|

Report from

North America

Hope for quick end to trade deal wanes

Talks to end the trade dispute between the US and China

have hit a roadblock and relations between the economic

superpowers have deteriorated. President Trump followed

up on earlier threats and increased tariffs from 10% to

25% effective May 10 on US$200 billion of Chinese

imports. China responded by upping tariffs on US$60

billion of US goods starting June 1.

China¡¯s State Council Customs Tariff Commission

announced that 2,493 US products will be subject to a

25% tariff, 1,078 products will be hit with a 20% tariff and

974 products will be subject to a 10% tariff. A 5% tariff on

595 products will also remain in place.

Tariffs have already had an impact. Over the six-month

period ending in March, wood product exports from the

US to China dropped by US$700 million or 42% percent.

Industries affected included firms that buy logs of

hardwoods like walnut, maple and cherry.

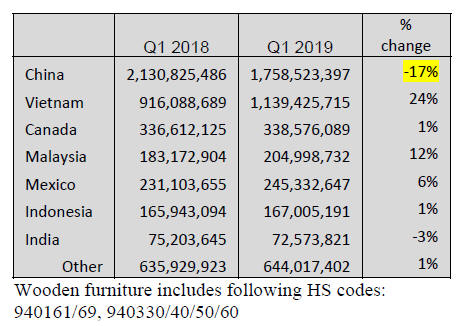

US furniture imports dip in March

US imports of wooden furniture fell by 9% in March.

Declining imports from China was the main cause of the

decline as imports of wooden furniture from China were

down 29% from February.

Imports from China for March 2019 were 28% below that

of March 2018 and finished the quarter down 17%.

Imports from Canada, Mexico and Indonesia rose in

March and all are now ahead of 2018 numbers for the first

quarter.

Imports from Vietnam were down by 12% from January

but remain well above March 2018 levels. Vietnamese

imports have gained the most in the 1st quarter, up 24%

year to date.

Housing starts on the rise

Housing starts rose 5.7% to a seasonally adjusted annual

rate of 1.235 million units in April, driven by gains in the

construction of both single- and multi-family housing

units. Groundbreaking was also likely boosted by drier

weather in the Midwest.

Data for March was revised up to show homebuilding

rising to a pace of 1.168 million units, instead of falling to

a rate of 1.139 million units as previously reported.

Building permits rose 0.6% to a rate of 1.296 million units

in April, after three straight monthly declines. Singlefamily

building permits, however, fell for the fifth straight

month.

But - sales of existing home slide

Existing-home sales saw a minor decline in April,

continuing March¡¯s drop in sales, according to the

National Association of Realtors. Two of the four major

US regions saw a slight dip in sales, while the West saw

growth and the Midwest essentially bore no changes last

month.

Total existing-home sales fell 0.4% from March to a

seasonally adjusted annual rate of 5.19 million in April.

Total sales are down 4.4% from a year ago (5.43 million in

April 2018).

Consumer sentiment highest in 15 years

US consumers appear optimistic as the Index for

Consumer Sentiment surged in early May to its highest

level in fifteen years. All of the May gain was in the

Expectations Index, which also rose to its highest level

since 2004, while the Current Conditions Index was

virtually unchanged and well below the cyclical peak set

in March 2018.

Consumers viewed prospects for the overall economy

much more favorably, with the economic outlook for the

near and longer term reaching their highest levels since

2004. The gains were recorded mostly before the trade

negotiations with China collapsed and China responded

with their own tariffs.

See:

http://www.sca.isr.umich.edu/

Manufacturing still expanding but at a slower pace

The overall economy grew for the 120th consecutive

month and economic activity in the US manufacturing

sector expanded in April, according to the nation¡¯s supply

executives in the latest Manufacturing ISM Report on

Business.

Comments from respondents reflect continued expanding

business strength, but at the softest levels since the fourth

quarter of 2016. Export orders contracted for the first time

since February 2016.

The wood products sector was among six of the 18

manufacturing industries surveyed to report contraction in

April, but it also reported growth in new orders.

US distributor coalition to fight cabinetry anti-dumping

decision

A coalition has been launched to fight the recent unfair

trade allegations against ready-to-assemble cabinetry

imports from China.

The formation of the American Coalition of Cabinet

Distributors (ACCD), a group made up of US distributors,

dealers, contractors, installers and importers, was in direct

response to the antidumping and countervailing petition

filed March 6 by the American Kitchen Cabinet Coalition.

The petition alleges the Chinese government's

"manipulation and unfair trade practices" have led to a

more than 75 percent rise in Chinese imports of kitchen

and bath cabinetry since 2015 and created a threat to the

US$9.5 billion American industry.

According to its website, (American Cabinet

Distributors.org,) the small and medium-sized businesses

represented by ACCD represent less than 10 percent of the

US domestic cabinet industry sales, while employing tens

of thousands of American workers. The ACCD claims

imposition of proposed duties could effectively eliminate

the RTA option from the US marketplace.

