Japan

Wood Products Prices

Dollar Exchange Rates of 10th

March

2019

Japan Yen 111.16

Reports From Japan

¡¡

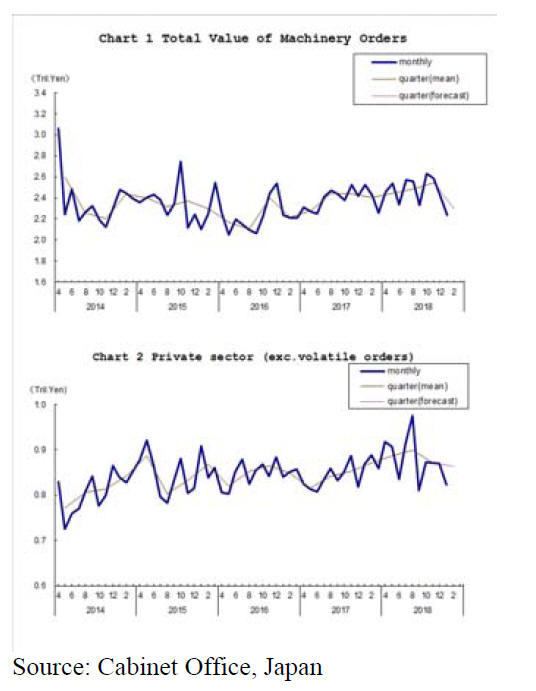

Major economic indicator dips for

third month

Private-sector machinery orders fell over 5% in January

from the previous month according to the latest news from

the Cabinet Office. The trend in machinery orders is an

indicator of capital expenditure by Japanese companies

and as such reflects business prospects.

The January decline in orders was the third consecutive

monthly decline.

Economy into reverse once again

In a reversal of its earlier claim that the Japanese economy

the country had enjoyed six years and two months of

sustained growth, the longest since the end of World War

II now the Cabinet Office has downgraded its assessment

saying the economy has been in negative growth since the

end of 2018 signalling a technical recession.

It now seems that Japan¡¯s economic expansion may have

peaked several months before January. The main reason

for the abrupt change is the slowdown of the Chinese

economy which is having a heavy impact on Japan and has

resulted in the government downgrading its assessment

of industrial output for the first time in more than three

years.

Workers likely to see smaller pay rise this year

Rengo, The Japanese Trade Union Confederation and

most unions have been calling for increases in base pay in

negotiations with employers. Rengo demanded a further

2% increase in base which, if accepted would be the fourth

consecutive year of increases but the employers are in no

mood to agree it appears.

In an interview the head of the Japan Business Federation

(Keidanren) said the government should avoid trying to be

specific on how much companies should raise wages.

Companies have increased wage hikes in each of the past

three years but this has never been at a level considered

necessary to drive up inflation.

Higher pay for workers has been a key part of the

government¡¯s economic growth strategy which is based on

the philosophy that improved pay will lift consumption

and drive prices higher but this has not proven very

successful so far and with the prospects of a consumption

tax rise later this year prospects for boosting consumption

have dimmed.

See:

https://www.japantimes.co.jp/news/2019/03/11/business/japaninc-

push-back-workers-can-expect-smaller-raisesyear/#.

XIYZUYYzbIU

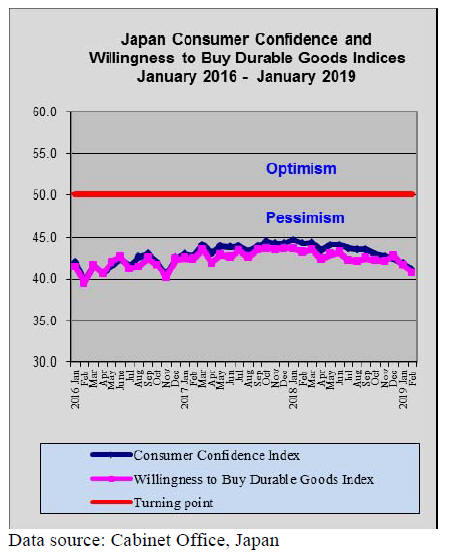

Consumer confidence suffers triple whammy

Consumer confidence in Japan continues to weaken and

the index released by the Cabinet Office shows confidence

and willing ness to buy durable goods such a furniture at

the lowest level since November 2016.

