Japan

Wood Products Prices

Dollar Exchange Rates of 25th

March

2019

Japan Yen 110.63

Reports From Japan

¡¡

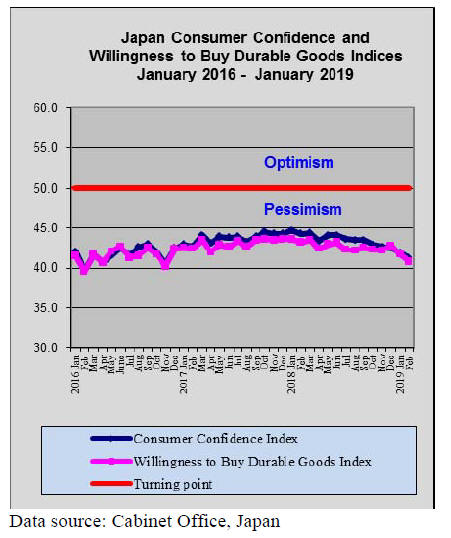

Business leaders pessimistic on

prospects for global

economy

In a recent survey Japanese business leaders suggested

they expect the global economy to be in worse shape in six

months and this negative mood spilled over into the

government¡¯s assessment of the economy. For the first

time in 3 years the government downgraded its economic

assessment citing the slowdown in exports to China as the

main reason.

However, the government denied the economy had fallen

into recession saying in its monthly economic report that

the economy is ¡°recovering at a moderate pace while

weakness is seen recently in exports and industrial

production in some sectors.¡±

https://www5.cao.go.jp/keizai3/getsurei-e/2019mar.html

At its most recent policy board meeting the Bank of Japan

(BOJ) was downbeat on its assessment of the economy

because of the impact of global trends on exports and the

knock-on effect on production. The BoJ opted to maintain

its current monetary policy.

Re-shoring - a noticeable new trend in Japan

A trend has been observed in increased Japan-based

production by domestic firms which previously moved

production overseas.

The driving force for this is said to be external demand for

high-quality ¡°made in Japan¡± products along with the

decline in advantages in overseas production as wages

rise, a factor most noticeable in emerging Asian

economies.

The trend of Japanese manufacturers shifting their

production bases back to Japan from overseas, or boosting

domestic production, has been observed in several sectors.

http://www.the-japan-news.com/news/article/0005635339

Financial sector working to anticipate impact of Era

change

In Japan, the Heisei Era will end in April and a new

imperial age will begin when Crown Prince

Naruhito accedes to the Chrysanthemum Throne on the

abdication of Emperor Akihito.

The Era name is significant for Japanese as it represents

more than just a new calendar. The name for the new era,

which will remain a secret until 1 April is chosen to reflect

the mood of a period in the same way as "the '60s" is

remembered by many western countries.

The financial sector in Japan is working hard to anticipate

the impact of the new era. It is thought that exchange rates

could become more volatility, there could be a surge in

demand for cash as people prepare for the 10 day

celebratory holiday and there could be computer problems

as the new calendar is introduced on 1 May when the new

emperor is enthroned.

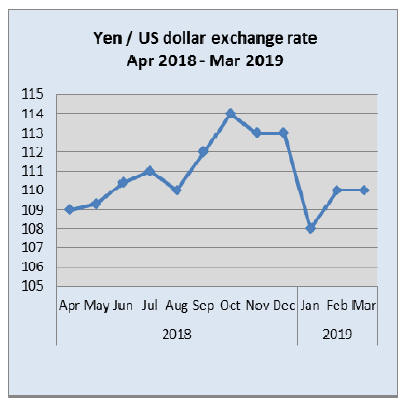

The announcement from the US Federal Reserve that it

will slow interest rate hikes promoted dollar sales and a

strengthening of the Japanese yen despite the gloomy

outlook for the Japanese economy.

Land prices in Japan are rising

Recent data from the Ministry of Land, Infrastructure and

Tourism has confirmed that land prices in Japan are rising.

