Japan

Wood Products Prices

Dollar Exchange Rates of 25th

August

2019

Japan Yen 106.13

Reports From Japan

¡¡

Nothing at present to reverse current

negative trade

trends

All eyes in Japan have been focused on the trade

negotiations between Japan and the US and while there are

signs that a deal is close the news was not enough to lift

Japanese business sentiment or sway foreign exchange

markets that have seen the Japanese yen, a safe haven in

times of anxiety, strengthen to 104 to the dollar for a short

while in late August. Analysts say there is little that could

reverse the negative trends at present.

The weak business sentiment in Japan stems from the

impact of the US/China trade dispute, the weakening

Chinese currency and the slowdown in manufacturing in

all industrialised nations.

Export growth into reverse

The Ministry of Finance has reported that exports fell

1.6% year on year in July marking one of the longest

periods of monthly declines since a 14-month long bad

period in between October 2015 and November 2016. The

main reason for the decline was the drop in exports to

China of electronic goods and car parts.

Not surprisingly, manufacturers¡¯ confidence (Reuters poll)

turned negative for the first time in more than six years.

See: https://www.reuters.com/article/us-japan-economytrade/

japans-exports-slip-for-eighth-month-sales-to-china-dropas-

recession-fears-grow-idUSKCN1V9015

No increase in annual bonuses for workers

Most Japanese companies have decided not to raise annual

bonuses this year. Annual bonus payments are considered

another measure of business confidence in Japan. In

contrast, the National Personnel Authority has advised the

Cabinet to raise salaries and bonuses for government

employees in fiscal 2019.

If this recommendation is adopted it will be the sixth

consecutive pay rise for civil servants. The Authority said

the increase is necessary to close the income gap with the

private-sector.

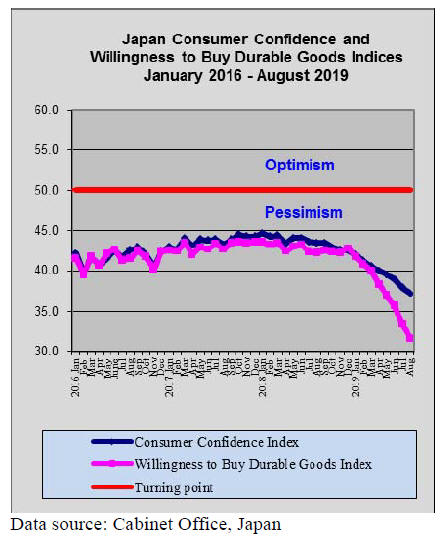

Consumer sentiment at five and half year low

The Cabinet Office August consumer sentiment survey

reports sentiment fell for the 11th month in a row,

dropping to the lowest level in nearly five-and-a-half

years. The survey covered 8,400 households across Japan

on their perceptions of overall livelihood and other

categories for the next six months.

The overall index fell to a low last seen in April 2014.

Among the other sub-indexes the index reflecting

households¡¯ inclination to buy durable goods continued

down as did indicators measuring overall livelihood and

employment prospects.

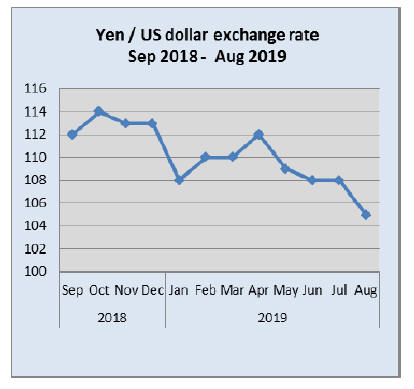

Rush to yen as global uncertainty rises

The flight to safety brought on by another series of US

tariff increases on Chinese exports caused a sharp

strengthening of the yen which rose to its highest level

against the US dollar since late 2016.

