3.

MALAYSIA

4.6 million ha. PEFC certified

forests in Malaysia

The Malaysian Timber Certification Council (MTCC)

started operation in January 1999 as an independent

organisation to develop and operate the Malaysian Timber

Certification Scheme (MTCS). This has been endorsed by

the Programme for the Endorsement of Forest

Certification (PEFC) which covers around than 300

million ha. of certified forests worldwide.

As of April 2019 there were 4.607 million hectares of

PEFC Certified Forests in Malaysia. There are 362 PEFC

Chain of Custody certificate holders.

In collaboration with the Peninsular Malaysia Forestry

Department, MTCC recently organised a seminar to

expand the understanding of forestry officers from the

various state forestry departments on the implementation

and requirements of forest management certification under

the MTCS.

Forestry officers from state forestry departments of Johor,

Kedah, Kelantan, Negeri Sembilan, Pahang, Perak,

Selangor and Terengganu as well as FD HQ staff

participated in the seminar.

2019 GDP forecast at almost 5%

The World Bank has forecast that Malaysia’s 2019 GDP

should reach 4.7% driven by private consumption. Richard

Record, the resident economist for Malaysia, said private

consumption should continue rise but at slightly slower

pace than in recent years.

See:

https://www.malaymail.com/news/malaysia/2019/04/24/worldbank-

keeps-malaysias-2019-gdp-outlook-at-4.7pc/1746392

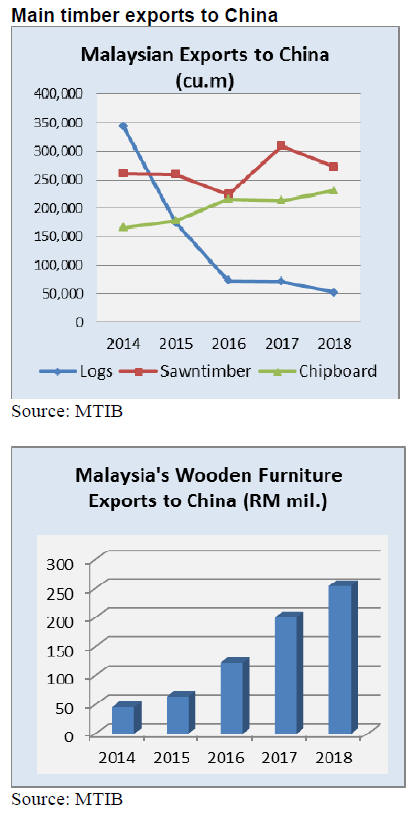

Timber trade with China continues to rise – but steady

decline in log exports

Demand for raw material from China’s timber processing

industries continues to rise and Malaysia’s exports of

timber to China are providing much of China’s timber raw

material needs.

In 2014 Malaysia’s exports of wood products to China

were valued at RM872.6 million and this jumped to

RM1.1 billion in 2018 with sawnwood being the main

export. Malaysia’s imports of wood products from China

are also significant and growing. Imports were worth

RM708.6 million in 2013 rising to RM1.5 billion in 2018.

Malaysia mainly imported wooden furniture (RM719.4

million), plywood (RM135.5 million), veneer (RM155.3

million) and other products including builders woodwork,

joinery, mouldings and fibreboard.

Plans for pulp/paper mill in Sarawak

A recently signed MOU between a China-based Fortune

500 company and the Sarawak State Economic

Development Corporation (SEDC) outlines plans for a

joint investment in a pulp and paper manufacturing plant

to be located in the Samalaju Industrial Park, Bintulu.

The Chinese company, Shan Ying, which is listed on the

Shanghai Stock Exchange, is a manufacturer and

distribution of paper products.

The proposed plant will integrate pulp and paper

manufacturing and the production capacity is said to be in

the region of 2 million tonnes annually. The Malaysian

media has reported construction will begin next year.

Sarawak Chief Minister, Abang Johari Tun Openg, said

the plant would use imported recycled paper for its

production not natural resources from Sarawak within.

