|

Report from

North America

U.S. and Peru resolve PTPA dispute

The United States and Peru have successfully resolved the

concerns raised in the first-ever environment consultations

under the United States ¨C Peru Trade Promotion

Agreement (PTPA).

In January, the U.S. requested consultations under the

2009 trade treaty¡¯s environmental chapter to oppose Peru¡¯s

decision to place its forest monitor, OSINFOR, under the

environmental ministry, despite a provision requiring

OSINFOR to be an independent agency.

Following technical consultations in January and

deliberations by the PTPA environmental affairs council in

February, Peru reversed course, annulling the December

decision on April 9.

https://ustr.gov/about-us/policy-offices/press-office/pressreleases/

2018/april/ustr-successfully-resolves-concerns

ITC - U.S. producers harmed by China wooden cabinet

imports

The U.S. International Trade Commission (ITC) has

determined that there is a ¡°reasonable indication¡± that

imports of wooden cabinets from China are harming

American producers, keeping alive a trade investigation

that could lead to tariffs on the products.

The preliminary findings by the trade panel mean the U.S.

Commerce Department will move ahead with an

investigation into whether Chinese wooden cabinets,

vanities and component parts are unfairly subsidised or

sold in the U.S. market at less than fair value.

If the Commerce Department determines the products are

unfairly subsidised or dumped on the U.S. market and if

the ITC upholds its preliminary finding of harm, the

United States would impose tariffs on the imports for a

period of five years.

The United States imported some US$4.4 billion worth of

wooden cabinets, vanities and their component parts from

China in 2018. The trade investigation was launched in

March based on petitions from the American Kitchen

https://www.usitc.gov/press_room/news_release/2019/er0419ll1088.htm

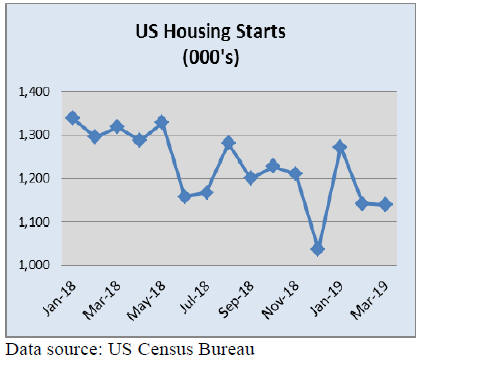

Housing starts approach two-year low

U.S. homebuilding dropped to a near two-year low in

March, pulled down by persistent weakness in the singlefamily

housing segment, suggesting the housing market

continued to struggle despite declining mortgage rates.

Some of the weakness in homebuilding likely reflected

disruptions caused by massive flooding in the Midwest,

with housing starts in the region declining to levels last

seen in early 2015. The report bucked a recent tide of

upbeat data that indicated the economy regained speed as

the first quarter ended.

Housing starts fell 0.3% to a seasonally adjusted annual

rate of 1.139 million units last month, the lowest level

since May 2017.

Data for February was revised down to show

homebuilding tumbling to a pace of 1.142 million units

instead of the previously reported 1.162 million-unit rate.

Housing starts in the Midwest, which was devastated by

floods during the month, dropped 17.6%.

Single-family homebuilding, which accounts for the

largest share of the housing market, dropped 0.4% to a rate

of 785,000 units in March, the lowest level since

September 2016.

Single-family homebuilding in the Midwest tumbled

21.2% last month to the lowest level since February 2015.

Single-family starts also fell in the populous South. But

they rose in the Northeast and West.

Building permits fell 1.7% to a rate of 1.269 million units

in March, the lowest in five months. Building permits have

now declined for three straight months.

Permits for single-family housing dropped to a more than

1-1/2-year low in March.

https://www.usitc.gov/press_room/news_release/2019/er0419ll1088.htm

In related news, existing-home sales declined in March,

following February¡¯s surge of sales, according to the

National Association of Realtors. Each of the four major

U.S. regions saw a drop-off in sales, with the Midwest

enduring the largest decline last month.

Existing-home sales fell 4.9% from February to a

seasonally adjusted annual rate of 5.21 million in March.

Sales were down 5.4% from a year ago (5.51 million in

March 2018).

March existing home sales fell 7.9% in the Midwest and

were off 8.6% from a year ago. Existing-home sales

decreased in the Northeast by 2.9%, trailing behind March

2018 sales by 1.5%. Sales fell by 3.4% in the South and

are down 2.1% from last year. In the West, existing home

sales fell by 6.0% and are 10.7% below a year ago.

Manufacturers report improving wood products sector

Economic activity in the U.S. manufacturing sector

expanded in March, and the overall economy grew for the

119th consecutive month, say the nation¡¯s supply

executives in the latest Manufacturing ISM Report on

Business.

Comments from respondents surveyed by the Institute of

supply Management reflected continued expanding

business strength, supported by gains in new orders and

employment. Demand expansion continued, with the New

Orders Index and the Customers¡¯ Inventories Index both

improving, and the Backlog of Orders Index softening to

marginal expansion levels.

While the wood product sector reported only average

growth in March among the 18 manufacturing industries

surveyed, the sector reported the highest growth in

imports, new orders, and new export orders. The wood

products sector also reported the second highest levels of

employment growth.

https://www.instituteforsupplymanagement.org/ismreport/mfgrob.cfm?SSO=1

|