Japan Wood Products Prices

¡¡15¨C 30th April

2019

Japan

Wood Products Prices

Dollar Exchange Rates of 25th

April

2019

Japan Yen 111.63

Reports From Japan

10 day public holiday to boost consumer spending

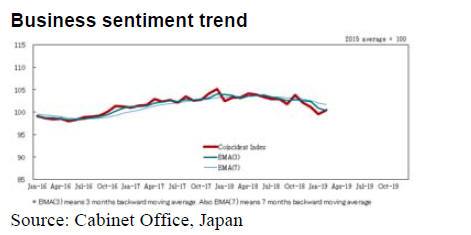

Sentiment among Japan's largest manufacturers became

more pessimistic in the first quarter of 2019 as reported by

the Bank of Japan's (BoJ) business survey, the ¡®Tankan

report¡¯.

Of the 10,000 companies surveyed most see the slowdown

in Chinese imports as a risk to businesses in Japan. The

likely rise in crude oil prices is also an issue as this would

push up production and distribution costs. A BoJ official

pointed to weaker demand in Asian markets including

China as having a negative impact on business sentiment.

If the trade talks between the US and China are concluded

quickly then this would greatly ease the concerns of

Japanese businesses.

On the bright side, Japanese people are in a festive mood

as they prepare for an unprecedented 10-day holiday to

celebrate the enthronement of a new Emperor.

This long holiday is expected to give the sluggish

economy a short-term boost. Breweries, hotels, retailers,

restaurants and train/airline operators are all expected to

benefit from the holiday which runs from April 27 to May

6. Banks, schools, government offices and many

businesses (including ITTO¡¯s HQ in Yokohama) will be

closed.

Will they or will they not?

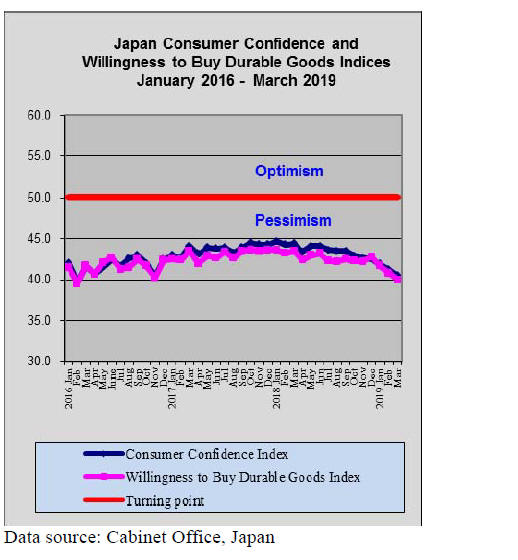

The government was quick to dispel the suggestion from a

close aide to the Prime Minister that a delay in the

consumption tax rise could be considered if business

sentiment continues to weaken.

A government spokesperson reiterated that the

consumption tax will be raised to 10% from the current

8% ¡°unless Japan's economy suffers a shock on the scale

of the global financial crisis¡±.

A 10% tax is far too low according to the Organisation for

Economic Cooperation and Development (OECD). In its

biennial report, the OECD said the combined impact of a

rapidly aging population and the huge government debt

requires a "comprehensive fiscal consolidation plan,

including specific spending cuts and tax increases."

According to the Ministry of Finance Japan¡¯s public debt

is equivalent to more than 230% of GDP.

Fiscal normalisation dismissed for now

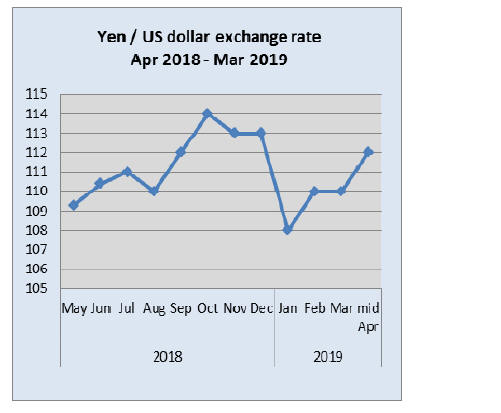

In late April the BoJ announced it plans to hold interest

rates at the current low level for an extended period which

analysts read as indicating no rise in interest rates for the

next 12 months. This decision was expected and had an

impact on the Yen/US dollar exchange rates.

