Japan

Wood Products Prices

Dollar Exchange Rates of 25th

February

2019

Japan Yen 111.06

Reports From Japan

¡¡

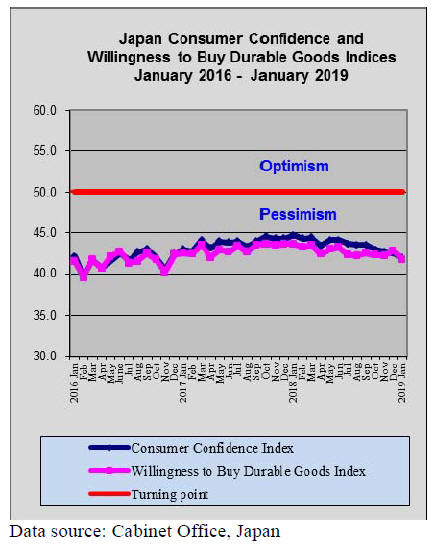

Exports nosedive

Data from the Ministry of Finance points to a more than

8% decline in exports over the past 12 month. This is

focusing attention on the impact of slowing global demand

and trade frictions on business confidence and investment.

Foreign purchases of Japanese machinery, another

indicator of business prospects, have dipped to the lowest

for the past 10 years.

Sentiment amongst Japanese businesses is at a two-year

low, raising a question on the continuing rosy economic

outlook promoted by government agencies. Many analysts

warn that economic growth this year will not be as good as

last year. The Cabinet Office, in its latest monthly

assessment of industrial output, downgraded its

assessment for the first time in three years.

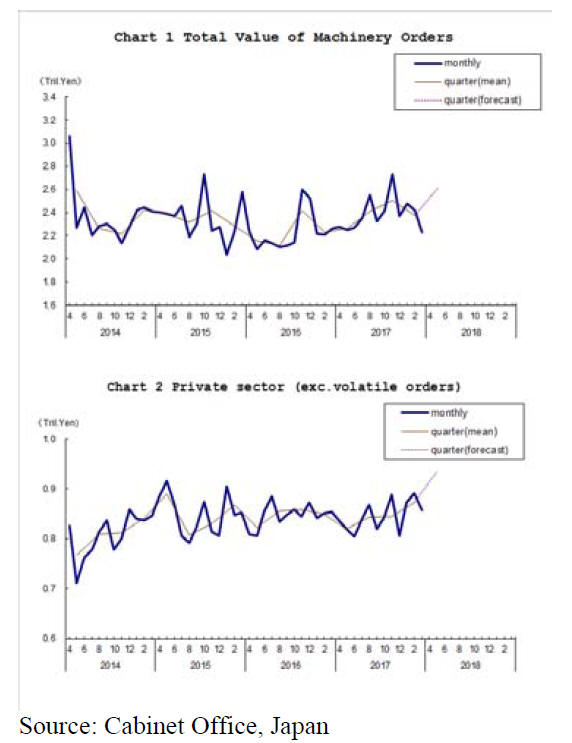

In introducing the January to March forecast for

machinery orders the Cabinet Office says: ¡°In the January-

March period the total amount of machinery orders was

forecasted to decrease by 13.0% and private-sector orders,

excluding volatile ones, were forecasted to fall by 1.8%

from the previous quarter respectively.

This forecast was basically made by summing up the

figures from 280 machinery manufacturers.¡±

See: https://www.esri.cao.go.jp/en/stat/juchu/1812juchu-e.html

Bank of Japan mulls more fiscal stimulus if

yen

strengthens

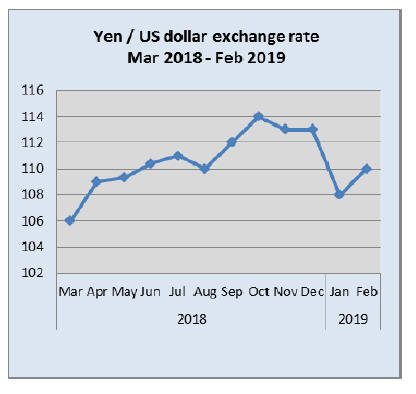

In a rare explicit coupling of policy and the yen, Bank of

Japan (BoJ) governor, Haruhiko Kuroda, surprised

analysts but explicitly pointing to the possibility of more

fiscal stimulus if exchange rate movements start to

undermine Japan¡¯s inflation target and the wider and

economy.

