3.

MALAYSIA

Plywood production threatened by

declining log

supplies and rising costs

The media in Sarawak recently highlighted the impact

declining log production and rising production costs are

having on the plywood industry in Sarawak.

Hashim Bojet, General Manager of the Sarawak Timber

Industry Development Corporation, (STIDC) said he is

concerned that, because of the log shortage and rising

production costs, some plywood mills, including the major

producers in Sarawak, have had to cut production and that

some are considering closing operations entirely.

Industry analysts point out that increased charges by the

State such as the ‘cess’ and ‘premium’ are the main causes

for the higher production costs. Since July 2017 the

Sarawak government has raised the ‘premium’ to RM50

per cubic metre for all species from hill forests as well as

logs of hill species from agro-conversion areas. Previously

the ‘premium was RM0.8 per cubic metre.

The increase in hill timber ‘premium’ and the

rehabilitation and development ‘cess’, which amounts to

RM55 per cubic metre has raised the cost of logs and

timber products by around RM110 per cubic metre

(assuming a recovery rate of 50%). (Note: Premium and Cess

are financial mechanisms which allow States in Malaysia to

capture payments from concessionaires).

According to Hashim, the Sarawak government has

allowed plywood mills to import logs adding this is

exactly what other countries such as India, Vietnam and

Japan doing in order to maintain production.

See: https://www.theborneopost.com/2019/07/01/sun-setting-onplywood-

mills/

Review of Criteria and Indicators for Forest

Management

Every five years the Malaysian Timber Certification

Council (MTCC) undertakes a review of its ‘Criteria and

Indicators for Forest Management Certification or MC&I

and the latest review is underway. An Enquiry Draft has

been published and can be found on the MTCC website

(mtcc.com.my).

The Enquiry Draft is a revised standard that combines the

requirements of both the MC&I (Natural Forest) and

MC&I Forest Plantation.v2.

The MC&I Forest Management Certification maintains the

format as in the previous standard with updated

requirements based on feedback from the first public

consultation as well as the key requirements of the ISO

17021-1 and the PEFC benchmark standard on sustainable

forest management.

The major changes proposed in the revised MC&I Forest

Management Certification are summarised below:

Incorporation and streamlining of the

requirements under Principle 10 of the MC&I

Forest Plantation.v2 into the corresponding

Principles 1-9 of the MC&I Forest Management

to reduce redundancy. All the requirements in the

standard apply to both natural forest and forest

plantation, with requirements that apply only to

natural forest or forest plantation clearly

specified.

Inclusion of requirement on conversion of

degraded forest to forest plantation that is not

subject to the cut-off date of 31 December 2010

for conversion of natural forest to other land uses.

Stronger requirements on social aspects through

the incorporation of all core ILO Conventions

and the principle of gender equality.

Incorporation of requirements that provide

guidance for internal audit and management

review and improvement.

Improved clarity on the requirements for

communicating claims from certified areas.

Currently, MTCC is undertaking regional consultations in

Sabah, Sarawak and Peninsular Malaysia. As of May

2019, Malaysia had 4.27 million ha. of PEFC Certified

Forest (14 FMUs and 7 FPMUs). There are 362 PEFC

Certificates for Chain of Custody holders.

Joint Palm Oil Council and Sabah Forestry Department

initiative to restore forests

The Malaysian Palm Oil Council (MPOC) and the Sabah

Forestry Department (SFD) have agreed a project to plant

1 million native trees in the permanent forest of Lower

Kawag in Lahad Datu, Sabah.

An agreement was signed to formalise the pledge from the

Ministry of Primary Industries (MPI) to collaborate with

the SFD to plant one million trees in Lower Kawag which

is part of Ulu Segama Malua Forest Reserve as the first

site for the restoration project.

Sabah Deputy Chief Minister, Christina Liew, thanked the

MPI for their initiative in getting the major oil palm

industry players to fund the planting of native forest trees

in the east coast of Sabah over a period of 10 years. SFD

has identified 2,500 hectares of degraded forest in Lower

Kawag for restoration.

The first stage of the project involves providing a wildlife

reserves and also creating wildlife corridors (between

adjacent forests). This, said Liew, will help protect the

Borneo Pygmy Elephant and the Orang-Utan both of

which are endangered species.

