3.

MALAYSIA

An opportunity to bring down

regional shipping costs

Trading between Brunei, Indonesia, Malaysia and the

Philippines will get a boost following the new shipping

service launched by Reefer Express Lines.

The launching of the service was initiated by the East

ASEAN Growth Area (BIMPT-EAGA) Business Council

through a memorandum of understanding aimed at

increasing trade volume within the BIMP-EAGA region.

Analysts say the new service could bring down costs and

cut shipping times.

For more see: https://www.hellenicshippingnews.com/new-linershipping-

operations-set-to-increase-cross-border-trade-withinbimp-

eaga-region/

ASEAN mutual recognition for timber legality

Delegates from Indonesia, Thailand, Vietnam, Myanmar,

Cambodia, Brunei and Malaysia recently met to discuss a

regional mechanism for mutual recognition of timber

legality definitions.

The objectives of this meeting were:

to enhance understanding through sharing

to enhance understanding through sharing

experiences on developing MRA from other

sectors referring to the ASEAN Framework

Agreement on Mutual Recognition Arrangements

(MRA 1988) and Guidelines on Accreditation

and Conformity Assessment;

to discuss the requirements for MRA

to discuss the requirements for MRA

development and clearly identify the

steps/processes on setting standards and

procedures to be followed and how to move the

process forward;

to discuss a stepwise approach and timeline on

to discuss a stepwise approach and timeline on

ASEAN regional mutual recognition arrangement

for AMS on timber legality

The meeting agreed on a five year timeline for

implementation.

See: http://www.mtib.gov.my/en/maskayu/category/35-

emaskayu-2019

Furniture exports a major contributor to export

earnings

Teresa Kok, Malaysia’s Minister of Primary Industries,

has reported that timber exports in the first 5 months of

2019 rose 2.3% year on year.

Malaysia is one of top ten global furniture exporters and in

the first five months of 2019 the furniture industry

contributed 36% to Malaysia’s total timber-related

exports, up almost 13% year on year. She remarked that

Malaysian manufacturers need to be alert as non-wood

products are a threat in some of the traditional wood

product markets.

See: https://www.thesundaily.my/business/malaysia-s-timberexports-

hit-rm9-1b-in-first-five-months-of-2019-CD1151848

Malaysian Wood Expo

The Malaysian Timber Council (MTC) and the publisher

of the magazine Panels and Furniture are jointly

organizing the Malaysian Wood Expo (MWE 2019)

scheduled to be held 19 to 21 November 2019 at the Putra

World Trade Centre in Kuala Lumpur.

MWE 2019 is expected to attract the finest international

wood-based manufacturers, exporters as well as

woodworking machinery suppliers and buyers.

See:

http://www.malaysianwoodexpo.com.my/

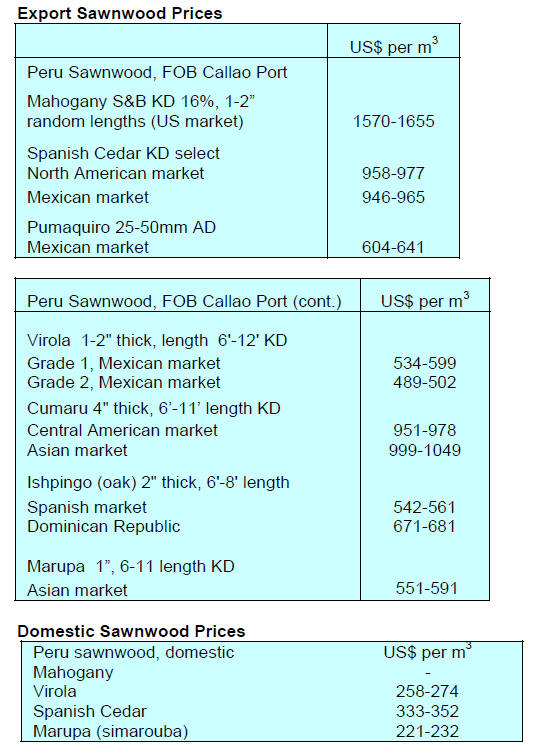

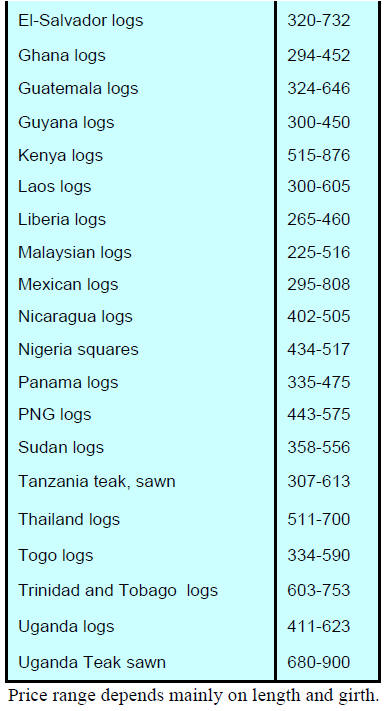

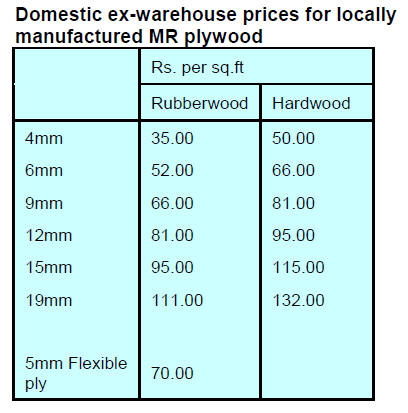

Plywood prices

Plywood traders based in Sarawak reported the following

June export prices.

4.

INDONESIA

Industry optimistic exports

can be boosted

There is growing optimism that the value of wood product

exports (excluding pulp and paper) could reach US$3.09

billion by 2025. Soewarni, Chairman of the Indonesian

Sawmill and Woodworking Association (ISWA), said this

would be possible if the supply of logs can be verified

legal and if global demand picks up.

Bambang Supijanto, Chairman of the Indonesian Wood

Panel Association (Apkindo), projected the value of wood

based panel exports in 2025 could be as high as US$2.47

billion from a volume of around 4 million cubic metres.

On the issue of log supply, Secretary General of the

Ministry of Environment and Forestry (KLHK), Bambang

Hendroyono, believes future log sources will develop as

community plantation forests and industrial plantations

expand. To encourage this expansion, Bambang said

efforts would be made to help community forestry licenses

holders build small-scale wood processing facilities as this

would encourage further investment in plantations.

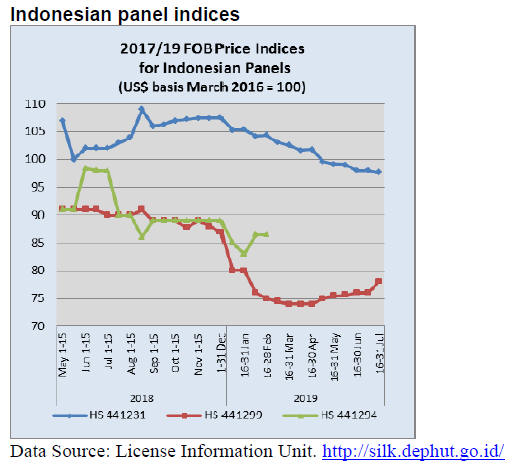

In the first six months of 2019, the value of processed

wood product exports was US$5.58 billion, down almost

6% year on year.

Wooden furniture export were US$695.2 million down

slightly year on year, panel exports were valued at

US$1.05 billion, down a massive 16% year on year mainly

because of weak demand in Japan. Paper exports earned

US$1.93 down slightly from a year earlier but, in contrast,

pulp exports rose around 2% and veneer exports, at

US$48.50 million, were down 9% year on year.

In commenting on the export figures, the Chairman of the

Association of Indonesian Forest Concessionaires (APHI),

Indroyono Soesilo, said that the trade war between China

and the United States was one of the causes of declining

demand for processed wood.