The average price of all types of land across Japan has

now risen for four consecutive years and in 2018 average

prices for residential land in rural areas increased for the

first time in 27 years.

http://www.mlit.go.jp/en/totikensangyo/totikensangyo_fr4_0000

02.html

One reason for the rise in land prices, especially in urban

areas, was buying by overseas investors mainly Chinese

and Taiwanese investors seekingrent income from offices

and apartments. However, several real estate companies

selling into this market are seeing a decline in sales.

The average price of existing apartments in Tokyo barely

increased in 2018 after the 3% plus rise the previous year.

According to the Land Institute of Japan, existing

apartment sales in Tokyo fell slightly in 2018 and sales of

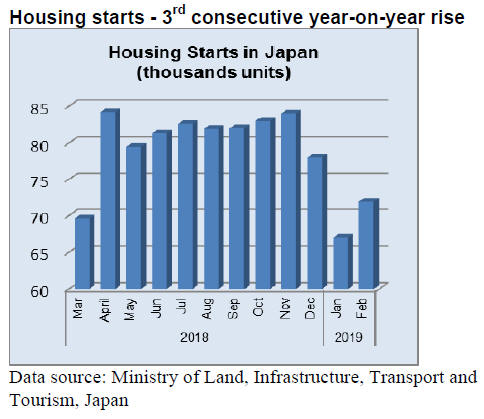

existing detached homes also fell. In 2018 housing starts

were over 2% down from a year earlier.

Housing starts in February rose 4% year on year to

71,966

units, the third consecutive year on year rise. The increase

was led by higher starts for owner-occupied homes and

apartment blocks.

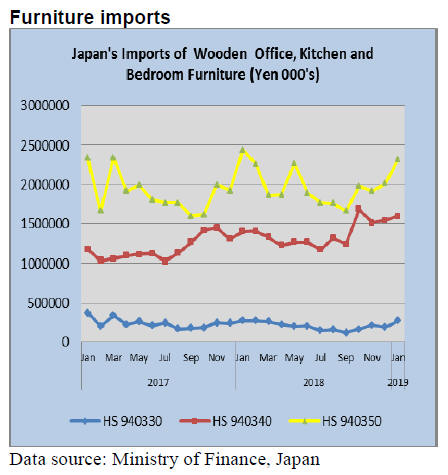

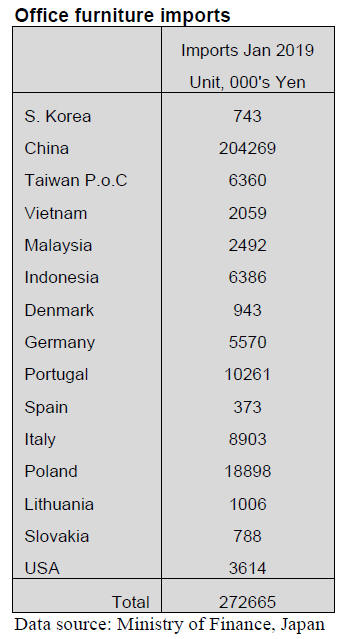

Office furniture imports (HS 940330)

The top three shippers of wooden office furniture

(HS940330) to Japan in January were China at a huge

75% of all January imports (up 60% from a month earlier)

followed by Poland (7%) significantly up from the value

of December 2018 shipments and Portugal (4%). Together

the three top shippers accounted for 86% of all Japan¡¯s

wooden office furniture imports in January.

Year on year the value of Japan¡¯s January 2019 imports of

wooden office furniture (HS 940330) were little changed

but month on month imports rose sharply.