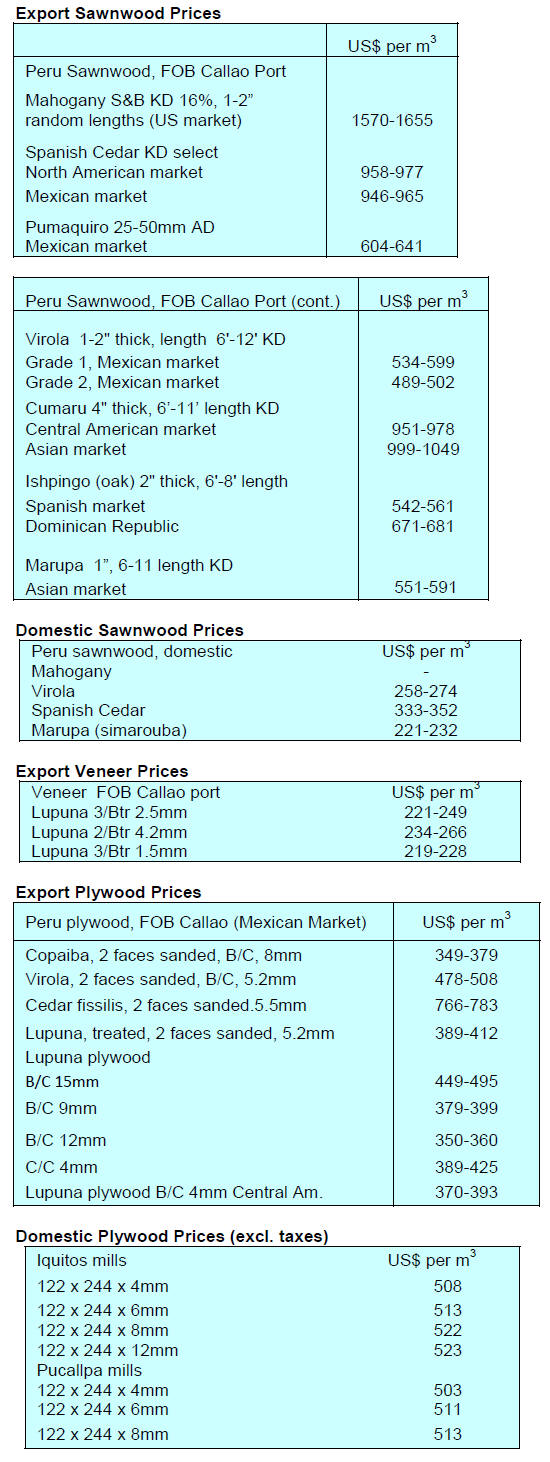

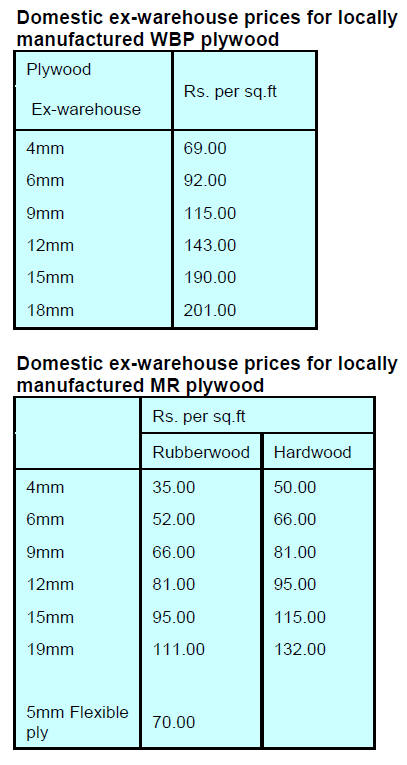

Plywood prices

Plywood traders based in Sarawak reported the following

June export prices.

4.

INDONESIA

Trade deal with US sought to

boost exports

The Ministry of Commerce will take advantage of the

trade dispute between the US and China to export more

furniture, handicrafts and textile products to the US.

The Ministry of Trade's Director General for Export

Development, Arlinda, has announced the government

would make efforts to secure an agreement with the US to

import more products from Indonesia. In return, the

government would be willing to offer wider market

opportunities for US products in Indonesia.

In addition to the US, the government will also boost

Indonesia's exports to target markets such as Mozambique,

Chile, Pakistan, India, Bangladesh and Sri Lanka.

