3.

MALAYSIA

Formaldehyde limits for domestic

panel sales

Limits on formaldehyde emissions are mandatory in many consumer countries

and the Malaysian panel products industry responds accordingly when

exporting.

However, presently in Malaysia there are no regulations on formaldehyde

emission levels for the domestic market. All wood panel products whether

manufactured locally for imported for Malaysian consumers are not subject to

inspection for formaldehyde emission levels.

To address this, the Malaysian Panel Products Manufacturers Association

(MPMA) requested the Ministry of Primary Industries (MPI) to regulate

formaldehyde emission for all panel products for the

domestic market whether they be locally manufactured or imported.

Since 2016, the Malaysian market has been flooded with imported plywood

which was suspected to have high formaldehyde content.

An awareness event was recently conducted by the Malaysian Timber Industry

Board (MTIB) among domestic plywood mills, workers, agents/importers,

intermediate users and the public. An investigation of formaldehyde emission

from Malaysian made plywood for the domestic market has been completed and

studies on MDF and particleboard are on-going.

Based on the results of an earlier study and after considering the

capability of the local wood-based panel sector a regulation for a

formaldehyde emission limit of ≤ 1.5 mg/L (F**/E1 class) on imported and

locally produced wood-based panels products was recommended. The majority of

Malaysian manufacturers can reach this standard.

Yayasan Sabah strikes a deal to spur downstream processing

The timber group Priceworth International has signed a memorandum of

understanding on log supply which will see Yayasan Sabah’s Innoprise Corp.

become a shareholder with a stake of 30% in Priceworth.

Innoprise Corp. is the investment arm of Yayasan Sabah. Yayasan Sabah (Sabah

Foundation) is a state sanctioned organisation that promotes education and

economic opportunities for the benefit of the people of Sabah. Yayasan Sabah

has the state’s largest timber concession and forest plantations.

The local media report that Priceworth and Yayasan Sabah will work on a

framework for a partnership to encourage more downstream processing in

Sabah’s timber industry at the same time complementing each other in

sustainable forest management.

Harvesting limits and low rainfall hit earnings of Sarawak companies

Sarawak timber companies WTK Holdings (WTK) and Jaya Tiasa Holdings (Jaya

Tiasa) have reported first six month2019 earnings and both point to the poor

performance of their timber and plantation sectors.

Jaya Tiasa reported a 24% drop in revenues in the first six months while WTK

reported a 17% decline in revenues for its first six months of 2019. In

commenting on the performance WTK blamed lower log output due to the dry

weather which hampered river transportation.