This statement had an immediate impact on the US

dollar/Yen exchange rate bringing the Yen back to 110 to

the US dollar. In recent weeks some ex-BoJ officials had

warned that if the Yen strengthened sharply there would

be little the BoJ could do but Kuroda said the BoJ could

influence bond yields and increase asset purchases.

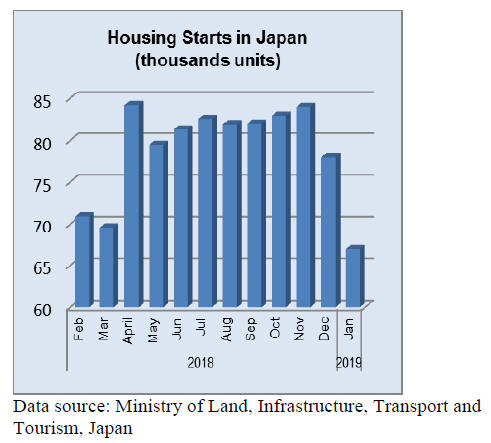

Poor start to year for housing starts

January housing starts dipped a surprising 12% year on

year, matching the decline seen in January 2016 and

setting a new record low for January.

The harsh winter weather always drives down construction

activity in January but at just 67,000 starts this year has

not started well. Compared to a month earlier, January

housing starts were down around 14%.

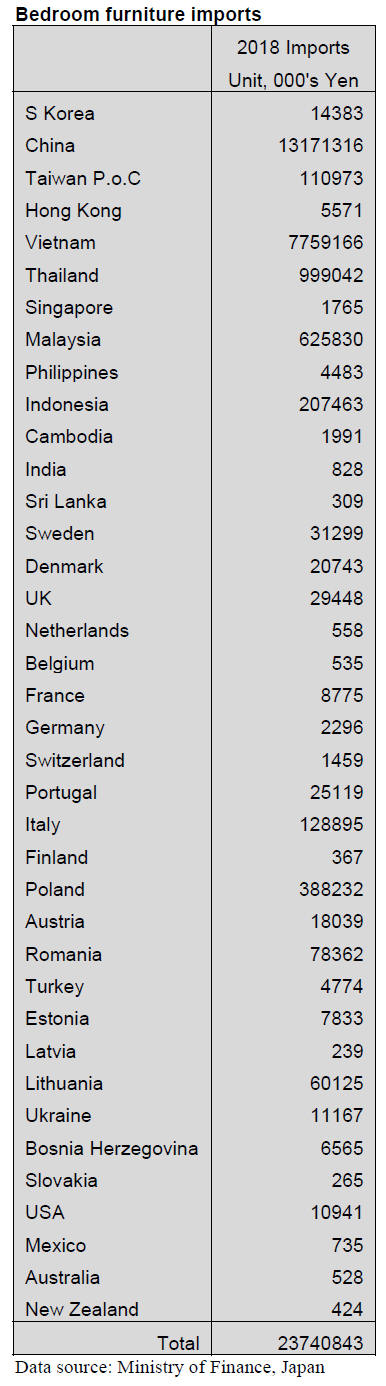

Furniture imports

Details of full year 2018 wooden furniture imports into

Japan are given below. The tables for imports of Wooden

Office, Kitchen and Bedroom furniture (HS 940330/40/50)

are shown below along with indications of the main

suppliers. It will be noted that for all three categories of

furniture the top 3-5 suppliers account for well over 80%

of all wooden furniture imports.

