Japan

Wood Products Prices

Dollar Exchange Rates of 10th

August

2019

Japan Yen 106.74

Reports From Japan

¡¡

Economy gets a boost from holiday

spending

Japan's economy grew faster than expected in the second

quarter driven higher by consumer spending over the 10

day public holidays to celebrate the new imperial era. Is a

welcome boost to the government as it intends to raise the

consumption tax in October. The last time Japan raised the

consumption tax in 2014 there was a decline in

consumption and this especially affected spending on

durable goods such as furniture.

Some economists have warned that now is not the time to

raise taxes because of uncertainty over global trade and the

possibility of a ¡®no-deal¡¯ Brexit. However, the government

seems determined to go ahead and has planned measures

to cushion the impact on the economy.

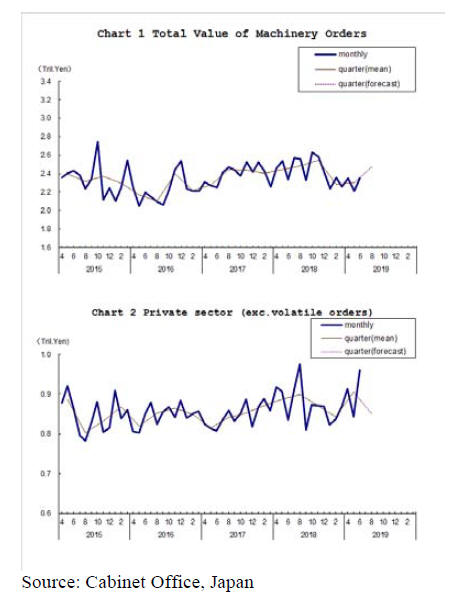

Expansion of capital investment forecast

The Cabinet Office has just released data on machinery

orders in June, 2019 and its forecast for the third quarter.

The total value of machinery orders received by 280

manufacturers operating in Japan increased by 6.3% in

June from the previous month which translates to a 1.1%

rise in the April-June period compared with the previous

quarter.

In the July-September period the total amount of

machinery orders is forecast to increase by around 7% but

private-sector orders have been forecast to drop by 6%

from the previous quarter.

Machinery orders, while a highly volatile data series, are

regarded as an indicator of capital spending in the short

term.

See: https://www.esri.cao.go.jp/en/stat/juchu/1906juchu-e.html

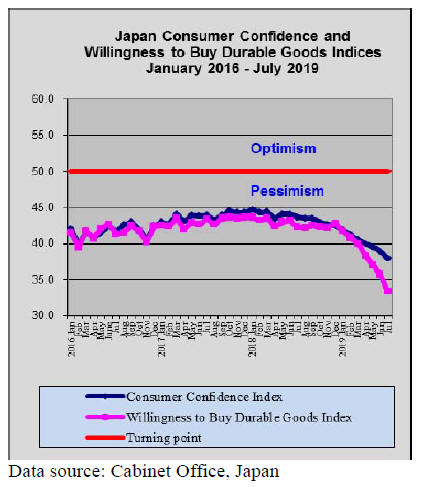

Consumer spending at all time low

While over the past month household spending has risen

over the past decade there has been a steady decline as

households spend less and less of their disposable income.

Data just released by the ministry of internal affairs shows

that the percentage of income spent dropped to 64% in

June, the lowest on record. The reluctance to spend is

reflected in the consumer confidence survey data which

reported that consumer confidence in July fell to its lowest

level in more than five years.

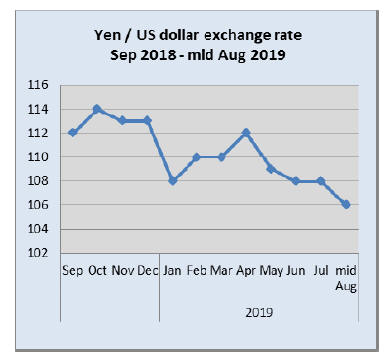

Yen set to strengthen further

From a high of 114 to the US dollar in November 2018 the

yen is now 7% lower at 106 to the dollar and it is forecast

to strengthen further which will undermine the actions of

the Bank of Japan (BoJ).

If the yen strengthens to 100 to the US dollar this would

be a serious blow to exporters and is likely to result in

further monetary easing by the BoJ. Last month, the BoJ

said it would act without hesitation if the stability of the

economy is threatened.