At an international level, the collapse of the Swedish

krona to its lowest level in a decade highlighted a common

concern in financial markets, namely the stance of central

banks around the world.

Sweden¡¯s central bank has now joined many others such

as the BoJ and the Bank of Canada in dismissing prospects

of fiscal normalisation because of concerns on slowing

international trade and prospects for growth.

Zero-energy housing by 2030

Japan aims to achieve zero-energy status for all housing by

2030 through having new home owners install solar power

and other energy-saving features. This is part of the

government strategy to achieve its commitments to Paris

Agreement, the international framework to combat global

warming.

It is also proposed that energy balanced status will be the

aim for existing houses through renovations and subsidies.

See:

http://the-japan-news.com/news/article/0005690517

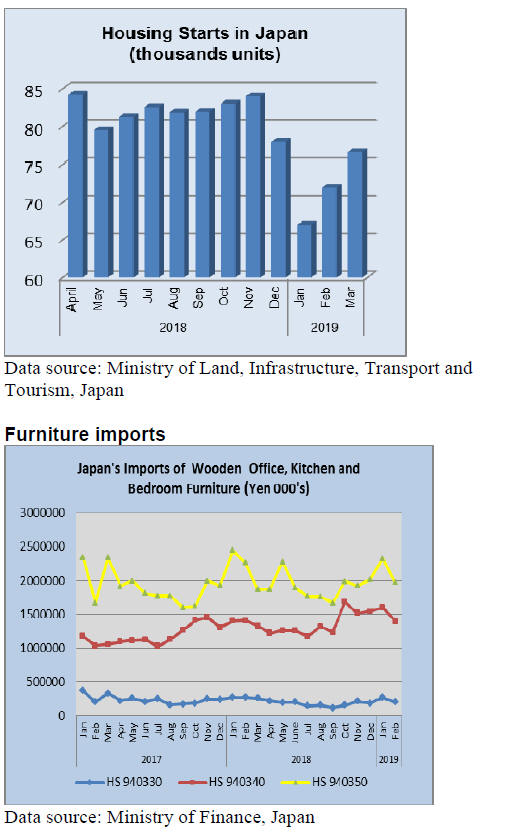

Japan¡¯s March 2019 housing starts were 10% higher than

in last March and month on month starts were 6.5%

higher. The good figures for March mark the third straight

rise in starts this year. However, total starts in the firs

quarter of 2019 were unchanged from levels in the first

quarter 2018.

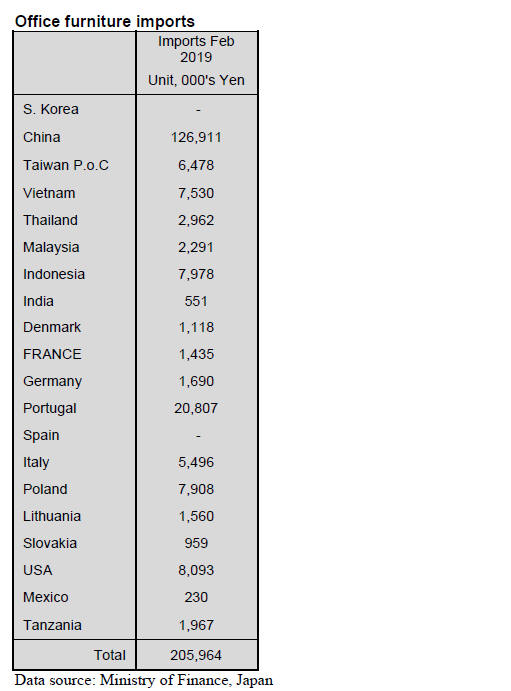

Office furniture imports (HS 940330)

In February the top two shippers of wooden office

furniture (HS940330) to Japan accounted for over 70% of

all HS940330 arrivals. China alone contributed around

60% with another 10% shipped from Portugal. Four other

shippers made it into the top 10 list namely US, Viet Nam

Indonesia and Poland with each contributing around 4% of

February 2019 imports.

Year on year the value of Japan¡¯s February 2019 imports

of wooden office furniture (HS 940330) were, once again

little changed but month on month imports dropped 24%.

