|

Report from

Europe

Shrinking EU demand for tropical flooring

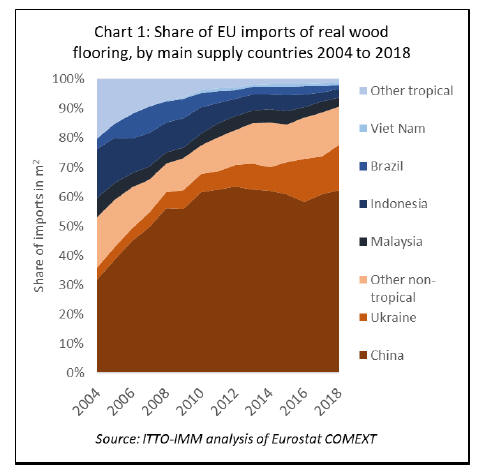

Total imports of real-wood flooring into the EU increased 6.2% to 29.52

million sq.m in 2018. Tropical countries accounted for only 9.2% of

total imports in 2018, down from 11.1% the previous year and close to

50% before the financial crises.

After nearly two decades of almost continuous decline, the real-wood

flooring sector in the EU is now a negligible market for VPA partner

timber products (Chart 1).

EU imports of real-wood flooring from China increased 10% to 18.04 million

sq.m in 2018. China¡¯s share of total imports increased from 59.2% in

2017 to 61.1% in 2018, regaining some of the share lost between 2012 and

2016.

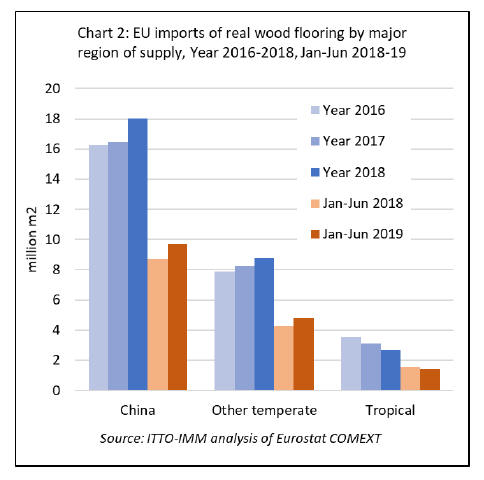

This trend continued in the first half of 2019; imports from China, at

9.68 million sq.m, were 11% more than the same period last year (Chart

2).

The biggest increase in EU flooring imports in 2018 was from other

temperate countries, notably Ukraine.

Imports from Ukraine increased 19% to 5.02 million sq.m last year.

Ukraine¡¯s share of total imports increased from 15% in 2017 to 17% in

2018.

Imports from Ukraine and several other temperate countries have

continued to rise in 2019. In the first six months, total imports from

temperate countries other than China were 4.83 million sq.m, 13% more

than the same period in 2018. Imports from Ukraine increased 17% to 2.91

million sq.m.

EU imports of real-wood flooring from tropical countries fell by 12% in

2018 to 2.70 million sq.m and were down by 4%, to 1.46 million sq.m, in

the first six months of 2019. Imports from Malaysia were down 8% to

950,000 sq.m in 2018 and fell 25% to 400,000 sq.m in the first half of

2019.

Imports from Indonesia were down 7% to 800,000 sq.m in 2018 and a

further 8% to 380,000 sq.m in the first half of this year. Imports from

Brazil fell 24% to 450,000 sq.m in 2018 but recovered a little ground,

up 4% to 240,000 sq.m, in the first half of 2019.

Only Vietnam has consistently bucked the declining trend. Imports from

Vietnam, which increased 4% to 250,000 sq.m in the whole of 2018, had

already reached 270,000 sq.m in the first 6 months of 2019, 50% more

than the same period in 2018. (Chart 3).

Flooring offers insights into wider EU market for tropical timber

Despite the shrinking share of tropical countries in the EU

market for real-wood flooring, analysis of this sector is worthwhile for

the insights it provides into wider market trends more directly relevant

to VPA countries.

Due to the efforts of the European Association of Parquet Flooring

Manufacturers (FEP), this is the only sector using significant volumes

of hardwood for which there is reliable data on the usage of different

species in finished products. Flooring is also a high visibility product

which impacts significantly on the look and feel of a room.

The consumer choices made in the selection of flooring are likely to be

strongly correlated with choices of other products, such as furniture,

kitchens, doors and panelling which are all more important markets for

VPA Partner countries and for which there is little or no data on wood

species preferences.

The real-wood flooring sector highlights the significance of fashion

trends in driving demand for different wood products. A complex mix of

forces is at play in setting these trends. Fashion is itself an

iterative process driven by the interaction, through the media and other

communication channels, between designers, manufacturers and retailers

on the one hand, and their customers on the other.

In their designs and material choices, manufacturers and designers both

respond to signals from their customers and the wider socio-economic

environment, and some of the larger and more influential can themselves

reinforce consumer attitudes and preferences. The smaller, less

influential and innovative, or simply more risk-adverse, will follow

their lead and reinforce the trend.