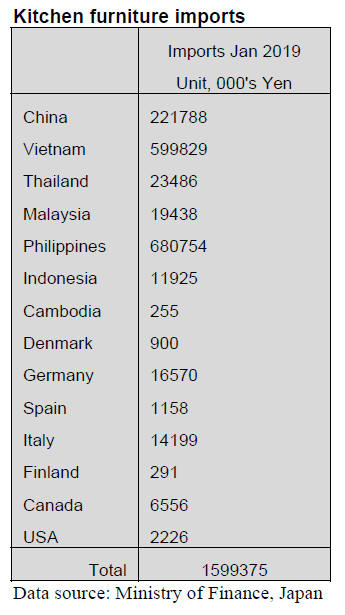

Kitchen furniture imports (HS 940340)

January data for the value of Japan¡¯s wooden kitchen

furniture imports reaffirmed the dominance of the top two

shippers, the Philippines and Vietnam which together

accounted around 95% of Japan¡¯s wooden kitchen

furniture imports in the first month of the year.

In January shipments of wooden kitchen furniture from the

Philippines topped those from Vietnam. The third largest

shipper, China, could only secure a 14% share of imports

in January. Year on year the value of January 2019

imports of wooden kitchen furniture were up 14% but

month on month there was little change. Other shippers of

note in January were Germany and Italy but the value of

shipments was small.

Bedroom furniture imports (HS 940350)

The value of Japan¡¯s imports of wooden bedroom

furniture (HS 940350) continue to trend higher, a trend

seen in previous years. If imports follow the same pattern

as in 2017 and 2018 the value of imports will reverse

direction to fall steadily until around September.

In January 2019, year on year the value of imports were

some 7% down but month on month there was a 15% rise

in the value of imports with the two main shippers, China

and Vietnam both seeing higher shipments. The combined

value of shipments for China and Vietnam accounted for

just over 90% of all January 2019 imports of this category

of wooden furniture.

Thailand, Malaysia and Poland are also suppliers of

wooden bedroom furniture and the combined shipments

from these three accounted for almost all of the 5%

balance.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Import of North American logs in 2018

Total log import from North American in 2018 was 2,552,

986 cbms, 2.0% less than 2017. Decline for two

consecutive years. Logs from the U.S.A. were almost the

same as 2017 while logs from Canada decreased by about

10%.

There was no serious climate factor to impact log

production in 2018 but domestic lumber market

skyrocketed in the first half of the year then plunged in the

second half so domestic log demand was strong in the first

half then got weak toward year end.in the U.S.A. but

Canada was different. Domestic demand in Canada was

strong and there was not much surplus for export.

Douglas fir logs from the U.S.A were 1,585,762 cbms,

0.2% less than 2017 then from Canada were 746,387

cbms, 9.0% less.

Total Douglas fir logs were 2,332, 149 cbms, 3.2% less

and share of Douglas fir in total North American log

import dropped to 91.3% from 92.5% in 2017.

IS sort Douglas fir log prices in January 2018 peaked at

US$1,040 per M Scribner FAS then started sliding and

down to US$870 for December shipments. Meantime,

Canadian Douglas fir log prices were US$135 in January

and climbed to US$150 by middle of 2018 and stayed high

through 2018 without dropping.

Canadian small Douglas fir logs are for plywood use in

Japan but demand by Canadian veneer plants was very

active so availability for export stayed tight. Unlike

softwood lumber, which is imposed anti-dumping duty

and countervailing duty for U.S. export, Canadian veneer

is duty free so export volume of veneer did not drop so

that Canadian veneer plants are anxious to buy suitable

logs for veneer manufacturing.

With stable supply, Douglas fir log FAS prices for Japan

dropped in late 2018 but by chronic unprofitable business

with high log cost, second largest Douglas fir sawmill in

Japan, Toa Ringyo gave up the business in late 2018 so

Toa¡¯s consuming volume of 400,000 cbms disappears this

year.

Hemlock log supply was 142,030 cbms, 23.1% more than

2017.Domestic plywood mills now consume more

hemlock due to tight supply of Canadian Douglas fir logs.

Spruce was 35,413 cbms, 5.5% more but the volume is far

smaller compared to old days so declining trend continues.

Canadian supply increased by 59.1% but U.S. supply

decreased by 40.5%. Yellow cedar was 6,653 cbms, 34.7%

less and red cedar was 6,312 cbms, 37.3% less.