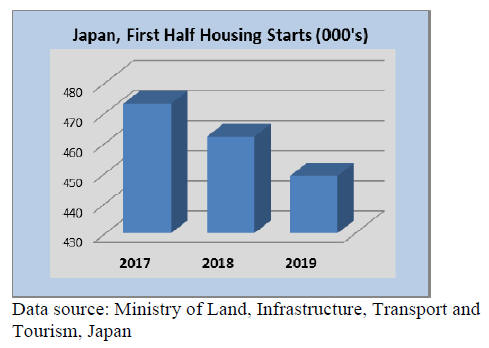

Housing starts down for 3 consecutive years

Over the past 3 years there has been a steady decline in

housing starts in Japan. Between 2017 and 2018 first half

year starts dipped 2% and there was a 3% decline between

2018 and 2019. Housing stars have dropped around 5%

over the past three years.

Residential building prices have started to fall according to

data from the Land Institute of Japan. The average price of

new condominiums in Tokyo dropped 1.65% y-o-y in the

second quarter of 2019, a sharp slowdown from growth of

almost 10% a year earlier.

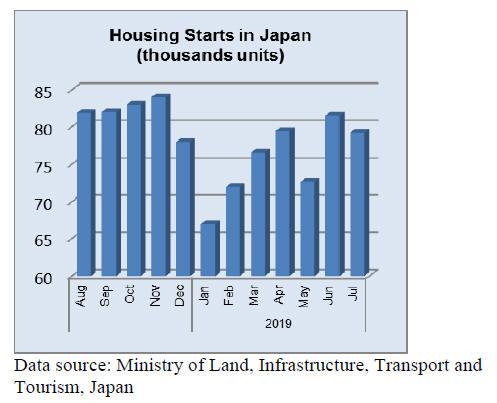

July 2019 housing starts dropped 3% month on month

and

were down around 4% year on year.

Import update

Furniture imports

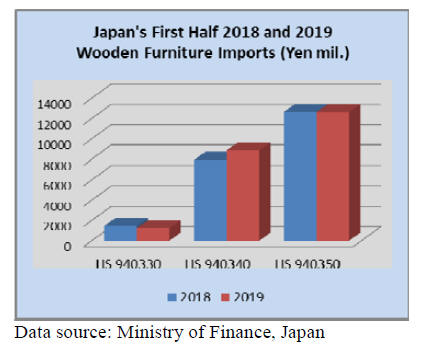

The value of first half 2019 imports of wooden office

furniture HS 940330 were down around 14% compared to

the first half of 2018 and there was a slight year on year

dip in imports of wooden bedroom furniture in the first

half of 2019.

What stands out was the 12% increase in wooden kitchen

furniture in the first half of 2019 compared to the same

period in 2018. This rise in kitchen furniture imports

mirrors the steady increase in housing starts in Japan

which, except for May, have been rising since January this

year (see housing starts above).

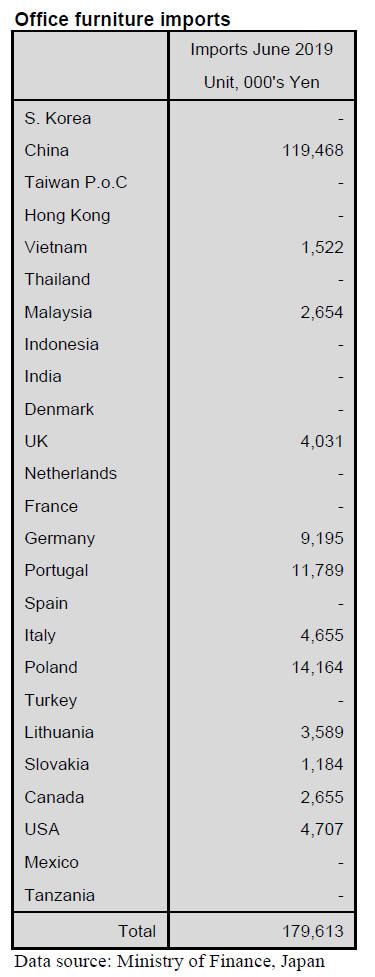

Office furniture imports (HS 940330)

Year on year, the value of June imports of wooden office

furniture declined 12% and month on month, June 2019

imports were down 19%.