Higher plantation log production forecast in second

half 2019

Purwadi Soeprihanto, Executive Director of the

Association of Indonesian Forest Concessionaires (APHI),

said log production between January-May 2018 reached

19.26 million cubic metres while between January-May

this year production was around 18.71 million cubic

metres, an almost 3% decline.

The latest data corrects earlier statements that there was an

increase in production in the early part of 2019.

Purwadi said the decline in production was due mainly the

impact of the ongoing peatland restoration in industrial

timber plantation concessions [HTI] and revision of the

targets in the Business Work Planning Document [RKU].

Log production from natural forests in the period January-

May 2019 increased sharply to 2.73 million cubic metres

compared to 1.85 million cubic metres last year.

Although plantation log production declined, Purwadi was

optimistic that in the second half of 2019 log production

from industrial plantations wouldl rise as peatland

restoration will be completed and controlled harvesting of

peatland plantations will commence.

APHI noted that the average price of logs from natural

forests currently range from Rp1.4 million/cu.m to Rp1.5

million/cu.m while the average price of logs from

industrial plantations such as acacia, eucalyptus and jabon

is currently around Rp. 600,000 cu.m to - Rp.

700,000/cu.m.

See:

https://ekonomi.bisnis.com/read/20190628/99/939034/produksikayu-

bulat-terkoreksi-tipis

Market downturn – plywood industry proposing

changes to fiscal policies

Indonesia’s panel product exports fell almost 20% year on

year in the first half of 2019. Plywood exports to the US

are currently down 38% from a year earlier.

The Executive Director APHI has reported that stocks of

plywood are mounting up because of sluggish demand.

There has been a decline in plywood prices since the

beginning of the year (see index below) and this is

affecting demand for domestic natural forest logs.

To help the sector weather the current downturn the

industry is proposing changes to number of fiscal policies

including accelerating the VAT refunds and a review of

wood pricing assumptions used to determine taxes and a

waiver of the Land and Building Tax. The industry is also

again pursuing a decision to allow log exports.

https://www.indopos.co.id/read/2019/07/08/180659/dunia-usahaminta-

insentif-pasar-kayu-bulat-alam

Diversify production to raise sector output

Forestry sector players estimate that, if the so-called

‘multi-forestry concept’ that would have companies

extensively diversifying to produce a wide range of

products can become a reality, then export values from the

forestry sector could rise from the current US$12 billion in

2018 to US$70 billion in 2045.

Purwadi said this projection was based on two scenarios:

First, through optimising utilisation of forest

areas which cover over 68 million hectares

For production of upstream and downstream

products.

Second, developing markets for non-timber forest

products, environmental services and ecotourism.

Purwadi said, he has identified 12 non-timber forest

products that can be commercialised more effectively by

the forestry sector including pine gum, rattan, honey,

agarwood, citronella, bamboo, coffee and rubber.

5.

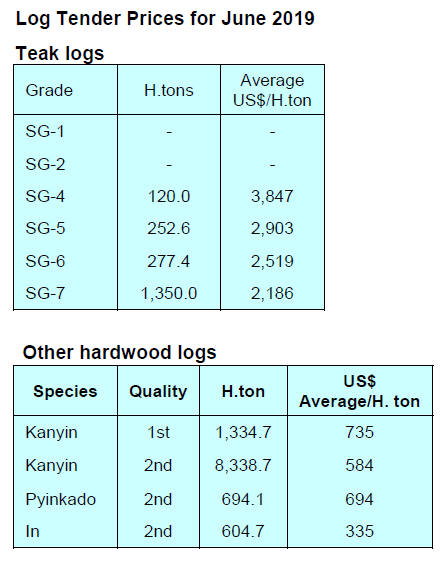

MYANMAR

Calls for lower taxes on

imported logs

It has been reported that the Myanmar Timber Merchants

Association (MTMA) will submit a proposal to the

government to reduce the import tariff on the imported

logs.

The Managing Director of one company which imports

logs from Africa said the company has to pay 15%

Custom Duty, 5% Special Commodity Tax, 5%

Commercial Tax plus the 2% advance settlement of

corporate tax. The high tax is discouraging development of

the industry, say analysts.

Myanma Timber Enterprise (MTE) Deputy General

Manager, U Khin Maung Kyi, responded saying the matter

will be taken up with the Forest Department, the Custom

Department, Myanmar Port Authority and other importers.

Commenting on the proposal analysts pointed out that

imported logs help balance supply and demand in the

domestic market as well as create export opportunities so

would encourage the government to review the taxes and

charges on imported logs.