In related news, Purwadi Soeprihanto, Executive Director

of the Association of Indonesian Forest Concessionaires

(APHI), said the market for mouldings from Indonesia

could rise to US$1.17 billion as Indonesia has the potential

to produce 1.7 million cu.m of mouldings, 200,000 cu.m

from natural forests raw material and 1.5 million cu.m

from plantations.

See:https://industri.kontan.co.id/news/cuma-mencapai-us-558-

miliar-ekspor-kayu-olahan-turun-563-di-semester-i-2019

Raw material exports – short term solution to address

trade deficit

Indroyono Soesilo, Chairman of APHI, proposed that the

short-term solution to lower Indonesia's trade deficit

would be to optimise harvesting and trade in natural

resources, notably timber raw materials which he said are

100% local content and do not require imports of capital

goods. Plantation owners in Indonesia have long been

seeking permission to export plantation logs.

At the same time, Indroyono pointed out that there are

opportunities to export wood pellets to Japan and South

Korea.

In support of this suggestion, Purwadi Soeprihanto, the

APHI Executive Director, said that international demand

for wood pellets is huge. In South Korea, the demand for

wood pellets is supported by government policies that will

provide tax incentives if the industry uses renewable

energy from biomass.

See;

https://ekonomi.bisnis.com/read/20190710/99/1122389/trenenergi-

terbarukan-buka-peluang-ekspor-pelet-kayu-ke-jepangdan-

korsel

5.

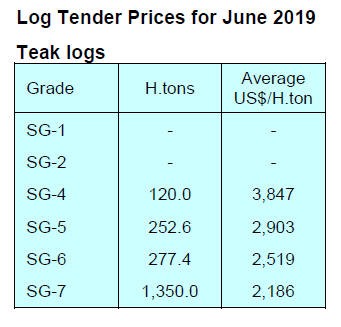

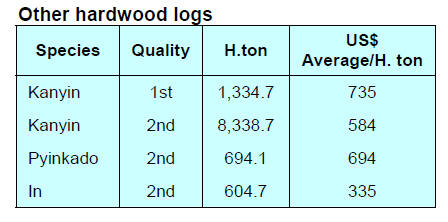

MYANMAR

Exports face uncertain future

in EU market

According to the Ministry of Trade, exports of wood

products declined around 13% between October to June of

2018-19. From October 2017 to June 2018 export earnings

totalled US$147.456 million while they were US$128.637

million between October 2018 and June 2019. According

to analysts, exporters are facing growing uncertainty

especially with respect to exports to the EU.

According to a report by the Extractive Industries

Transparency Initiative (EITI) Myanmar report the

Sagaing Region was the top teak producer in the two years

of 2014-15 and 2015-16 accounting for 46% of national

teak production. In second place was Shan State which

contributed a further 27%.

FDI company to produce yachts

Shinkwang Marine Company, a new foreign venture in

Myanmar, has been given approval to build yachts in the

country. It is common for teak to be used for interior trim

in yachts.

Analysts writes “ although details of the type of yachts

that will be built is not yet known this may be a first step

to bring boat building for export to Myanmar”.

Stalled Dawei special economic zone project to be

discussed at international gathering

The governments of Myanmar, Japan and Thailand will be

meeting over the troubled Dawei special economic zone

(SEZ) project that has stalled since 2013 for lack of

funding. It has been reported that the aim is to establish a

Joint Cooperation Committee and to try and attract

investment from Japan.

This SEZ is 20 Km north of Dawei, the capital of

Tanintharyi Region on Myanmar’s southeast coast

bordering Thailand. Discussion on whether Myanmar

needs to develop a deep-sea port, and if so where, has been

going on for years. If completed, the Dawei project will

boost the economy of Dawei and the surrounding area as

investment in infrastructure and power supplies will be

required.