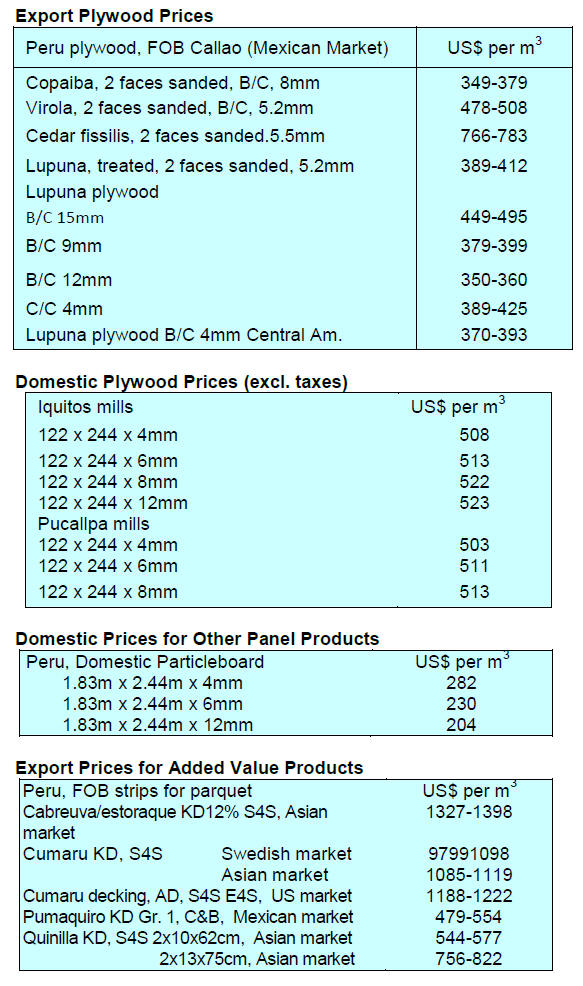

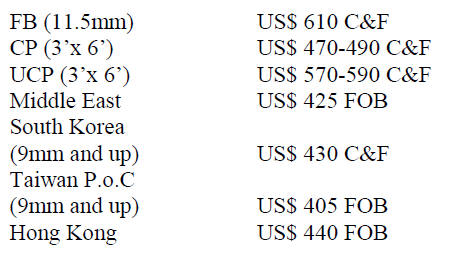

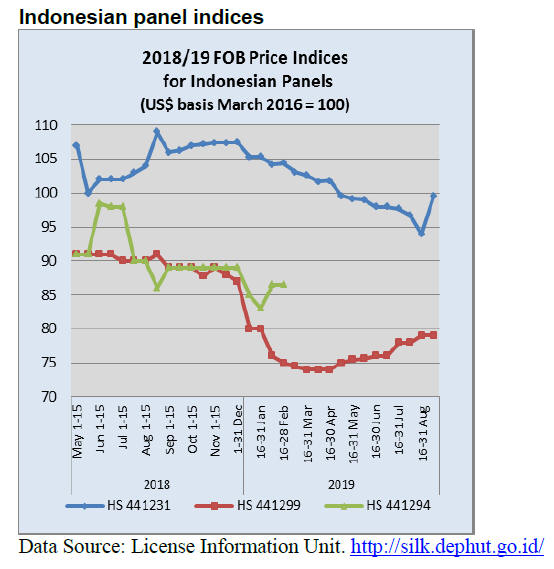

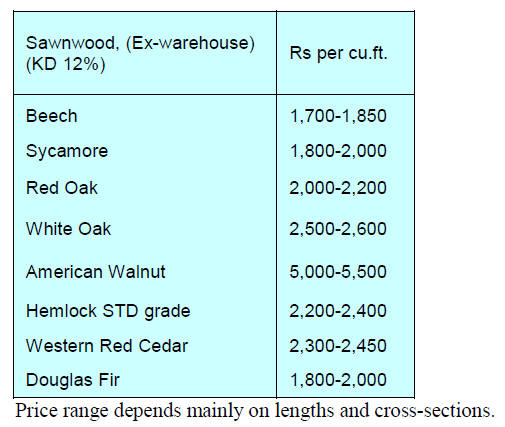

Plywood prices

Plywood traders based in Sarawak reported the following July export prices.

4.

INDONESIA

Looking for wider markets in Australia

When the new Indonesian Timber Exchange is up and running the Association of

Indonesian Forest Concessionaires (APHI) expects this year’s sales to

Australia to increase by as much as 10%.

Purwadi, APHI Chairman, said that at present only merbau from Papua and West

Papua is marketed in Australia but hopes other timbers such as matoa,

mersawa, nyatoh and resak can secure market share in Australia.

John Halkett, General Manager of the Australian Timber Importer Federation,

said that hardwood from Indonesia is used mainly for home construction in

Australia and that to market other non-structural timbers a strong marketing

campaign must be launched.

Site of new capital announced

Indonesia’s President, Joko Widodo, has announced that planning is underway

to move the capital to Borneo. Jakarta overcrowded and prone to flooding as

much of the city is below sea level and because it continues to sink.

Physical infrastructure worksfor the new capital will likely begin in 2024.

The new capital would be located in East Kalimantan Province near Samarinda

and the port city of Balikpapan.

Estimates put the cost at around US$33 billion of which around 20% would

come from government, the rest coming from public-private partnerships and

private investment. Homes for around 1.5 million civil servants will be

required.

CIFOR applauds improvements in forest governance

The Director General of the Center for International Forestry Research

(CIFOR), Robert Nasi, has applauded the advances made in forest governance

in Indonesia.

In a presentation at a forest policy discussion hosted by the Ministry of

Environment and Forestry he specifically mentioned achievements over the

past five years in establishing the Peat Restoration Agency and efforts to

reduce the occurrence of fires on peatlands.

Also mentioned was the social forestry programme which is distributing

forest land user rights over more than 12 million hectares of forest to

local communities.

Other successes mentioned were the conclusion of the VPA and issuance of

FLEGT licenses to verify Indonesia's legal wood products exported to the EU

and the moratorium on granting of new concessions for oil palm plantations.

Nasi stated that there was still a lot of work to be done especially in

terms of mapping, monitoring, transparency, and implementation in the field.

See:

https://indopos.co.id/read/2019/09/04/191911/perbaikan-signifikan-tata-kelola-hutan-di-indonesia-diapresiasi-cifor/

Furniture exhibited at Cologne show

Indonesian companies took part in the 2019 Spoga + Gafa International

exhibition held in Cologne as this was an opportunity to promote Indonesian

furniture products, not only for the German market, but also markets in

neighbouring countries.

Apart from Germans, visitors were from England, Spain, Italy, Norway, Sweden

and Latin America. Indonesian furniture entrepreneurs who participated in

the exhibition said that Indonesia's biggest competitor in international

furniture markets is now Vietnam.

Business mission to Europe and US

Indonesia's Chamber of Commerce and Industry (KADIN) will arrange a business

mission to 14 European nations and the US to boost investment and trade ties

and follow up on the ongoing trade agreement negotiations. The business

mission will focus on the vision "Making Indonesia 4.0" which aims to make

Indonesia one of the world's 10 largest economies in 2030.