This underlines the sentiment of both consumers and

manufactures regarding prospects for the Japanese

economy at a time when tough trade talks with the US are

about to begin, economic growth in China has slowed

driving down imports from Japan and the likelihood that

the consumption tax will be raised in October this year.

See: https://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

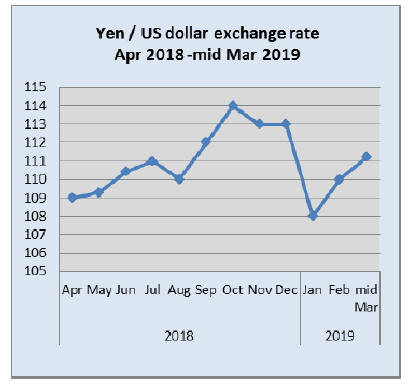

US pushes for currency clause in trade

negotiations

In early March the Japanese yen strengthened against the

US dollar despite the recessionary news.

This raised the alarm in the Bank of Japan (BoJ) which

immediately called for additional stimulus should growth

stall even further. Comments from the BoJ have

complicated the build up to trade talks with the US which

is asking that a currency clause be included in any trade

agreement with Japan.

But the government is opposed to this claiming the

correlation between the yen¡¯s exchange rate and exports

has weakened significantly since the global financial

crisis. But the US side is remaining firm on this having

already secured such an arrangement in the trade pacts

with Canada and Mexico and is said to be seeking one

from China.

See:

https://www.japantimes.co.jp/news/2019/03/06/business/econom

y-business/japan-stresses-weak-link-strength-yen-exports-aheadu-

s-trade-talks/#.XIYYxYYzbIU

Lest we forget

March 11th 2019 marked eight years since a massive

magnitude 9 earthquake struck Eastern Japan. The

Japanese media reported that, as of 11 March this year,

over 50,000 people still remain displaced from their homes

destroyed by the tsunami triggered by the earthquake or

forced to evacuate after the explosion and release of

radiation when workers at the nuclear plant in the region

were unable to secure the reactors during the crisis which

led to a core meltdown.

The number of people killed directly or indirectly by the

disaster and those missing and feared dead, is 22,131,

according to the National Police Agency.

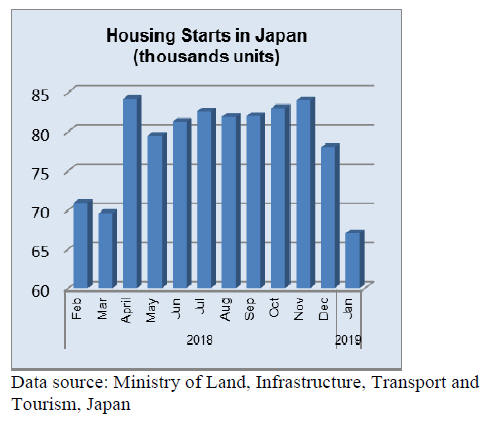

Efforts to avoid rush-to-buy before October tax

increase

The Ministry of Land, Infrastructure and Transport will

launch a scheme to reward those buying or renovating a

home before the planned increase in consumption tax in

October this year. More information can be found in the

Japan Lumber Report extracts on page 14.

