|

Report from

Europe

EU tropical timber imports rising since

mid-2018

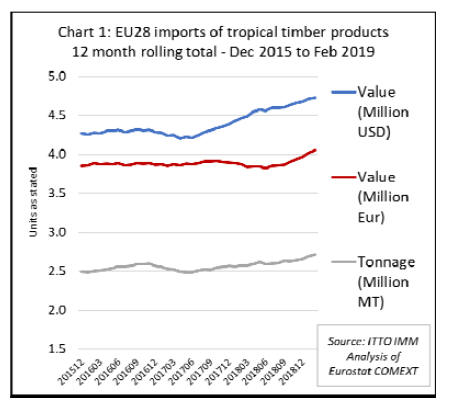

ITTO¡¯s analysis of Eurostat year-end data showed that the

total value of tropical wood imports into the EU increased

slightly in 2018, although at a slower rate than imports

from non-tropical countries tropical wood continued to

lose share last year (ITTO MIS Volume 23 Number 4 16-

28 February 2019).

Closer analysis of monthly data to end February 2019

reveals a slightly more positive picture, showing that EU

imports of tropical timber products began to rise more

strongly, both in quantity and value terms, in the second

half of 2018.

EU imports began to rise earlier, from the start of 2017, in

dollar terms as the euro strengthened significantly against

the US currency between December 2016 and February

2018 (Chart 1).

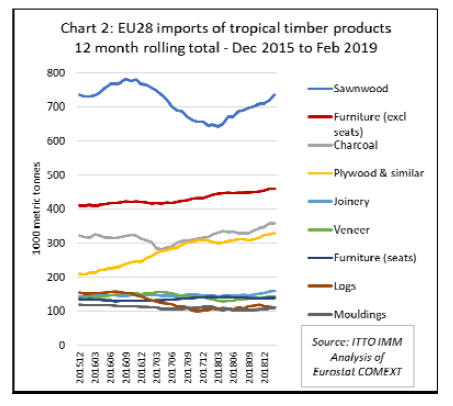

The rise in EU imports of tropical timber in the second

half of 2018 and the first quarter of 2019 was driven by

several products groups. EU imports of tropical

sawnwood, which have been highly volatile in recent

years, regained ground lost during the slump in the second

half of 2017.

EU imports of wood furniture (excluding seating) from

tropical countries have been rising slowly and consistently

since the start of 2017, driven by Vietnam and India.

Imports of tropical charcoal and plywood have also been

rising during this period. Most tropical charcoal is derived

from Nigeria and Cuba. The rise in tropical hardwood

plywood imports is concentrated in product from China

and Indonesia, the latter partly boosted by FLEGT

licensing. (Chart 2).

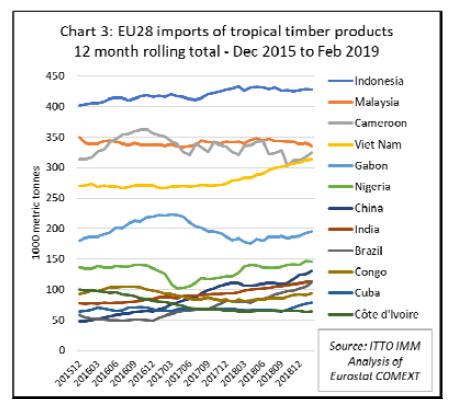

While imports of plywood from Indonesia have been

rising, EU imports from Indonesia across all product

groups were flat in 2018 and have remained so in 2019. So

too have imports from Malaysia.

EU imports from Cameroon have been extremely volatile

in recent times, with the overall trend downward.

However, there was a slight uptick in imports from

Cameroon at the start of 2019.

EU imports from Vietnam, nearly all furniture have been

rising steeply since the start of 2018 and this trend

continued into the New Year. After a long period of very

slow trade, EU imports from Brazil, mainly of decking,

have been recovering in the last six months. (Chart 3).

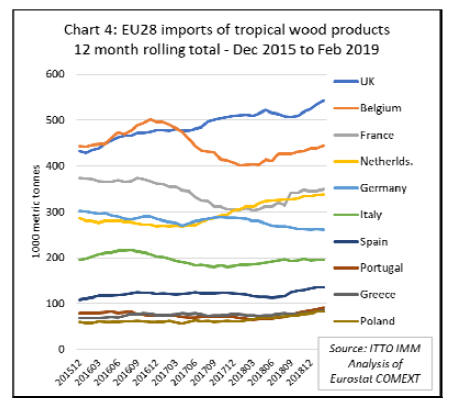

Imports vary widely between member states

Trends in tropical timber imports tend to vary widely at

national level, although the latest upturn in imports has

been quite well distributed across the EU. Of the largest

destination countries, only Germany registered a decline in

direct trade of tropical timber at the start of this year (and

as noted in the last issue of ITTO MIS, a feature of

Germany¡¯s trade in tropical timber is that most is now

sourced indirectly from other EU countries).

Imports increased sharply into the UK in the opening

months of 2019 and were also rising in Belgium, France,

Netherlands, Spain, Portugal, Greece and Poland. Imports

remained flat in Italy however (Chart 4).

The recent upturn in tropical timber imports is rather

surprising as, to a large extent, it is against broader

economic trends in the EU. The value of the euro and the

British pound eased against the dollar in 2018 and remain

at historically low levels, acting as a drag on imports.