In a press conference Kadin Deputy Chief for International Relations, Shinta

Widjaja, said the mission will emphasise multisectoral development

encompassing agriculture, chemical industry, packing industry, food and

beverage industry, logistics, shipbuilding, maritime port, furniture, and

the handicraft industry.

The mission to Europe began 13 September and covers visits to Turkey,

Bulgaria, Greece, Serbia, Romania, the Netherlands, Slovakia, Poland,

Switzerland, Germany, Italy, the United Kingdom, Belgium, and France.

The mission to the US will conclude on 9 October and cover involves visits

to New York, Washington, Atlanta, and Los Angeles.

5.

MYANMAR

Plan to garner support from ethnic groups

to protect the forest

The Myanmar Times has reported on comments from U Ye Myint Swe, Deputy

Minister of Natural Resources and Environmental Conservation and Dawn Del

Rio, Deputy Resident Representative of the United Nations Development

Programme (UNDP), to the effect that the government needs the cooperation of

armed ethnic groups across the country if it is to effectively address the

destruction of forests.

It was announced that a plan to fight deforestation is being jointly drafted

by the ministry and the UNDP.

See:

https://www.mmtimes.com/news/officials-want-enlist-ethnic-armed-groups-deforestation-fight.html

Support from Karen needed to protect natural resources

The forests in the Tanintharyi Region have been subject to massive

harvesting for charcoal production, a threat that first came to light 10

years ago.

The Tanintharyi Region borders the Andaman Sea and much of the coastal

mangrove has been over harvested for charcoal production. This threat

emerged in about 2005 and worried the mainly ethnic Karen villagers who had

seen the destruction caused by charcoal burners.

In related news, the Forest Department and the Karen National Union have met

to initiate cooperation for the protection of the natural resources and

lives of the Karen people.

Community forest project back on track

A 30-year forestry master plan launched by the Forest Department in 2001 set

a target of establishing community forests on almost 1 million ha, or three

percent of total forest land in Myanmar, by 2030.

As of November last year, community forests had been established on only

221,169ha, or about 24 percent of the target according to data compiled by

Voices for Mekong Forests, a European Union-funded project being implemented

by a consortium of national and international NGOs.

Government figures show that community forest approvals have increased

significantly since 2014, however. Over the past four years, 162,480 ha of

community forest has been created, compared to less than 60,000 ha in the

preceding two decades.

U Kyaw Zaw, Deputy Permanent Secretary in the Ministry of Natural Resources

and Environmental Conservation, said harvesting in community forests would

provide cash incomes for rural communities.

