Japan

Wood Products Prices

Dollar Exchange Rates of 10th

April

2019

Japan Yen 112.00

Reports From Japan

¡¡

Private consumption held back by slow

wage growth

Revised figures show that Japan¡¯s economy expanded in

the last quarter of 2018 mainly due to increased capital

expenditure. The final quarter 2018 figures indicate that

there was a rebound in growth following a series of natural

disasters that resulted in a steep slowdown.

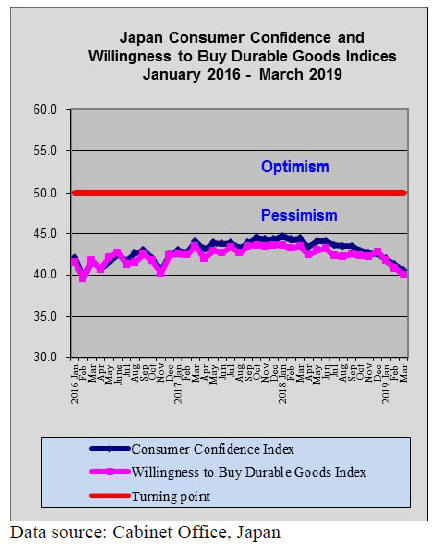

Despite the positive numbers on overall growth, private

consumption, which traditionally accounts for a large slice

of the economy, barely moved as disappointing wage

growth cut household spending.

Looking ahead, Japanese business confidence was

assessed at a two-year low in the first quarter of 2019,

largely the result of weak global demand and declining

imports in China.

The negative sentiment was most obvious among large

companies where sentiment dropped at its fastest pace in

more than six years. Continued weakness of the Japanese

economy will likely ensure the Bank of Japan maintains,

or even expands, its stimulus policy.

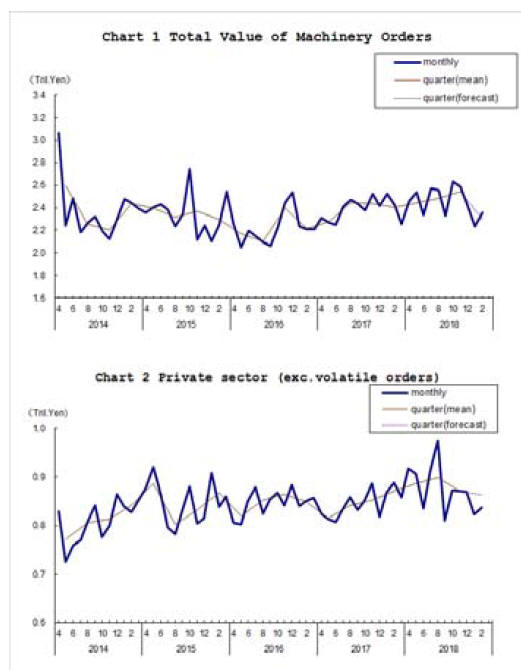

Short-term rise in machinery orders

The value of machinery orders received by 280

manufacturers operating in Japan increased by 5.4% in

February compared to a month earlier. Private-sector

machinery orders, excluding those for ships and from

electric power companies, increased a seasonally adjusted

by 1.8% in February.

A government official told a press conference that an order

for a large ship engine was the main factor lifting the

February data. Despite the rise, the Cabinet Office

maintained its assessment for the third consecutive month

that orders are "stalling". Machinery orders are considered

a leading indicator of capital expenditure, a key driver of

Japanese economic growth in recent months.

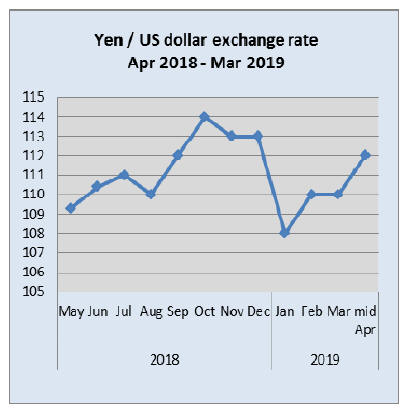

Bank of Japan tightening forecast by

economists

A group of economists were recently surveyed on their

opinion as to whether the Japanese government will raise

the consumption tax in October this year as planned. Most

thought yes and most raised concerns about this pushing

the economy into recession. The government is aware of

this risk and has planned a yen 2 trillion budget to boost

spending.

In the same survey most economists said they believe the

Bank of Japan will soon begin easing away from its loose

monetary policy. The impact of this on exchange rates

could be significant; a strengthening of the yen is the most

likely outcome.