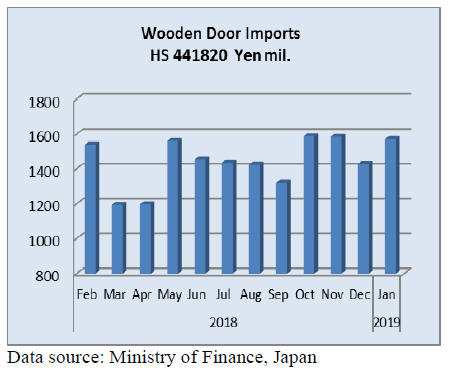

Wooden door imports

The value of Japan¡¯s January imports of wooden doors

(HS 441820) were little changed from January 2018 but

compared to December 2018 there was a 10% increase in

the value of imports.

Four supply countries accounted for around 90% of

all

Japan¡¯s wooden door imports, China (60%), Philippines

(18%), Indonesia (7%) and Malaysia (5%).

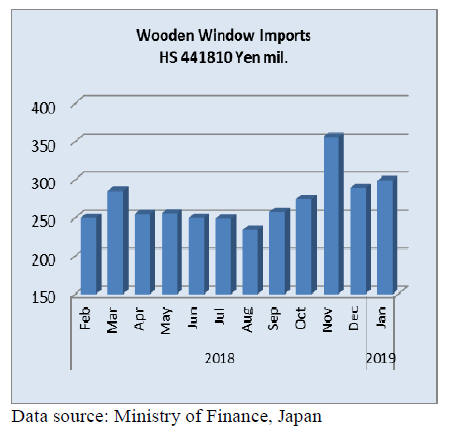

Wooden window imports

After falling sharply in December following a surge in

imports in November 2018 the value of imports steadied in

January coming in at around the average for the previous

year. Year on year, January 2019 wood window imports

(HS441810) rose 12% but were little changed from levels

in December 2018.

In January 2019 the top suppliers were China (33%), USA

(19%) Sweden (17%) and the Philippines (15%)

representing over 80% of the value of all shipments of

wooden windows to Japan.

Assembled wooden flooring imports

Year on year the value of Japan¡¯s January 2019 imports of

assembled wooden flooring (HS441871-79) dipped 27%

but, month on month the value of imports rose 25%.

In January 2019 three products accounted for all wooden

floor imports, HS441873 (16%), HS 441875 64% and

HS441879 20%. As in previous months HS441875

accounted for most of the wooden floor imports with

shippers in China, Thailand and Indonesia accounting for

61%, 12% and 11% respectively.