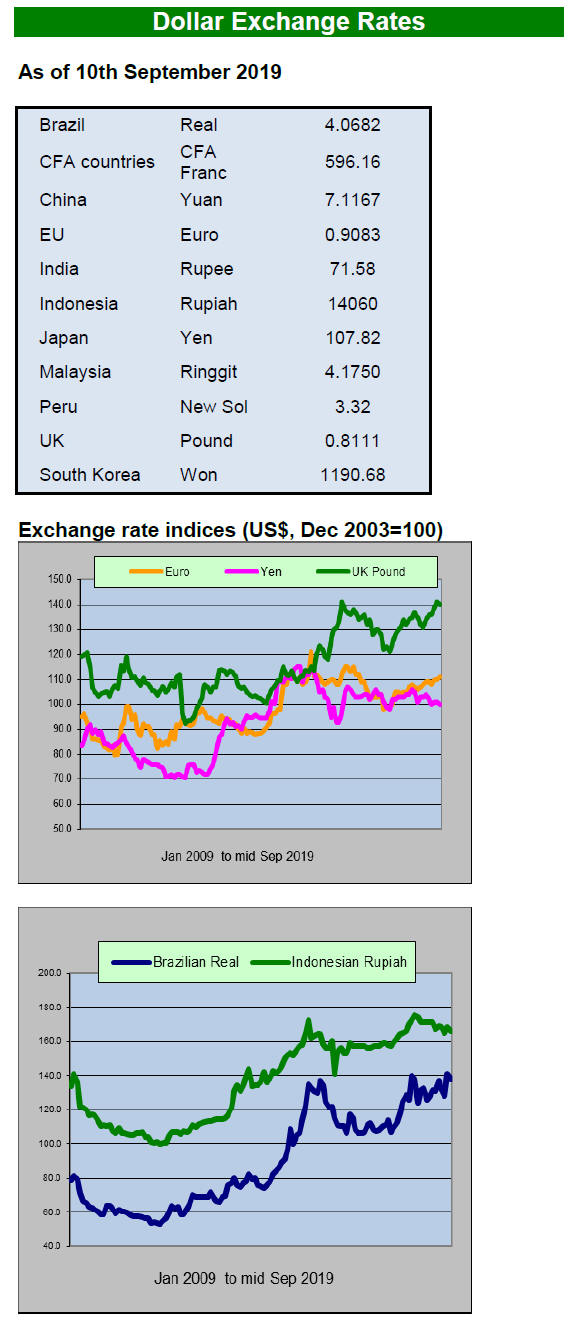

Volatility in exchange rate addressed by Central Bank

According to U Soe Min, Vice Governor of the Central Bank of Myanmar (CBM),

the bank has acted to stabilise the Kyat exchange rate and may consider

intervening in the foreign exchange markets. This was in response to the

recent exchange rate volatility the result of comments from officials to the

effect that local banks have “runaway non-performing loans”.

6. INDIA

Residential real estate sector has

potential to almost double from the current 1.5 million units in key cities

CREDAI, in association with its knowledge partner CBRE (one of the largest

real estate and investment firms) released a report “India 2030 – Exploring

the Future” at its 19th Annual International Convention, NATCON 2019 in

Israel. The report encapsulates the potential of Indian economy by 2030 and

its implications on the growth of Indian Real Estate sector.

India is projected to have a US$9 trillion economic opportunity by 2030,

wherein the per capita income could touch US$5,625 for a population of about

1.5 billion and required annual spending on infrastructure could rise to

7-8% of GDP.

Emergence of India’s digital, sharing and consumer economy, evolution of

workplace strategy, technology will also bode well for the industry. The

demand for residential and office stock will continue to grow at the back of

policy reforms on Affordable Housing and close-integration of start-ups and

conglomerates to offer tech-enabled services.

By 2030 the residential real estate sector has the potential to almost

double from the current stock of 1.5 million units in key cities says the

report. The millennial population is expected to account for 77% of the

overall working population in India by 2030. The housing needs of this group

is unique as they look for convenience, service and a stressfree experience

when purchasing.

Consumer demand will remain concentrated in the affordable segment and will

gradually shift towards the mid-range segment but affordable housing will

remain the dominant segment in the coming years.

See:

https://credai.org/press-releases/credai---cbre-report-exploring-the-future-identifies-key-trends-paving-the-way-for-growth-of-real-estate-in-2030

Unintended consequences – CITES rosewood regulation impacts

livelihood of Indian farmers

Writing in the Times of India under the headline “The commercial extinction

of Indian rosewood from global markets - Abundant yet redundant“ Varsha

Singh explains the impact on Indian farmers of the CITES listing of

rosewood.

Despite the decision by CITES to allow cross border transport of finished

musical instruments with rosewood components without the need for CITES

permits as well as trade in finished rosewood products such as handicrafts

weighing less than 10 kilograms per shipment, the tight regulation of

rosewood is impacting Indian farmers.

Dalbergia sissoo or rosewood is available in abundance in India and is

widely preferred in Indian households as the best choice for home

furnishings.

The decision to list rosewood by CITES has affected farmers in India who

rely on sissoo (shisham) trees to supplement their income. Singh writes “Dalbergia

sissoo is a species for agroforestry and millions of farmers plant this in

their fields as an investment for future needs such as children’s education,

medical emergencies etc. and as an insurance against bad years“.

Citing a Botanical Survey of India which shows Dalbergia sissoo does not

fall into any threatened category and is available in abundance both in the

wild and cultivated populations the Ministry of Environment attempted to

delist Indian rosewood but CITES was not convinced.

Read more at:

http://timesofindia.indiatimes.com/articleshow/70941048.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Indian furniture makers show interest in Swedish softwood

In a press release Swedish Wood, which represents the Swedish sawmill

industry and is part of the Swedish Forest Industries Federation, reports

that its experience at the recent ‘India Wood‘ was that Indian industry is

showing strong interest in Swedish pine, particularly for furniture and

joinery.

There was strong interest in the Swedish softwoods, particularly pine, from

visitors who mainly comprised representatives of Indian furniture and

joinery companies, wood importers and, to a lesser extent, interior

designers, architects and furniture designers.

Charlotte Dedye Apelgren, Director of Interior and Design at Swedish Wood

writes “The signals we received from the Indian furniture market at the

trade show is that the younger generation are showing an interest in

softwood furniture that is relatively light, feels modern and is easy to

transport when moving house, for example.”

Swedish exports of sawn wood products to India are currently quite modest

but they are growing rapidly. Last year Sweden exported 27,000 cubic metres

of sawn softwood worth around SEK 50 million. Sweden is the fifth largest

country for softwood exports to India and has seen the greatest increase in

exports in recent years. The Swedish sawmill industry sees India as a

priority market for the future, and exports to India from Sweden are

expected to continue growing.