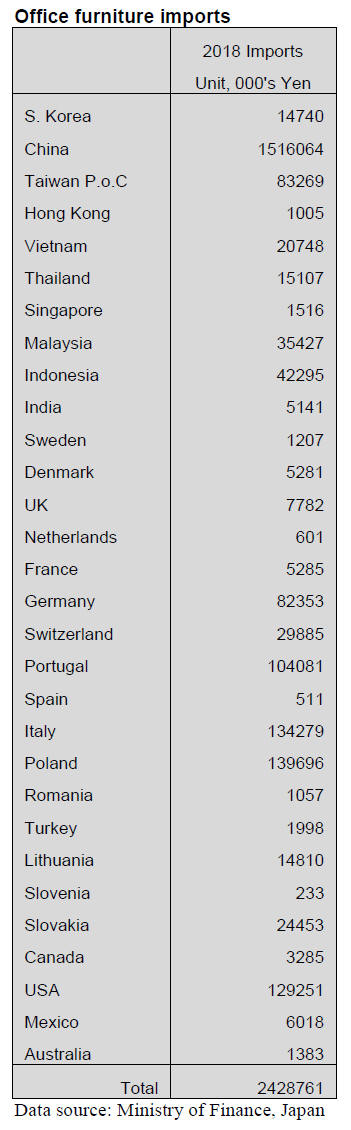

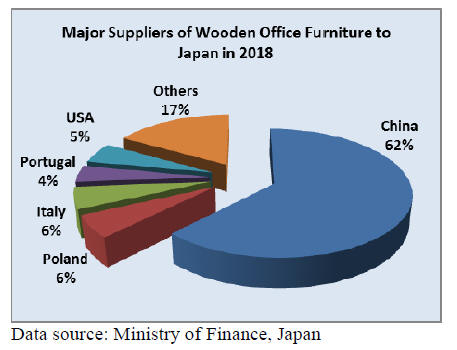

Office furniture imports (HS 940330)

2018 wooden office furniture import values were down

16% from a year earlier. In 2018 the top suppliers in order

of rank were China (62%), Poland and Italy (6% each), the

USA (5%) and Portugal (4%).

2018 imports from China were down around 5%, Poland

scored a 40% rise in 2018 shipments over 2017. In

contrast shipments from Italy fell more than a quarter.

Shipments from both the USA and Portugal were

significantly higher than in 2017.

The top five shippers of wooden office furniture accounted

for 83% of all Japan¡¯s imports of this category of

furniture.

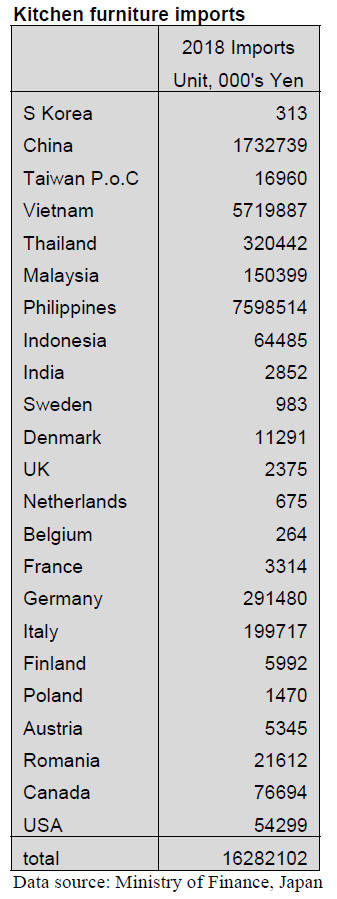

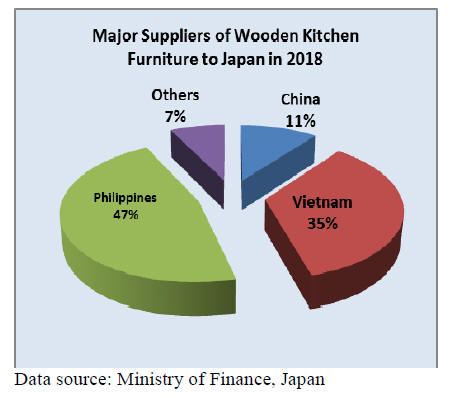

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s imports of wooden kitchen furniture

in 2018 was some 15% up on levels in 2018 and shipment

were dominated by three shippers the Philippines,

Vietnam and China which provided 47%, 35% and 11%

respectively.

The value of shipments of kitchen furniture from the

Philippines in 2018 was significantly higher than in 2017,

rising over 40%. The value of shipments from the second

largest supplier, Vietnam, was unchanged from a year

earlier and there was a modest 10% increase in the value

of shipments from China.

Amongst the ¡°others¡¯ group shipments from Thailand,

Malaysia, Germany and Italy were significant.