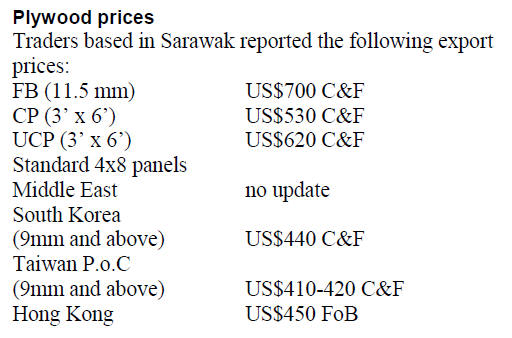

Plywood import ban

The Sarawak Timber Industry Corp (STIDC) website has

an announcement a ban on importation into Sarawak of

ordinary plywood above 6 mm thickness with effect 18

April 2019. As more information becomes available it will

be reported.

https://www.sarawaktimber.gov.my/pages.php?mod=announcem

ent&sub=announcement_detail&id=41

4.

INDONESIA

Fall in plantation log

production

Plantation roundwood production in the first two months

of 2019 fell 21% compared to production in the same

period in 2018 according to Purwadi Soeprihanto,

Executive Director of Indonesian Forest Concessionaire

Association (APHI). In 2018 roundwood production was

3.91 million cubic metres per month.

Purwadi said the decline in log production in early 2019

was a reflection of weaker demand for raw materials.

Millers have said the on-going US-China trade conflict is

affecting the performance of the main finished product

exporters for whom plantation logs are the raw material.

Based on the V-Legal data from the Ministry of

Environment and Forestry, in the first quarter of this year

export of processed wood products totalled US$2.82

billion down 18% year on year.

Purwadi forecast that this year roundwood production

from industrial timber plantation concessions (HTI) will

increase 10% compared to last year's production of 40.13

million cubic metres while production from natural forests

will be about the same as in 2018.

https://ekonomi.bisnis.com/read/20190409/99/909457/rerataproduksi-

kayu-bulat-terkoreksi-21

In related news, the Ministry of Environment and

Forestry

(KLHK) has announced it is not planning to issue new

permits for industrial timber plantation concessions (HTI)

this year. Hilman Nugraha, Director General of

Sustainable Production Forest Management in the KLHK,

said the current HTI permits covering 11.43 million

hectares is sufficient to meet the industrial needs.

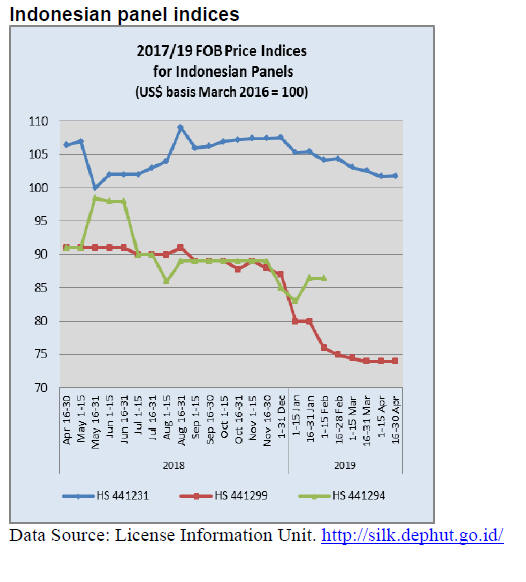

First quarter 2019 panel exports drop

The KLHK export database is showing that the value of

panel exports in the first quarter of 2019 fell sharply. The

Director of Processing and Marketing of Forest Products

at KLHK said international demand remains sluggish and

this is affecting exports.

In the first quarter of 2019, the value of panel exports was

US$550.27 million, down 13% compared to 2018. In

contrast to the decline in the value of panel exports,

exports of veneer in the first quarter 2019 increased 12%.

https://ekonomi.bisnis.com/read/20190409/99/909445/kuartali2019-

ekspor-kayu-panel-terkoreksi-us83.17-miliar

Need to expand downstream manufacturing

The Executive Director of the Center of Reform on

Economics, Mohammad Faisal, has pointed out that,

despite being one of the largest wood product exporters in

the world, the value of Indonesia’s furniture exports is

only ranked 17th in the world. He urged greater efforts to

restructure the development of the manufacturing industry.

He lamented that raw materials are exported especially to

China to be manufactured into high value products for

export.

https://www.liputan6.com/bisnis/read/3937454/genjot-ekspormebel-

indonesia-harus-benahi-industri-hilir-kayu

Minister of Trade – no raw rattan export

The Indonesian Minister of Trade, Enggartiasto Lukita,

has reiterated his ministry’s intention not to permit exports

of raw rattan because it will undermine the Indonesian

rattan industry and only enrich manufacturers in the

importing countries. He said Indonesia needs to find ways

to expand rattan product manufacturing within the

country.