See:

https://www.swedishwood.com/about_us/news/2018/3/india-has-the-potential-to-become-an-important-market-for-swedish-pine-in-the-future2/

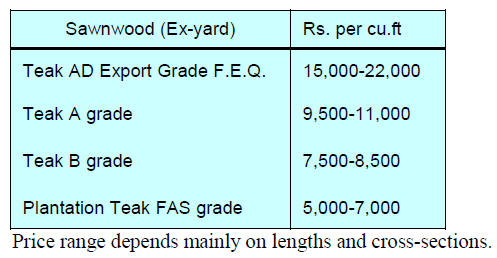

Plantation teak imports

The rupee/dollar exchange rate has become more volatile in recent weeks. In

early September the dollar was at over 72 rupees but a slight strengthening

of the dollar lifted the rate back to 71 to the dollar in mid-month.

Analysts write that the government has signalled it is closely watching

exchange rates and the performance of the economy. Many analysts expect

further stimulus to boost growth.

C&F rates for Indian ports from various other sources continue within the

same range as given earlier.

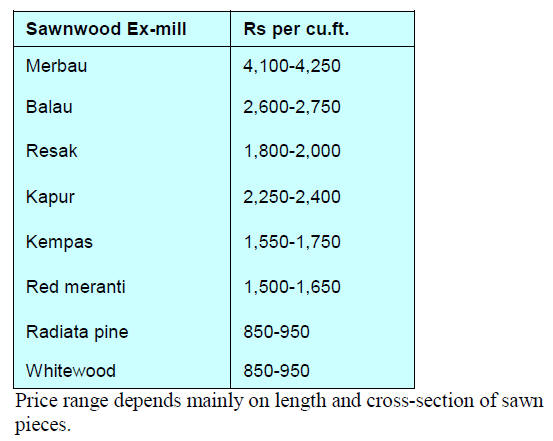

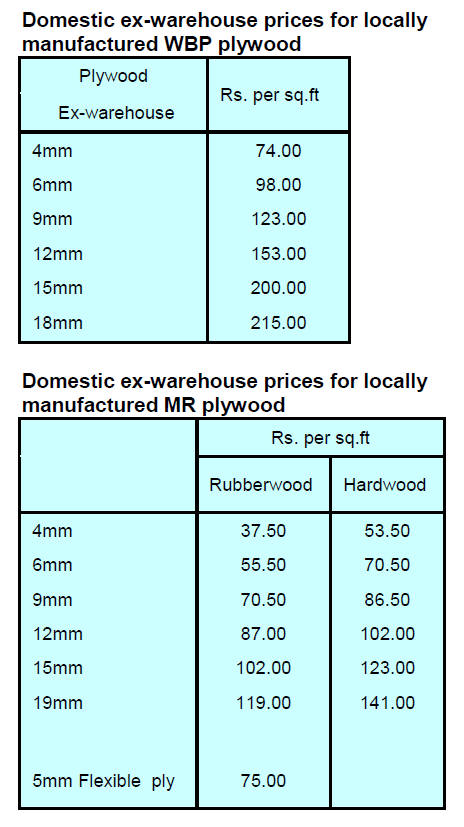

Locally sawn hardwood prices

Demand for domestically sawn imported hardwoods has been maintained and

supplies are stable. Prices remained unchanged over the past two weeks.

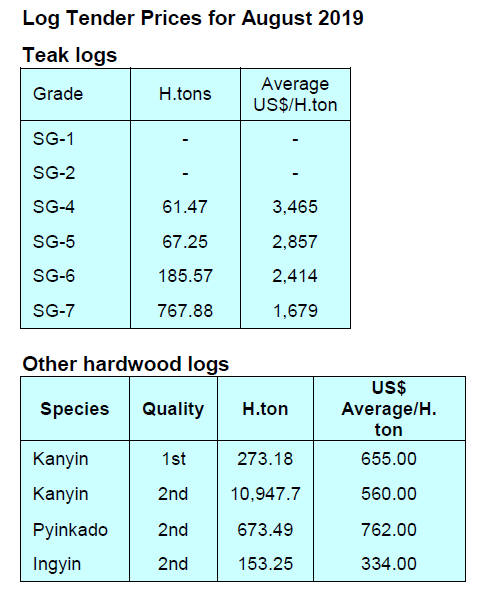

Myanmar teak prices

Demand for Myanmar teak has slowed mirroring the strengthening of the rupee

which pushed up import costs. Looking ahead, importers are hoping a change

in GST rates will allow them to maintain sales prices.

Sawn hardwood prices

Current prices are unchanged.

Plywood

End-users continue to purchase at the recently increased base price.

7.

VIETNAM

Production and exports first 7 months of

2019

In early September the Ministry of Agriculture and Rural Development

arranged a conference on forestry development and wood processing,

production and exports for the first 7 months of 2019. During the conference

the Ministry presented its plans for the final months of this year. It was

reported that Vietnam’s exports of forest and wood products in the first 7

months reached US$6.047 billion up by 17.9% compared to the same period in

2018.

