|

Report from

North America

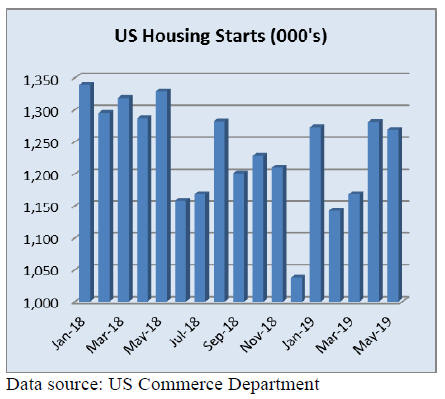

Housing starts fell in May after flooding

US home building unexpectedly fell in May, but data for

the previous two months was revised higher. Building

permits also increased suggesting the housing market was

drawing some support from a sharp decline in mortgage

rates.

Housing starts dropped 0.9% to a seasonally adjusted

annual rate of 1.269 million units in May amid a decline in

the construction of single-family housing units, the

Commerce Department reported.

Data for April was revised up to show home building

rising to an annual pace of 1.281 million units, instead of

increasing to a rate of 1.235 million units as previously

reported. Housing starts in March were also stronger than

initially estimated. Economists polled by Reuters had

forecast housing starts edging up to a pace of 1.239

million units in May.

The building of single-family homes, which accounts for

the largest share of the housing market, dropped 6.4% in

May. Single-family housing starts fell in the Northeast, the

Midwest and West, but rose in the South, where the bulk

of home building occurs.

Some of the weakness in groundbreaking activity probably

reflects heavy rain and flooding in some parts of the

country.

Canadian housing starts fell in May compared with the

previous month as groundbreaking tumbled by 18.5%. The

seasonally adjusted annualized rate of housing starts fell to

202,337 units in May from a revised 233,410 units in

April, the Canadian Mortgage and Housing Corporation

(CMHC) said. Economists had expected starts to fall to

205,000.

In related news, existing-home sales rebounded in May

recording an increase in sales for the first time in two

months, according to the National Association of Realtors.

Each of the four major US regions saw a growth in sales,

with the Northeast experiencing the biggest surge.

Total existing-home sales jumped 2.5% from April to a

seasonally adjusted annual rate of 5.34 million in May.

Total sales, however, are down 1.1% from May 2018.

US job growth slows ¨C blamed on trade tensions

US job growth slowed sharply in May and wages rose less

than expected, raising fears that a loss of momentum in

economic activity could be spreading to the labour market.

Non-farm payrolls increased by 75,000 jobs last month,

the government said. This was the second time this year

that job gains dropped below 100,000. Economists polled

by Reuters had forecast payrolls rising by 185,000 jobs

last month. Job growth in March and April was revised

down by 75,000.

The broad cool-off in hiring reported by the Labor

Department was before a recent escalation in trade

tensions between the United States and two of its major

trading partners, China and Mexico. Analysts have warned

the trade fights could undermine the economy, which will

celebrate 10 years of expansion next month, the longest

sustained expansion on record.

Federal Reserve - willing to cut rates if economy falters

The US Federal Reserve did not change interest rates in

June, but strongly signaled a willingness to cut soon to

prevent the economy from slowing further. The US

President has, for months, urged the central bank to cut

rates to boost growth.

Business investment is slowing, uncertainty has increased,

and the US economy is growing only at a ¡°moderate¡±

pace, the Fed announced after its June meeting, a notable

downgrade from last month when the central bank

characterised the economy as ¡°solid.¡±

The Fed indicated it would take action ¡°as appropriate¡± if

the economy shows any more signs of decline.

Manufacturing continues to expand

Economic activity in the US manufacturing sector

expanded in May and the overall economy grew for the

121st consecutive month, say the nation¡¯s supply

executives in the latest Manufacturing ISM Report on

Business.

Comments from the panel reflect continued expanding

business strength, but at soft levels consistent with the

early-2016 expansion. Demand and consumption

continued to expand while inputs ¨C expressed as supplier

deliveries, inventories and imports ¨C were lower in May.

Prices remain at a relatively stable level.

Tariff threat on Mexico withdrawn

Following a commitment by Mexico to deploy additional

resources along its southern border, the US announced that

escalating tariffs he had threatened are "indefinitely

suspended." Before the deal was announced, Cindy

Squires of the International Wood Products

Association stated ¡°Tariffs paid by US importers,

manufacturers and ultimately consumers are not the way

to address the crisis at the border."

Trade talks to resume

After a hostile month-long standoff, the United States and

China will restart trade talks when President Trump and

Chinese leader Xi Jinping meet on the sidelines of the G20

summit in Osaka, Japan.

After months of fruitless negotiations and increasing

tariffs, Chinese officials are increasingly cautious and

many experts believe the chances for a breakthrough in

Osaka are slim.

Deforestation-Free procurement bill moves to

California Senate

The California Deforestation-Free Procurement Act has

been approved by the California Assembly and sent to the

state's Senate for further consideration.

If enacted, this legislation would require entities that

contract with the State of California to provide so called

"forest-risk commodities" such as wood and wood

products to certify that the products were not derived from

land where deforestation occurred after January 1, 2022.

The bill defines deforestation as "direct human-induced

conversion of tropical forest to agriculture, a tree

plantation, or other non-forest land use, or severe and

sustained degradation of a tropical forest resulting in

profound change in species composition, structure, or

ecological function of that tropical forest."

To become law, it must be approved by both chambers of

the California Legislature and signed by California¡¯s

governor. See: International Wood Products Association at

https://www.iwpawood.org/

|