This decline mirrors the pattern of trade over the past three

years and if this pattern is maintained there a rise will be

observed in March imports.

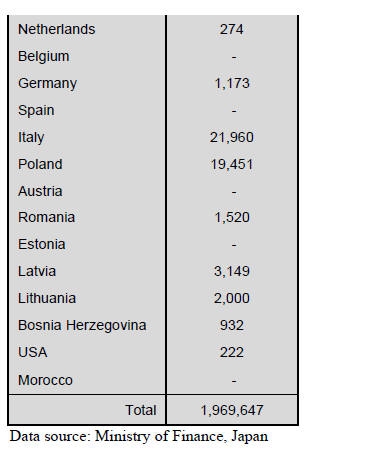

Kitchen furniture imports (HS 940340)

February data for the value of Japan¡¯s wooden kitchen

furniture imports (HS940340) reaffirmed the dominance

of the top two shippers, the Philippines and Vietnam

which together accounted for over 90% of Japan¡¯s wooden

kitchen furniture imports.

The third largest shipper, China, saw its share of February

imports drop to 12% from 14% in January.

Year on year the value of February 2019 imports of

wooden kitchen furniture rose 35% but month on month

there was a 14% decline.

Bedroom furniture imports (HS 940350)

The continuously rising value of Japan¡¯s imports of

wooden bedroom furniture which began in in the third

quarter of 2018 and extended to January this year came to

an end in February when the value of imports dropped

15% compared to January. However, year on year the

value of imports for this category of furniture was up 16%

in February.

In February there was an over 30% drop in the value of

wooden bedroom furniture from China, imports from Viet

Nam were little changed from a month earlier but imports

from Thailand and Malaysia rose (8% and 26%

respectively).

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Wood based public buildings increase

The Ministry of Land, Infrastructure and Transport and the

Ministry of Agriculture, Forestry and Fisheries announced

that percentage of wood based public buildings less than

three stories built in fiscal year 2017 is 63 %. This is the

first time that percentage exceeded 60%.

However, many buildings are small so that floor space did

not increase as much as number of unit then buildings with

wood interior finish are 171 units, 9.5% less than 2016 so

wood use decreased by 14.9% with 3,139 cbms. This

move is based on the law to promote using wood for

public buildings in 2010 and in particular, lower buildings

of less than three stories are object of wood use.

In 2018, public buildings of less than three stories are 127

units, 30.9% more than 2016 with total floor space of

14,293 square meters, 3.5% more. In these, wooden

buildings are 80 units, 90.5% more with floor space of

9,457square metres, 29.9% more.

By type of building, bicycle parking is the top with18 units

with floor space of 509 square meters. Second is 10 units

of warehouse and parking garage with floor space of 652

square metres.

Third is eight rest areas along highways with floor space

of 1,570 square meters.

Others with large floor space are four office buildings with

floor space of 1,441 square metres, two lodgings with

floor space of 1,042 square metres. Other types are park

facilities, exhibition facilities, social welfare facilities and

toilets.

Used wood for public buildings in 2014 was 2,705 cbms,

in 2015 was 2,327 cbms, in 2016 was 3,689 cbms and in

2017 was 3,139 cbms.

By Ministry, Ministry of Defense put up 64 buildings,

Ministry of Land, Infrastructure and Transport built 23

units, Supreme Court built 17 units, Justice Ministry built

15 units. By the prefectures, Akita is the highest with

50.5%. Akita is the highest for last four years with more

than 50% share. 34 prefectures increased wood based

share in 2018.

Besides public buildings, the statistics include privately

built buildings such as educational facilities and medical

and welfare facilities, which have high public nature. Six

prefectures of Aomori, Akita, Yamagata, Gunma, Shimane

and Miyazaki have maintained high share of wood

buildings with more than 22% since 2010.

Compared to these prefectures, large populated prefectures

like Tokyo, Osaka, Kanagawa, Chiba and Aichi have

much tighter fire control restrictions, which make it hard

to use wood.

Law of wood use promotion for public buildings was

enacted in 2010 so share of wooden buildings is getting

larger.