Over the past six years, the BoJ has been trying to achieve

a 2% rate of inflation but is yet to succeed.

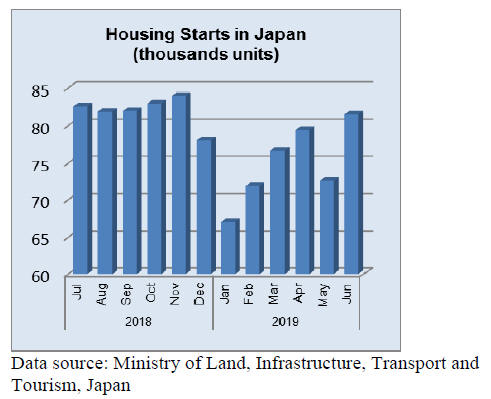

Overseas investors pour money into Japanese

real

estate

Japanese real estate companies have once again reported

that US and British investment firms are very active in the

Japanese real estate market, being attracted by the very

low cost of borrowing.

It is reported that British firm plan to invest in housing for

the elderly, clearly a growth market given Japan¡¯s aging

population. Several Japanese finance companies are

teaming up with overseas investors in a yen 100 billion

rental housing scheme.

The surge of interest in Tokyo properties has caused

analysts to caution that the market could be ¡®overheating¡¯.

Sales on buildings in Tokyo according to Daiwa Real

Estate Appraisal were the highest since before the 2008

financial crisis.

Import update

Wooden door imports

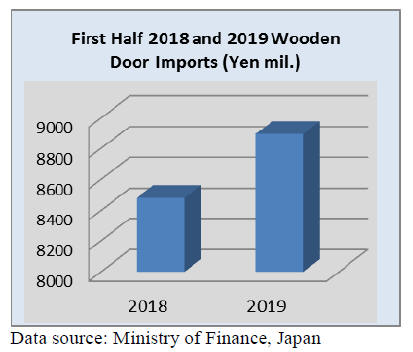

The value of Japan¡¯s first half 2019 imports of wooden

doors (HS441820) were up around 5% on the same period

in 2018

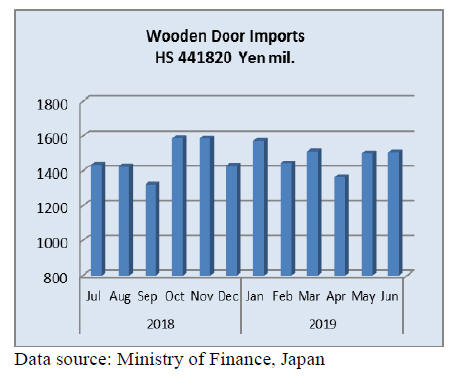

The value of Japan¡¯s June imports of wooden doors

(HS441820) rose around 3% from May, the third

consecutive monthly increase.

As in previous months the top four shippers accouted for

over 80% of June imports with manufacturers in China

accounting for 67% of Juneimports followed by the

Philippines (19%). A further 3-4% was shipped from both

Indonesia and Malaysia .

Wooden window imports

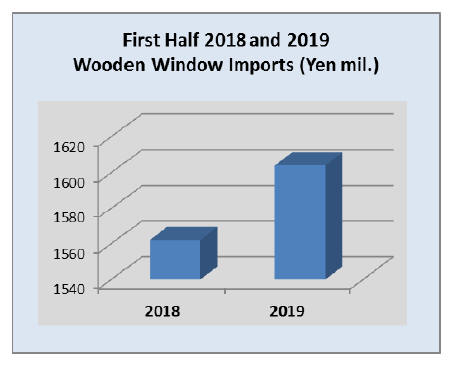

The value of Japan¡¯s first half 2019 imports of wooden

windows (HS441810) were up around 3% on the same

period in 2018.

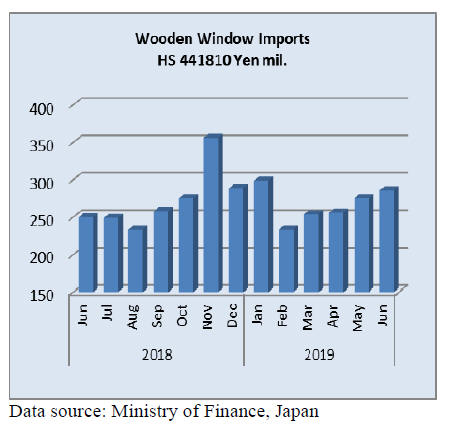

Since February this year there has been a steady

rise in

Japan¡¯s imports of wooden windows (HS441810).