Building on the rise in shipments in May, the value

of

June shipments of wooden office furniture rose again in

June and accounted for around 66% of all Japan¡¯s wooden

furniture imports. China is the biggest supplier and the

other significant suppliers in June were Poland (8%) and

Portugal (7%). In total, shippers in the EU accounted for

just 28% of June imports.

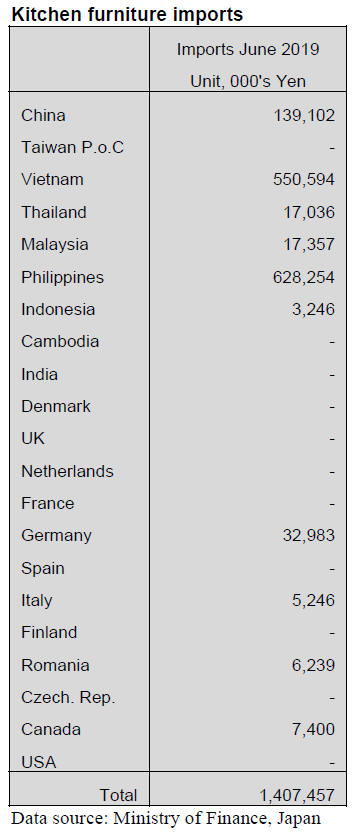

Kitchen furniture imports (HS 940340)

Exporters in the Philippines and Vietnam maintained their

huge share grip of Japan¡¯s imports of wooden kitchen

furniture. In June exports from the Philippines edged

Vietnam into second place. However, both sources

dominate wooden kitchen furniture imports into Japan.

In June the Philippines accounted for 45% of Japan¡¯s

wooden kitchen furniture imports while Vietnam provided

another 39%. China is not a major shipper of wooden

kitchen furniture to Japan, supplying just 10% of June

import values. Exporters in Asia accounted for 96% of

Japan¡¯s wooden kitchen furniture imports in June.

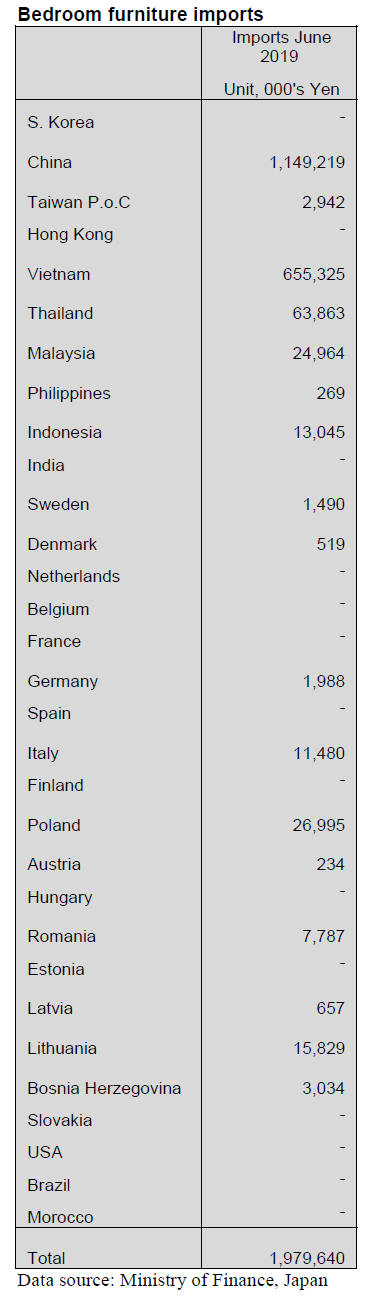

Bedroom furniture imports (HS 940350)

With Japan being a highly developed and quality

conscious market it is surprising that just 4% of bedroom

furniture imports are from the EU. Manufacturers in China

and Vietnam have successfully penetrated the Japanese

bedroom furniture market supplying almost 85% of all

Japan¡¯s June wooden bedroom furniture imports.