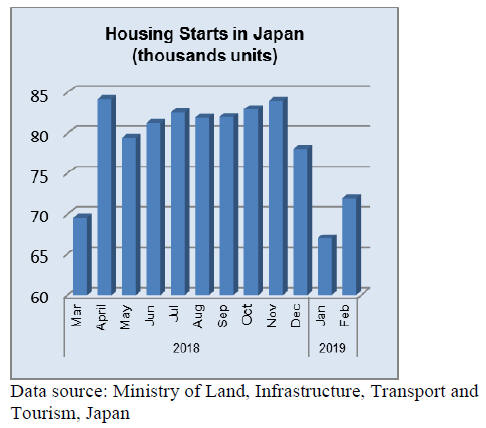

Encouraging housing starts in past 3 months

Year on year, February housing starts rose 4.2% the third

consecutive year. The increase was led by starts for

owner-occupied housing and condominiums.

Starts for owner-occupied housing, such as custom-built

houses, rose 10%, the fifth year on year rise. Interest rates

continue to be very low in Japan and banks are willing to

extend loans as they try and increase business.

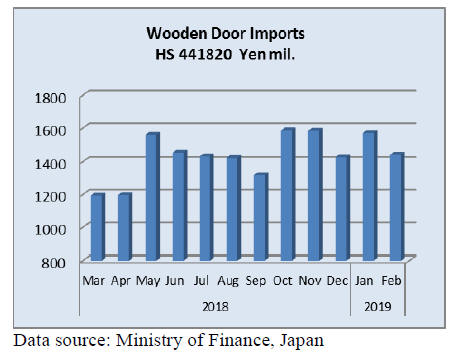

Wooden door imports

Year on year, the value of Japan¡¯s February wooden door

imports dropped 6% and compared to the value of imports

in January there was a 7% decline in February.

In February shippers in three countries accounted for 90%

of all wooden door imports with China delivering 64% of

the total, the Philippines 20% and a further 6% was

shipped from suppliers in Indonesia.

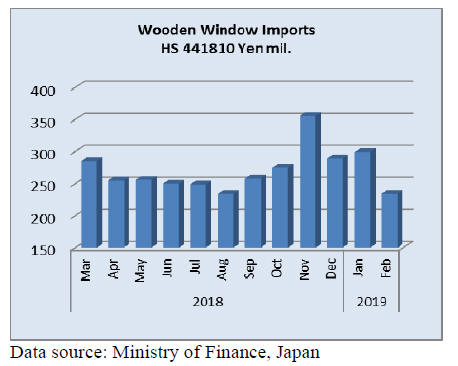

Wooden window imports

As was the case with wooden doors, the value of Japan¡¯s

imports of wooden windows declined year on year and

month on month (-6% and -22% respectively).

As in previous months the top shippers were in China, the

US, the Philippines and Sweden. Shipments from China in

February accounted for 40% of all wooden window

arrivals followed by the US (24%) the Philippine (20%)

and Sweden. The top four delivered 97% of the total value

of Japan¡¯s wooden window imports in February.

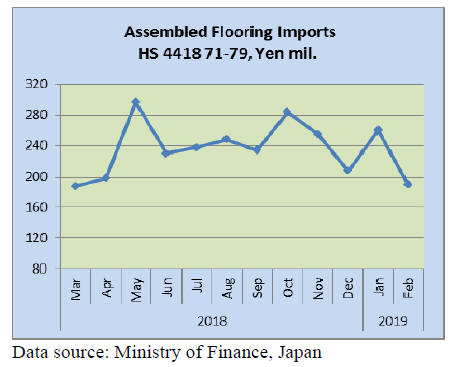

Assembled wooden flooring imports

The value of assembled flooring imports nosedived in

February with year on year imports dropping 17% and

month on month there was a 19% decline.

In February 2019 imports of HS441875 accounted for

75% of all imports in the range of HS441871-79. As in

previous months the main shippers of HS441875 were

China (50%), Indonesia (28%) and Thailand (13%).