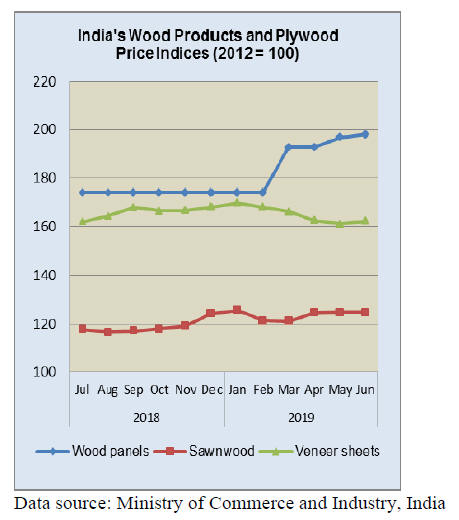

6. INDIA

Modest rise in wood product price

indices

The official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for June 2019 rose to 121.5 from

121.2 for the previous month.

The June index for the group 'Manufactures of Wood

and

of Products of Wood and Cork ' rose to 134.6 from 134.3

(provisional) from the previous month due to higher price

for wooden boxes and crates wood panels however, prices

for veneer sheets declined.

The annual rate of inflation based on monthly WPI in June

stood at 2.02% compared to 5.68% in June in the previous

year.

The press release from the Ministry of Commerce and

Industry can be found at:

http://eaindustry.nic.in/cmonthly.pdf

A first for India – a shipment of pine logs arrives from

Uruguay

For the first time a shipment of pine logs from a country

other than New Zealand has been unloaded in Kandla Port.

Members of the Kandla Timber Association (KTA) were

on hand to view the shipment which it is hoped would

result in more competition in the pine log market.

Navneet Gajjar, president of KTA, said this first shipment

was of 35,000 cubic metres at a price of around US$145

per cubic metre, some US$20 per cubic metre lower than

pine from other sources. Officials from the Plant

Quarantine Station at Kandla said the Uruguayan logs met

Indian phytosanitary standards.

For more see:

https://indianexpress.com/article/cities/ahmedabad/gujarat-firstever-

consignment-of-pinewood-from-uruguay-lands-at-kandlaport-

5805776/

Credit – when they can get, it is too expensive for real

estate developers

Real estate developers have raised alarm over the rapidly

rising costs of borrowing which can be as high as 20%.

Adding to their concerns are the problems in finding loans

even at the high interest rates. This problem stems mainly

because the credit ratings of developers have dropped

significantly.

The impact of this has been seen in the housing starts data.

New housing launches fell by almost 50% in the first

quarter (April-June) of the current financial year and home

sales were down over 10%. Because of the decline in

housing starts India‘s housing inventory declined by over

12% in the past 12 months.

For the full analysis see: https://housing.com/news/proptigercom-

real-insightreport/?

utm_source=internal&utm_medium=email&utm_campai

gn=subscribersDigest

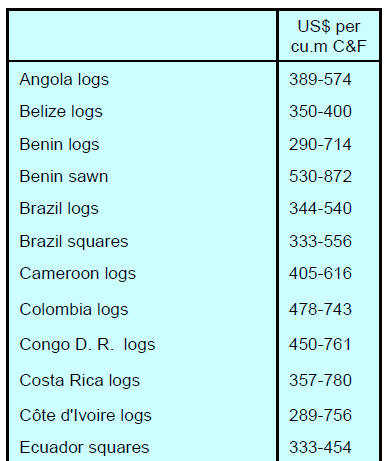

Plantation teak imports

In a slack market along with the ongoing credit squeeze

and high GST there is no mood in the industry to take any

chances on building up stocks which means that C&F

prices for imported plantation teak have stalled.

Serious efforts are being made by importers to ease the

advance payment conditions for GST. The only bright note

is that the rupee exchange rate is stable against the US

dollar.