MTE Tests QR Code for traceability

The MTE has announced the results of a pilot test of QR

Code traceability covering about 500 logs from the Gan

Gaw area which is acknowledged as ‘the home of good

teak’. The Myanmar Timber legality Assurance System

(MTLAS) Gap Assessment Project undertaken in 2016-17

recommended the simplification of the traceability

mechanism and introduction of an IT system.

The Forest Department and MTE worked on a system to

address the concerns identified in the Gap Analysis. It was

this review that led to the publishing of the so-called CoC

Dossier which detailed the log flow process and relevant

documents along the supply chain.

Myanmar EITI calls for greater data transparency

The Myanmar EITI (MEITI) office has just published its

second report for Myanmar which includes the forestry

sector. The MEITI report has attracted mixed reactions

from the forestry sector as it points out significant

inconsistencies in the data reported from various

government agencies. MEITI has called on the authorities

to reconcile the data and establish greater transparency in

the sector.

6. INDIA

Economic Survey forecasts 7% GDP

growth next year

Prior to the discussion on the latest national budget the

Economic Survey 2018-19 was presented to the Indian

parliament. This suggests the Indian economy is likely to

be the fastest-growing major economy in the world as

GDP is expected to rise to 7% in fiscal 2020, driven higher

than the 6.8% growth this year by accelerating investment

and private consumption.

Additional tax benefit for ‘affordable home’ buyers

The Indian government has raised the level of tax

deduction allowed against interest on home loans for

affordable housing. This benefit is available for home

loans agreed until March 31, 2020.

This added benefit for home buyers is expected to lift sales

this financial year. Analysts had expected the stamp duty

to be abolished given that the GST is in effect.

For more see: https://housing.com/news/budget-2018-top-5-

expectations-real-estatesector/?

utm_source=internal&utm_medium=email&utm_campai

gn=subscribersDigest

Calls for increased import duty on wood raw materials

Vadiraj Kulkarni, Chief Operating Officer of the

Paperboard and Specialty Papers Division of the

diversified ITC (previously known as the Imperial

Tobacco Company), has said, in order to encourage

domestic sources of raw material and processing, the

customs duty on timber imports should be raised to 10%

as the current rate (nil from ASEAN countries under

preferential agreements) discourages investment in

forestry in India.

ITC’s pulp mill at Bhadrachalam utilises pulpwood from

sustainably managed sources across the country. This raw

material can substitute for imported pulp, said Kulkarni

and an expansion of local raw material production will

generate income for rural communities.

Plantation teak imports

The dull market and declining profitability in the timber

importing sector has been further aggravated by the

requirement for many companies and traders to make

advance GST payments. Generally, GST is applied on a

supplier of goods and service at the time of receipt of

payment. However, in some cases, an advance payment is

required.

See: https://taxguru.in/goods-and-service-tax/gst-advancepayment.

html

Efforts are being made by importers to lobby the

authorities to ease the advance payment conditions. It was

hoped that the new budget would address this and other

issues facing traders and manufacturers but analysts say

there is little that has changed.

The rupee is steady against the US dollar at around Rs.69

and is trading in a narrow range as prospects of an interest

rate cut by the US Federal Reserve will change the

direction of exchange rates.

C&F prices for teak imports from various sources continue

within the same range as reported earlier.

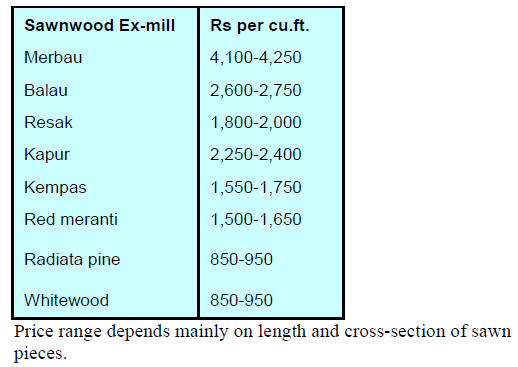

Locally sawn hardwood prices

Analysts report there are signs of improved demand which

has lifted import volumes.