Vietnamese wood products are exported to over 128 markets. The top 5 export

markets are the US, EU, China, Japan and S. Korea which accounted exports of

US$5.3 billion or around 88%, of total exports.

In Vietnam, as of July, there were about 5,424 enterprises of which 621 were

foreign investments.

In the conference, the VFA commented on future opportunities and challenges,

especially how Vietnamese exporters could take advantage of the US-China

trade conflict to capture a large share of the US market lost by Chinese

competitors.

This said, the VFA could identify opportunities for Vietnamese firms to

enhance their productivity, market capacity and economic value as added

value products are demanded in the US market.

The other advantage for the country as a result of the US/China conflict has

been increasing foreign investment flows from China into Vietnam aiming to

take advantages of competitive labour costs, the favourable business

environment and supportive infrastructure. Furthermore, the Vietnam/EU VPA

FLEGT and new forest laws that came into forces in June 2019 has facilitated

wood processing and exports to the EU as well as other global markets.

Regarding challenges the VFA highlighted concerns on possible negative

environmental, social and economic impact of incoming investment in the

forestry sector. There are also serious concerns on possible commercial

fraud and fake origin documentation for wood products which would undermine

the credibility of reputable companies that export.

The other worrying issue is the increasing trade deficit between Vietnam and

the US,. Discussions are underway to find a solution to address this

imbalance.

See:

http://tongcuclamnghiep.gov.vn/LamNghiep/Index/hoi-nghi-danh-gia-tinh-hinh-che-bien-xuat-khau-go-va-lam-san-cac-thang-dau-nam-2019-4060

Fostering forest plantation for exports in Vietnam

Quangtri, in the Central Vietnam, has suffered serious forest loss and is a

poor province but efforts by the government in cooperation with WWF are

having a positive impact and the forest cover has risen from 47% in 2010 to

almost 50% this year. The support for Quangtri was initiated in 2017 through

a joint programme for sustainable forest development by WWF, the Vietnam

Forest Administration (VFA) and the Quangtri Department of Agricultural and

Rural Development.

At the same time as the forest area was being expanded policies were adopted

to support local enterprises in establishing wood processing capacity. There

is an estimated 22,000 ha of FSC-certified plantation forests in 31 clusters

in 51 districts of Quangtri.

See:

https://nongnghiep.vn/day-manh-trong-rung-gan-voi-xuat-khau-post248941.html

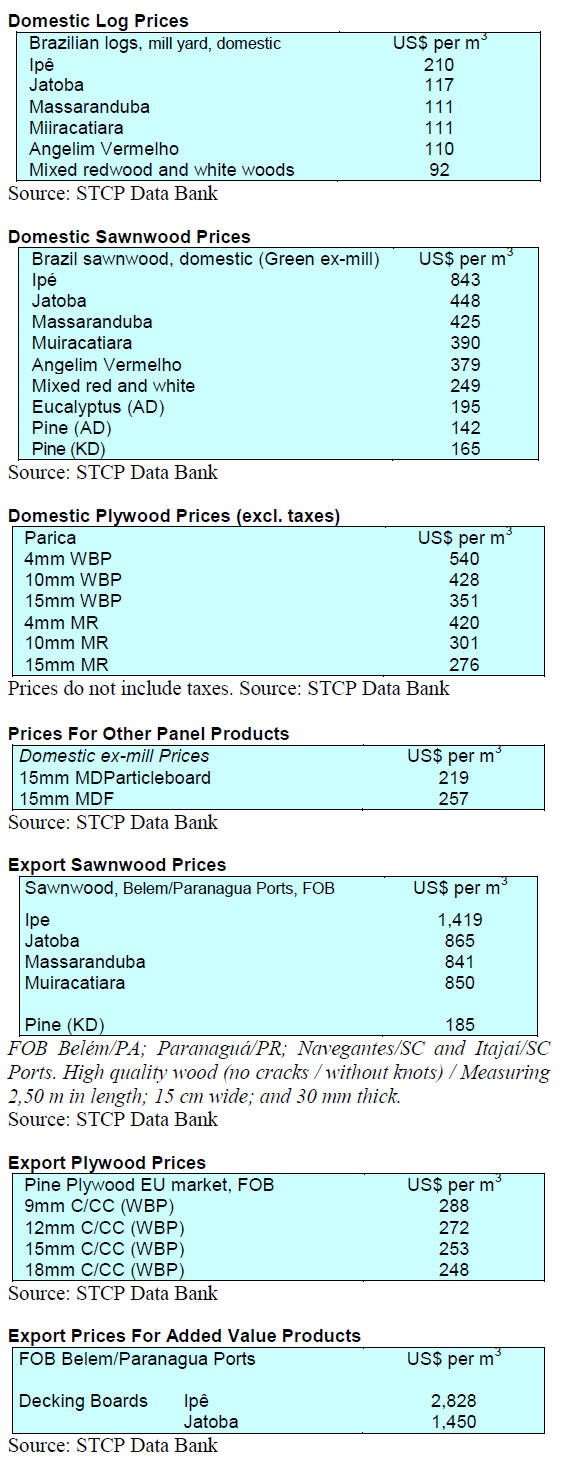

8. BRAZIL

Drop in June furniture production but

half year figures remain positive

The Furniture Industry Association of Rio Grande do Sul (Movergs) recently

presented the results of its survey of the furniture sector in Rio Grande do

Sul. The survey covers the retail trade, industry and job creation.