February plywood supply

Total plywood supply in February was 489,800 cbms,

0.1% more than February last year and 5.0% less than

January. This is the first time that the supply dipped below

500,000 cbms. Domestic production continued active but

the imported plywood supply declined.

Softwood plywood production in February was 252,800

cbms, 4.1% more and 2.2% more. In this non-structural

plywood production was 21,700 cbms, 21.8% more and

11.5% more. This is to replace declining imported

hardwood plywood for flooring.

The shipment of softwood plywood was 252,600 cbms,

6.1% more and 6.9% less in which shipment of nonstructural

plywood was 22,600 cbms, 26.7% more and

17.3% more.

Demand for structural plywood by precutting companies

was busy and for non-structural panel was also active so

that the production and shipment are balanced. The

inventories were 117,100 cbms, 2,900 cbms more than

January.

The inventories increase some but the manufacturers¡¯

inventories are low so that they intend to build up some

more before lengthy holidays in late April and early May.

Imported plywood by source was 86,500 cbms from

Malaysia, 0.9% more and 7.2% less, 83,200 cbms from

Indonesia, 5.8% more and 8.8% more but total import for

January and February from Malaysia was down by 5% and

Indonesia was down by 4%.

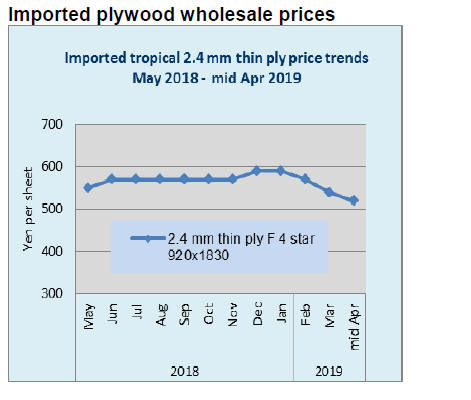

Because of escalating export prices and weak demand in

Japan, the importers are not so anxious to commit future

volume.

Plywood market is deadlocked. Demand for domestic

softwood plywood is steady by precutting plants but

wholesale channel is dull and some low offers are going

around. Imported plywood is weak in demand but high

priced cargoes keep arriving so price reduction is

impossible.

Movement of softwood plywood varies by the regions. In

Western Japan, supply tightness is easing but active

movement continues in Kyushu and Osaka region.

Plywood manufacturers in Western Japan carry

limited inventory and experience shortage of delivery

trucks.

Meantime, in Eastern Japan, movement is stagnating. Dull

movement of wholesale channels and some of inventory

disposals by trading firms for book closing in March

soften market.

Imported plywood market is confusing as the demand in

Japan continues weak while bullishness of

suppliers continues, which insist on selling cost base

prices.

Some suppliers switch to container from bulk carriers,

which plugs up port warehouses so warehouse companies

are increasing handling charge, which is another cost up

factor. The market prices are weak by soft demand

Wood panel review 2018

Total supply of wood panels (plywood and wooden board)

in 2018 was 9,144,495 cbms, 0.2% more than 2017.

In this, domestic panels were 5,064,623 cbms, 0.6% less.

Imported panels were 4,079,872 cbms, 1.3% more. Share

of domestic and import was 55.4% vs 44.6%. Domestic

supply of wooden board decreased by 37,031 cbms while

that of import increased by 33,565 cbms. Decrease of

domestic supply was mainly particleboard and MDF.

New housing starts in 2018 were 942,370 units, 2.3% less

than 2017 with wood based units of 539,394 units, 1.1%

less. Problems wood panel supply faced in 2018 were

manpower shortage and logistics such as lack of long haul

trucks.

For plywood, one new mill started in April by Nisshin so

total supply should have increased but total production of

domestic plywood increased only by 0.2%. Reasons are

tightening of labor standard law and shortage of young

workers, particularly in local regions.

To secure young workers, working rules are changing to

reduce overtime works. Plywood mills had been running

over the weekend and late hours when orders are heavy

but now such extra works are largely reduced so that the

production does not increase.

Logistic problems are getting serious year after year.

Many wood panel manufacturers have plant in local

regions and it is necessary to transport products to large

consuming markets like Tokyo and Osaka but securing

long haul trucks is getting harder and harder. For imported

panels, as containers shipment becomes standard after the

volume for Japan drops, the suppliers switched from bulk

ships to containers.