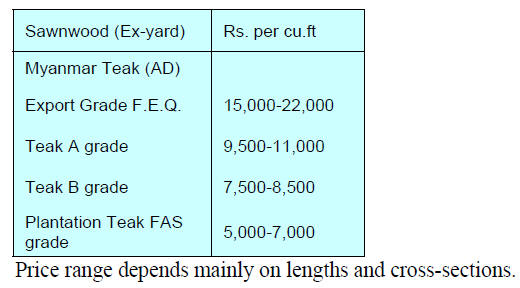

Myanmar teak prices

A steady demand for Myanmar teak is supporting recent

price increases but is not sufficient for traders to think

about further increases.

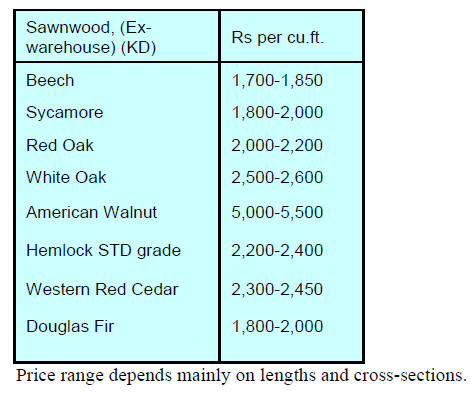

Sawn hardwood prices

No prices movements have been reported.

Plywood update

Plywood producers are saying there was little in the 2019

budget that offers any relief for the tough trading

conditions they are experiencing.

Most of all they are looking for a reduction in the GST for

wood products, considered raw material inputs to other

sectors such as housing. No price movements have been

reported.

7.

VIETNAM

Vietnam captures opportunities

from US/China trade

dispute

In the first three months of 2019 Vietnam’s wood product

exports were valued at around US$2.3 billion, some 16%

higher than in the same period in 2018. The top export

markets for wood products are traditionally the USA, EU,

China, Japan and S.Korea.

According to the Ministry of Agriculture and Rural

development (MARD), the export growth rate is expected

to rise once the EU/ Vietnam Free Trade Agreement enters

into force.

As is the case with several other countries the USA/China

trade conflict is creating opportunities for expanded

investment and exports for Vietnam-made wood products

to take advantages of preferential tariffs into the US.

However, some Vietnamese exporters have fallen into the

trap of relabeling Chinese imports as made in Vietnam.

Vietnamese authorities are now addressing this and have

stepped up Customs checks.

See: https://baohaiquan.vn/manh-tay-loai-bo-go-bat-hop-phapde-

thuc-xuat-khau-go-103078.html

Vietnam jumps to top of ASEAN wood product

exporters

Mr. PhamVan Dien, Deputy Director of the Department of

Forestry, has reported that in the first half of 2019

Vietnam jumped to the top of the list of ASEAN wood

products exporters. It also became the 5th largest globe

wood product exporter because of the sustained high

growth of industrial production.

He pointed out that the top international markets US, EU,

Japan and S. Korea accounted for over 80% of Vietnam’s

wood product exports in the first six months of 2019 and

this contributed to the positive socio-economic

development of the national forest sector which now

supports millions of jobs.

In the first half of 2019 around 110,000 ha. of new

plantations were established however, currently, there is a

drought in many areas in Vietnam and this is increasing

the risk of forest fires especially in provinces such as

Nghean, Hatinh, Quangbinh, Quangtri, Thuathienhue,

Danang, Quangnam, Quangngai and Phuyen.

Rising demand for verified legal raw materials

Recently, Vietnam has become more dependent on

imported timber raw materials to produce wood products

for export and a large volume of American hardwoods is

being imported.

Robert Hanson, Head of the Foreign Agricultural Service

of the US Embassy in Vietnam, has said Vietnam is now

one of the main S.E. Asian importers of American

hardwoods accounting for over 70% of US timber exports

to S.E. Asia.

He continued, “American wood is known as highly

traceable, legally planned and harvested, as well as fully

documented which meets the legal requirements and

technical standards of the major finished product

importing countries”.

At an ASEAN Conference on ‘American wood in

furniture design and production’ held in June Mr. Ha Cong

Tuan, Vice Minister of MARD has said US is the

Vietnam’s biggest partner in the trade of wood products

and that the trade is in both directions with finished

products being shipped to the US.

Mr. Nguyen Ton Quyen, Deputy Chairman of the Vietnam

Timber and Forest Product Association, has said Vietnam

is aiming to export wood products valued at US$11 billion

in 2019 and to meet this target Vietnam needs about 35-40

million cubic metres of raw timber, much of which must

be imported.