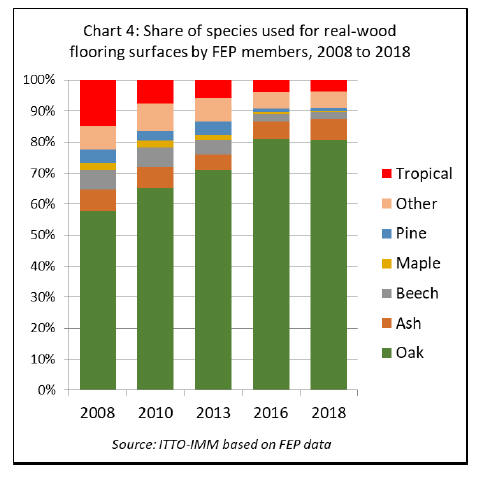

Analysis of the real-wood flooring sector suggests this process has been

a powerful force in reducing demand for tropical timber products in the

EU market. FEP data shows how a single species ¨C oak ¨C has come to

dominate surfaces in this sector.

The share of oak surfaces in European real-wood flooring production was

80.7% in 2018, up from 71% five years earlier and 58% in 2008. During

the same period, the share of tropical timber fell from 15% to less than

4% (Chart 4).

The initial preference for oak amongst manufacturers was due to the

species being readily available from regional sources in Europe, the

species attractive grain and good working properties, and that it had

strong appeal as a ¡°traditional¡± product in the European market.

The fashion has focused very much on European oak due to its distinctive

grain and colour, although American white oak is widely used as an

alternative.

As it is perceived to be less attractive to European customers,

manufacturers have been less inclined so far to use American red oak

despite this being the staple wood for flooring in North America.

Over time, European manufacturers have extended the range of looks that

can be achieved with oak through development of new stains and other

finishes and broadened applications with development of new surface

coatings. The appeal of European oak to customers has been further

boosted by it being widely portrayed as an environmentally benign

material, widely available either FSC or PEFC certified, contributing to

development of rural livelihoods and with a low carbon footprint.

However, this level of market dominance of a single, relatively slow

growing and naturally constrained, hardwood species, has created its own

problems for the European hardwood sector. Demand has declined for other

hardwoods, including temperate species which are now much more readily

available, such as beech and maple, as well as tropical timbers.

Prices for European oak have risen dramatically in recent years,

particularly since manufacturers in China and other Asian countries have

also followed the fashion for oak.

Under normal circumstances, high prices for oak might be expected to

encourage manufacturers to look for and switch to cheaper hardwood

alternatives. However, there has been enormous resistance to this.

The only species other than oak to have seen any recent growth in usage

has been ash, primarily because it can most closely match the grain and

look of oak. Availability of ash timber may also be increasing,

temporarily, due to the spread of ash die back in Europe and the emerald

ash borer in North America.

The reasons for the resistance amongst European manufacturers to switch

away from European oak are not entirely clear and may be varied. Some

larger hardwood processors in the EU have mitigated the impact of rising

oak log prices through innovation to increase yield, for example through

CT scanning of logs and use of increasingly thin face veneers alongside

new impact resistant layers.

The wood flooring sector in Europe is also highly fragmented, dominated

by many smaller manufacturers, which lack the resources to develop and

market innovative new products using different wood species. In this

sector, there are many more followers of fashion than operators willing

and able to shift customers¡¯ entrenched attachment to oak.

The ability of real-wood flooring manufacturers in Europe to influence

the market is further constrained by the intense competition in the

sector, not only from other real-wood manufacturers, but from the wide

and expanding range of producers of laminates and non-wood products.

Margins have been severely squeezed by this competition.

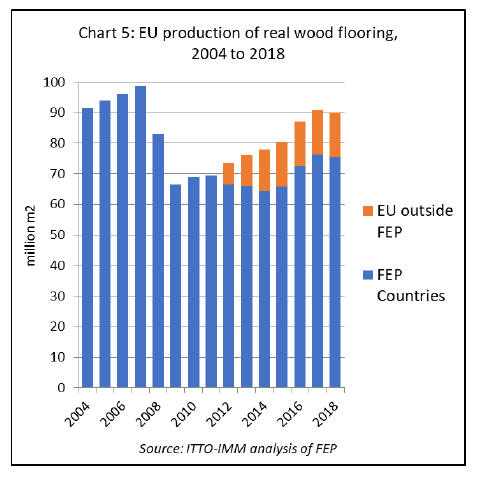

One indicator of this competition is provided by FEP data which shows

that, after reaching a decadal high in 2017, real-wood production in FEP

countries fell 1.3% to 75.3 million sq.m in 2018 (Chart 5). Total

real-wood flooring consumption in FEP countries also fell in 2018, by

2.3% to 79.9 million sq.m.

The real-wood flooring sector faces particularly fierce direct competition

from Europe¡¯s laminate flooring industry which is large and

sophisticated with sales dwarfing those of the real-wood sector (Chart

6).

Through scale and innovation, this industry has become increasingly

capable to supply products which mimic the look and feel of real wood,

while offering superior technical performance and lower maintenance at a

fraction of the cost.

According to the Association European Producers of Laminate Flooring total

European sales of laminate flooring were 334 million sq.m in Europe in

2018, around 4% less than in 2017 and the second straight year of

decline. While sales of laminate flooring in Eastern Europe were flat at

128 million sq.m in 2018, sales in Western Europe declined 6% to 206

million sq.m.

This shows that even the laminates industry may be losing share in the

EU to a range of non-wood flooring products such as luxury vinyl tiles,

porcelain tiles, and products made of recycled materials and other

renewables like bamboo and cork.

|