Hardwood logs from the U.S.A. were 30,420 cbms, 19.9%

more. This is rebound of large drop in 2017. The arrivals

after August were much larger than usual years.

Radiata pine logs and lumber import

Total radiate pine log import from New Zealand in 2018

was 389,814 cbms, 3.3% more than 2017. This slight

increase is not by demand increase but delayed shipment

on statistic.

Actually log demand is declining by high export prices

and sawmills suffer poor profitability all through the year.

The demand of radiate pine lumber shifts to Chilean

radiate pine lumber and low cost domestic cedar lumber

from lumber sawn from New Zealand logs.

Export log prices are largely influenced by prices of export

logs for China, which is now dominant New Zealand log

buyer so the prices for Japan had been over US$150 per

cbm C&F.

Radiata pine flitch is the main item from New Zealand,

which is mainly used for cable drum. Demand of cable

drum was active for restoration of flood and landslide

damages in Western Japan and also busy orders from

overseas countries but the supply was unstable.

Import of Chilean radiate pine lumber in 2018 was

333,430cbms, 15.6% more than 2017. With active demand

of crating lumber all through the year, there was no supply

glut despite increased supply but in late 2018, the demand

of crating lumber started dropping after Chinese economy

started slowing down by trade war with the U.S.A.

Export cargoes from Japan to China started deceasing so

that crating lumber demand decreased. Robust orders for

Chilean lumber faded. Export prices of Chilean lumber

had been firm and with weaker yen, the importers needed

to increase the sales prices by about 1,000 yen per cbm.

Composite flooring in 2018

Production of composite flooring in 2018 was 63,948,720

square meters, 5.5% less than 2017. This is decline of two

straight years. The shipment was also dropped down to

66,327,690 square meters, 7.4% less. The decline is

proportionate to decline of new housing starts. By base

materials, 21,379,710 square meters of imported plywood

with MDF, 2.6% less and 16,215,870 square meters of

imported plywood, 10.6% less.

On the other hand, domestic plywood and MDF base

increased to 16,426,080 square meters, 2.9% more. This is

due to unstable supply of imported plywood and many

floor manufacturers shifted todomestic plywood from

imported plywood. Particleboard base was 5,752,230

square meters, 1% less and MDF base was 3,860,340

square meters, 31.5% less.

For surface materials, thin sliced wood was 2,342,175

square meters, 12.9% less and decorative sheet is

40,526,970 square meters, 0.6% less.

Base material of imported plywood for wood veneer

surface is 36% but the production dropped largely to

8,456,900 square meters. Meantime, majority of base

materials of decorative surface sheet is combination of

imported plywood and MDF, which production increased

to 13,769,580 square meters, 4.2% more and combination

of domestic plywood and MDF also increased to

11,023,980 square meters, 4.8% more.

Demand of composite base materials with low cost and

stable supply has been increasing after South Sea

hardwood plywood supply gets tight and the prices are

soaring.