Vietnam has halted exploitation of natural forests for three

years and has been pushing afforestation. The 3.5 million

hectares of plantations will provide about 35 to 40 million

cubic metres of timber in the next five to 10 years in

which time Vietnam will be dependent on imports of raw

materials.

See: http://vietnamnews.vn/economy/521804/viet-namdevelops-

forestry-industry-explores-collaboration-withus.

html#QCyQgWFFY4jOSF3a.99

High occupancy rate in Economic Zones

According to the Ministry of Planning and Investment, in

June 2019 there were 326 Industrial Parks (IPs) and 17

coastal special economic zones (EZs) in Vietnam of which

251 are fully operational. The occupancy rate of the

completed zones is around 75%.

It is estimated that in the first six months of 2019, the IPs

and EZs attracted 340 foreign investors with a registered

capital of about US$8.7 billion. As of June 2019 there

were over 8,900 investment projects underway worth

about US$186 billion.

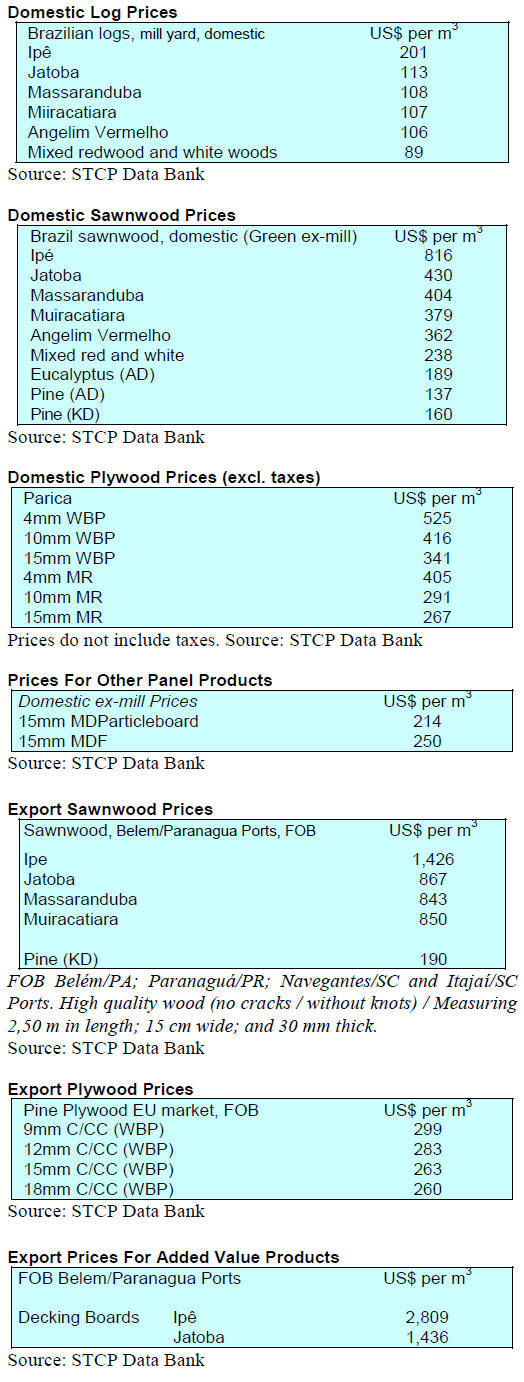

8. BRAZIL

Brazil may lead ‘new forest economy’

- has great

potential for reforestation

With increasing investments in restoring natural forests

and expanding sales of certified timber local analysts say

Brazil could become a global leader in what some are

calling a "new forest economy."

Companies involved in commercial logging and timber

certification are currently examining a market model that

reconciles profit with forest preservation and reforestation

goals.

The Brazilian Agricultural Research Corporation

(EMBRAPA) has been carrying out studies to identify

how best to recover deforested areas using native timber

species specific for each biome. After restoration these

areas could be made available for sustainable commercial

logging.

Among the native timber species of economic value is

paricá (Schizolobium amazonicum) found in the Amazon

region. This species is said to have a growth rate equal to

that eucalyptus and is a good raw material for industry.

While companies in the US invest about US$100 billion a

year in commercial reforestation projects Brazil is

investing much less with most being in pine and

eucalyptus with very little investment in natural forest

restoration.

Brazil has about 50 million hectares of forest area, much

of which is degraded due to over harvesting and

abandoned farms which are suitable for reforestation

according to a study published in the Journal Science in

July.