The value of June imports were up almost 6% year on year

and month on month June imports rose around 4%.

The top three in June were China (36% of imports) the US

(28%) and there was a sharp rise in imports of wooden

windows from the Philippines which contributed over 20%

to total window imports.

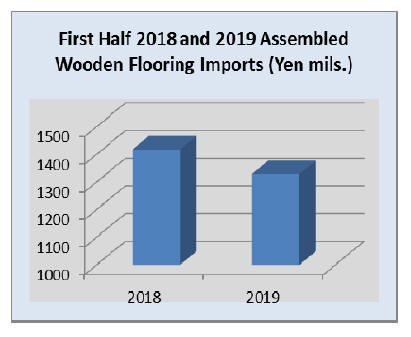

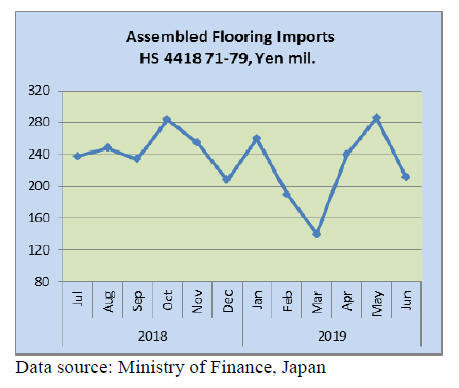

Assembled wooden flooring imports

The value of Japan¡¯s first half 2019 imports of assembled

wooden flooring (HS441871-79) dropped 6% from the

same period in 2018.

Of the range of categories of assembled wooden

flooring

imported into Japan, HS441875 accounts for the largest

proportion with China, Indonesia, Malaysia and Thailand

being the top shippers in order of magnitude. June 2019

imports of assembled wooden flooring were down 8%

year on year and down a massive 25% compared to the

value of May imports.