Warehouses at ports are plugged up with incoming

cargoes and handlings are delaying. Transporting

products from manufacturing plants to the markets is a

problem but transporting raw materials like logs and wood

chip to manufacturing plants poses the same problem.

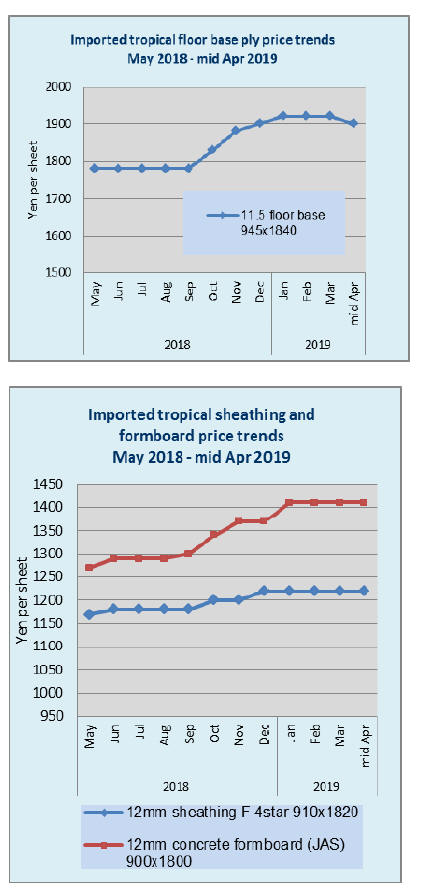

The market of wood panels in 2018 stayed rather firm,

supported by active demand. Domestic softwood plywood

prices of 12 mm 3x6 have been held firm at 1,050 yen per

sheet delivered since March 2018. The manufacturers did

not reduce the prices even when the market softened

temporarily.

On imported plywood, the suppliers are determined to sell

based on actual cost so the export prices have been

climbing month after month and the Japanese buyers had

to accept high prices.

Total imported plywood in 2018 was 2,923,056 cbms,

0.7% more than 2017. By source, 1,062,086 cbms from

Malaysia, 10.8% less than 2017. 977,557 cbsm from

Indonesia, 11.4% more. 642,008 cbms from China, 1.9%

less. 241,405 cbms from other countries, 32.2% more.

Export prices of uncoated concrete forming 3x6 panel

were $520-530 per cbm C&F and coated concrete forming

panel were $600 at the beginning of the year and the prices

climbed to $580-590 and $680-690 by the end of 2018.

The increase was $50-90 in one year. Also Indonesian 2.4

mm thin panel prices climbed by $300 in six months to

$1,100.

Supply of wooden board (fiber board and chip board) in

2018 was 3,004,642 cbms, 0.1% less than 2017. Domestic

supply was 1,847,826 cbms, 2.0% less and imported

supply was 1,156,816 cbms, 3.0% more.

Despite housing starts in 2018 were down by about 20,000

units, the supply of wooden board did not drop. By item,

in early 2018, supply of 2x6 particleboard was tight but

the supply recovered in the second half. Thin MDF for

flooring continues tight but overall supply and demand

were balanced.

Domestic supply of particleboard was 1,075,019 cbms,

1.7% less. Imported particleboard was 541,935 cbms,

2.6% more. In this, OSB was 285,360 cbms, 1.7% more.

Total supply of MDF was 1,007,830 cbms, 0.2% more.

Domestic supply was 395,727 cbms, 4.5% less while

imported MDF was 612,103 cbms, 3.6% more.

Trend to switch floor base from tropical hardwood

plywood to MDF, domestic softwood plywood and

composite floor base made of planted species of falcate

continues.

Looking at the production of composite flooring,

combination of MDF and imported hardwood plywood

declined by 1.8% but combination of MDF and softwood

plywood increased by 2.9% so MDF demand for flooring

continues increasing. Also after the prices of thin plywood

from South East Asian countries have kept climbing,

demand for thin hardwood MDF increased.

OSB supply from North America increased some but the

supply from Europe declined as the demand in Europe was

active and the prices are more attractive and the freight

also increased, which discouraged supply for Japan.

|