Although an April 19 preliminary vote by the US

International Trade Commission determined that "there is

a reasonable indication" that American cabinetry

manufacturers are being harmed by Chinese imports of

wooden cabinets and vanities, the ACCD said it is

"encouraged" by the commission's views on the industry.

For more see:

https://www.woodworkingnetwork.com/news/woodworkingindustry-

news/us-distributor-coalition-set-fight-trade-case-rtacabinetry-

imports

Largest US grocery chain pursues No-Deforestation

policy

The largest grocery chain in the US will develop and

implement a new plan to improve its protection of tropical

forests.

See:

https://www.greencentury.com/kroger-to-adopt-deforestationpolicy-

following-green-century-engagement/

https://www.treehugger.com/corporate-responsibility/krogercommits-

no-deforestation-policy.html

Two years ago, the Union of Concerned Scientists released

a report that ranked 13 major food companies on their

deforestation-free beef commitments and practices,

highlighting that fact that, "beef is the largest driver of

tropical deforestation ¨C and companies that buy beef from

tropical countries could be doing a lot more to stop it."

Kroger, the United States' largest grocery chain and the

country's largest second-largest general retailer behind

Walmart, received zero points out of 100 in the rating of

deforestation-free beef policies and practices. But now the

company will be developing and implementing a nodeforestation

policy that will cover its private label "Our

Brands" products, according to a statement from Green

Century Funds.

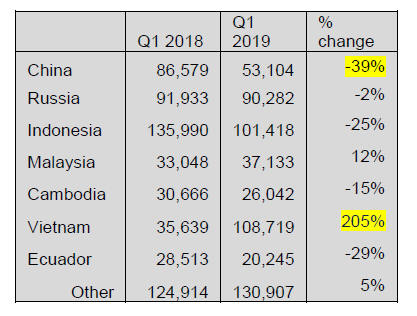

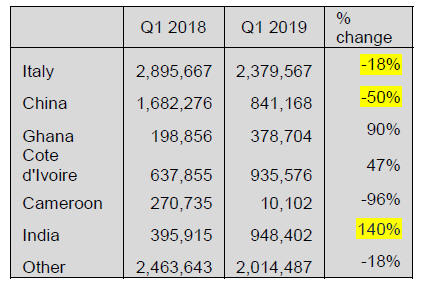

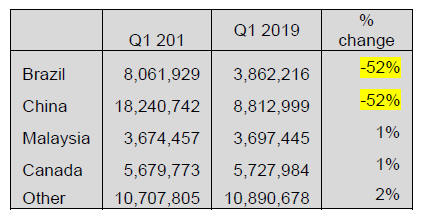

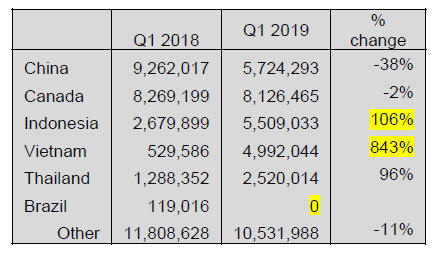

US imports, Q1 2019 compared to Q1 2018

Highlights

Plywood

An overall decline from the main shippers An overall decline from the main shippers

Imports from China fall further Imports from China fall further

Surge in imports from Viet Nam Surge in imports from Viet Nam

Veneer

Top shippers, Italy and China, saw

declines in Top shippers, Italy and China, saw

declines in

Q1 2019

Strong export performance from India Strong export performance from India

Mouldings

Two main shippers, China and Brazil, saw Two main shippers, China and Brazil, saw

quarter on quarter declines in Q1

2019

Assembled flooring

Shipments from China continue down Shipments from China continue down

Strong export performace by

Indonesia and Viet Strong export performace by

Indonesia and Viet

Nam

No shipments from Brazil in Q1 2019 No shipments from Brazil in Q1 2019

Wooden Furniture

All main shippers saw increased exports in

Q1 All main shippers saw increased exports in

Q1

2019 compared to Q1 2018 except China

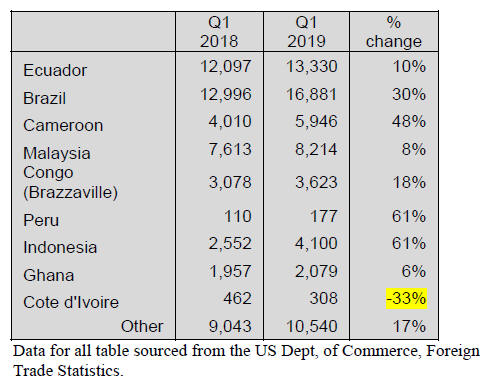

Hardwood sawnwood

Strong export performance by Cameroon,

Brazil Strong export performance by Cameroon,

Brazil

and Indonesia

Sharp drop in shipments from Cote d¡¯Ivoire Sharp drop in shipments from Cote d¡¯Ivoire

|