|

Report from

North America

Wooden furniture imports catch up, but retail sales

dip

as confidence weakens

The volume of US imports of wooden furniture grew by

17% in May, surging ahead of 2018 year to date for the

first time this year. Imports from China, Vietnam,

Malaysia and Mexico all rose by more than 10%. Year to

date, imports from Vietnam and Malaysia are up 29% and

13% respectively.

The results of the Smith Leonard survey of residential

furniture manufacturers and distributors for April show

business to be slowing down. New orders in April were

down 9% from April 2018 and only 36% of the

participants reported increased orders.

Year to date, new orders were 3% lower than the same

period a year ago and down in a flat first quarter.

Shipments were down 2% from April 2018, down for 55%

of participants. Year to date, shipments were up 2%, but

only 48% reported increased year to date shipments.

Backlogs remained even with March as dollar amounts of

orders and shipments were about the same.

See: https://www.smith-leonard.com/2019/07/01/june-2019-

furniture-insights/

US consumer sentiment cooled in June from an eightmonth

high on less optimism about the economic outlook

in the wake of slower global growth and trade concerns.

Households¡¯ long-term inflation expectations also

retreated.

The University of Michigan¡¯s final sentiment index

dropped to 98.2, slightly above the median forecast in a

Bloomberg survey of economists, from 100 a month

earlier.

The gauge of expectations decreased to 89.3 from a 15-

year high in May, while an index of current conditions

climbed to 111.9 from 110.

Most of the June slippage was concentrated in prospects

for the national economy, with the unemployment rate

expected to inch upward instead of drifting downward in

the year ahead. Interest rates were anticipated to rise by

the fewest respondents in six years and declines in

mortgage rates have begun to have a positive impact on

home buying.

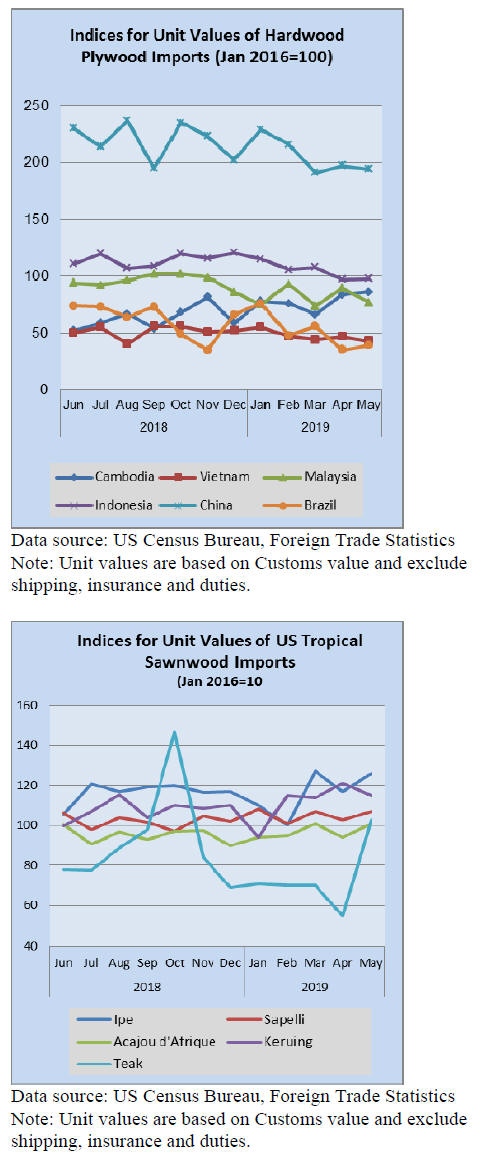

Imports of keruing and jatoba rose sharply in May

US imports of sawn tropical hardwood remained strong in

May rising by 5% to 24,166 cubic metres, which is 38%

higher than that of May 2018. Import volumes are ahead

of 2018 by 26% year to date. A 55% jump in imports from

Malaysia fueled most of the gain for May, as imports from

Ecuador, Brazil, Cameroon and Congo (Brazzaville) all

declined.

Imports from Ecuador are down 10% year to date, while

imports from most other trading partners are ahead by

more than 25%. Imports of keruing and jatoba both rose

by more than 66% in May, accounting for most of the

increased volume, while imports of balsa, sapelli, ipe,

mahogany, virola, teak, and acajou d¡¯Afrique all fell.

Balsa imports are 10% behind 2018 year to date, while

sapelli, keruing, acajou d¡¯Afrique, jatoba, teak and ip¨¦ are

all well ahead 2018 volume figures for the year.

Canadian imports of sawn tropical hardwoods rose by

38% in May to the highest level since June 2018. Imports

from Brazil, Cameroon and Ecuador are all up sharply

year to date, while lagging from most other countries.

Overall imports are down 9% year to date.

Imports of plywood from Vietnam double

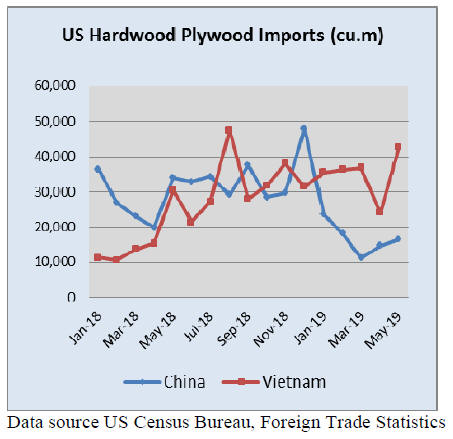

US imports of hardwood plywood rose by 7% in May, but

the volume, at 191,701 cubic metres, remains more than

25% less than that of last May. Import volumes are down

9% year to date, with imports from China, Indonesia and

Cambodia all down more than one third for the year.

May imports from Vietnam were their strongest of the

year and are now more than doubling 2018 in volume year

to date. Imports from Russia rose by 29% in May, but still

were weaker than those of May 2018.

Cameroon¡¯s veneer shipments drop 70%

US imports of tropical hardwood veneer dropped by 23%

in May, falling from already depressed levels. Year-todate

totals remain down by 19%.

After a dismal first four months of the year, imports from

Cameroon recovered to the level seen for most months last

year, but the weak first quarter places Cameroon nearly

70% behind 2018 year to date. Imports from China fell 5%

in May and remain well below their 2018 pace.

Four straight months of increased flooring imports

US imports of hardwood flooring by volume improved for

the fourth straight month, rising by 16% in May. Imports

for the month were more than 30% higher than in May

2018 and are up 18% year to date.

Imports from China rebounded strongly from very weak

numbers in March and April, but still are down 43% year

to date. Imports from Brazil fell slightly in May but

continue to be strong as Malaysia and Brazil make up for

the depressed imports from China.

Imports of assembled flooring panels also moved up

strongly in May, rising by 32%. Imports are ahead of 2018

by 11% year to date. Imports from China rose sharply in

May, but still lag behind May 2018 totals. Imports from

Vietnam and Thailand more than doubled in May, as both

countries continue to increase their market share at

China¡¯s expense.

China surges back with moulding shipments

The volume of US imports of hardwood moulding rose by

24% in May, fueled chiefly by increased imports from

China. While Chinese imports are still down 48% year to

date, a 71% increase from April to May brought overall

imports up from the weak numbers of the past few months.

Despite the rise, May imports remained behind 2018 levels

and are down 27% year to date. Imports from Brazil fell

by 11% in May and are down more than 50% year to date.

|