Forest biomass exports from Southern Brazil

During the IV International Biomass Congress a

spokesperson from the Forestry Association of Santa

Catarina (ACR) reported that in 2018, Brazil exported 1.6

million tons of wood chips, sawdust and wood waste

generating about US$144 million. Japan imported just

over half of all exports, mainly wood chips for energy and

pulp production.

The ACR participated in a panel discussion on forest

biomass and presented an overview of the potential of

Santa Catarina. According to the Forestry Statistical

Yearbook 2019 Santa Catarina State accounted for 29% of

Brazilian exports of wood pellets for energy purposes last

year. In 2018, Brazil exported 226,100 tonnes of wood

pellets of which the United Kingdom imported US$24.4

million and Italy US$12.6 million.

The level of industrialisation in Santa Catarina for wood

products is high according to ACR. The State has a

diversified industry. The ACR 2019 Yearbook illustrates

that municipalities that host an active forestry sector have

seen significant improvements in the quality of life of the

population over the last few years.

Potential increase in wood products supply to

international market

Following the first meeting held in Brazil between the

Brazilian Association of Mechanically-Processed Timber

Industry (ABIMCI) and the US National Association of

Home Builders (NAHB) in May, a follow-up meeting

between the two organizations took place in Washington

DC, recently.

ABIMCI reports that the objective was to advance

negotiations for a possible increase in the supply of wood

products from Brazil to meet the demands and

requirements of NAHB. The NAHB represents more than

140,000 associated companies in the civil construction

sector.

While exports of sawnwood and flooring continue the

agenda of the meeting addressed the possibility of

expanding Brazilian exports of plywood and doors since

these products can satisfy the technical and environmental

requirements demanded in the American market.

Regarding sawnwood, the primary demand is for structural

use timber and for a better understanding of legal

requirements and applicability the NAHB provided all the

necessary technical information established by the

American Lumber Standard Committee (ALSC).

According to NAHB, the US civil construction sector is

concerned about the recent tax imposed by the US

government on China and also on the slow progress in

negotiations with Canada and Mexico as this may disrupt

supplies from these producers thus creating an opportunity

for Brazil.

9. PERU

Government and private sector

committed to the

promotion of wood value chain

To promote the forestry sector and strengthen the wood

value chain the Regional Government of Ucayali

(GOREU) and the National Forestry and Wildlife Service

(SERFOR) arranged technical meetings to plan

implementation of the Forest Transport Guides (ER-GTF)

and the Electronic Operations manual for wood products

which are part of the Control Module of the National

Forest and Wildlife Information System (MC-SNIFFS).

SERFOR and GOREU consider MC-SNIFFS as key to

boost the forestry sector as an activity that promotes the

economic and social development of the country through

sustainable use and legal access to timber resources.

In related news Pro-Ucayali, a private sector initiative,

announced a new pilot project for reforestation and

development of the wood industry in the Ucayali region.

The work will be conducted in cooperation with the

Regional Government of Ucayali and the Chamber of

Commerce, Industry and Tourism of Ucayali. Pro-Ucayali

is working with the Andean Development Corporation

(CAF), various green funds and other institutions to try

and secure soft loans for small and medium sized entities

in Ucayali.

Funding secured for ecological projects in the Loreto,

San Martín and Madre de Dios regions

The Ministry of Economy and Finance (MEF) has

authorised loans from the Inter-American Development

Bank (IDB) for up to US$16. 8 million for the financing of

ecological projects in the Loreto, San Martín and Madre

de Dios regions.

These resources will be used to partially finance the

project "Improvement of support services for the

sustainable use of the biodiversity of the ecosystems in the

forest landscape in the Tarapoto - Yurimaguas corridor, of

the Departments of San Martín and Loreto".

Parallel projects will be undertaken in the Puerto

Maldonado - Iñapari corridor and in the Amarakaeri

Communal Reserve in the Department of Madre de Dios.

Some resources will be allocated for efforts on improving

of environmental monitoring and mapping deforestation in

the Amazon forests of Peru.

Successful trade mission to Dominican Republic

A third trade mission by Peruvian timber sector companies

was recently undertaken in the Dominican Republic.

Meetings were held with importers of sawnwood,

woodbased panels and flooring.

The mission included companies from Ucayali and Madre

de Dios and provided for direct contact with Dominican

importers as well as an opportunity to assess the level of

wood product demand in the Dominican Republic which is

Peru’s fourth largest market for wood products.