Overall, furniture sales in June declined as the number of furniture pieces

sold fell 9.7% compared to May and retail income also fell (-10%). The

recent decline reverses an uninterrupted period of expansion that began in

February this year. However, due to the good sales results up to May, the

growth in sales in the first half of 2019 expanded 3.2% year on year.

In terms of production, June saw an 11% decline compared to May. Despite

this, in the first six months of 2019 the overall decline in production was

just 1.2% compared to the first half of 2018 yet revenues earned by the

furniture industry grew 7.5% in the first months of 2019.

Furniture production in Rio Grande do Sul has shown ups and downs. In the

first quarter there were two months of consecutive declines (February and

March). The months of April and May showed growth but that was reversed in

June, the worst month of the year so far.

Because of the slowdown, job creation in the sector fell in June and

compared to the first half of 2018 there was a fall in jobs this first half.

New report – recovery of 12 million ha. of native vegetation

possible by 2030

The Brazilian Platform on Biodiversity and Ecosystem Services (BPBES),

supported by the Research Programme on Biodiversity Characterisation,

Conservation and Sustainable Use (-FAPESP-BIOTA) and the International

Institute for Sustainability (ISS), has released the document “Landscape and

Ecosystem Restoration”, which states that it is possible to recover 12

million hectares of native vegetation of the country by 2030.

Brazil has lost about 71 million hectares of native vegetation in the last

30 years as a result of deforestation and forest fires among other factors

according to MapBiomas. This damage can be repaired through enabling the

recovery of 12 million hectares of native vegetation across the country by

2030 as set out in the National Ecological Restoration Plan.

Through this it would be possible to sequester 1.4 megatons (Mt) of carbon

dioxide (CO2) from the atmosphere, interconnect natural fragments in the

landscape and further increase biodiversity conservation without impairing

agriculture output.

Brazil has the opportunity to develop a unique native vegetation recovery

programme for forested areas of the Atlantic Forest and the Amazon

rainforest.

This is because the country can count on a great diversity of species in

restoration projects.

See:

https://www.ipbes.net/news/launch-summary-policy-makers-1st-brazilian-assessment-biodiversity-ecosystem-services

China is main competitors in the US moulding market

The global market for mouldings is important for Brazilian exporters. In

2018, Brazil exported about US$214 million in mouldings mainly to the US

which accounted for over 90% of the total volume of timber mouldings

exported. The balance was exported to over 20 countries.

Brazilian wood mouldings are mainly made from pine and the main producers

are located in Paraná and Santa Catarina. Together these states produce

almost the entire volume of mouldings made in the country. Paraná leads in

exports, accounting for about 75% of the total volume.

According to the Brazilian Association of Mechanically-Processed Timber

Industry (ABIMCI), “the moulding market is stagnant due to constraints on

civil construction work in the US and the aggressive strategy of Chinese

producers. China is Brazil’s biggest competitor in the US market, the

world's main consumer.

Furniture imports and exports

The Brazilian Furniture Industry Association (Abimóvel) has released the

main furniture market indicators for June and July 2019. In June 2019,

Brazilian furniture exports totaled US$50.8 million, down 10.7% over the

previous month, while imports grew 3.5% in June, reaching US$15.5 million.

In July, Brazilian furniture exports totalled US$54 million, an increase of

6.3% compared to June, while imports increased 6.7% in July, reaching

US$16.5 million. In June 2019, the share of imported furniture in Brazil in

apparent consumption was 3.1%, while the share of exported furniture in

production was 7.3%.

On the other hand, Brazilian furniture sector exports totalled US$353.6

million in the year to June 2019 representing a 4.1% increase compared to

the same period of 2018. Of this total, furniture exports to the United

States which accounts for a third of exports increased of 12.5% year on

year.

The states of Santa Catarina (41.3%), Rio Grande do Sul (28.9%) and Paraná

(14.8%) together accounted for over 80% of Brazilian furniture exports

between January and July 2019.

In terms of imports, of the main suppliers French and Mexican shippers saw

significant growth compared to a year earlier.