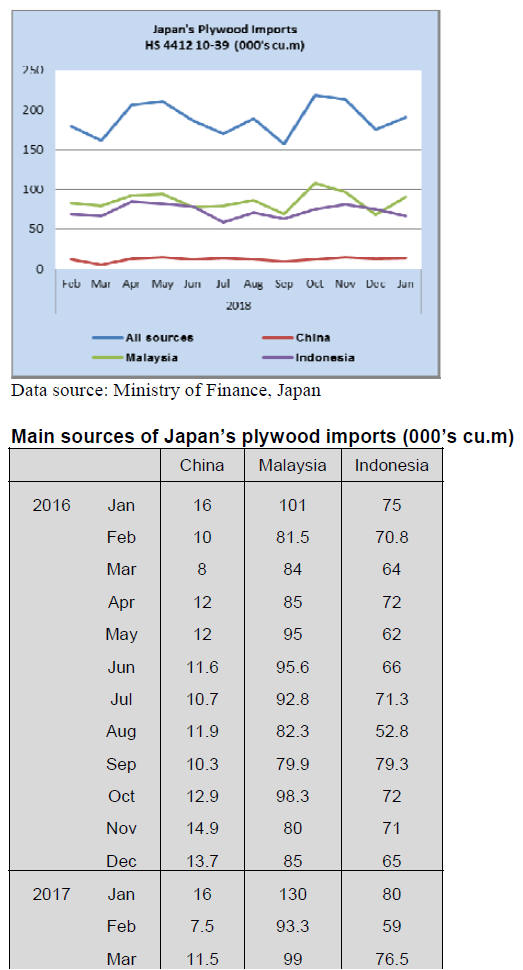

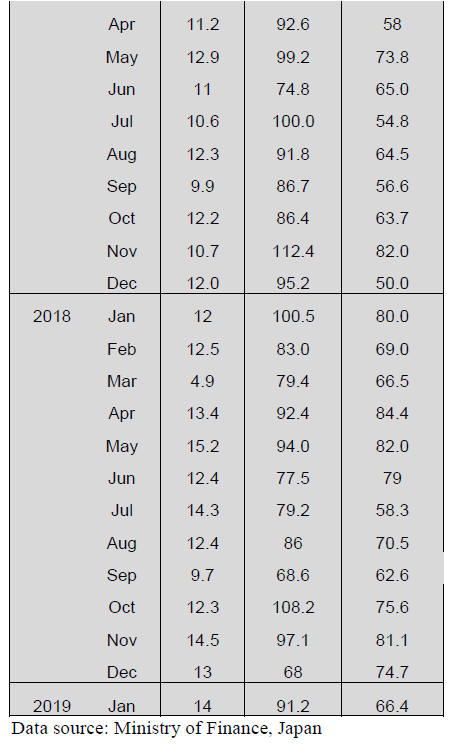

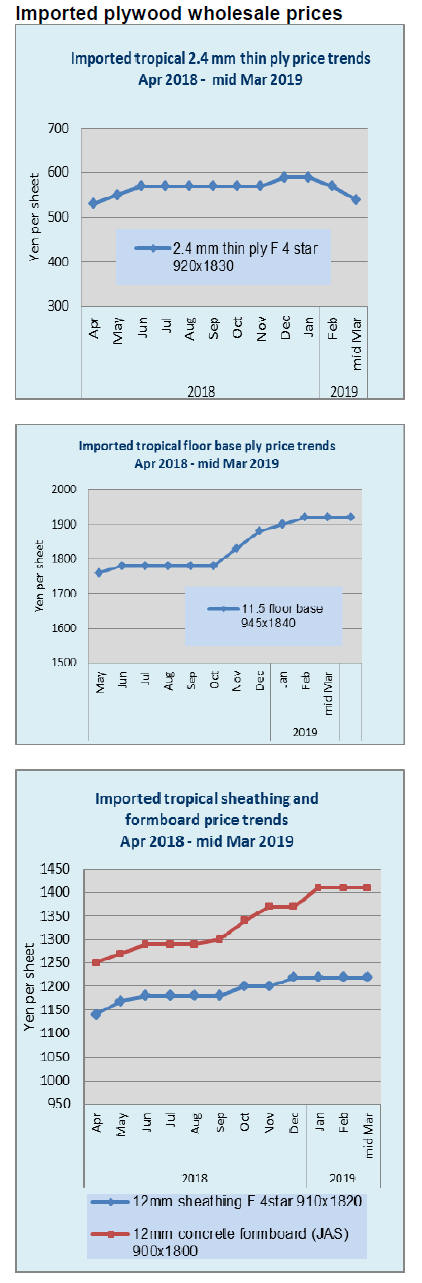

Plywood imports

As was the case in 2018, three supply countries continued

to account for over 85% of Japan¡¯s imports of plywood in

January 2019.Malaysia, Indonesia and China dominate

plywood imports but shippers in Vietnam are steadily

securing market share.

Year on year, the volume of Japan¡¯s January 2019 imports

of plywood (HS441210-39 were down 9% but compared

the volume of imports in December there was a steep rise

in January imports due mainly to a 34% rise in shipments

from Malaysia (68,000 cu.m in December 2018 to 91,200

in January 2019).

January shipments from China were little changed year on

year and month on month but Indonesian shipments were

down 17% compared th January 2018 and were down11%

compared to a month earlier.

HS441231 is the main category of plywood imports into

Japan accounting for over 80% of all arrivals in January

2019.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Import of wood products in 2018

The Japan Lumber Importers Association summed up

import of wood products in 2018. All the items except for

wooden board decreased for two straight years. New

housing starts in 2018 declined by about 2% in 2018 so

that the demand for building materials decreased.