One issue to be resolved is the difference between the

abundance of rattan in Central Kalimantan and the long

distance to manufacturers who are mainly concentrated in

West and Central Java.

In sharp contrast to the stance of the Minister of Trade,

rattan producers complain about the effect of the export

ban on rattan prices. They claim that the domestic industry

cannot absorb their production and this drives down raw

rattan prices. They say they have witnessed a 40% drop in

prices over the past 2 years.

Chairman of the Indonesian Rattan Entrepreneurs

Association (APRI) Kalimantan, Herman Yulius, said

currently land owners are depressed because rattan prices

continue to fall and they have no alternative market

outlets.

APRI has requested the government to either permit the

export of raw rattan so land owners can benefit or make

greater efforts to attract investment in rattan product

manufacturing.

5.

MYANMAR

Power outages scheduled – manufacturers and

households affected

Manufacturers and households have been advised by the

Mandalay Electricity Supply Corporation (MESC) to

brace for scheduled power cuts. In a statement the MESC

said it will cut power across different areas in Mandalay

and the cuts will be around one to two hours at a time.

MESC has blamed increased demand and lower output

from its power plants.

Myanmar’s capital Yangon experienced day time

temperatures of 42 degrees centigrade last week beating

the past record high of 41 degrees. The Department of

Meteorology in Myanmar reported new temperature

records for five cities.

The hottest was Chauk on the banks of the Irrawaddy

River in central Myanmar where temperatures have been

above 40 degrees in April. In these temperatures forest and

mill operations have slowed considerably.

Trade regulation to protect domestic manufacturers

Added value wood products are amongst the target of an

initiative of the Ministry of Commerce (MOC) as it drafts

new trade regulations aimed at protecting domestic

manufacturers and at the same time promoting exports of

locally made products.

U Than Myint, Minister of Commerce, said because local

manufacturers have been slow in investing in the latest

production technologies they face tough competition from

exporters in neighbouring countries.

The draft regulations are being developed with

assistance

from the World Bank and German development agency

GIZ. Sectors with the greatest potential for higher added

value production have been identified as agricultural and

marine products, textiles and wood products.

Domestic building boom – timber producers

benefitting

Domestic timber producers have been able to take

advantage of the booming investment in the real estate

sector in Myanmar which has seen massive inflows of

foreign investment.

According to a report from the Directorate of Investment

and Company Administration (DICA) over US$1 billion

in foreign investment flowed into the real estate sector in

fiscal 2017, second only to the amount that went into

manufacturing.

https://www.colliers.com/en-gb/myanmar/insights/marketintelligence/

mar25-mar29-2019

6. INDIA

Public-private partnership to develop

plantations

The draft Indian Forest Act 2019, an amendment to the

Indian Forest Act 1927, includes reference to production

forests, mainly commercial plantations, in its definition of

forests.

There is heated debate as to whether tree plantations can

be defined as forests given the commonly understood

definition in India. The government has said no action on

the draft will be taken before receiving state governments’

comments.

Professor, NH Ravindranath of the Indian Institute of

Science commented “If production forests are located in

protected or reserve forest areas it’s not good idea as there

will be fragmentation of forests. Such a move he says

could also open the gates for illegal smuggling”.

In a follow-up to the draft amendment of the Forestry Act

the government has released details of its policy for

public-private partnership to develop plantations in

“degraded” forests. Analysts say the draft awaits Cabinet

approval and will be taken up after the elections.

https://www.hindustantimes.com/india-news/timber-productionforests-

find-place-in-forest-act-draft/story-

4BKI0rOsqjSYNXDMpQdegN.html

World Bamboo Workshop 2019

A five-day workshop focused on the need to make better

use of and develop bamboo as it is a renewable sustainable

and alternative to timber and plastics.

The Executive Director of the World Bamboo

Organisation, Susanne Lucas, called for the wider

application of biodegradable products such as bamboo.

