

The Japan Lumber Reports (see page 18) says many

warehouses along Tokyo Bay were affected by the storm

surge and inundated in salt water and goes on to say the

renovation and rebuilding work will require large volumes

of wood products.

August marked the third consecutive decline in housing

starts. Year on year August starts were down around 7%

while month on month there was a 4% drop.

As anticipated Japanese consumers have been on a

spending spree in advance of the 1 October consumption

tax increase and it could be that it was in preparation for

the rush to buy furniture items that imports of furniture

rose so sharply in July. When August figures become

available a further rise in imports it is likely these will

show further increases in imports before a September

decline.

Many families have made last-minute purchases while the

tax is still 8%, but this strategy may not be as sound as it

appears as retailers are joining a government-sponsored

reward point system that smart shoppers can use to receive

discounts on goods and services that may be even lower

than the current tax rate.

In the month before the last tax increase spending on

household soared but early sales figures from some major

retailers are signaling that the extent of rush buying is not

so pronounced this time.

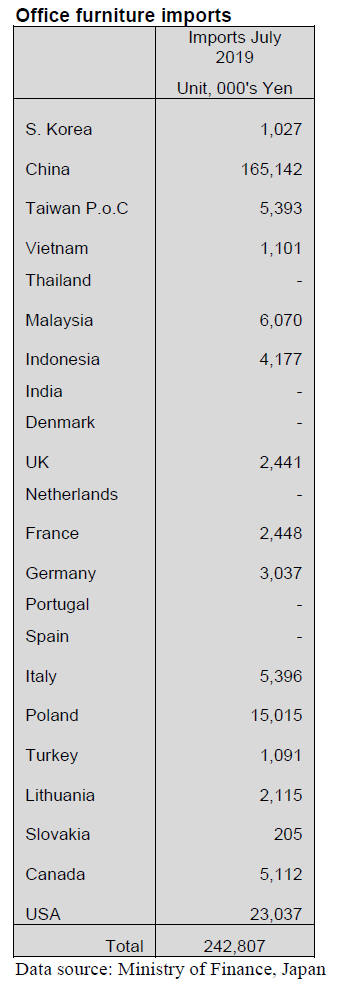

Office furniture imports (HS 940330)

Year on year, the value of July imports of wooden office

furniture (HS 940330) rose a dramatic 64% and month on

month, July were up 34%.

As was the case for most of the year three shippers

accounted to over 80% of Japan¡¯s imports of wooden

office furniture. China was the top supplier at 68% of all

July shipments followed by the US (9.5%), a new comer

to the top league of wooden office furniture suppliers. The

third ranked supplier in terms of value shipped was

Poland.

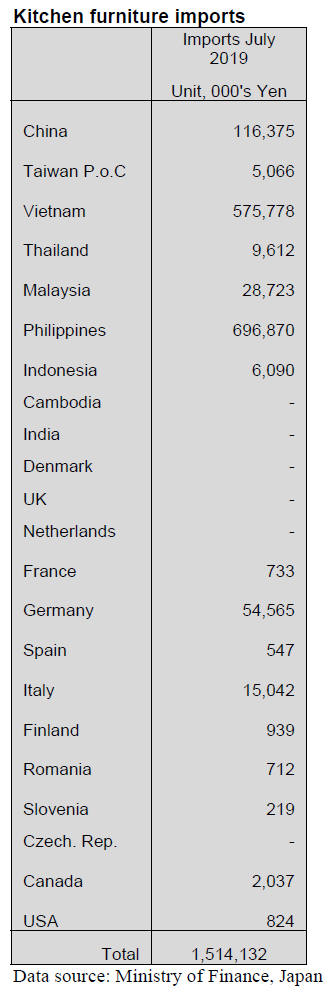

Kitchen furniture imports (HS 940340)

In July exporters in the Philippines and Vietnam

maintained their huge share of Japan¡¯s imports of wooden

kitchen furniture. For the second consecutive month

shipments from the Phillipines were marginally above

those from Vietnam. Over 90% of Japan¡¯s July imports of

wooden kitchen furniture came from 3 suppliers, the

Philippines (48%), Vietnam (38%) and China (8%).

Year on year July wooden kitchen furniture imports

were

up 29% while compared to June imports rose 8%. For the

first time in several months arrivals of wooden kitchen

furniture from German manufacturers jumped above those

from Malaysia.