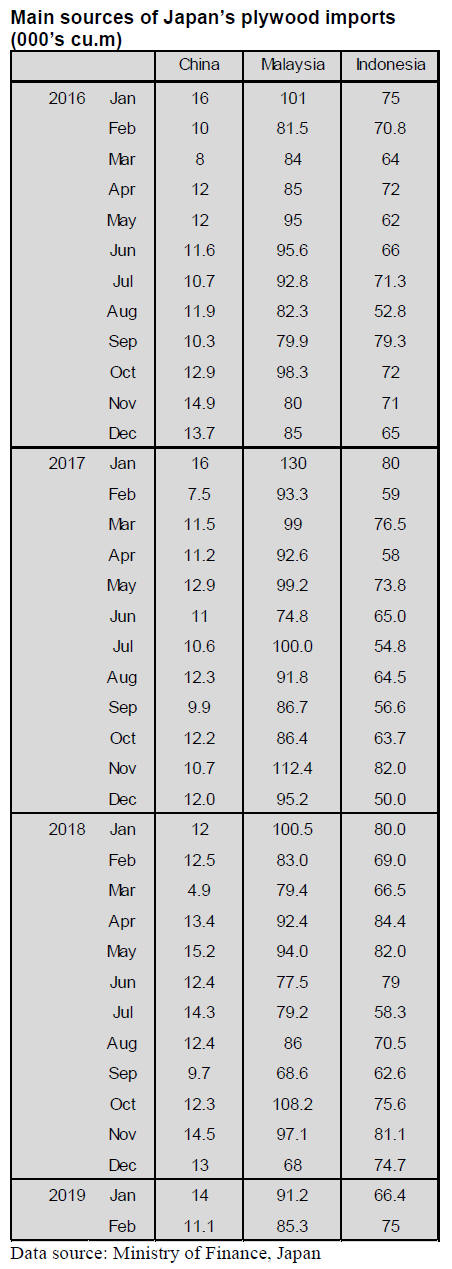

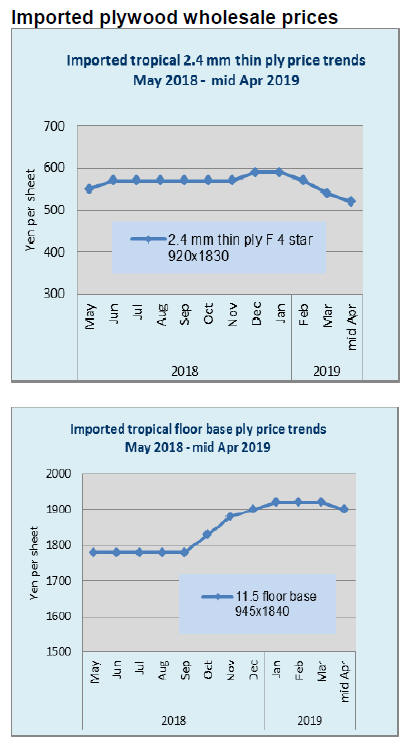

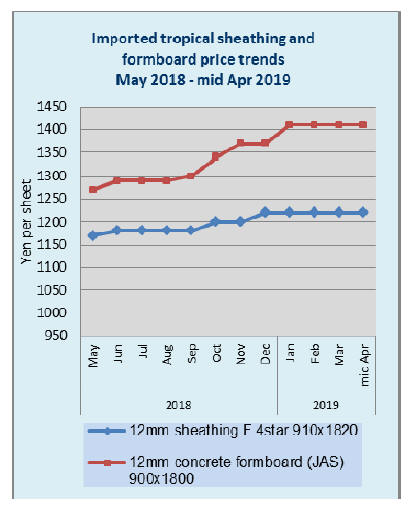

Plywood imports

Despite the intense activity in the construction sector as

Japan readies for the 2020 Olympics, plywood imports in

February were only up 3% year on year and there was a

surprising drop in month on month imports (-3%).

This provides a measure of the growth in domestic

production from domestic logs.

The top three suppliers Malaysia, Indonesia and

China

continue to dominate plywood imports. In February the

volume of plywood imports from Malaysia accounted for

46% of all imports of products in the categories of

HS441810-39.

The other shippers were Indonesia (40%) and China (6%).

Vietnam consistently supplies around 6% of Japan¡¯s

plywood imports. Almost 90% of Japan¡¯s plywood

imports fall within HS 441234.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

European lumber import in 2018

Total import volume of European softwood lumber in

2018 was 2,565,528 cbms, 9.2% less than 2017. This is the

first decline after three years.

In the first half of 2018, the supply volume did not

increase due to robust demand of North America and

China. The market in Japan did not feel supply shortage

and the market lacked vividness.

Supply of whitewood KD stud and other processed lumber

was 858,582 cbms, 7.3% less. Semi-finished products like

genban and lamina were 1,706,941 cbms, 10.2% less. One

of two major suppliers of stud had stayed low supply by

about 20-30% and other supplier skipped the supply for

January, September and November so the export prices

increased from Euro 320-325 per cbm C&F for January

and February shipment to Euro 345 for November and

December shipment.

This is due to oversupply and dropped prices in 2017. The

inventories in Japan did not dropped as much as supply

reduction so the market prices in Japan increased only by

1,000 yen from 47,000-48,000 yen in the first half to

48,000- 49,000 yen in the second half.

Export prices of lamina and genban stayed high due to

high log cost and strong demand by Europe, North

America and China. Lamina prices were Euro 250-260 per

cbm C&F and genban prices were Euro 280-290 per cbm

C&F. On redwood, orders dropped after the third quarter

due to ample supply.

Supply from major sources decreased across the board as

shown in the chart. Scandinavian countries lost supply

volume of lamina in the second half. In central Europe,

supply of quality logs was tight because of clean-up of

blowdown timber and beetle damages so mills were not

able to increase the supply for Japan.

