|

Report from

North America

Imports of wooden furniture dropped in first quarter

2019

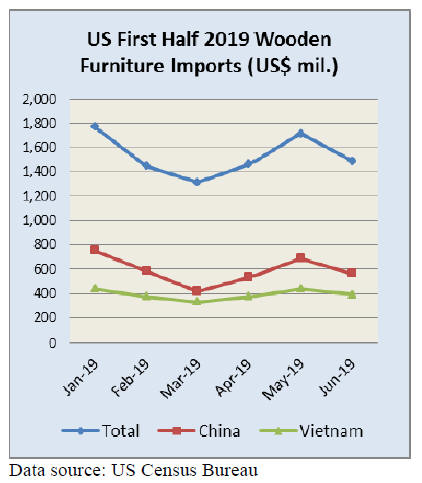

US imports of wooden furniture slowed by 13% in June

and have now fallen behind 2018 totals for the first time

this year. At US$9.17 billion through June, total imports

are down 2% year to date.

Imports from China account for most of the slowdown,

falling 18% both for June and for the year to date. Imports

from Vietnam, while falling 11% in June, are up 28% year

to date.

US removes some tariffs - furniture exporters to

benefit

The United States Trade Representative's (USTR) office

has announced that tariffs will be removed from some

Chinese imports. The majority of the removed tariffs are

those on furniture products including wooden chairs and

children¡¯s furniture.

"Certain products are being removed from the tariff list

based on health, safety, national security and other factors

and will not face additional tariffs of 10 percent," said a

USTR press release. As part of USTR¡¯s public comment

and hearing process it was determined that these tariffs

should be delayed until December.

EPA publishes correction to formaldehyde rule

The Final Technical Corrections Rule that makes technical

fixes to the US Environmental Protection Agency's (EPA)

Formaldehyde Emission Standards for Composite Wood

Products regulation was published in the Federal Register.

The International Wood Products Association (IWPA) is

working with EPA to schedule a webinar on the technical

fixes following the Labor Day holiday.

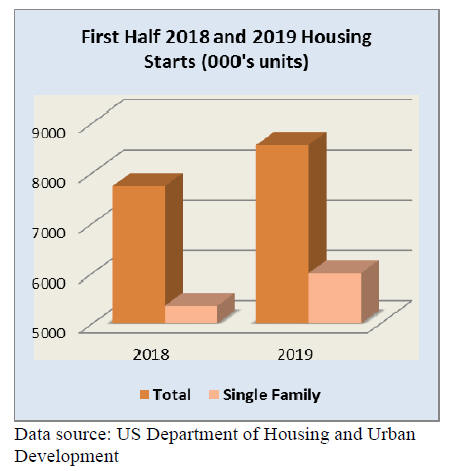

Weakness in US apartment building

US new-home construction unexpectedly fell in July for a

third month on another drop in starts of apartment

buildings that masked a gain in single-family units.

Residential starts dropped 4% to a 1.19 million annualised

rate after a downwardly revised 1.24 million pace for June.

Multifamily home construction slumped for a second

month, while starts of single-family housing increased to

the highest level since January.

Starts for multifamily homes, a category that tends to be

volatile and includes apartment buildings and

condominiums, decreased 16.2% after a 16.4% decline in

June, while permits increased 21.8% last month.

Single-family starts climbed 1.3% to an 876,000

annualized rate, and permits rose for a third month. Singlefamily

housing starts rose in the Northeast, West and

Midwest, but dropped 3.9% in the populous South.

Record high employment, but 2018 figures revised

down

Payroll growth rose in line with expectations in July and

the unemployment rate remained at 3.7% amid a sharp

jump in the size of the labour force to its highest level

ever.

The Labor Department reported that payrolls increased

164,000 during the month, just 1,000 below the 165,000

Dow Jones forecast. This also was about the average

monthly gain for the year.

Economists had expected the unemployment rate to drop

to 3.6%, which would have tied a 50-year low, but an

influx of 370,000 new workers to the labour force brought

the participation rate up to 63%, its highest since March.

The total labor force of 163.4 million set a record high.

This positive news was offset by a Labor Department

announcement that it was revising down total job gains

from April 2018 to March 2019 by 501,000, the largest

downward revision in a decade.

The agency¡¯s annual benchmark revision is based on state

unemployment insurance records that reflect actual

payrolls while its earlier estimates are derived from

surveys. The large change means job growth averaged

170,000 a month during the 12-month period, down from

the 210,000 initially estimated.

Manufacturing still growing but at a slower pace

Economic activity in the US manufacturing sector

expanded in July and the overall economy grew for the

123rd consecutive month, say the nation¡¯s supply

executives in the Manufacturing ISM Report on Business.

The ISM manufacturing index continued to show

expansion, but slipped lower for the fourth straight month.

Manufacturing supply executives reported contraction in

both imports and new export orders.

However, the wood products industry was the only one of

the 18 ISM sectors reporting growth in imports in July.

Wood products led the nine industries that reported growth

in July, although some respondents credited that to

seasonality.

US consumer confidence falls to lowest level for 2019

US consumer sentiment fell to 92.1 in August, the lowest

indicator since the start of 2019. The dip points to further

uncertainty in the US economy, as consumers navigate

wild market swings and a constantly shifting trade

environment.

The University of Michigan¡¯s preliminary August reading

came in well below Wall Street estimates. The August

losses spanned all index components, according to the

report. Businesses across all sectors have curtailed

spending amid efforts to counteract the impact of

reciprocal US and China tariffs. Poor consumer sentiment

suggests those efforts haven¡¯t fully staved off concern.

Disclaimer:

|