|

Report from

North America

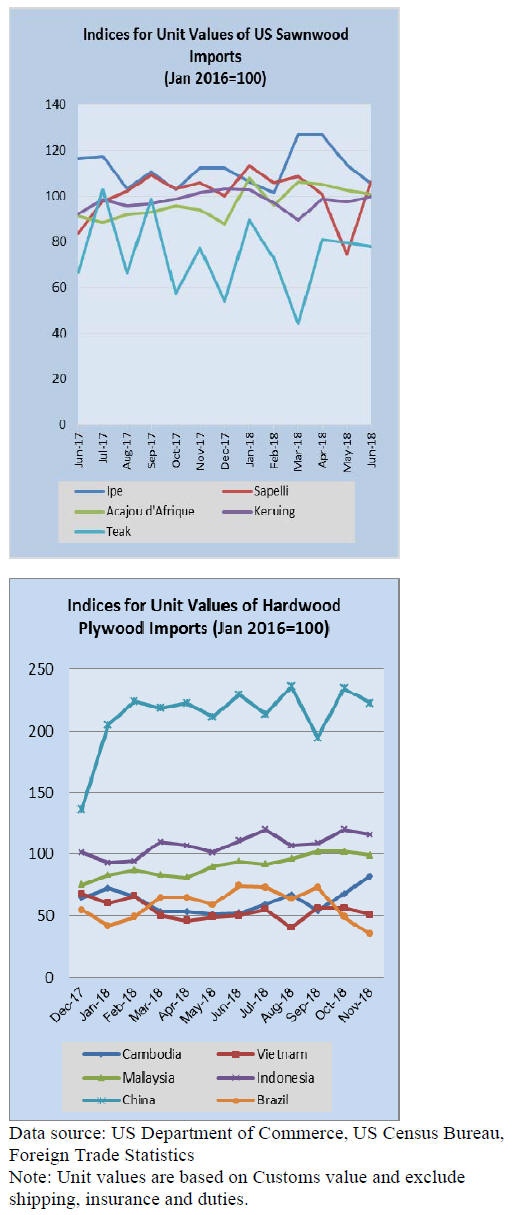

US hardwood plywood imports recovered in November

2018

US imports of hardwood plywood increased in volume by

11% in November but are still down 20% year to date

from 2017. Gains were sharp in November from the many

countries gaining from cooling US trade with China.

Imports from Malaysia and Indonesia were both up nearly

50% for November and are now ahead by around twothirds

for the year to date.

Imports of plywood from China, while gaining 4% in

November, are down 76% year to date. China, which in

2017 held nearly half of the US import market in

hardwood plywood, is now well behind Indonesia in

volume sent to the US this year.

Although the volume of hardwood plywood is down, total

sales in dollars are ahead by 9% year to date, due to higher

prices for the types of panel being sold.

Sawn tropical hardwood imports dip

US Imports of sawn tropical hardwood fell by 3% in

November to 19,791 cubic meters, which is 10% higher

than November 2017.

Year to date, imports are behind by 10% with Ecuadorian

imports down by a quarter. Imports of balsa fell by 15%

in November and are more than 25% behind 2017 imports

year to date. Sapelli and Acajou d¡¯Afrique both gained

sharply in November, but still remain down about 20%

year to date.

Jatoba and Keruing imports also gained in November and

are well ahead of 2017 year to date.

Veneer imports continue to wane

US imports of tropical hardwood veneer declined by 12%

in November, falling for the third straight month. The

decline is bringing imports back toward 2017 levels after a

much stronger early part of the year.

Year-to-date imports still outpace 2017 by 27% as imports

from India continue to grow, increasing by 17% in

November. Imports of veneer from India have more than

doubled in 2018 over 2017.

While Imports from China slipped by nearly a third in

November, year-to-date totals are still up 44%.

Flooring imports mixed in November

US Imports of hardwood flooring continued to be strong in

November, rising by 10% over October to a level nearly

double that of November 2017.

Imports from Chinese fell by 13% in November but

remain ahead of 2017 year to date by more than 60%.

Imports from Brazil were up 31% in November and are

also ahead year to date by more than 60%.

Malaysian exports of flooring are also very strong with

imports more than tripling in November for the strongest

month since October 2015. Malaysian imports are up 76%

year to date over 2017. Total imports are ahead of 2017

by 41% year to date.

Imports of assembled flooring have not been as robust,

declining by 6% in November. However, year-to-date

imports remain about 10% above 2017.

Moulding imports remain flat

US imports of hardwood moulding fell by 3% in

November, remaining fairly consistent as they have

throughout the year. Most trading countries have not

strayed more than 5% from 2017 year-to-date numbers all

year. The exception has been Canada, which now is 23%

behind year to date after dropping 9% in November.

Imports from Brazil also had been lagging, but a rise of

35% in November brought year-to-date imports even with

2017 numbers.

New furniture orders continue to rise - But at slower

rate

The results of the latest Smith Leonard survey of

residential furniture manufacturers and distributors

indicated a 3% increase in new orders in November

compared to November 2017. This increase followed a 7%

increase reported in October and 9% increases in

September and August. Year to date, new orders remained

6% ahead of last year.

Existing home sales declined sharply in December

Total existing-home sales, released by the National

Association of Realtors, decreased 6.4% to a seasonally

adjusted rate of 4.99 million in December, after two

consecutive months of increase. Compared with a year

ago, sales decreased 10.3% in December, the lowest level

since November 2015. Total existing home sales include

single-family homes, townhomes, condominiums and coops.

In 2018, the existing home sales remained sluggish due to

rising mortgage rates, growing home prices and tight

inventory. Though the sales bounced back in October after

six consecutive months of declines due to an increase in

inventory and slower home price growth, it still ended the

year on a low note. The total sales remained down at both

national and regional level compared to a year ago.

Regionally, existing home sales fell in all regions in

December compared to the previous month. Year-overyear,

sales declined in all four regions, ranging from 6.8%

in the Northeast to 15% in the West.

|