The year on year value of shipments of wooden bedroom

furniture was up 4% in June but, compared to a month

earlier, June arrivals were down 9%.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

June plywood supply

Total supply in June was 476,200 cbms, 7.4% less than

June last year and 5.3% more than May. Production of

softwood plywood was 276,300 cbms, 1.6% more and

8.3% more, the highest record. Supply of imported

plywood was 189,900 cbms, 18.2% less and 1.8% more.

Domestic supply renewed record high after two new

plywood mills started in late May and the production by

these mills added on in June. The shipment of softwood

plywood was 270,200 cbms, 8.2% more and 2.4% more.

This is the second highest after last January. Since the

production exceeded the shipment, the inventories were

121,800 cbms, 6,800 cbms more than last month. Plywood

mills¡¯ inventories were only 0.4 month so hand-to-mouth

operation continues.

In imported plywood, Malaysian supply was 61,000 cbms,

23.5% less and 4.3% less. This is the lowest in last five

years. Indonesian supply was 70,700 cbms, 17.4% less and

22.8% more. China supplied 43,000 cbms, 7.7% less and

16.8% less. Because of sluggish market in Japan, the

importers have not placed much orders to the supply side

so future arrivals seem to continue low.

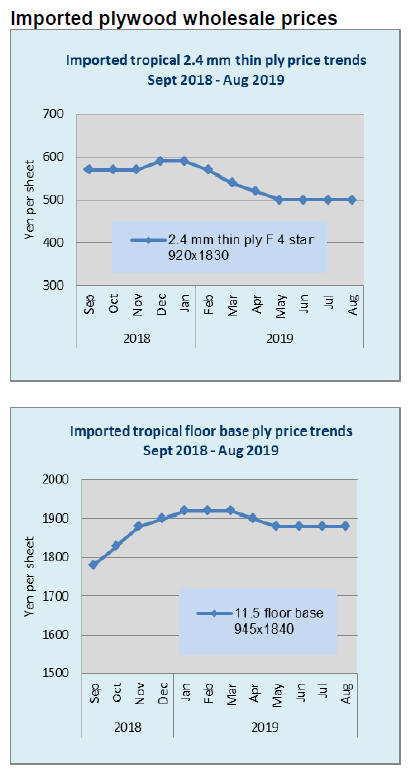

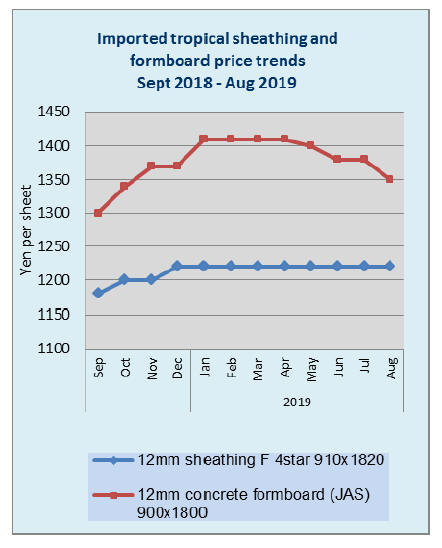

Plywood

There are two different pictures between domestic

plywood and imported plywood. Domestic softwood

plywood shipments continue very active and the

manufacturers continue a full production with low level

inventories.

Meantime, movement of imported plywood market

continues slow and high export prices and low market

prices in Japan continue.

Precutting plants secured enough orders from large house

builders so the operations keep busy. They need more

volume of softwood plywood to catch up orders.

Movement in distribution channels is slow.

Domestic manufacturers continue a full production but due

to high level shipments same as the production, they

are not able to build up the inventories so there are some

short items like thick panels, which delivery takes much

longer now.

Since the manufacturers have received enough orders for a

month, they are not able to accept any more order for

August. In this situation, plywood mills try to correct price

difference and bring the prices up to the proposed prices

after there were gaps between proposed prices and actual

market prices and the gap is gradually narrowing.