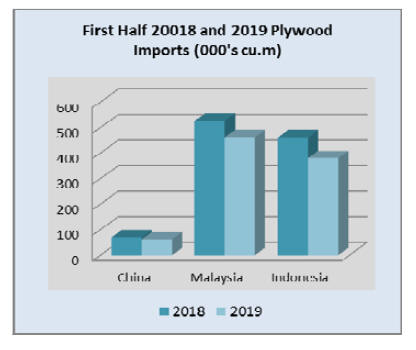

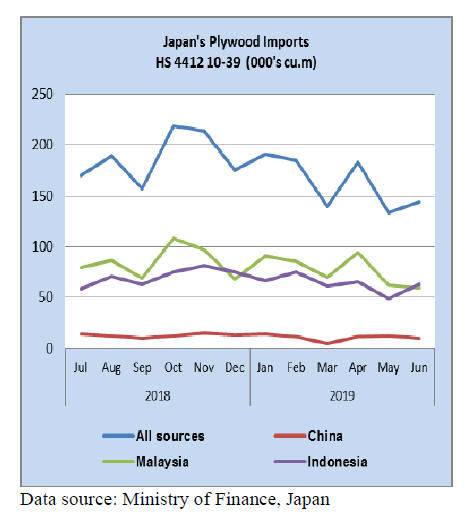

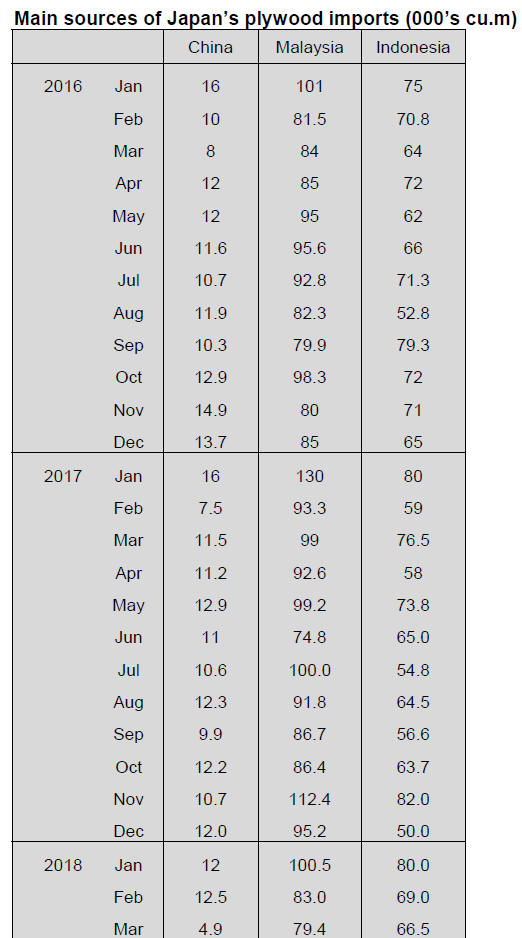

Plywood imports

The volume of Japan¡¯s first half 2019 imports of plywood

(HS441210-39) dropped 15% compared to the same

period in 2018. There has been a downward trend in the

volume of imports since November 2018. The volume of

imports from the main suppliers Malaysia, Indonesia and

China have fallen with Malaysia and Indonesia posting the

largest declines.

One category of plywood, HS441875, dominates Japan¡¯s

plywood imports and in June, as in the previous months,

accounted for well over 60% of all plywood imports. The

changes reported in Japan¡¯s plywood importing sector

continue to emerge.

Year on year the volume of June imports of plywood were

down a massive 23% . Year on year shipments from

Malaysia were down 23% in June, shipments from

Indonesia dropped 21% in June and there was a 25% drop

in June shipments from China.

As in previous months plywood imports were dominated

by HS 441231, accounting for 88% of all June imports.

HS441233 and HS441234 contributed 5% each with

another 2% being HS441239.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

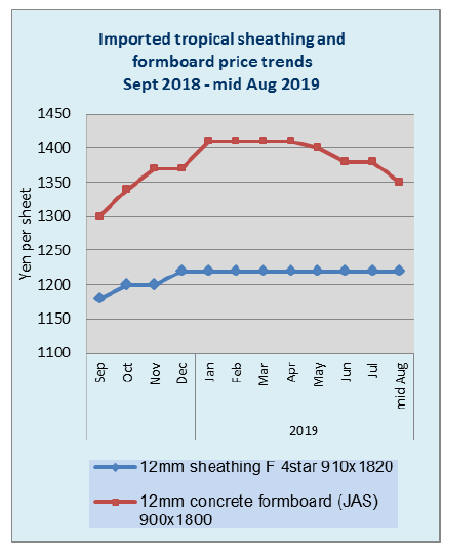

South Sea (tropical) logs

Log supply from PNG is steady. May arrivals from PNG

were 4,162 cbms. Total arrivals during January and May

were 49,305 cbms, 2.5 times more than the same period of

last year.

Japanese plywood mills are able to build up log inventory

of two to three months but the demand for South Sea

hardwood plywood remain weak and there is pressure to

reduce the sales prices as imported South Sea plywood

prices are softening but log cost is high so the mills cannot

afford to reduce sales prices.

Laminated free board market is slow but the prices are

unchanged by sporadic orders. The supply seems to be

increasing as the Indonesian suppliers are anxious to ship

more to take advantage of weak Rupiah so future seems

shaky.

Chinese LVL is firm for core use but crating use is

dropping by weak orders as a result of U.S./China trade

war.

Review of energy saving standard

The Ministry of Land, Infrastructure and Transport and the

Ministry of Economy, Trade and Industry held committee

meeting to review energy saving standard. Obligation to

keep the energy saving standard for detached house is left

over but explanation to house owner may be

institutionalised. Then top runner standard, which has been

for major house builders to build units for sale only, is

now fit to major house builders and rental unit builders as

well.

The committee revises a part of the law of energy saving

performance of buildings by two steps. In November,

widen subject to fit top runner standard system then in

2021, obligation to explain energy saving performance

should be entered into force in two years. The committee

meeting will be held in August and September then invites

public comments and finalized in late October.

At revision of the law this time, the reason why obligation

to conform to energy saving standard for detached

building is left over is about a half of architects and

smaller contractors are not able to make energy saving

calculation so only about 60% of newly built houses fits to

the standard so revision at this time will promote

simplifying calculation of energy saving performance

(evaluation).

Present energy saving standard consists of primary energy

consumption of a house and outer shell like roof, wall,

window and for small contactors, it is hard to figure out

such calculation so simple evaluation to calculate by

specifications only should be made.

European lamina market

Market of structural laminated lumber in 2017-2018

suffered high export prices as the U.S.A. and China

market was booming.