EU domestic demand still buoyant

According to the EU¡¯s Spring 2019 Economic Forecast,

issued on 8th May, ¡°economic activity in the EU slowed

further in the second half of 2018 as growth in the global

economy and trade weakened amid tightened global

financing conditions, unresolved trade tensions, high

uncertainty, and as a result of exceptional weakness in the

manufacturing sector that extended into the start of 2019.¡±

The Forecast identifies a wide range of factors that

¡°weighed on sentiment¡± in the EU, including ¡°disruptions

in the car manufacturing sector, social tensions, policy

uncertainty, as well as uncertainty related to Brexit.¡±

Overall, GDP growth in the EU is forecast to moderate

from 2.1% in 2018, to 1.4% this year and to remain at this

lower level in 2020.

On the other hand, according to the Forecast, ¡°domestic

demand has been less affected. Employment growth,

which has so far remained resilient, is expected to

continue in the euro area, but at a slower pace.

Combined with rising wages, muted inflation and

supportive fiscal measures in some Member States, job

creation should continue to underpin household spending

this year and next. At the same time, low financing costs

should help to at least partly offset the negative impact of

lower sales expectations on investment¡±.

The relative resilience of domestic demand goes some way

towards explaining the rise in tropical timber imports in

the EU in recent months. It has been enough to encourage

importers that have been holding stocks at relatively low

levels for many months back into the market.

Equally, some cooling in global demand against the

background of slowing economic growth in China and the

trade dispute with the US, has made international prices

for hardwood products more attractive to European

buyers. The growing global competitiveness of Vietnam

and India is also becoming more evident as these countries

are increasing penetration of the EU wood furniture

market.

The particularly strong growth in the UK market in the

opening months of 2019 is surprising given the high levels

of uncertainty in the UK economy created by Brexit.

Both new construction and building renovation markets,

the latter being critical for hardwoods, were slowing at the

end of 2018. The UK economy appears to have grown

weakly in the first quarter of 2019, with the services and

manufacturing purchasing managers index hovering only

slightly in expansionary territory amid soft new orders.

Latest surveys from the Construction Products Association

(CPA) and Federation of Master Builders (FMB) are

slightly more positive. The CPA¡¯s State of Trade Survey

for the first quarter 2019 shows continued growth in UK

sales of construction products and materials, while the

FMB¡¯s survey demonstrates better expectations for small

and medium sized builders.

However, the surveys also indicate that the political and

economic situation is holding back product manufacturers¡¯

capital investment in the UK, particularly in commercial

offices, industrial factories and high-end residential.

Feedback from the UK hardwood trade indicates that

buying remains quite cautious, although trade data

suggests some importers may have carried out stockpiling

in the weeks immediately before 29 March 2019, the

original date of UK departure from the EU. It may be that

imports tailed off in March and April after the decision to

delay the official Brexit date until 31 October.

The growth in Belgium tropical timber imports this year is

driven mainly by sawn timber and decking products and

mainly reflects Belgium¡¯s key role as a distributor of

tropical timber to other parts of the EU. This has become

more pronounced with the move to Just-in-Time

purchasing and EUTR implementation which discourages

manufacturers and smaller distributors from direct imports

from the tropics.

Prospects for consumption of tropical hardwood within

Belgium itself are not promising. There was sluggish but

stable economic growth in Belgium last year but

household spending is falling with declining consumer

confidence. Economic sentiment is falling in the run-up to

federal elections in May.

The market in France is turning around slowly after

several years of stagnation. Fourth-quarter GDP growth

was modest but resilient, stable from a quarter earlier

despite the social unrest of last year¡¯s ¡®gilets jaunes¡¯

protests.

Domestic demand was hit by the demonstrations, with a

decline in household spending. Market sentiment was

improving in France in the first quarter of this year and

fiscal policy is helping to prop up private consumption.

However, growth is likely to be constrained against the

backdrop of global trade tensions and lingering Brexitrelated

uncertainty.

The Italian market remains subdued and is still adjusting

to the long-term effects of the economic crisis of a decade

ago, with fewer manufacturers processing a narrower

range of species and fierce competition for business.

The bigger hardwood importers and distributors now

favour smaller just in time ordering, as end users try and

keep stock to a minimum and order only what they

immediately need to process.

The Italian economy continues to struggle weighed down

weak domestic demand which is driving down industrial

output and sales and contributing to low business

confidence. As for households, worsening consumer

confidence and a deterioration in the labour market point

to subdued spending patterns.

In other news, the Italian government endorsed China¡¯s

Belt and Road Initiative in late March, in the hope of

receiving substantial infrastructure financing.

Spain¡¯s hardwood market dipped after the summer break

in 2018 with importers blaming instability both internally

and externally.

At home, the issue of independence for Catalonia has not

gone away, state budgets are not approved and indecision

about potential new mortgage taxes affected investment in

the housing sector. Generally, importers have reacted by

maintaining stock at low levels and buying only essential

items on a ¡°just in time¡± basis.

However, there are also positive signs in Spain. Industrial

production rebounded solidly in January and the services

sector is stable. Private consumption is quite solid,

propped up by healthy employment growth and higher

purchasing power thanks to low inflation. There was a

slight upturn in Spain¡¯s imports of tropical products at the

end of 2018 and in the first two months of 2019.

The Netherlands still stands out as a growth area for the

EU market. In the final quarter of last year, the Dutch

economy accelerated on the back of firming domestic

demand and an improved trade balance.

Economic growth is expected to moderate in the

Netherlands during 2019 as the external environment

becomes more challenging, but domestic demand should

remain robust on the back of fiscally expansionary

policies.

Turnover in the Dutch construction sector increased 10%

to a 10-year high last year. The total number of new home

starts was stable, with 70,000 building permits issued, the

same as in 2017. That is some way below pre-crisis levels,

when around 80,000 new permits were given every year,

but still implies good levels of consumption this year in

the finishing sectors important to hardwoods.

|