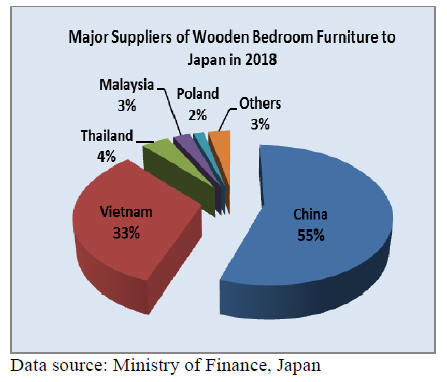

Bedroom furniture imports (HS 940350)

Compared to a year earlier there was only a modest rise

(5%) in Japan¡¯s 2018 imports of wooden bedroom

furniture. The top five shippers China, Vietnam, Thailand,

Malaysia and Poland accounted for a massive 97% of all

wooden bedroom furniture imports in 2018.

Shipments from China in 2018 were about the same value

as in 2017, this was also the case for Malaysian and Polish

suppliers. The big winners in 2018 were Vietnam for

which shipments rose 11% and Thailand which saw a 12%

in the value of shipments.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Change of duty with EPA

On February 1, 2019, EPA between EU and Japan takes

effect. Import duty on European softwood lumber,

structural laminated lumber, OSB and particleboard will

be reduced step by step and they will be totally abolished

after eight years.

Time to start is February 1, 2019 and April 1 of every

year. Reduction rate is equal every year .For instance,

lumber duty is 4.8% which is reduced by 0.6% every year

but some items like laminated lumber of 3.9% cannot be

divided by eight so 0.5% is reduced every year except for

fourth year at which year, reduction rate is 0.4%. Wooden

board rate is6.0% which is reduced by 0.7 and 0.8 %

alternately.

Review of 2018

Problem in last two years is how high cost of lamina is

passed onto sales prices of finished products.

On laminated whitewood post, based on lamina cost,

sales prices need to be 2,000 yen per piece delivered but

due to low cost domestic cedar laminated post of about

1,700 yen, laminated whitewood post prices had been

1,860-1,880 yen.

With rigid high lamina cost, supply of imported laminated

post and domestic production were curtailed in early stage

then the demand and movement improved since last fall so

the prices have been firming and 1,900 yen seems possible

in January.

Meantime, redwood laminated beam prices climbed up to

63,000 yen per cbm delivered in early 2018 but with

competition with Douglas fir solid wood KD beam, which

prices had been held at 58,000 yen, further increase of

redwood beam became impossible with 5,000 yen price

spread. However, the supply continued robust so

oversupply resulted in drop of market prices.

Based on lamina cost, 65,000 yen should be sales prices of

redwood beam but the market prices dropped down to

61,000 yen as future prices of imported beam dropped.

Imported volume of structural laminated lumber for the

first ten months of 2018 was 381,350 cbms of small size,

7.7% less than the same period of 2017 then 302,032 cbms

of medium size, only 1.2% less than 2017. Export prices

of lamina and genban had stayed up high due to high cost

of logs in Europe and busy other markets.

Lamina prices were Euro 250-260 per cbm C&F and

genban prices were Euro 280-290.Redwood prices

climbed to Euro 270-280 through the third quarter then the

demand dropped. At the same time, North American

lumber market sharply weakened and purchase by China

slowed down so supply side bullishness is fading.

Based on the statistics, LVL production in 2017 was

179,000 cbms out of which 55% was used as structural

materials.

There is new LVL plant was built in Aomori and with old

plant, total of 300,000 cbms of cedar is consumed a year.

