US Dollar Exchange Rates of

25th July

2019

China Yuan 6.8792

Report from China

Developers scaling back land purchases

The pace of growth in the mainland housing market

slowed in the first six months of this year largely because

builders have found it harder to access credit as the

government has put in place measures to try and bring

down debt levels in the sector.

The tight credit environment and slower buyer interest

have meant Chinese property developers are having a

tough time. The People¡¯s Court Daily, a state-owned

publication has reported that over 270 building companies

have filed for bankruptcy, 50% more than in the first half

of 2018.

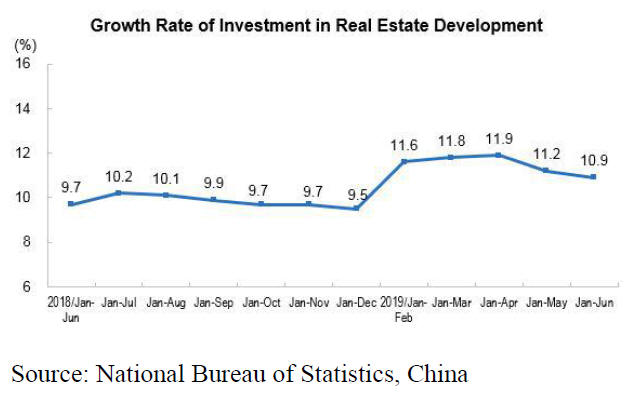

The National Bureau of Statistics has reported investment

in real estate development in the first six months of 2019

rose by 10.9% reflecting a year on year decline.

Between January and June this year land area purchased

by developers was down by close to 30% year-on-year.

See:

http://www.stats.gov.cn/english/PressRelease/201907/t20190719

_1677190.html

Trade with ¡®Belt and Road¡¯ countries outpaces others

The growth in China's foreign trade remained stable in the

first half of 2019 and the total foreign trade value reached

RMB14.67 trillion, up 3.9 % year-on-year.

Customs data showed that exports expanded 6.1 % while

import rose 1.4 %. China saw its trade surplus widen by

41.6 % year-on-year to RMB1.23 trillion during the first

half of 2019.

The value of trade between China and the EU, ASEAN

and Japan rose in the first half to RMB2.3 trillion,

however, the value of trade between China and the US fell

9% to RMB1.75 trillion year on year. China's trade with

countries participating in the ¡®Belt and Road Initiative¡¯

outpaced of expansion in other areas rising 9.7% year on

year.

It has been reported that China intends to further lower

overall import tariff levels, refine export tax rebate

policies and speed up the tax rebate process.

For its part, China Customs plans steps to further simplify

customs clearance procedures, support cross-border ecommerce,

share effective reform practices in free trade

zones and promote diversification of export markets.

Revised standard for laminated floors

The standard for laminated floors has recently been

revised by the Wood Industry Research Institute in the

Chinese Academy of Forestry and will be implemented as

soon as possible.

The revisions mainly deal with the terms and definitions,

classification, requirements, inspection methods and

inspection rules. Quality requirements for the non-flat

impregnated paper laminated wood flooring have been

added and the quality requirements for flat impregnated

paper laminated wood floor have been modified.

The performance indices such as the expansion rate of

water-absorption, locking strength and formaldehyde

emission, have been upgraded.

The implementation of the new standard for laminated

floors is intended to promote safe, exquisite and durable

impregnated paper laminated wooden floor in China

domestic market and improve the image and reputation of

the products in international markets.

Dachang county - the largest redwood producer in

North China

It has been reported that Dachang county has become the

largest redwood products production base in northern

China. There are 134 redwood registered enterprises, 800

private traders and 40,000 employees in the sector in

Dacheng county of Hebei province. The annual output

value is in the region of RMB8 billion accounting for

more than 85 % of market share in North China.

Reduced panel production causes prices to rise

In order to improve air quality and the environment

producers of woodbased panels in many cities in

Shandong province will be closed or required to undertake

refurbished to new environmental standards.

The number of enterprises stopping production is rising

mainly because production costs have risen because the

government has strengthened environmental standards and

is applying these vigorously.The impact on production

costs of rising raw material costs is also a factor.

As mills close analysts write that it is expected that prices

for panels will rise and some shortages are likely in the

short-term.

|