By items, lumber import decreased by 5.1%. This is the

first decline after three years. Particularly European

lumber import dropped by 9.2% and Canadian lumber

dropped by 6.3%.

Reason of decline of European lumber is adjustment of

oversupply in 2016 and 2017. Total of 380,000 cbms of

lumber decreased from both Europe and North America.

Russian lumber supply recovered and Chilean lumber

supply increased by 15.6% with 330,000 cbms, the highest

volume in last ten years.

Log import decreased by 1.2%.Main source of North

America decreased by 2%. Reasons are users in Japan

shied away from high prices and import reduction by drop

out of one large Douglas fir sawmill.

Radiata pine logs increased from New Zealand. South Sea

hardwood logs also increased despite log export ban by

state of Sabah, Malaysia as supply source moved to PNG.

Decline of Russian log import continues.

Plywood is the largest in imported finished products. The

volume is steady despite log supply tightness in producing

countries, which proves solid demand in Japan. MDF

import was 612,000 cbms, the record high import by

declining domestic supply and growing demand. Both

import of OSB and particleboard increased. Import of

laminated lumber was curtailed in 2018 to adjust over

import in 2017.

Increasing use of domestic wood

The Wooden Home Builders Association of Japan

disclosed result of the survey about use of domestic wood

for wooden houses through house builders and precutting

plants. The survey is made in every three years since 2005

by sending out questionnaires. This is the fifth survey.

160 member of housing companies responded, which built

62,412 units. 66 precutting companies responded, which

supplied 117,023 units in 2017. Percentage of domestic

wood use by house builders in 2017 was 45.4%, 13.1

points more than previous survey.

By members, more than 50% is domestic wood are sill,

stud, girder, floor sheathing, wall and roof. Use of

domestic wood by precutting plants is 33%, 1.5 points up.

Sill and structural panel are two items with over 50% of

domestic wood.

Use of domestic wood increased for post, sill, standard

lumber and plywood but use for other members decreased.

Remarkable change is use of laminated lumber from solid

wood lumber on both house builders and precutting plants.

House builders¡¯ use of lumber is 32%, 9.6 points less than

2014 survey while laminated lumber is 63.9%, 7.9 points

up. Precutting plants¡¯ use of lumber is 33.7%, 25.8 points

less while laminated lumber is 63.4%, 24.8 points more.

By species, increase use of cedar and Douglas fir

laminated lumber is apparent. House builders use 7.6% of

cedar laminated lumber, increase of more than 1.7 times.

Precutting plants use 5.3% of cedar laminated lumber,

increase of more than 2.5 times. Increase use of Douglas

fir laminated lumber is result of tight supply of European

redwood laminated lumber in 2017.

Wood products export in 2018

Total wood export in 2018 in value was 35.069 billion

yen, 7.4% more than 2017 and this is the first time that the

value exceeded 35 billion yen since 1977. Log export was

1,157,438 cubic meters, 19.3% more than 2017 and the

first time to hit over one million cbms.

As destination, China took 948,339 cbms, 22.2% more,

this pushed total up in 2018.

As to lumber export, total was 145,995 cbms, 12.3% more.

22,703 cbms for the U.S.A., 74.6% more and 11,403 cbms

for Taiwan P.o.C, 78.5% more and they are leaders of

lumber export.

Log export climbed sharply for three years since 2013 then

it paused in 2016 but it increased sharply in 2017 again

and high pace continued in 2018. The volume for China is

large factor of increase then 74,620 cbms for Taiwan

P.o.C, 34.7% more and 9,087 cbms for Vietnam, 64.7%

more also contributed the increase.

By species, cedar logs were 838,784 cbms, 29.4% more

while cypress logs were 132,352 cbms, 6.6% less. China

bought 697,731 cbms of cedar logs, 24.5% more and

83,466 cbms of cypress logs, 40.1% more.