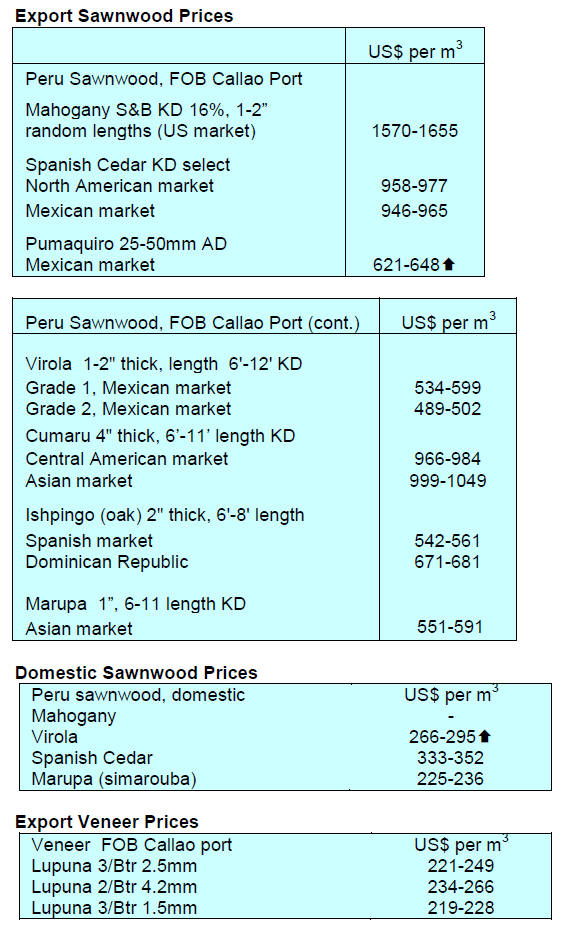

9. PERU

National training on forest

product identification

Stakeholders involved in monitoring, control and promotion of wood products

have been participating in a national training programme on a recently

updated Explanatory Guide for Timber Identification which was published at

the end of last year.

This training was an initiative of the National Forest and Wildlife Service

(SERFOR) with technical support from the USAID FOREST programme and the

United States Forest Service.

The objective of this training programme was to raise awareness of the

criteria and methodology used in preparation of the guide and the additional

features. The training aimed to facilitate the identification of the 85

forest products contained in the new list.

The training programme began at the end of July and culminated at the

beginning of September. Workshops were held in Lima, Ucayali and Madre de

Dios and involved about 150 technicians and specialists in the forestry

sector.

Exchange visit to Colorado

In early September a delegation of Peruvian officials visited the US to meet

with US Forest Service staff to experience environmental management and

impact assessment in projects in Colorado national forests.

The Peruvian delegation comprised officials from the National Environmental

Certification Service (SENACE), the Environmental Assessment and Control

Agency (OEFA), the Ministry of Environment and the Ministry of Energy and

Mines. A representative of the Confederation of Amazonian Nationalities of

Peru (CONAP) and a student from the National University of the Peruvian

Amazon (UNAP) also participated.

During the visit the Peruvian delegation were shown various projects

implemented within national forests managed with the participation of the

USFS, Bureau of Land Management (BLM), Colorado Department of Natural

Resources, Colorado State Forest Service and the private sector.

The visit allowed Peruvian officials to understand that with proper zoning

and management it is possible to conserve the forest and wildlife while also

performing profitable and responsible extractive activities.

Forest fires extinguish in Ucayali

Four forest fires recorded during the first week of September in the

districts of Campo Verde, Yarinacocha, Raymondi and Alexander Von Humboldt

(Ucayali) were completely extinguished thanks to the work of the personnel

of the Volunteer Fire Department of Peru, local authorities and residents of

area. Personnel from the Office of Disaster Risk Management conducted damage

assessment and needs analysis.

SERFOR - Amazon countries must establish a pact to protect the

Amazon

The Executive Director of the National Forest and Wildlife Service (SERFOR),

Alberto Gonzales-Zúńiga Guzmán, has emphasised the willingness of the

governments of Peru and Colombia to integrate their respective policies for

sustainable use of the Amazon and said that this vision should be shared by

all Amazonian countries.

Gonzales-Zúńiga said that, although it is important that the G7 developed

countries announced their intention to present a plan for the reforestation

of the Amazon it is much more important that the Amazon countries themselves

establish a pact to ensure protection of the Amazon.

Gonzales-Zúńiga indicated that deforestation is a permanent problem in

Amazonian countries. In Peru, in 2017, 155,914 hectares of Amazon forest

were deforested. Almost 60% were concentrated in four Amazonian regions,

Ucayali, Madre de Dios, Huánuco and Loreto.

Shifting agriculture is one of the causes of deforestation in the humid

Amazonian forests that is why Gonzales-Zúńiga said that SERFOR will continue

with a campaign to raise awareness among farmers that they cannot burn

illegally.