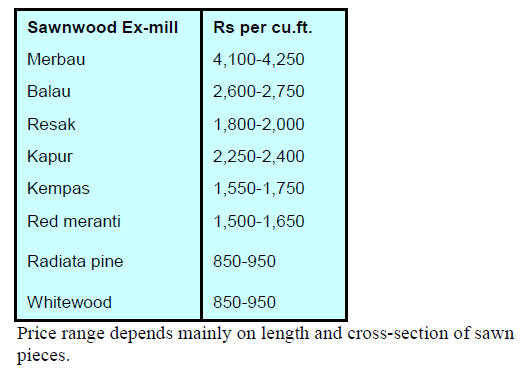

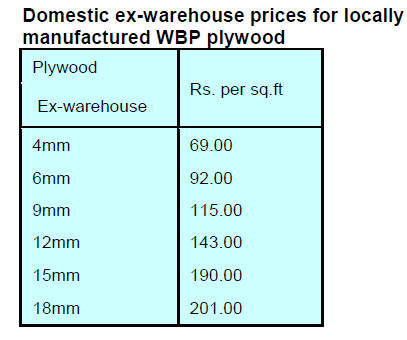

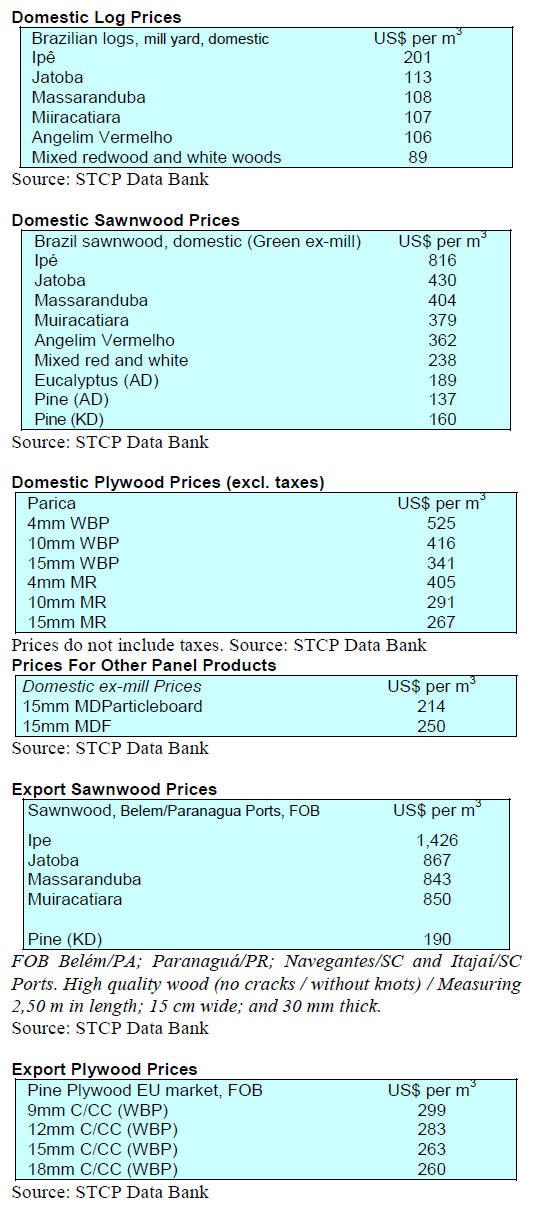

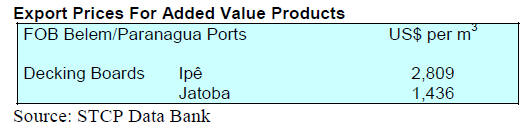

Locally sawn hardwood prices

Active competion in the market for imported hardwoods

has kept prices in check and this is supported by evenly

balanced supply and demand.

Ex-mill prices for imported sawnwood are shown below.