She announced that the WBO and government of Manipur

will be signing an agreement which recognises the

essential contribution of bamboo in the fight against

climate change. It sets out to free bamboo from the

restrictions of outdated national forestry codes and to

support research, exchange knowledge and improve

communication on bamboo development.

http://www.ifp.co.in/page/items/56116/3rd-world-bambooworkshop-

2019-concludes

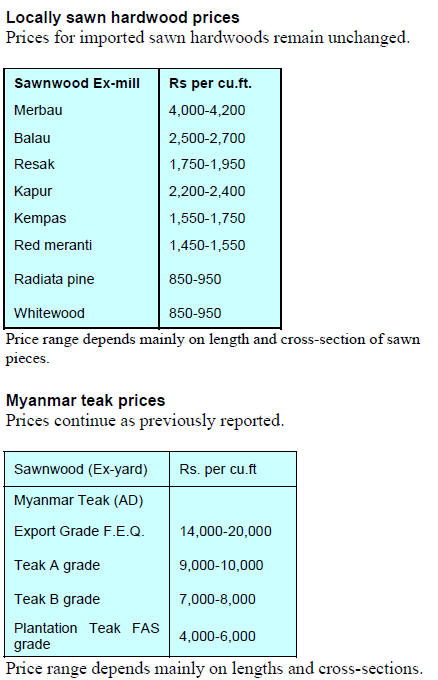

Plantation teak prices

C&F prices for plantation teak landed at Indian ports are

within the same range as shown in the previous report.

Sawn hardwood prices

Shipments of US sawn hardwoods to India are rising and

this, along with a steady flow of European hardwoods, is

keeping market prices stable.

Indicative prices for some imported timbers are shown

below.

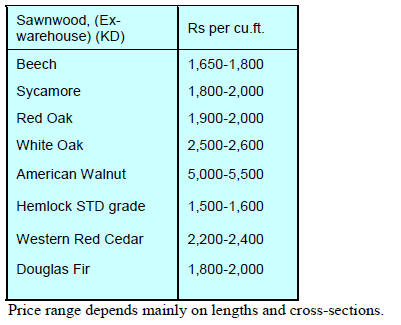

Plywood

The financial plight of domestic plywood manufacturers

has not improved. Production costs continue to rise but the

quiet market for plywood offers no chance for price

increases. Manufacturers are looking to lower labour costs

through automation and improved veneer recovery.

Veneer producers in Gabon are increasing production and

shipments to India. Some of the Indian mills in Gabon,

especially those that do not have forest concessions, have

raised concerns on log availability.

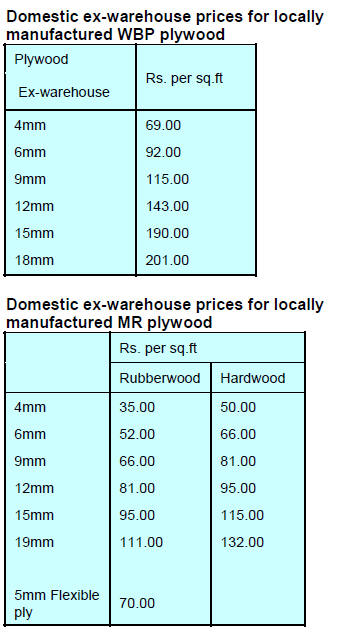

7. BRAZIL

Positive start to year for furniture makers

in Rio Grande do Sul

The Market Intelligence Institute (IEMI), in a report

published in March, shows that January 2019 furniture

production in Rio Grande do Sul State, one of the major

furniture producing states, was up 5% compared to

December 2018.

Over the past 12 months industrial production in the State

expanded by 15%. The apparent consumption of furniture

in Rio Grande do Sul in January 2019 was reported at 6.5

million pieces, a 6% increase over the previous month.

The Furniture Industry Association of Rio Grande do Sul

(Movergs) is forecasting a good year ahead.

Private sector partnership to boost SFM in Mato

Grosso

The forest-based sector in Mato Grosso, through the

Center for Timber Producers and Exporters of Mato

Grosso State (Cipem) and the Sustainable Trade Initiative

(IDH), signed a memorandum of understanding in March

to promote the forest-based sector of Mato Grosso, one of

major timber producing states in the Amazon Region.

Through the partnership, various activities will be

developed to improve the value chain of the forestry sector

in the state.

Actions include technical and financial support; exchange

of knowledge; feasibility studies and operationalisation of

a sustainability certification system that complies with

Brazilian legislation and international protocols and the

development of communication strategies to improve the

image of the forest base sector and access to new markets,

both in Brazil and abroad.