Korea took 69,143 cbms of cedar logs, 85.9% more then

38,666 cms of cypress logs, 48.3% less. One possible

reason of this decline of cypress for Korea is that logs

exported to China are processed and exported to Korea.

Lumber exporst of cypress to Korea also dropped by 4.5%.

Cedar lumber export to the U.S.A. continues expanding

since 2016 for exterior use like fencing and decking. The

U.S.A. is now the third largest lumber export destination

next to China and Philippines.

Log export to Taiwan P.o.C is decreasing while lumber

export is increasing.

Plywood supply in 2018

Total plywood supply in 2018 was 6,139,800 cbms, 0.4%

more than 2017. Domestic plywood production was

3,216,700 cbms, 0.2% more out of which softwood

plywood was 3,088,100 cbms, 0.8% more.

Imported plywood was 2,923,000 cbms, 0.7% more.

Import plywood has been less than three million cbms for

last four years. Share of domestic supply was 52.4% and

the domestic supply surpassed the imports for three

straight years.

In domestic production, structural plywood was 2,861,300

cbms, 2.2% less than 2017 while non-structural panel

production exceeded over 200 M cbms for the first time.

Shipment of softwood plywood was 3,046,100 cbms, 0.3%

less in which structural panel was 2,824,100 cbms, 3.1%

less. Shipment of softwood plywood exceeded three

million cbms for two straight years. Despite startup of new

plywood mill in 2018, total production did not increase

because plywood mills stopped overtime and week end

operations to improve working conditions for securing

young workers.

Imported plywood supply varies by source. Malaysian

supply was 1,062,000 cbms, 10.8% less than 2017 while

Indonesia was 977,500 cbms, 11.4% more.

Chinese supply was 642,000 cbms, 1.9% less. Indonesian

supply was over 900,000 cbms after two years while

Malaysian supply was less than 1,100,000 cbms. Because

of high export prices by supplying countries, total volume

of imported plywood will drop this year.

South Sea (tropical) logs and Lumber

Total import of South Sea logs in 2018 was 153,407 cbms,

4.5% more than 2017. Logs from Malaysia decreased after

Sabah banned log export since May last year but PNG

covered shortfall of Malaysia with 76,394 cbms, 64.5%

more than 2017. Log prices in Japan are unchanged

because log prices in PNG are lower than Malaysian log

prices.

Inventory of laminated free board has been dropping so

orders to supply side started increasing, not because of

demand recovery but by dropping inventory in Japan.

Import of Chinese red pine lumber and Indonesian

mercusii pine is getting low so the suppliers prices are

firm.

Next generation housing point system

The Ministry of Land, Infrastructure and Transport newly

created next generation housing system to ease rush-in

demand for housing before the consumption tax is raised

from present 8% to 10% in October 2019. This gives merit

to buy house after October. This budget is about 130

billion yen and has been approved in December 2018 so

the amount is allocated in 2019 budget.

The system is to give points, which can be used to

purchase home appliances when energy saving, earthquake

proof, barrier free houses are built. Maximum points given

is 350,000 yen for newly built house or 300,000 yen for

renovation. Contract needs to be made by March 31, 2020.

Also deduction period of housing loan tax is extended

from 10 years to 13 years. Also tax free limit of gift tax is

increased from 1.2 million yen to 3.0 million yen. Tax

deduction on housing loan of 1% of loan balance at the

end of the year is refunded. For instance loan amount is 30

million yen to buy 30 million yen house, total tax

deduction amount for ten years is about 2.69 million yen.

2% tax on 30 million yen is 600,000 yen so if loan amount

is large, 2% tax increase is easily offset by this measure.

Benefit on new house purchase is increased from 100,000

yen to 400,000 yen for people with income of 7.75 million

yen, which was 5.1 million yen when consumption tax rate

is 8% so it is better to buy house after the tax rate is

increased to 10% for people with income of less than 7.75

million yen.

Last measure when the tax rate was increased was mainly

designed by the Ministry but this time, Liberal Democratic

Party strongly promoted so this is politically promoted

deal.

|