|

Report from

North America

November cabinet sales drop

According to the Kitchen Cabinet Manufacturers

Association (KCMA)¡¯s monthly Trend of Business

Survey, participating cabinet manufacturers reported an

increase in cabinet sales of just 0.3% for November 2018

compared to the same month in 2017. Stock sales

increased 7.4%; semi-custom sales decreased significantly

at 8.1%; and custom sales increased 2.2% compared to

November 2017.

Compared to last month, sales decreased 9.4%. Every

category took a hit with stock sales down 4.1%, semicustom

sales down 12.2%, and custom sales down 10.4%

compared to October.

Year-to-date cabinetry sales through November 2018 are

up slightly (2.1%) according to participating

manufacturers. Stock sales are up 4.7%; semi-custom

sales continue to decrease with a downturn of 1.5%; and

custom sales up 4.6%.

See: http://www.kcma.org/news/pressreleases/

November%202018%20Trend%20of%20Business%20P

ress%20Release.

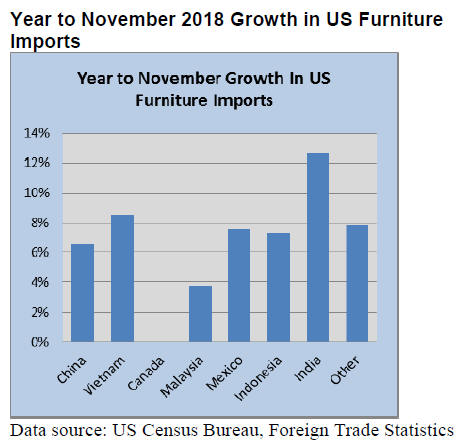

Wooden furniture imports consistent for most of 2018

US imports of wooden furniture gained less than 1% in

November rising to US$1.78 billion. Wooden furniture

imports have been consistent for most of 2018 and are up

7% year-to-date. Imports from China, which accounts for

nearly half of US imports, were also up 7% year-to-date

and were up 2% in November.

Imports from Vietnam, Indonesia and Mexico are all up

between 7% and 9% year-to-date, while Canadian imports

are nearly identical to where they were at this time in

2017. While imports from India were down 12% in

November, India has had the highest percentage of growth

in 2018, up 13% year-to-date.

US manufacturing still growing but exports slowing

Economic activity in the US manufacturing sector

expanded in January, and the overall economy grew for

the 117th consecutive month, say the nation¡¯s supply

executives in the latest Manufacturing ISM Report on

Business.

Comments from the panel reflect continued expanding

business strength, supported by strong demand and output.

Consumption continued to strengthen, with production

expanding strongly and employment continuing to expand

at previous-month levels.

¡°Exports continue to expand, but at the lowest level since

the fourth quarter of 2016. Prices contracted for the first

time since the first quarter of 2016. The manufacturing

sector continues to expand, reversing December¡¯s weak

expansion, but inputs and prices indicate fundamental

changes in supply chain constraints,¡± said Tim Fiore,

Chair of the ISM Manufacturing Business Survey

Committee.

California targets deforestation

This week a group of legislators introduced a bill in the

California State Assembly titled AB-572, the California

Deforestation-Free Procurement Act.

If enacted, the legislation would require firms contracting

with the State of California for the procurement of ¡°forestrisk

commodities¡± such as wood, paper, pulp, palm oil,

soy, beef, leather, coffee, cocoa, and rubber to certify that

those products do not contribute to tropical deforestation

or illegal land conversion. Initial consideration of this

legislation in the California State Assembly is expected in

mid-March, and it could be enacted by fall 2019.

For details see:

https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_i

d=201920200AB572

Government shutdown drives up unemployment

Both the US unemployment rate and the number of

unemployed persons, at 6.5 million, edged up in January.

Total nonfarm payroll employment increased by 304,000

in January, and the unemployment rate edged up to 4.0

percent, according to the US Bureau of Labor Statistics.

US consumer sentiment rebounded by more than forecast

from a two-year low, suggesting recent weak retail sales

will be a temporary blip after the government shutdown

ended and the US Federal Reserve signaled it would hold

off on interest-rate hikes.

The University of Michigan¡¯s preliminary February

consumer sentiment index rose to 95.5, exceeding the

median forecast in a Bloomberg survey for an increase to

93.7. The measure of current conditions rose 1.2 points

while the expectations gauge jumped 6.3 points, indicating

the rise in sentiment was concentrated in the outlook.

Confidence remains elevated compared with historical

levels, though it¡¯s below average for the period since

Donald Trump was elected president. The gauge may

stabilise as the government avoided another shutdown and

US trade negotiators work toward a new deal with China.

Sentiment may be getting a boost from muted expectations

for prices and rate hikes, as fewer respondents saw

borrowing costs rising. Consumer expectations for

inflation in the next five to 10 years fell to 2.3 percent,

matching the lowest in the past half century, while the

expected rate in the coming year dropped to the lowest

since 2017.

|