One of the objectives is to establish mechanisms for

transparency and governance to attract investments to

Mato Grosso State to underpin the sustainable

development of the state. The commitment to the natural

forests is to reach 6 million hectares under sustainable

forest management in the Mato Grosso state. Currently,

the state has 3.7 million hectares of managed private

forests.

https://www.cipem.org.br/cipem-e-idh-firmam-parceria-paraimpulsionar-

cadeia-produtiva-do-manejo-florestal-sustentavelem-

mato-grosso/

Export update

In March 2019, Brazilian exports of wood-based products

(except pulp and paper) increased 3.4% in value compared

to March 2018, from US$ 270.8 million to US$ 279.9

million.

The value of pine sawnwood exports increased 13.5%

between March 2018 (US$44.6 million) and March 2019

(US$50.6 million). In terms of volume, exports increased

29% over the same period, from 211,700 cu.m to 273.9

cu.m.

Tropical sawnwood export volumes rose 24% from 38,100

cu.m in March 2018 to 47,400 cu.m in March 2019. The

value of these exports increased 15% from US$17.5

million to US$20.1 million over the same period.

In contrast, the value of pine plywood exports dipped 12%

in March 2019 in comparison with March 2018, from

US$64.3 million to US$56.5 million but in volume trems

there was a slight rise from 194,600 cu.m to 206,300 cu.m.

Tropical plywood exports also declined in March from

16,600 cu.m (US$7.1 million) in March 2018 to 9,600

cu.m (US$ .6 million) in March 2019.

The growth in furniture exports slowed in March with the

value rising to just US$45 million from the US$ 44

million in March 2018.

Increased use of logs for export manufacturing

The Brazilian Agricultural Research Corporation

(EMBRAPA) and the Paraná State Forest Based

Companies Association (APRE) recently concluded there

has been an increase in the demand for logs for domestic

processing.

Demand for logs is high despite the weak domestic

economy because companies are increasing their exports.

The consumption of logs by local mills is estimated at

about 14 million cubic metres annually.

Most millers are vertically integrated but also buy between

30% and 40% in the open market. Millers complain that

logs in the open market are becoming smaller in diameter

and the transport distance is increasing all as a result of

increased consumption.

The states of Paraná and Santa Catarina have expanded

their eucalyptus plantations by about 190,000 hectares to

meet the rising demand.

Fast pace furniture export growth

The Bento Gonçalves Furniture Industry Union

(Sindmóveis) reported an almost 18% year on year rise in

furniture exports in the first quarter of 2019. Since 2018

exports of furniture from the State grew at a faster pace

than anywhere in the entire country.

Among the main destinations for furniture exports were

the United States, followed by Uruguay, Chile, Colombia

and Saudi Arabia, which were the five main destinations

for furniture in the first quarter. Other markets included

Mexico (+ 93%), the United Kingdom (+ 228%), Panama

(+ 84%) and Puerto Rico (+ 67%).

Sindmóveis focuses its work aiming for greater

international investments and diversification of markets.

Sindmóveis works on many fronts with the Brazilian

furniture sector to explore markets opportunities.

8. PERU

Flooring/decking exports up over 30%

According to the Association of Exporters (ADEX),

exports of wooden flooring/decking in the first two

months of the year earned just over US$13 million, an

increase of 31% over the same period in 2018. The

improved performance was due to increased demand in

China, France and Denmark.

Flooring/decking shipments accounted for almost three

quarters of total timber exports, significantly overtaking

shipments of sawnwood (US$3.1 million) and builders’

woodwork, joinery and mouldings.

The timbers shipped included shihuahuaco, ana caspi and

storaque which are used primarily for pool surrounds and

terrace construction.

The value of 2018 shipments of timber for flooring was

nearly 8% higher than a year earlier, the highest for the

past eight years.

The top markets for wood products were China (US$6

million, a 46% share) and France (US$2.9 million, 22%

share). Other market destinations included Denmark

(US$0.8 mil.), Mexico (US$0.6 mil.), Dominican

Republic (US$0.5 mil.), Belgium (US$0.4 mil.) and

Australia (US$0.4 mil.).

There was a recovery in exports to the US at US$2.9

million and this reversed the decline which began in 2014.

Mission to Interzum and Ligna

In May this year Peruvian business executives, with the

support of Tropical Forest Peru, will participate in

Interzum and Ligna, leading fairs for the wood and

furniture sector to be held in Cologne and Hannover. This

will mark the seventh occasion entrepreneurs have

participated.