Movement of imported plywood varies by the area.

In Tokyo region, condo starts slowed down and many

redeveloping properties are in stage of interior finishing

and new properties will be next year so the demand for

imported plywood is slow. Meantime, in Kyushu and

Nagoya regions, condo starts are busy so that there is

ample demand for concrete forming panels but desired

prices by the contractors are severe.

By stagnating movement of imported plywood in Tokyo

market, the market prices continues depressed while the

suppliers export prices remain high. There are some short

items in the inventories so the dealers wish to place orders

but price gap between the suppliers and market in Japan is

too much so they are not able to place new orders.

Actually new orders dropped considerably since late last

year so arrivals of imported plywood in May and June

were less than 200,000 cbms, record low arrivals for two

straight months. There is no more congestion of bulk ships

so the inventories will decrease further more.

South Sea (tropical) logs and Lumber

Arrivals of PNG logs are steady. Log production in PNG

is dropping due to rainy season but plywood mills in

Japan carry ample log inventories so there is no fear of

supply shortage. Log demand by China and India is not

so active so the suppliers are not able to push the log

export prices up.

Log prices in Sarawak, Malaysia are softening by

improved log production but the prices of higher grade

logs Japan wants have very little influence.

Market prices of laminated free board from South East

Asian countries are s steady. Mercusii pine supply is

steady in Indonesia and the prices are the same as Chinese

red pine laminated board.

Orders for interior refurbishing of public facilities and

commercial shops got active before summer vacation,

which stimulated the demand. Interior works for building

to complete before the consumption tax increase will start

shortly so the demand should stay firm despite increased

supply.

Domestic logs and lumber

Due to prolonging rainy season, log production dropped in

July but the supply was ample in the first half of the

year so that sawmills¡¯ log inventory is full.

After log supply declined, post cutting cedar log prices are

firming and cypress log prices are also firm in Kyushu and

Chugoku region. August is the month with least log

production so log prices seem to stay firm through

September.

Lumber orders increased since last July by major

precutting plants. Orders on KD solid wood lumber, cedar

laminated lumber and cedar FJ stud are active. Meantime,

supply of 120 mm post, stud, sill and girder is excessive.

Market lumber prices are weak by oversupply with active

supply from sawmills. Also supply of imported Douglas

fir KD beam, hemlock sill, whitewood laminate post and

whitewood stud increased this year and the prices are

weakening, which influence domestic lumber market

Import of wood fuel for the first half.

Import of major wood fuel during the first six months of

this year is 750,319 ton of wood pellet, 56.7% more than

the same period of last year while PKS is 628,029 ton,

3.2% less.

Sources of wood pellet are Vietnam with 420,902 ton,

219.6% more, Canada with 266,806 ton, 19.4% less,

Australia with 29,255 ton, 211.6% more, Malaysia with

19,822 ton, 417.9% more. This is the first time that

Vietnam¡¯s volume exceeded Canadian as the demand to

use with coal burning increased.

Reasons that the Canadian volume dropped are Canadian

pellet manufacturing plant had some trouble then stop of

Keihin biomass power generation plant, which used

Canadian wood pellet mainly. Wood pellet from the U.S.A

is only 163 ton but there are several long term contracts

with large power plants, which will start up shortly so the

U.S. will be a major supplying country in coming years.

International wood pellet market is firming with recovery

of European demand but there is difference between long

term contracts and spot deals. Spot deals in the South East

Asia are soft after Korean demand decreased so the

Vietnamese pellet prices are on weak side.

Present prices for Japan market are holding at $130-140

per ton C&F. North American long term contract prices

are very firm since there are limited number of suppliers.

Demand for wood pellet in Japan seems to be firm but

large new power plants are looking for long term contracts

with South East Asian suppliers because North American

prices are high.

PKS import for the first half is almost the same as last

year. Sources are Malaysia with 131,455 ton, 31.3% less,

Indonesia with 496,280 ton, 8.6% more. FIT power plants

look for sustainable supply of PKS so the future is

uncertain.

|