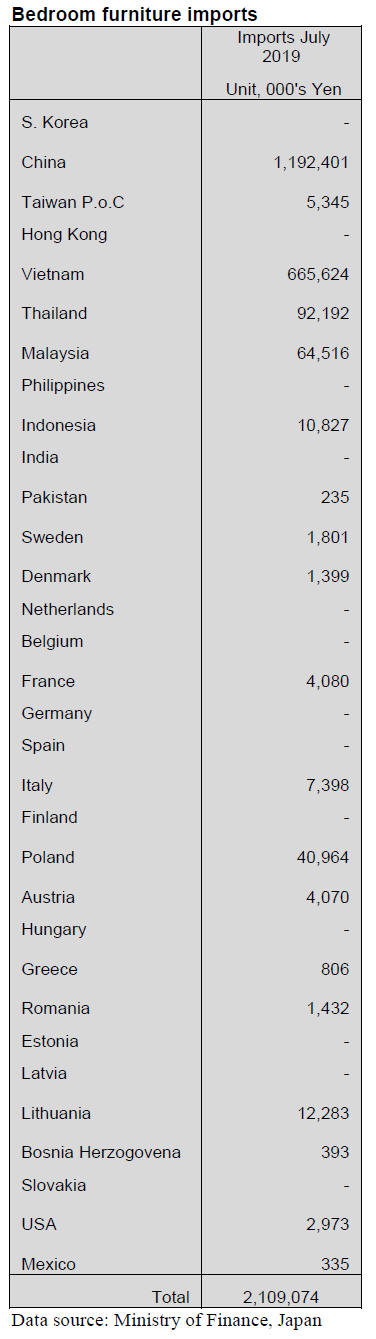

Bedroom furniture imports (HS 940350)

The year on year value of shipments of wooden bedroom

furniture into Japan in July expanded 19% but month on

month the rise was more modest at 6.5%.

China¡¯s dominance of Japan¡¯s imports of wooden

bedroom furniture continued into July as over 50% of all

wooden bedroom furniture was shipped from Chinese

suppliers.

Manufacturers in Vietnam held onto their second rank in

term of the value of shipments to Japan and in July

accounted for 32% of all wooden bedroom furniture

imports. The other two significant but small shippers in

July were Thailand (4%) and Malaysia (3%).

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

South Sea logs and lumber

Supply and demand of South Sea log are well balanced.

Log supply from PNG has declined due to rainy season

but log users in Japan carry two to three month inventory

so there is little influence.

Movement of laminated free board is firm. Harvest of

mercusii pine is delayed by foul weather so free board

production did not increased as much as initially expected

so forecasted over supply did not happen. In Japan,

demand for interior works of commercial facilities has

been active so the prices have not changed much.

In imported LVL, demand for Chinese popular LVL is

steady for use of core of interior fittings but movement for

crating and stud of condominiums is not growing.

Revision of JAS rules

The Ministry of Agriculture, Forestry and Fisheries made

an official announcement of revision of JAS rules on CLT,

lumber, flooring and structural panel on August 15. They

will be effective since November 13, 2019. New grading

method by quality management record in manufacturing

process is added on top of former method of random

sample check of finished products.

Former inspection of random sample of finished products

takes time and until result is cleared, inventories pile up so

the manufacturers have been demanding grading by

quality management record in manufacturing process.

Regarding CLT, use of waney lamina is allowed. To

correspond to standard strength set by the Building

Standards Act, bending strength is revised and shear

capacity is classified by species.

The point of lumber rules revision is to allow up to 1 mm

in length of difference between indicated size and actual

size.

Regarding young modulus, it is measured by machine

on

kiln dried lumber for grading and green lumber is now

excluded. On hardwood lumber, split on the end was

allowed as 50% of length but now whole length of split is

taken.

As to flooring, board by shrinking process is excluded as it

may swell up by moisture so data of swelling is necessary.

Decorative composite flooring needs to show used species.

Bark seam, pitch pocket and pitch steak used to be

considered defect but now they are considered decorative

factor so as long as it is used as decorative sheet, they are

not considered as defects. 455 mm is added as standard

width of composite floor to deal with demand for wider

flooring.

Distribution system of domestic wood products

The Ministry of agriculture, forestry and fisheries

announced the investigation of domestic wood products in

2018.

On domestic logs, percentage of logs sold to sawmills

through trading firms and wholesalers is 63.1%, 4.9 point

more than 2016.On plywood, percentage sold through

trading firms and wholesalers is 80.1%, 23.1 points more.

On laminated lumber, the volume sold through distributors

is 40.6%, 17.3 points more. In short, trading increased

through using intermediate dealers. On domestic lumber,

volume through auction market and wholesalers decreased

to 50.2%, 11 points less. The Ministry investigates once

every five years through domestic mills and wholesalers

on purchase and sales volume.

Domestic logs sold without going through auction market

doubled, which means logs go direct to sawmills without

going through public auction market but through large

trading firms then also logs shipped to auction market are

sold without auction direct to sawmills. The volume

handled by large trading firms increased.