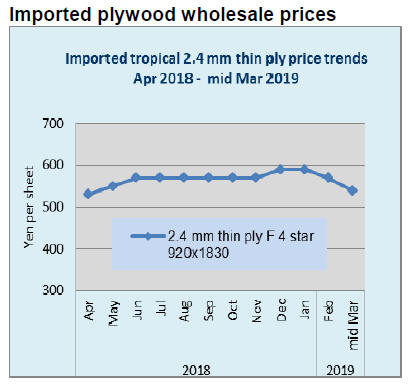

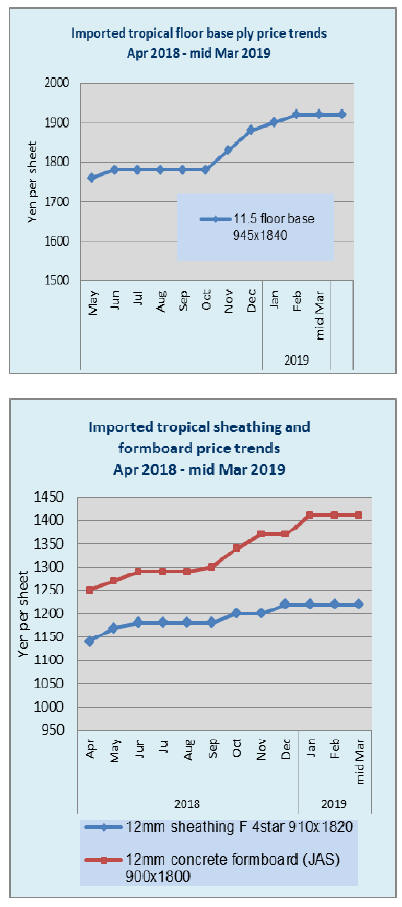

Plywood

Movement of both domestic and imported plywood is

getting slower now. February is demand slow month and

dealers are watching the market closely while the

manufacturers are trying to raise the sales prices to prevent

dealers from dropping the prices.

Imported plywood cost continues high so both domestic

and imports have no room to reduce the prices. Since

March is book closing month, the dealers are caught in

between maintaining the prices and disposition of the

inventories.

Softwood plywood production in January was 247,500

cbms, 0.8% more than January last year and 2.1% less

than December.

Shipment of softwood plywood in January was 271,300

cbms, 7.6% more and 5.1% more. With lengthy New

Year¡¯s holidays, January production dropped but the

shipment was busy because deliveries in December

delayed by shortage of trucks, which were shipped in late

January so the shipment volumewas more than 270,000

cbms. The inventories dropped down to 132,600 cbms,

23,000 cbms less than December.

This is four straight months decline of the inventories.

Orders for precutting plants in the Eastern Japan are down

except for large plants but the movement in Western Japan

is rather busy and mills¡¯ inventory of 12 mm thick panel is

tight and the prices stay firm.

In Tokyo market, the prices fluctuate in March as smaller

dealers try to dispose of the inventories before book

closing and the manufacturers tell dealers that they will

hold the prices adamantly to tighten the market.

In imported plywood, market prices of thin and medium

thick panel are weakening after the export prices softened.

Some dealers are offering lower prices on 12 mm thick

panel in stagnant market but majority of inventories are

high priced items now so it is unlikely that large volume of

low priced is offered.

The importers are well aware that 12 mm panel export

prices continue firm and strong so they need to maintain

present sales prices. Facing higher export prices, the

importers are not able to go after future cargoes.

Major log exporting ports

Total log export by Japan in 2018 was 1,157,438 cbms,

19.3% more than 2017. According to trade statistics the

Ministry of Finance made, top log exporting port is

Shibushi (Kagoshima prefecture) Kyushu with 372,000

cbms, 24.2% more than 2018.

Shibishi has been top exporting port for last nine years. Up

until 2017, port with the volume exceeding 100,000 cbms

was Shibushi only but in 2018, three ports shipped more

than 100,000 cbms. They are Saheki, Hososhima and

Yatsuhsiro, all in Kyushu.

Chinese demand was mainly construction and engineering

works but such demand is peaking now and new demand

is crating boxing lumber for transporting machine and

home appliances.

Also China has been shipping exterior lumber like fencing

and decking made from Japanese cedar and China rushed

exporting such lumber before import duty is raised, which

stimulated cedar log purchase in 2018.

China has been buying large volume of Southern Yellow

pine logs from the U.S.A. but this will slow down by high

export duty so China needs substituting source of log

purchase so it will continue buying Japanese cedar logs as

long as the prices are competitive with New Zealand

radiata pine log prices.

Lumber export in 2018 was 145,995 cbms, 12.3% more

than 2017. The volume for Taiwan P.o.C and the U.S.A.

increased. Particularly lumber for the U.S.A. increased by

74.6%, which is mainly exterior cedar lumber like fencing

and decking.

Taiwan P.o.C volume also increased by 78.5% and the

main species is cypress. However, the export prices are

almost the same as domestic sales prices so after deducting

freight and marine insurance, it is not profitable business.

|