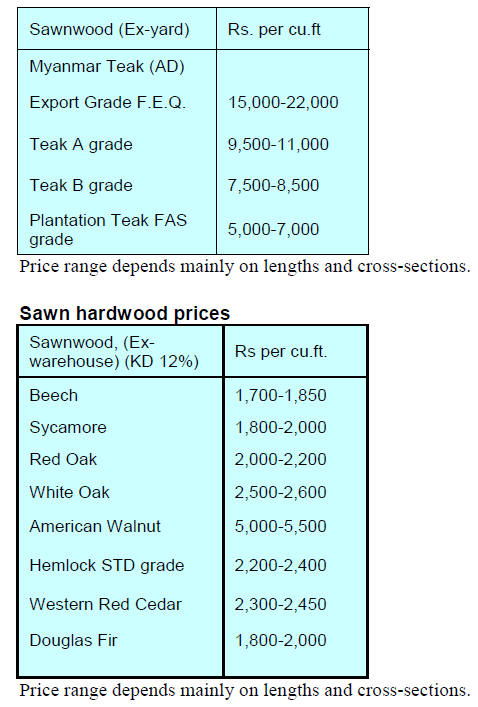

Myanmar teak prices

Anlaysts report that demand for Myanmar teak products

appears to have eased in recent weeks which has resulted

in a drop in the inflow of imports.

Plywood

The various State Governments have already concluded

the issuing licenses and the entire sector is suffering a log

shortage such that many mills have cut production. The

reduction in GST for the plywood industry is now a matter

of urgency, say analysts, if mill closures are to be avoided.

7.

VIETNAM

Vietnam - anti-dumping

investigation on imported MDF

According to the Trade Remedies Authority in the

Ministry of Industry and Trade (MoIT) an anti-dumping

investigation on MDF imported from Thailand and

Malaysia was initiated in October last year.

This investigation was the result of complaints from four

Vietnamese MDF manufacturers on behalf of the domestic

industry. The technical dossier claimed dumping and

damage to local companies.

The Vietnamese firms claimed that the price of imported

MDF from Thailand and Malaysia was below production

cost by between 18-50% which was damaging the

domestic MDF industry.

The Trade Remedies Authority sent questionnaires to local

companies and required a reply by mid-July, 2019 and an

assessment from the Ministry is awaited. This is the first

time Vietnam’s timber industry has raised a trade conflict

to protect the local industry.

First half 2019 trade

The Department of Customs has reported Vietnam’s

exports of wood products in the first 6 months of 2019

were worth US$4.82 billion, up 16.6% over the same

period last year.

Among the top 5 export markets were the US, Japan,

China, South Korea and the EU. Exports to China and

South Korea declined by 30% and 13% respectively.

For the first 6 months of 2019, wood product imports were

valued at US$1.233 billion, up 15% in comparison to the

same period of 2018. Vietnam had a trade value surplus

of US$3.586 billion in wood products in the first 6 months

of 2019.

Opportunities and challenges in the US market

In the first 6 months of 2019 the US continued as

Vietnam’s top export market for wood products with

exports totalling nearly US$2.25 billion, accounting for

47% of total wood product exports.

Analysts in Vietnam’s Ministry of Industry and Trade

anticipate total 2019 wood product exports of US$4 billion

to the US. Furthermore, the US is the biggest suppliers of

timber raw material utilised by Vietnamese manufacturers.

In the first 6 months of 2019 imports of wood products

from the US were worth over US$160 million, a rise of

almost 25% year on year.

It is forecast that the US will become the major supplier of

timber raw material for industries in Vietnam because

large volumes are available the quality is good and the

origin is traceable.

On the downside, there are growing concerns on the risk

of US anti-dumping investigations of Vietnamese exports

and also the risk that not all timber raw material entering

the export supply chain can be verified legal especially

from wood processing industries that have recently

relocated to Vietnam.

Vietnam in action to implement the VPA/FLEGT

The Vietnam-EU VPA/FLEGT came into force 1 June,

2019. According to the Vietnam Administration of

Forestry, the VPA will lead to greater potential for wood

products exports from Vietnam to the EU market. The

adoption of the VPA is also expected to contribute to the

sustainable development of Vietnam’s forests and a strong

commitment to eliminate illegal timber from the supply

chain.

Vietnam will launch its domestic timber legality

assessment system and plans to issue the first FLEGT

license in June, 2020. License legislation for the VPA is

the next step and it is planned to expand this legal

requireto all markets in the future.

