|

Report from

North America

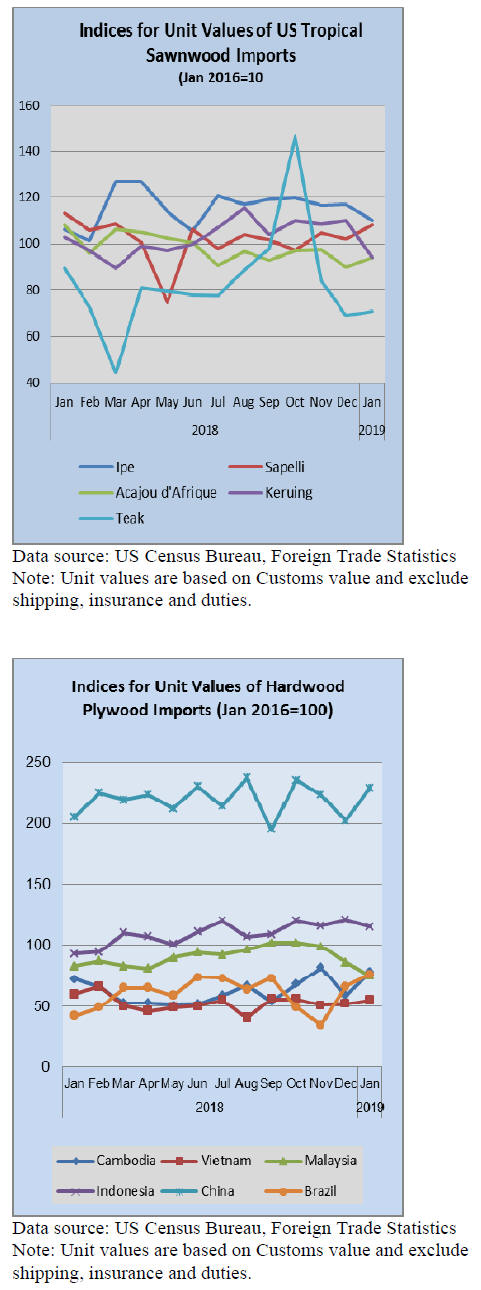

US hardwood plywood imports dip in January

US imports of hardwood plywood declined by 15% in

January from the previous month but were nearly even

with totals from January 2018. While China remains the

largest supplier, import volume continue to fall being

down 51% from December and 35% from the previous

January.

Vietnam and Russia continue to make up the difference

with gains of 13% and 22% respectively. Imports from

Vietnam were nearly three times higher in January 2019

than in January 2018.

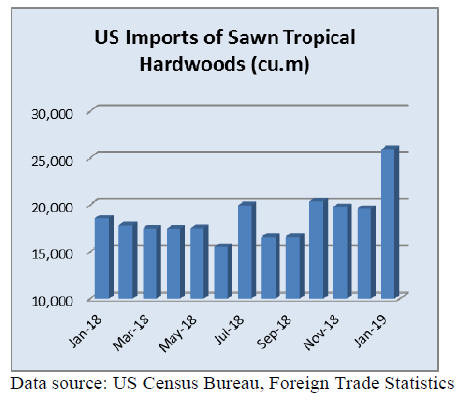

Sawn tropical hardwood imports surge

After showing no growth in 2018, US imports of sawn

tropical hardwood had a promising start for 2019. January

imports rose by 32% over December and were 40% higher

than January 2018.

The volume of imports from Ecuador, Brazil, Cameroon

and Malaysia were all up sharply.

Monthly imports of teak, keruing, ipe and acajou

d¡¯Afrique were all more than double that of January 2018.

Tropical veneer imports disappoint

US imports of tropical hardwood veneer fell by 10% in

January, starting the year sluggishly after a strong 2018.

Imports lagged 18% behind that of January 2018. While

imports from China improved by 53% over a poor

December showing, they remain down nearly 70% from

2018 levels. Imports from Italy fell by 35% in January

and lag behind last year by 17%.

Imports from India and Cote d¡¯Ivoire both saw strong

gains in January.

Weakening Chinese imports drives down flooring

Hardwood flooring and assembled flooring panel imports

were weaker in January. US imports of hardwood flooring

declined by 29% from December totals, but were still

ahead of January 2018 by 30%. A sharp decline of 67% in

Chinese imports brought down the totals, despite strong

gains from Malaysia, Indonesia and Brazil.

Imports of assembled flooring panels were down by 10%

in January, but ahead of January 2018 by 17%. Falling

Chinese imports were again the culprit. Imports from

China were down by nearly 60%.

Moulding imports start 2019 badly ¨C the worst month

this decade

US imports of hardwood mouldings fell sharply in

January. Imports declined by 33% in January and trail

January of 2018 totals by 35%.

Imports of US$10.9 million January were the lowest of

this decade. Imports from Brazil and China fell by 41%

and 53% respectively.

Wooden furniture imports drop ¨C prospects dim

US imports of wooden furniture dropped by 11% in

January to US$1.73 billion. That figure is still up 3%

from January 2018. Imports fell 26% from China and

19% from India in January. Imports from Vietnam and

Malaysia both rose by more than 10%.

The results of the latest Smith Leonard survey of

residential furniture manufacturers and distributors

showed an 8% increase in new orders in January 2019

compared to January 2018. Yet the survey found that not

all participants are benefitting. Only half of the

respondents reported increased orders for the month.

Many reported slight declines.

Furniture shipments were up by 14% over January 2018

and nearly three quarters of respondents reported increased

shipments for the month.

Consumer confidence improving

US consumer confidence is improving faster than most

Wall Street economists had expected following the stock

market's selloff in December. The University of

Michigan's Index of Consumer Sentiment for March

jumped to a reading of 97.8, up from 93.8 in February.

Economists had expected a reading of 95.5, based on

estimates from the data provider FactSet.

The gains came largely from households in the bottom

two-thirds of the income distribution. The new reading

comes amid reports that despite a projected slowdown this

year in the economy American workers are seeing faster

wage increases, with the US unemployment rate currently

at 3.8%, close to the lowest in a half century.

|