Purchase and sales amount of logs direct to sawmills from

national forest and private log supplier took 33.5% in total

while the volume was 36.9% so average prices are low.

Meanwhile, the volume through intermediate dealers was

43.2% in total but the amount was 47.5% so sales through

trading firms is higher than direct deals. Distribution of

laminated lumber through public market increased by

about seven times but direct sales from the manufacturers

to precutting plants decreased. One thinkable factor is that

laminated lumber took some share of solid wood lumber.

Increase of domestic wood laminated lumber

manufacturing influences distribution of domestic solid

wood lumber. Direct sales from sawmills to precutting

plants remain almost unchanged but sales to laminated and

CLT manufacturing plants increase by 1.5 times. This

means lamina manufacturing by sawmills has been

increasing. CLT volume was 14,000 cbms, seven times

more than 2016.

Sales used to be direct to builders but now 8.5% of sales is

going through trading firms. Wood chip sold to the most to

paper manufacturing plants with 61.8% then others are for

power generation and for heat utilisation.

Wood pellet production

The Forestry Agency announced production of domestic

wood pellet in 2018. Total production was 131,401 ton,

3.8% more than 2017.Demand increased by small scale

biomass power generation, wood stove for heating and

vinyl house for agricultural products. Compared to

imported wood pellet, growth is small.

By use, 126,127 ton for fuel, 3.4% more and 2,422 ton for

agriculture, 14.5% more. Number of manufacturing plant

is 154, 7 more than 2017 and workers are 396, 58 more.

By prefecture, Okayama is the top with 27,651 ton, 4%

less. Miyazaki with 12,756 ton, 8.8% less. Kochi with

6,747 ton, 34.1% more. Hokkaido with 6,305 ton, 0.3%

less.

Raw materials are 66,601 ton of lumber mills¡¯ residue,

17% more than 2017. This takes 51% in total. Second is

leftover fiber in the woods with 40,326 ton, 12.2% less

and building scrap wood with 21,831 ton, 0.8% more.

Imported wood pellet in 2018 was 1,059,542 ton, 109.2%

more so share of domestic wood pellet is down to 11%. It

was 56.6% in 2014 then it has been decreasing year after

year by rapid increase of imported wood pellet. Imported

wood chip for fuel increased by 2.5 times from 2017. t will

keep increasing this year and next.

Number of operating wood biomass power generation

plant approved by FIT as of end of 2018 is 110, 29 more

than December 2017. Total power output is about

1,230,000 kw, 330,000 kw more.

The Forestry Agency announced that use of domestic

thinning and fiber left in the woods are about 2,740,000

BDton, 4.2% more than 2017. This is equivalent to about

6,040 M cbms in log volume. Pitch of increase is slowing

compared to 2015-2017. This type of fiber is mainly

consumed by the plants classified as user of unused

resources but number of approved plant of this type is not

increasing because of difficulty of acquiring this type of

fuel and license of some approved plants is cancelled

because the plants have not started up yet.

Meantime, volume of building scrap and pruned branches

decreased. Building scrap was over-supplied and purchase

was restricted by the buyers.

Imported wood chip was about 330,000 BD ton, 145.4%

more. Main of imported wood fuel is wood pellet. Last

year¡¯s import was 1,060,000 ton, 109.2% more. Imported

PKS was about 1,270,000 to, 11.2% more. Both surpassed

one million ton.

Strong typhoon hit Tokyo Bay

Typhoon number 15 hit Tokyo region on September 9.

This was one of the strongest recorded typhoons to hit the

region. Chiba prefecture, east side of the Tokyo Bay is the

hardest hit and fell many electric poles and even high steel

power transmission towers so power outages in many

areas.

Many trees are fallen and block the road or lean onto

electric lines. Since the damaged area is so extensive and

with limited manpower to make repairs, blackout

continues and more than 60,000 households in Chiba

prefecture are still without power after ten days. Water

supply stations also lost power so that water supply is also

disrupted.

Removing blowdown trees in remote area is not

progressing as heavy machines like cranes are needed but

road is blocked with fallen electric poles and blown down

trees.

The power company has been working hard to restore

electricity supply and complete repair will take another

week so many people still suffer life without electricity

and water.

Warehouses along Tokyo Bay also suffer floor by high

tide and cargoes are inundated in salt water. Detail of how

much damages local forests suffer is unknown yet.

There is no serious landslide this time as rain fall was not

much but the damage of blowdown by strong wind is the

main. Many houses¡¯ roof tile were blown away. Building

materials manufacturing plants did not have much damage

by rain or wind but power outage is the main problem.

There will be restoration demand for damaged houses of

plywood, lumber and roof tiles.

|