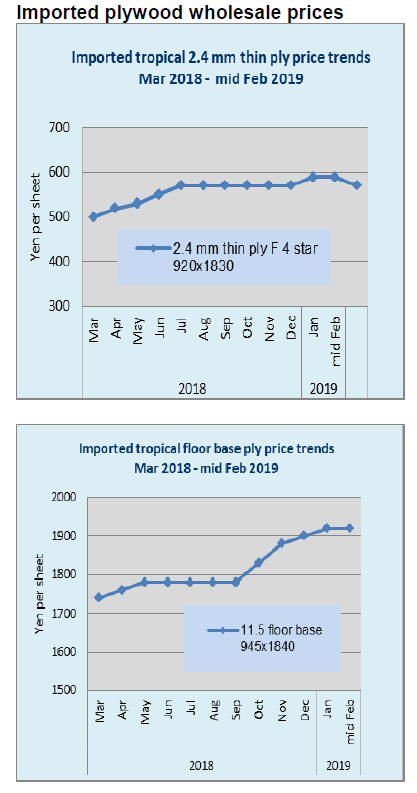

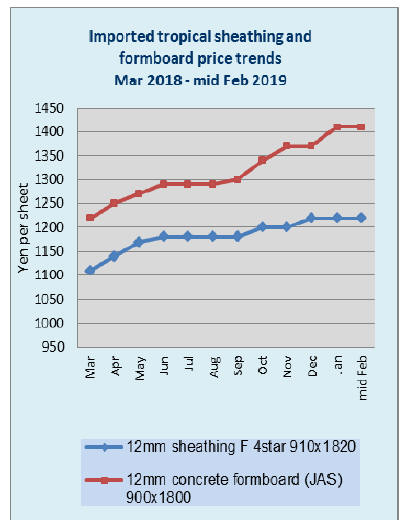

Plywood

Total estimated softwood plywood production in 2018

based on January through November figures is 3,093 M

cbms, 1.6% less than 2017 out of which structural

plywood production was 2,866,700 cbms, 4.8% less. The

shipment would be about 3,042,800 cbms, 0.5% less

despite one additional plywood mill started running in

April. Reason of why total production decreased even with

one additional new plant is labor shortage and log supply.

Labor shortage is becoming serious problem. In local

regions, securing young labor force is becoming awfully

hard so the mills change working rules. Mills used to run

overtime or week end when the demand was busy but now

mills stop such extra works to tie up young people. There

will be two more new mills staring up this year but total

supply would not increase much by the above reason.

Then there is log supply problem. Total demand for

domestic logs has been climbing for lumber, laminated

lumber and biomass but the supply has not increased to

meet increasing demand so if mills want to expand

production capacity, stable log supply becomes hurdle.

Another change is increasing production of non-structural

plywood used for floor base. The production of nonstructural

plywood continues increasing year after year

because main material of imported South Sea hardwood

plywood for floor base is becoming hard to secure.

Malaysian and Indonesian plywood mills suffer log supply

shortage so that shipments continue delaying. Japanese

floor manufacturers cannot count on stable supply from

South Sea countries so they are shifting to domestic

softwood non-structural plywood.

Also concrete forming plywood has mainly supplied from

Indonesian mills but the supply has been dwindling so

production of softwood concrete forming panel in Japan

has been increasing and last year¡¯s production was almost

50% more than 2017.

Movement of softwood plywood is steady and there are

constant orders for imported plywood. December

softwood plywood production was 252,800 cbms, 2.5%

less than December last year and 3.0% less than

November, first time to have less than 260 M cbms in

three months.

The shipment was 258,300 cbms, 0.4% more and 8.8%

less. The inventories were 155,600 cbms, 4,200 cbms less

than November, three straight months decline. Shortage of

trucks continues so that deliveries are delayed. This did

not cause much trouble because construction activities are

also delayed by labor shortage. Overall demand and

supply are balanced.

Export prices of South Sea hardwood plywood continues

firm and climbing. Production cost is up after Malaysia

raised minimum wage and log harvest tax in Sarawak is

increased. This is middle of rainy season and log

availability is extremely tight and plywood mills are afraid

of further increase of log prices. Plywood mills are not so

anxious to secure new orders.

In Japan, arrivals late last year rushed so delayed contract

balances are largely solved. In the second half of last year,

the dealers hesitated to place new orders because of high

export prices and dull movement in the market so future

supply will definitely drop down.

Total port inventories are ample now but some items like

concrete forming panels and structural panels are scarce

without any hope of recovery. The dealers plan to hold onhand

inventories and keep selling preciously.

Russian log export duty

The Russian government imposes 40% export duty on

spruce, fir and larch from Russian Far East but for the

companies which exported processed products in last three

years, log export duty is reduced to 6.5%.

The Russian government announced names and allocated

volume of companies. Total quota of logs for export is

four million cubic meters.

Total of 18 companies are approved. RFPG is the largest

company with allocated volume of 2,608,000 cbms, 65%

of total. Terneyles has 638,000 cbms. Rimbnan Hijau

(RH) MDF has 438,000 cbms. RH International has

105,000 cbms.

They are top five approved companies for 6.5% log export

duty. Actually majority of Far East logs are exported to

China and Korea so the volume for Japan is very little.

Japan mainly buys veneer, laminated lumber and cut stock

of hardwood species from Terneyles and veneer from

RFPG and some whitewood lumber.

|