Imported European lamina prices soared and Japanese

laminated lumber manufacturers struggled to pass high

lamina cost onto sales prices. In particular, imported

laminated post lost market share because many domestic

wood laminated lumber mills started up and existing mills

expanded the production so it was hard to pass high import

lamina cost onto the products.

According to the Ministry of Agriculture, Forestry and

Fisheries, total consumption of lamina for laminated

lumber manufacturing in 2018 was 2,691,000 cbms, 2.3%

less than 2017. In this, imported lamina was 1,640,000

cbms, 11.2%less and domestic wood lamina was

1,051,000 cbms, 15.7% more.

Laminated beam¡¯s material is mainly European redwood.

As competing North American Douglas fir solid wood

beam prices increased in 2018 by higher export log prices,

higher imported redwood laminated beam prices could be

passed onto sales prices to some extent but the market

prices started softening since spring of 2018 because of

oversupply so domestic redwood laminated lumber

manufacturers had hard time to come out.

When the U.S. and China markets were booming, lamina

cost stayed high until middles of 2018 then after the both

markets skidded, lamina prices started weakening and this

trend should continue this year.

Present lamina prices by the European suppliers are about

Euro 240 per cbm C&F on both whitewood and redwood.

Based on exchange rate of 122 yen per Euro, imported

cost would be about 34,000 yen per cbm FOB truck port

yard.

Peak of export prices of whitewood lamina was Euro 255-

260 in the fourth quarter of 2017 and of redwood was Euro

265-270 in the first quarter of 2018. Peak of imported cost

of whitewood was about 39,000 yen and redwood was

about 42,000 yen so compared to the peak time,

whitewood lamina cost is down by Euro 15-20 (5.9-7.7%)

and landed cost is 5,000 yen (12.8%) less. Redwood

lamina cost is down by Euro 25-35 (9.4-12.7%) and the

landed cost is down by 8,000 yen (19.0%).

On top of reduction of Euro based prices, strong yen and

reduction of import duty by EPA agreement contribute

drop of yen cost.

Market prices on both whitewood and redwood lumber are

weakening in Japan and it is obvious that sellers¡¯ market

of European lamina now turned to buyers¡¯ market so drop

of market share of European lumber should slow down.

Whitewood laminated post prices are still higher than

domestic cedar laminated post but Chugoku Lumber, a

major manufacturer of laminated cedar post, announced

2,000 yen per cbm price increase in last April so if

whitewood lamina prices drop some more, both prices

become almost even.

However, share of domestic cedar laminated post should

continue solid without any risk of exchange rate. Redwood

laminated beam continue to compete with solid wood

Douglas fir KD beam. After the second largest Douglas fir

lumber manufacturer, To last fall, supply of Douglas fir

beam is not as stable as before then orders by local

contractors to prefer solid wood beam are declining, which

is another favorable factor to European redwood beam.

As long as Douglas fir lumber prices stay up high, there is

chance for European redwood laminated lumber for other

use such as rafter and girder. Shortage of domestic larch

supply, redwood laminated lumber is replacing for sill use.

Looking at domestic lamina market, when laminated

lumber mills rely on lamina supply from outside suppliers,

they were not able to compete by higher lamina cost but

after laminated lumber manufacturing mills started

manufacturing its own lamina, lamina cost dropped and

the cost of cedar laminated post dropped.

Market prices of cedar laminated post are about 53,000

yen per cbm delivered (about 1,750 yen per piece) so it is

overwhelmingly advantageous to European whitewood

laminated post, which prices are 1,880 yen per piece.

What about log supply for laminated lumber mills? Large

laminated lumber manufacturing mills have its own

biomass power generation plant so the mills can utilize

any type of logs.

They buy class A logs, which are suitable to recover

lumber, B class logs, which are suitable to recover lamina

and even class C logs, which are used for wood chip. Log

suppliers do not have to make any sorting by use so the

cost is reduced that much.

Mills can select some class C logs for lamina recovery,

which reduce lamina cost. In other words, cedar laminated

lumber supply is becoming monopolized by large

manufacturers, which is why European whitewood

laminated lumber manufacturers cannot use domestic

cedar lamina.

Reason why domestic cedar laminated post market share

expanded is sizable increase of imported wood products in

2017 and 2018. Many house builders started using less

costly cedar laminated post to reduce overall cost, which is

less costly than whitewood laminated post.

|