North American lumber import in 2018

Total import of North American lumber in 2018 was

2,066,084 cbms, 6.1% less than 2017. This is five straight

years decline. Compared to recent peak year of 2013, it

was 27.9% less.

Impacted by record high lumber market prices in North

America, import of all major species decreased. SPF was

5.2% less. Douglas fir was 7.8% less. Hemlock was 10.2%

less and yellow cedar (cypress) was 17.1% less.

After North American lumber market nosedived in the

second half of the year, SPF lumber prices dropped but the

prices of all the other species like Douglas fir remained

high. SPF lumber volume in 2018 was 1,300,382 cbms,

lower than recent bottom year of 2014 and this is the

lowest since 2009.

Imported volume of SPF remained the same as 2017 until

October with strong purchase by component companies

then the volume plunged in the fourth quarter after the

export prices dropped sharply.

Douglas fir lumber volume was 387,799 cbms. The supply

from the U.S.A. was 190,863 cbms, only 1.1% less but the

Canadian volume dropped to 196,936 cbms, 13.4% less.

Log harvest was steady in Canada without much negative

factor by weather but strong demand by veneer plants on

the coast tightened log availability and sawmills produced

more hemlock lumber so supply from Canada was much

less.

Hemlock lumber supply was 224,324 cbms, 10.2% less.

Hemlock log harvest in Canada was steady but because of

purchase competition with China, the prices of green

hemlock square and genban soared so in Japan, demand of

preservative treated sill of green hemlock sharply

decreased by high prices.

After the fourth quarter, Chinese purchase slowed down so

the supply volume for Japan increased but the market

prices of KD hemlock weakened by ample supply and

demand for green sill lumber has not come back by high

prices. Cypress lumber was 45,127 cbms, 17.1% less.

South Sea (tropical) logs and Lumber

Sizable logs from both PNG and Sarawak, Malaysia

arrived in late 2018 so plywood mills and sawmills now

carry reasonable amount inventories. Malaysian log prices

go up after 2019 with increase of minimum wage and

harvest tax so it was last minutes rush-in import for

December arrivals and 2019 will be different with high prices.

PNG log export prices are weak in general as main buyer,

China is curtailing log purchase. China buys

all the harvested logs from forest while Japan buys

selected logs so prices of mersawa logs selected for

plywood remain high. Some sawmills started using low

priced dillenia from PNG for lumber. Inventory of

laminated free board finally drop so new orders are placed.

January plywood supply

Total plywood supply in January was 515,500 cbms, 2.8%

less than January 2017 and 4.6% more than December

2018.

Domestic production continued steady from beginning of

the year with 258,400 cbms, 0.7% more and 2.4% less.

Imported plywood supply in January was 257,000 cbms,

6.1% less and 12.8% more.

In domestic production, softwood was 247,500 cbms,

0.8% more and 2.1% less. In this, non-satructural panel

production was 19,400 cbms, 25.6% more and 0.9% more.

Despite decrease of total production, production of nonstructural

panel maintained the same as December to

respond to increasing orders of floor base by floor

manufacturers.

Shipment of softwood plywood was 271,300 cbms, 7.6%

more and 5.1% more. Shipment of non-structural plywood

was 19,300 cbms, 22.5% more and 14.0% more. The

inventories of softwood plywood were 114,200 cbms,

20,900 cbms drop from December. The inventories have

been dropping for four straight months since last October

after they increased to 179,300 cbms in September last

year.

Imported plywood in January increased by 9.7%. 93,200

cbms from Malaysia, 9.9% less and 32.0% more. 76,400

cbms from Indonesia, 12.7% less and 7.2% less. 65,200

cbms from China, 2.6% more and 19.2% more. 22,100

cbms from others, 16.0% more and 9.7% more. Usually,

January arrivals are high because of the delayed custom

clearance from December.

Compared to monthly average arrivals to December and

January arrivals from Malaysia and Indonesia, Malaysian

was 81,900 cbms, 7.4% less and Indonesian was 79,400

cbms, 2.5% less so the decrease was small.

Mitsubishi Real Estate built condo with CLT

Mitsubishi Real Estate (Tokyo) completed building 10

stories rental condominium building in Sendai. This is the

first high rise condo with CLT floor. By using CLT,

building time is shortened by three months.

In ten stories building, CLT is used as floor for fourth to

tenth floor and also part of bearing wall of first and fifth

floor. Some posts are one hour and two hour fire proof.

CLT floor is wrapped with fire proof film but Mitsubishi

Estate intentionally used wood in many places and some

are exposed. Actually some rooms with wooden interior is

classified as premium grade and rental is higher than the

others. It made survey through potential users and they are

willing to pay 5% premium for wood used rooms.

|