See:

https://www.google.com/amp/amp.tapchicongthuong.vn/baiviet/

hiep-dinh-thuong-mai-go-giua-viet-nam-va-eu-da-co-hieuluc-

62957.htm

8. BRAZIL

Paraná embraces SINAFLOR regulations

Paraná State has the highest number of entities registered

under the National Control System for Forest Products

Origin (SINAFLOR). Out of the 2,049 logging permits

granted in Brazil, about 400 have been granted in Paraná

since the system started in May 2018.

According to the Environmental Institute of Paraná

(Instituto Ambiental do Paraná - IAP) the high rate of

adoption of SINAFLOR is the result of training conducted

on the usefulness of the system.

The Water and Land Institute has promoted the use of

SINAFLOR as it brings many benefits, such as stricter

control of the State's forest area, swift document

processing and consequently rapid execution of projects.

The purpose of SINAFLOR is to make forest operation

authorisations transparent, to eliminate fraud in the

issuance of documents and to enable reporting to assist

environmental licensing and enforcement procedures

across the country.

Out of 7,818 projects registered in SINAFLOR throughout

Brazil, 1,549 projects were registered in Paraná.

According to IAP this number testifies to the quality of

training provided by the Institute and the Brazilian

Institute of Environment and Renewable Natural

Resources (IBAMA) on implementation of the system.

Incentives for the timber sector in Santa Catarina

After a long period of stagnation domestic demand for

wood products has started to expand. Enterprises in Santa

Catarina report increased sales and have started to raise

production levels. This is in contrast to the national trend

where sales and production are not improving.

Santa Catarina has entrepreneurs committed to the

development of the sector and the development of the

State. There are around 5,500 small, medium and large

timber, furniture, pulp and forestry companies which

support around 90,000 direct and indirect jobs.

Recently, on the initiative of a State congressman, a

channel for direct dialogue between forest enterprises and

the Santa Catarina state government was established which

will allow the sector to monitor public policies and

infrastructure works to ensure the logistics

competitiveness and economic development of the forestry

sector is maintained.

Agreement between EU and Mercosur will benefit

furniture industry

The Brazilian Association of Furniture Industries

(Abimóvel), an entity that represents the furniture sector in

Brazil, welcomed the agreement between Mercosur and

the European Union as this could help reverse the recent

decline in furniture exports to Europe.

The Commodity Trade Statistics Database (COMTRADE)

shows that Brazilian furniture exports to the EU were

worth just over US$24 million last year.

According to Abimóvel, the biggest challenge will be the

approval of the agreement by the European Parliament and

the Mercosur Legislative branch. Abimóvel is following

efforts of the Brazilian government to ratify the

agreement.

Exports grow in furniture cluster

Exports by the 300 companies in the Bento Gonçalves

furniture cluster in the state of Rio Grande do Sul

increased by over 8% in the first half of 2019 compared to

the same period of the previous year.

According to the Ministry of Economy, Foreign Trade

Secretariat (SECEX), local companies exported US$21

million between January and June 2019.

The pace of export growth from the Bento Gonçalves

region was higher than from the State and the country as a

whole where growth was 1.1% and 1.4%, respectively.

The main markets in the first half of 2019 were Uruguay,

the United States, Puerto Rico, Colombia, Mexico, India,

Bolivia, France, the Dominican Republic and Middle

Eastern countries.

Currently, Uruguay is the main export market for the

Bento Gonçalves furniture cluster followed by the United

States. In the first half 2019 exports to the US grew almost

250% while exports to Uruguay fell slightly.

9. PERU

US blocks timber shipment from Peru

A press release from the office of the US Trade

Representative (USTR) has directed the United States

Customs and Border Protection (CBP) to block future

timber imports from a specific Peruvian exporter because

of suspected illegally harvested timber was entering the

company’s supply chain.

This is the second time that the USTR has taken such

action under the United States – Peru Trade Promotion

Agreement’s (PTPA) Annex on Forest Sector Governance.

The USTR order was made after the timber verification

process conducted by the Government of Peru revealed

that a shipment from the company in question was not

harvested in compliance with Peru’s laws and regulations.

See:https://www.pressreleasepoint.com/ustr-announcesenforcement-

action-block-illegal-timber-imports-peru